Tax Credit Templates

Documents:

3232

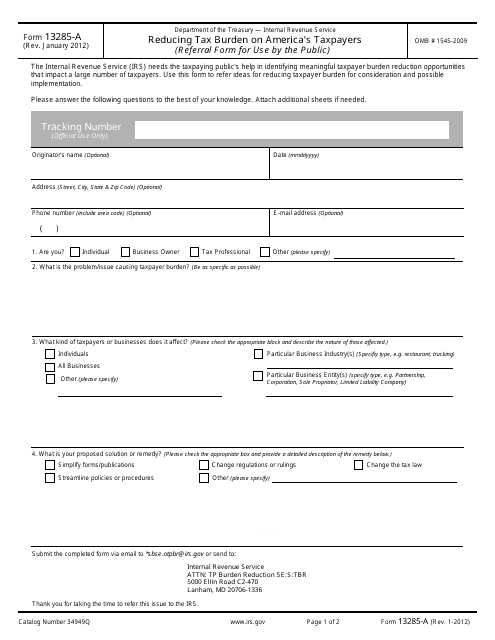

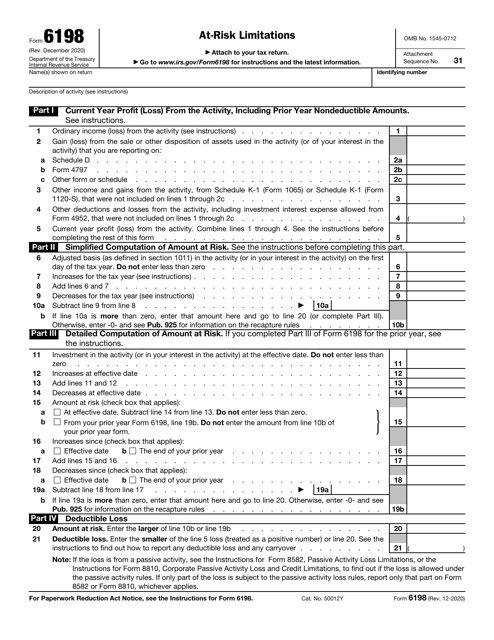

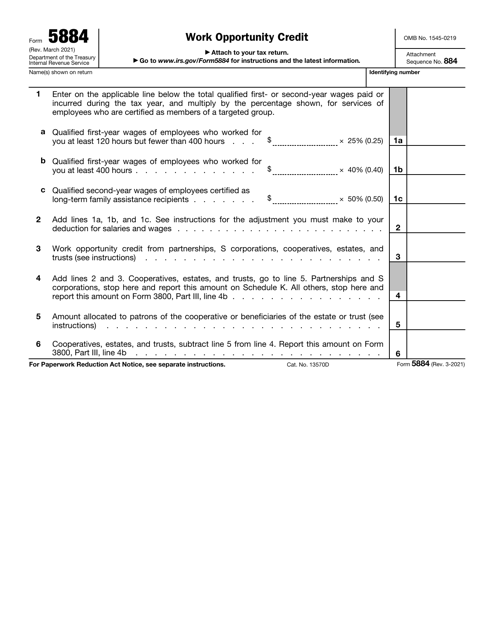

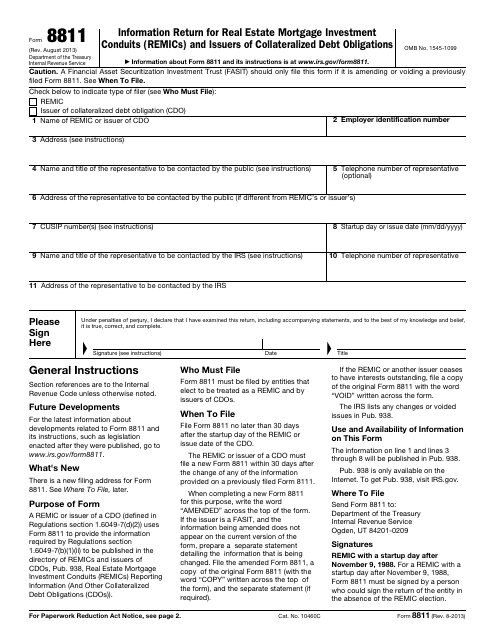

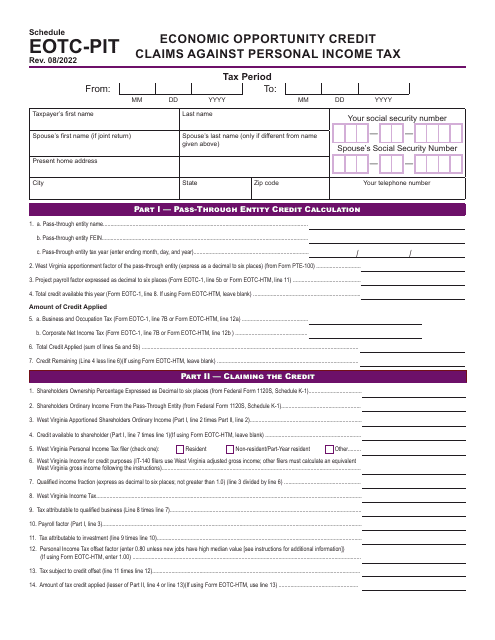

