Tax Withholding Templates

Documents:

407

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

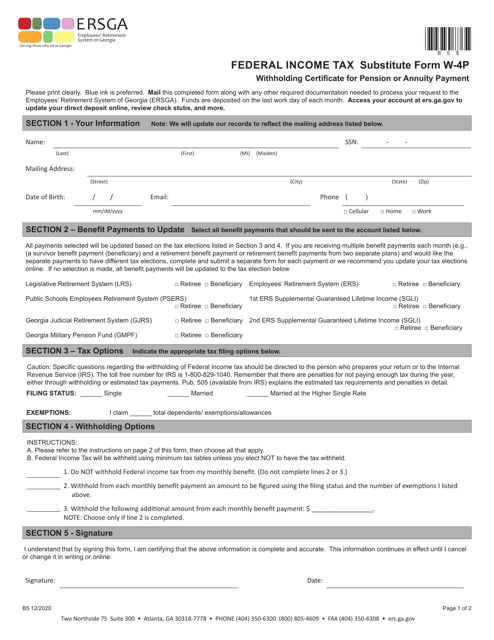

This form is used for reporting and withholding federal income tax for pension and annuity payments in the state of Georgia.

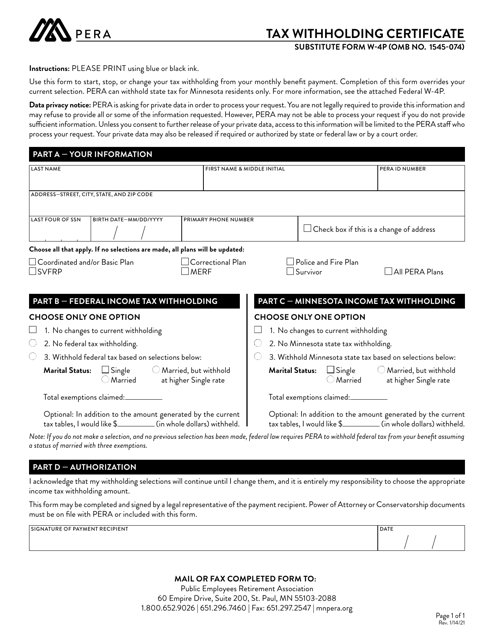

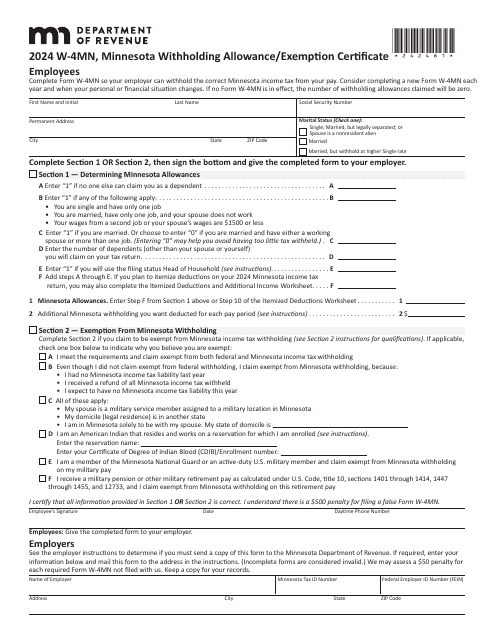

This Form is used for tax withholding for retirement or annuity payments in the state of Minnesota.

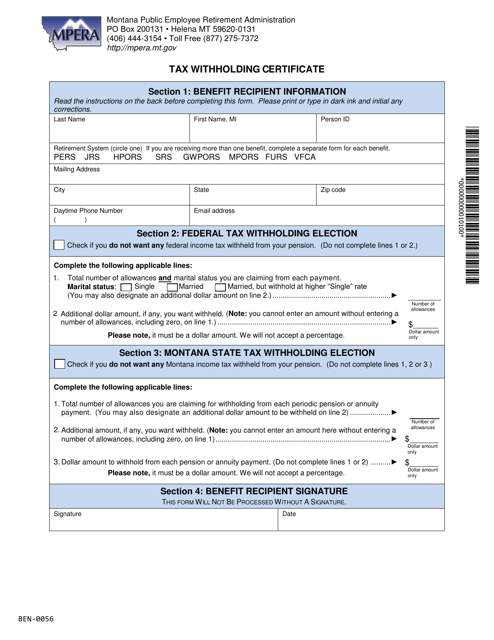

This Form is used for requesting the correct amount of withholding tax to be taken out of your wages in the state of Montana.

