Tax Withholding Templates

Documents:

407

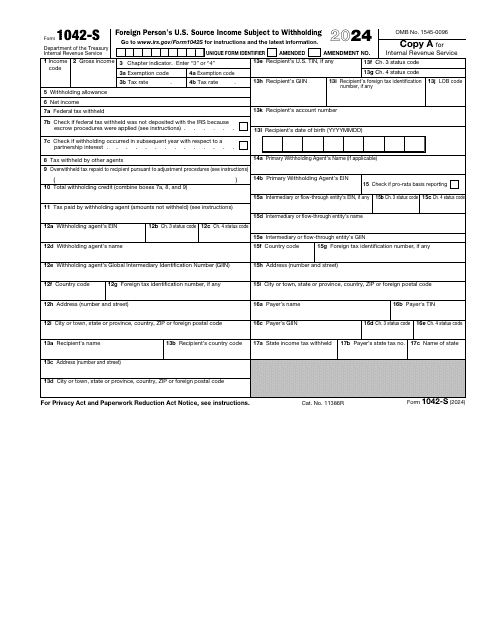

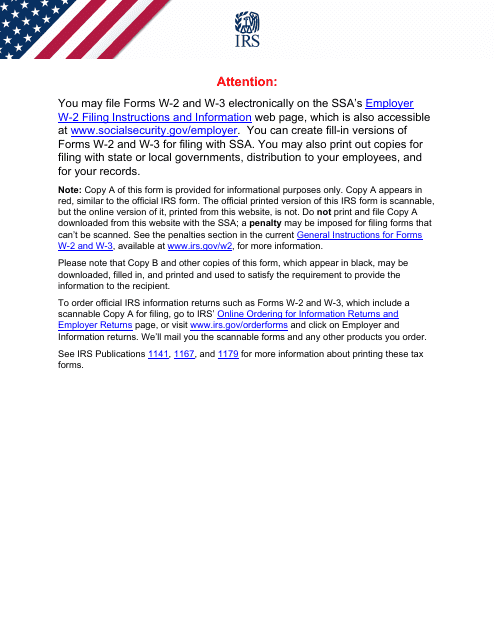

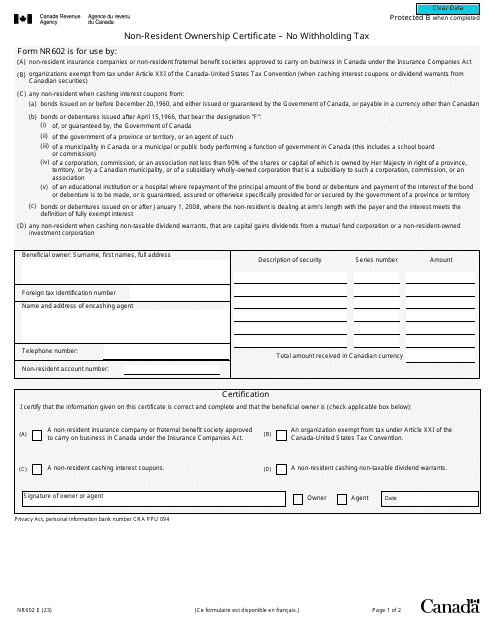

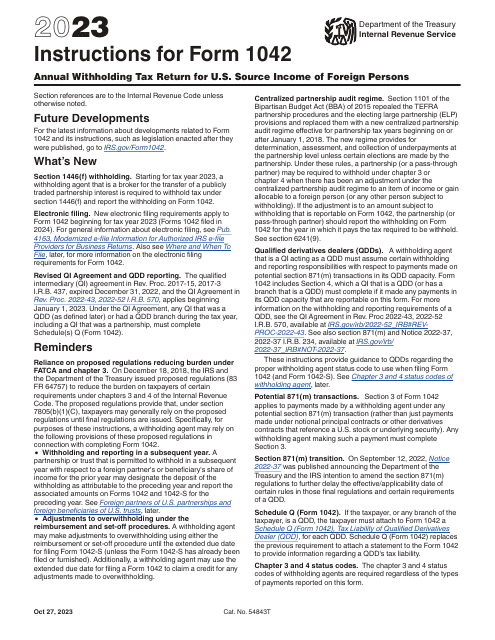

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

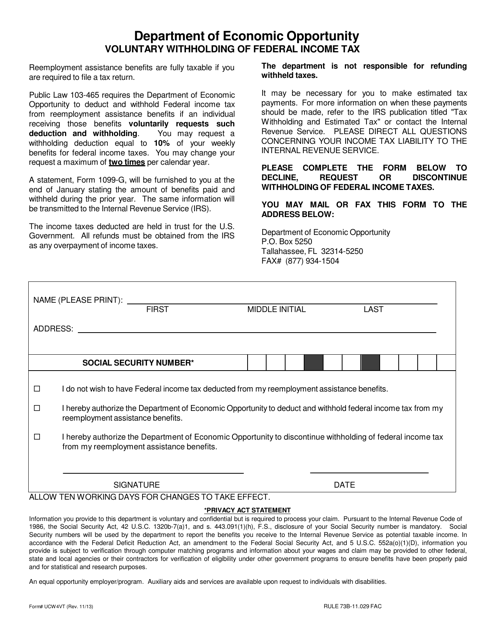

This form is used for voluntary withholding of federal income tax in the state of Florida.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

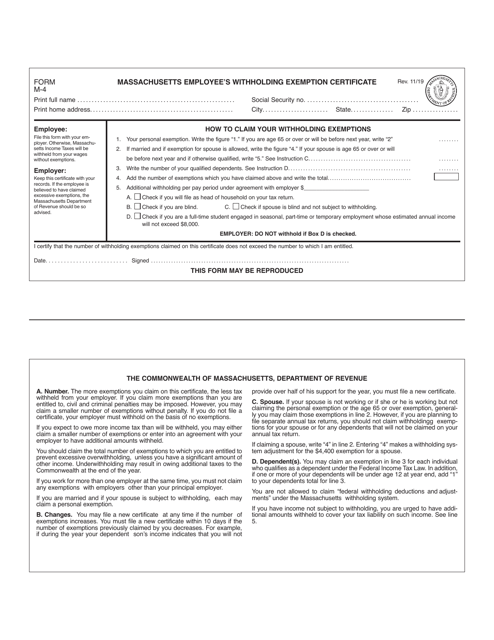

