Tax Credit Templates

Documents:

3232

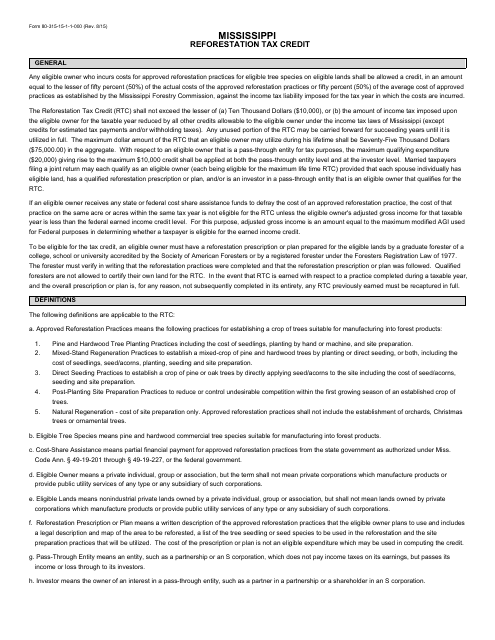

This Form is used for claiming the Mississippi Reforestation Tax Credit. It provides instructions for individuals or businesses in Mississippi who are eligible for this tax credit.

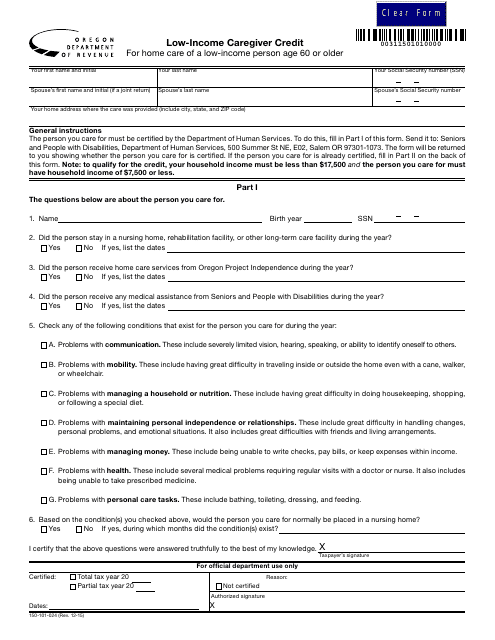

This form is used for claiming the Low-Income Caregiver Credit in the state of Oregon.

