Free Tax Filing Templates

Documents:

3000

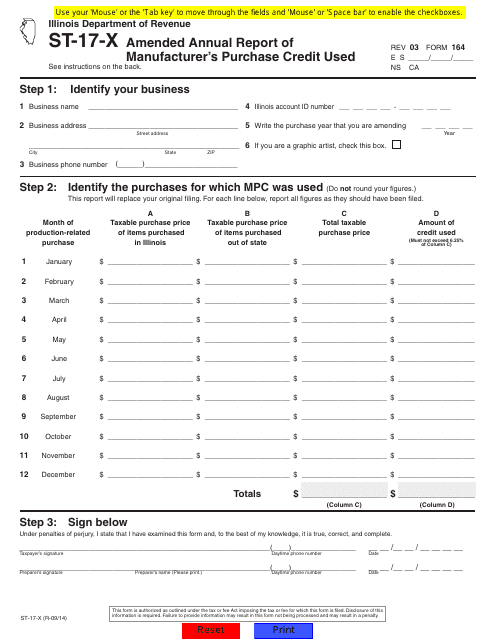

This form is used for filing an amended annual report of a manufacturer's purchase credit used in the state of Illinois.

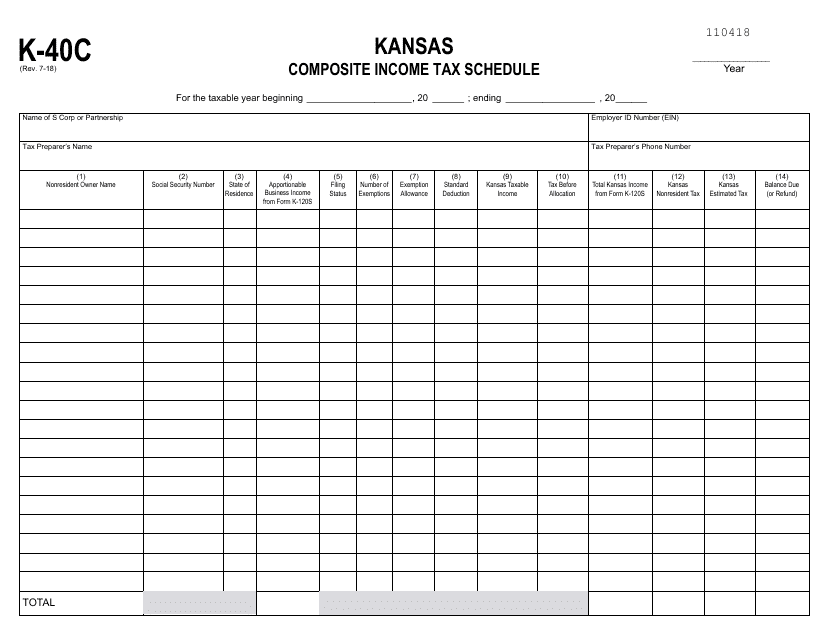

This form is used for reporting composite income tax for individuals in the state of Kansas.

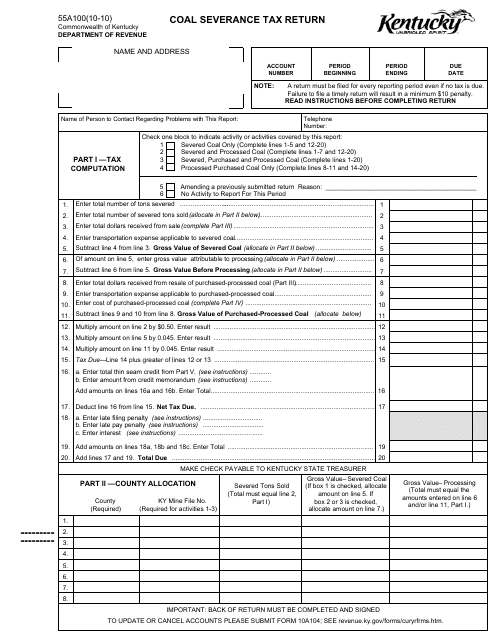

This form is used for filing the Coal Severance Tax Return in the state of Kentucky. It is required for individuals or businesses that generate income from coal severance activities.