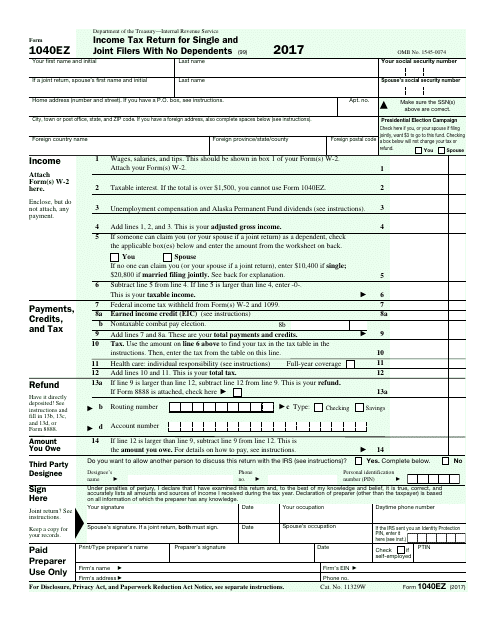

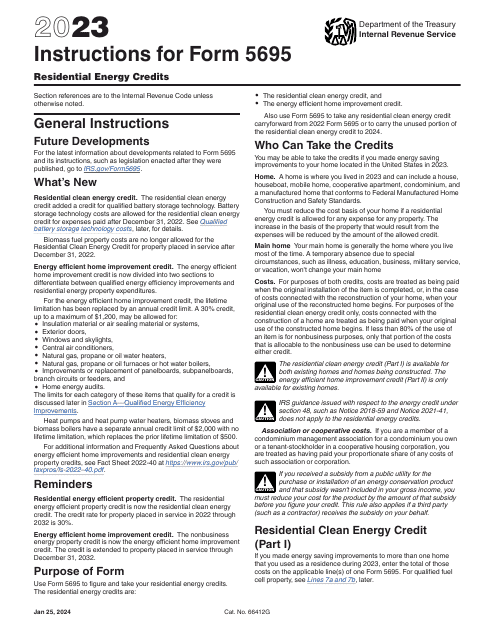

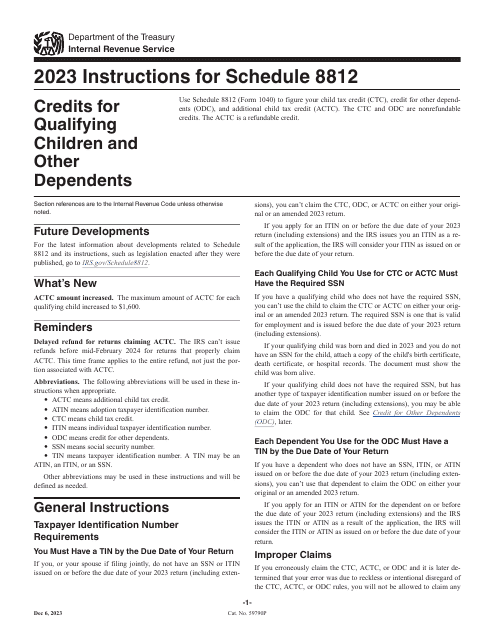

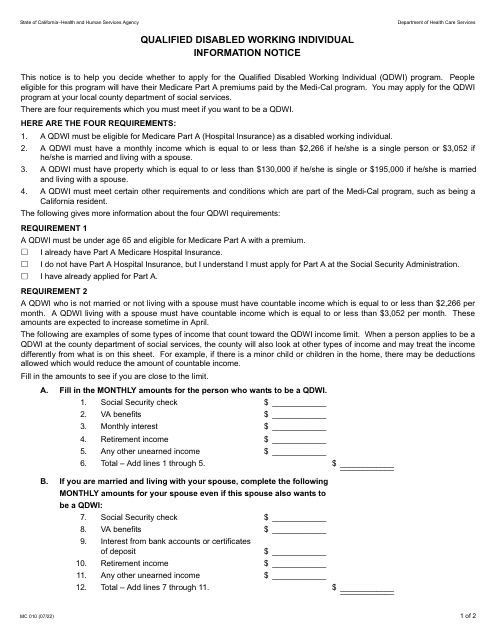

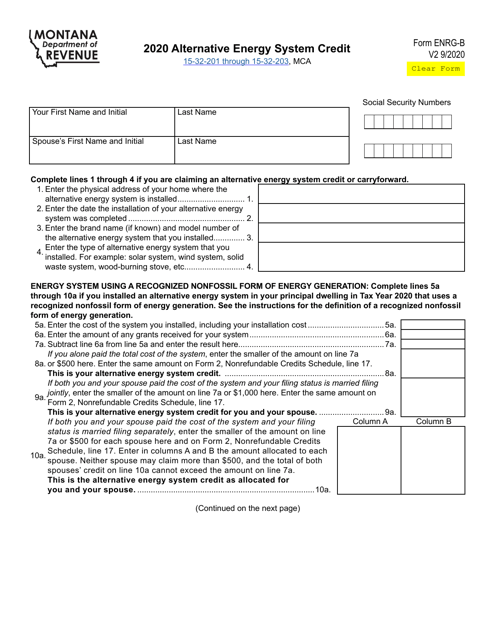

This Form is used for reducing the tax burden on American taxpayers. It provides eligible taxpayers with options to reduce their overall tax liability.

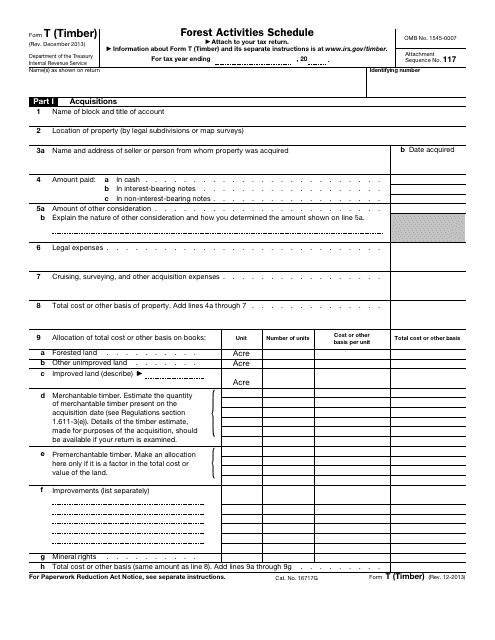

This document for reporting forest activities related to timber to the IRS.