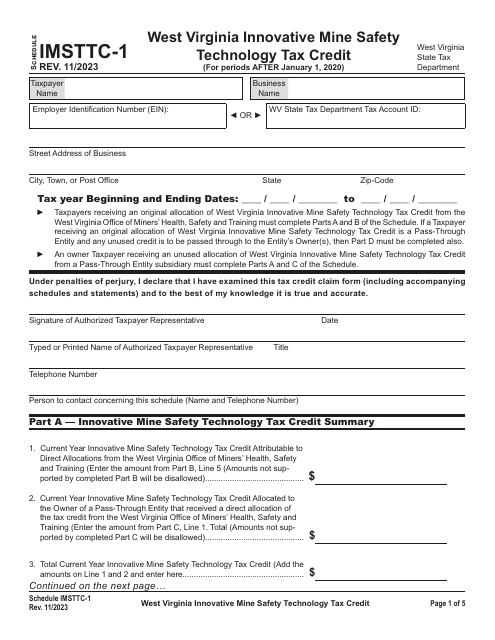

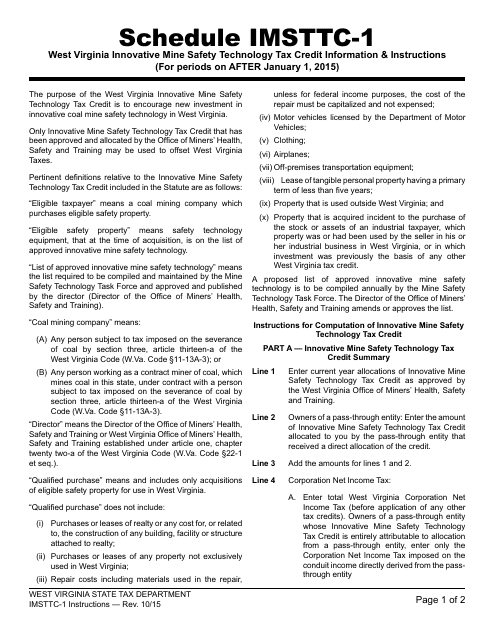

This document provides instructions for completing Schedule IMSTTC-1, which is the West Virginia Innovative Mine Safety Technology Tax Credit. The schedule is used by individuals and businesses in West Virginia to claim a tax credit for innovative mine safety technology investments.

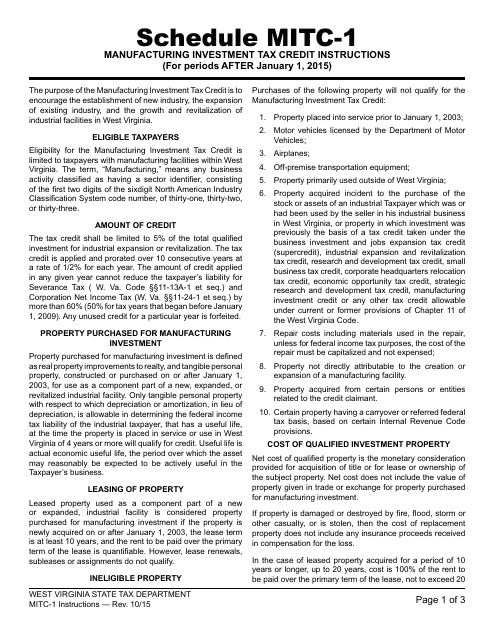

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

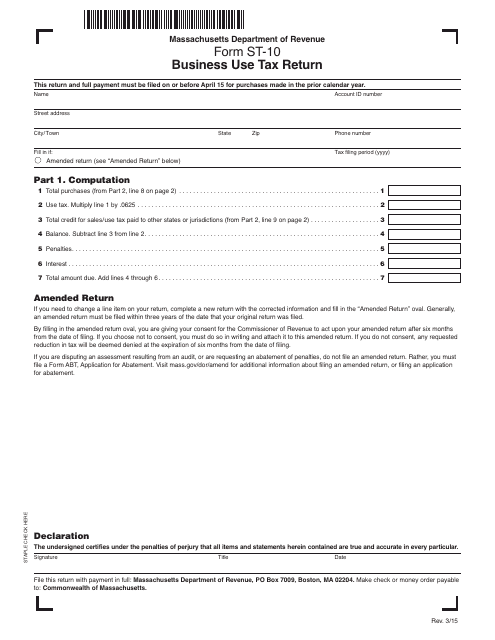

This form is used for reporting and paying business use tax in the state of Massachusetts.

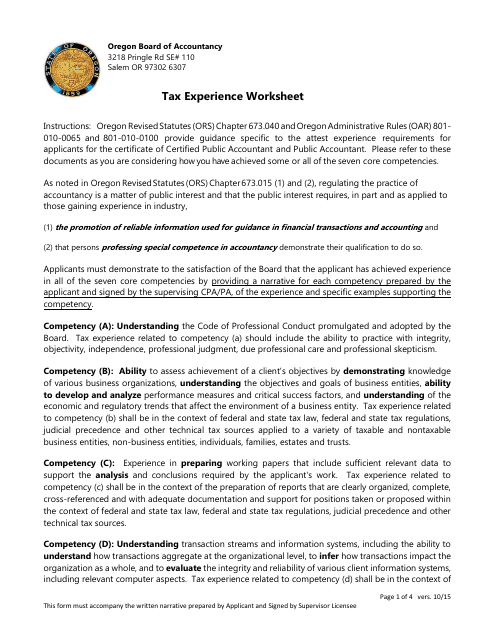

This document is a worksheet specifically for individuals with tax experience in Oregon. It can be used to organize and track relevant information when preparing state taxes in Oregon.

