Tax Credit Templates

Documents:

3232

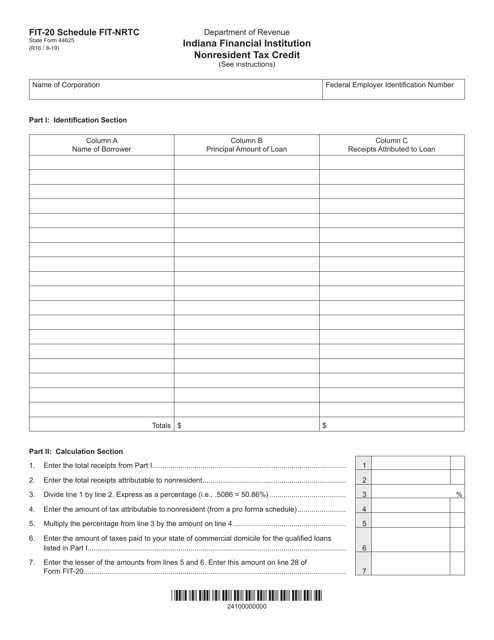

This Form is used for Indiana financial institutions to claim nonresident tax credits.

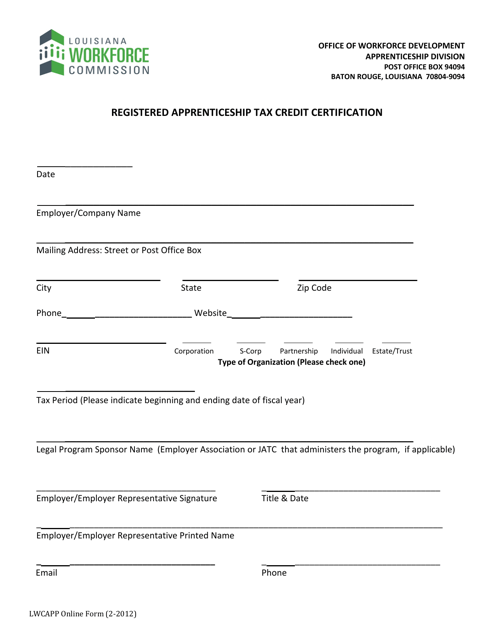

This document certifies the tax credit eligibility for businesses in Louisiana that participate in registered apprenticeship programs.

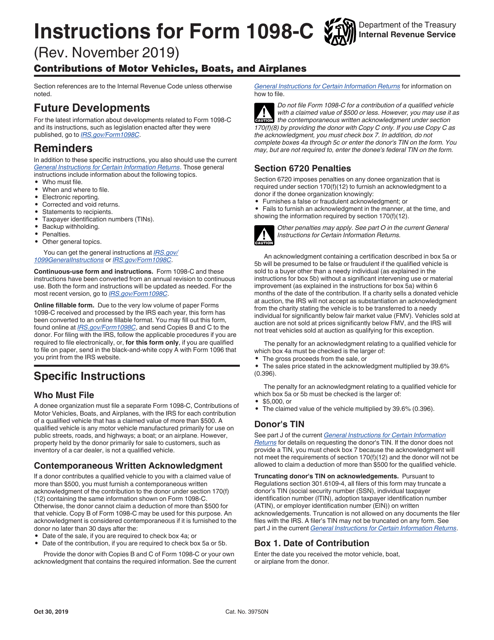

This Form is used for reporting contributions of motor vehicles, boats, and airplanes to the IRS. It provides instructions on how to properly report the donation for tax purposes.

This Form is used for reporting payments from qualified education programs under Sections 529 and 530 of the IRS code.