Tax Credit Templates

Documents:

3232

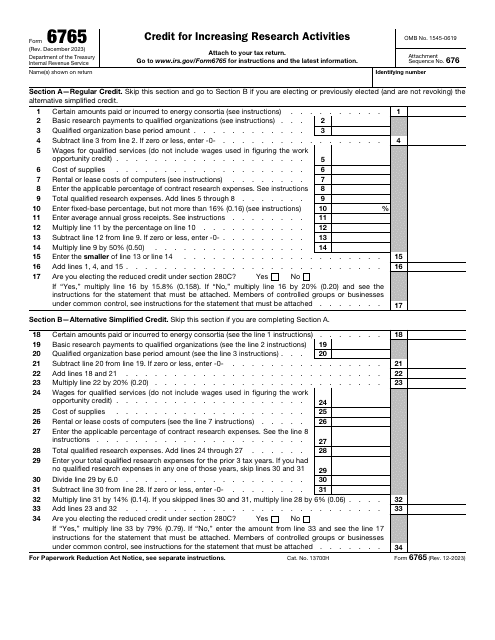

This is a document you may use to figure out how to properly complete IRS Form 6765

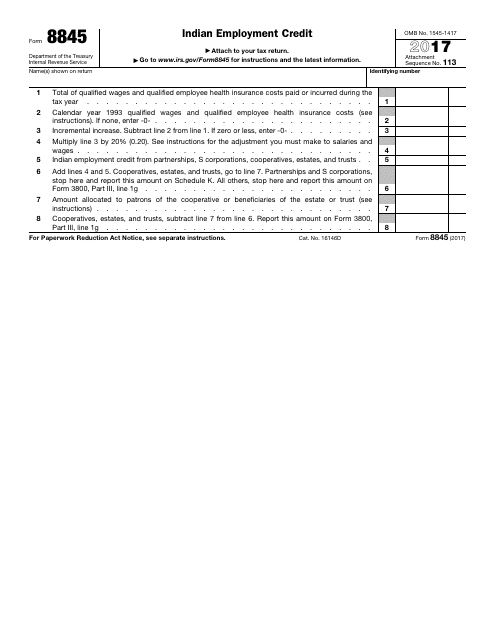

This Form is used for claiming the Indian Employment Credit, which provides tax incentives to businesses that hire Native Americans in certain geographic areas.

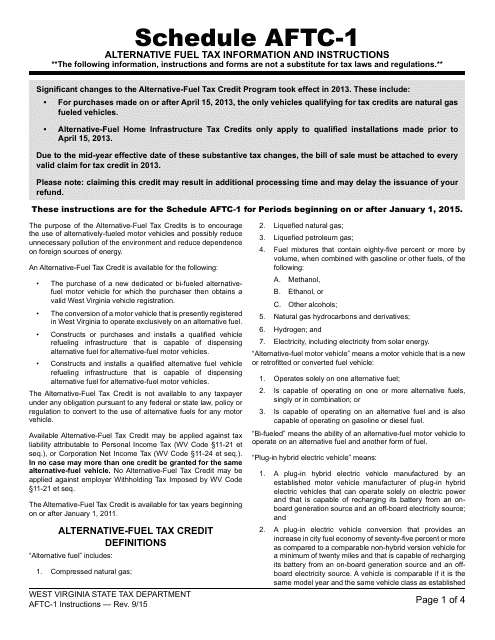

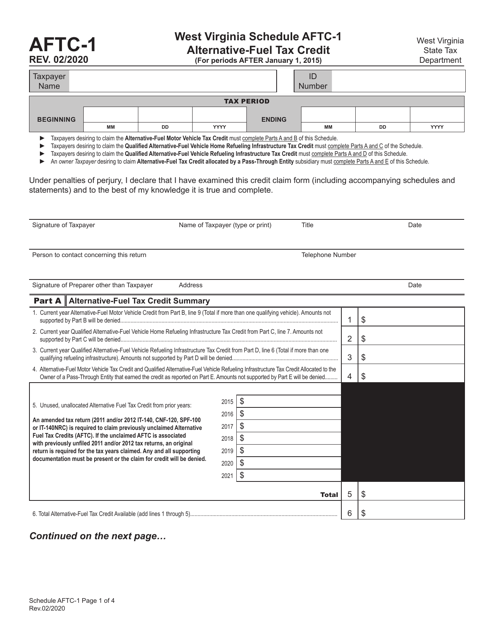

This document provides instructions for Schedule AFTC-1, which is used to claim the Alternative Fuel Tax Credit in West Virginia for periods beginning on or after January 1, 2015.