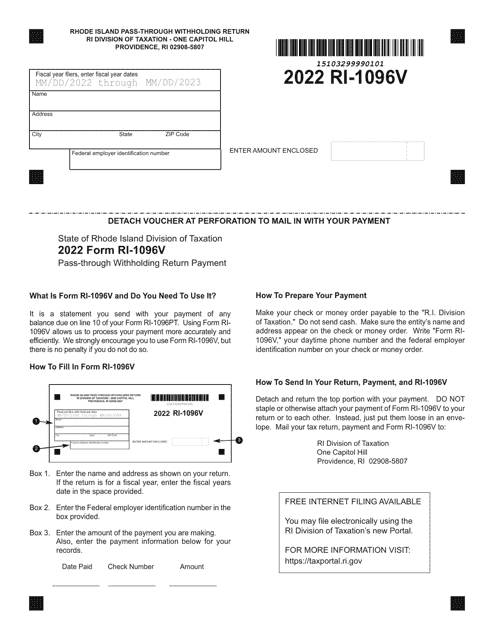

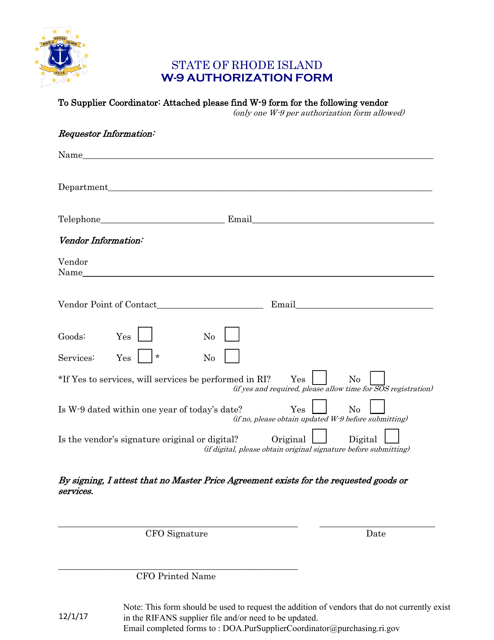

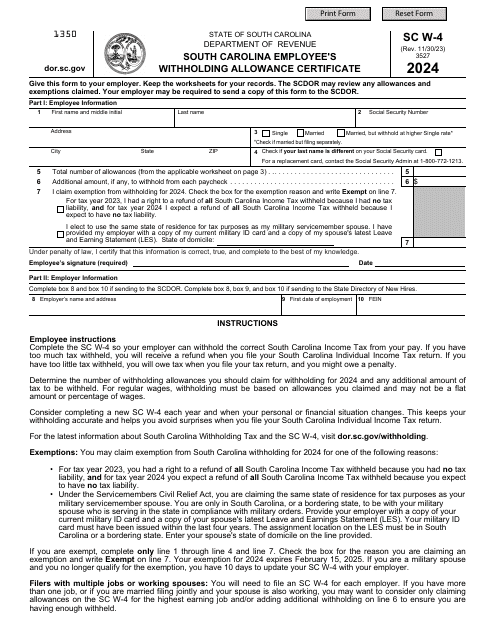

This document authorizes the withholding of taxes in Rhode Island.

