Tax Credit Templates

Documents:

3232

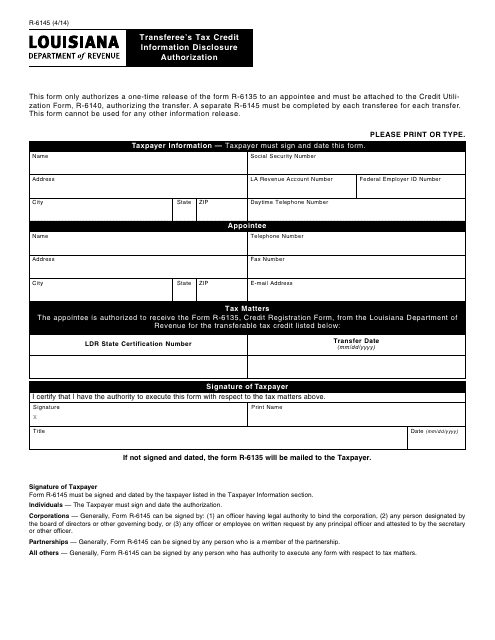

This form is used for requesting authorization to disclose tax credit information for the transferee in Louisiana.

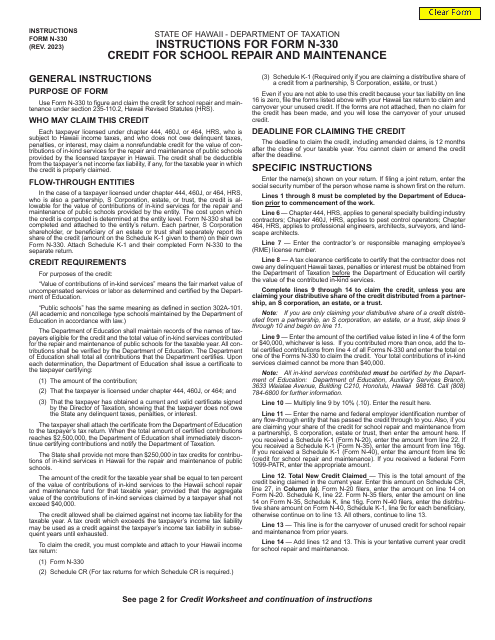

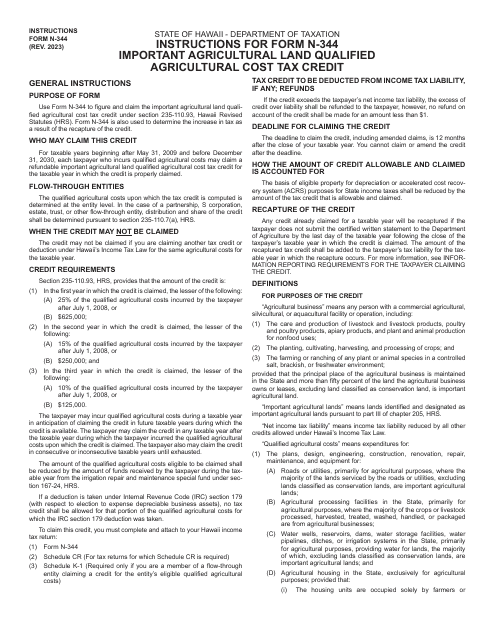

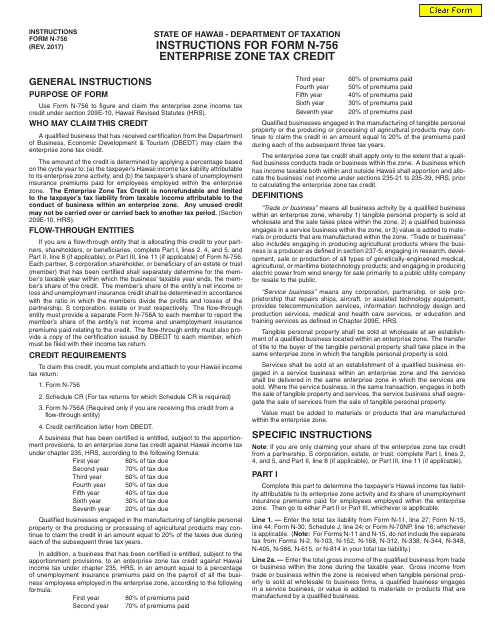

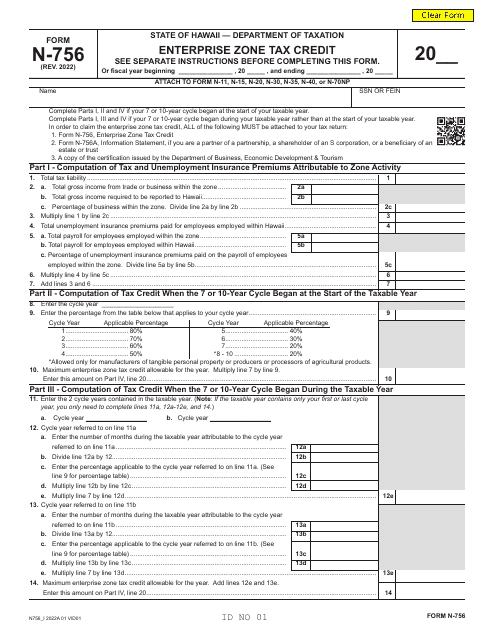

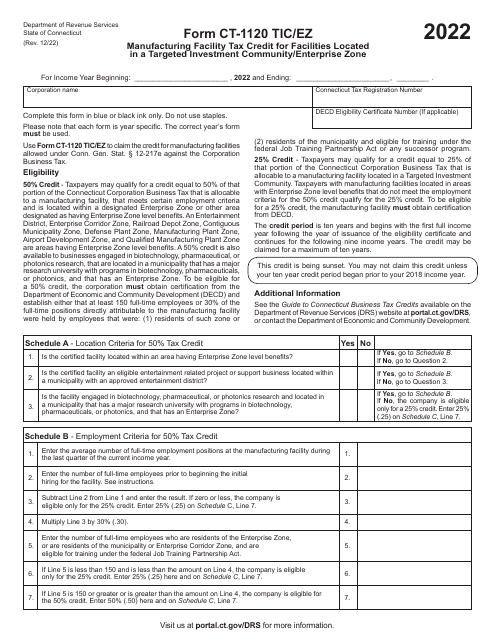

This form is used for claiming the Enterprise Zone Tax Credit in Hawaii. It provides