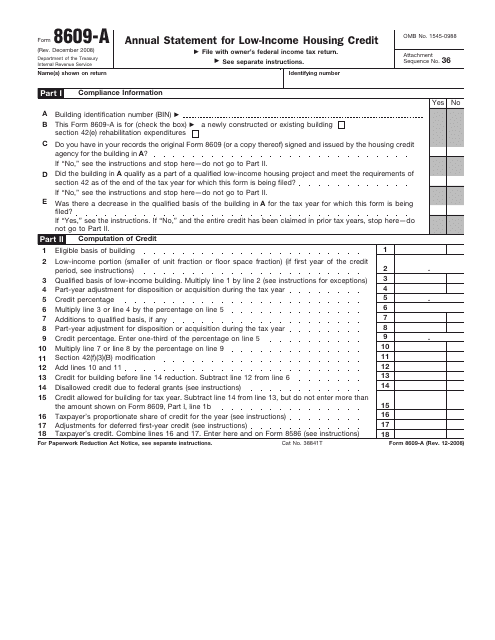

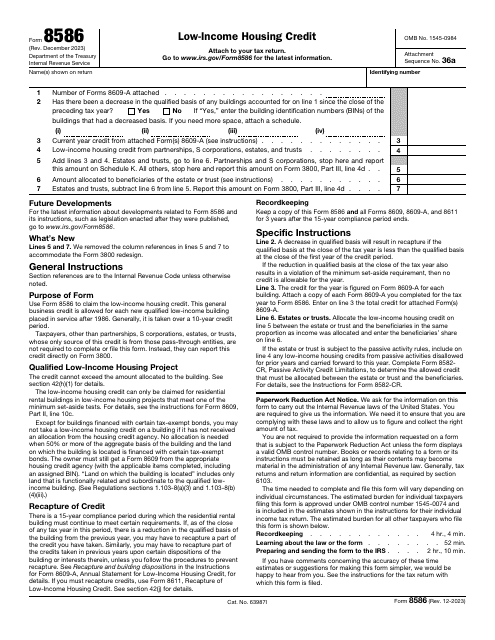

This document is used for reporting the annual statement for the Low-Income Housing Credit, as required by the IRS.

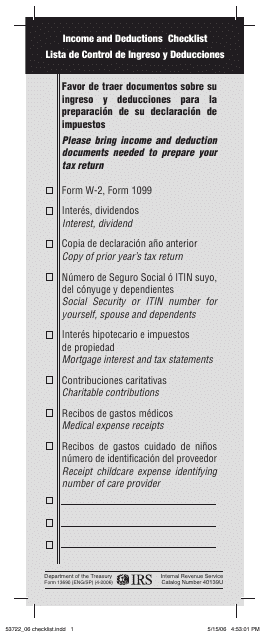

This form is used for checking income and deductions. It is available in both English and Spanish.

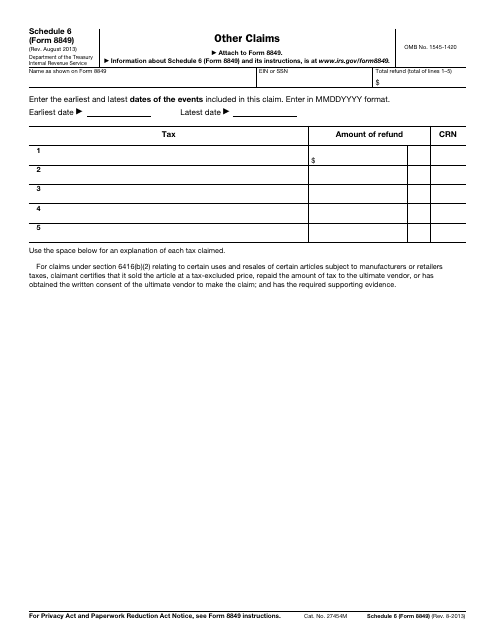

This Form is used for making other claims such as refunds for certain fuel-related taxes paid in error or excessive amounts.

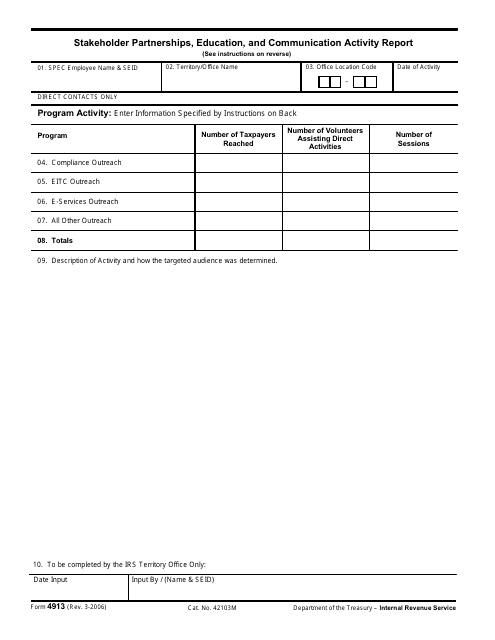

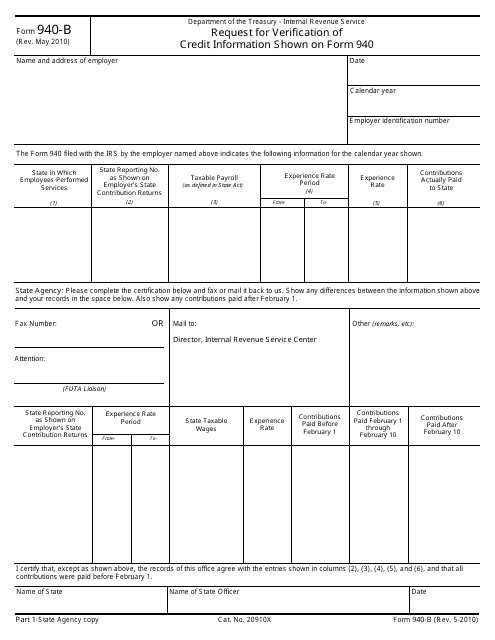

This document is used to request verification of credit information shown on Form 940 for the IRS.

