Tax Withholding Templates

Documents:

407

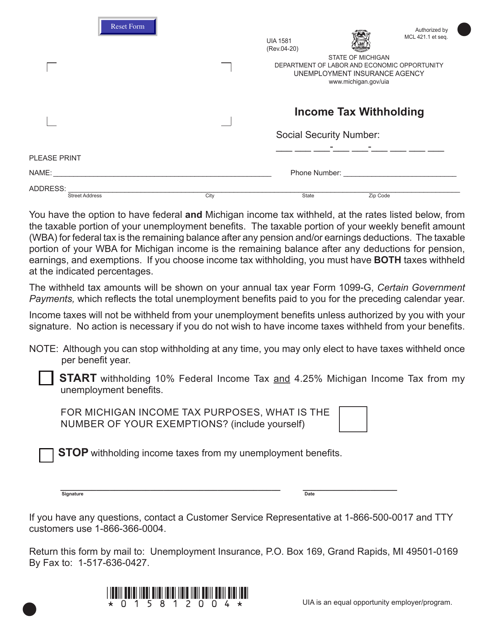

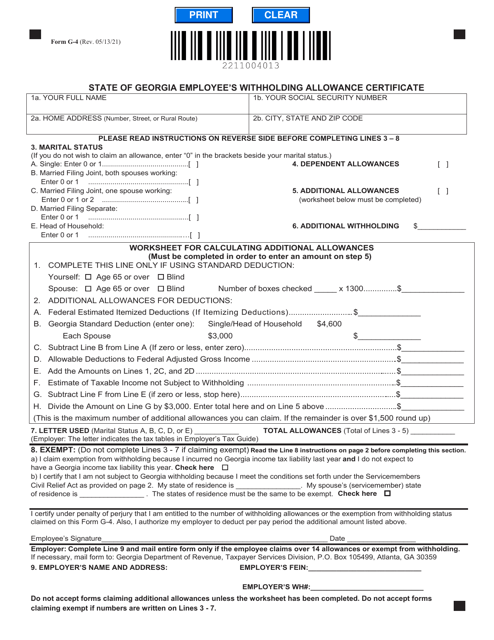

This Form is used for reporting and documenting income tax withholding for residents of Michigan.

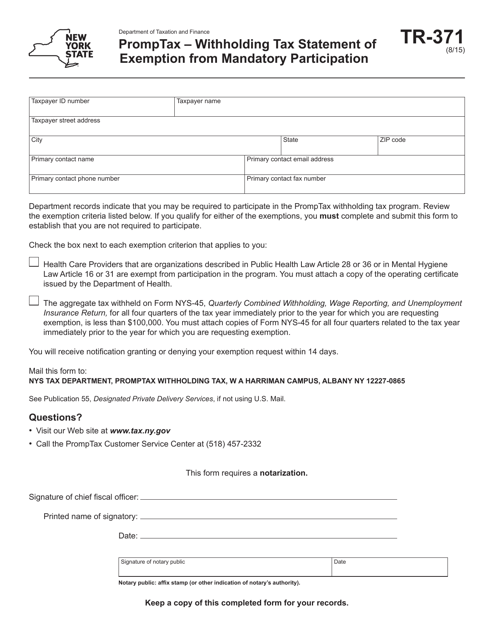

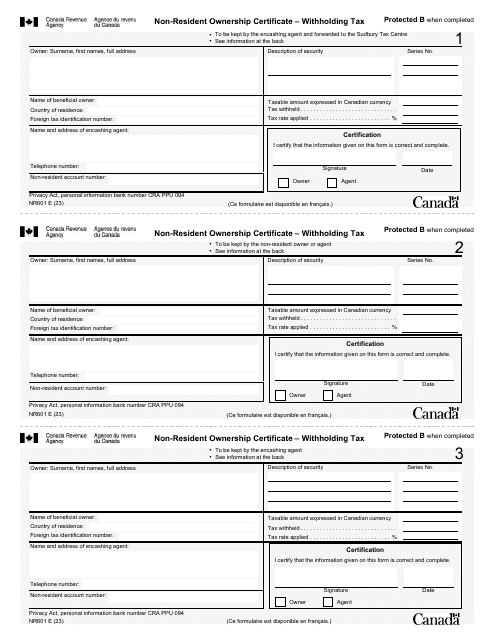

This Form is used for claiming exemption from mandatory participation in withholding tax in New York.

