Tax Withholding Templates

Documents:

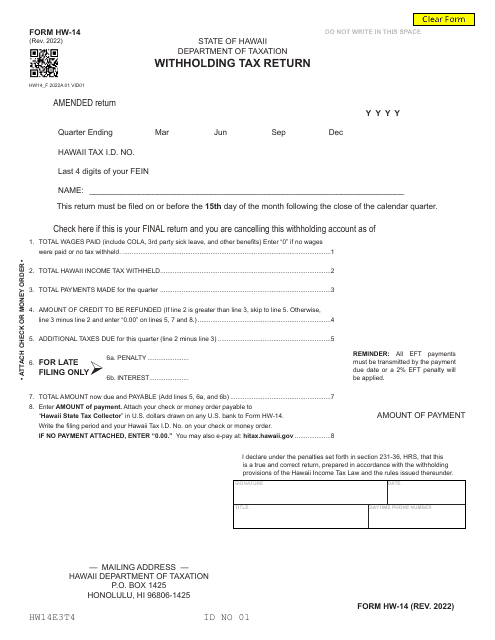

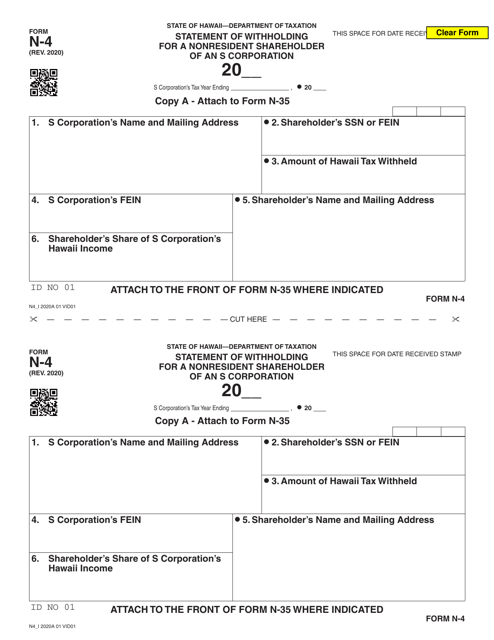

407

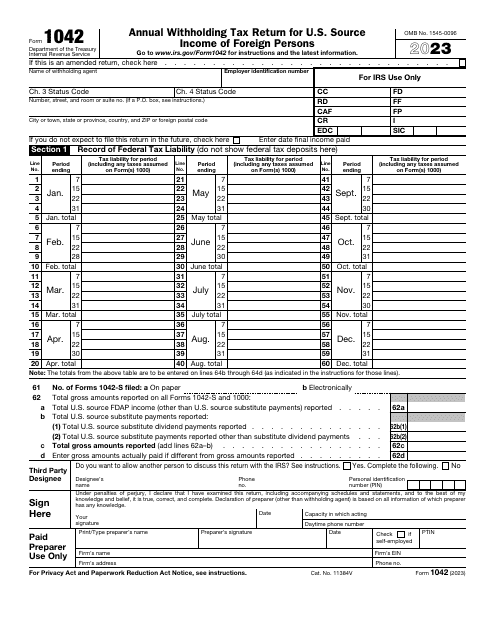

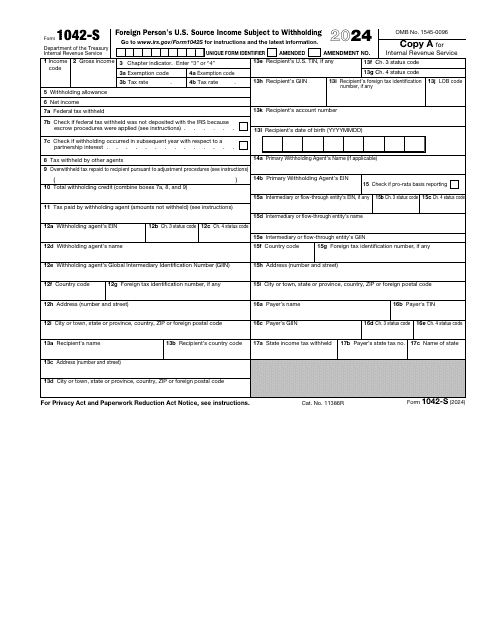

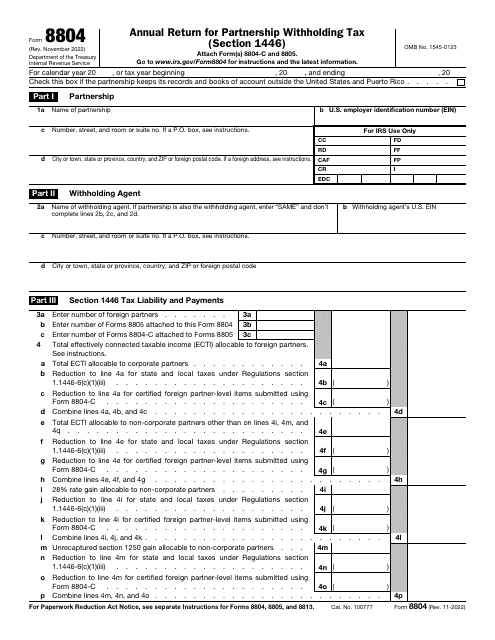

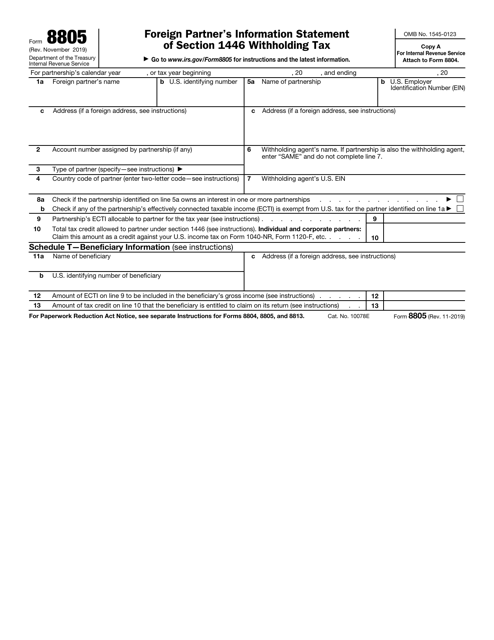

