Tax Credit Templates

Documents:

3232

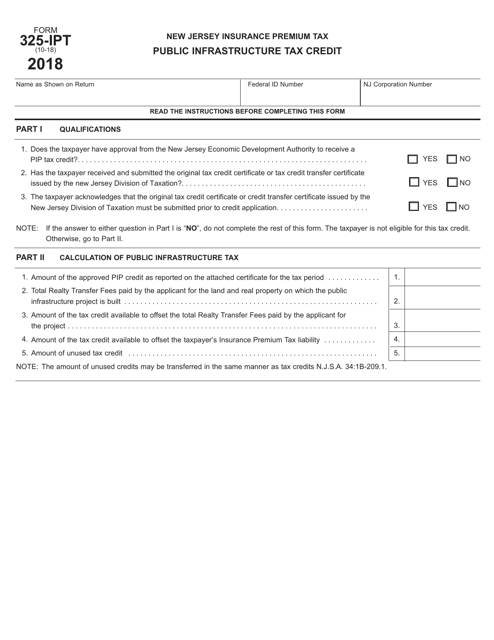

This form is used to claim the Public Infrastructure Tax Credit in the state of New Jersey.

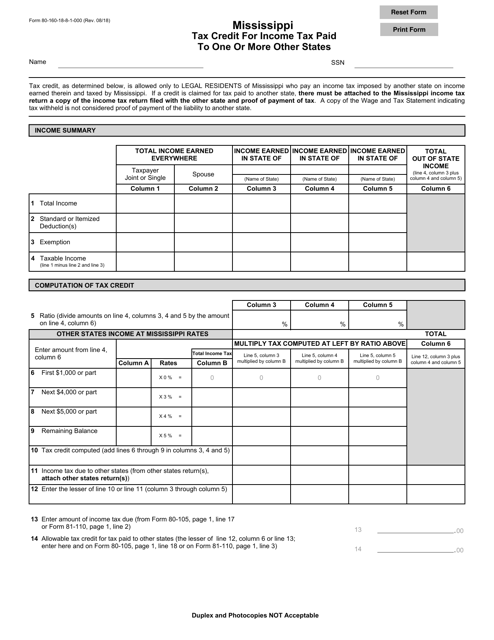

This document is used for claiming a tax credit for income tax paid to other states when filing taxes in Mississippi.

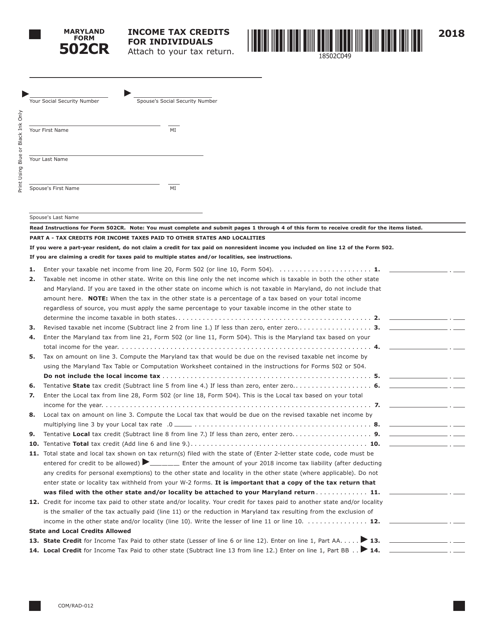

This form is used for claiming income tax credits for individuals in Maryland. It is designated as Form 502CR and is also referred to as COM/RAD-012.

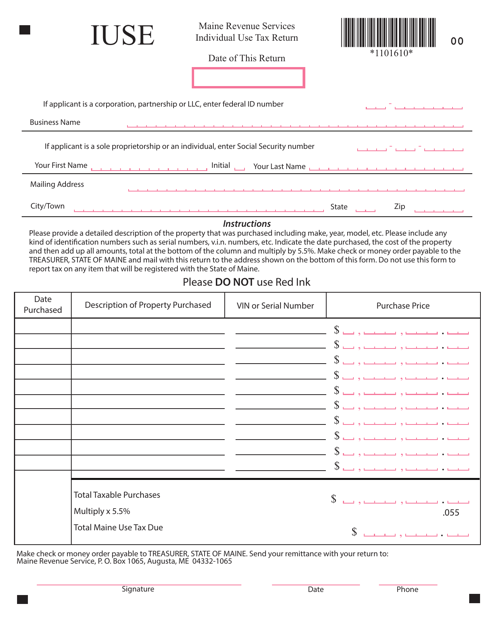

This form is used for reporting and paying individual use tax in the state of Maine. Individual use tax is owed on items purchased outside of Maine that would have been subject to sales tax if purchased in the state.