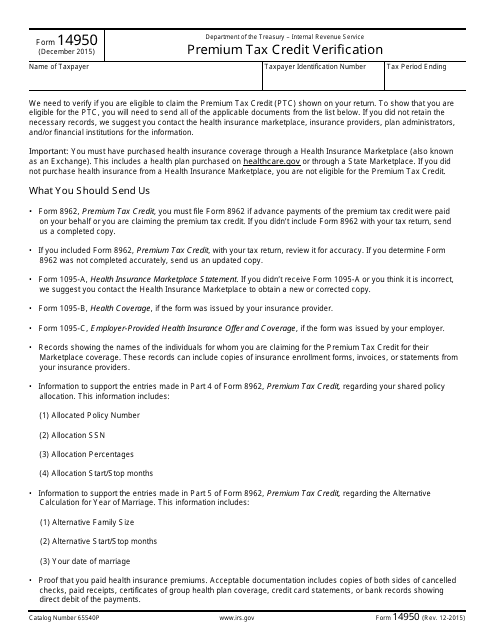

This document is used for verifying eligibility for the Premium Tax Credit, a subsidy provided by the government to help lower-income individuals and families afford health insurance.

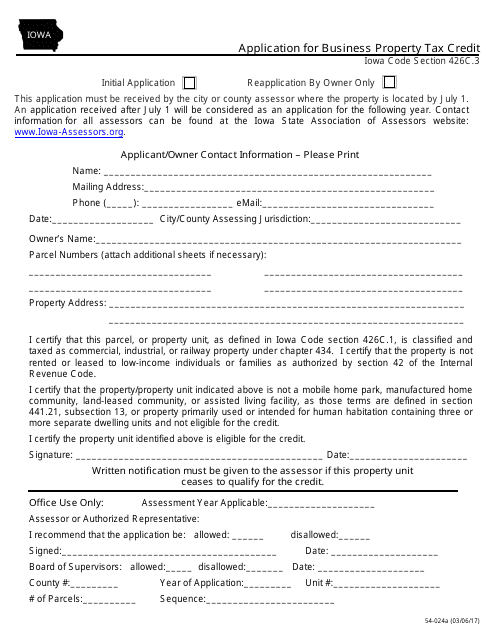

This form is used for applying for the Business Property Tax Credit in Iowa.

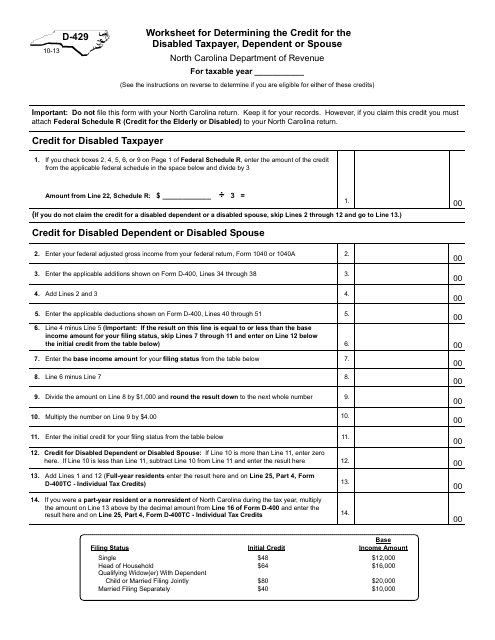

This Form is used for determining the credit for the disabled taxpayer, dependent or spouse in North Carolina.

