Tax Credit Templates

Documents:

3232

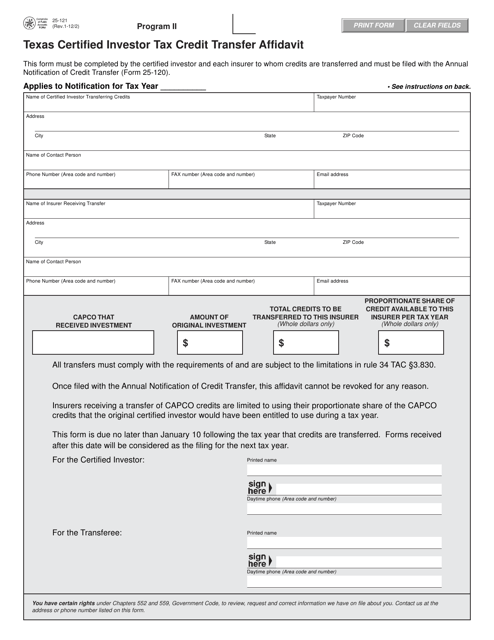

This document is used for transferring tax credits in Texas for certified investors participating in Program II.

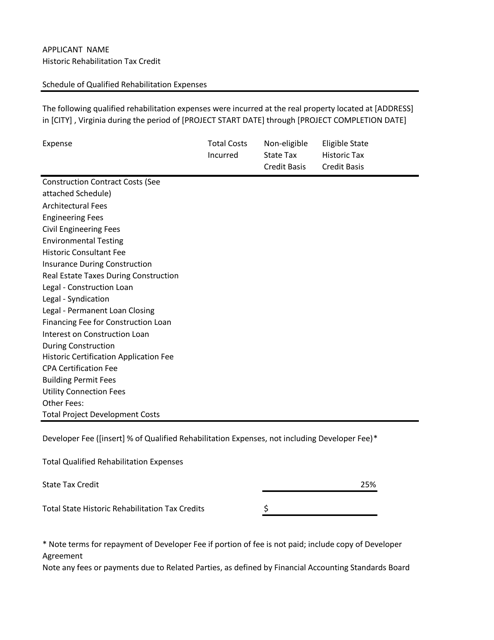

This document provides information about the schedule of qualified rehabilitation expenses in the state of Virginia. It outlines the expenses that qualify for rehabilitation tax credits in the state.

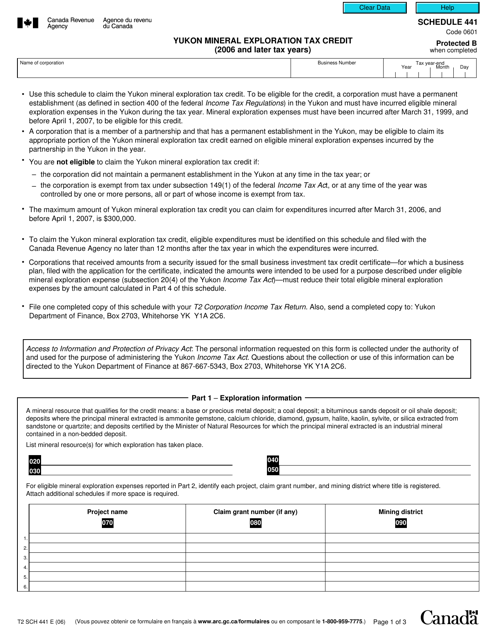

This form is used for claiming the Yukon Mineral Exploration Tax Credit for the tax years 2006 and later in Canada.