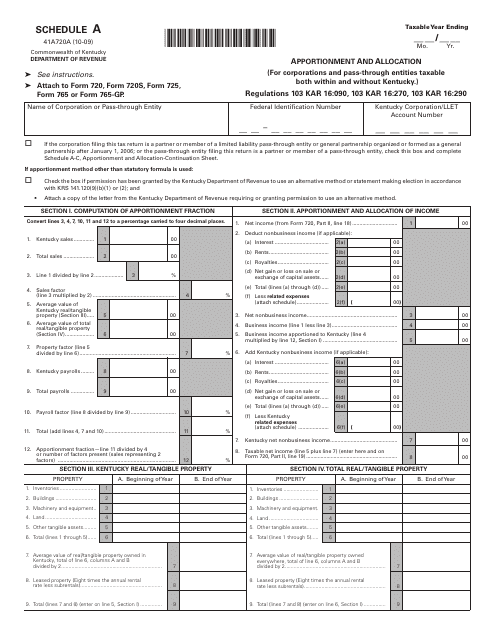

This form is used for apportionment and allocation in Kentucky. It helps determine the percentage of income and expenses that are allocated to the state for tax purposes.

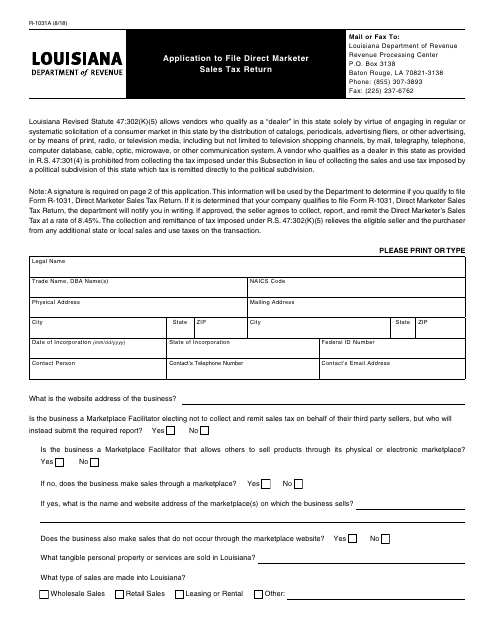

This Form is used for applying to file the Direct Marketer Sales Tax Return in Louisiana.

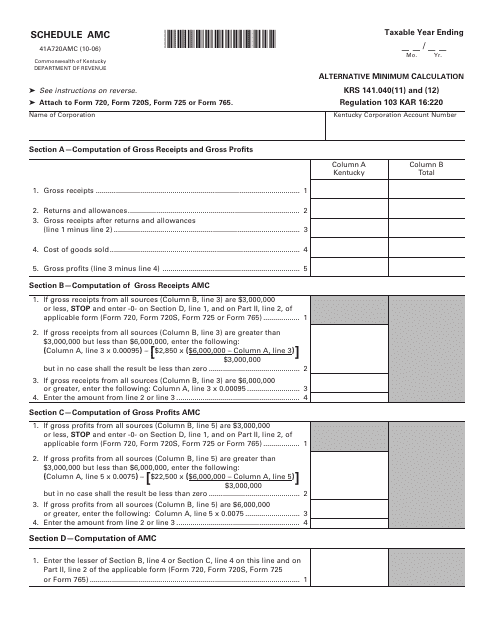

This form is used for calculating the alternative minimum tax in Kentucky.

