Tax Credit Templates

Documents:

3232

This is a document you may use to figure out how to properly complete IRS Form 6765

This Form is used for reporting information related to tax credit bonds and specified tax credit bonds to the IRS. It provides instructions for completing the IRS Form 8038-TC.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

This Form is used for claiming the Credit for Oil and Gas Production From Marginal Wells. It provides instructions on how to fill out and submit the form to the Internal Revenue Service (IRS).

This document provides information on the tax incentives available for businesses that provide accessibility accommodations for individuals with disabilities. It outlines the potential tax benefits and requirements for businesses to qualify for these incentives.

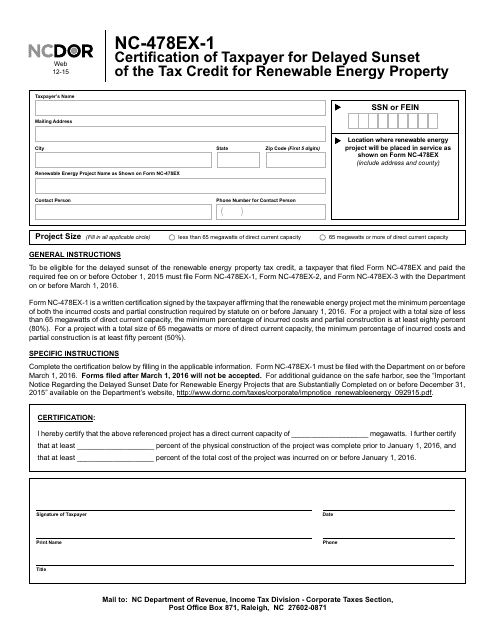

This Form is used for certifying taxpayers in North Carolina who are claiming the delayed sunset of the tax credit for renewable energy property.

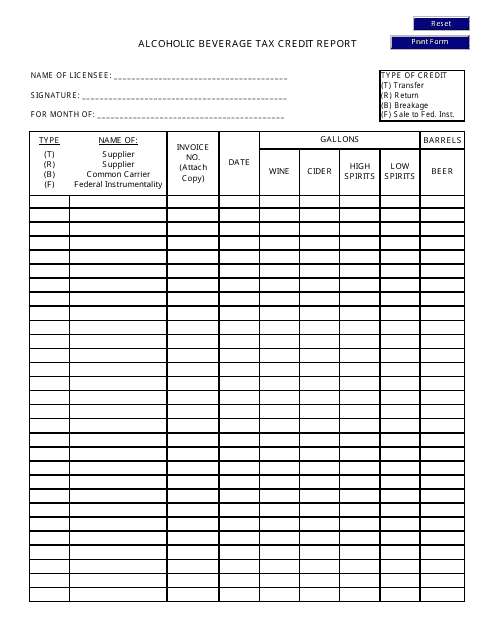

This document is used for reporting and claiming the alcoholic beverage tax credit in the state of Delaware.