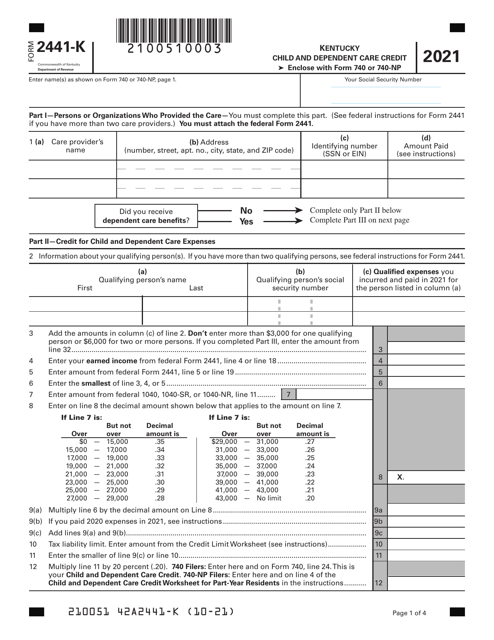

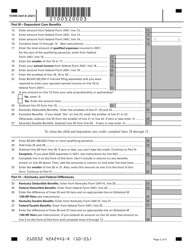

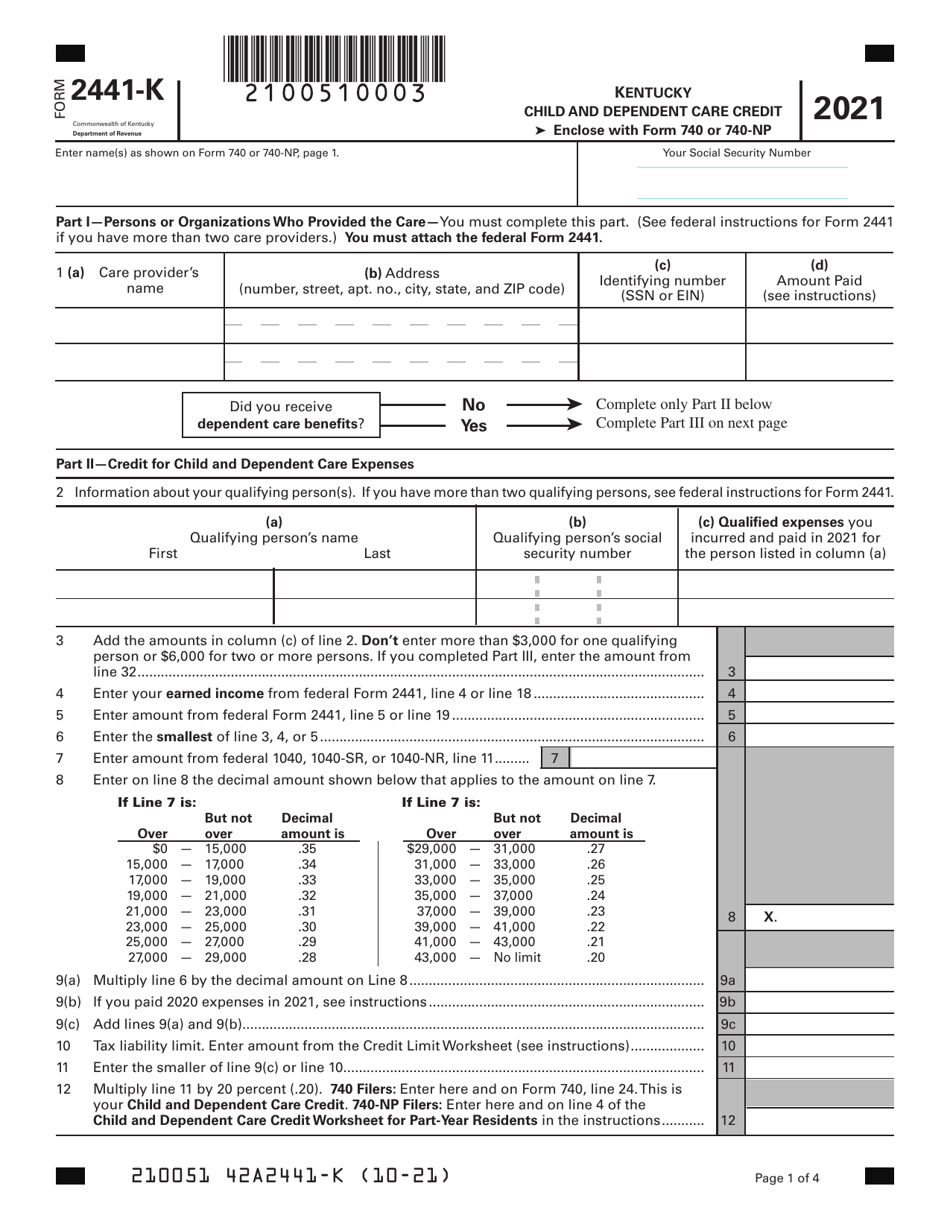

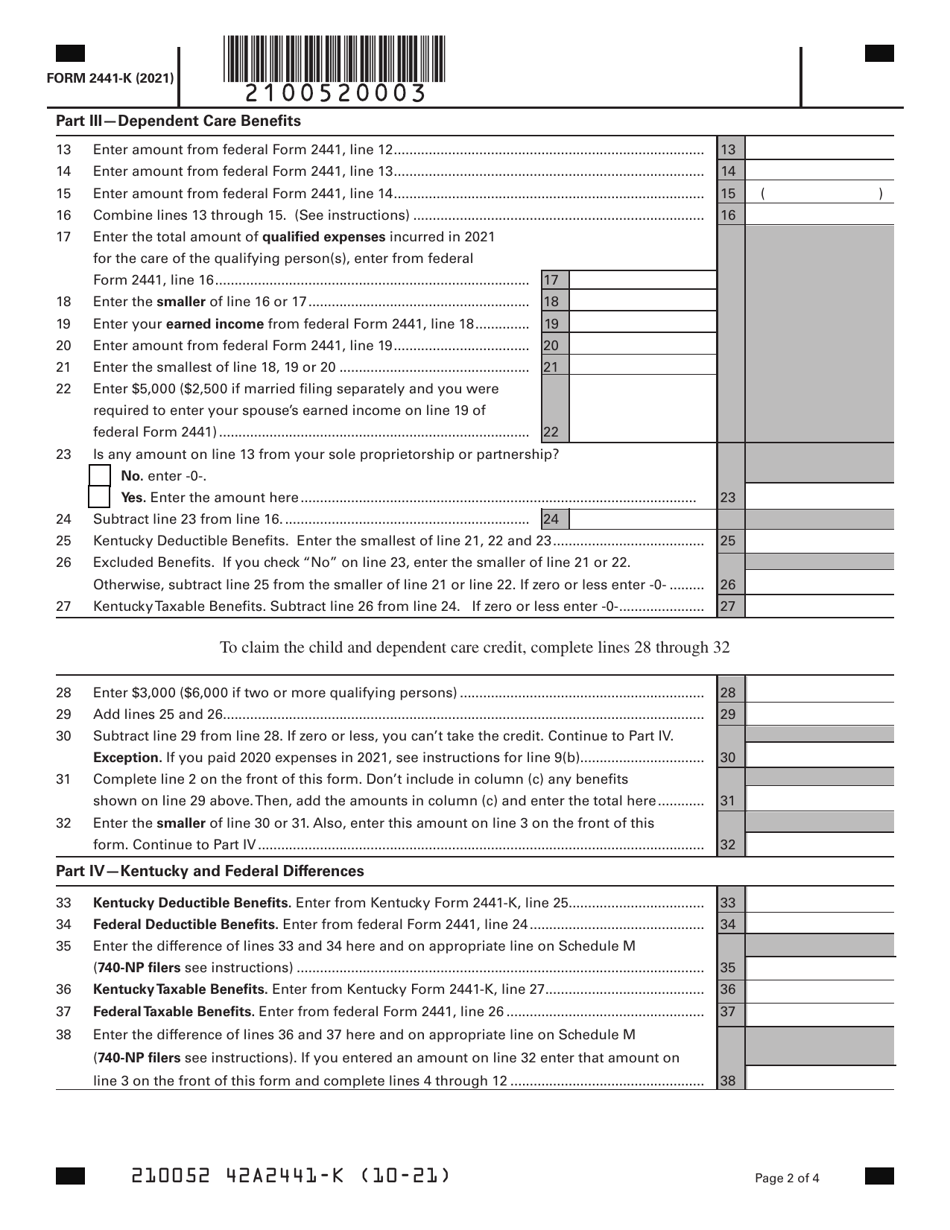

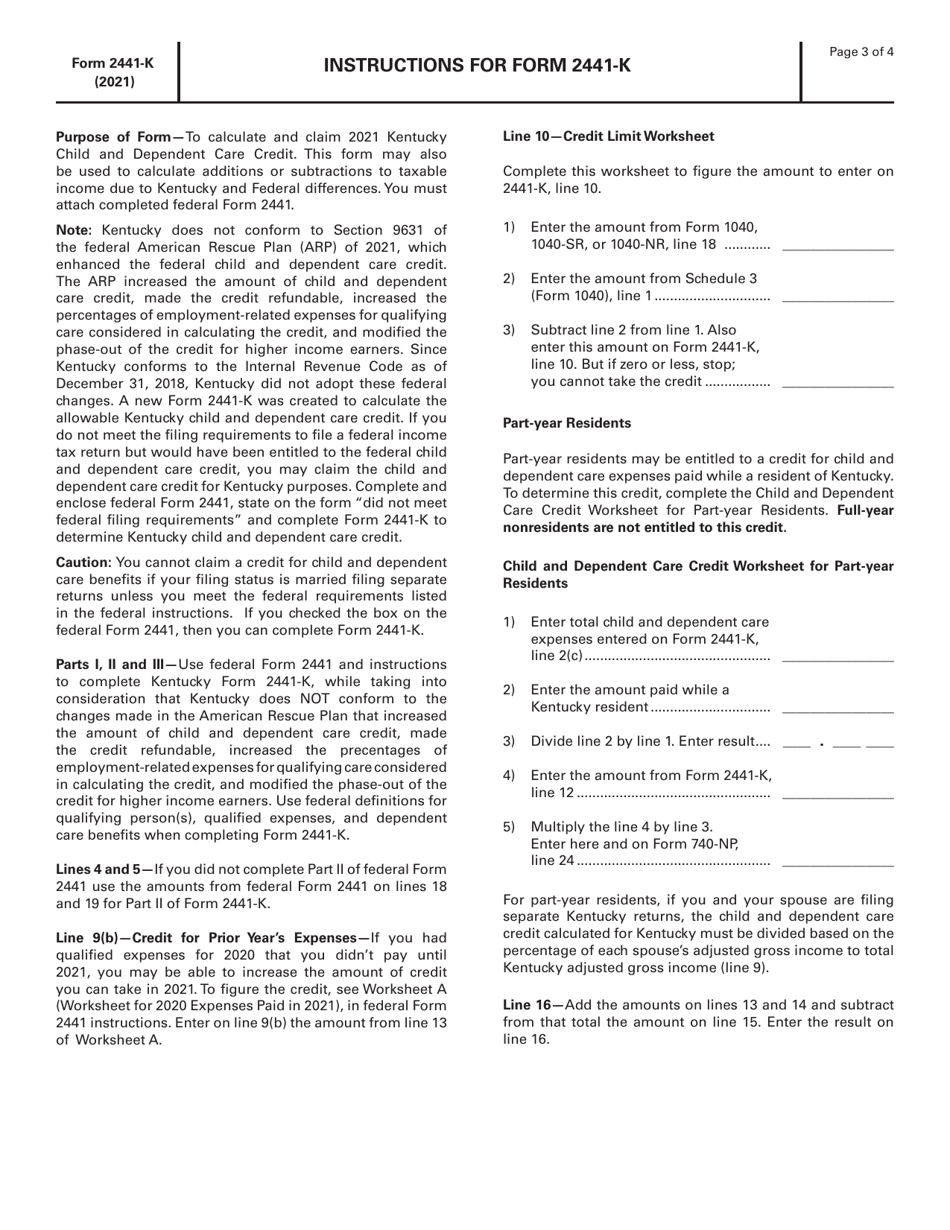

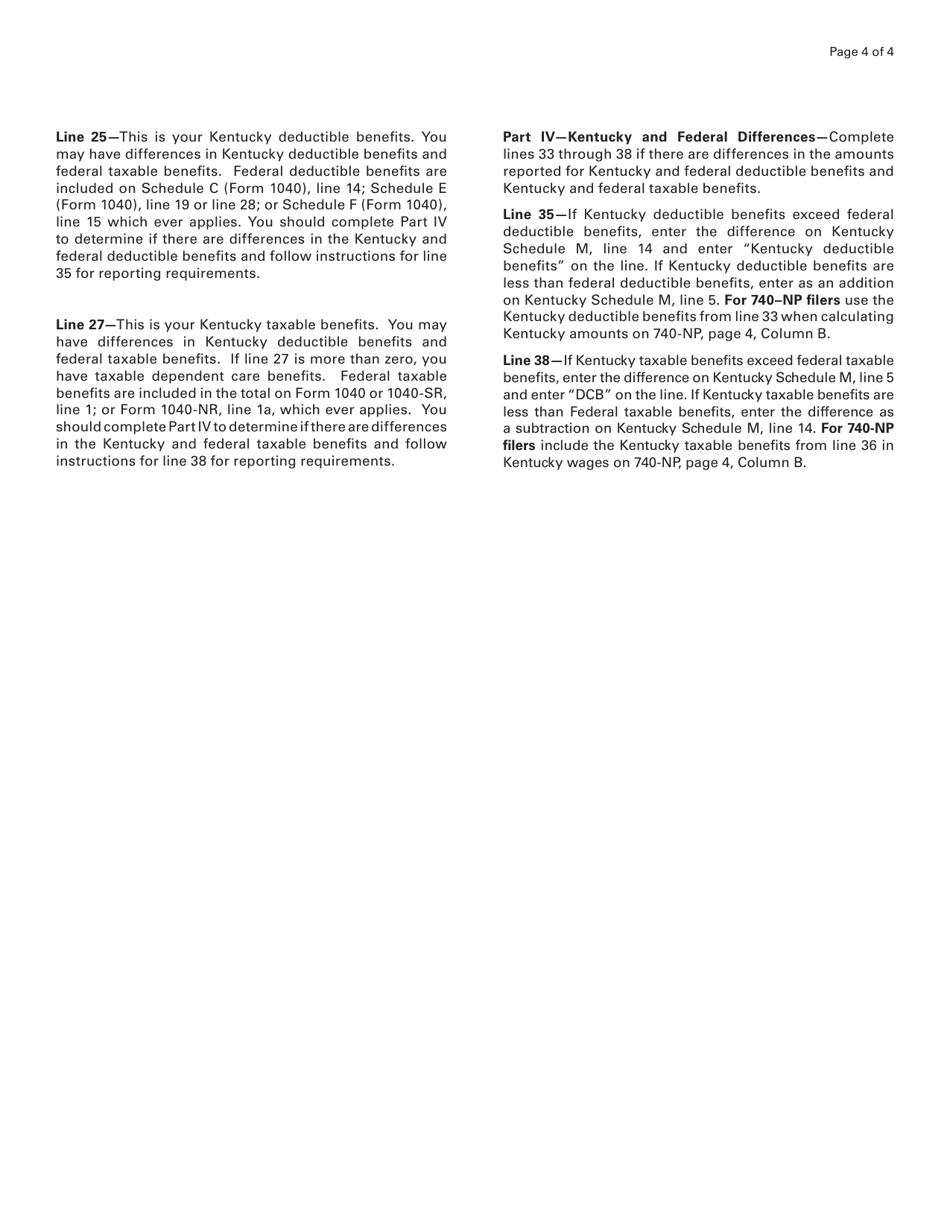

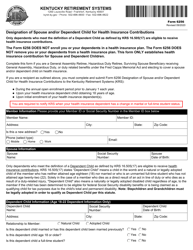

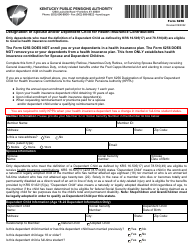

Form 2441-K Kentucky Child and Dependent Care Credit - Kentucky

What Is Form 2441-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2441-K?

A: Form 2441-K is the Kentucky Child and Dependent Care Credit form specifically for residents of Kentucky.

Q: What is the purpose of Form 2441-K?

A: The purpose of Form 2441-K is to claim the child and dependent care credit for expenses incurred in Kentucky.

Q: Who is eligible to file Form 2441-K?

A: Residents of Kentucky who have incurred child and dependent care expenses can file Form 2441-K.

Q: What types of expenses can be claimed on Form 2441-K?

A: Qualified child and dependent care expenses, such as daycare costs, can be claimed on Form 2441-K.

Q: Are there any income limits for claiming the Kentucky Child and Dependent Care Credit?

A: Yes, there are income limits for claiming the credit. Refer to the instructions of Form 2441-K for specific details.

Q: When is the deadline to file Form 2441-K?

A: The deadline to file Form 2441-K typically aligns with the deadline for Kentucky state tax returns, which is usually April 15th.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2441-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.