Tax Credit Templates

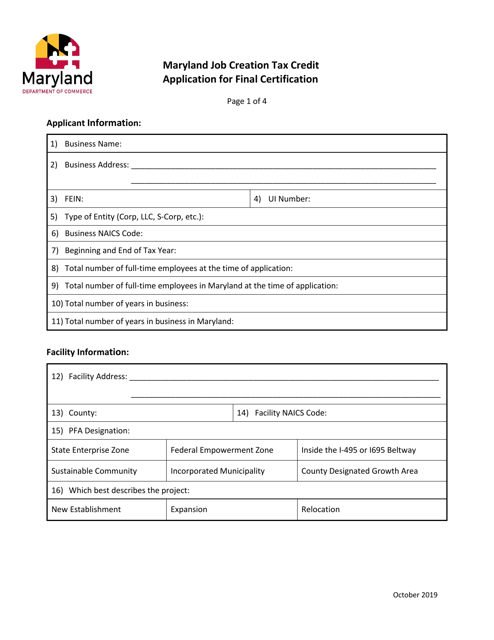

Documents:

3232

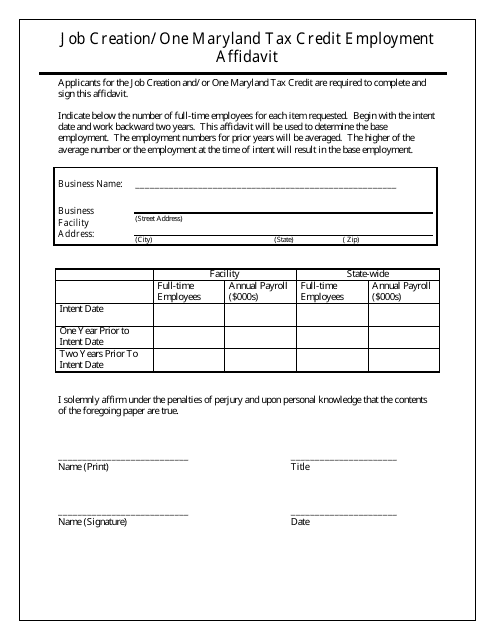

This Form is used for claiming the One Maryland Tax Credit Employment Affidavit, which encourages job creation in Maryland by providing tax credits to businesses that meet certain eligibility criteria.

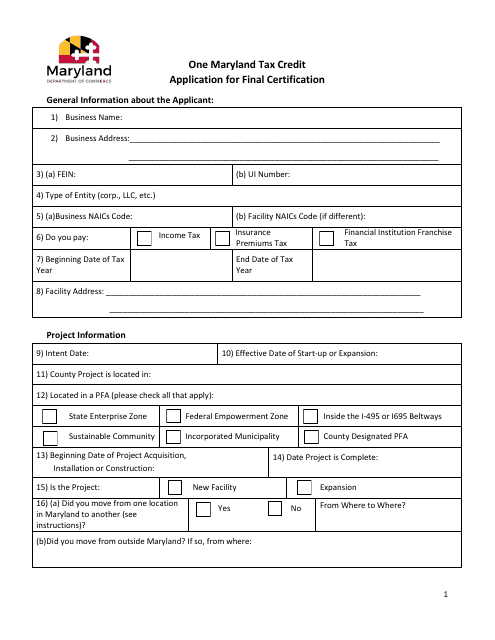

This application is for final certification for the One Maryland Tax Credit in Maryland.

