Tax Credit Templates

Documents:

3232

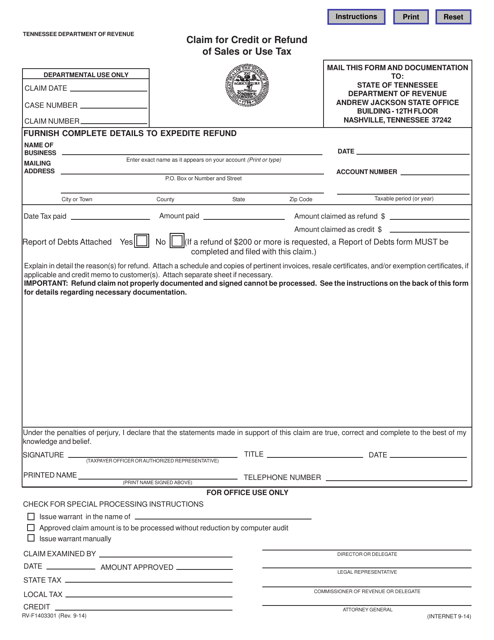

This form is used for claiming a credit or refund for sales or use tax paid in Tennessee.

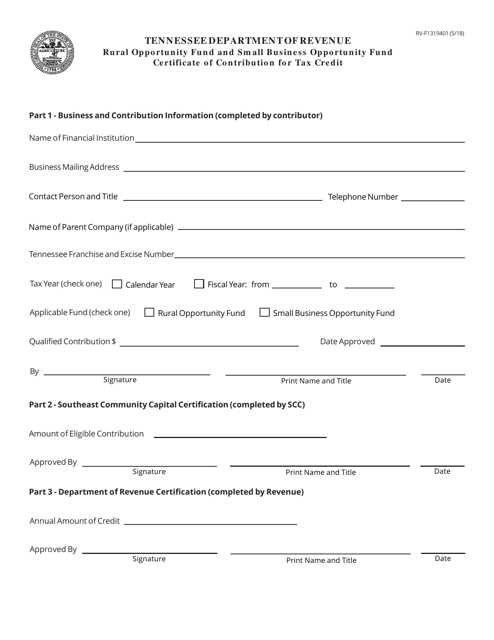

This form is used for obtaining a certificate of contribution for tax credit from the Rural Opportunity Fund and Small Business Opportunity Fund in Tennessee.

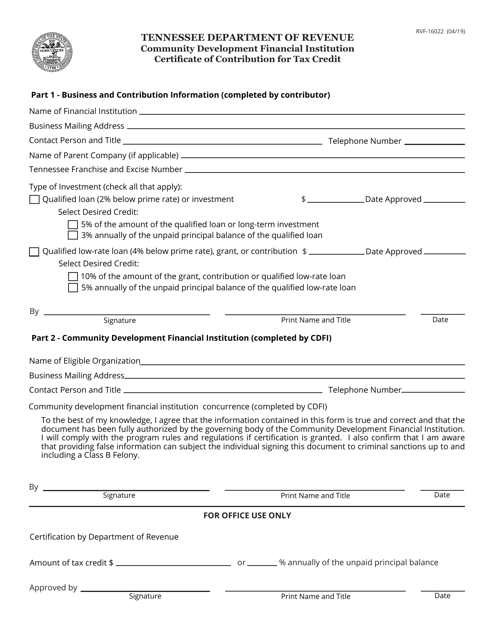

This form is used for Community Development Financial Institutions in Tennessee to certify their contribution for tax credits.

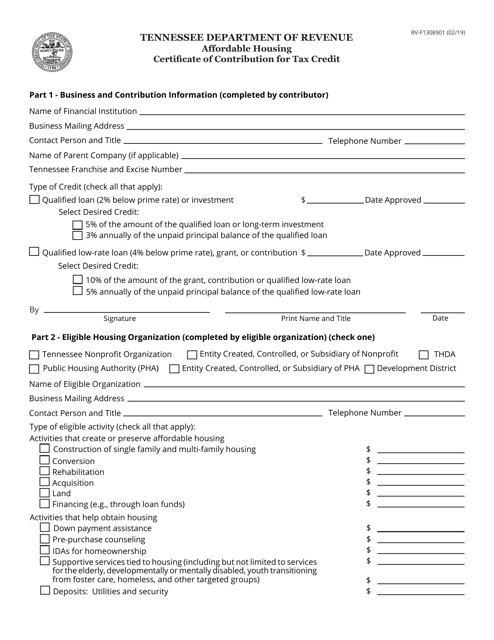

This document is used for claiming tax credits for contributing to affordable housing in Tennessee.

