Tax Credit Templates

Documents:

3232

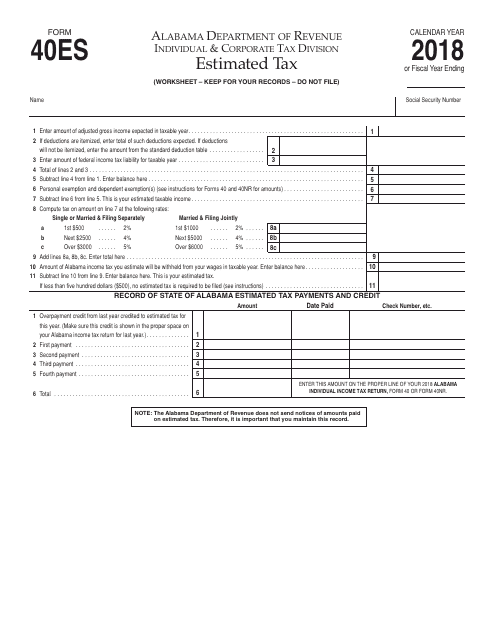

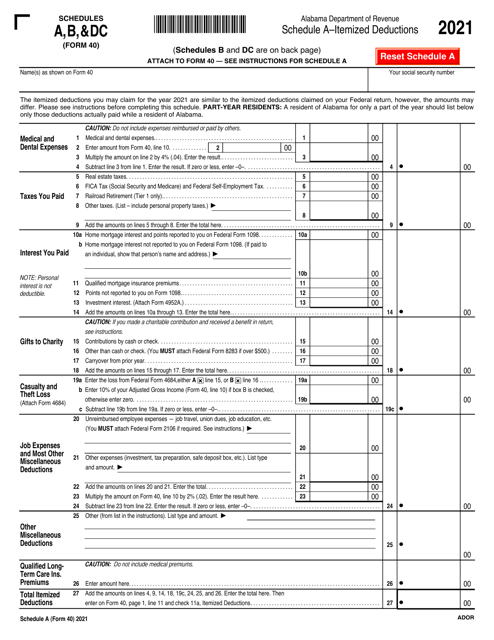

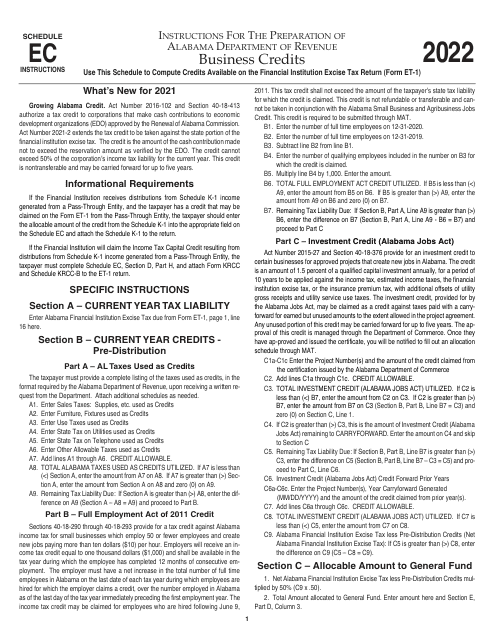

This form is used for individuals in Alabama to report and pay estimated taxes.

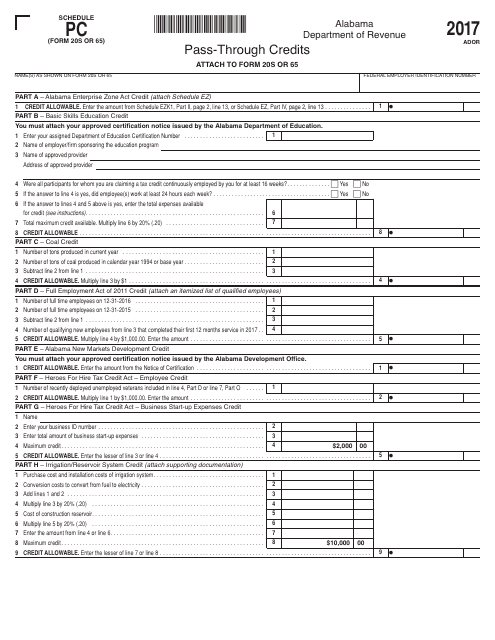

This form is used for reporting pass-through credits on Alabama Schedule PC for partnerships and S corporations.

