This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2441

for the current year.

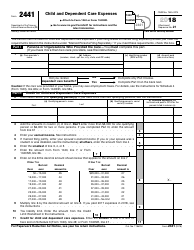

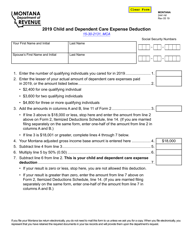

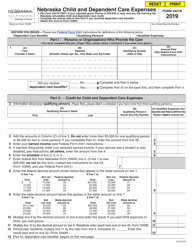

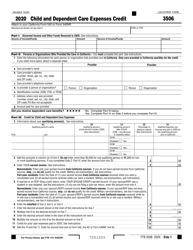

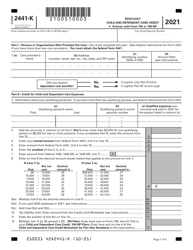

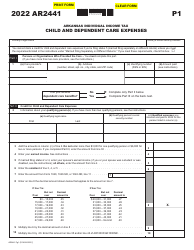

Instructions for IRS Form 2441 Child and Dependent Care Expenses

This document contains official instructions for IRS Form 2441 , Child and Dependent Care Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 2441?

A: IRS Form 2441 is used to report child and dependent care expenses.

Q: Who needs to file IRS Form 2441?

A: Individuals who have child and dependent care expenses may need to file IRS Form 2441.

Q: What are child and dependent care expenses?

A: Child and dependent care expenses are costs incurred for the care of children under the age of 13 or disabled dependents.

Q: What information is required on IRS Form 2441?

A: IRS Form 2441 requires information such as the care provider's name, address, and taxpayer identification number, as well as the amount of child and dependent care expenses paid.

Q: What is the purpose of filing IRS Form 2441?

A: The purpose of filing IRS Form 2441 is to claim the child and dependent care credit, which provides a tax benefit for eligible expenses.

Q: What is the child and dependent care credit?

A: The child and dependent care credit is a tax credit that helps offset the cost of child and dependent care expenses.

Q: Are there any limitations on the child and dependent care credit?

A: Yes, there are certain limitations on the child and dependent care credit, such as the maximum amount of qualifying expenses and the taxpayer's income.

Q: When is the deadline for filing IRS Form 2441?

A: The deadline for filing IRS Form 2441 is usually the same as the deadline for filing your federal income tax return, which is April 15th, unless it falls on a weekend or holiday.

Q: Can I claim child and dependent care expenses if I have a flexible spending account (FSA) or dependent care assistance program (DCAP)?

A: If you have a flexible spending account (FSA) or dependent care assistance program (DCAP), you can generally not claim those expenses on IRS Form 2441, as they are already pre-tax benefits.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.