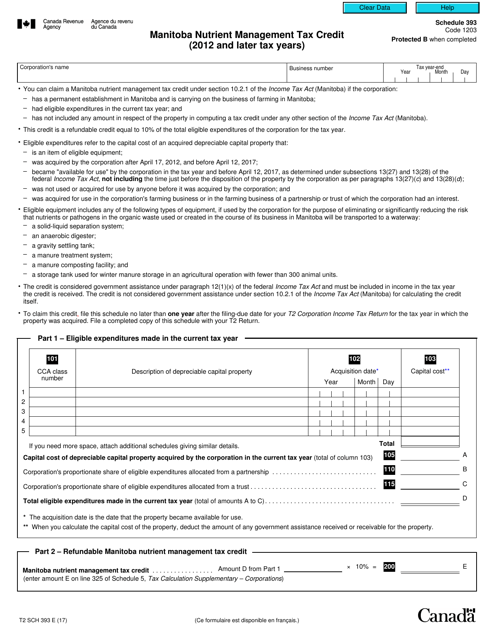

This form is used for claiming the Manitoba Nutrient Management Tax Credit in Canada for the tax years 2012 and later. It allows eligible taxpayers to receive a credit for their investments in nutrient management equipment and practices.

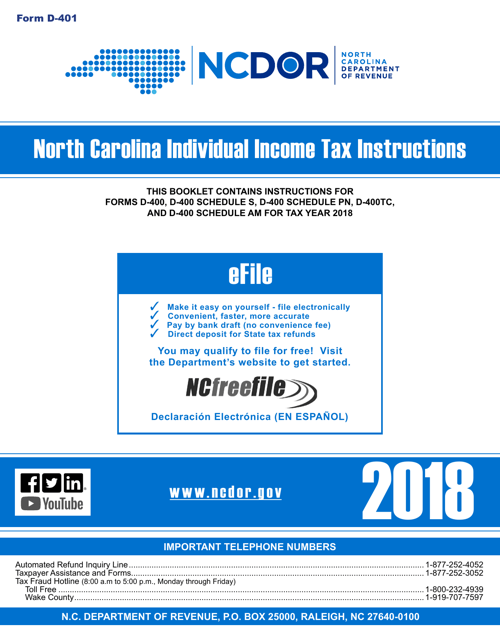

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

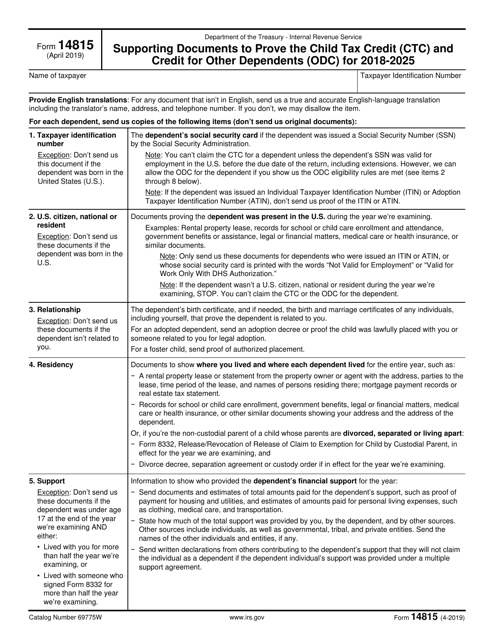

