Tax Credit Templates

Documents:

3232

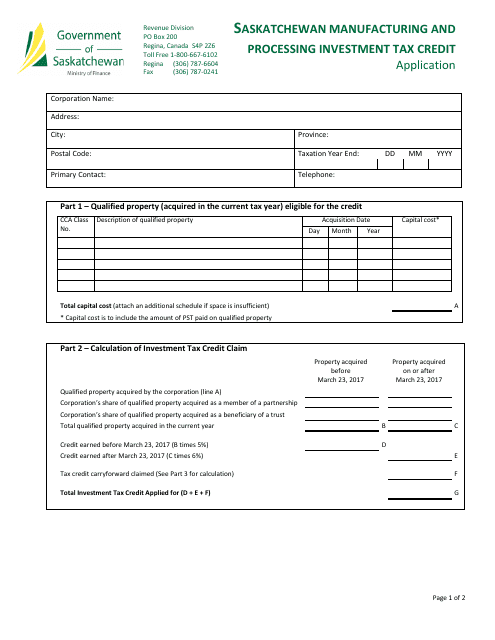

This Form is used for applying for the Manufacturing and Processing Investment Tax Credit in the province of Saskatchewan, Canada.

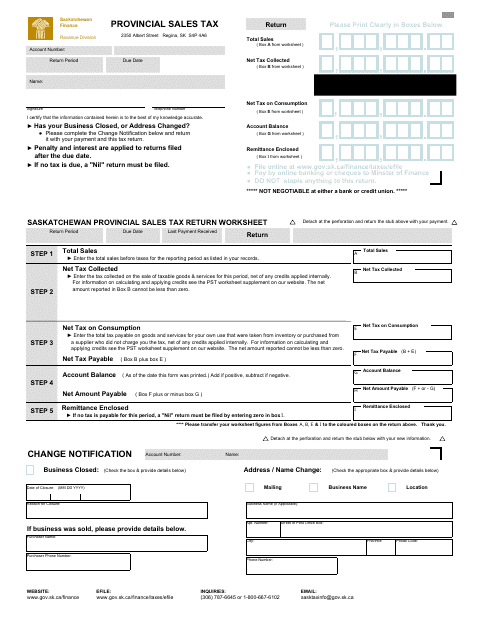

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

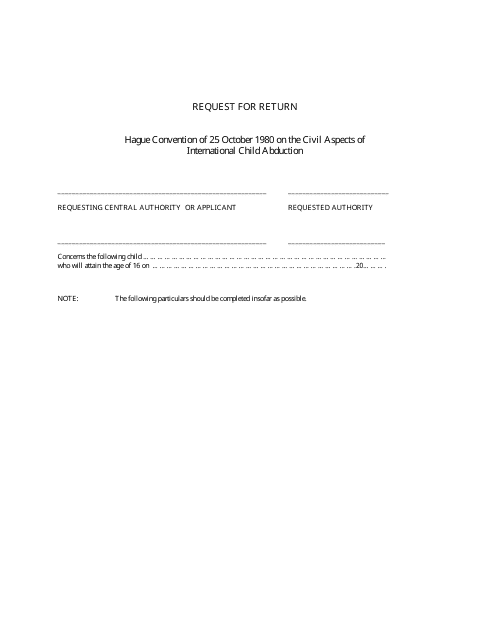

This document is used to request a return in the province of Saskatchewan, Canada.

