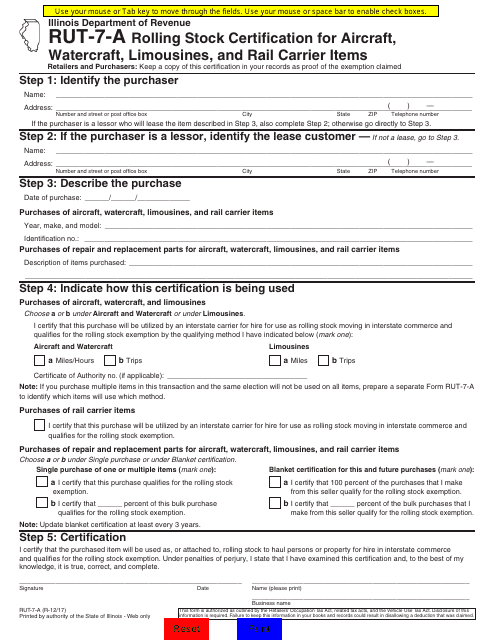

Form RUT-7-A Rolling Stock Certification for Aircraft, Watercraft, Limousines, and Rail Carrier Items - Illinois

What Is Form RUT-7-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RUT-7-A?

A: Form RUT-7-A is a certification form used in Illinois for aircraft, watercraft, limousines, and rail carrier items.

Q: What is the purpose of Form RUT-7-A?

A: The purpose of Form RUT-7-A is to certify that the listed items qualify for a reduced rate of tax.

Q: Who needs to file Form RUT-7-A?

A: Any individual or business in Illinois who owns or operates qualifying items, such as aircraft, watercraft, limousines, or rail carrier items, and wants to claim a reduced rate of tax.

Q: What information is required on Form RUT-7-A?

A: Form RUT-7-A requires information about the owner or operator of the qualifying items, the items themselves, and their usage.

Q: When is the deadline to file Form RUT-7-A?

A: Form RUT-7-A must be filed every year by January 31st.

Q: Are there any fees associated with filing Form RUT-7-A?

A: There are no fees associated with filing Form RUT-7-A.

Q: Is Form RUT-7-A only for residents of Illinois?

A: No, Form RUT-7-A can be filed by both residents and non-residents of Illinois who own or operate qualifying items in the state.

Q: What happens after Form RUT-7-A is filed?

A: Once Form RUT-7-A is filed and approved, the owner or operator of the qualifying items will be eligible for a reduced rate of tax on those items.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RUT-7-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.