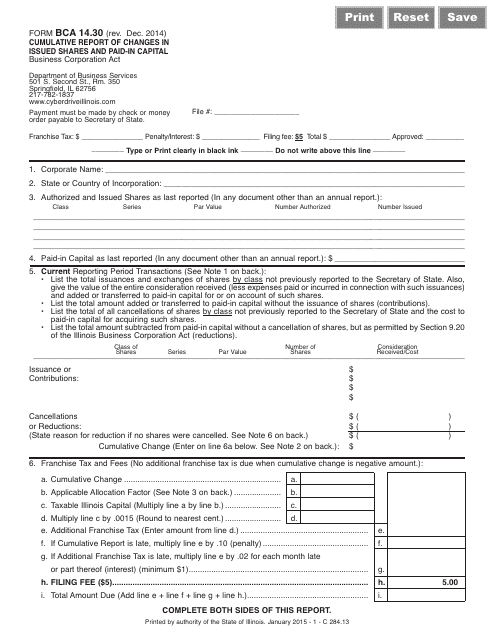

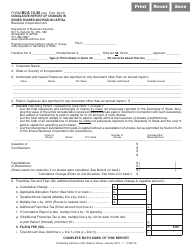

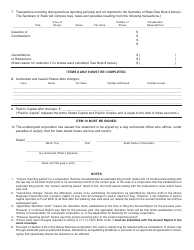

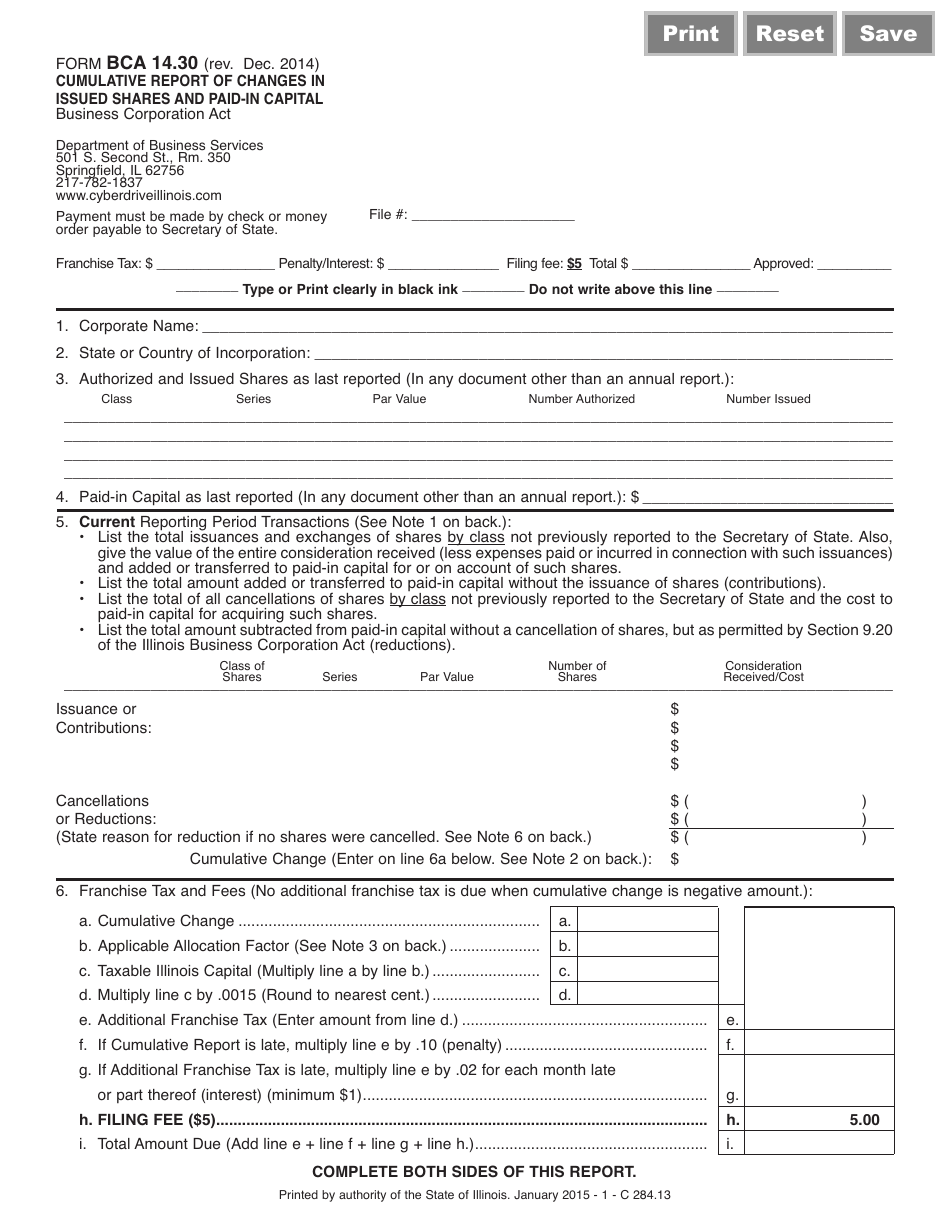

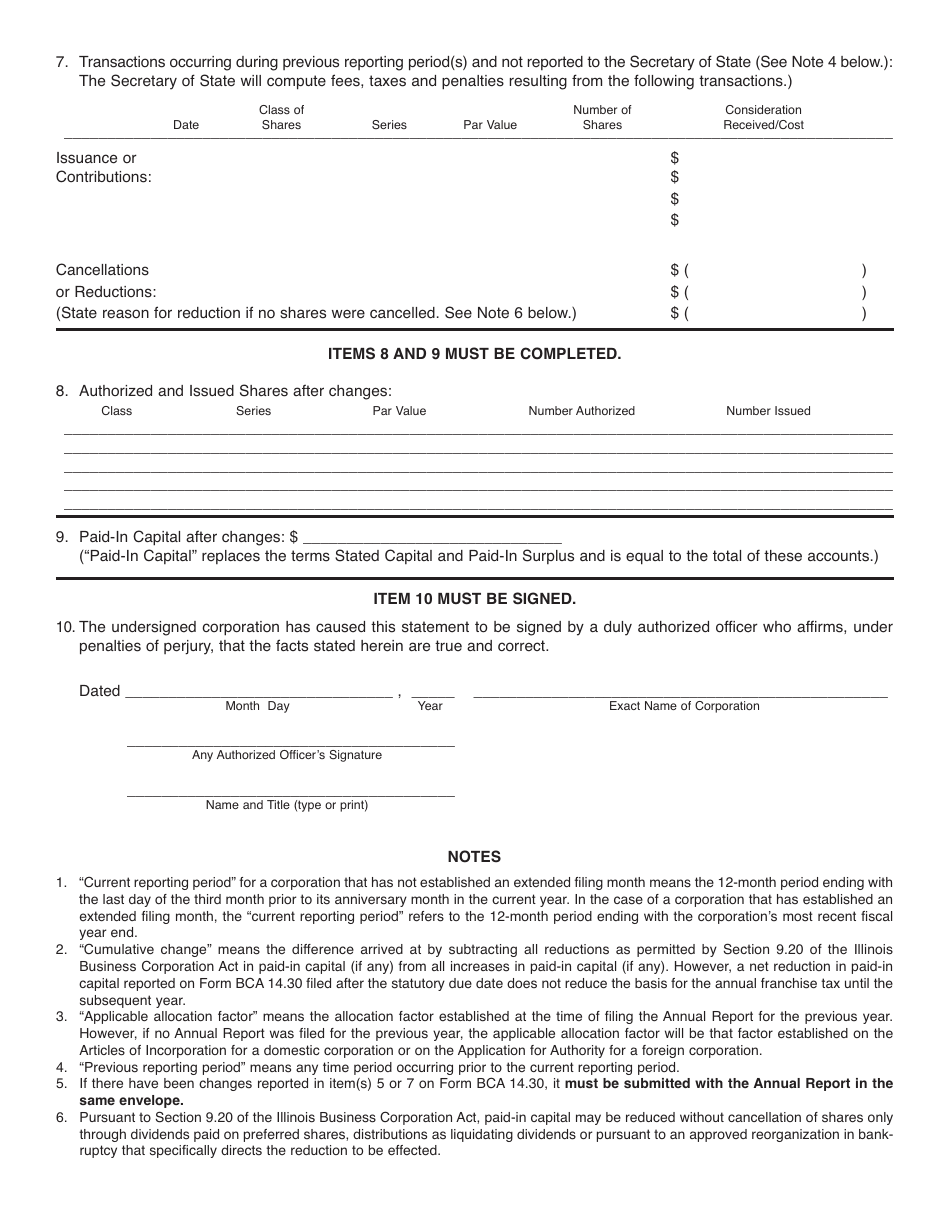

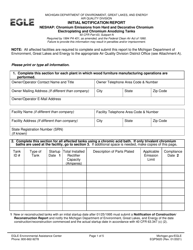

Form BCA14.30 Cumulative Report of Changes in Issued Shares and Paid-In Capital - Illinois

What Is Form BCA14.30?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form BCA14.30?

A: Form BCA14.30 is the Cumulative Report of Changes in Issued Shares and Paid-In Capital for the state of Illinois.

Q: What does the form BCA14.30 report?

A: The form BCA14.30 reports the changes in issued shares and paid-in capital for a business in Illinois.

Q: Who needs to file the form BCA14.30?

A: Businesses incorporated in Illinois that have made changes to their issued shares and paid-in capital must file the form BCA14.30.

Q: What information is required on the form BCA14.30?

A: The form BCA14.30 requires information about the business, such as its name, address, registered agent, and changes in issued shares and paid-in capital.

Q: When is the deadline to file the form BCA14.30?

A: The deadline to file the form BCA14.30 is determined by the Illinois Secretary of State and may vary.

Q: What happens if I don't file the form BCA14.30?

A: Failure to file the form BCA14.30 may result in penalties or consequences imposed by the Illinois Secretary of State.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCA14.30 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.