Tax Withholding Templates

Documents:

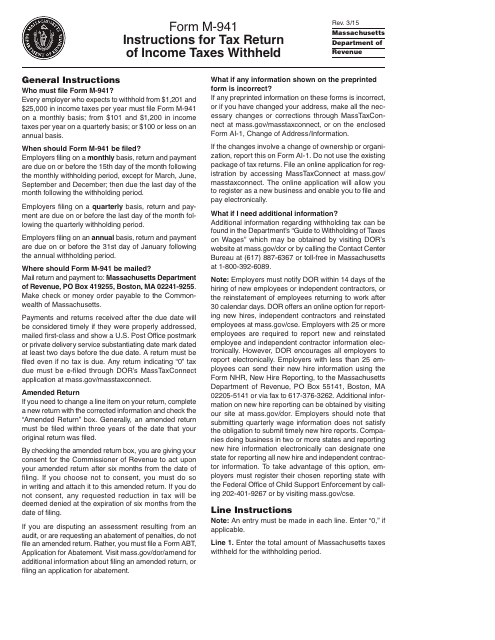

407

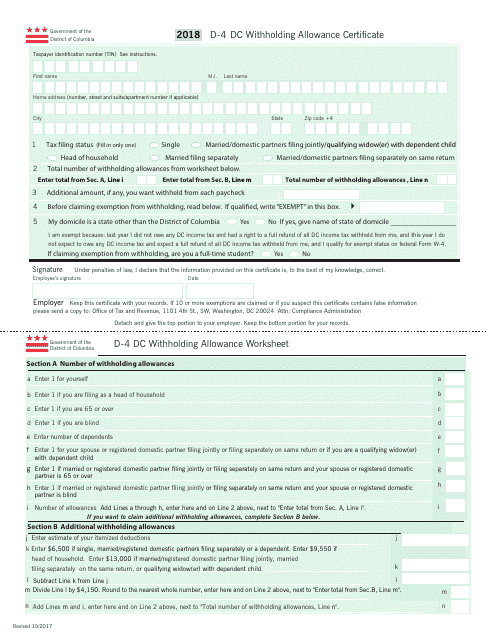

This form is used for Washington, D.C. residents to determine the amount of tax to be withheld from their paycheck.

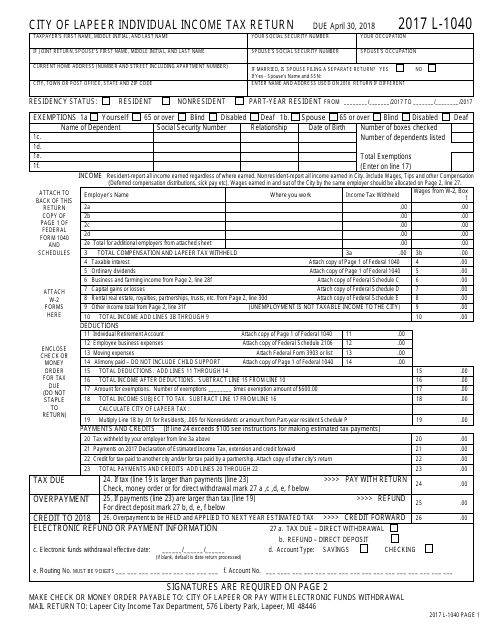

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

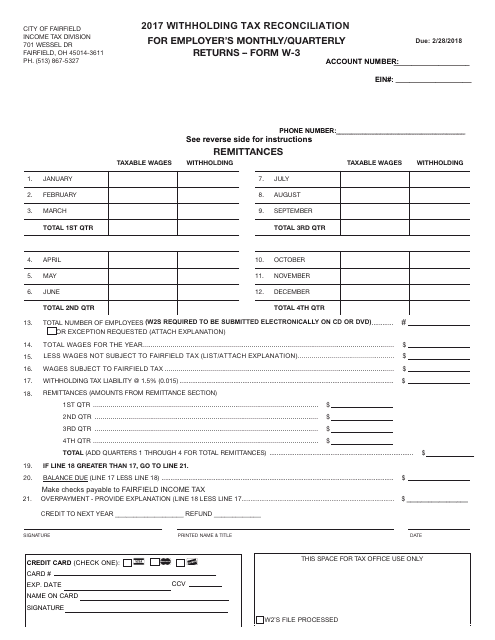

This form is used by employers in Fairfield, Ohio to reconcile withholding taxes from their monthly or quarterly returns. It helps ensure accurate reporting and payment of taxes to the city.