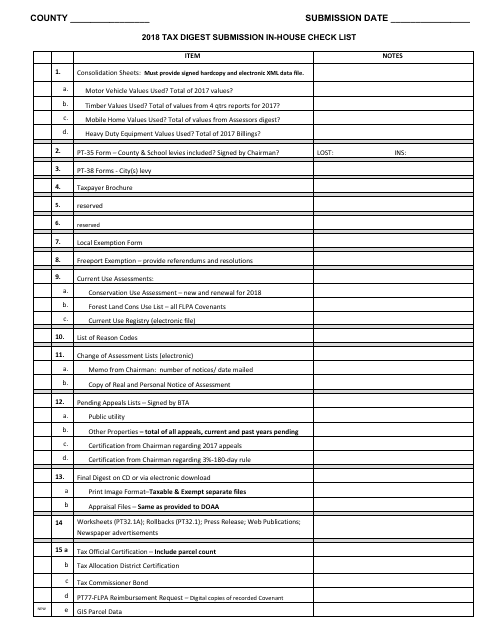

This checklist is used for submitting the tax digest in-house in the state of Georgia, United States. It provides a comprehensive list of items to be reviewed and included when submitting the tax digest.

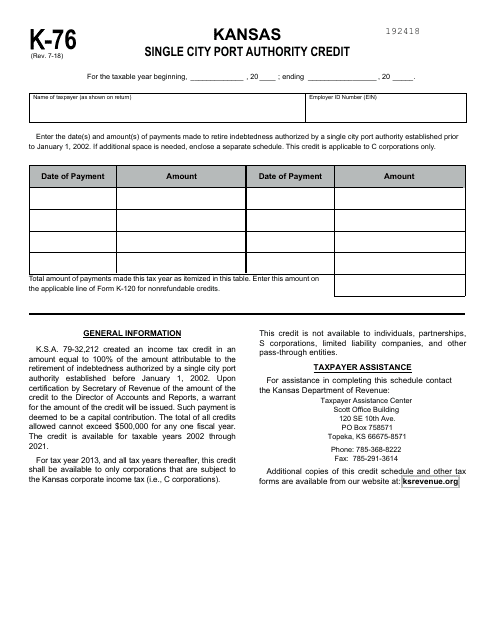

This Form is used for claiming a tax credit related to the operations of a single city port authority in Kansas.

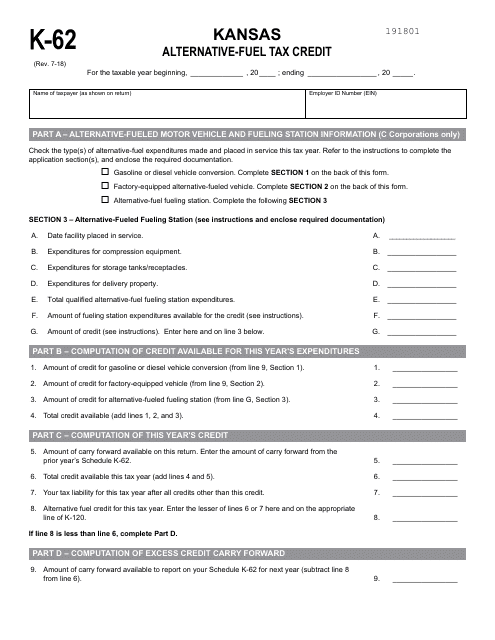

This Form is used for claiming the Alternative-Fuel Tax Credit in the state of Kansas.

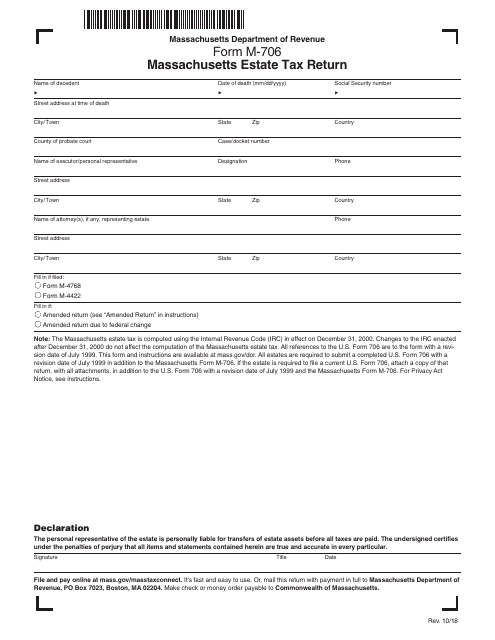

This form is used for filing an estate tax return in the state of Massachusetts.