instructions on how to accurately fill out the form and submit it to the appropriate authorities.

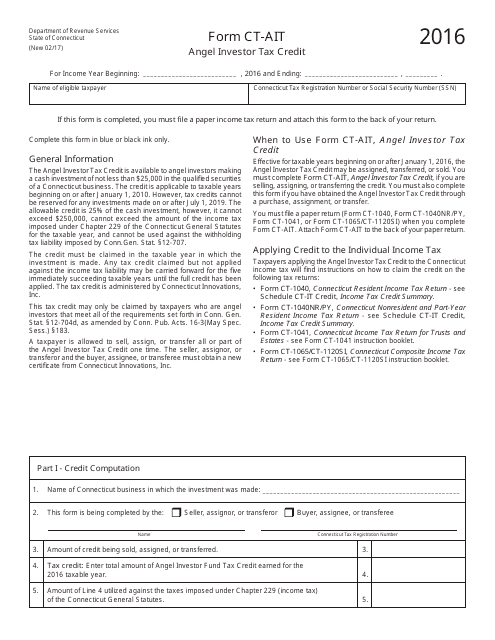

This form is used for claiming the Angel Investor Tax Credit in the state of Connecticut.

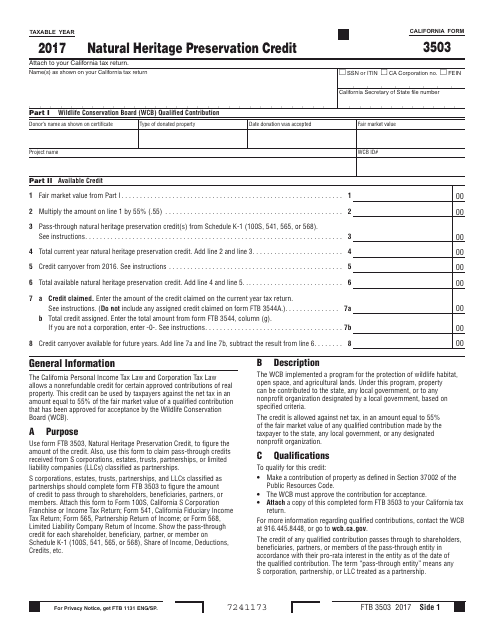

This form is used for claiming the Natural Heritage Preservation Credit in California. It allows individuals or businesses to receive a tax credit for contributing to the preservation of natural heritage sites in the state.