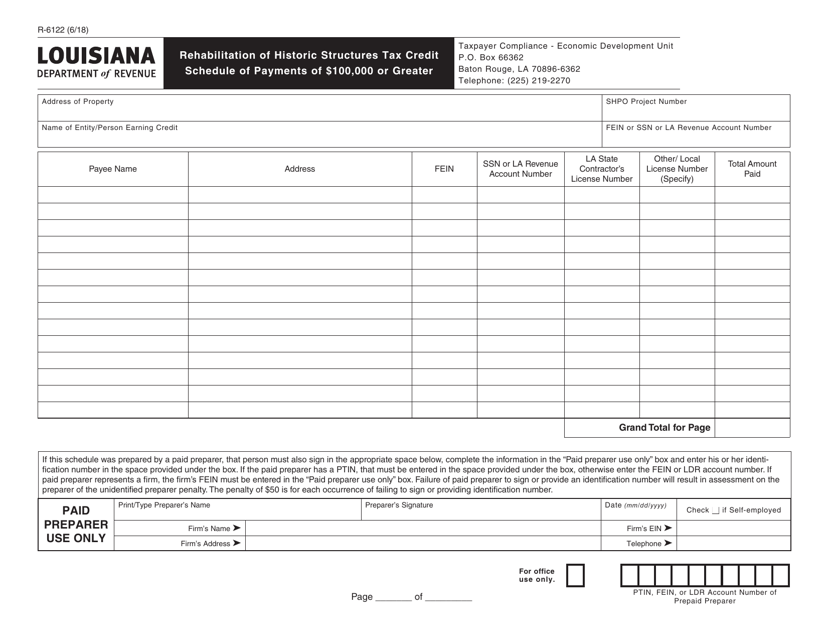

This form is used for reporting the schedule of payments of $100,000 or greater for the Rehabilitation of Historic Structures Tax Credit in Louisiana.

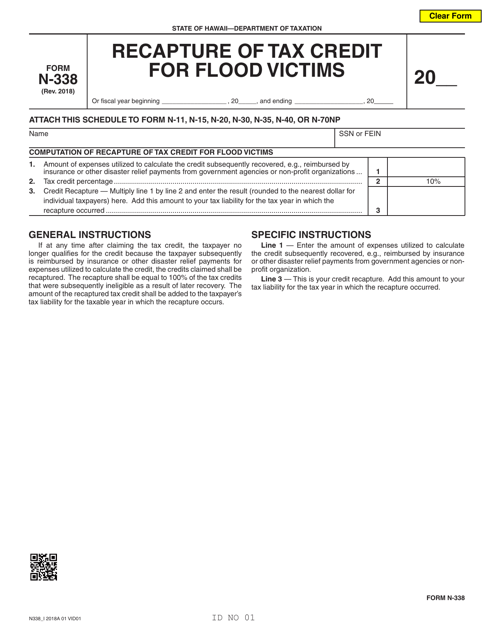

This form is used for flood victims in Hawaii to recapture their tax credit.

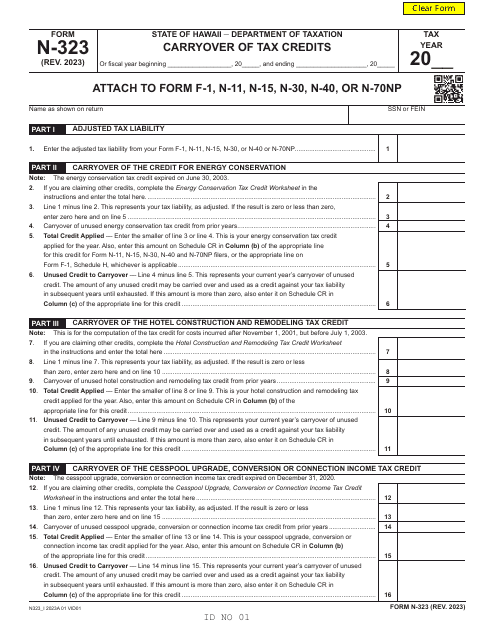

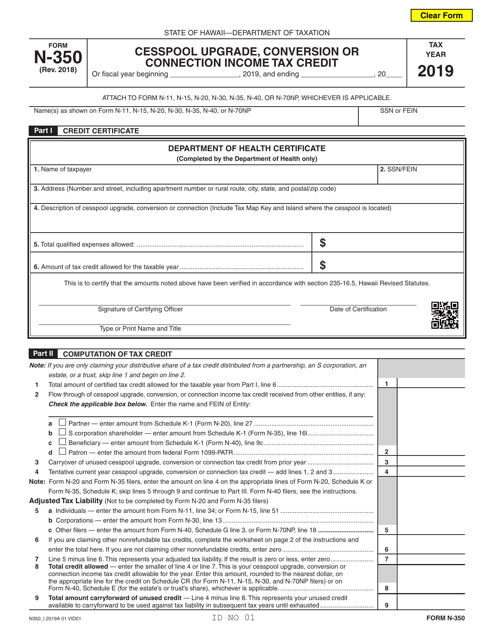

This Form is used for claiming an income tax credit in Hawaii for upgrading, converting or connecting a cesspool.