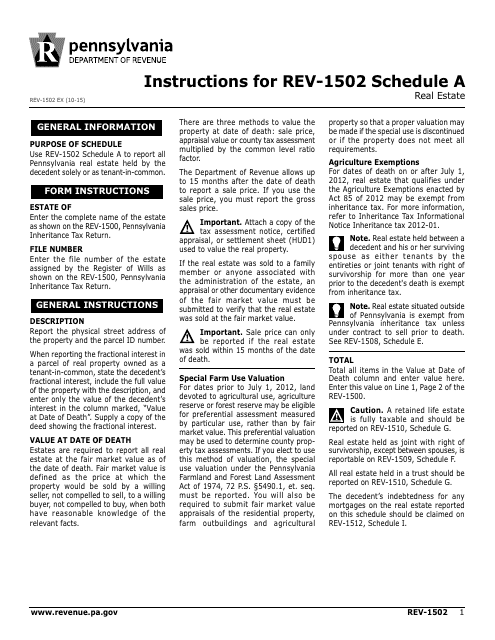

This document provides instructions for completing Form REV-1502 Schedule A, which is a real estate schedule in Pennsylvania. It guides taxpayers on how to report their real estate income and expenses accurately.

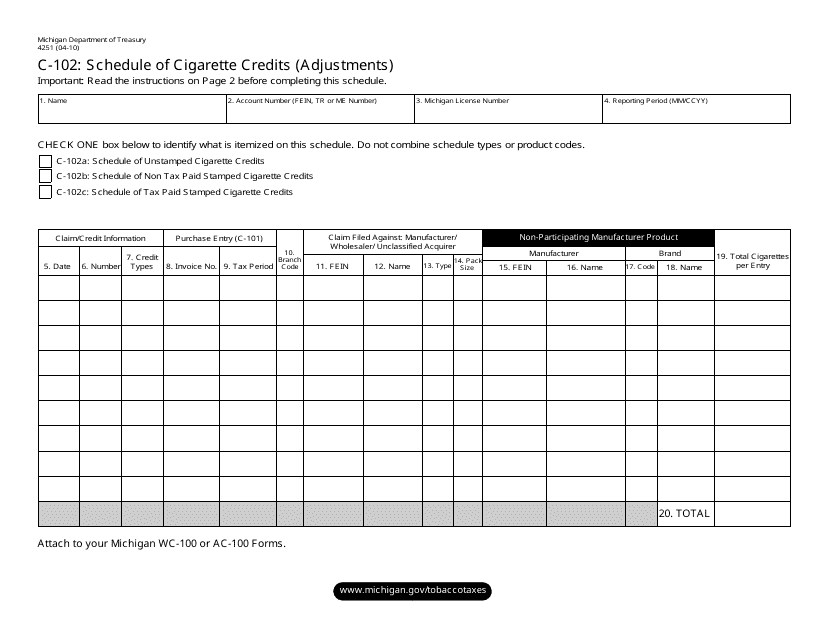

This form is used for reporting and adjusting cigarette credits in the state of Michigan.