This Form is used for employees in Massachusetts to declare their withholding exemptions for income tax purposes.

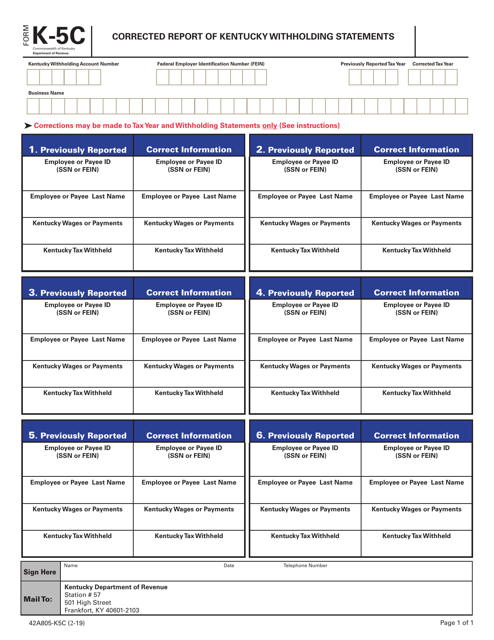

This form is used for submitting corrected withholding statements for Kentucky state taxes.

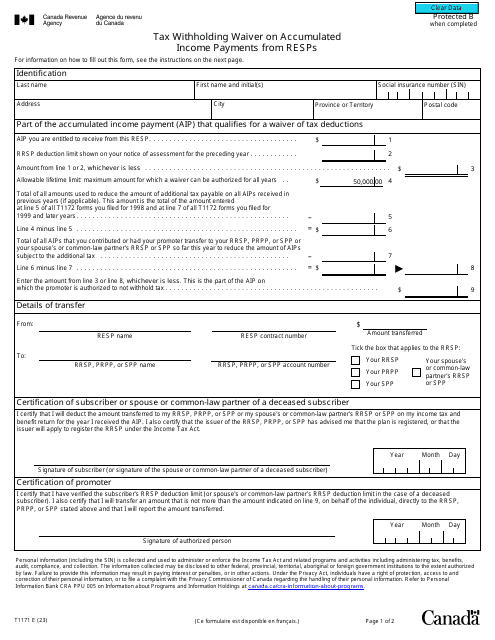

Canadian residents may fill out this form to notify their registered education savings plan (RESP) provider about their decision to withhold tax payments on accumulated income payments (AIPs) they are eligible to receive from the RESP.