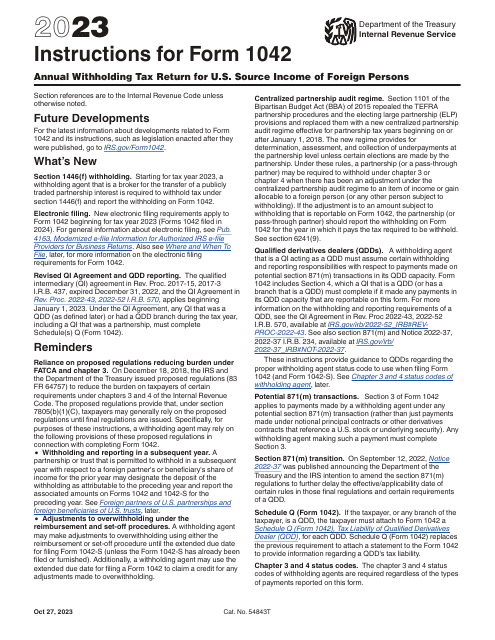

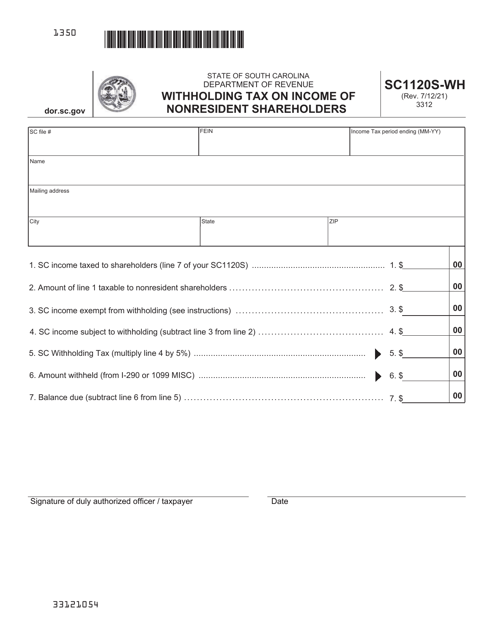

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

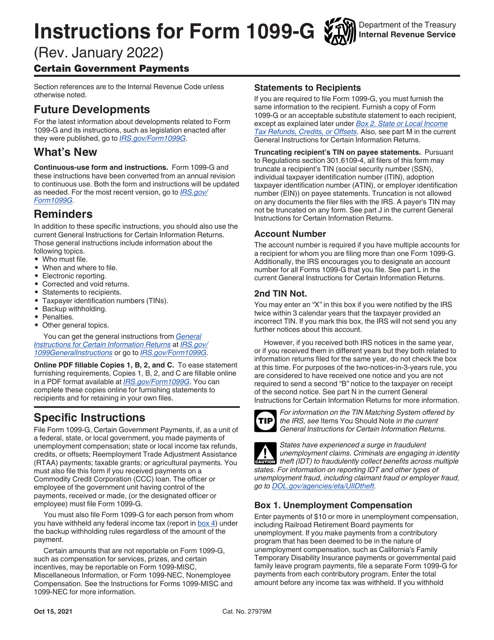

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

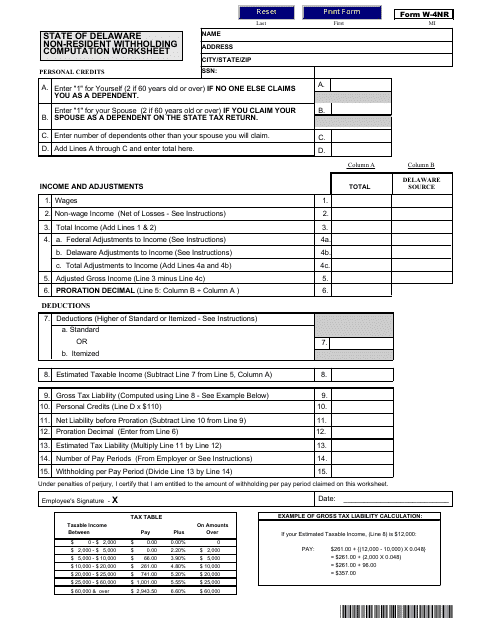

