Tax Withholding Templates

Documents:

407

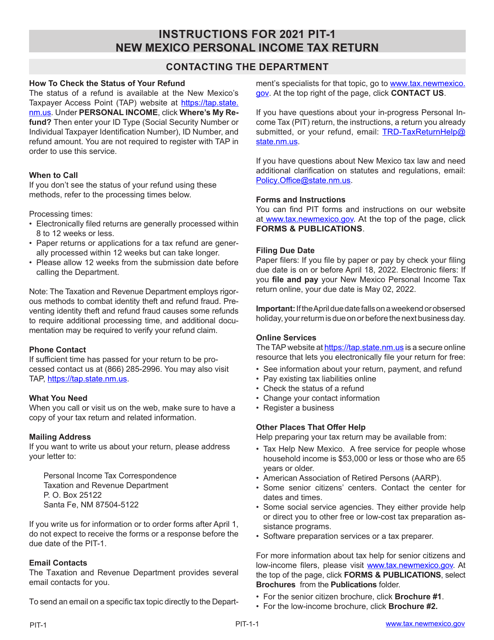

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

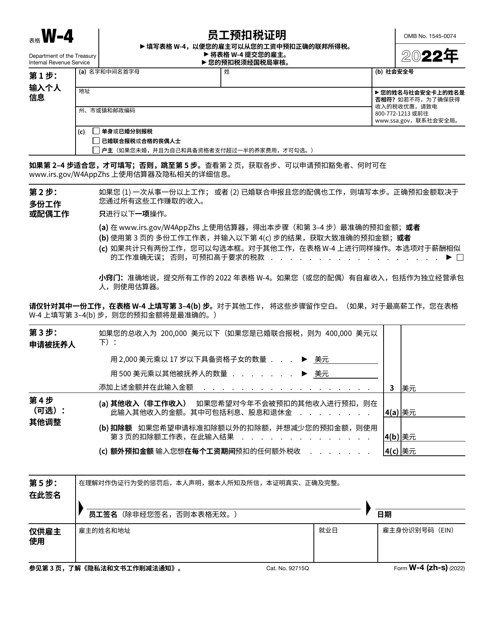

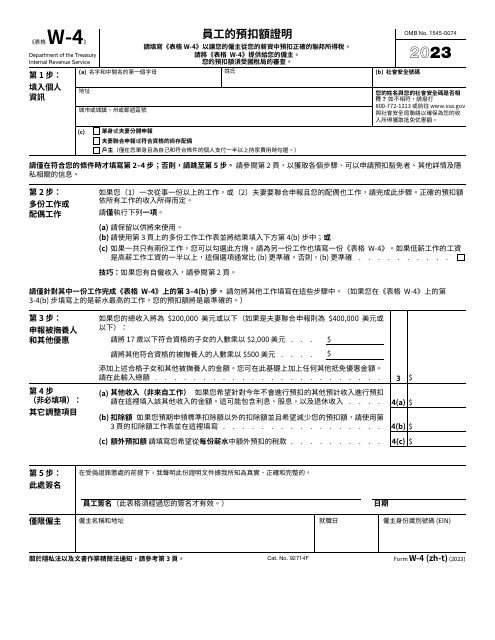

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

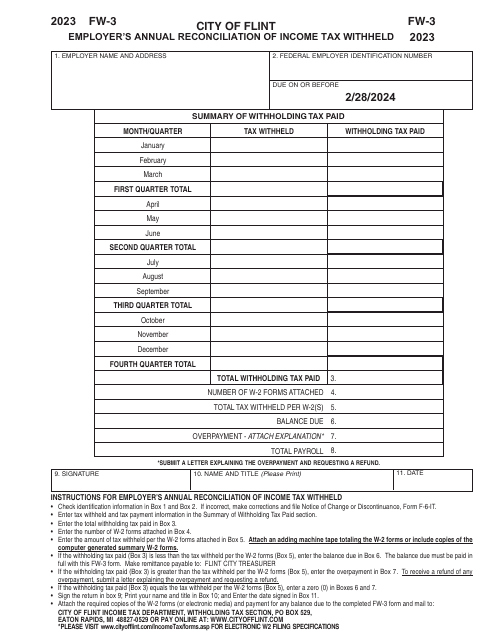

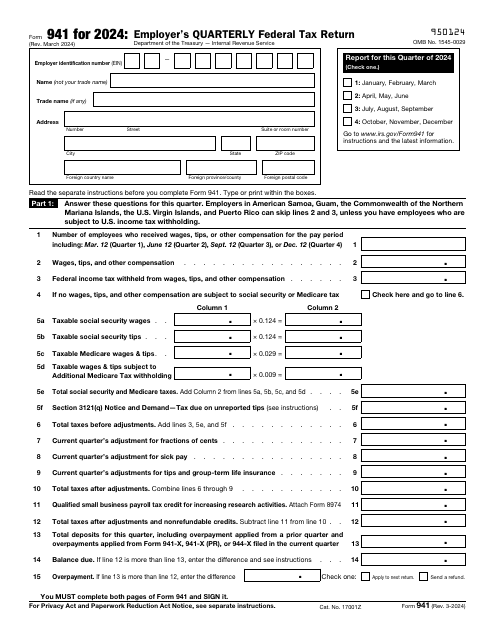

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

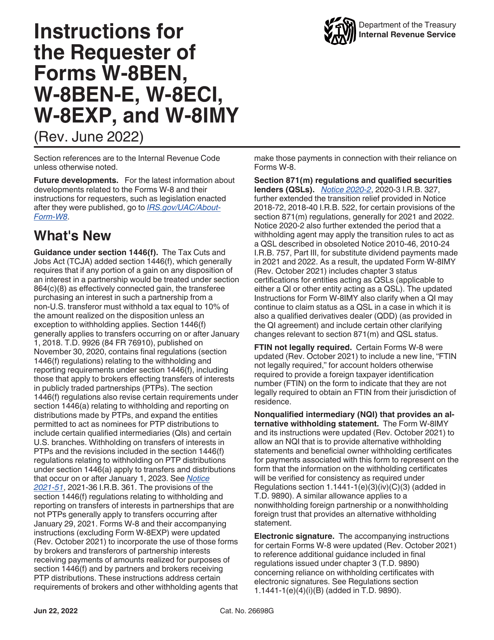

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

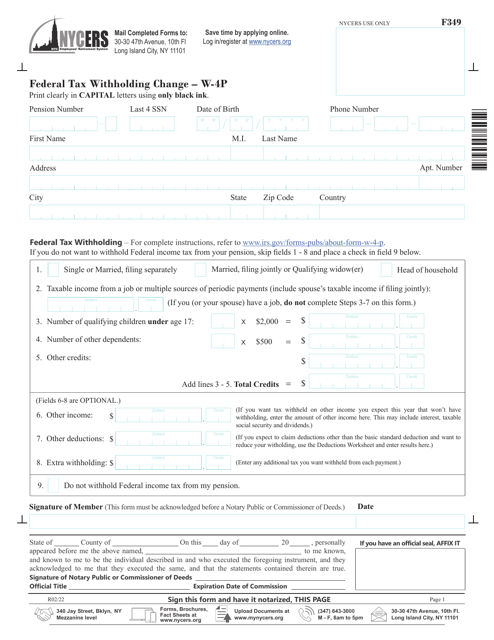