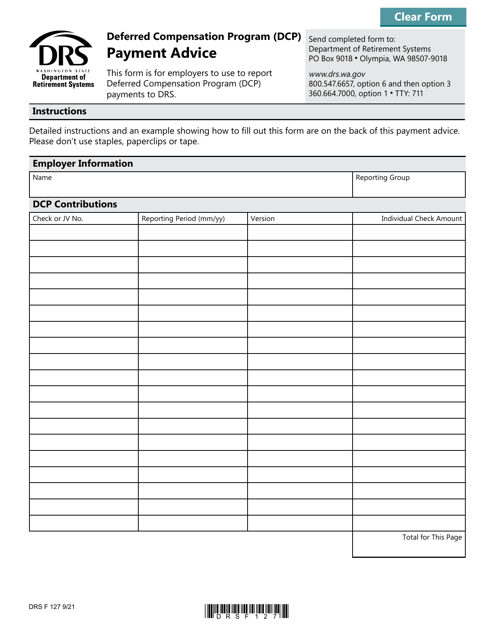

This form is used for providing payment advice for the Deferred Compensation Program (DCP) in Washington.

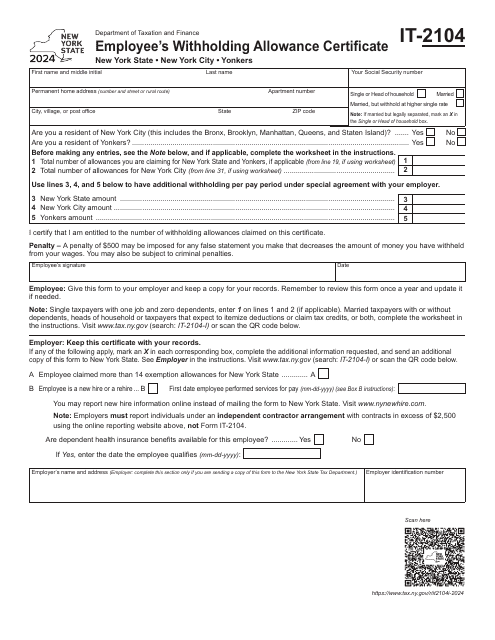

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

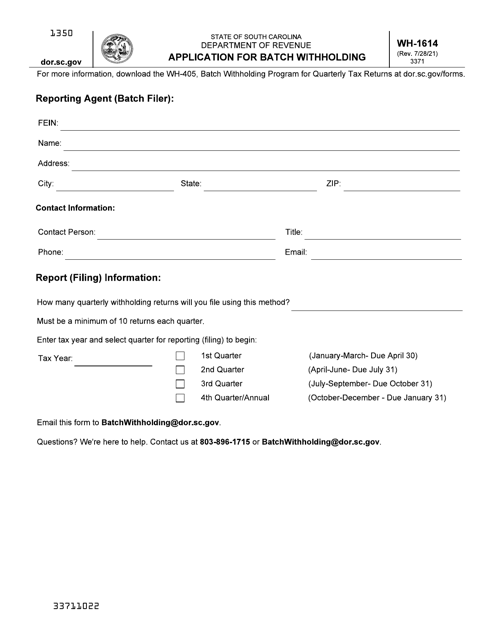

This form is used to apply for batch withholding in the state of South Carolina.