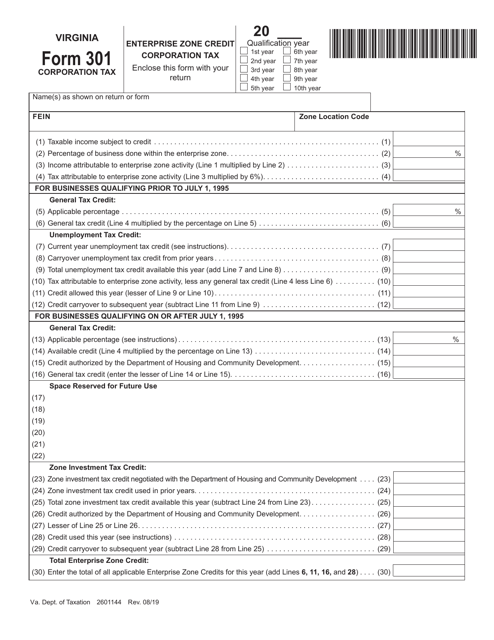

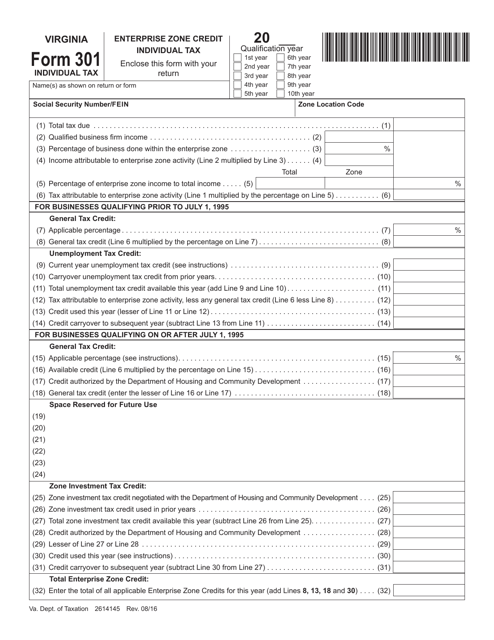

This form is used for claiming the Enterprise Zone Credit on individual taxes in the state of Virginia.

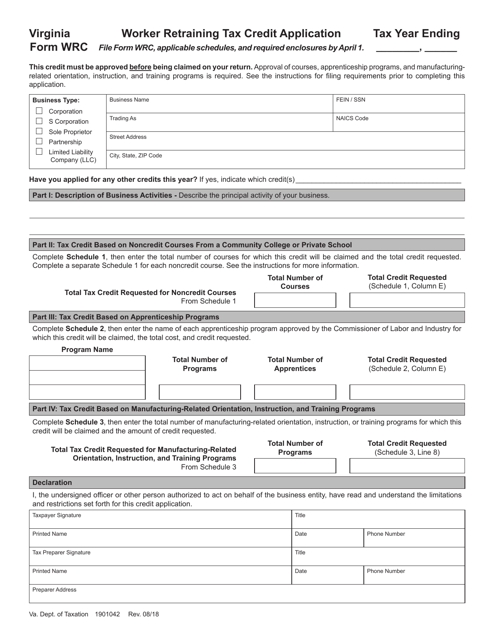

This form is used for applying for the Worker Retraining Tax Credit in the state of Virginia.

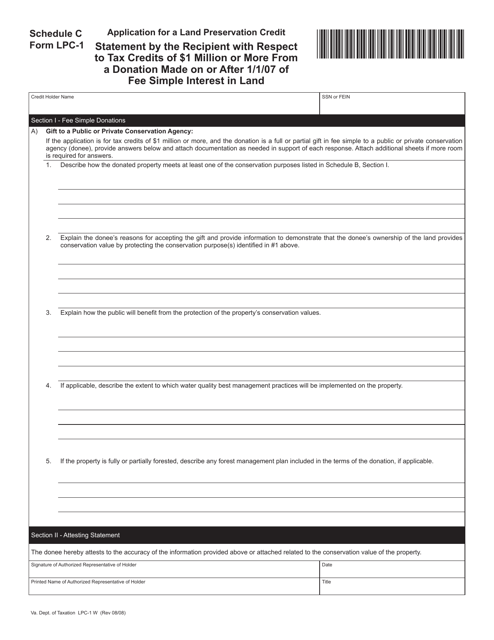

This Form is used for submitting a Schedule C statement in Virginia to report tax credits of $1 million or more received from a donation made on or after January 1, 2007, of fee simple interest in land.