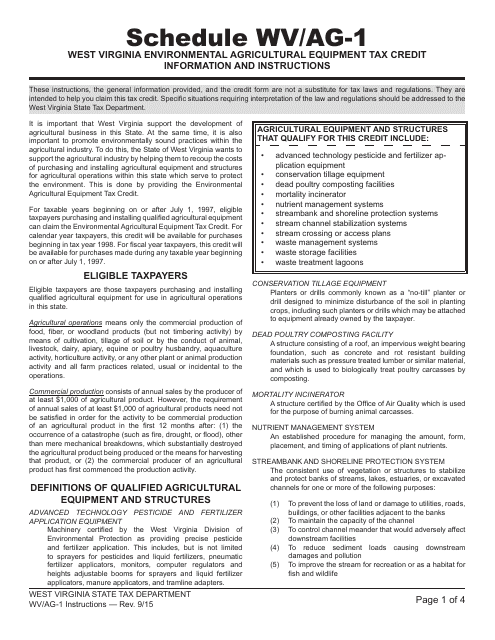

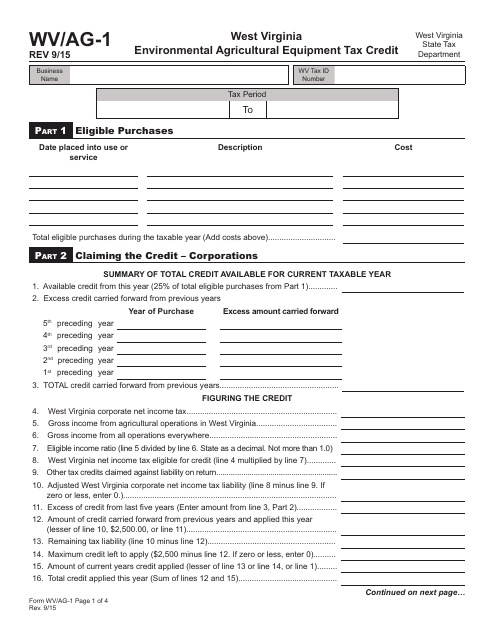

This document provides instructions for completing Schedule WV/AG-1 for claiming the Environmental Agricultural Equipment Tax Credit in West Virginia.

This Form is used for claiming the Environmental Agricultural Equipment Tax Credit in West Virginia. It allows farmers to receive tax credits for purchasing qualifying equipment that promotes environmental conservation in agriculture.

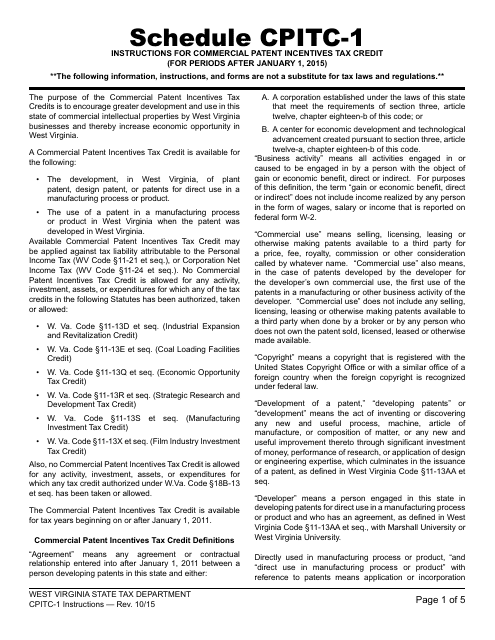

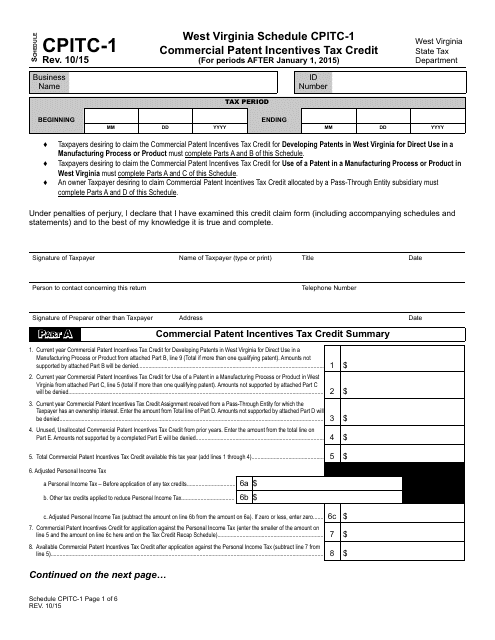

This document provides instructions on how to fill out Schedule CPITC-1 for claiming the Commercial Patent Incentives Tax Credit in West Virginia for periods after January 1, 2015.

This document is used for reporting and claiming the Commercial Patent Incentives Tax Credit in West Virginia for periods after January 1, 2015.