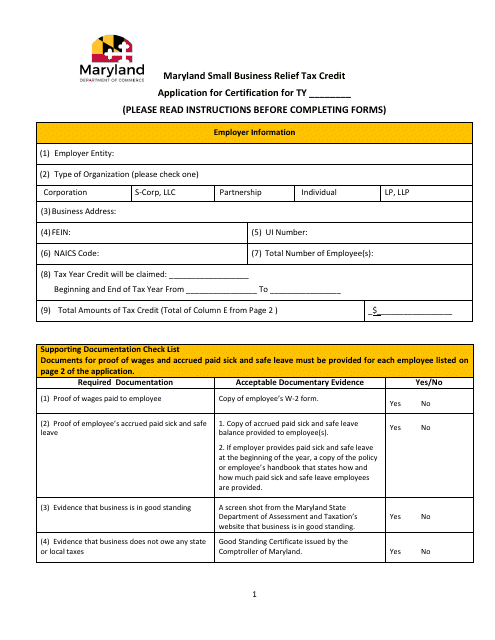

This document is an application for the Maryland Small Business Relief Tax Credit in the state of Maryland. It is used by small businesses to apply for certification and eligibility for the tax credit.

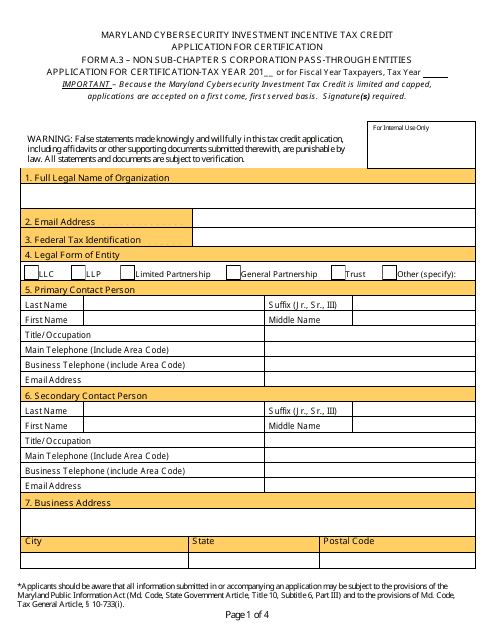

This Form is used for applying for certification as a non Sub-chapter S corporation pass-through entity for the Maryland Cybersecurity Investment Incentive Tax Credit.

