Tax Withholding Templates

Documents:

407

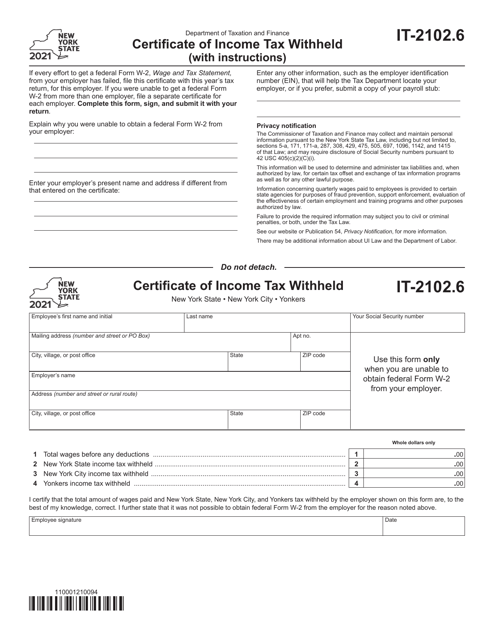

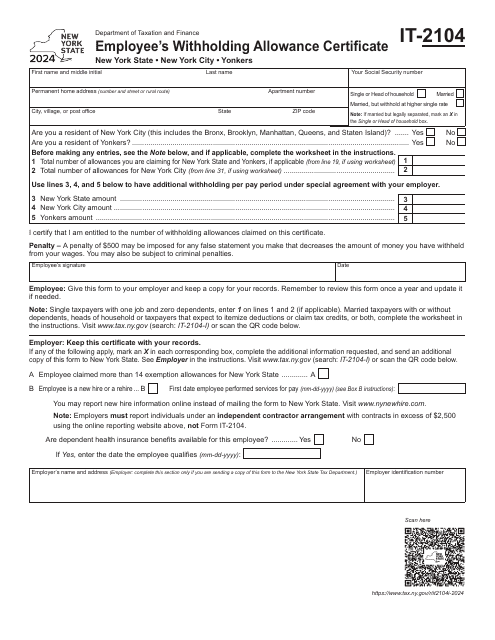

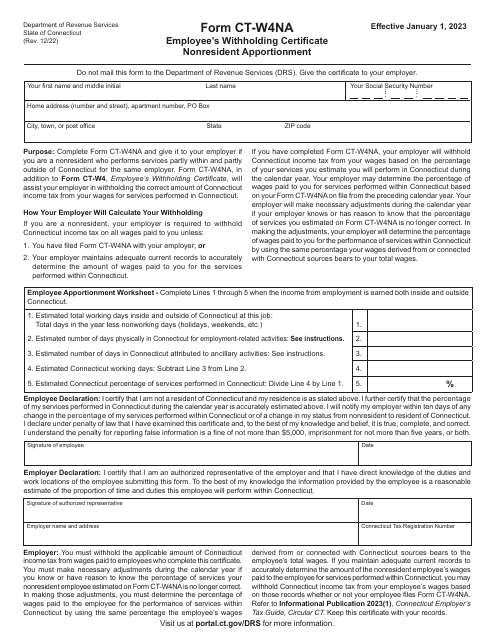

This form is used for reporting the income tax withheld from your wages in the state of New York.

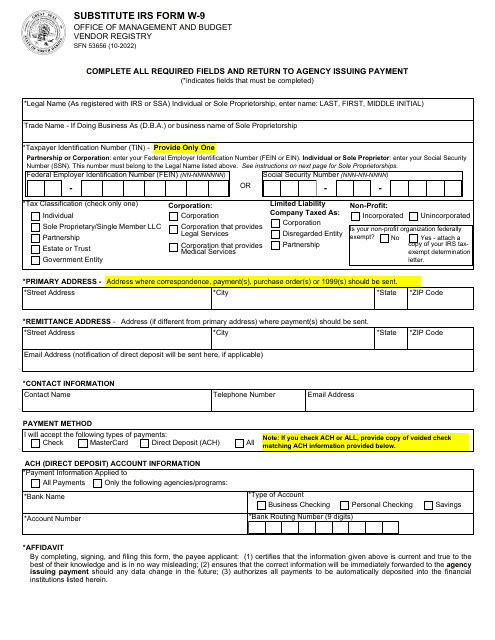

This form is used for requesting taxpayer identification number and certification from individuals or entities in North Dakota, as an alternative to the IRS Form W-9.