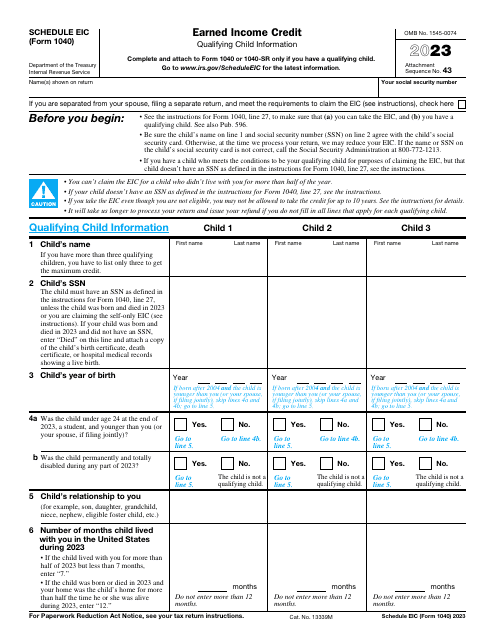

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

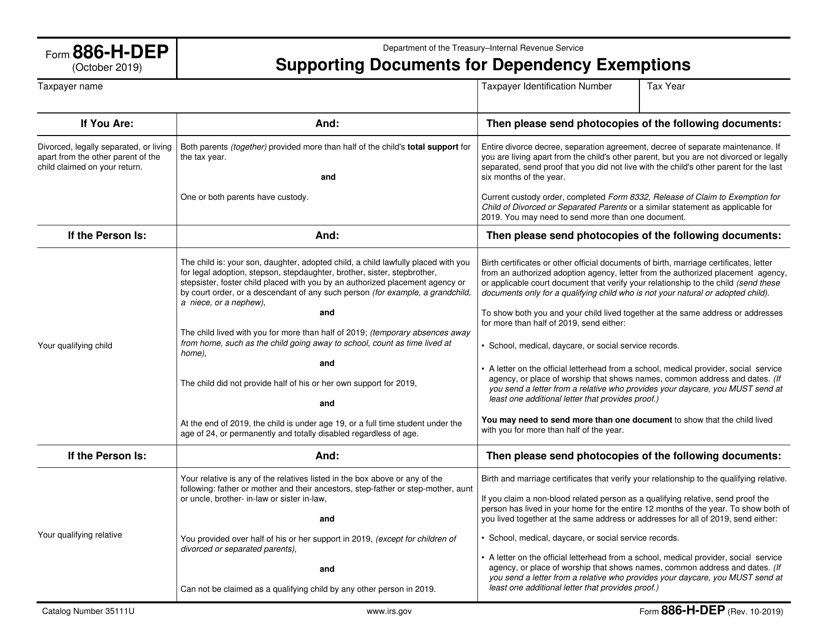

This type of document is used to provide supporting documents for dependency exemptions on Form 886-H-DEP.

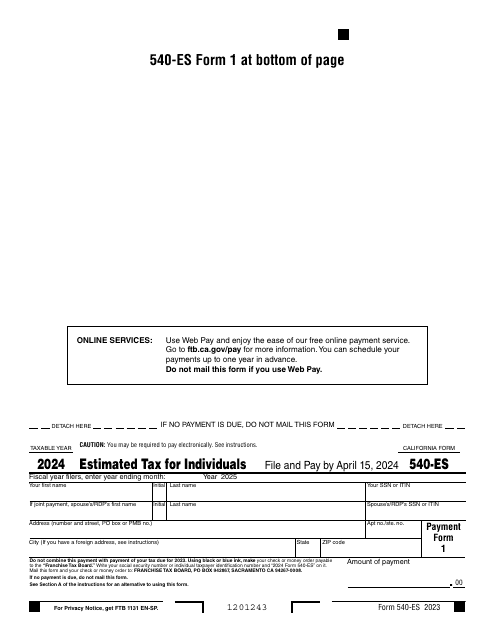

Fill out this form over the course of a year to pay your taxes in the state of California.