This form is used for making changes to federal tax withholding in New York City.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

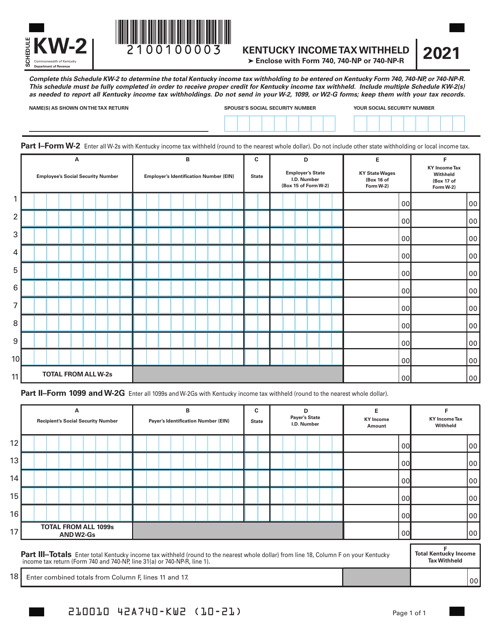

This Form is used for reporting Kentucky income tax withheld from employee's paychecks in Kentucky.

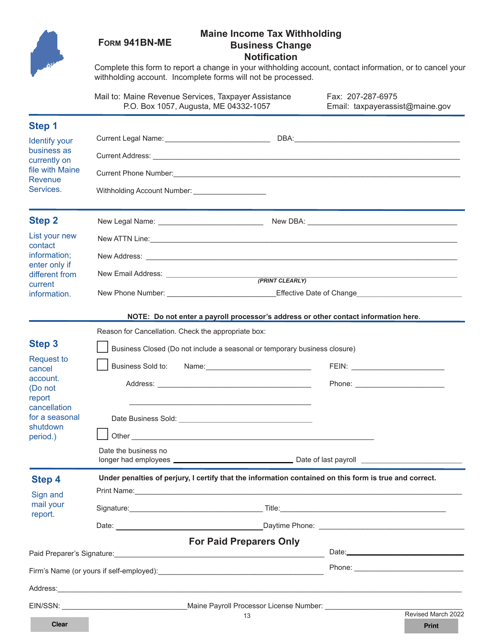

This form is used for businesses to notify the state of Maine about any changes in their income tax withholding.

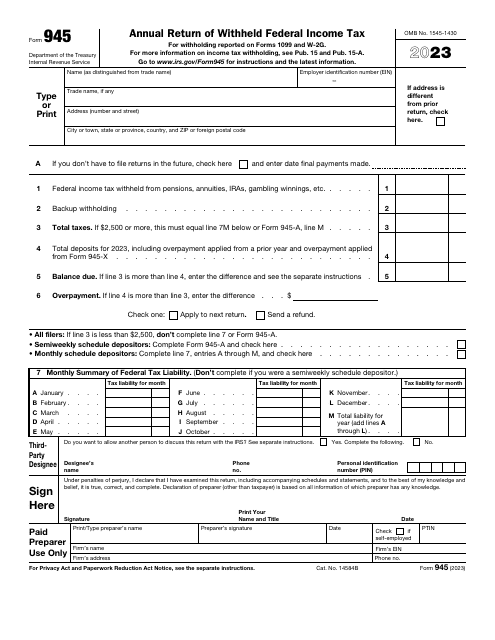

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.