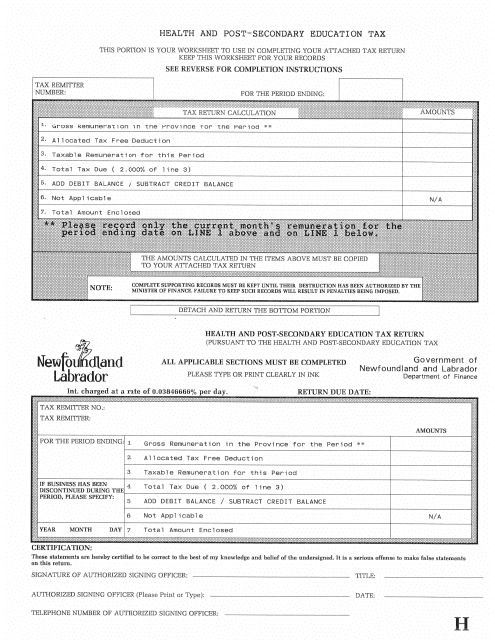

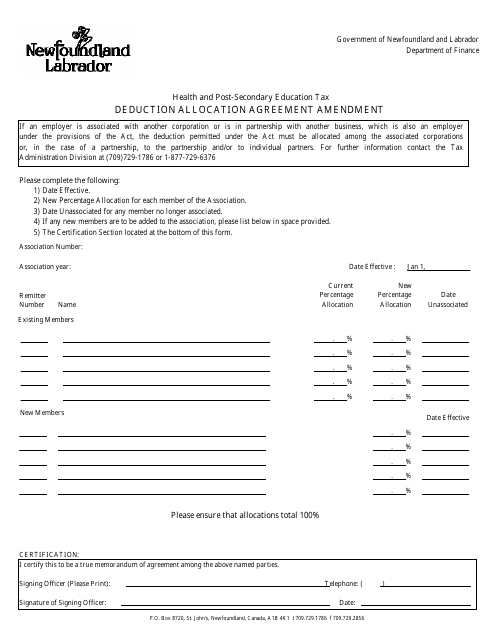

This document is for residents of Newfoundland and Labrador, Canada who want to claim health and post-secondary education tax credits.

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

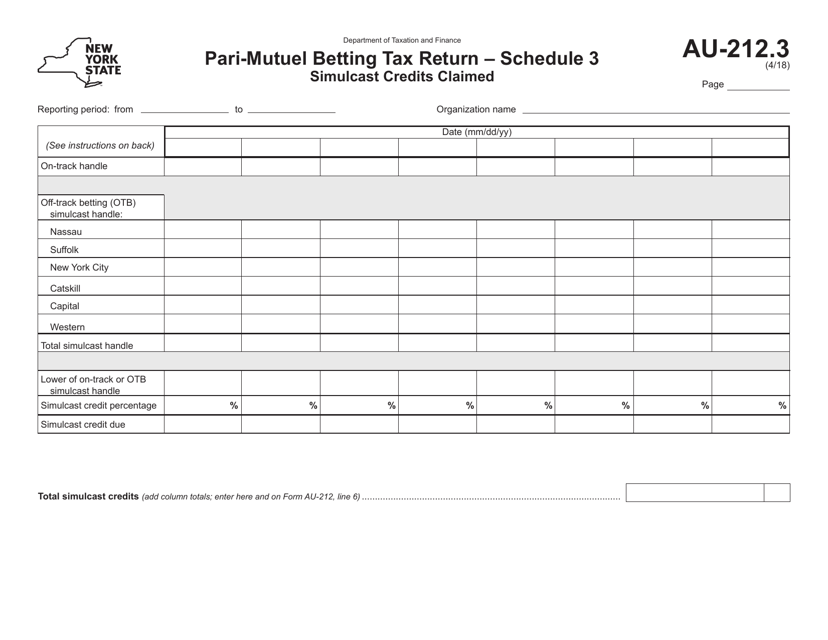

This form is used for claiming simulcast credits in New York.

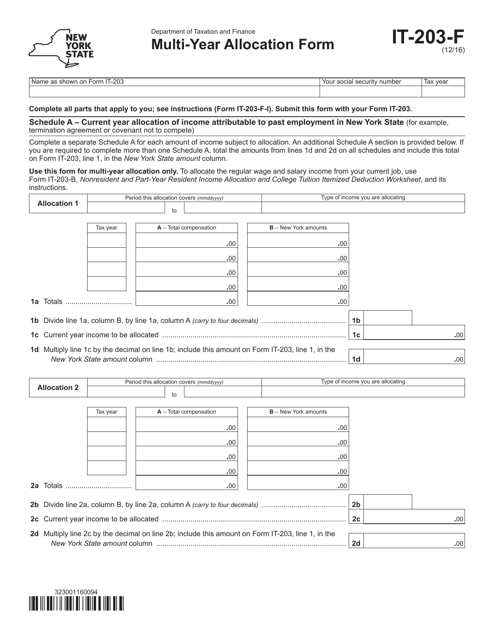

This Form is used for allocating income and deductions for multiple years in New York.