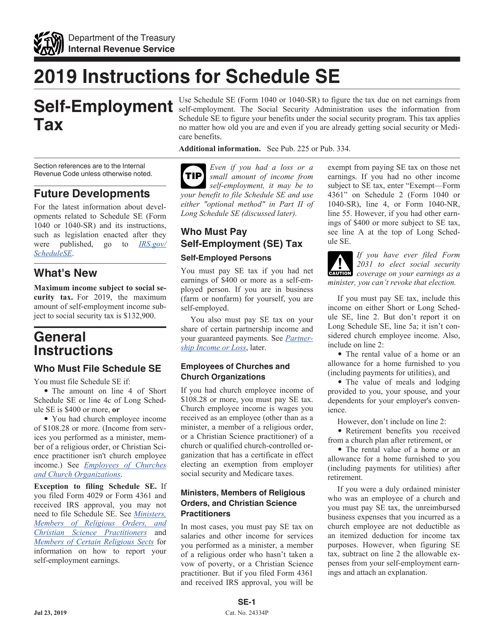

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

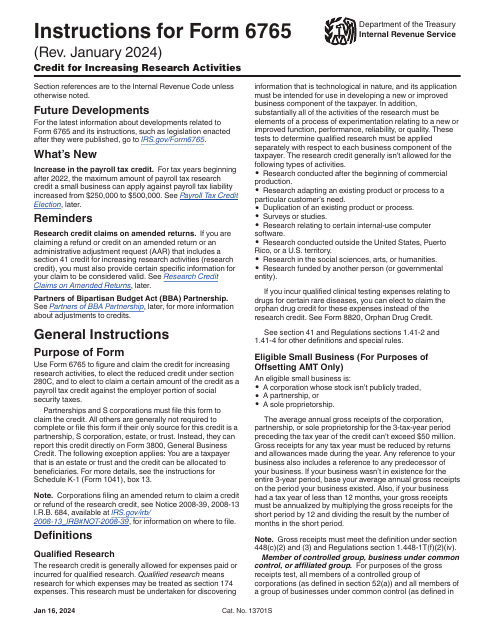

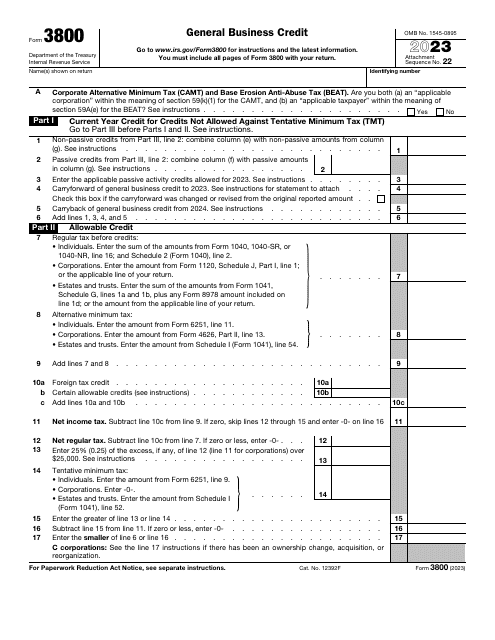

This is a document you may use to figure out how to properly complete IRS Form 6765