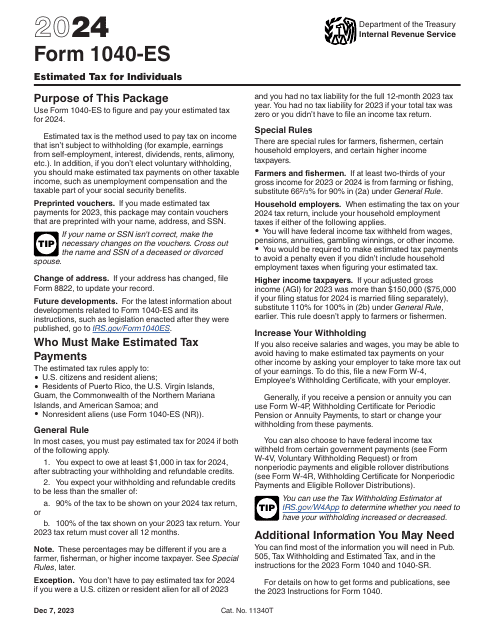

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

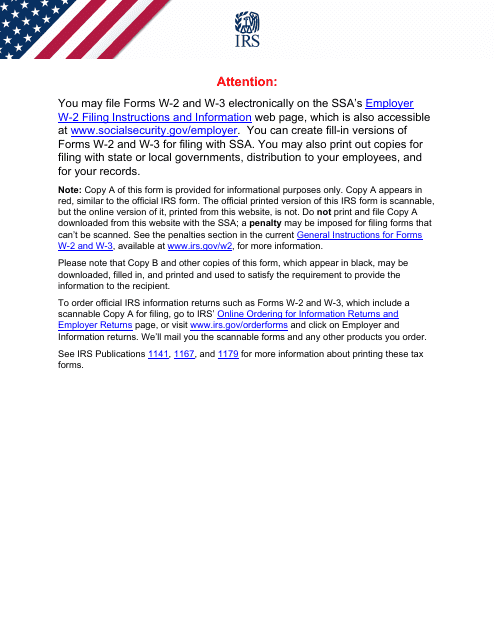

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

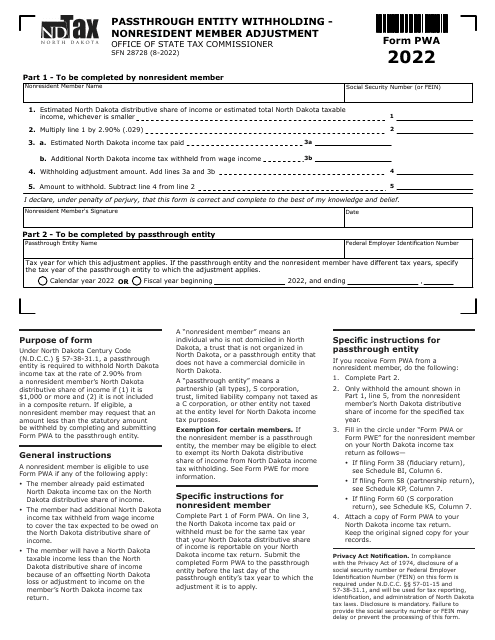

This Form is used for making adjustments to the nonresident member withholding for a passthrough entity in North Dakota.