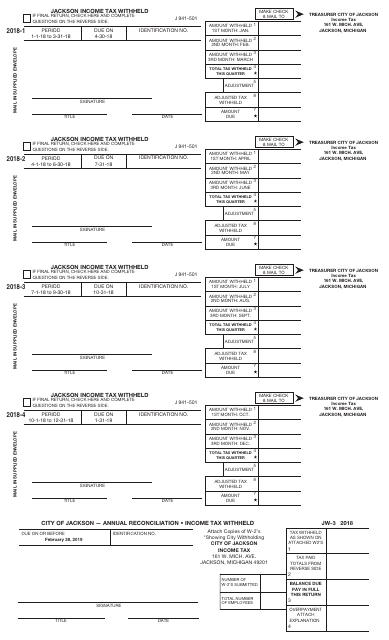

This form is used for reporting income tax withheld by employers in the City of Jackson, Michigan.

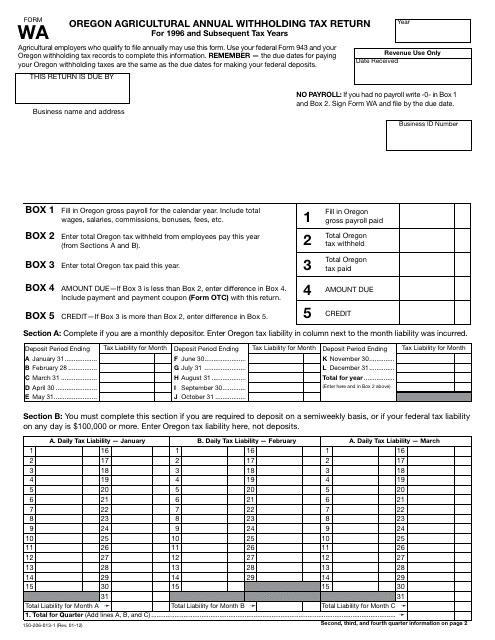

This document is used for reporting and paying the annual withholding tax for agricultural businesses in the state of Oregon.

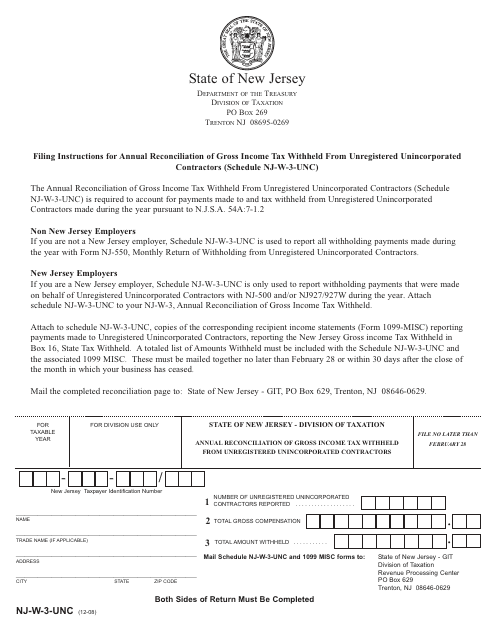

This form is used for the annual reconciliation of gross income tax withheld from unregistered unincorporated contractors in New Jersey.

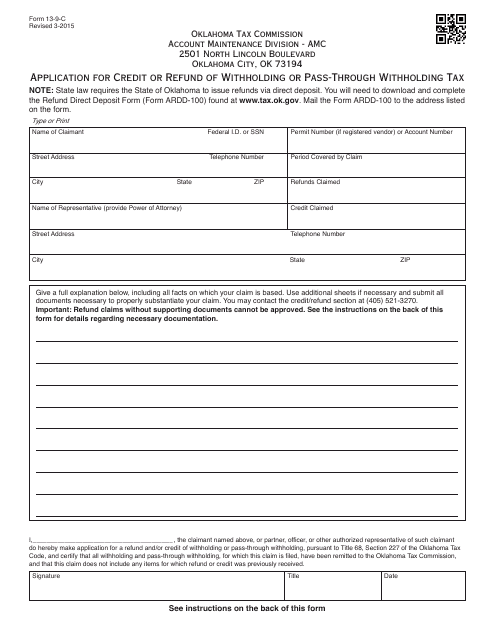

This Form is used for applying for a credit or refund of withholding or pass-through withholding tax in Oklahoma.