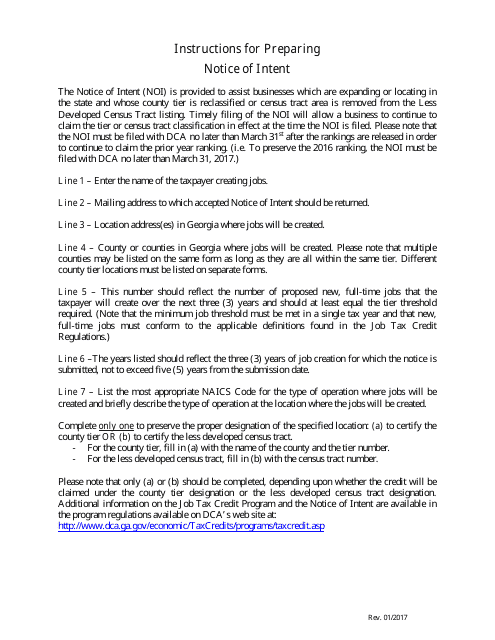

This document is a Notice of Intent for the Georgia Jobs Tax Credit in the state of Georgia. It is used by businesses to indicate their intention to claim a tax credit for creating new jobs in the state.

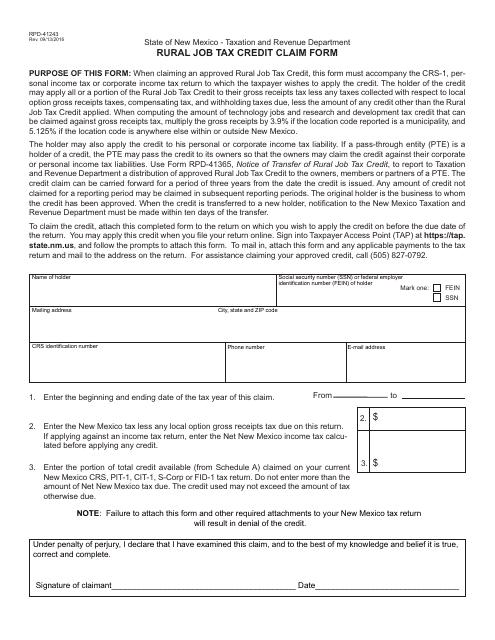

This form is used for claiming the rural job tax credit in the state of New Mexico. It is for businesses that have created jobs in rural areas and are eligible for this tax credit.

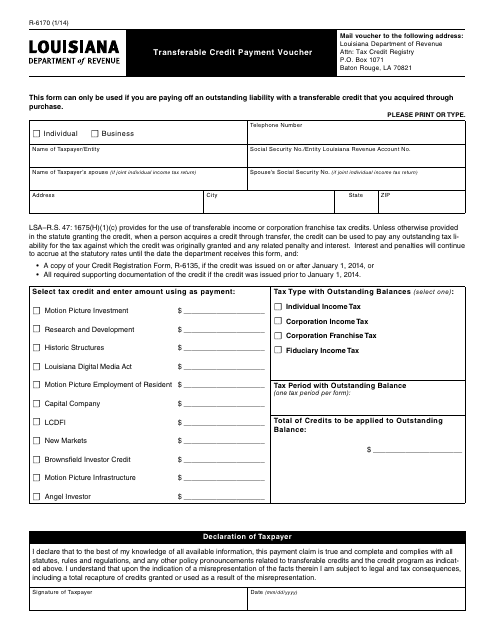

This form is used for making transferable credit payments in the state of Louisiana.