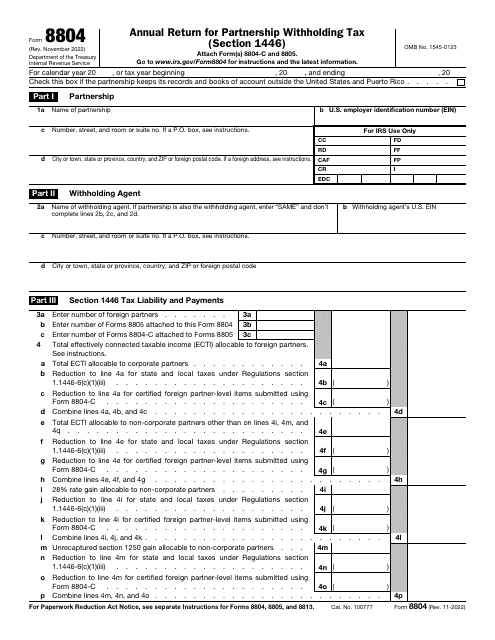

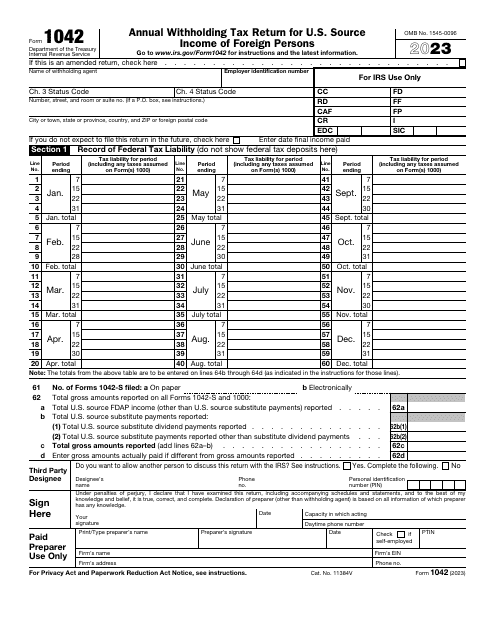

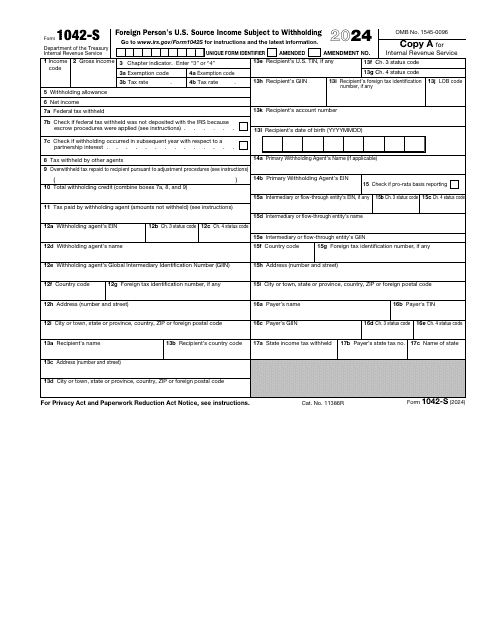

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

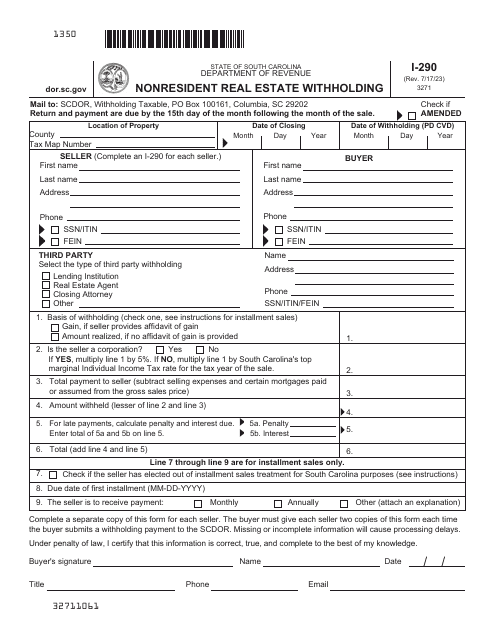

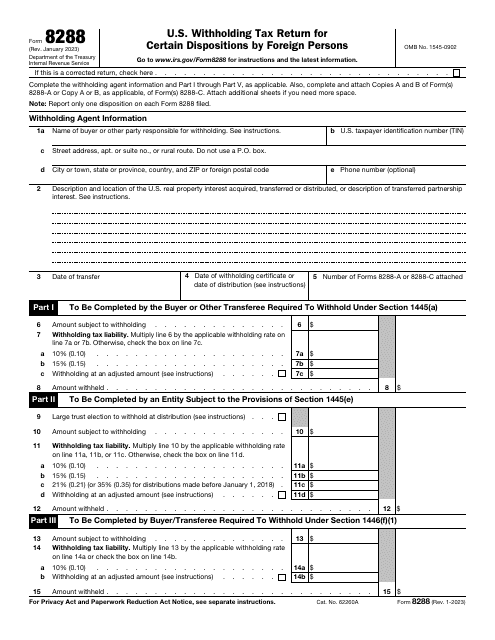

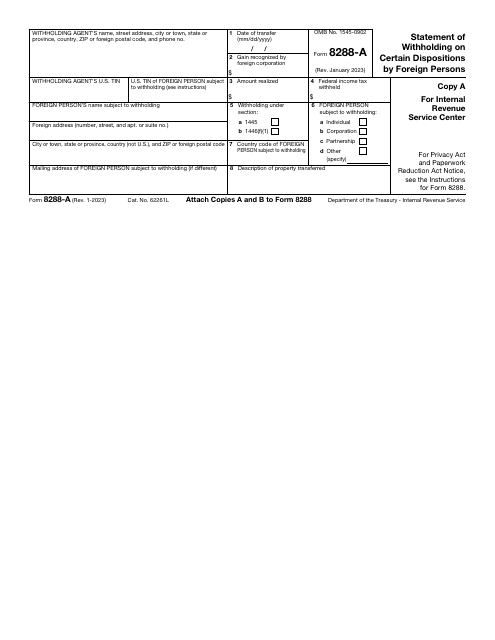