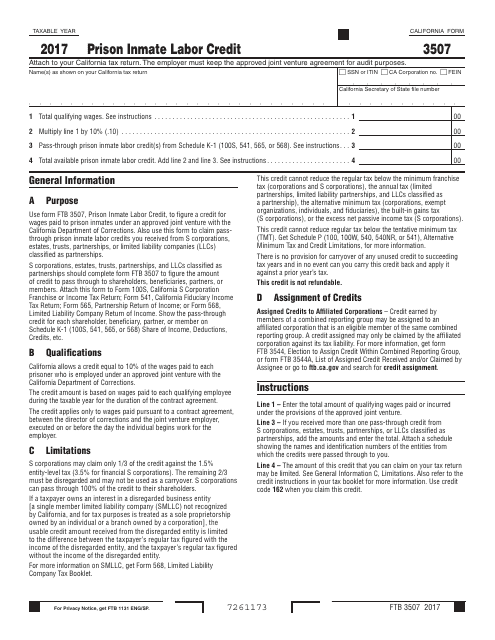

This form is used for claiming the Prison Inmate Labor Credit in California.

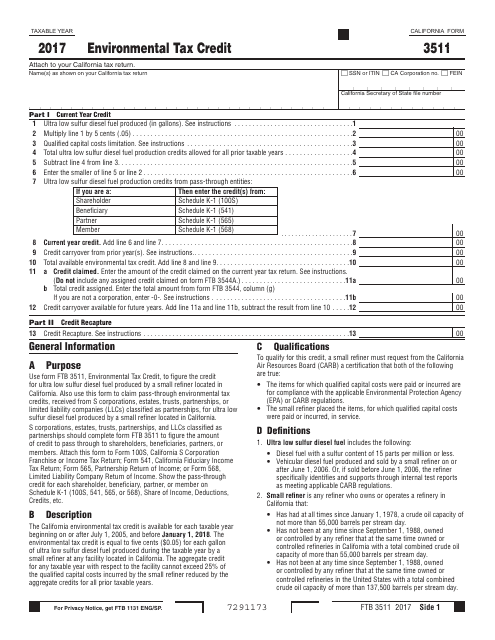

This Form is used for claiming the Environmental Tax Credit in the state of California.