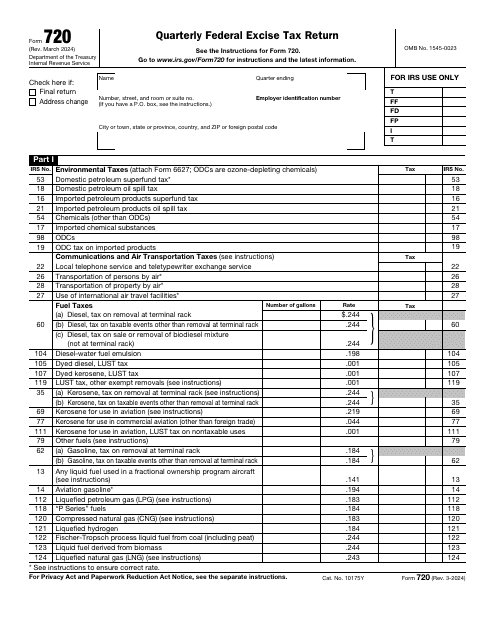

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

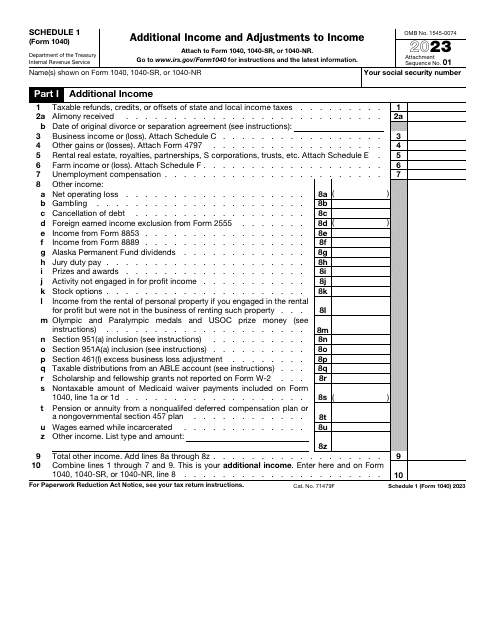

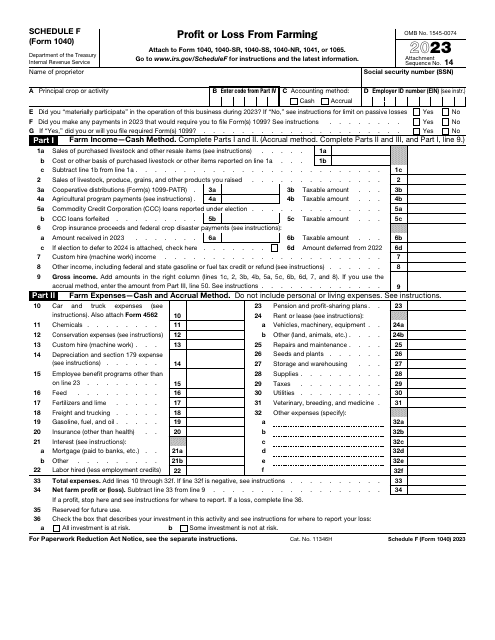

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

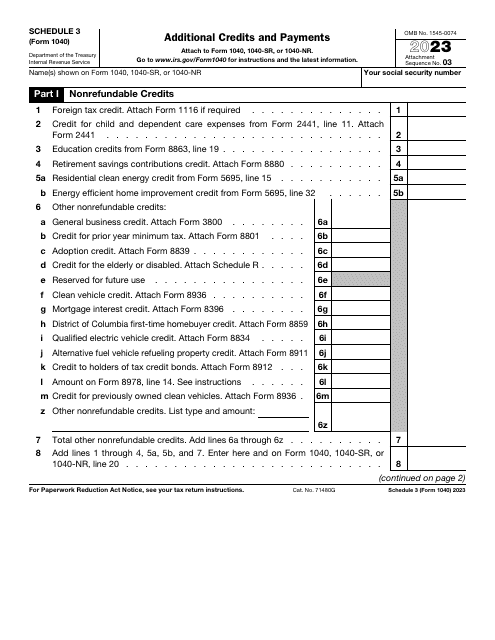

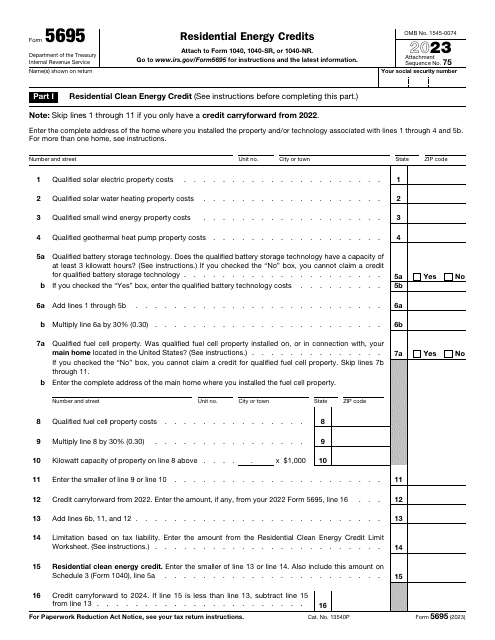

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

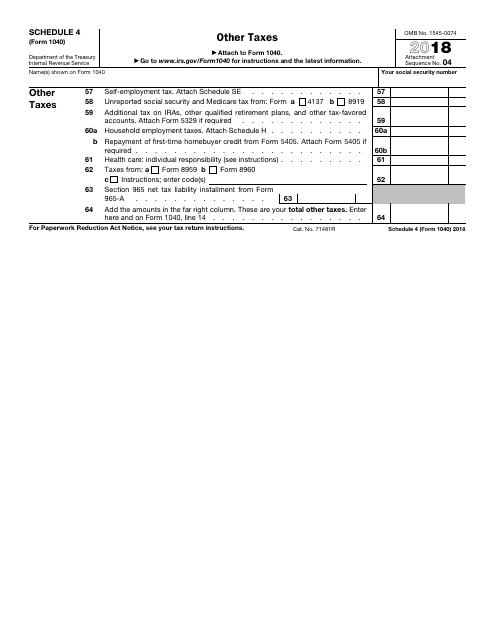

This Form is used for reporting other types of taxes that do not fit on the main IRS Form 1040.