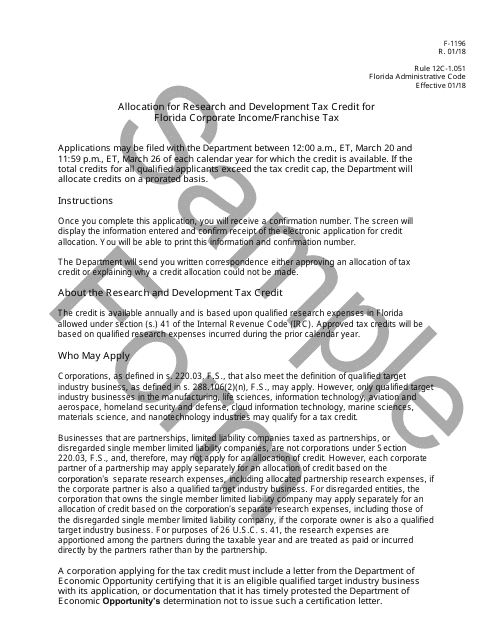

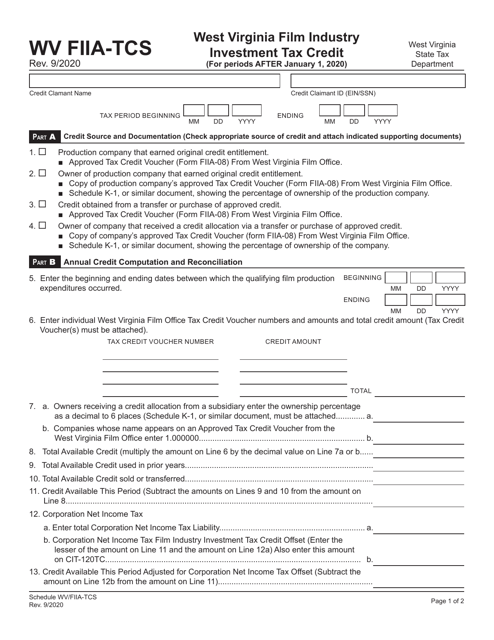

This form is used for allocating the research and development tax credit for Florida corporate income/franchise tax in the state of Florida.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

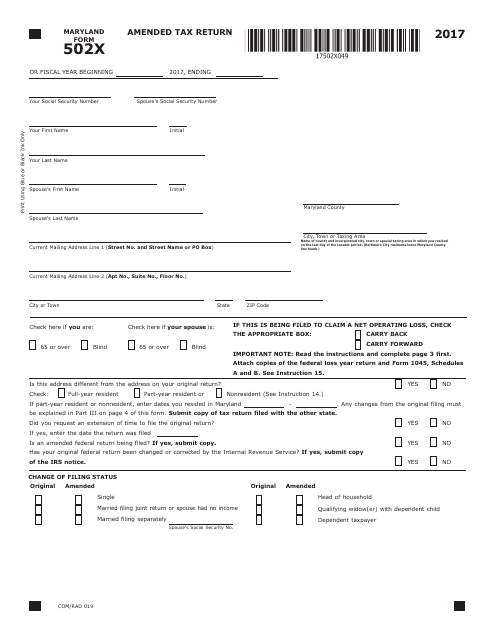

This form is used for filing an amended tax return in the state of Maryland.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

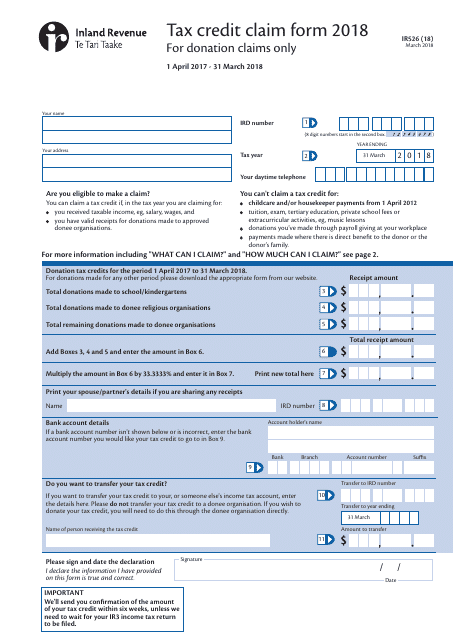

This form is used for claiming tax credits in New Zealand.

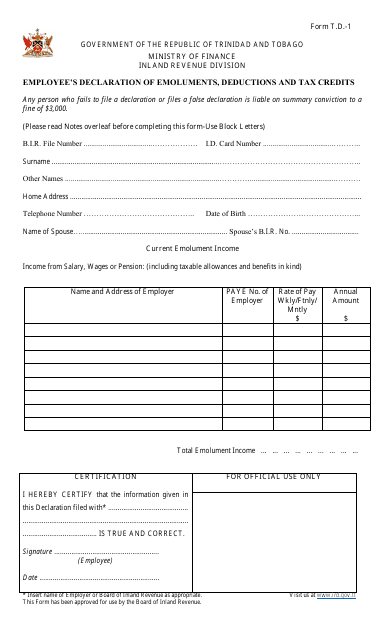

This Form is used for employees in Trinidad and Tobago to declare their income, deductions, and tax credits to the tax authorities.