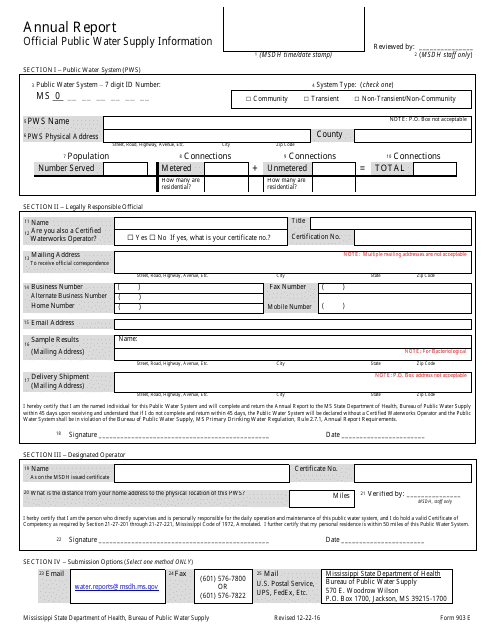

This Form is used for filing the annual report in the state of Mississippi. It is required for all businesses registered in the state to submit this report to maintain their legal status.

This form is used for applying for a tax certificate in the state of Montana.

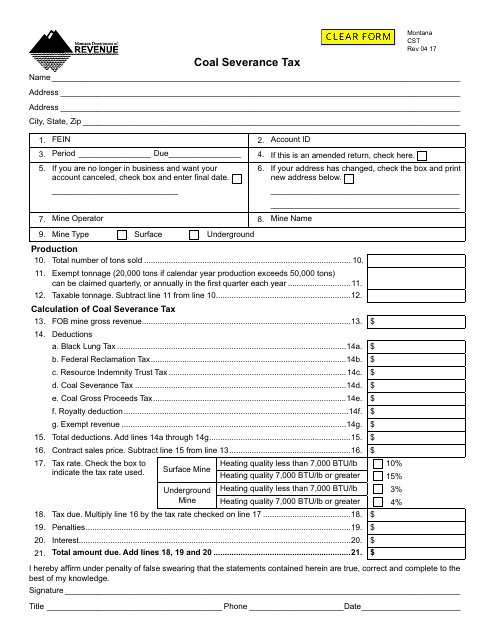

This Form is used for filing the coal severance tax in Montana. It is a tax form specifically for businesses involved in coal mining and extraction in the state.