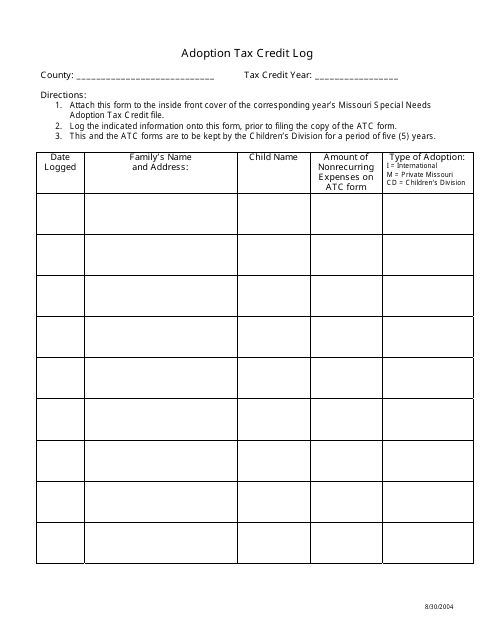

This form is used for tracking adoption tax credits in the state of Missouri. It provides a log to record expenses related to the adoption process for claiming tax credits.

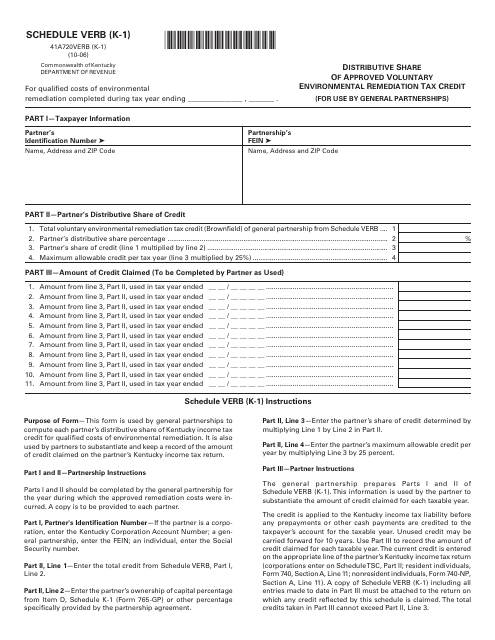

This form is used for reporting the distributive share of the approved voluntary environmental remediation tax credit in Kentucky for partnerships and limited liability companies (LLCs) filing as partnerships.

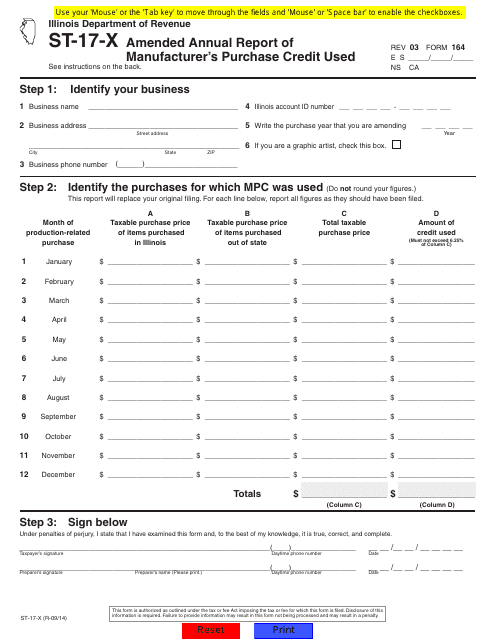

This form is used for filing an amended annual report of a manufacturer's purchase credit used in the state of Illinois.