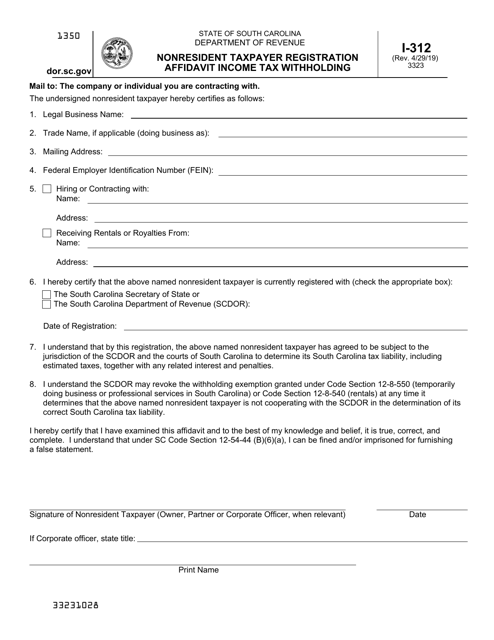

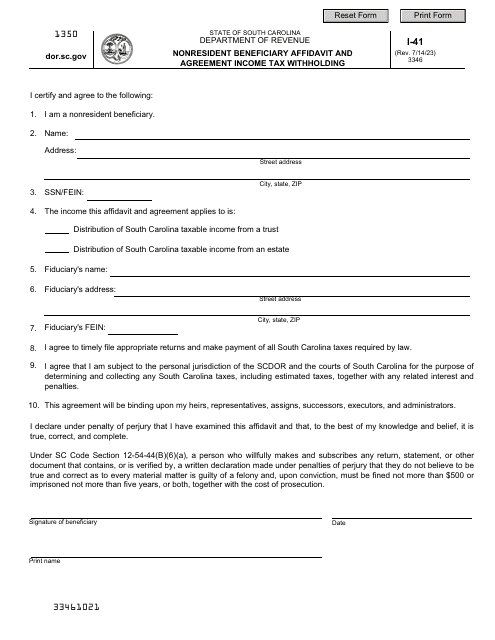

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

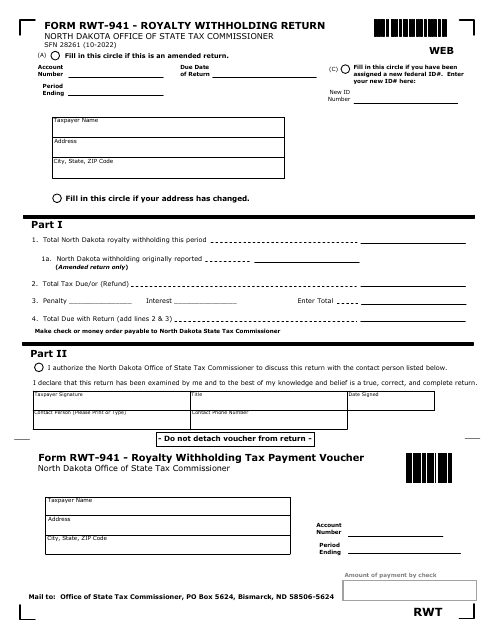

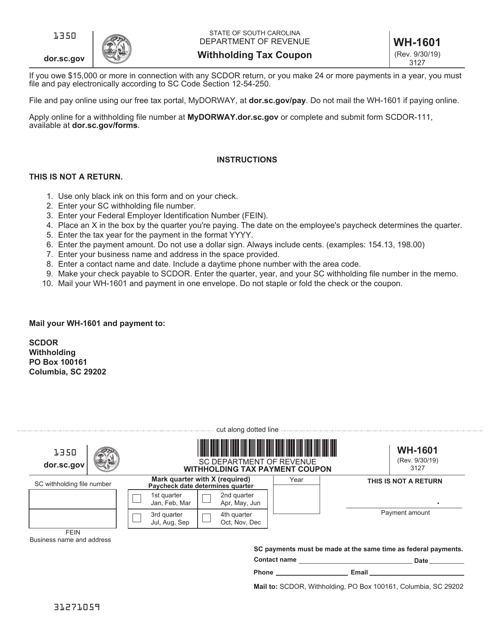

This Form is used for submitting withholding tax payments in the state of South Carolina.

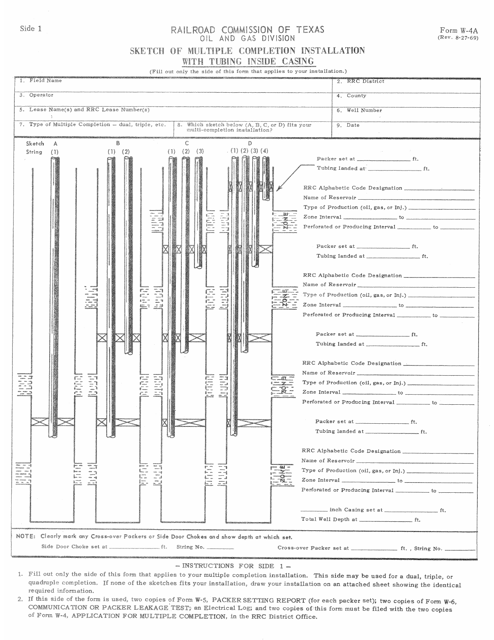

This form is used for sketching out the multiple completion installation of a project in Texas.