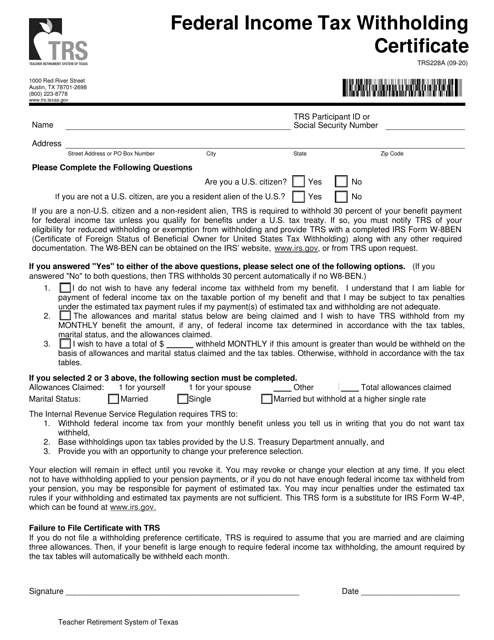

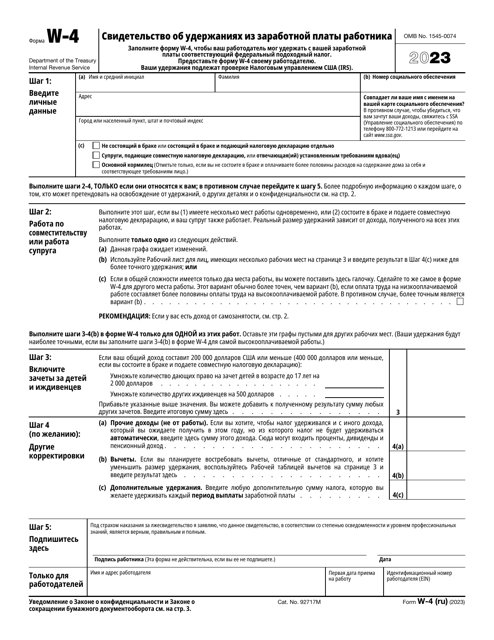

This form is used for the federal income tax withholding in Texas. It helps individuals to determine the correct amount of federal tax to be withheld from their paychecks.

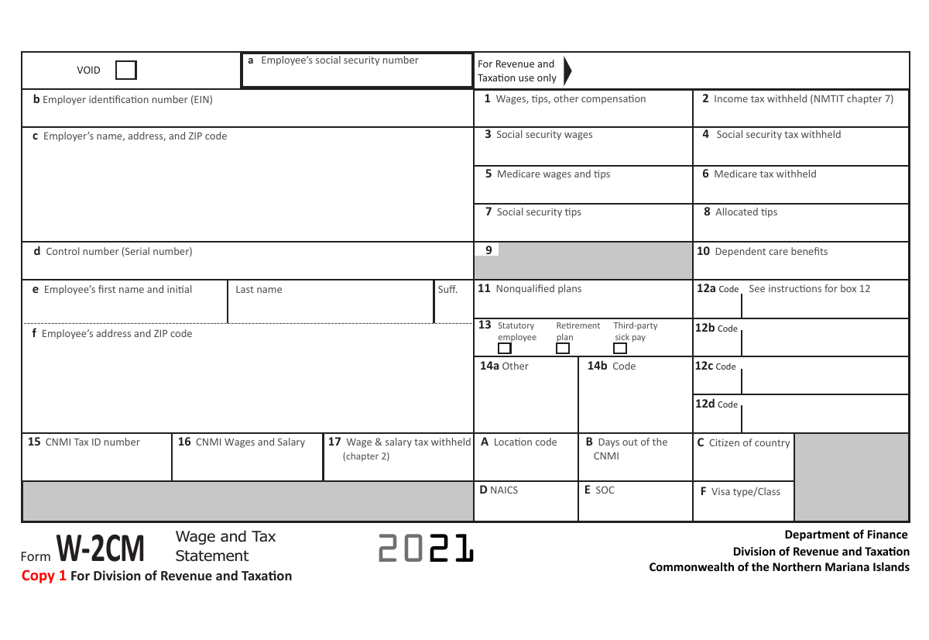

This Form is used for reporting wages and taxes in the Northern Mariana Islands.

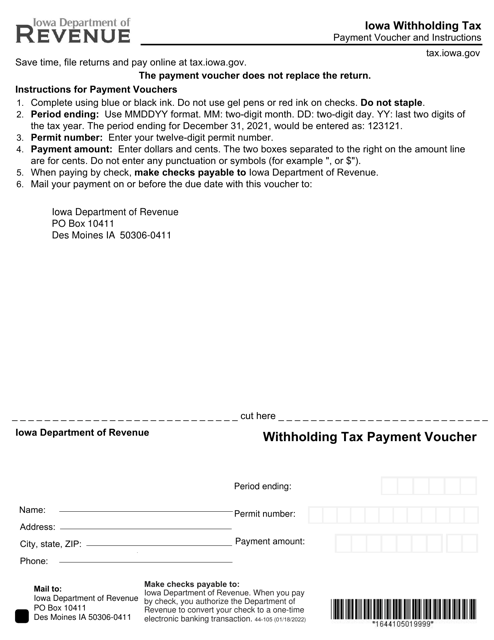

This form is used for making tax payments to the state of Iowa.