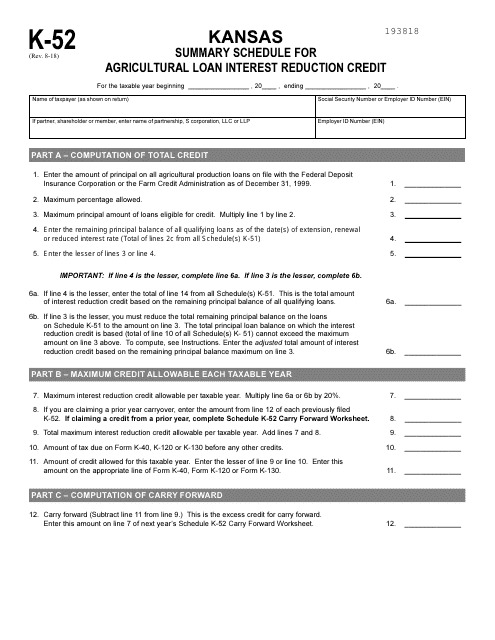

This type of document is used for providing a summary of the agricultural loan interest reduction credit in the state of Kansas. It is used by individuals or businesses who are claiming this credit on their tax return.

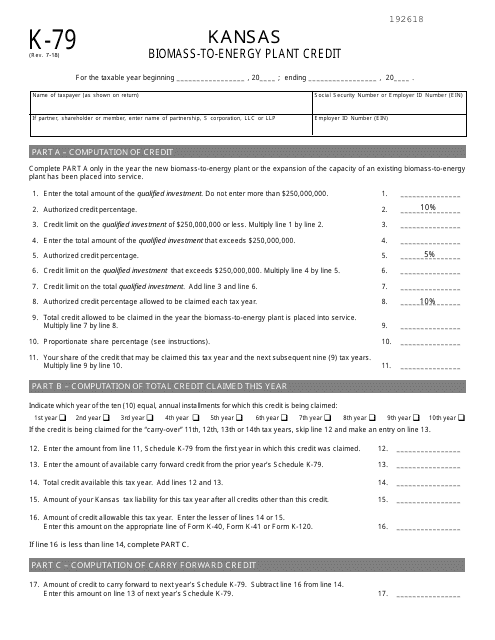

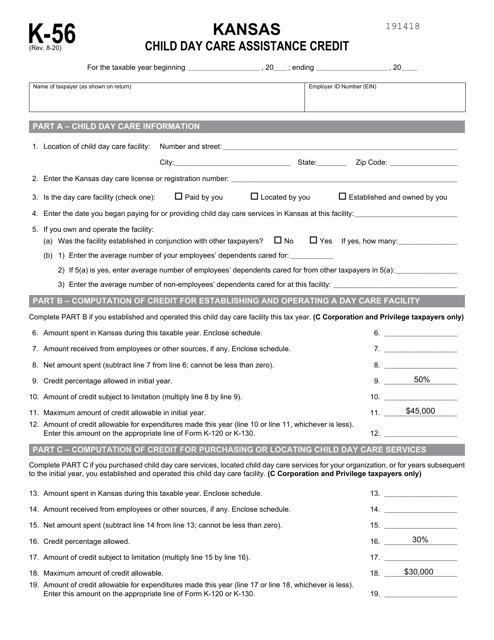

This form is used for claiming the Biomass-To-Energy Plant Credit in the state of Kansas. It allows businesses that operate biomass-to-energy plants to receive a tax credit for the energy generated from biomass sources.