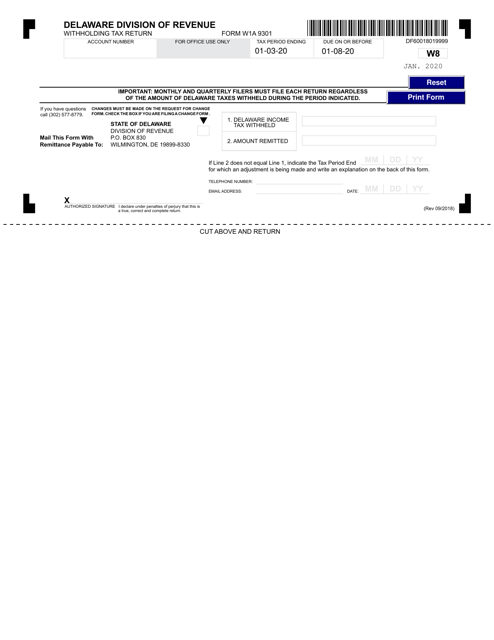

This form is used for filing withholding tax returns for the month of January in Delaware.

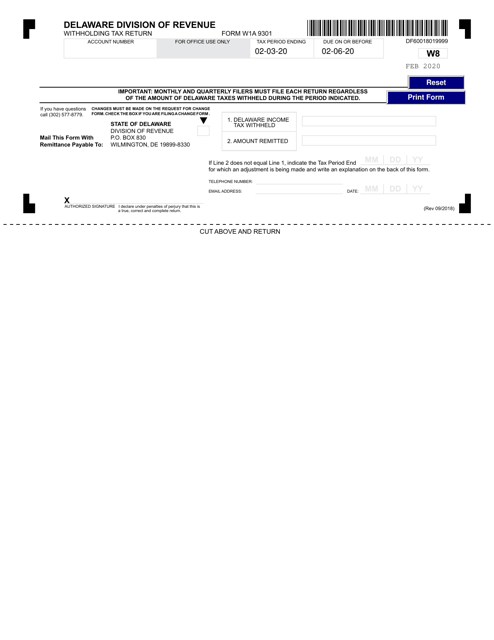

This form is used for filing the Delaware withholding tax return for the month of February.

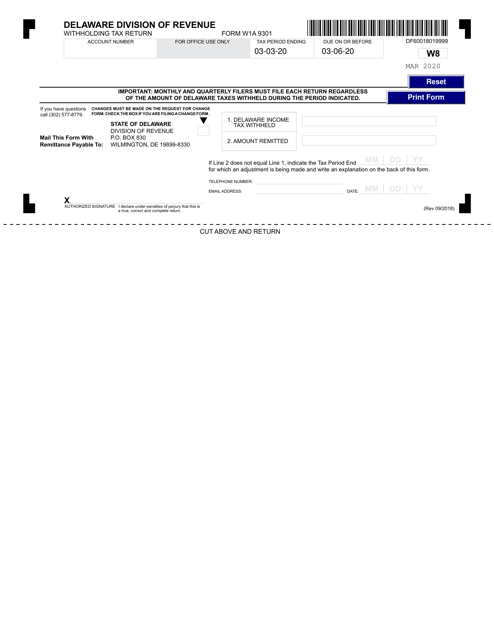

This Form is used for reporting and remitting withholding taxes owed by employers in Delaware for the month of March.