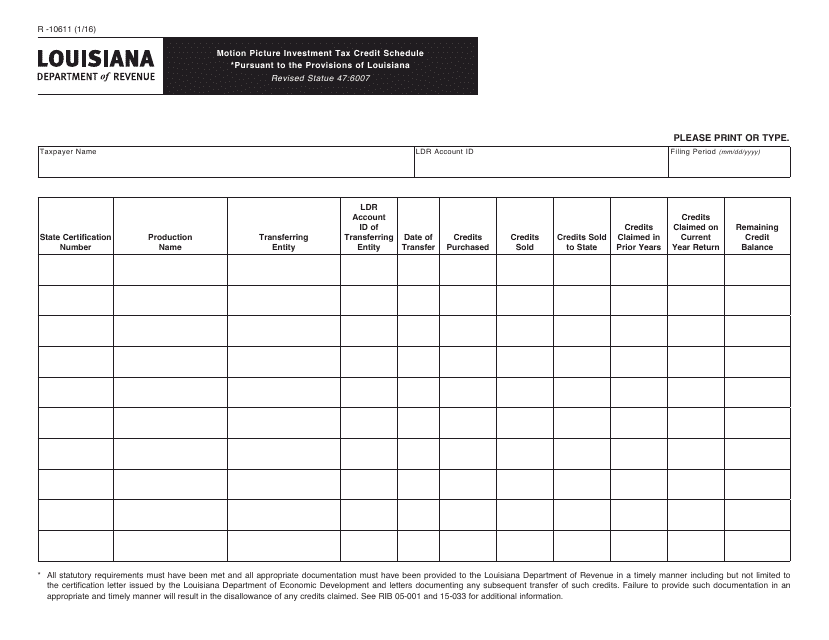

This form is used for reporting and claiming the Motion Picture Investment Tax Credit in Louisiana.

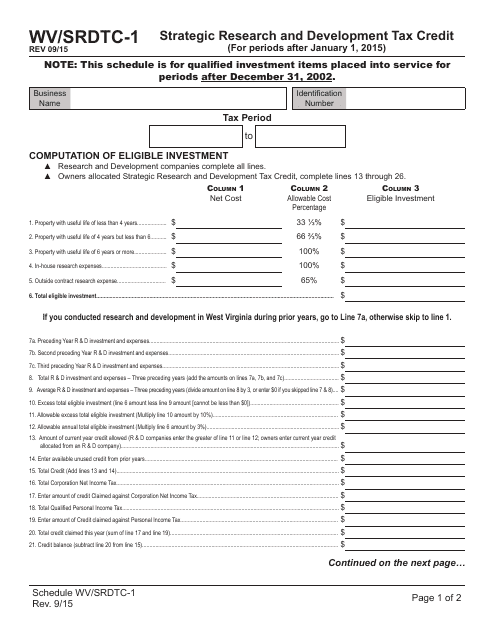

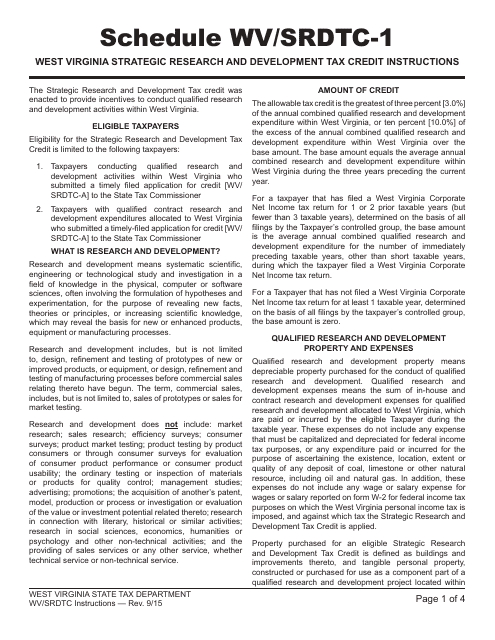

This document is for scheduling the WV/SRDTC-1 Strategic Research and Development Tax Credit in West Virginia.

This Form is used for claiming the West Virginia Strategic Research and Development Tax Credit in the state of West Virginia.

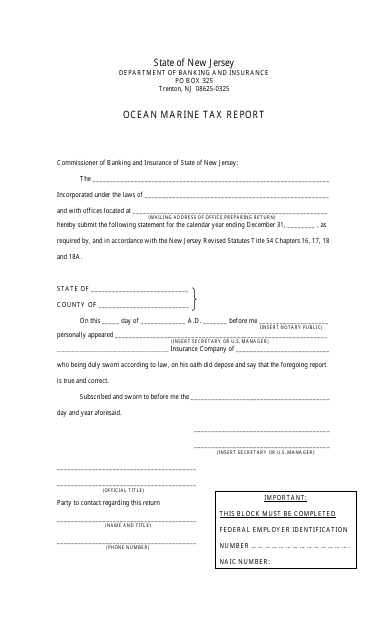

This document is used for reporting taxes related to ocean marine activities in the state of New Jersey.