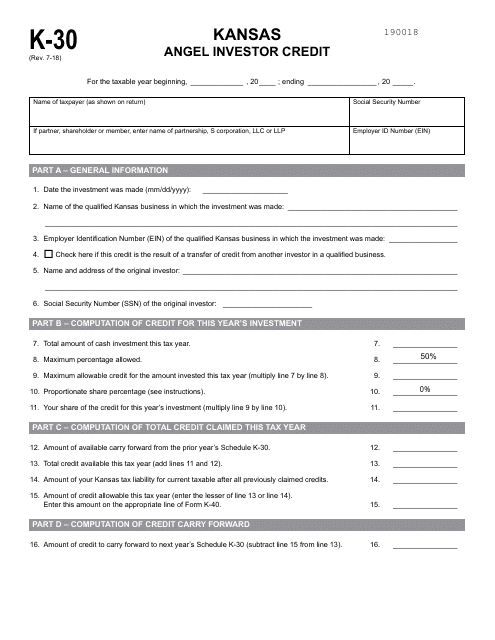

This form is used for claiming the Angel Investor Credit in Kansas. It helps individuals and businesses who invest in qualified Kansas businesses to claim a tax credit.

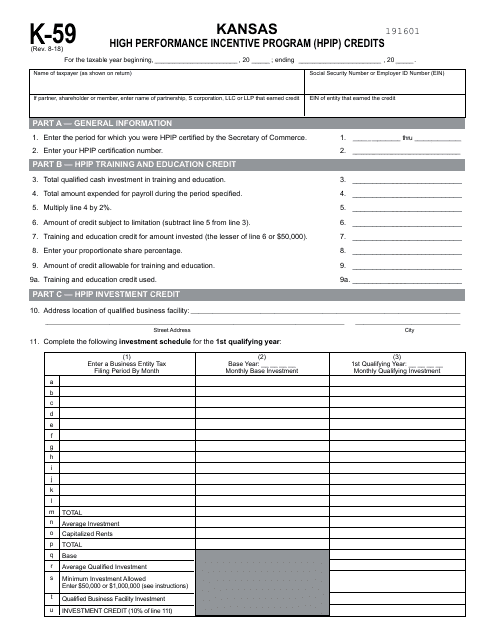

This form is used for claiming Kansas High Performance Incentive Program (HPIP) credits in the state of Kansas.

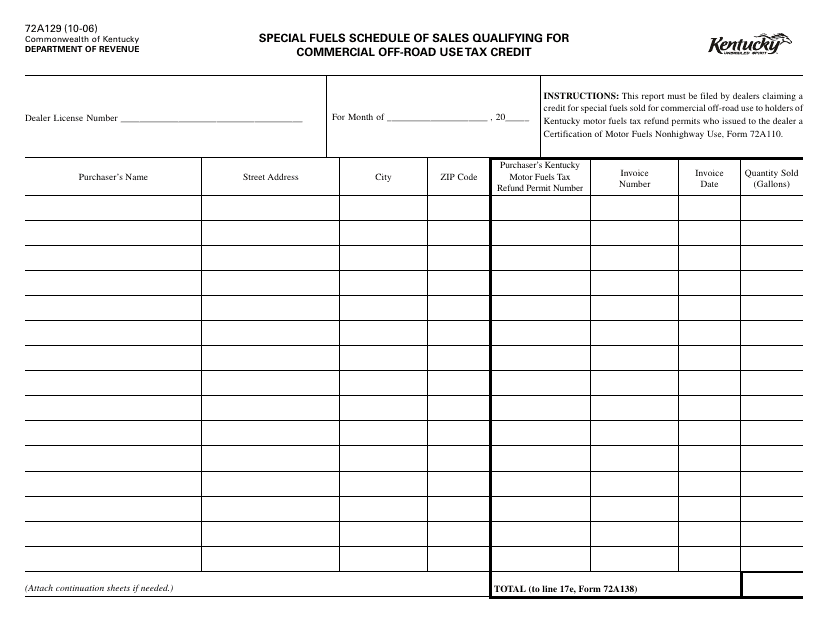

This Form is used for reporting sales of special fuels that qualify for the commercial off-road use tax credit in Kentucky.