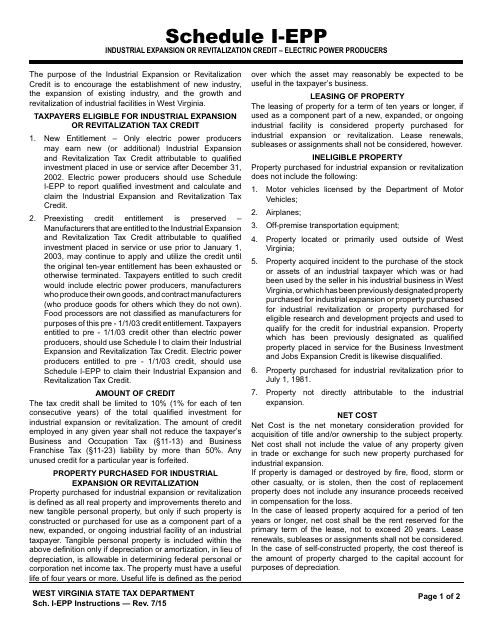

This document provides instructions for completing Schedule I-EPP for claiming the Industrial Expansion or Revitalization Credit for electric power producers in West Virginia.

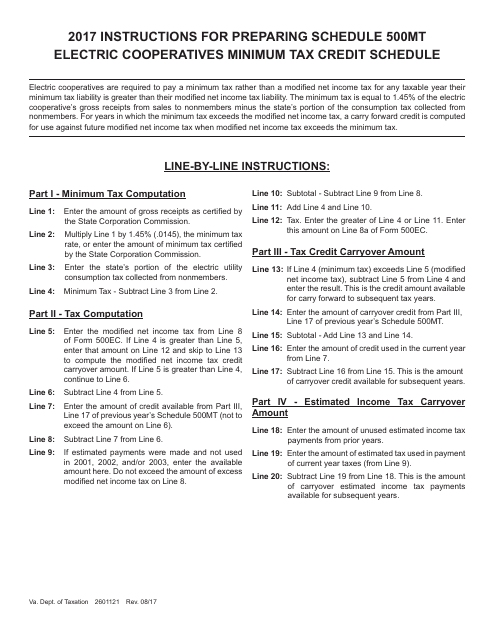

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

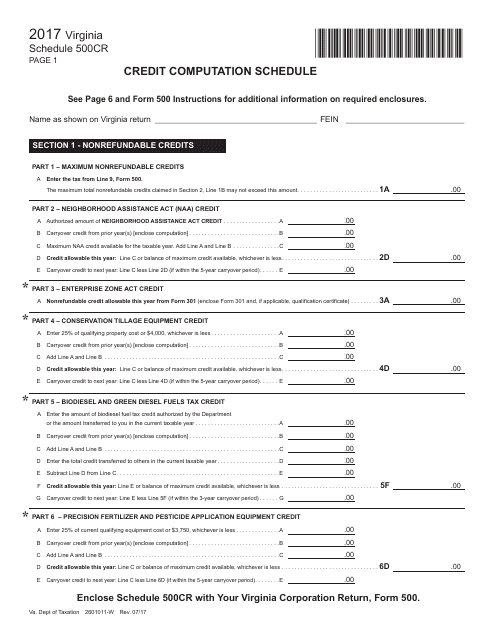

This Form is used for calculating the credit computation schedule for the state of Virginia.

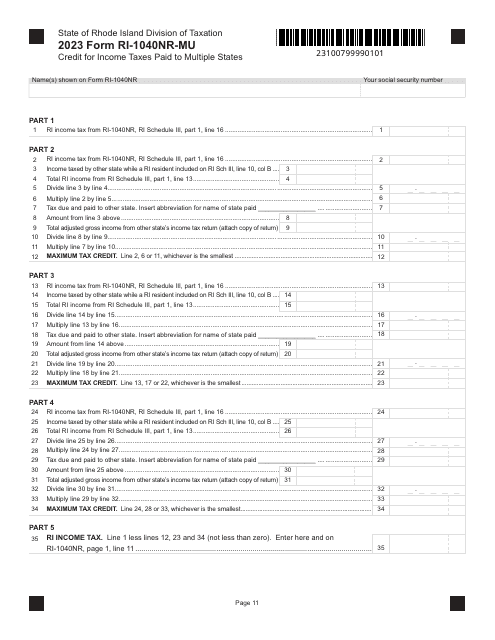

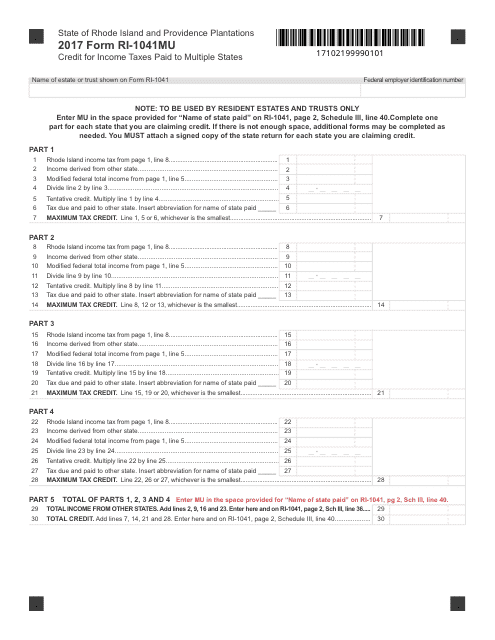

This form is used for claiming a credit for income taxes paid to multiple states when filing taxes in Rhode Island.