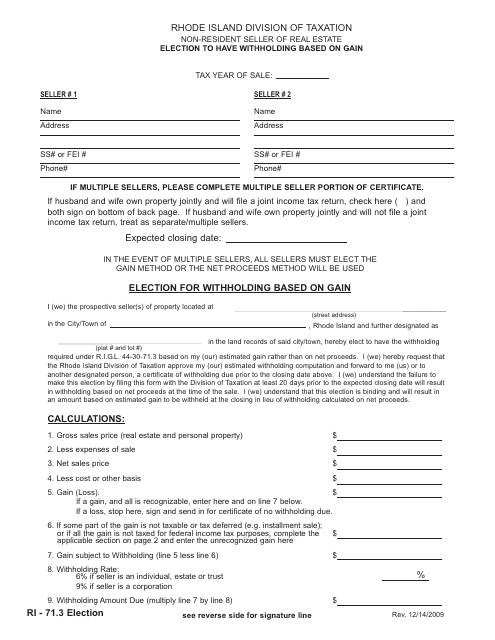

This form is used for non-resident sellers of real estate in Rhode Island to elect withholding based on gain.

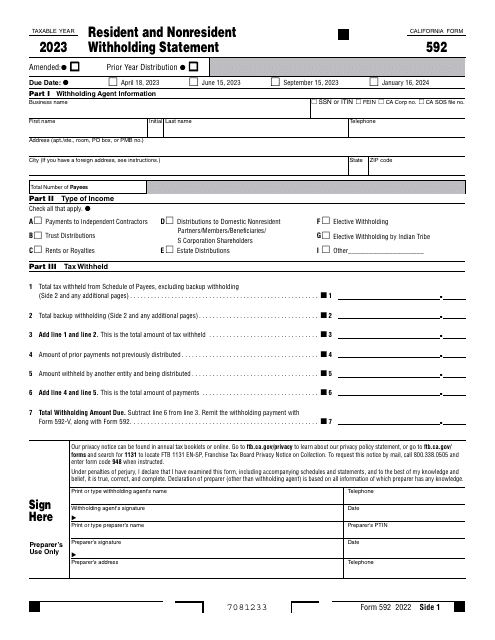

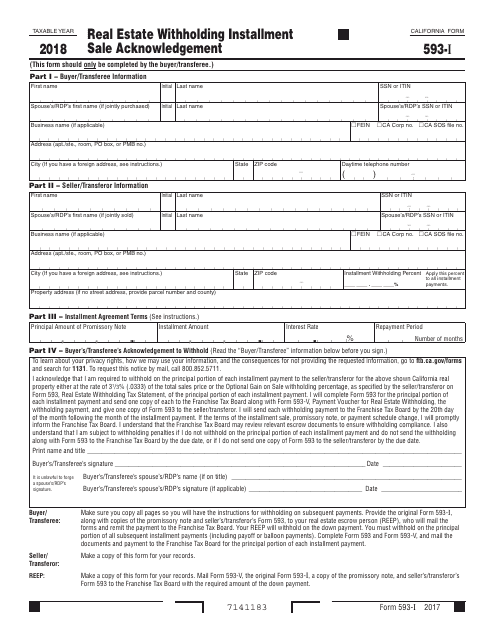

This form is used in California for acknowledging the installment sale of real estate properties and withholding taxes.