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

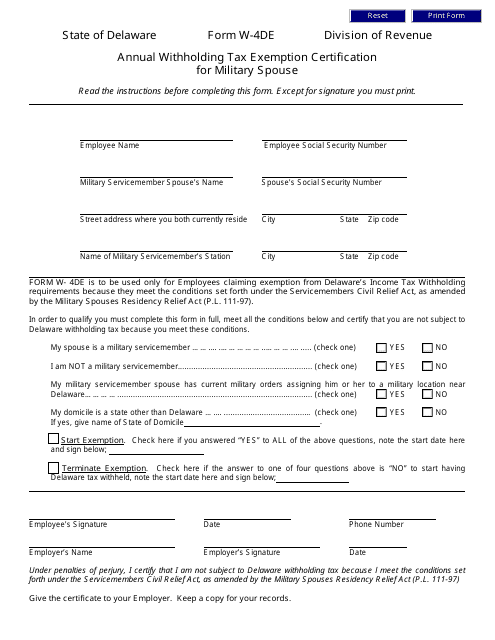

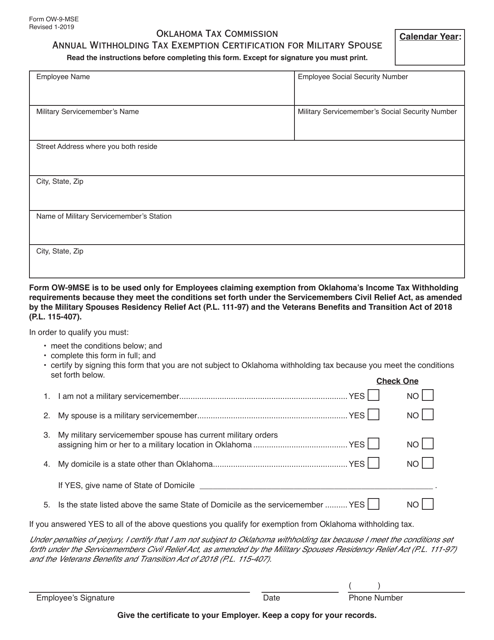

This document is used to certify tax exemption for military spouses in Delaware. It helps determine the amount of federal income tax to be withheld from their paychecks.