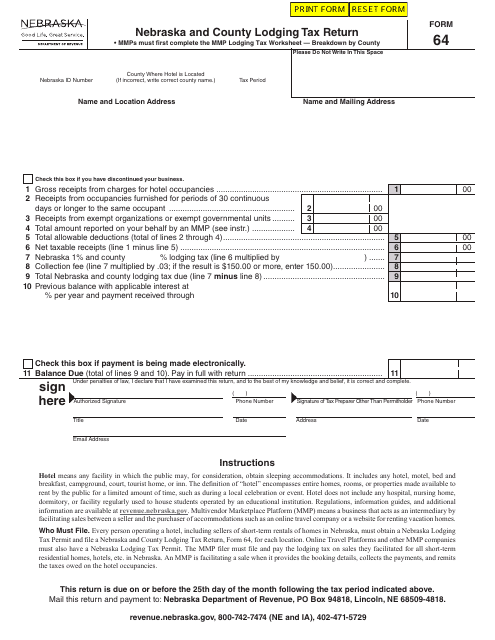

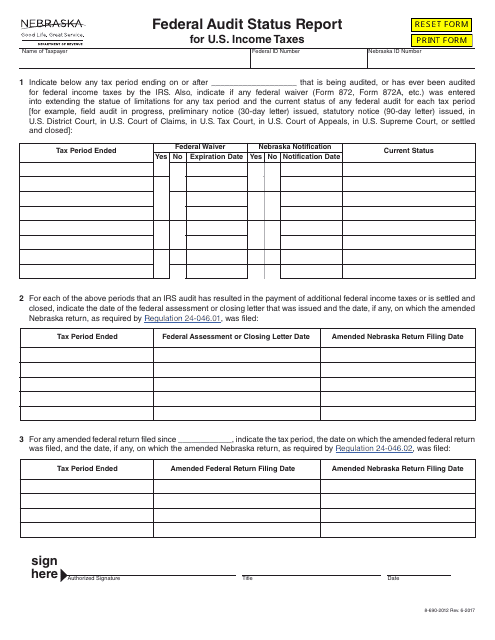

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

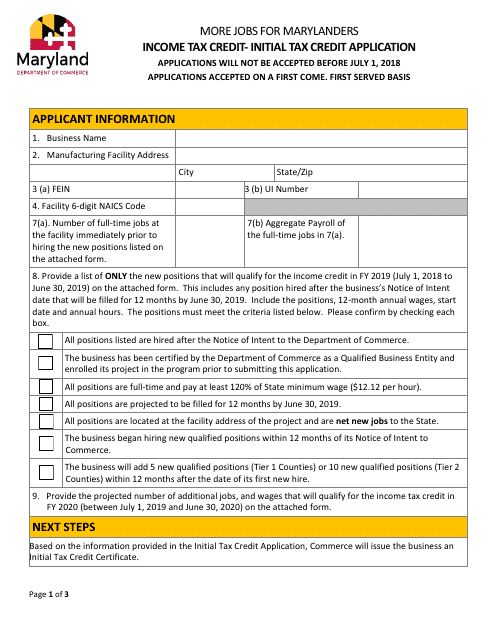

This Form is used for applying for the Initial Tax Credit in Maryland.

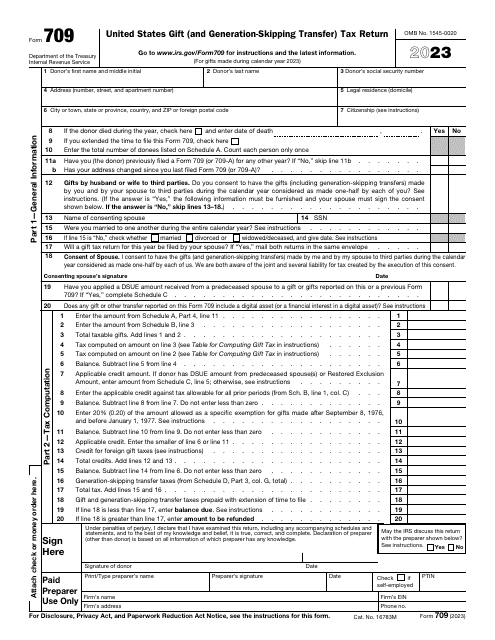

This is a formal document used by taxpayers to outline asset transfers that are considered gifts and are subject to tax.