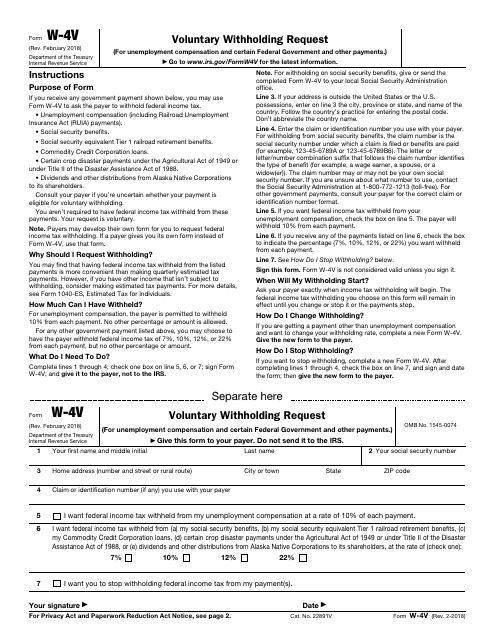

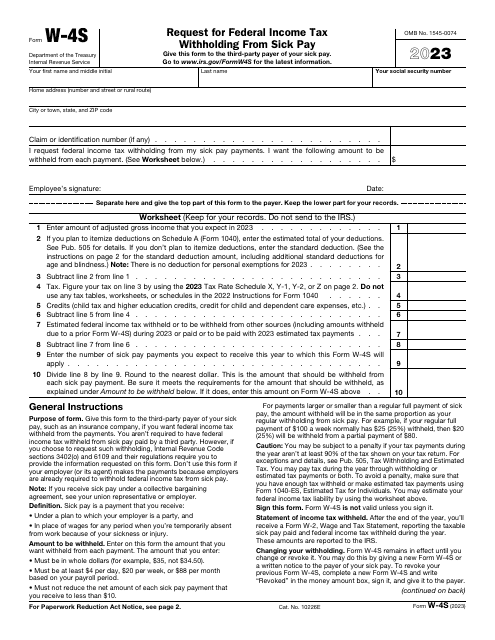

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

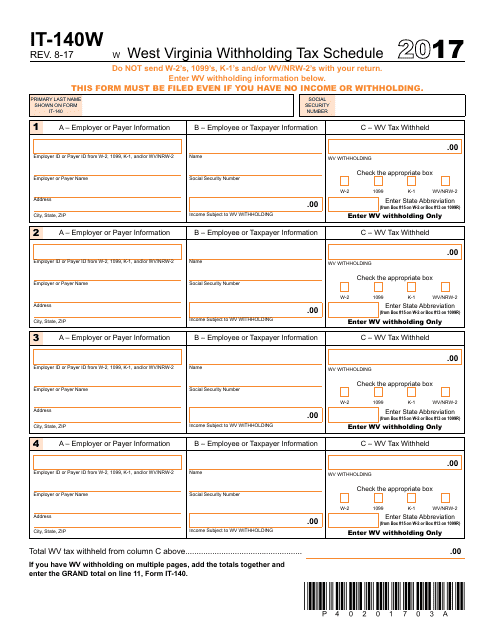

This Form is used for reporting and calculating withholding taxes in West Virginia.

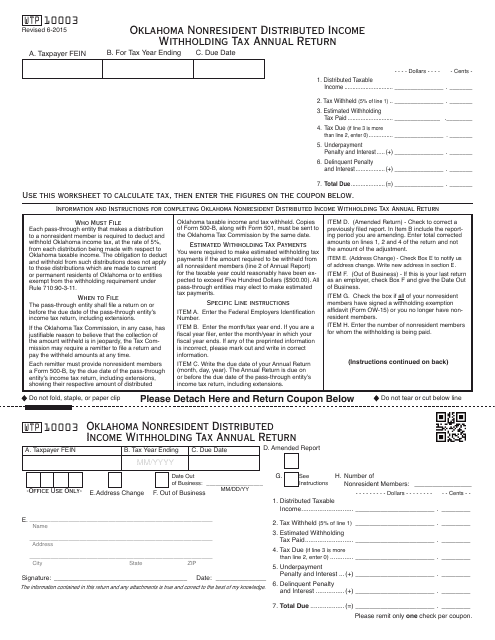

This Form is used for reporting and paying nonresident distributed income withholding tax in Oklahoma for the tax year.

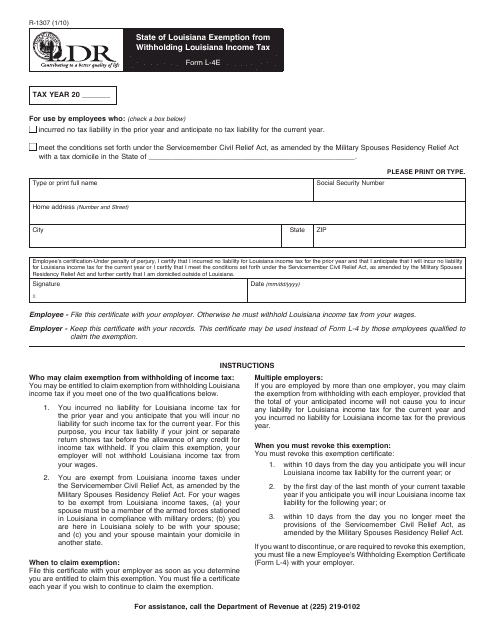

This form is used for individuals in Louisiana to claim an exemption from withholding Louisiana income tax.