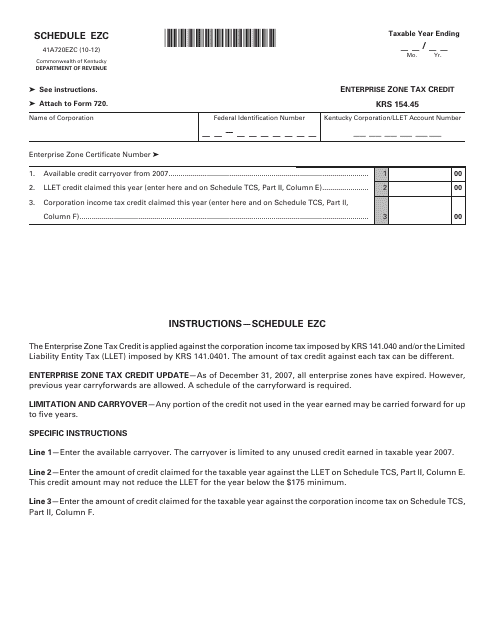

This form is used for claiming the Enterprise Zone tax credit in Kentucky.

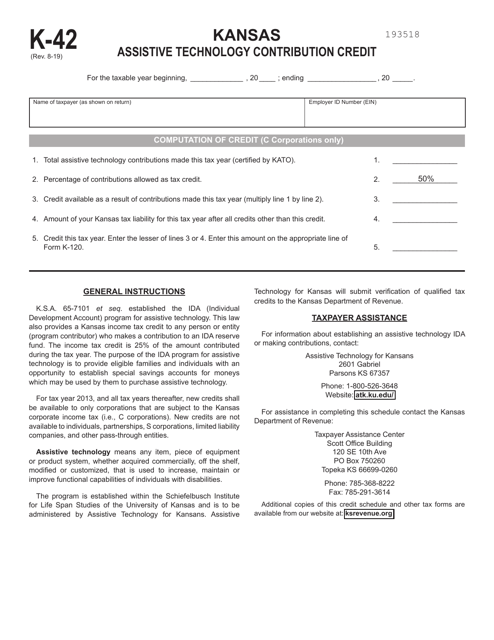

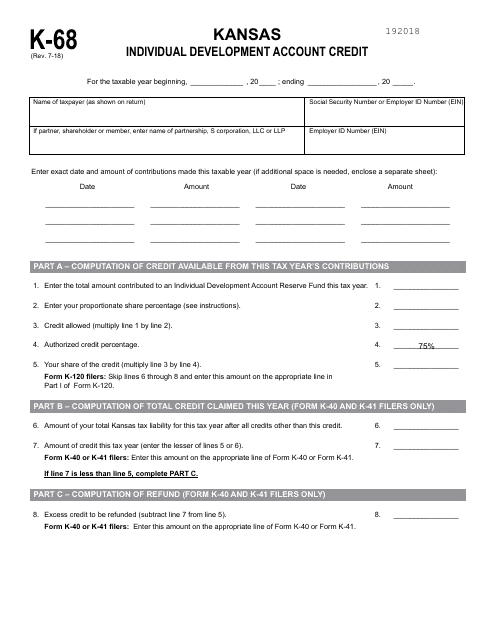

This form is used for claiming the Kansas Individual Development Account Credit.

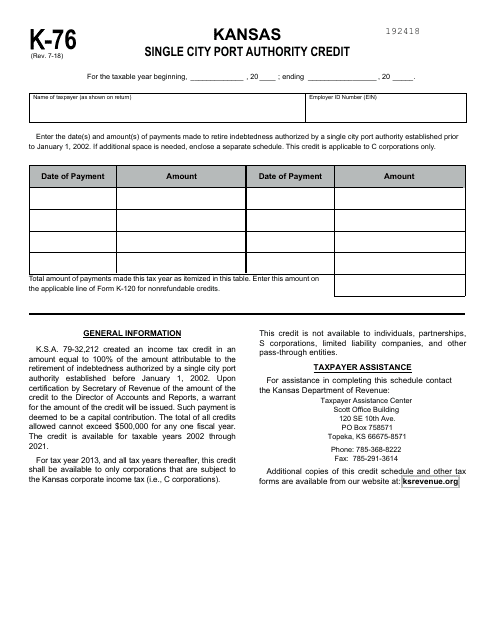

This Form is used for claiming a tax credit related to the operations of a single city port authority in Kansas.