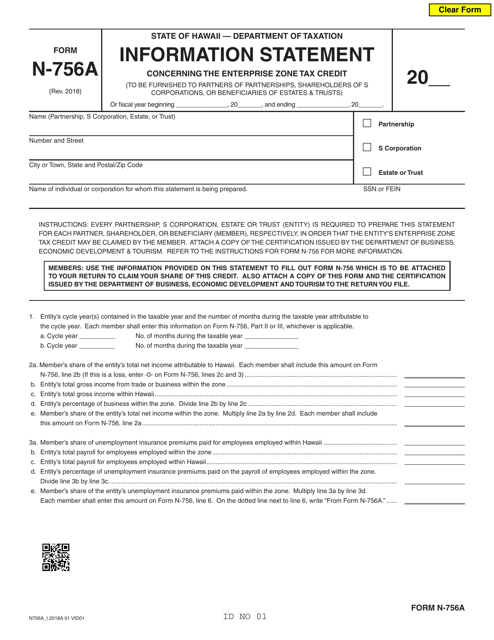

This document provides information about the Enterprise Zone Tax Credit specific to Hawaii. It includes details that individuals and businesses need to complete the Form N-756A.

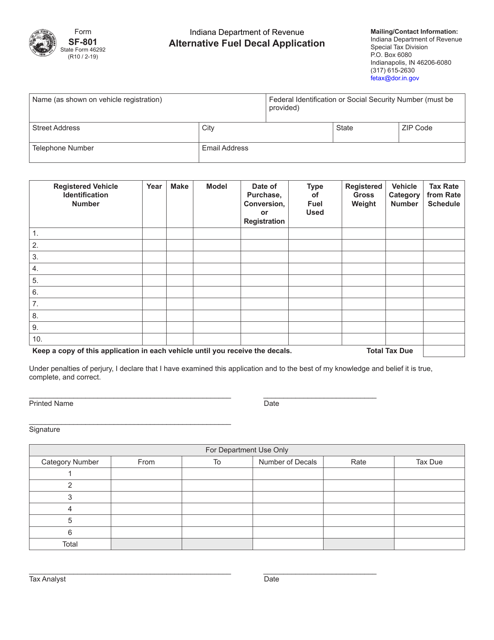

This document is used for applying for an alternative fuel decal in Indiana.

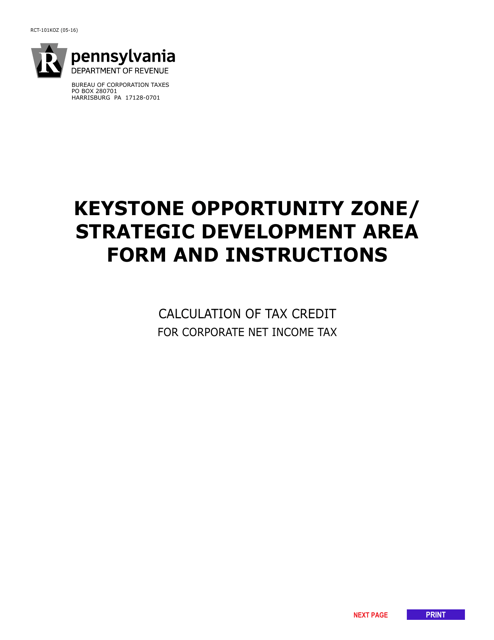

This Form is used for calculating the tax credit for corporate net income tax in Keystone Opportunity Zone/Strategic Development Areas in Pennsylvania.

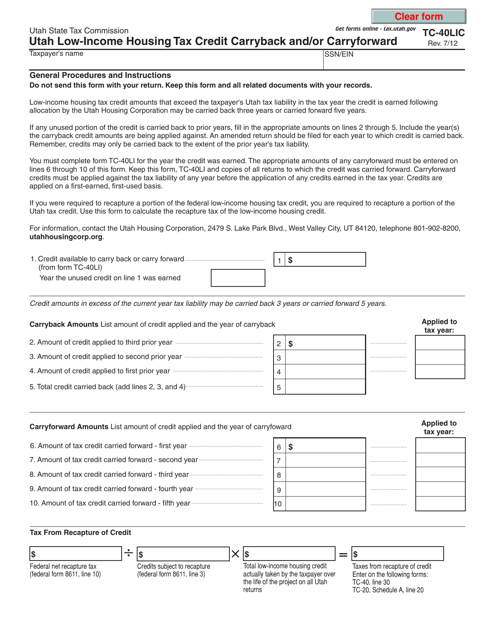

This form is used for reporting low-income housing tax credit carryback and/or carryforward in the state of Utah.