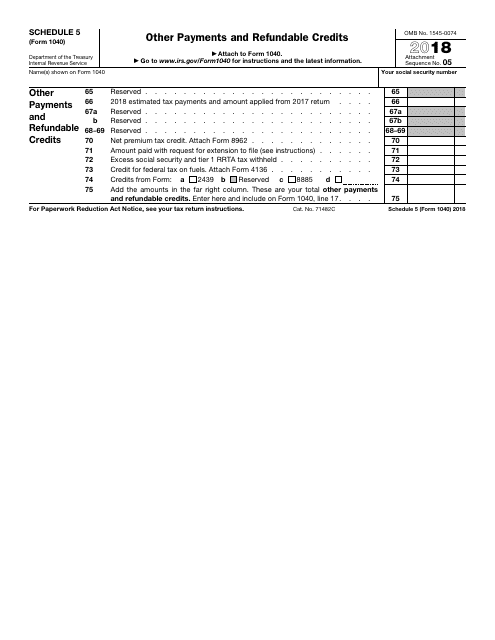

This form is used for reporting other types of payments and refundable credits that are not included in the standard IRS Form 1040.

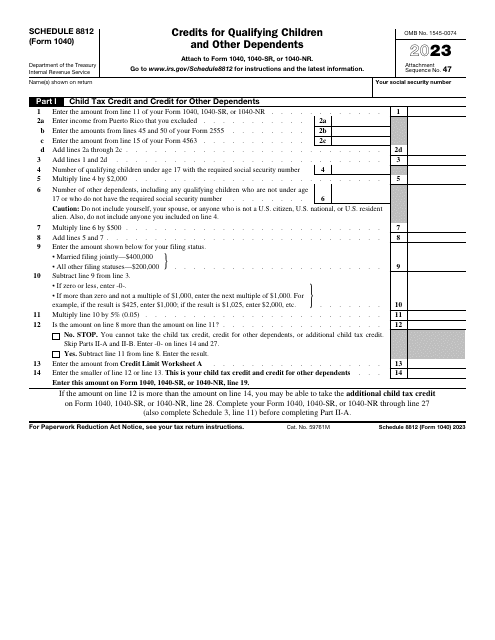

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

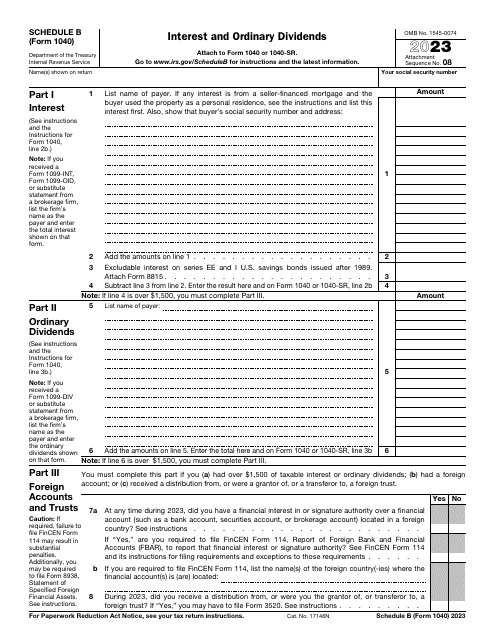

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

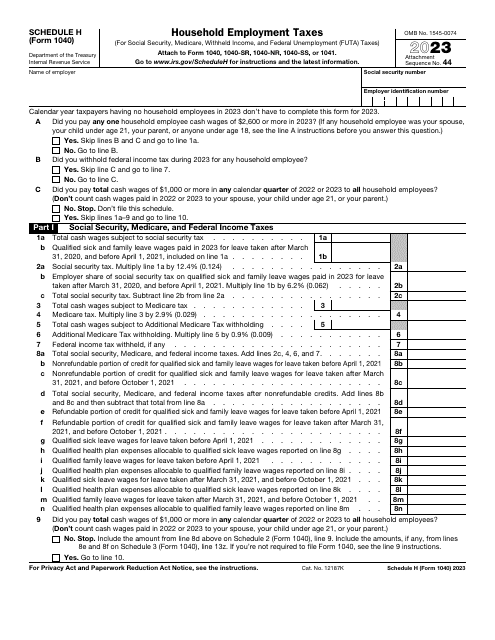

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

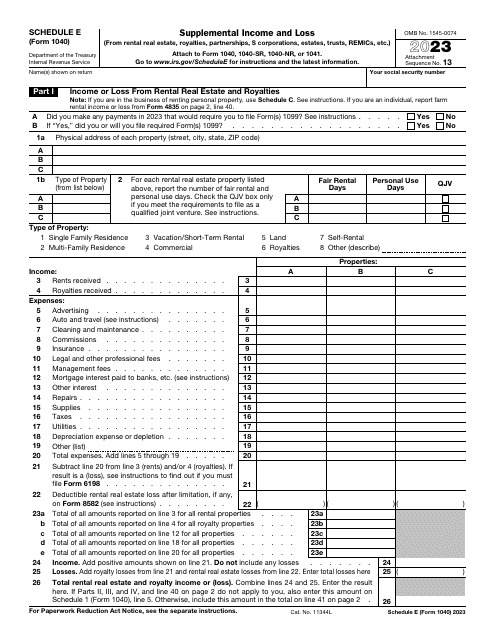