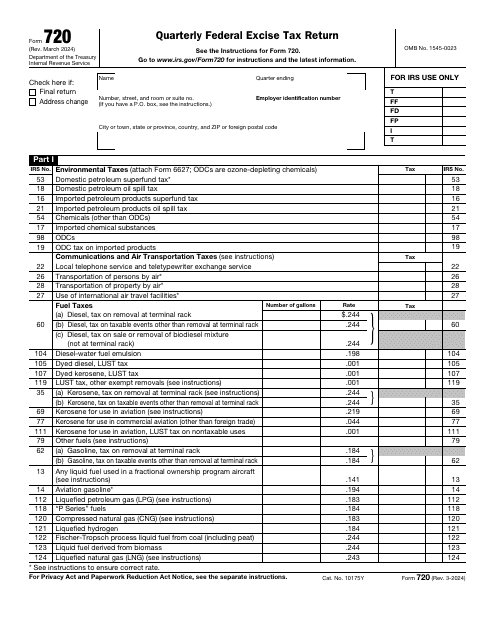

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

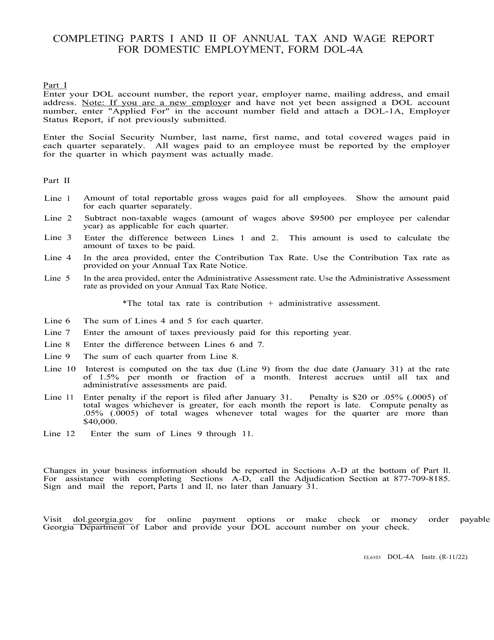

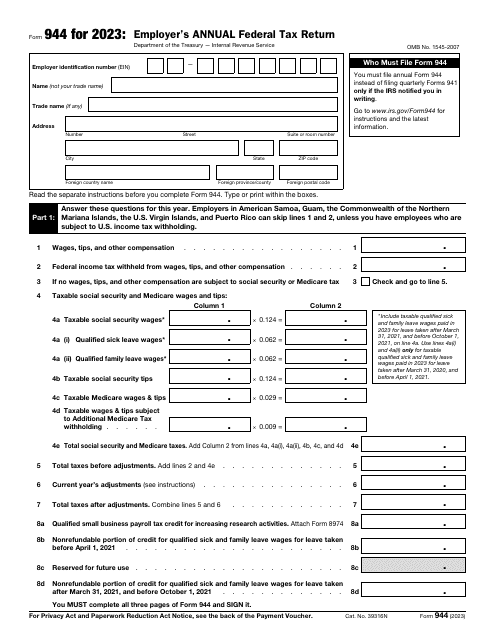

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.

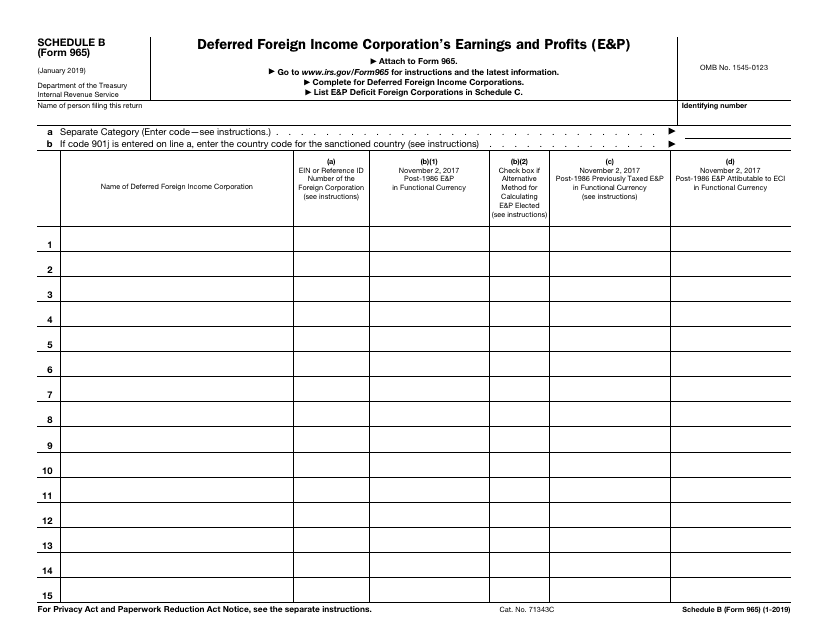

This Form is used for reporting the deferred foreign income and the earnings and profits of a foreign corporation.