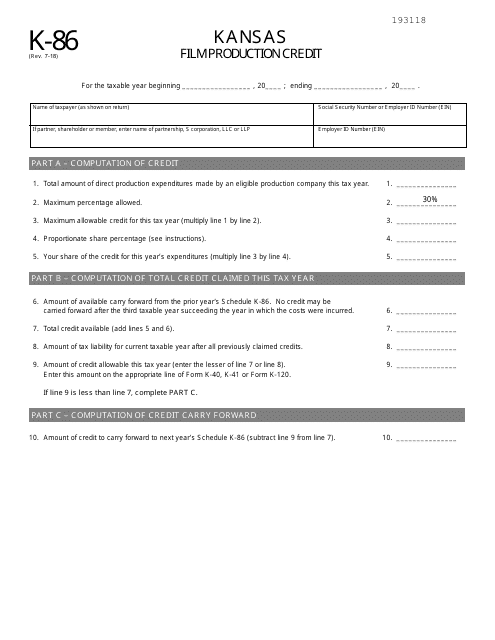

This Form is used to claim the Film Production Credit in the state of Kansas. It allows eligible film production companies to receive a tax credit for qualified production expenses incurred in Kansas.

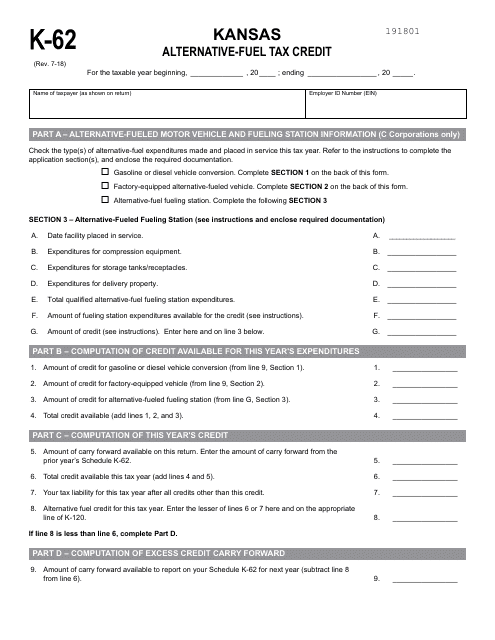

This Form is used for claiming the Alternative-Fuel Tax Credit in the state of Kansas.

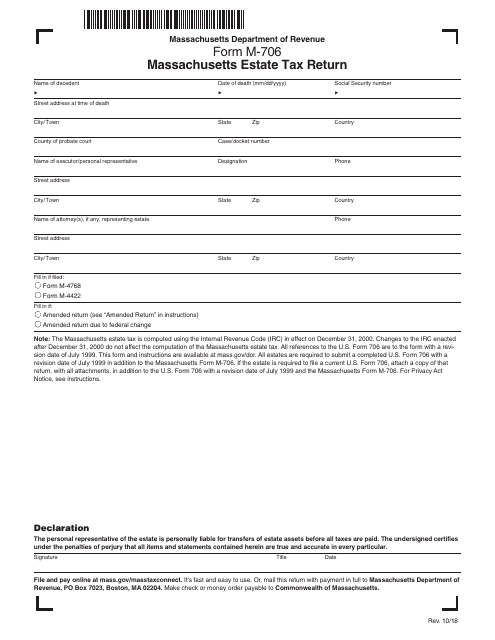

This form is used for filing an estate tax return in the state of Massachusetts.