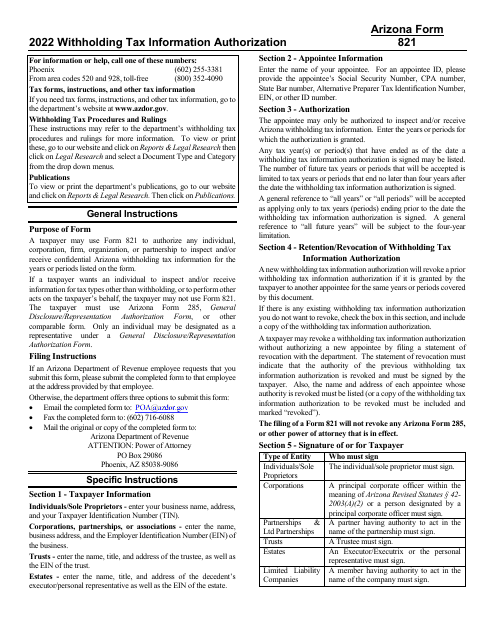

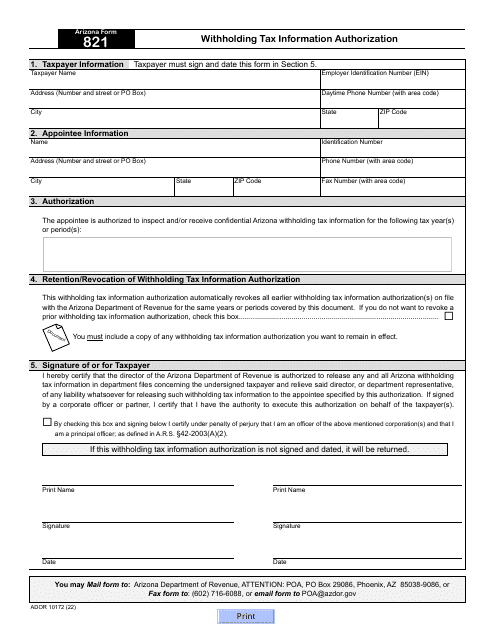

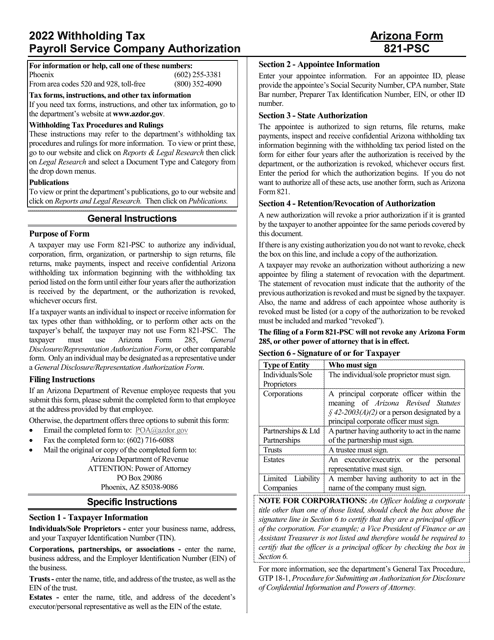

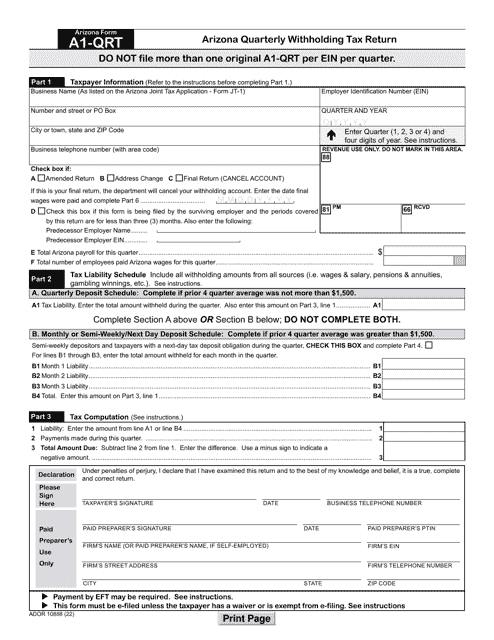

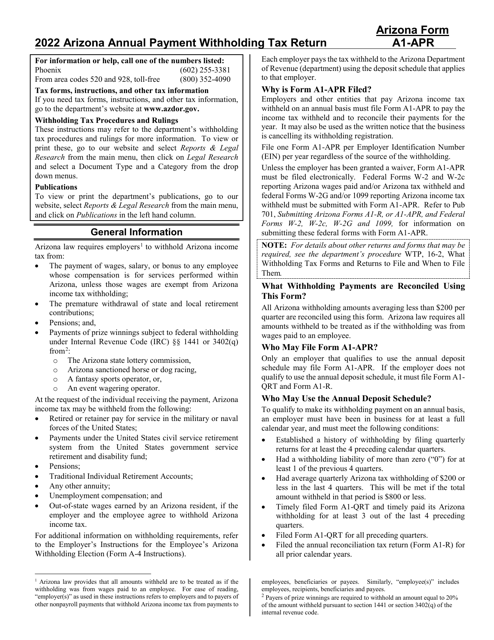

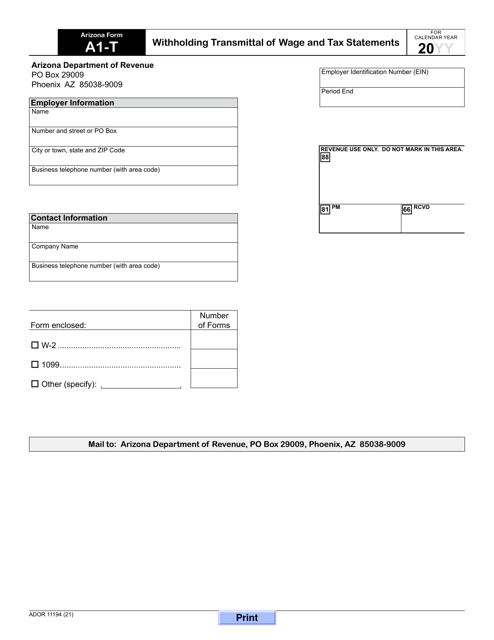

This form is used for transmitting wage and tax statements to the