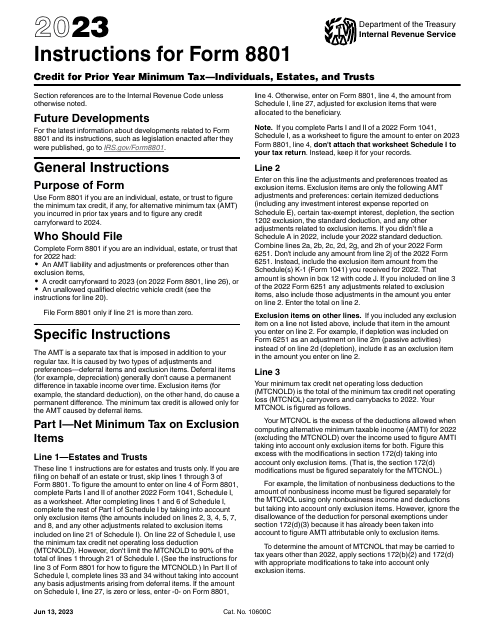

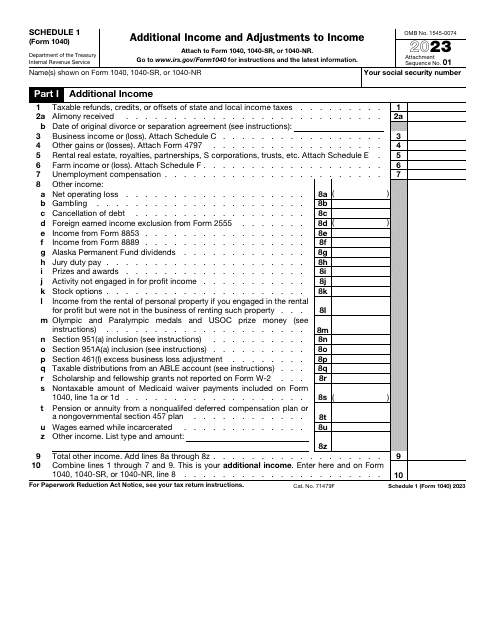

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

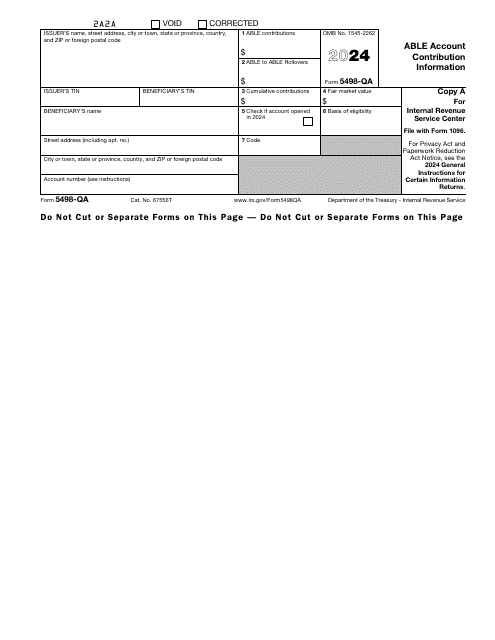

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

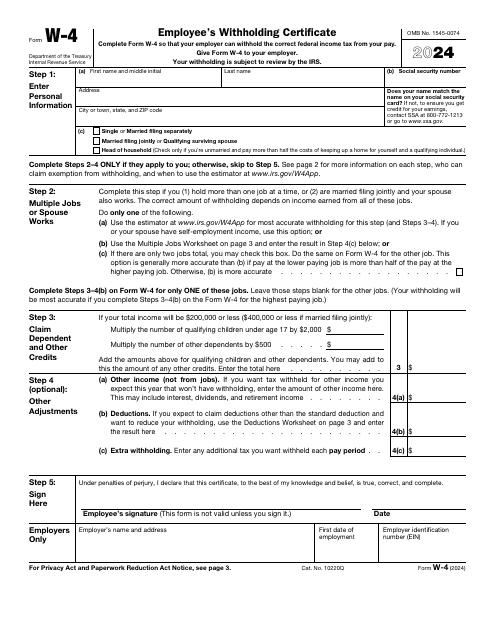

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

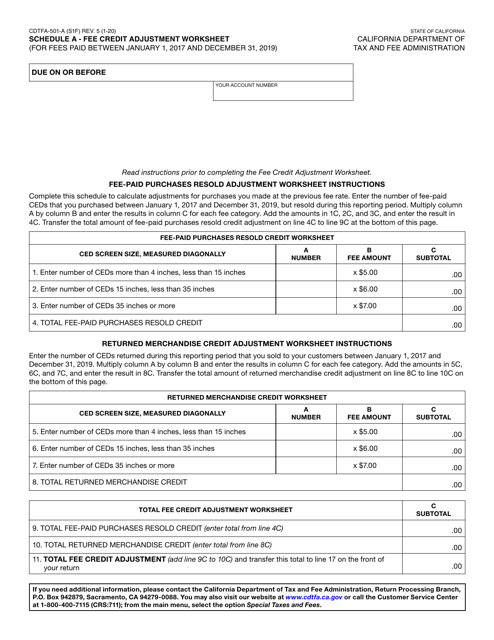

This form is used for calculating fee credit adjustments in California.