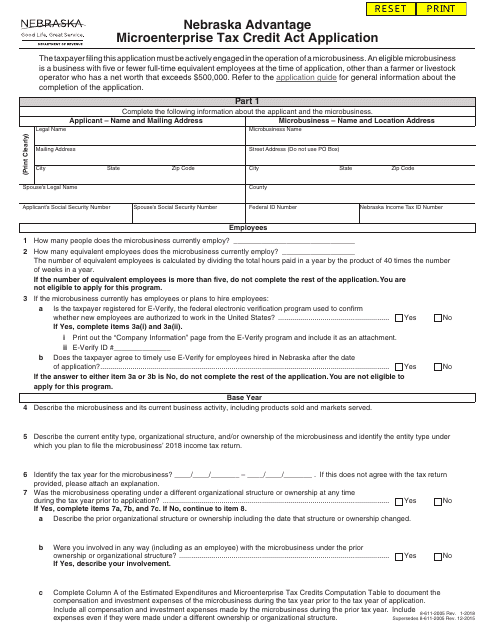

This form is used for applying for the Nebraska Advantage Microenterprise Tax Credit Act in Nebraska. It provides tax credits for small businesses in the state.

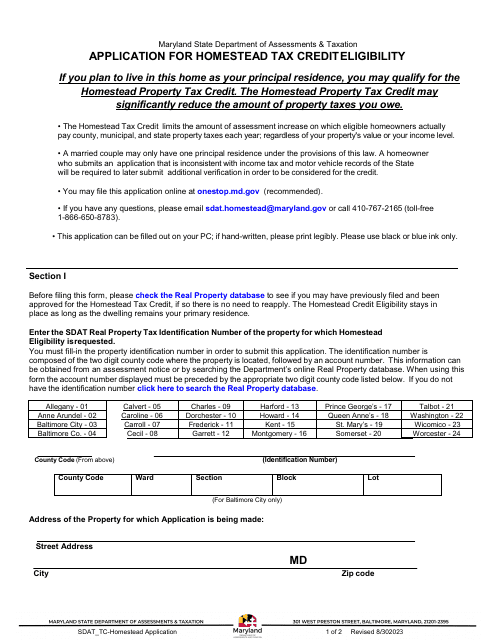

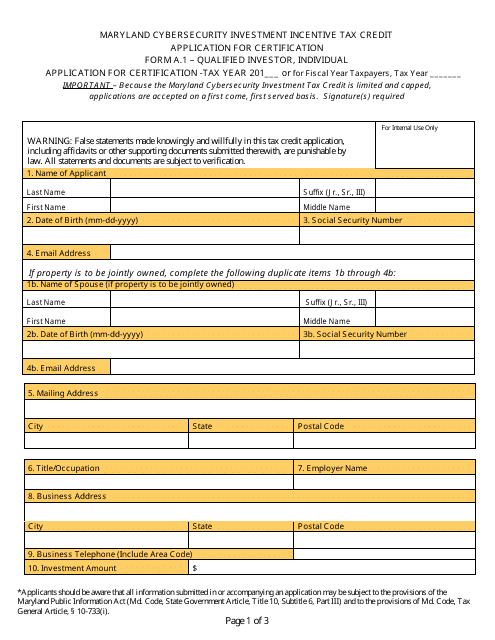

This Form is used for individuals in Maryland to apply for certification as a qualified investor for the Maryland Cybersecurity Investment Incentive Tax Credit.

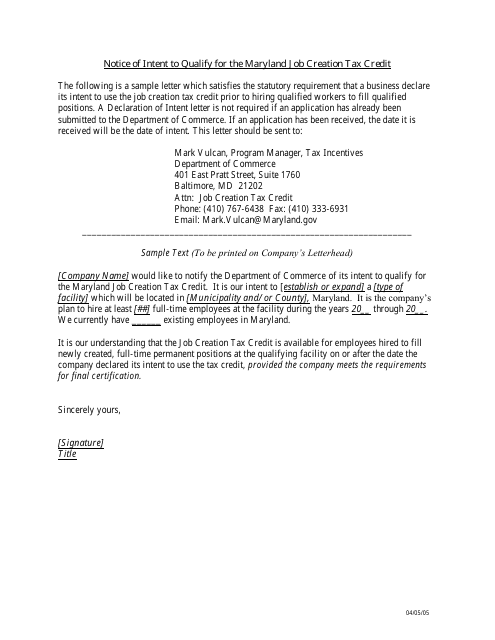

This document is used to notify the state of Maryland of your intent to qualify for the Job Creation Tax Credit.