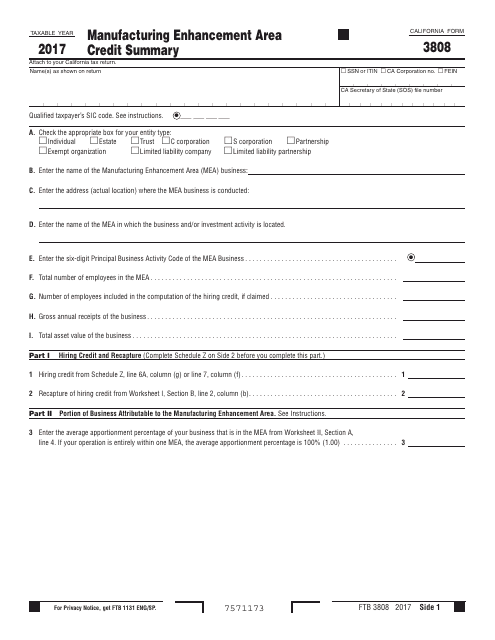

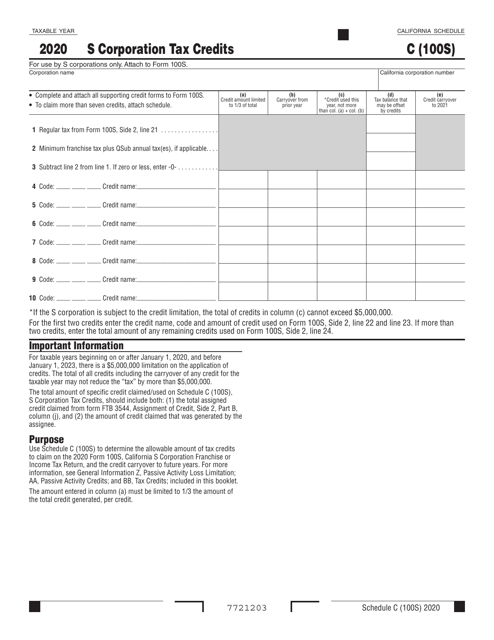

This form is used for summarizing the manufacturing enhancement area credits in California.

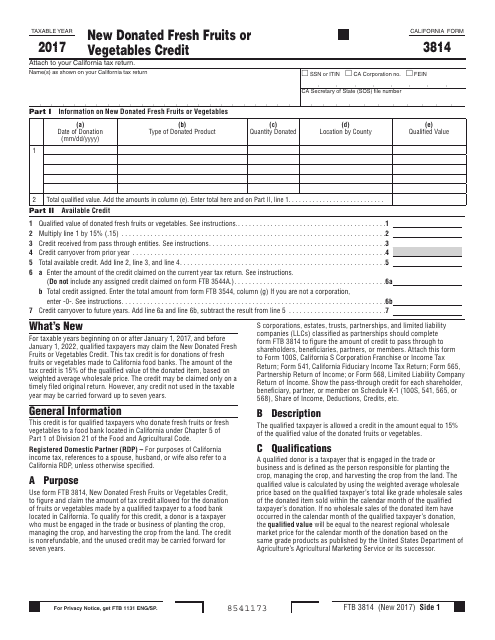

This form is used for claiming the New Donated Fresh Fruits or Vegetables Credit in California. It allows individuals or businesses to receive tax credits for donating fresh fruits or vegetables to California food banks or charitable organizations.

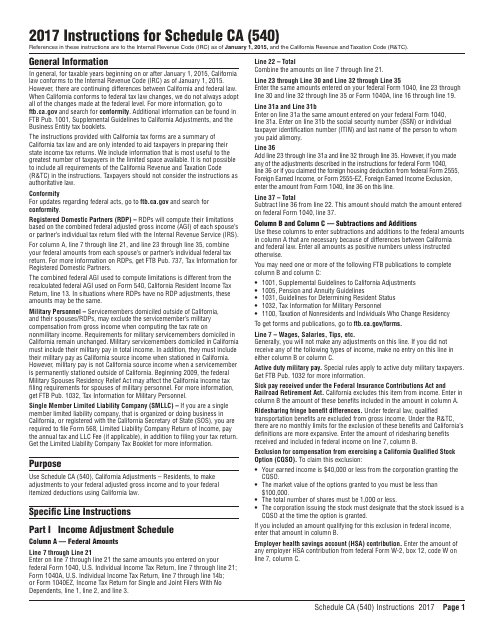

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

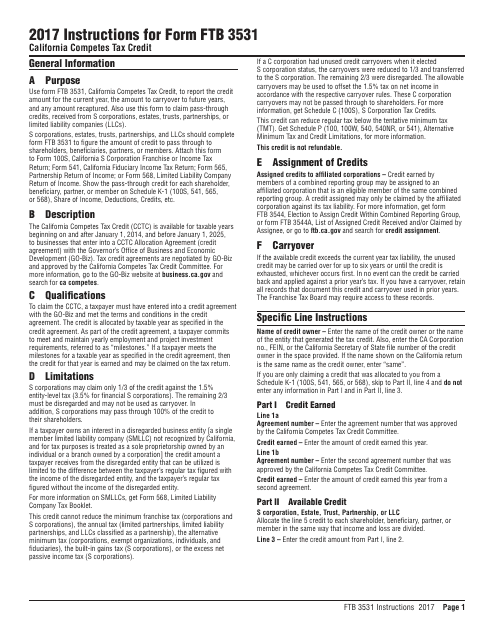

This document provides instructions on how to complete Form FTB3531, which is used to claim the California Competes Tax Credit in California. It guides taxpayers on what information to include and how to calculate their credit amount.