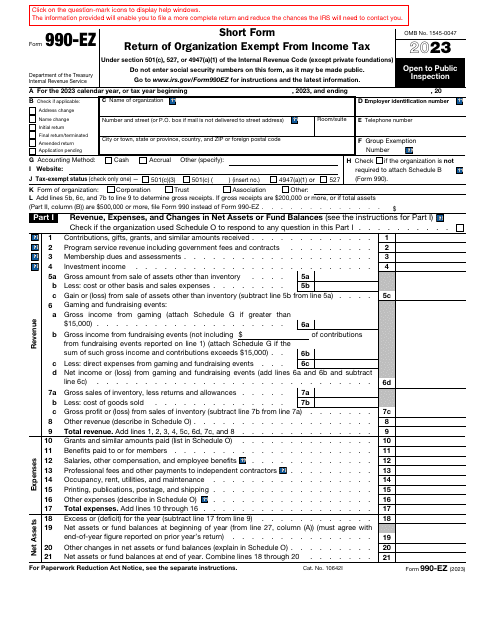

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

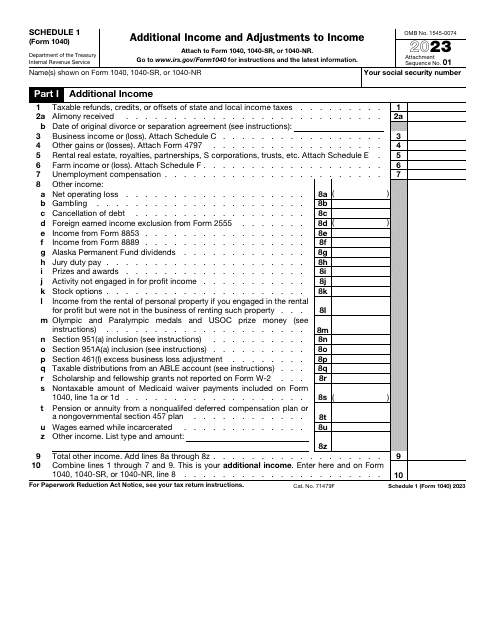

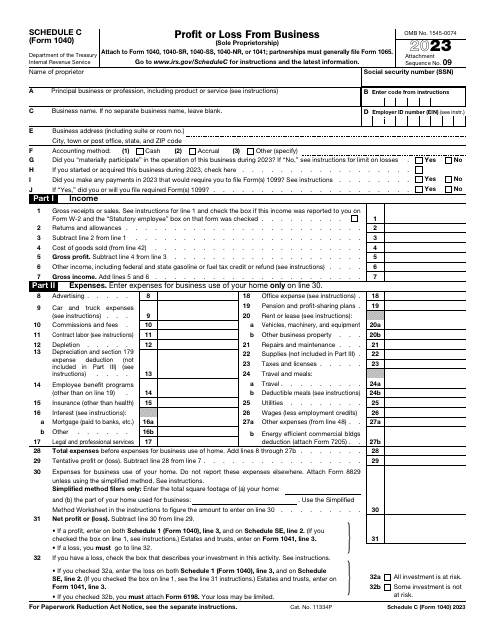

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

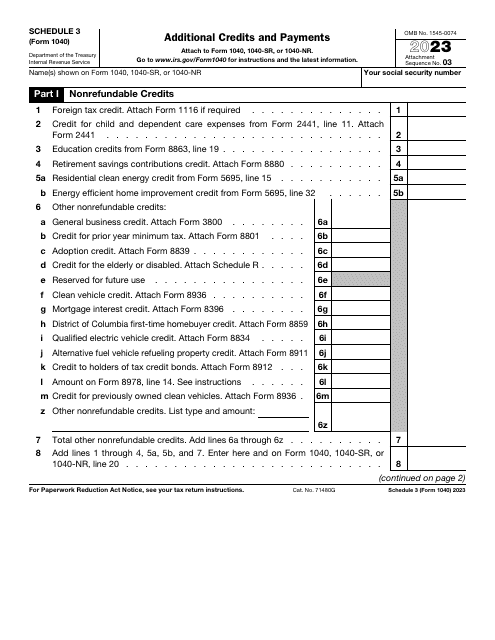

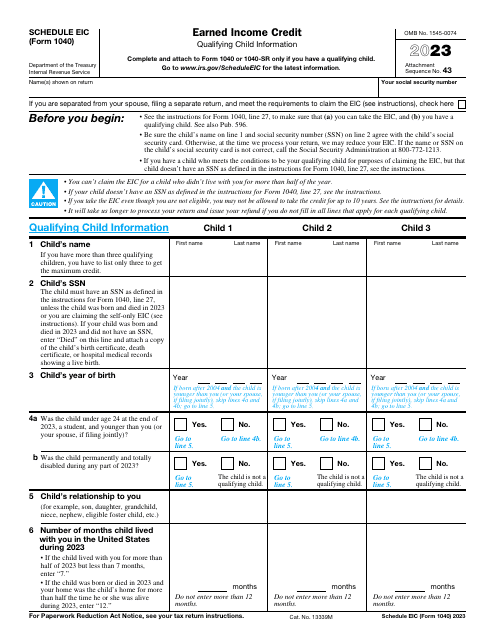