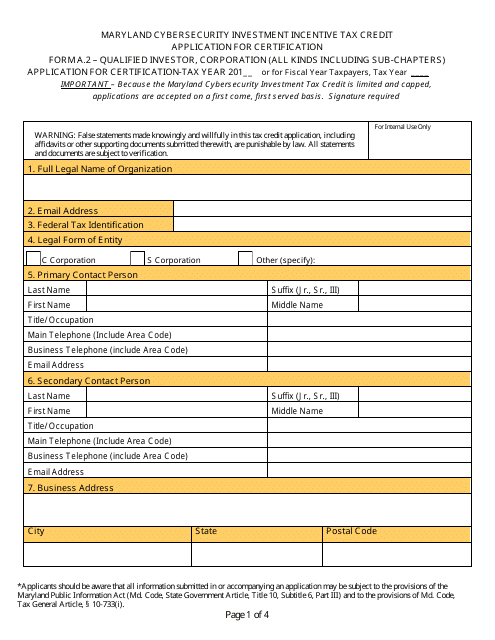

This Form is used for applying for certification as a qualified investor corporation in order to receive the Maryland Cybersecurity Investment Incentive Tax Credit.

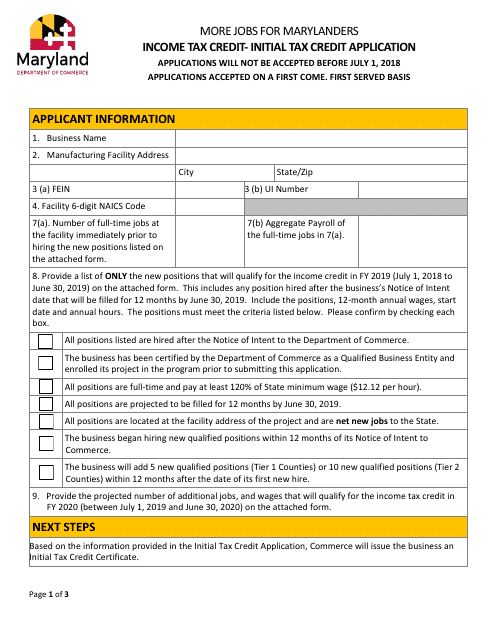

This Form is used for applying for the Initial Tax Credit in Maryland.

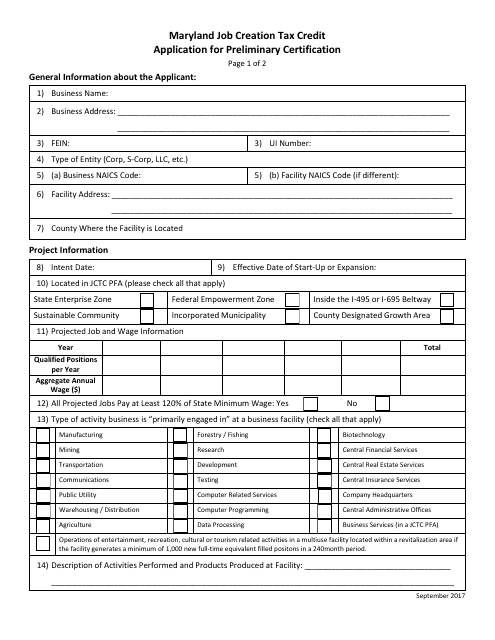

This form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit in Maryland.