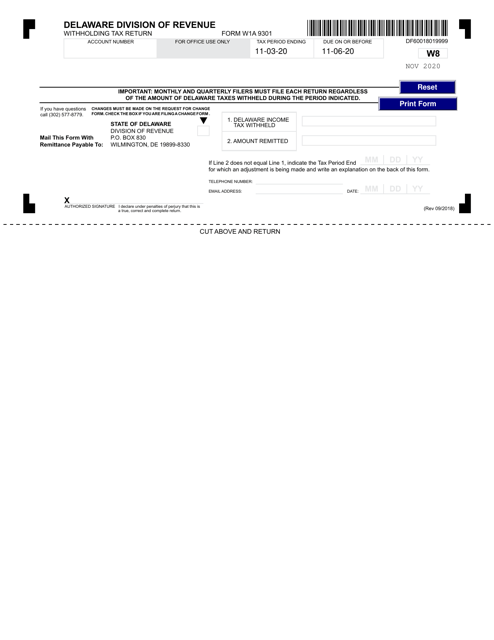

This form is used for filing withholding tax returns in Delaware for the month of November.

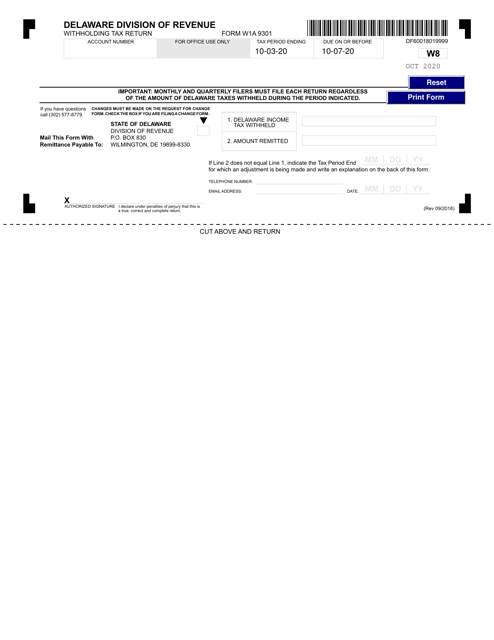

This Form is used for filing the Withholding Tax Return for the month of October in the state of Delaware.

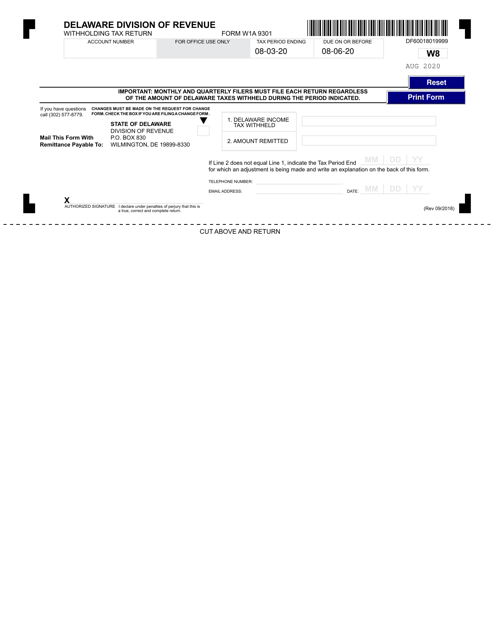

This form is used for filing withholding tax returns in the state of Delaware for the month of August.

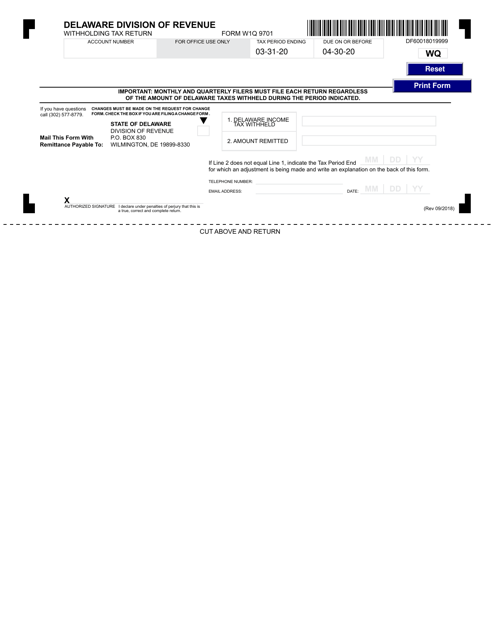

This Form is used for reporting quarterly withholding taxes in the state of Delaware.