Arizona Department of Revenue (ADOR) for withholding purposes.

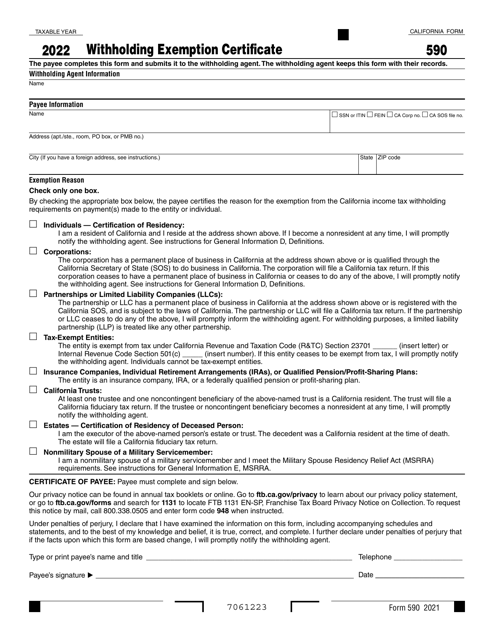

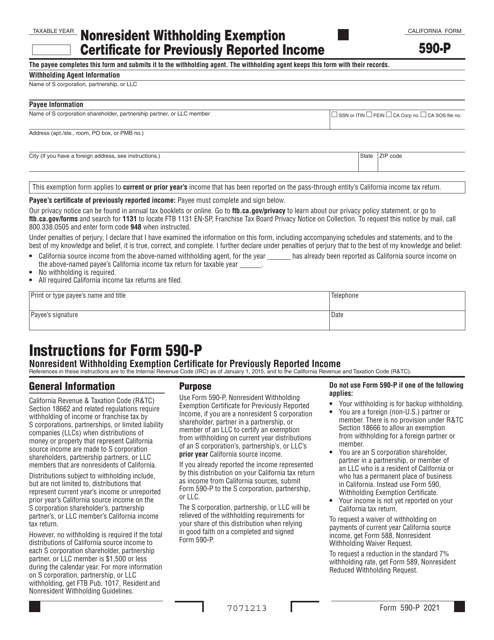

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

This Form is used for claiming an exemption from nonresident withholding for previously reported income in California.