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

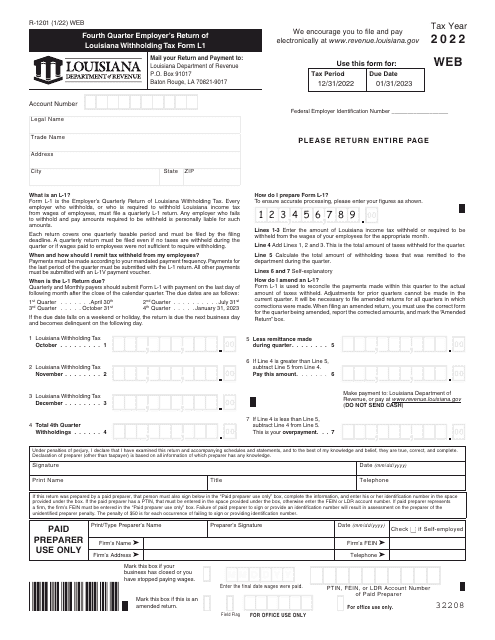

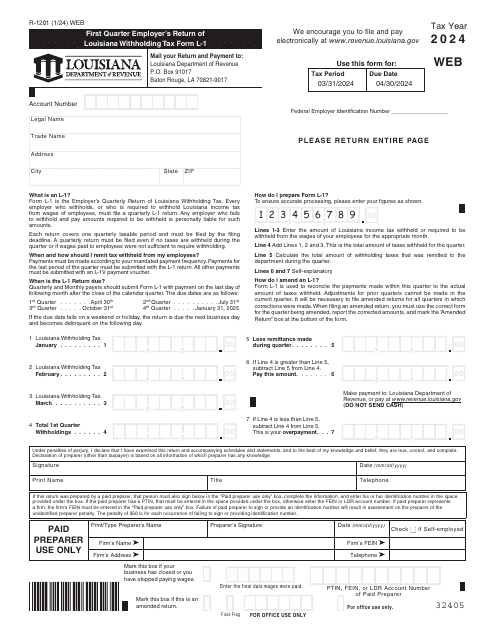

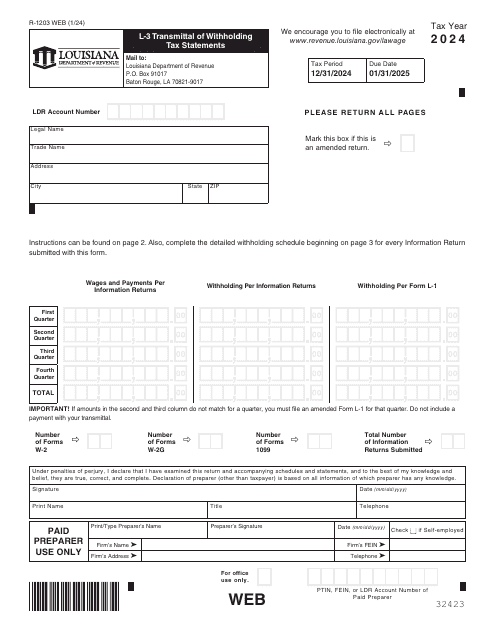

This form is used for reporting Louisiana withholding tax for the fourth quarter of the year. It is specifically designed for employers in Louisiana.