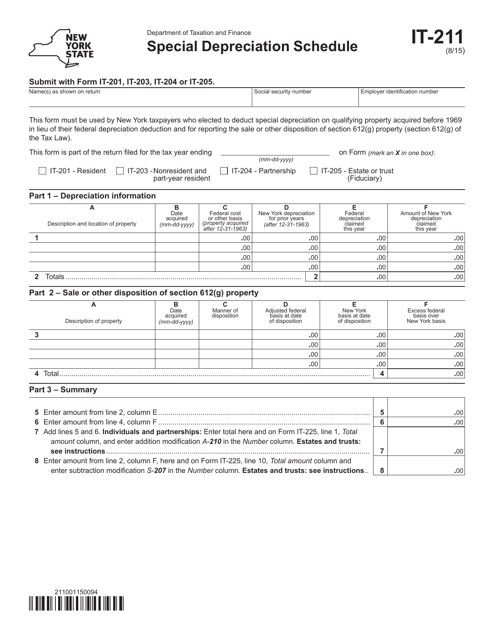

This form is used for reporting special depreciation for businesses in New York. It helps businesses calculate and claim deductions for depreciating assets.

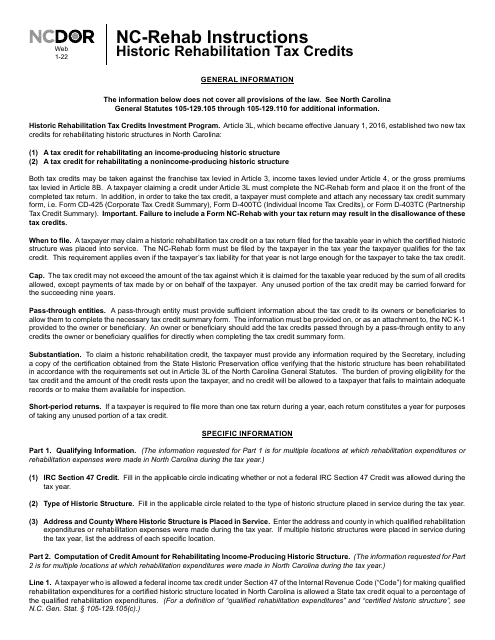

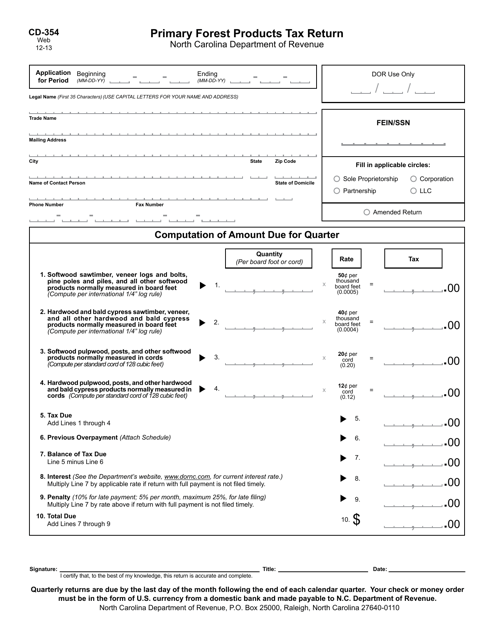

This form is used for reporting and paying taxes on primary forest products in North Carolina.

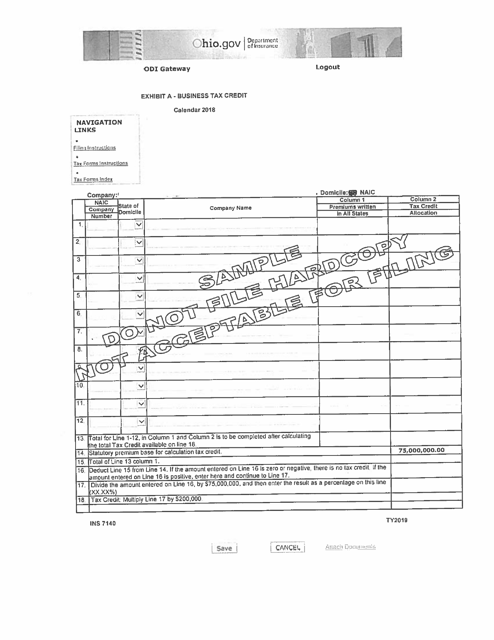

This form is used for claiming a business tax credit in the state of Ohio.