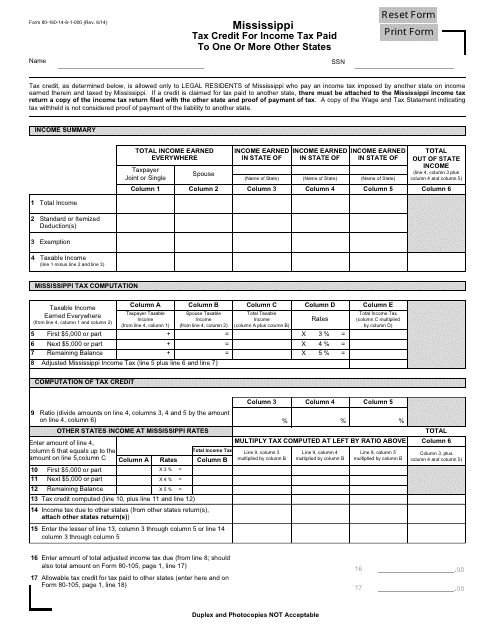

This Form is used for claiming a tax credit in Mississippi for income tax paid to other states.

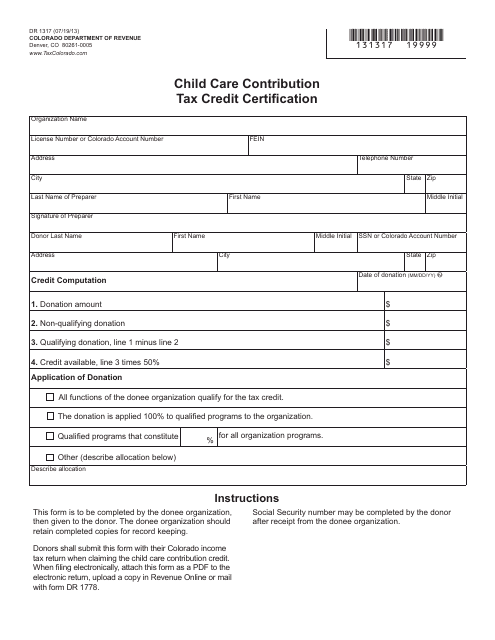

This form is used for applying for the Child Care Contribution Tax Credit in Colorado. It certifies that the taxpayer has made a qualifying contribution to a licensed child care facility.

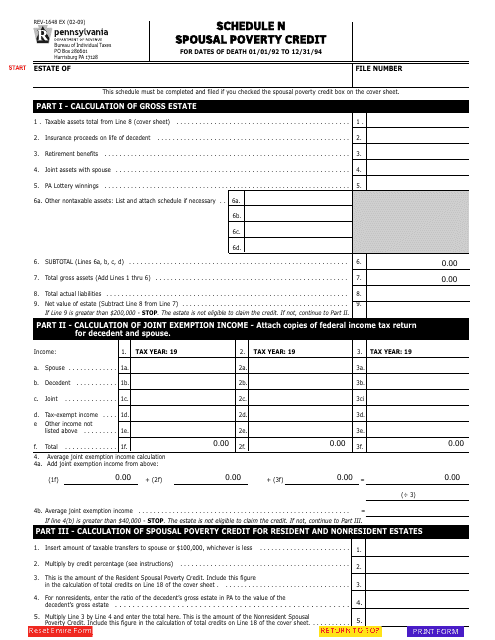

This form is used for claiming the Spousal Poverty Credit in Pennsylvania. It helps married couples who have a spouse with lower income reduce their tax burden.