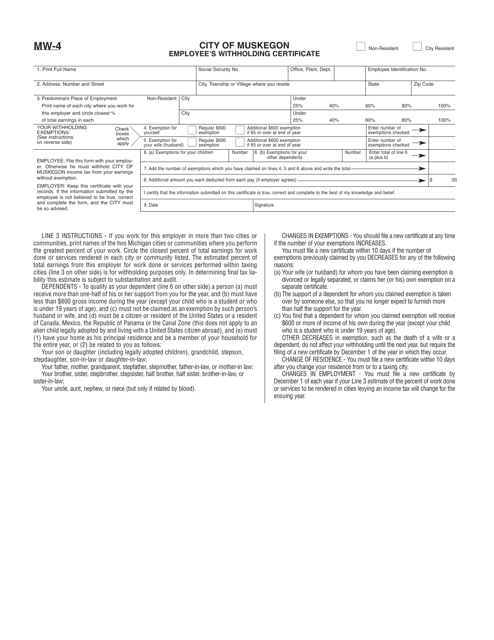

This Form is used for employees in the City of Muskegon, Michigan to declare their withholding status for state and local income taxes.

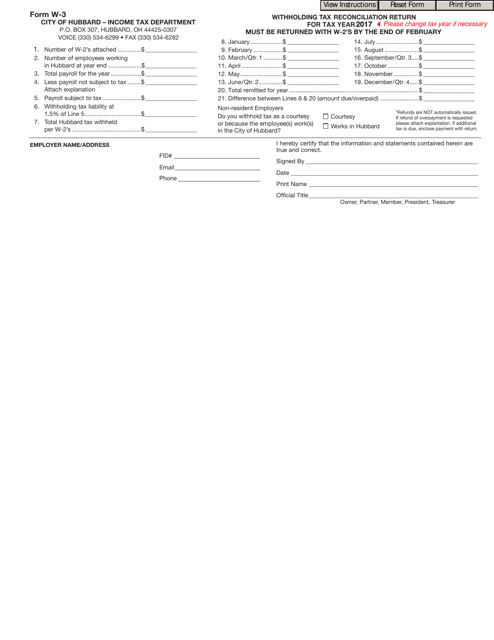

This form is used for reconciling and reporting withholding taxes for the City of Hubbard, Ohio.