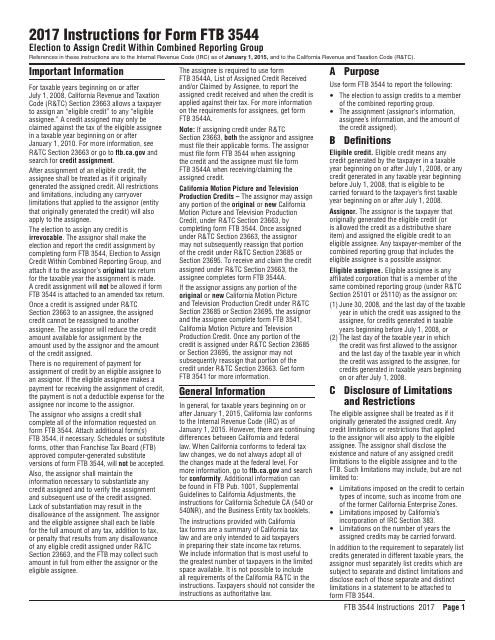

This Form is used for making an election to assign credit within a combined reporting group in California. The form provides instructions on how to complete the election process.

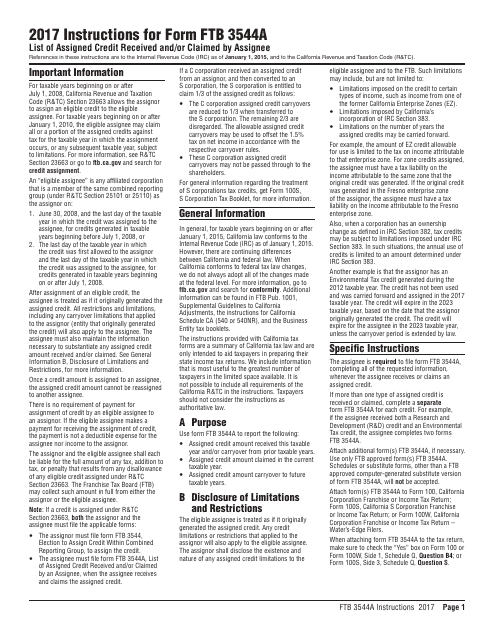

This Form is used for listing the assigned credits received and/or claimed by an assignee in California. It provides instructions on how to properly fill out the form to report the assigned credits.

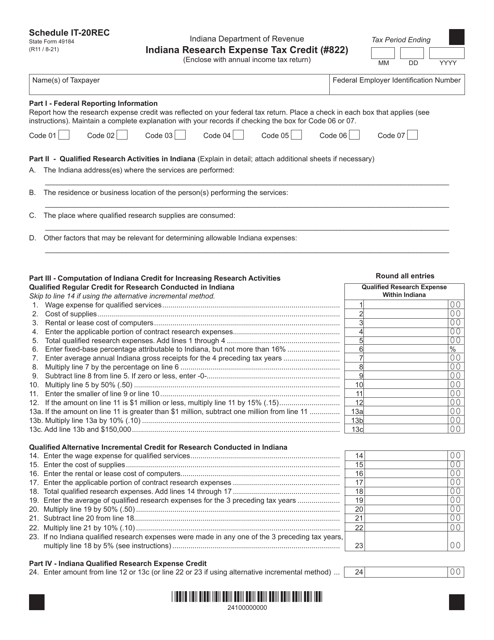

This form is used for explaining the adjustments made on Schedule E-1 in the state of Indiana.