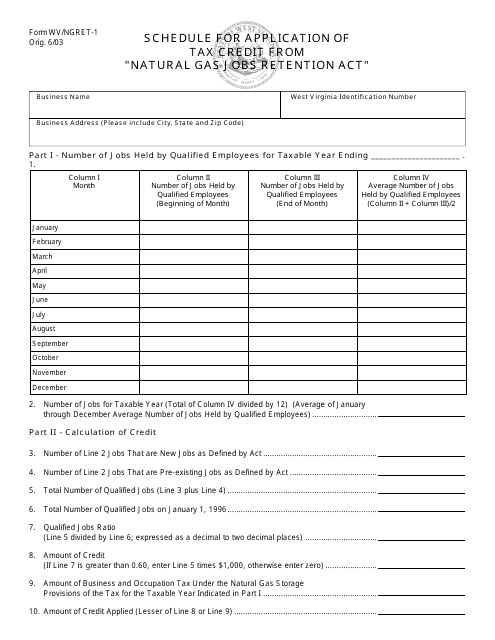

This Form is used for scheduling the application of tax credit for the Natural Gas Jobs Retention Act in West Virginia.

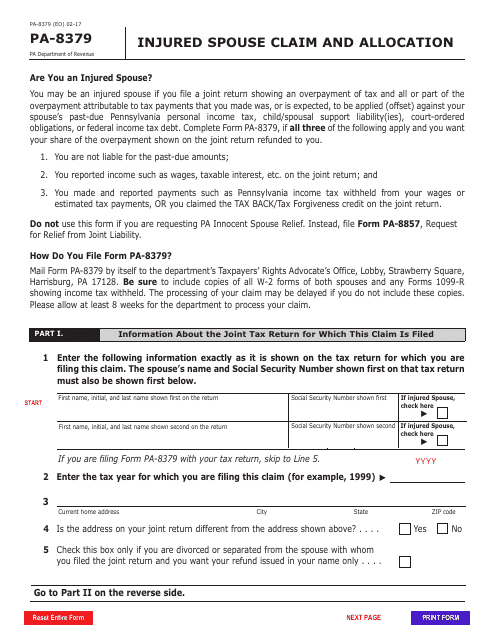

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

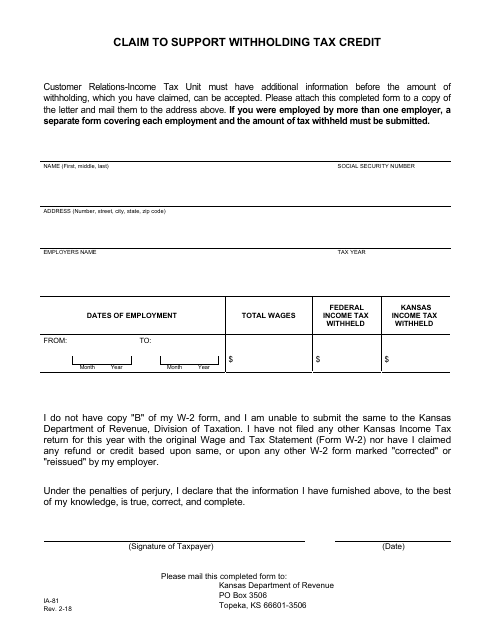

This Form is used for residents of Kansas to claim a withholding tax credit.

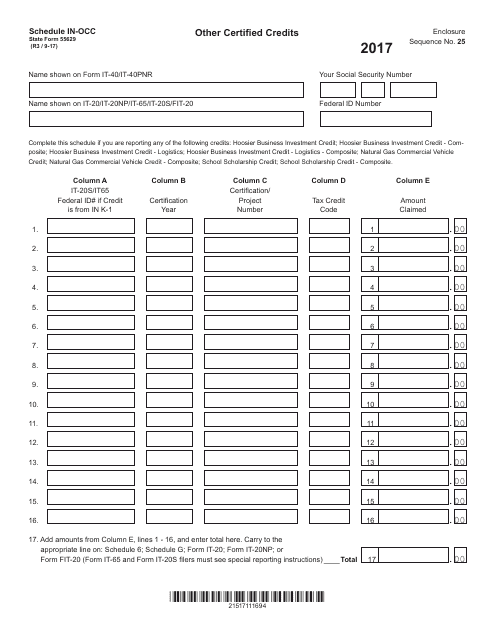

This form is used for reporting and claiming other certified credits in the state of Indiana.