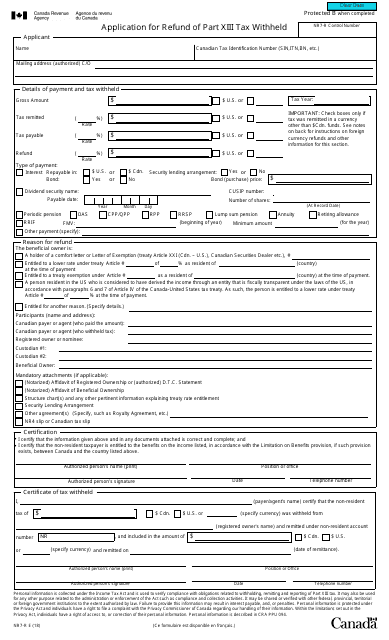

This form is used for applying for a refund of the Part XIII tax withheld in Canada.

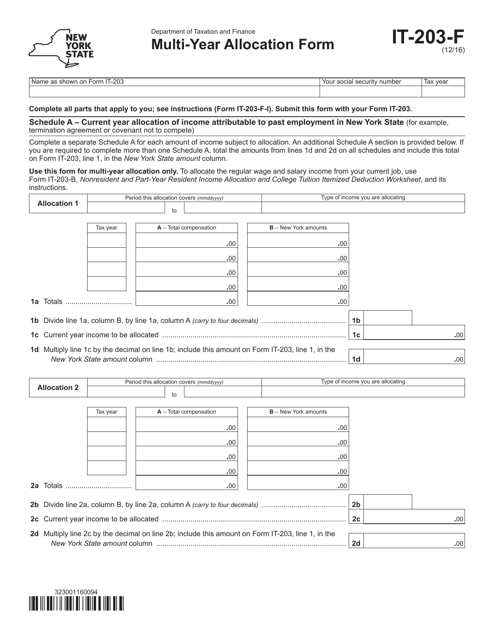

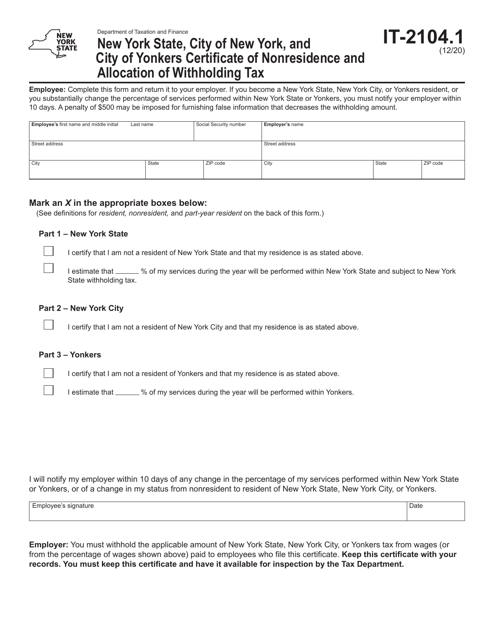

This Form is used for allocating income and deductions for multiple years in New York.

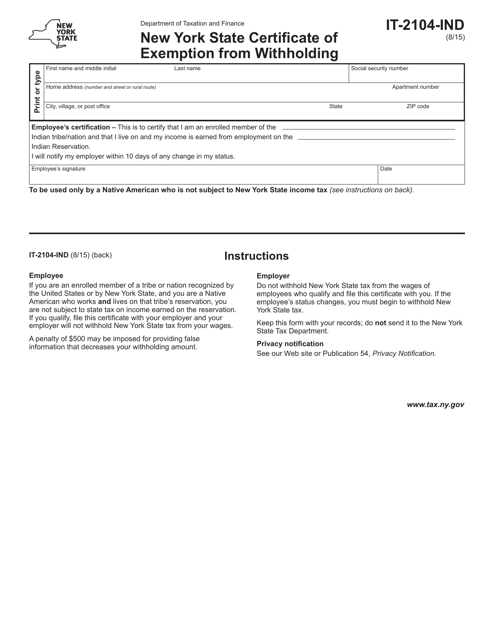

This Form is used for exempting individuals in New York State from income tax withholding. Individuals can use this form to claim an exemption from having taxes withheld from their wages.