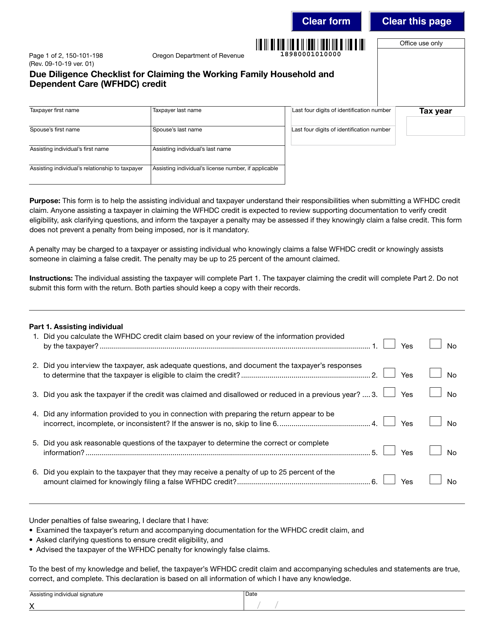

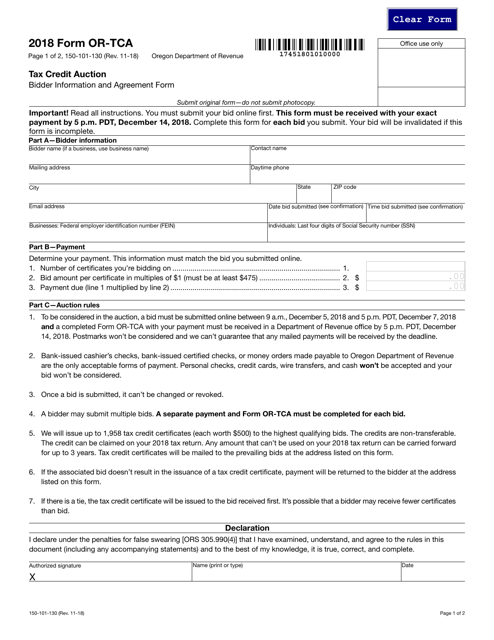

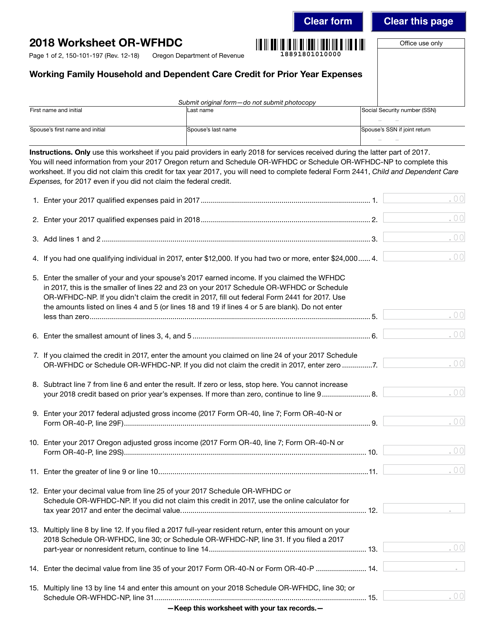

This form is used for claiming the Working Family Household and Dependent Care Credit for prior year expenses in the state of Oregon.