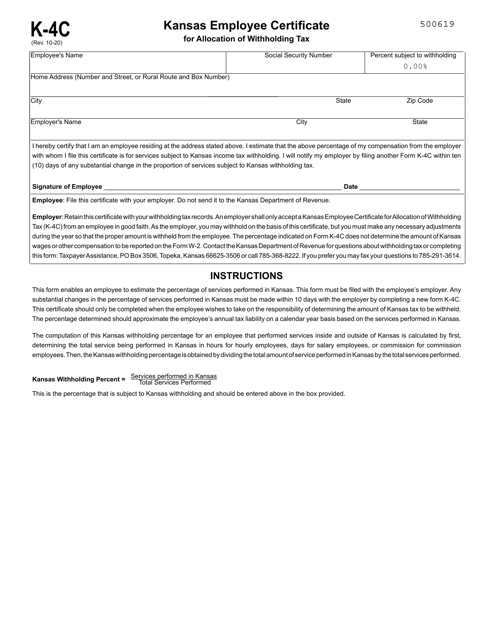

This form is used for Kansas employees to allocate their withholding tax.

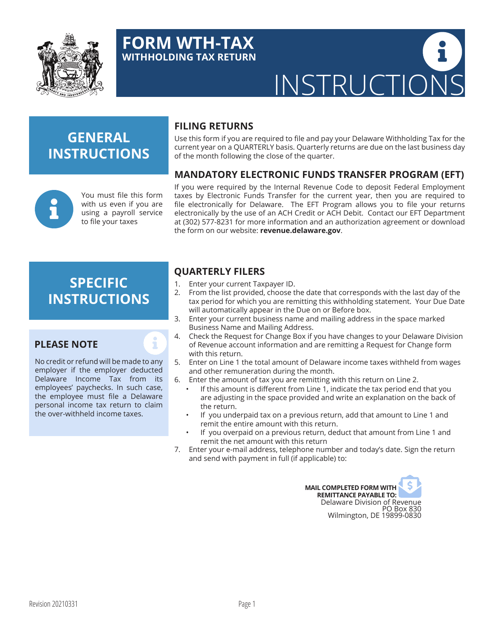

This form is used for filing tax withholding returns in Delaware. It provides instructions on how to report and pay the withheld taxes.

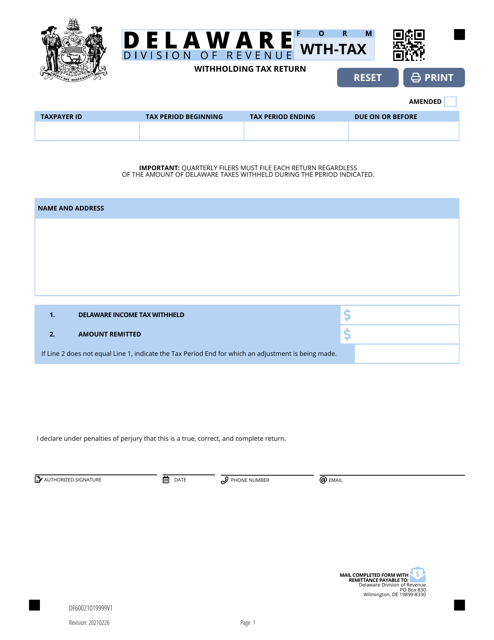

This form is used for reporting and paying withholding taxes for the state of Delaware.