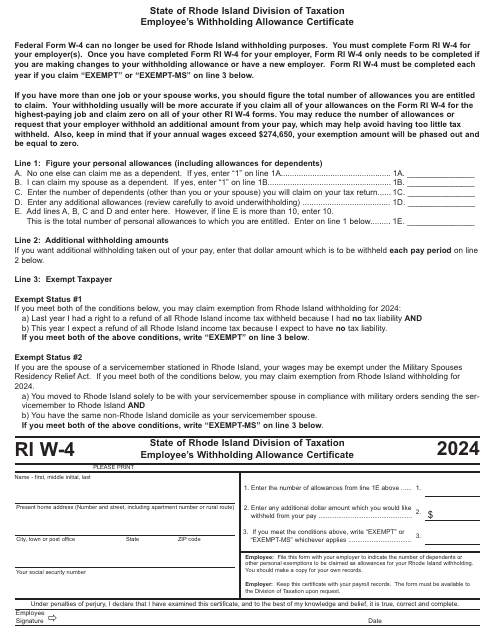

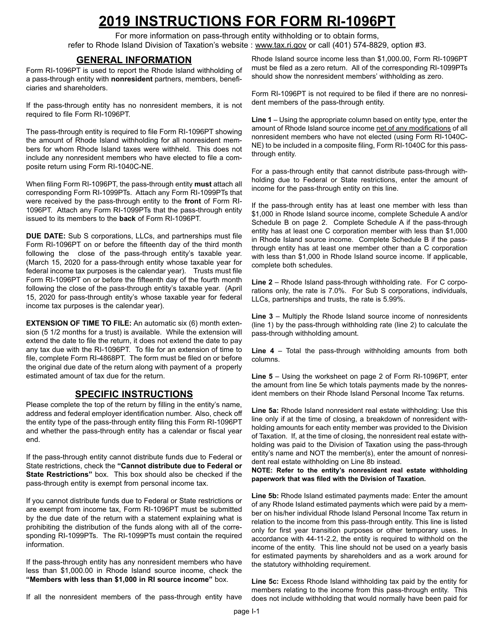

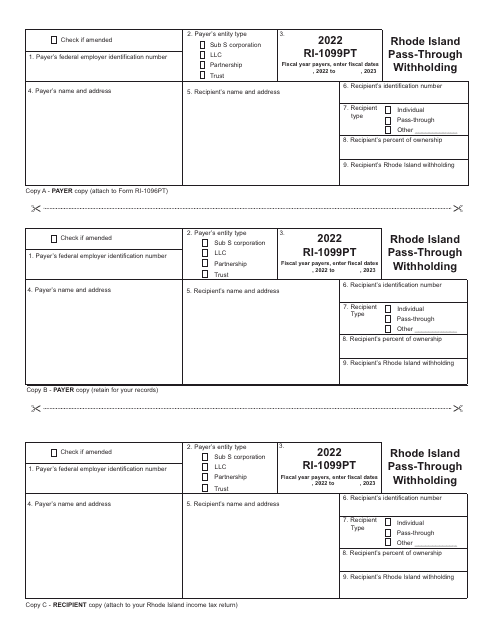

Instructions for Form RI-1096PT Pass-Through Withholding Return and Transmittal - Rhode Island, 2019

