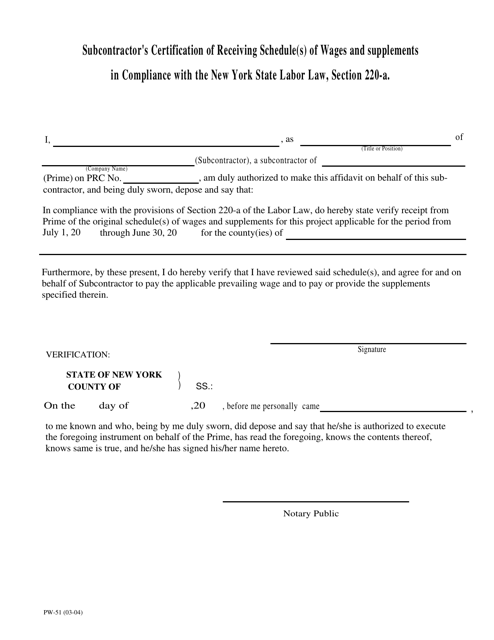

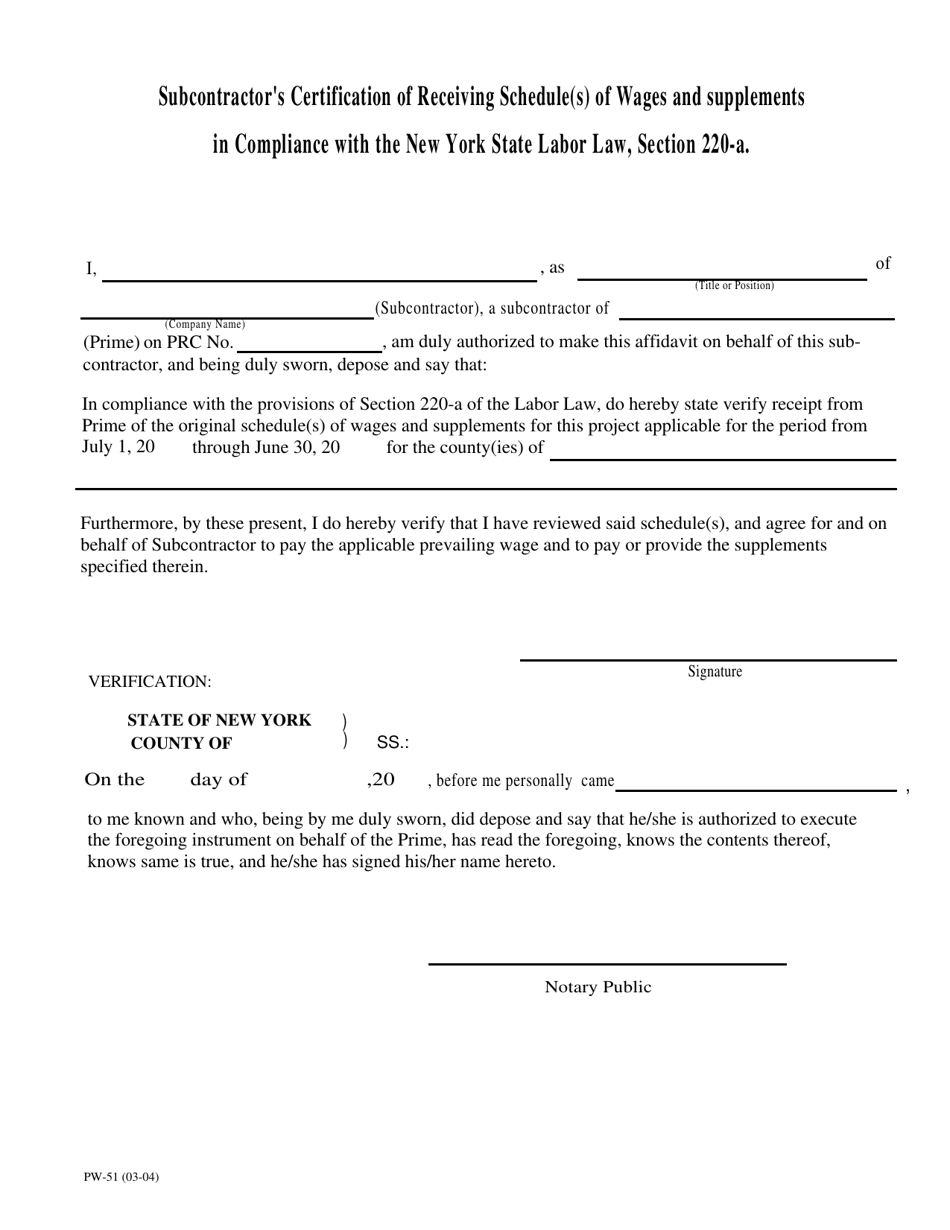

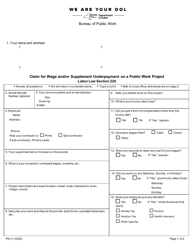

Form PW-51 Subcontractor's Certification of Receiving Schedule(S) of Wages and Supplements in Compliance With the New York State Labor Law, Section 220-a - New York

What Is Form PW-51?

This is a legal form that was released by the New York State Department of Labor - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PW-51?

A: Form PW-51 is the Subcontractor's Certification of Receiving Schedule(S) of Wages and Supplements in Compliance With the New York State Labor Law, Section 220-a.

Q: What is the purpose of Form PW-51?

A: The purpose of Form PW-51 is to certify that a subcontractor has received the required schedules of wages and supplements in compliance with the New York State Labor Law.

Q: Which law does Form PW-51 comply with?

A: Form PW-51 complies with the New York State Labor Law, Section 220-a.

Q: Who should use Form PW-51?

A: Subcontractors who are working on public works projects in New York State should use Form PW-51 to certify that they have received the required schedules of wages and supplements.

Q: Is Form PW-51 mandatory?

A: Yes, subcontractors working on public works projects in New York State are required to submit Form PW-51.

Q: What happens if a subcontractor does not submit Form PW-51?

A: Failure to submit Form PW-51 may result in penalties and may make the subcontractor ineligible to work on future public works projects in New York State.

Q: When should Form PW-51 be submitted?

A: Form PW-51 should be submitted to the contracting agency within five days after receiving the schedules of wages and supplements.

Form Details:

- Released on March 1, 2004;

- The latest edition provided by the New York State Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PW-51 by clicking the link below or browse more documents and templates provided by the New York State Department of Labor.