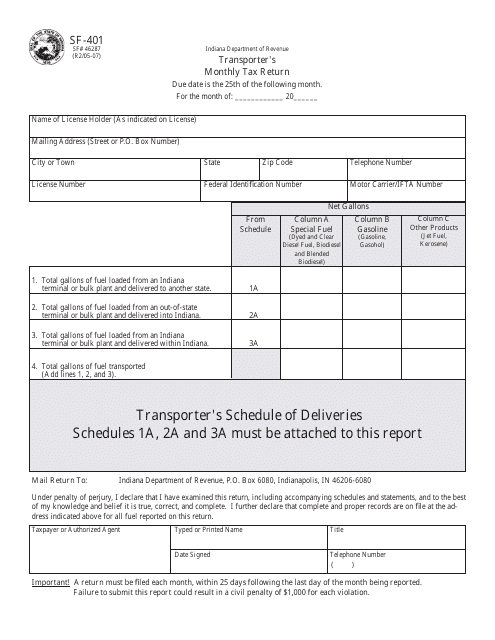

This document is used for reporting and submitting monthly taxes for transporters in the state of Indiana.

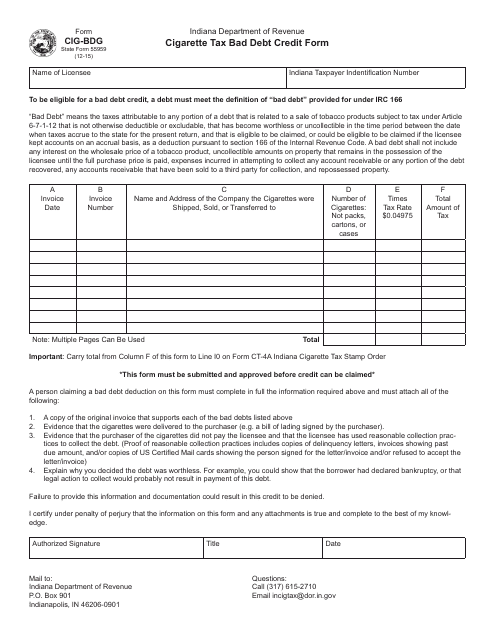

This form is used for claiming a bad debt credit related to cigarette taxes in Indiana.

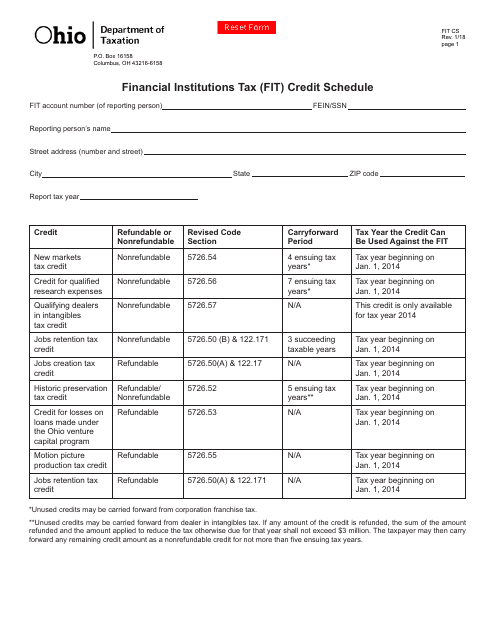

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

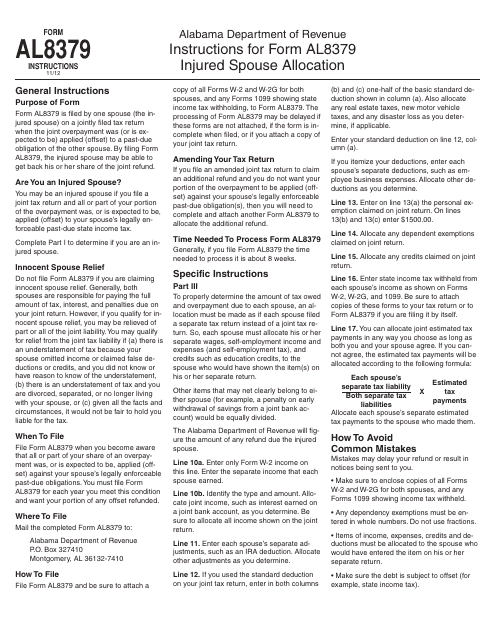

This Form is used for allocating the income and tax liability of a joint tax return when one spouse has outstanding debts or obligations. It is specifically for residents of Alabama.