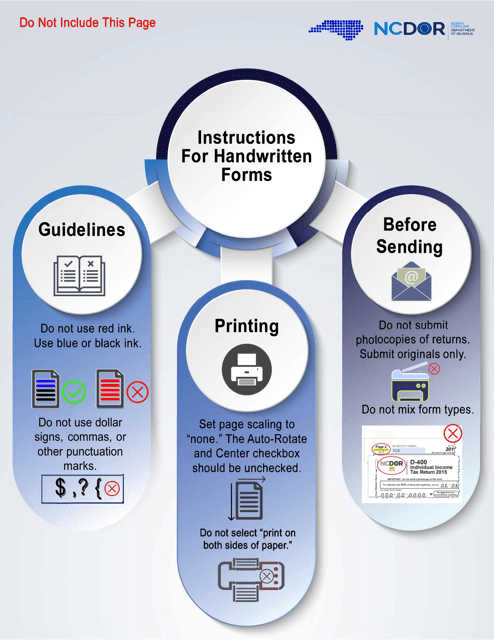

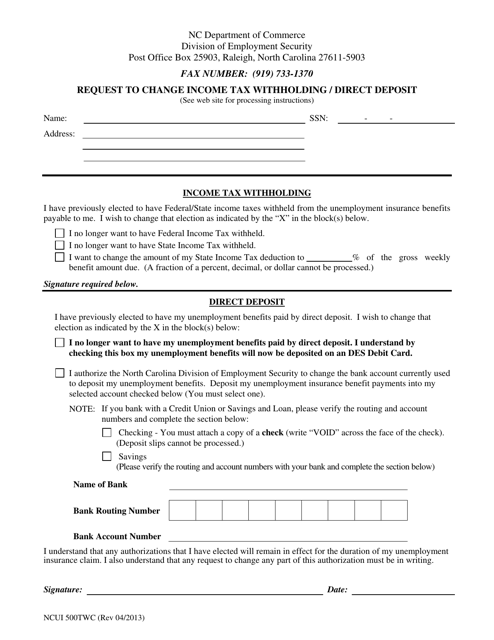

This form is used for residents of North Carolina to request a change in their income tax withholding or direct deposit information.

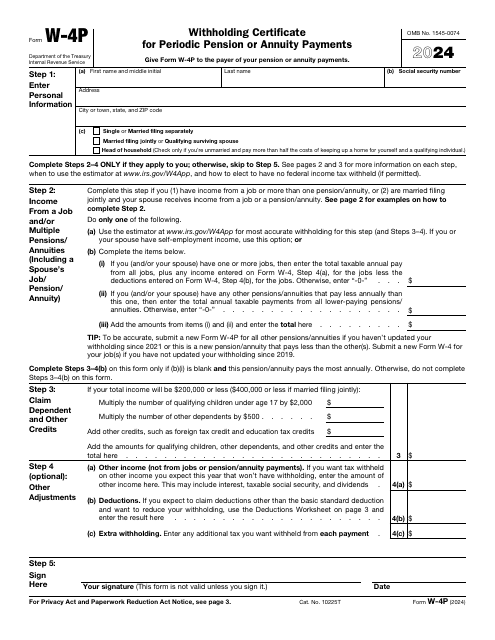

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

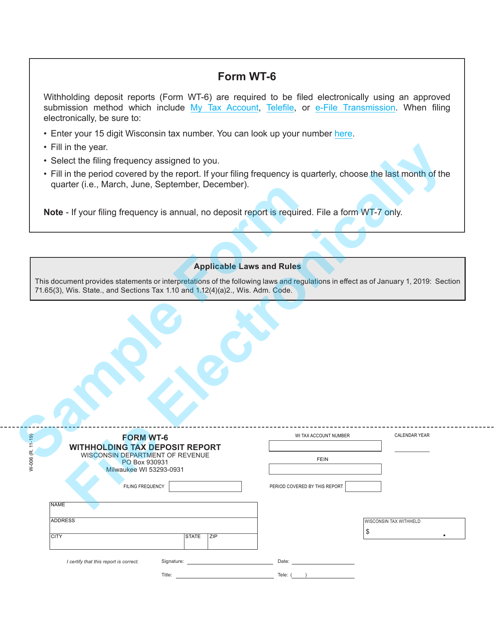

This form is used for reporting withholding tax deposits in the state of Wisconsin.

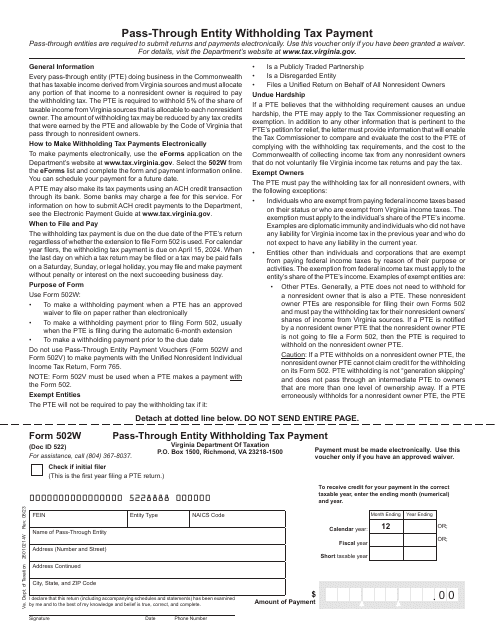

This Form is used for filing nonresident individual income tax return in the state of Virginia.