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

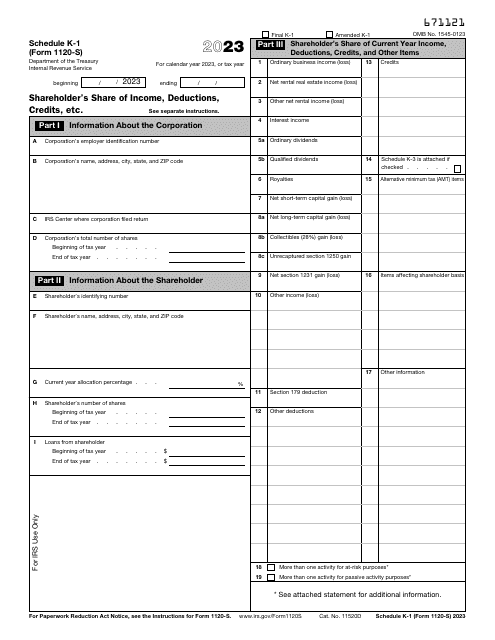

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

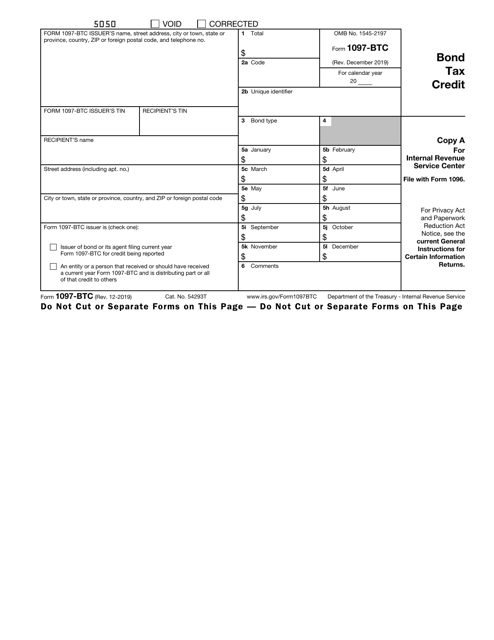

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

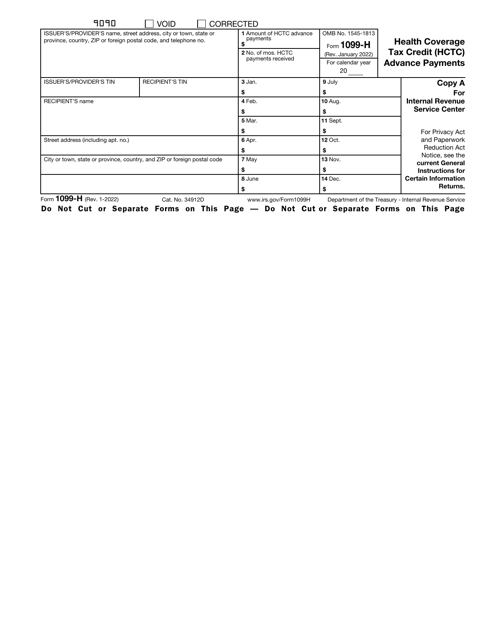

This is an IRS document released for those individuals who got payments during the calendar year of qualified health insurance payments for the benefit of eligible trade adjustment assistance.