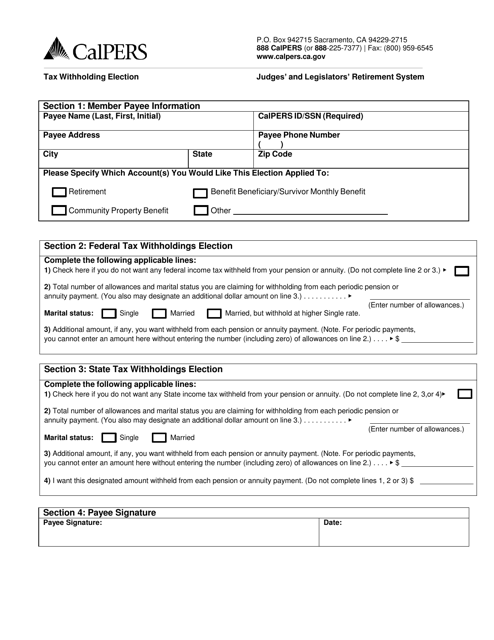

This form is used for making tax withholding elections for judges and legislators in the Retirement System in California. It is used to determine how much tax will be withheld from their earnings.

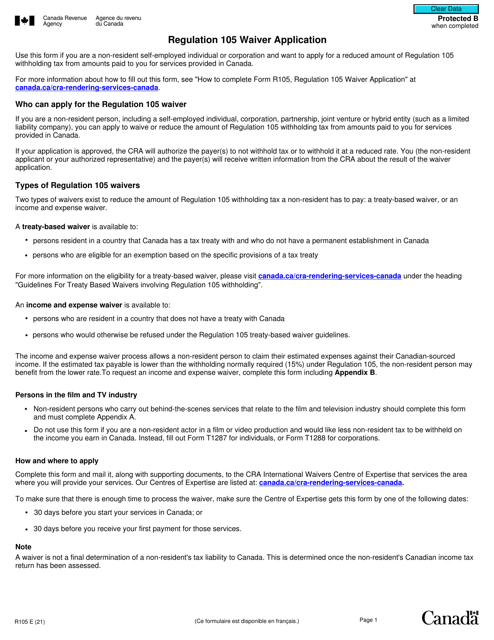

This form is used for applying for a waiver of Regulation 105 in Canada.

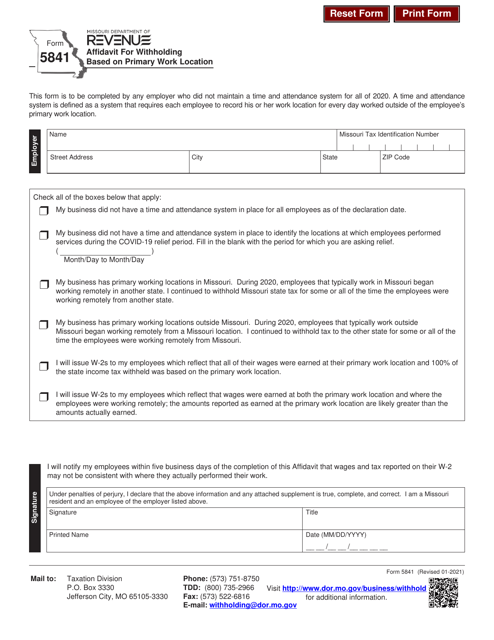

This form is used for submitting an affidavit to request withholding based on the primary work location in Missouri.

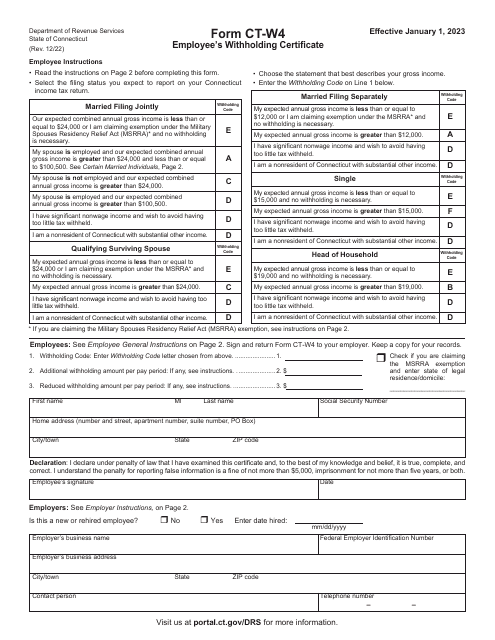

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.