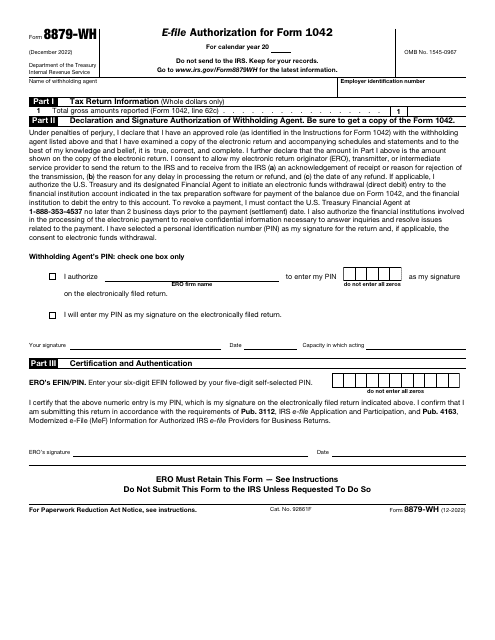

This form is used for authorizing electronic filing for Form 1042 to the IRS.

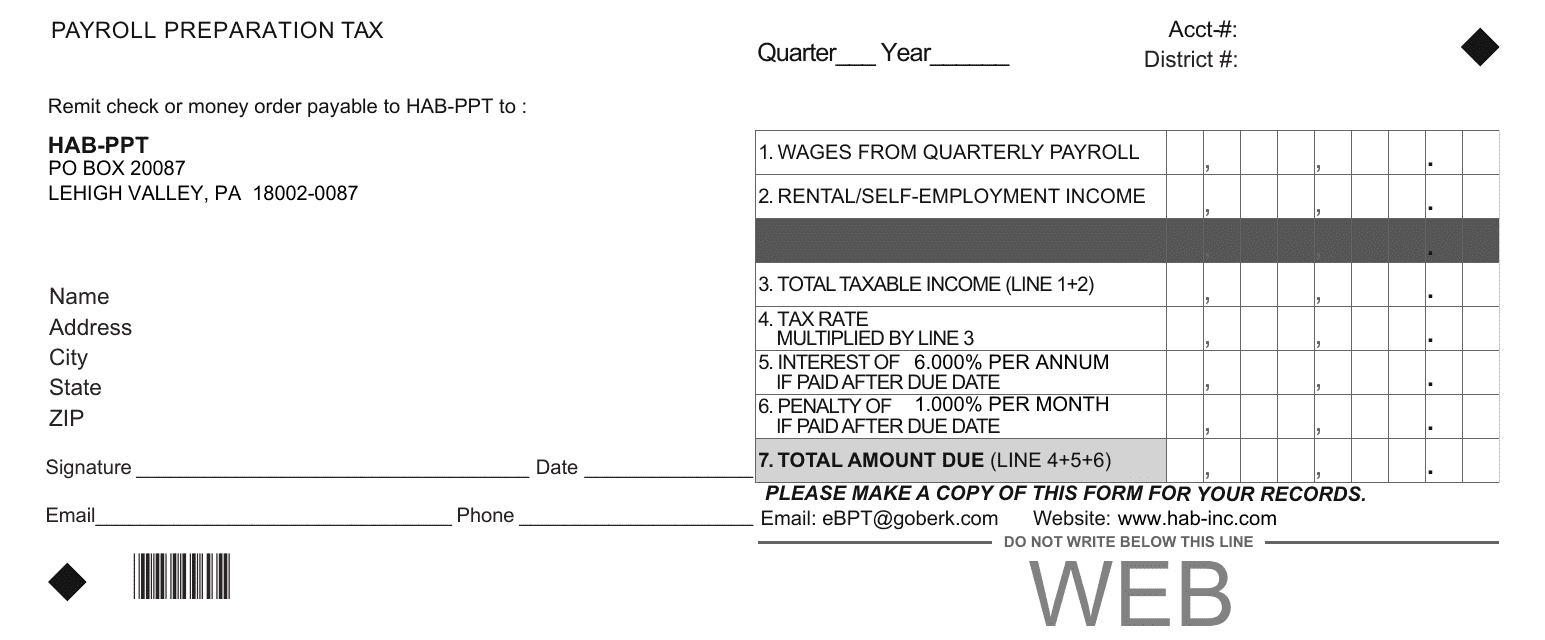

This document is for the preparation of payroll taxes in the state of Pennsylvania. It provides guidelines and instructions for calculating and filing payroll taxes for businesses operating in Pennsylvania.