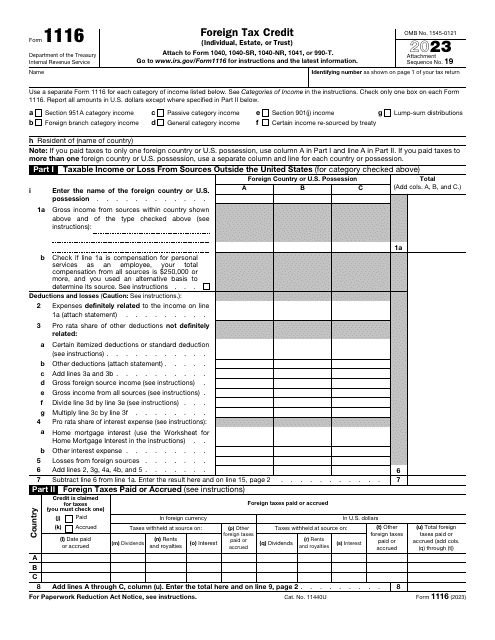

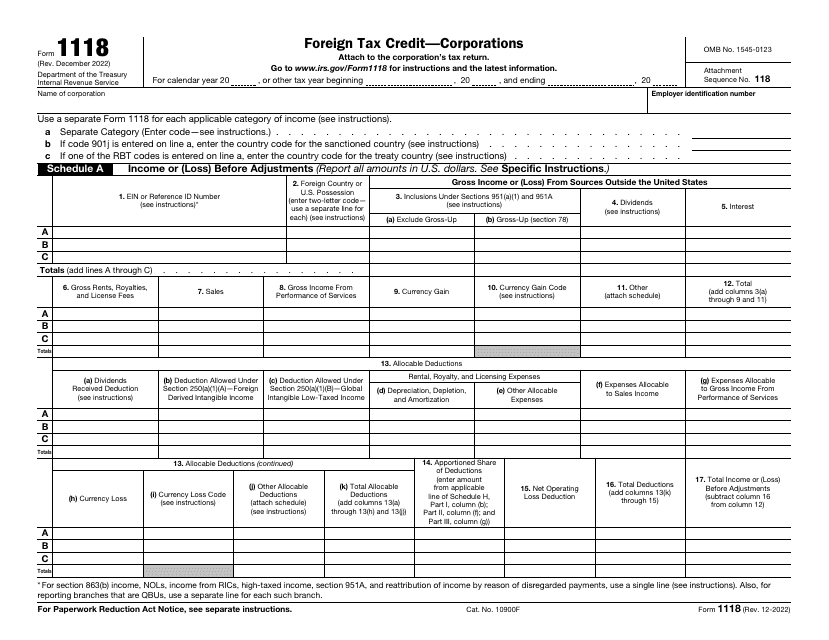

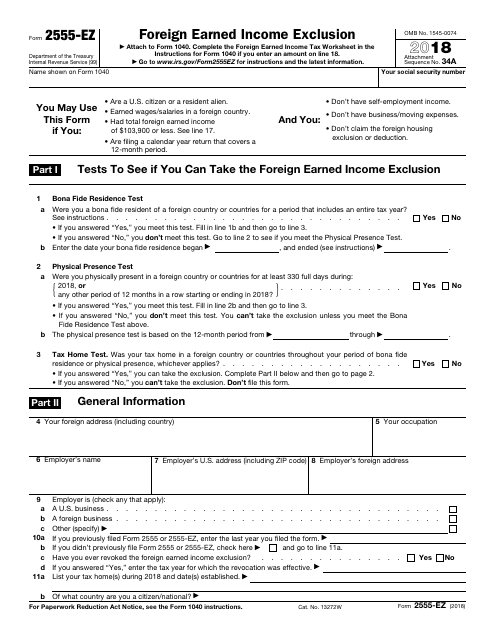

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

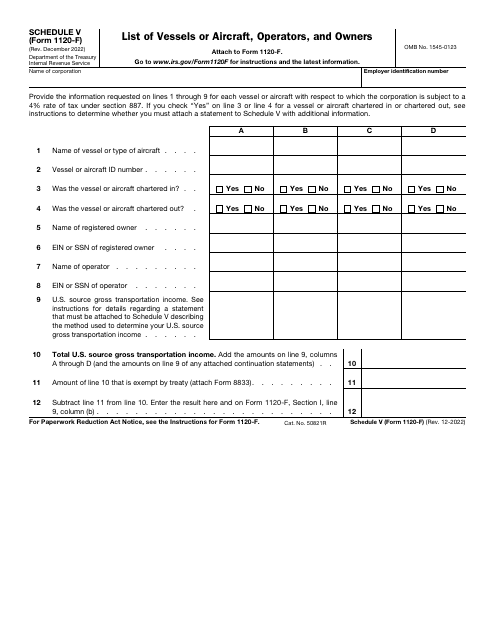

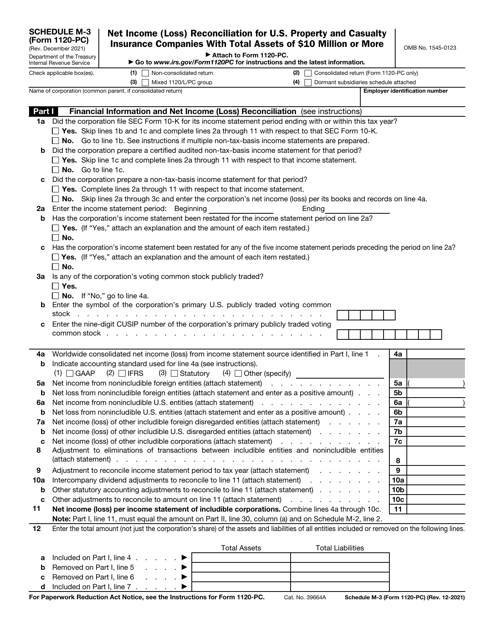