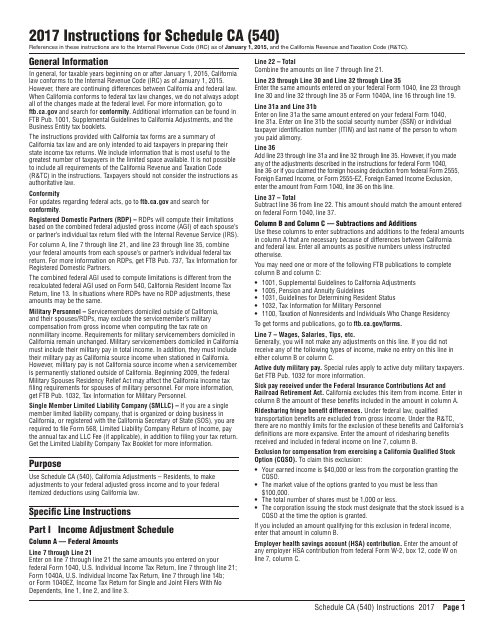

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

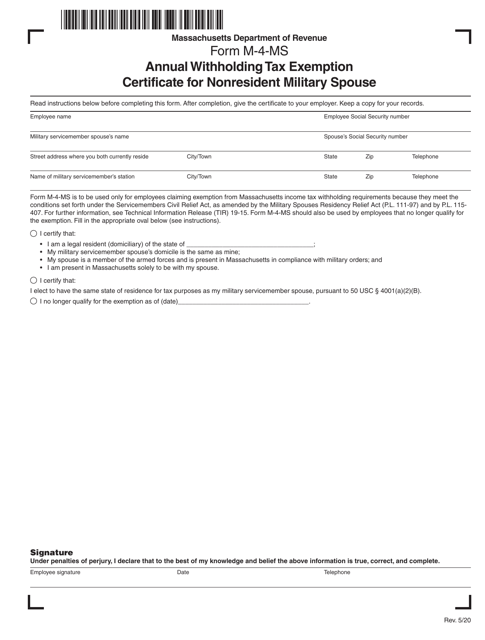

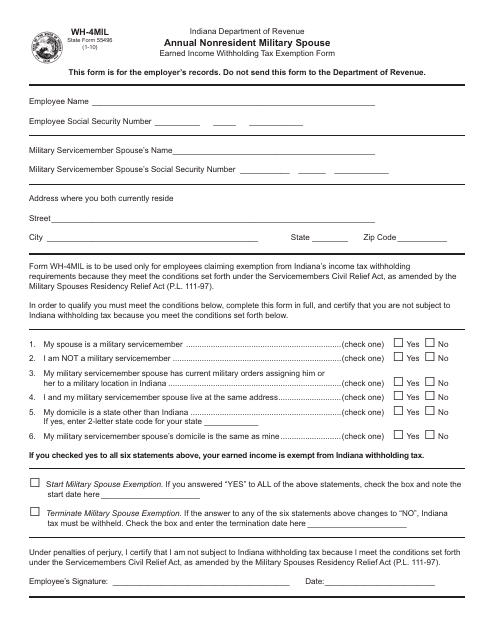

This Form is used for claiming an annual income withholding tax exemption for nonresident military spouses in Indiana.