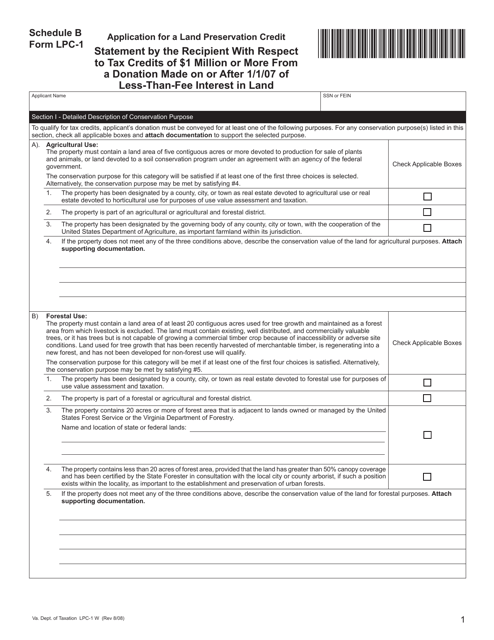

This document is for the recipient to provide a statement about tax credits of $1 million or more received from a donation of less-than-fee interest in land made in Virginia on or after 1/1/07.

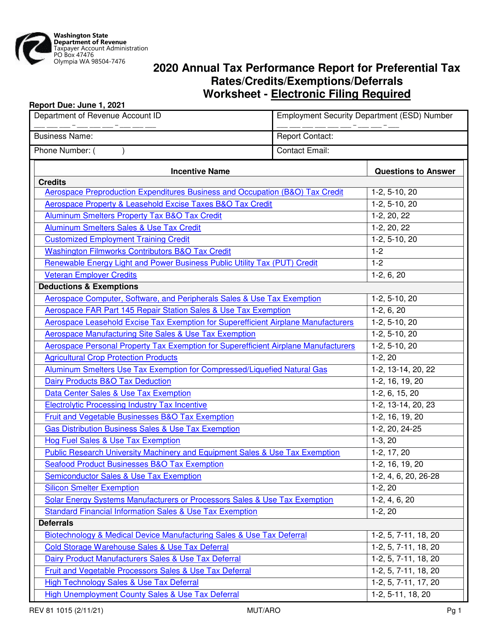

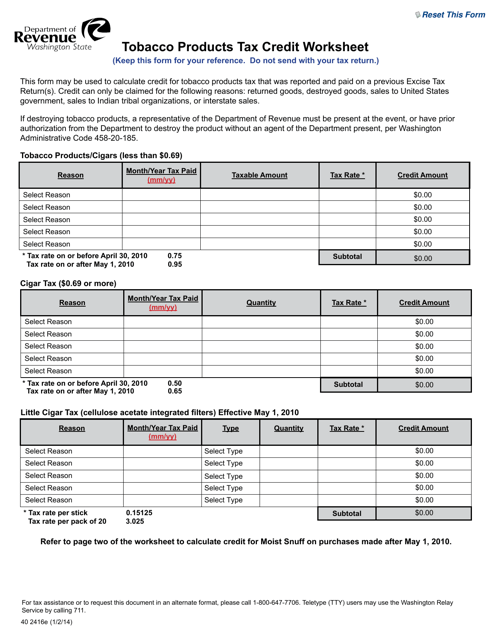

This form is used for calculating the tax credit for tobacco products in Washington state.