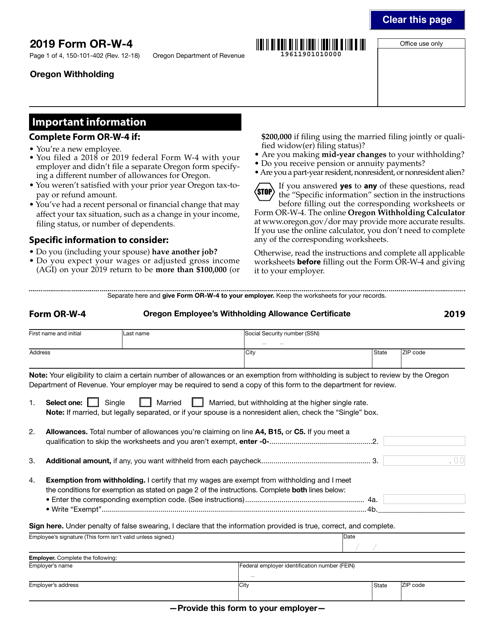

This form is used for Oregon residents to determine the correct amount of state income tax to withhold from their wages.

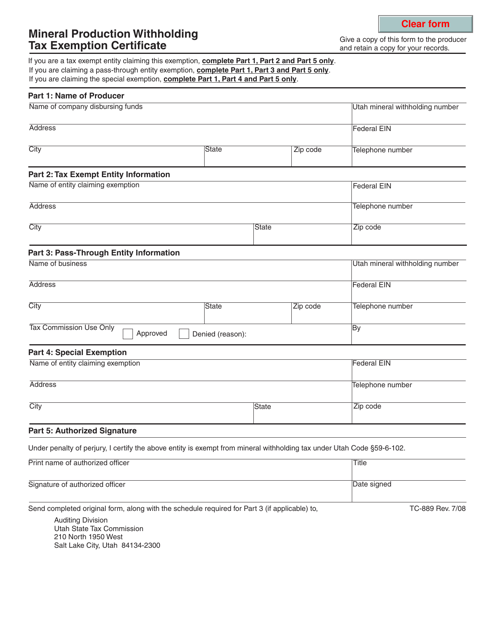

This form is used for requesting an exemption from the withholding tax on mineral production in the state of Utah.