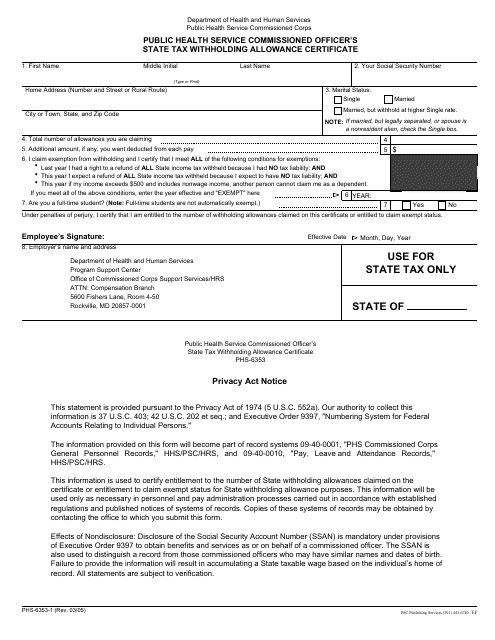

This type of document is used by Public Health Service Commissioned Officers to declare their state tax withholding allowances.

This document is used for providing a job description for domestic or household employees in New York City.

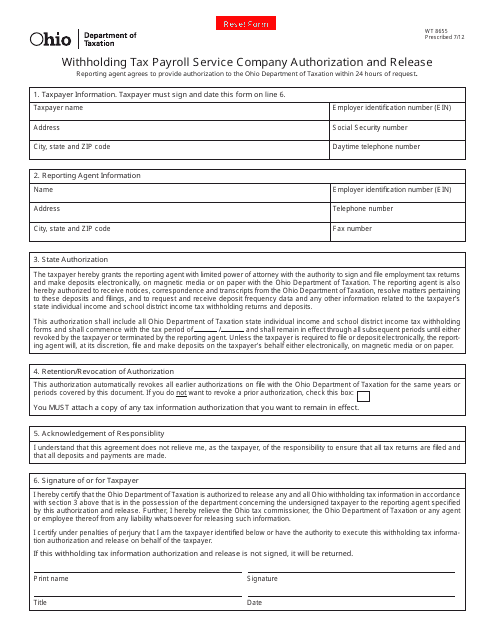

This form is used for authorizing a payroll service company to withhold tax payments on behalf of an employer in Ohio.

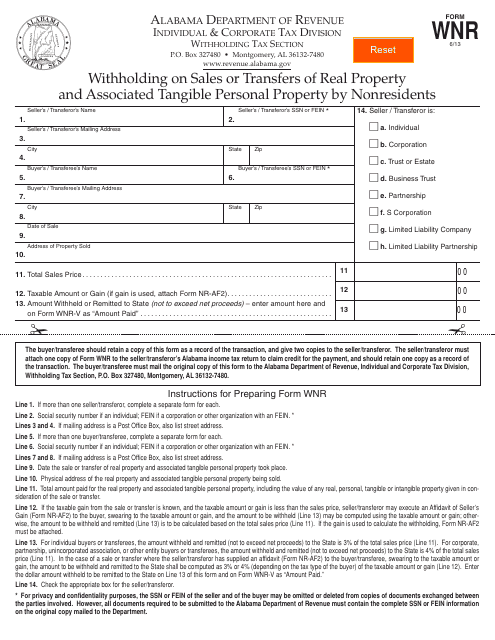

This form is used for reporting and withholding taxes on sales or transfers of real property and associated tangible personal property by nonresidents in the state of Alabama.

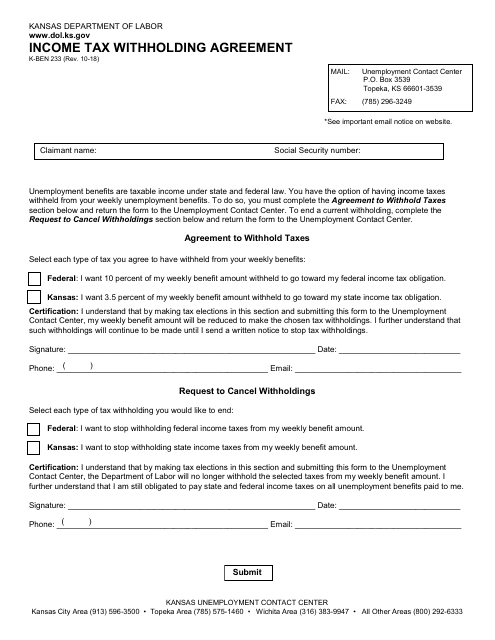

This form is used for an Income Tax Withholding Agreement in the state of Kansas. It allows individuals to authorize employers to withhold a specific amount of income tax from their wages.