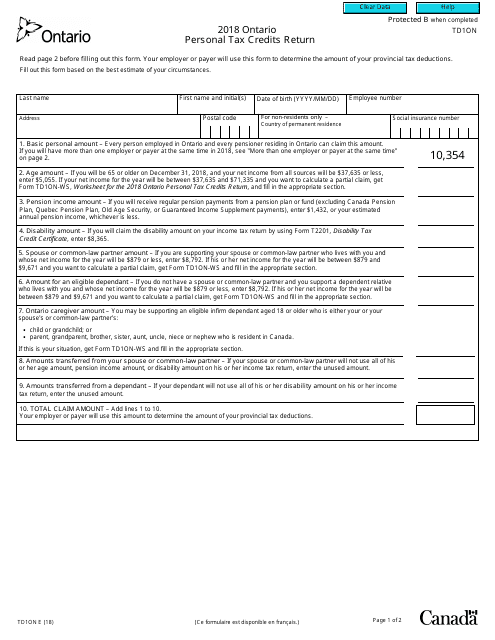

This form is used for reporting personal tax credits and deductions in the province of Ontario, Canada. It is specifically meant for individuals who reside in Ontario and want to claim tax credits that are unique to the province.

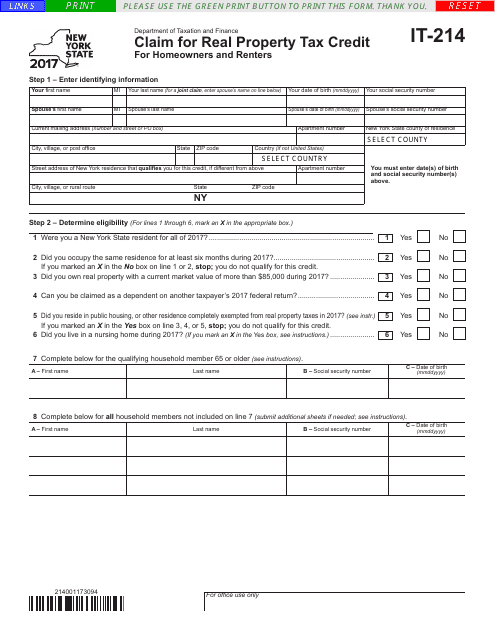

This form is used for claiming a real property tax credit in New York. It allows residents to receive a credit for the taxes they paid on their residential property.

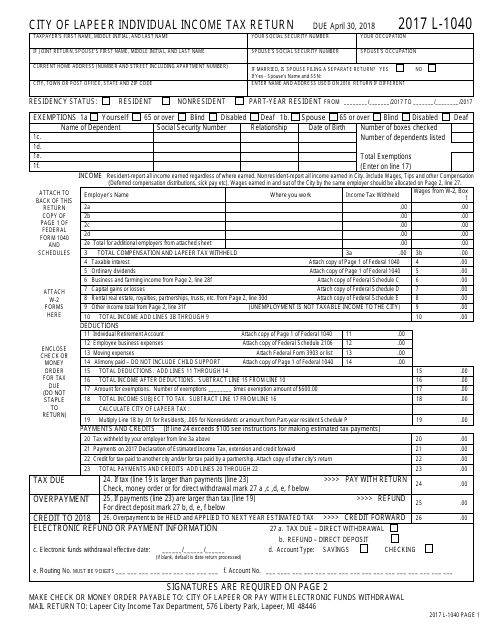

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

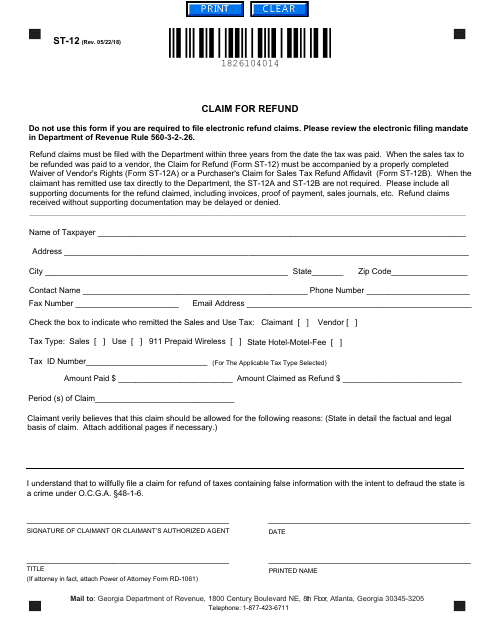

This Form is used for claiming a refund in the state of Georgia, United States.