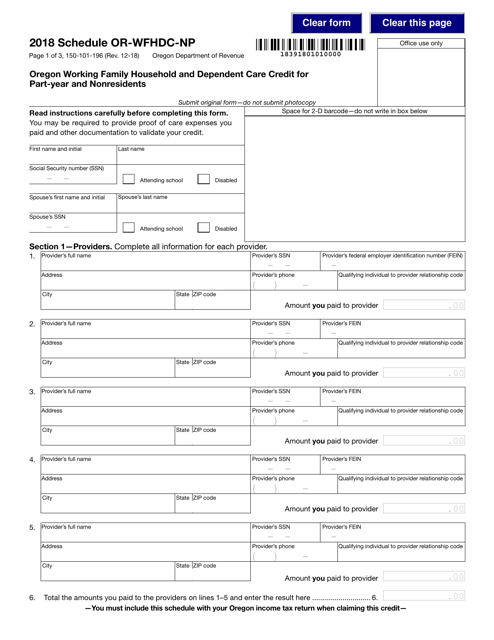

This Form is used for claiming the Working Family Household and Dependent Care Credit in Oregon for part-year residents and nonresidents.

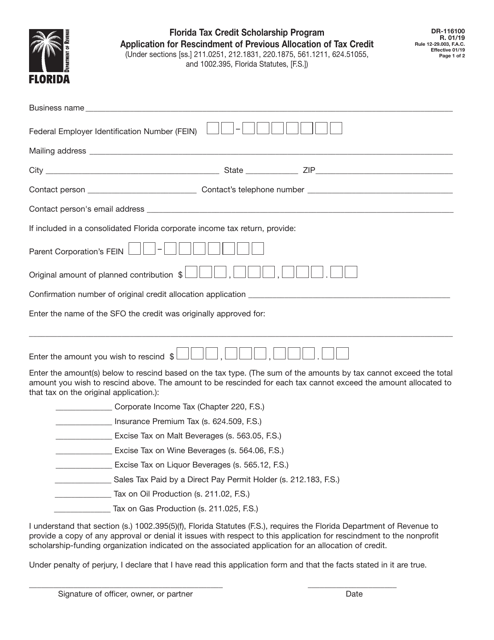

This form is used for the Florida Tax Credit Scholarship Program to apply for the rescindment of a previous allocation of tax credit.

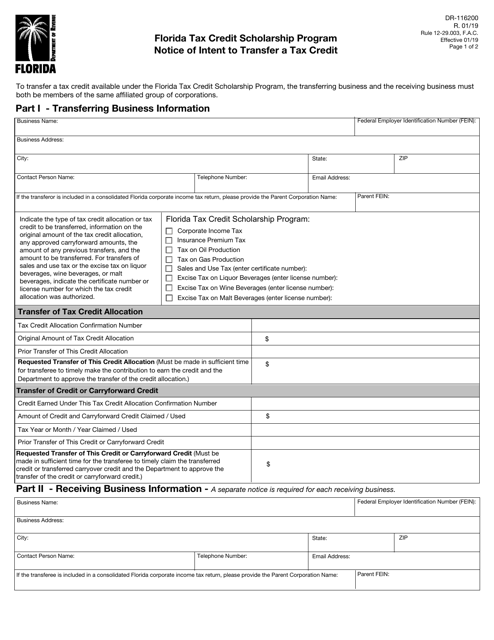

This form is used for notifying the Florida Tax Credit Scholarship Program of the intent to transfer a tax credit in Florida.