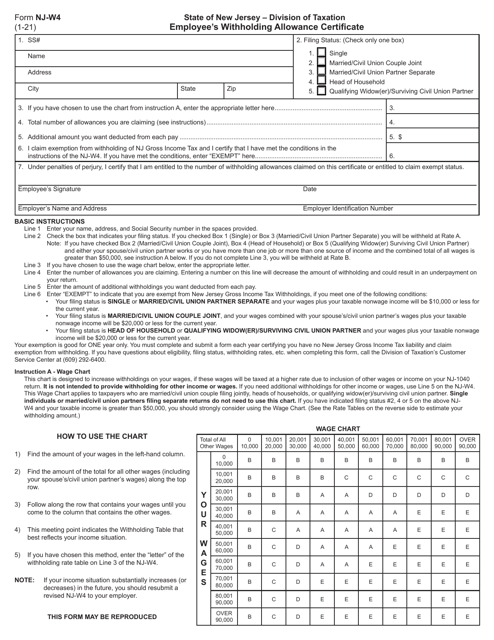

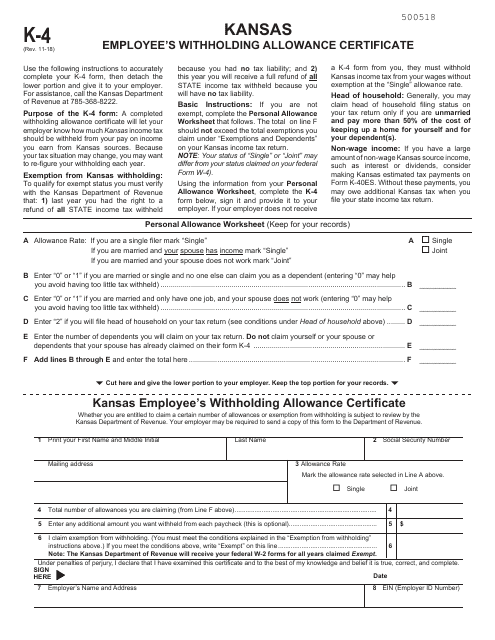

This form is used for employees in Kansas to declare their withholding allowances for state income tax purposes.

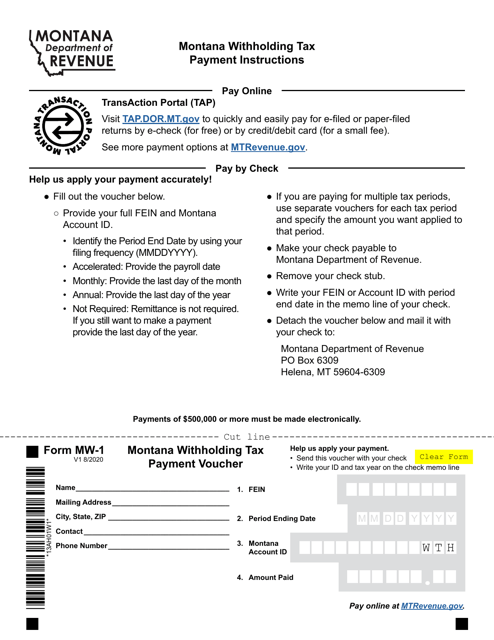

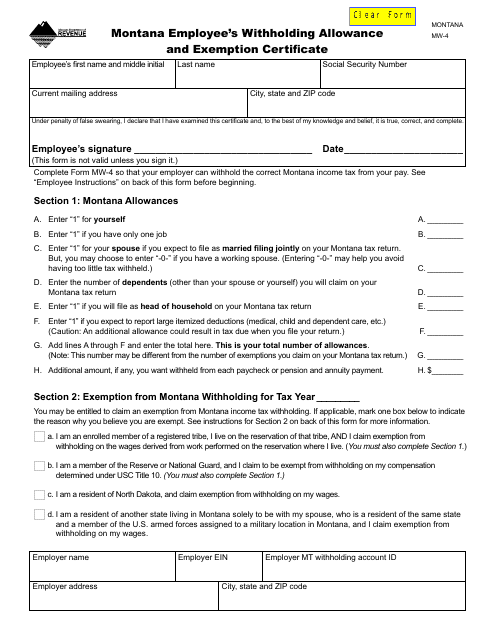

This form is used for reporting employee allowances and exemptions for state income tax withholding in Montana.