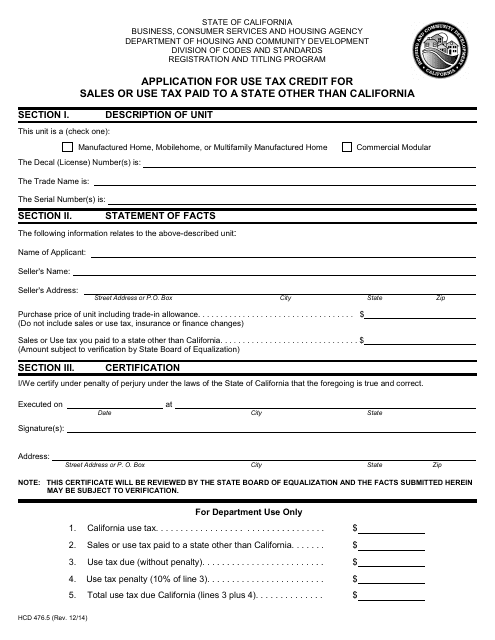

This Form is used for applying for a use tax credit in California when sales or use tax has been paid to a state other than California.

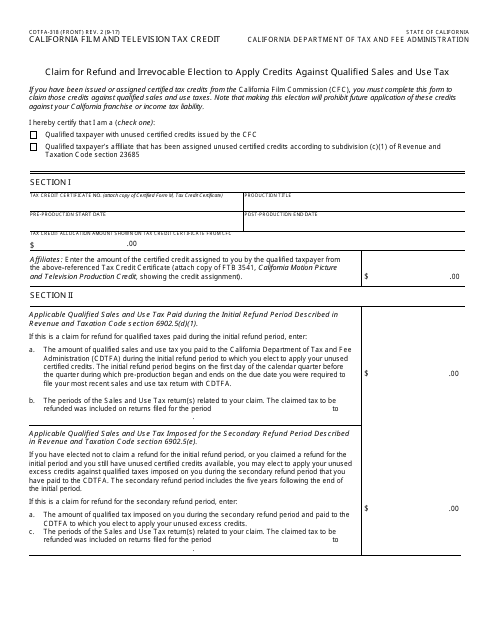

This form is used for applying for the California Film and Television Tax Credit in California.

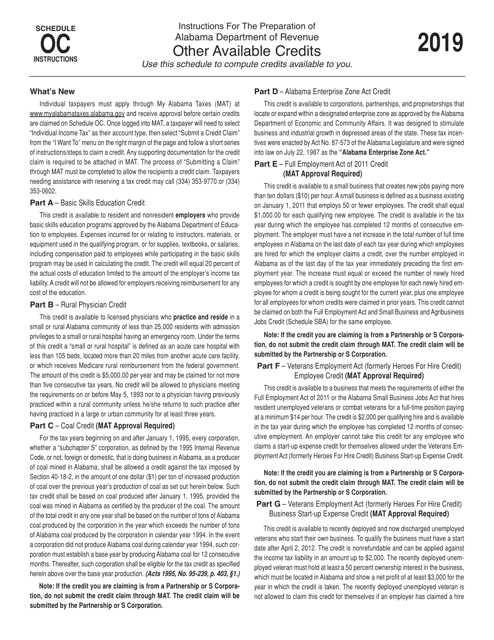

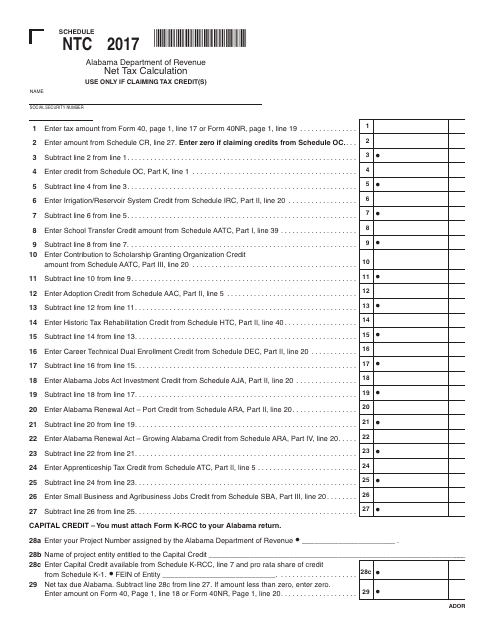

This document is used for calculating the net tax in Alabama using Schedule NTC.