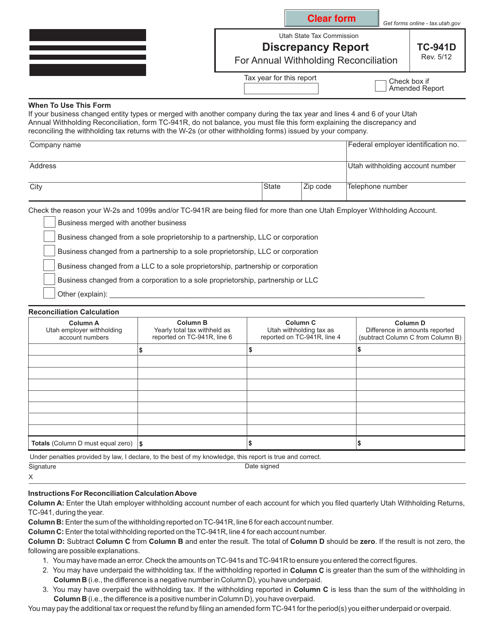

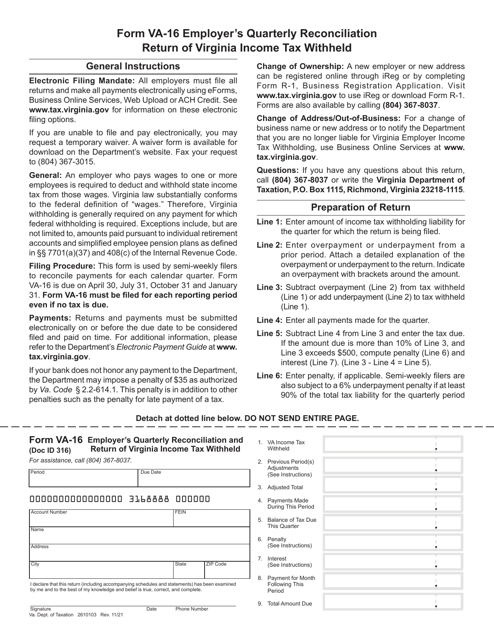

This form is used for reporting discrepancies in annual withholding reconciliation in the state of Utah.

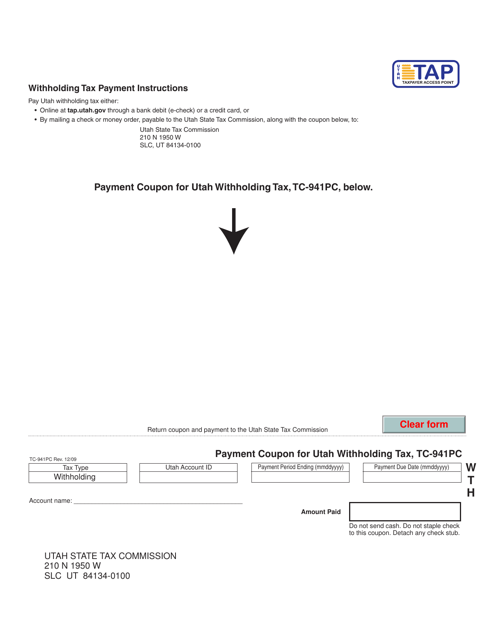

This form is used for making payment for Utah withholding tax in Utah.

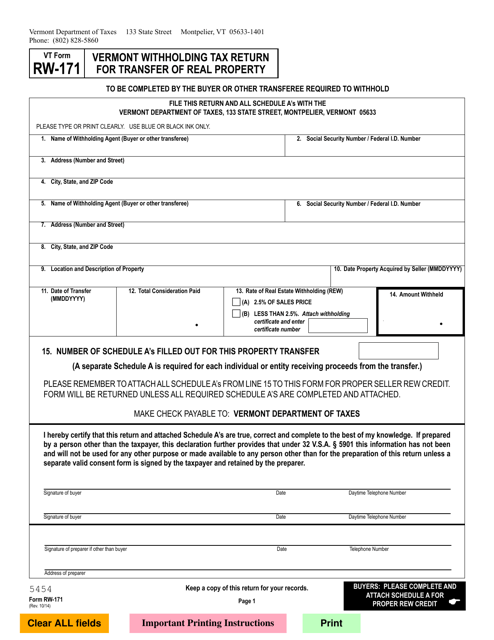

This Form is used for reporting withholding tax on the transfer of real property in Vermont.

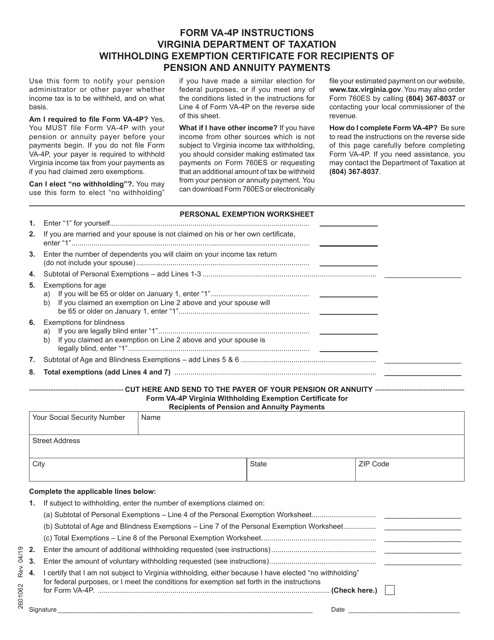

This Form is used for declaring withholding exemptions for pension and annuity recipients in the state of Virginia.