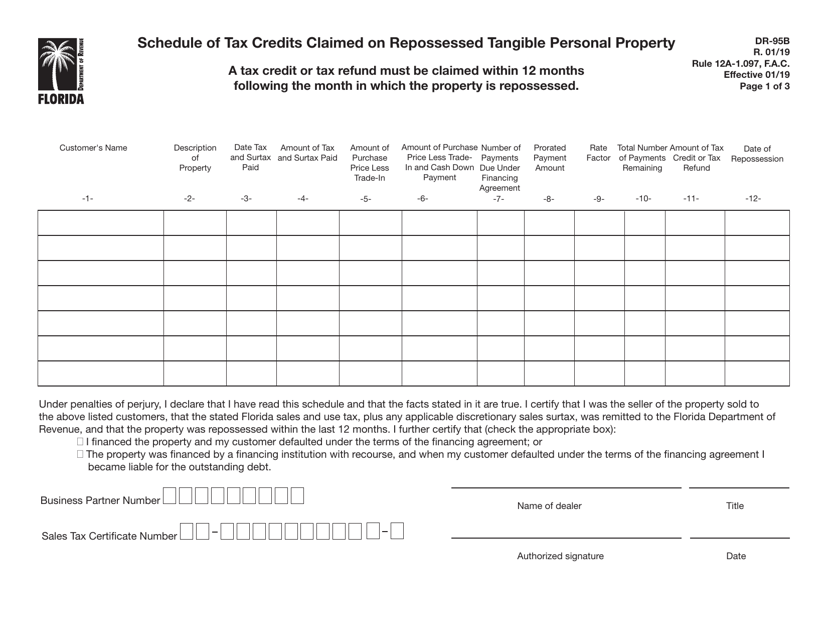

This form is used for reporting and claiming tax credits on repossessed tangible personal property in the state of Florida.

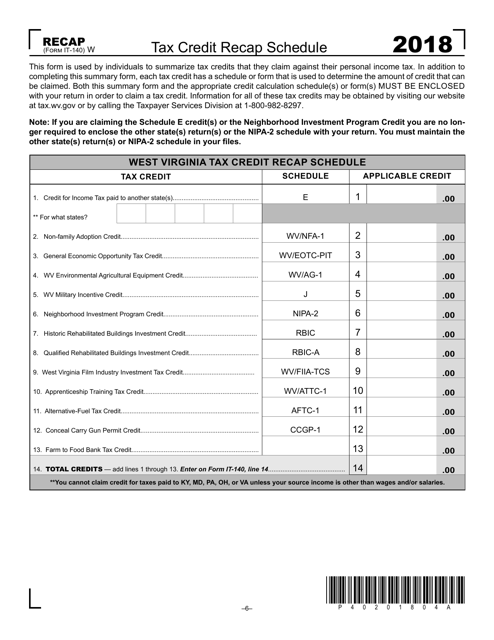

This form is used for summarizing tax credits in the state of Virginia. It helps individuals to calculate and report their tax credits in a concise manner.

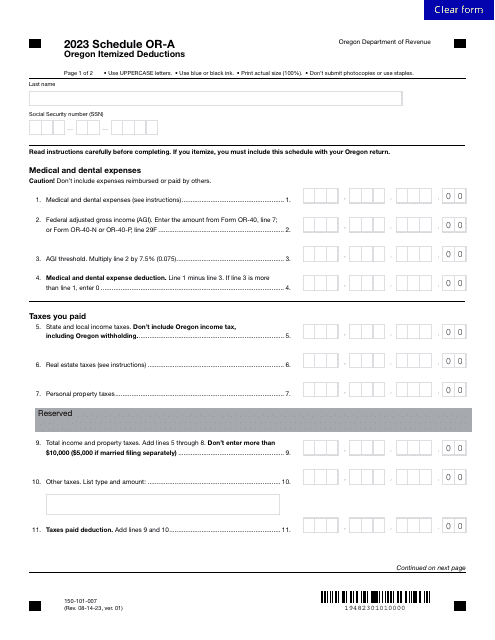

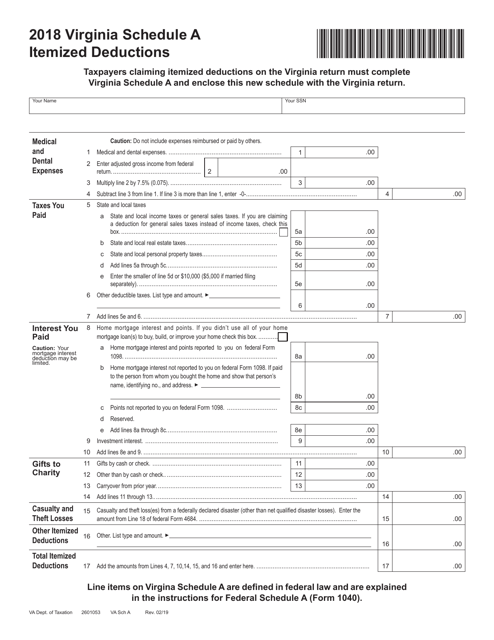

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.