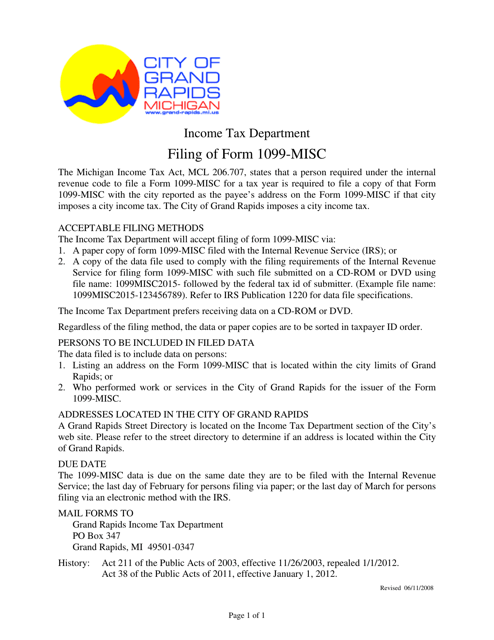

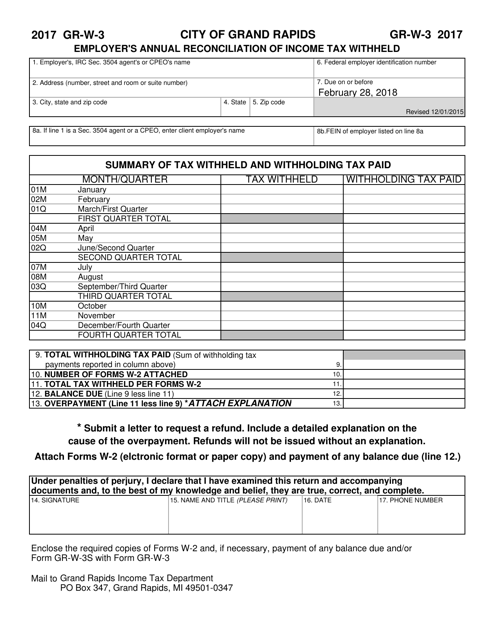

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

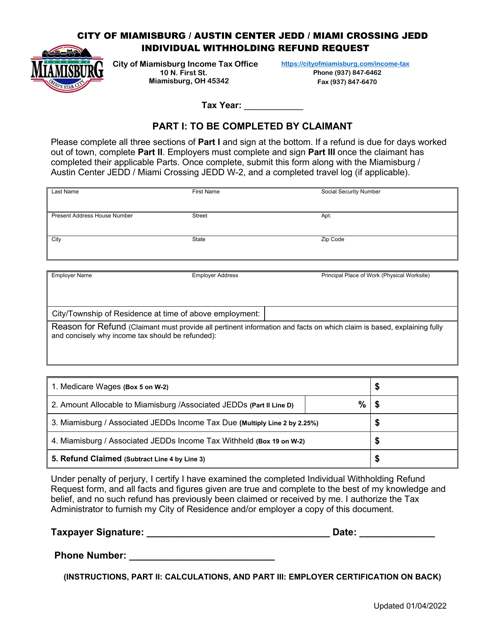

This document is used for requesting a refund of individual withholding taxes paid to the City of Miamisburg, Ohio.

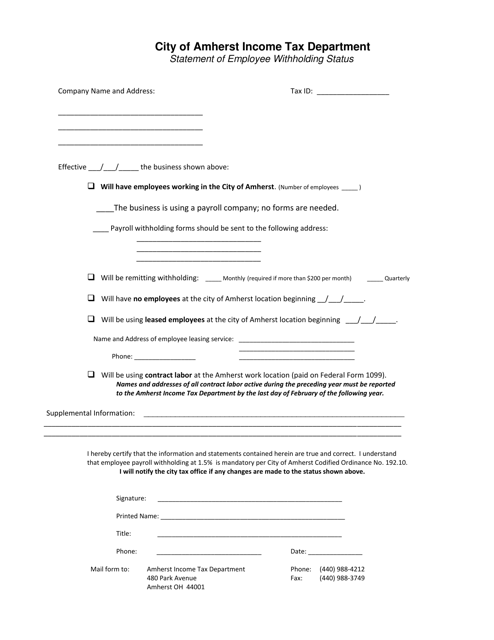

This document is for employees in the City of Amherst, Ohio to declare their withholding status for tax purposes.

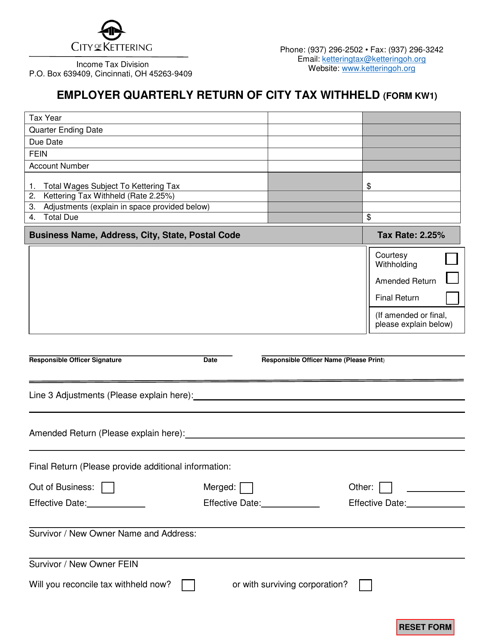

This form is used for employers in Kettering, Ohio to report the amount of city tax withheld from employee wages on a quarterly basis.