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

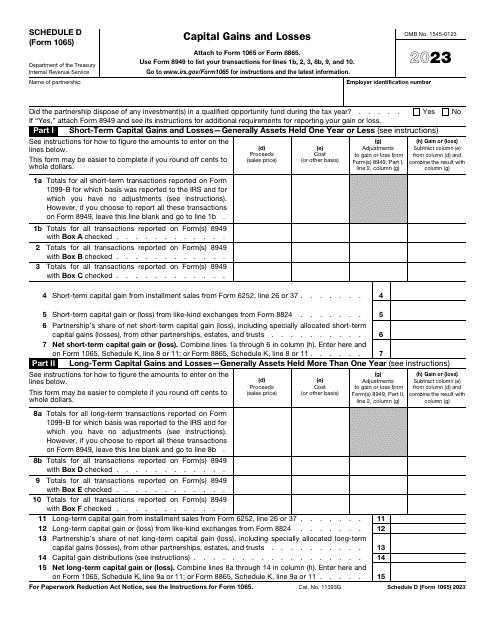

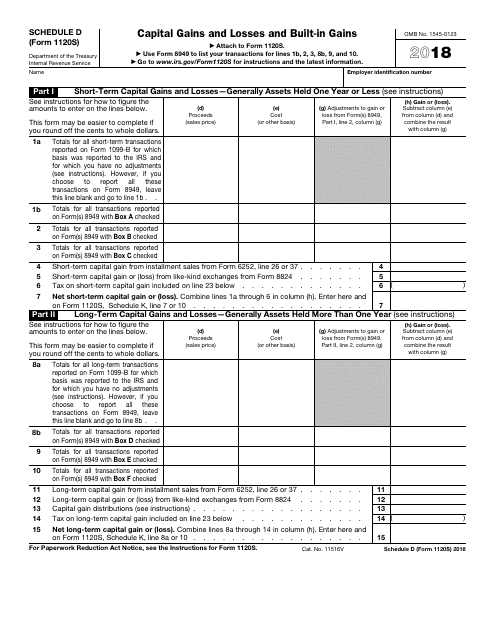

This document provides a schedule for reporting capital gains and losses, as well as built-in gains, on IRS Form 1120S. It is used by S corporations to report these financial transactions to the IRS.