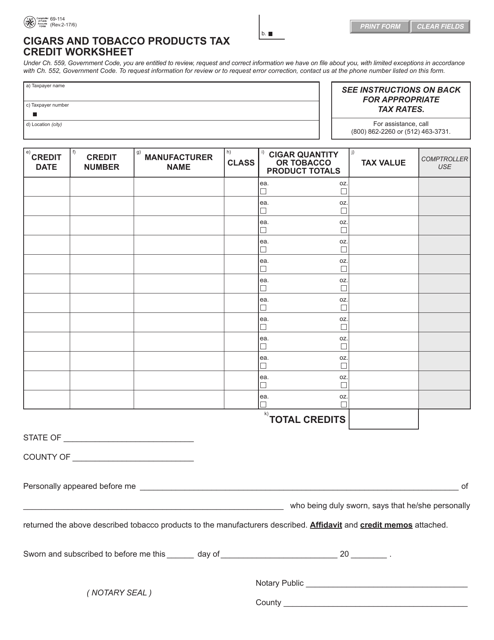

This form is used for calculating the tax credit for cigars and tobacco products in Texas.

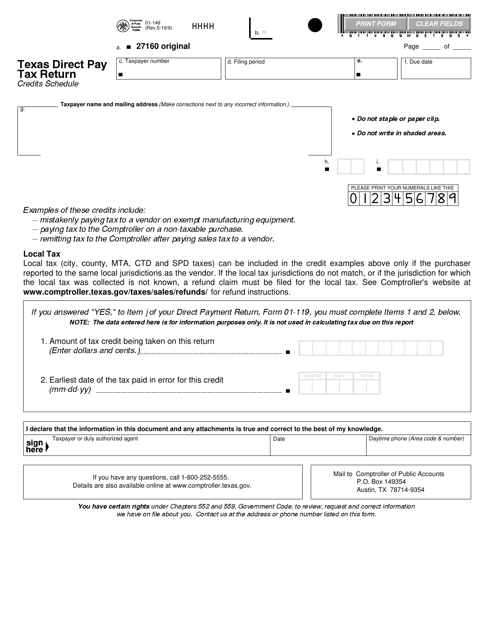

This form is used for reporting and claiming tax credits on the Texas Direct Pay Tax Return.

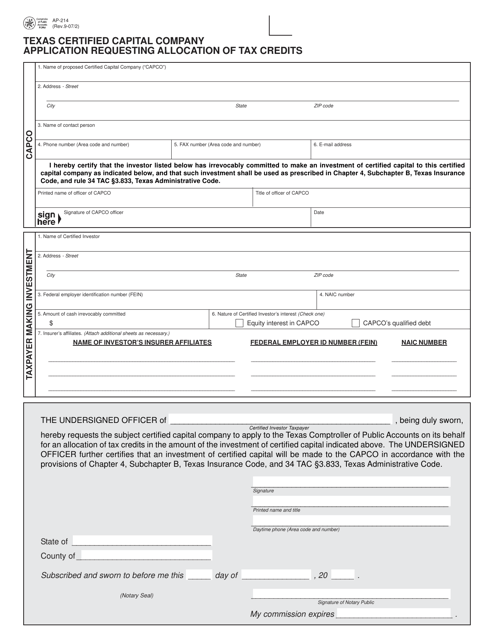

Form AP-214 Texas Certified Capital Company Application Requesting Allocation of Tax Credits - Texas

This form is used for requesting allocation of tax credits to Texas Certified Capital Companies in Texas.

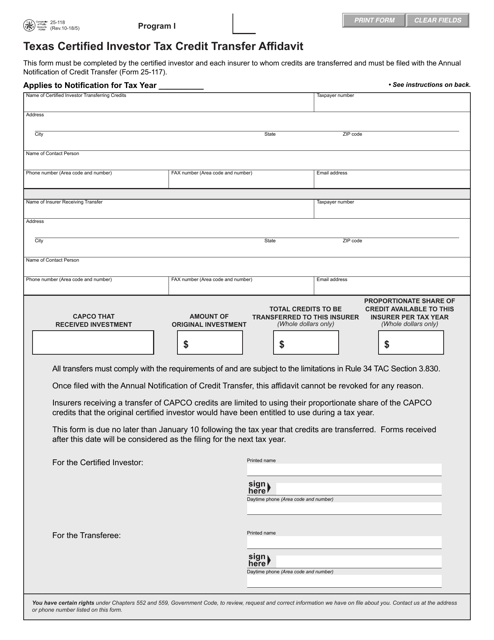

This document is used for transferring tax credits to certified investors in Texas under Program I. The Form 25-118 is a certified investor tax credit transfer affidavit specifically designed for this purpose.