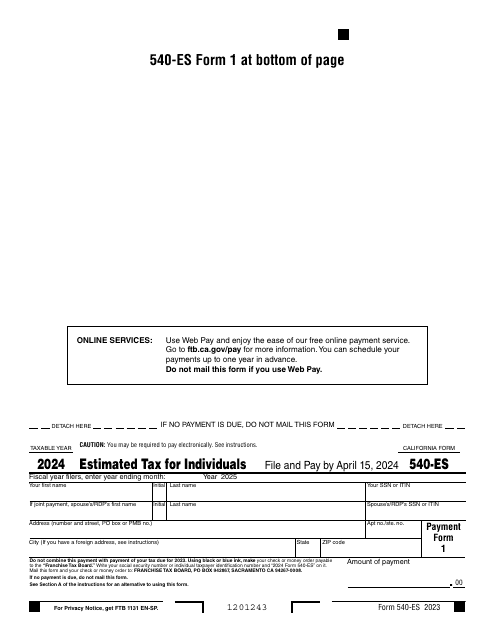

Fill out this form over the course of a year to pay your taxes in the state of California.

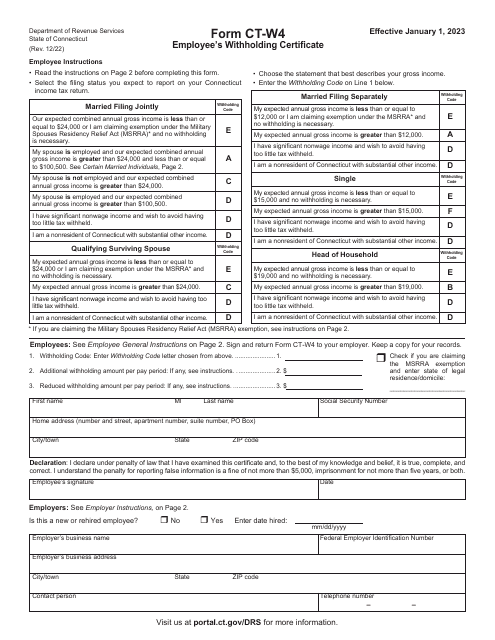

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

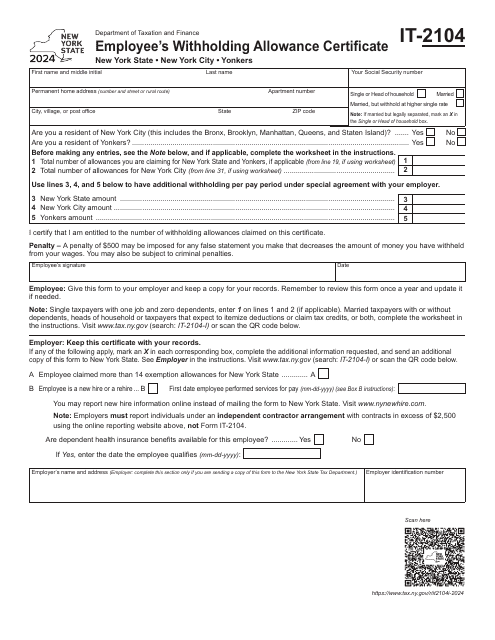

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

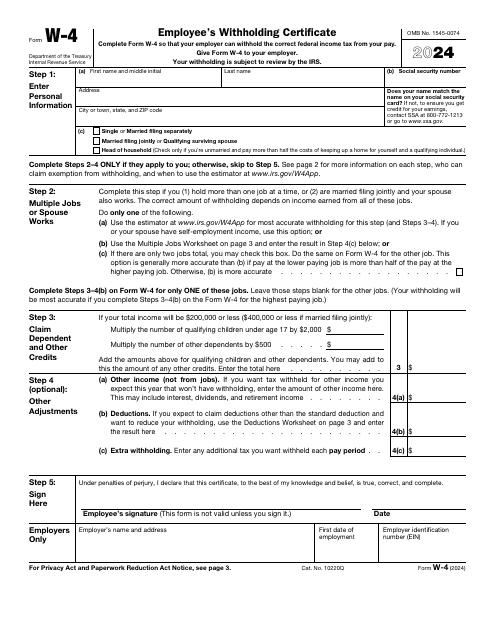

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.