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

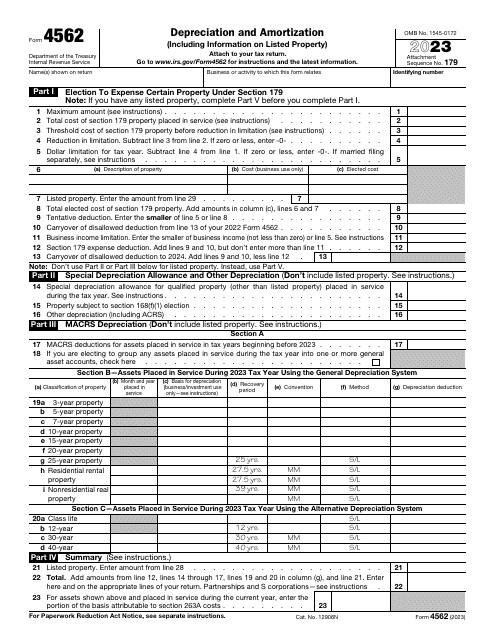

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

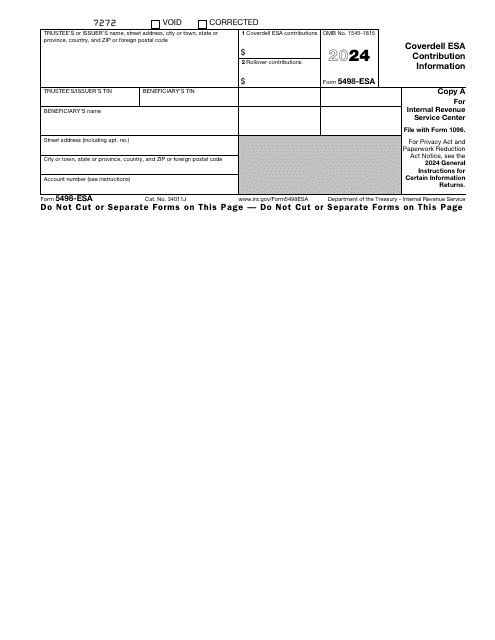

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.