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

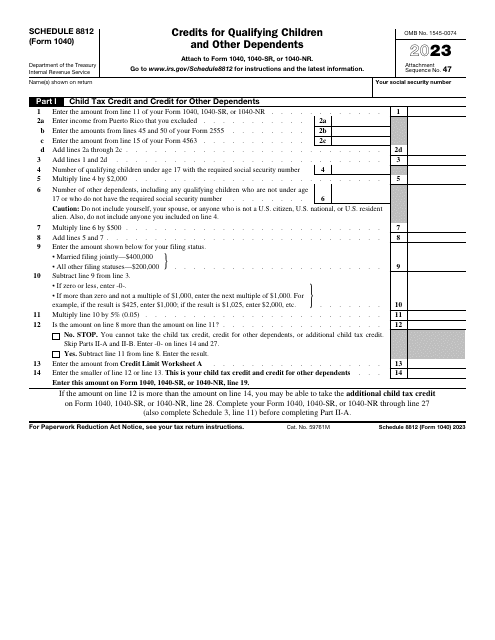

This is a fiscal statement created to let taxpayers with children make the most of the tax benefits they qualify for via extra tax credit.

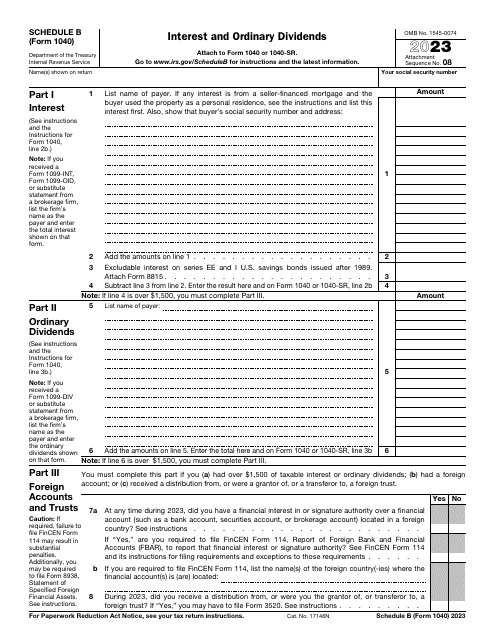

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

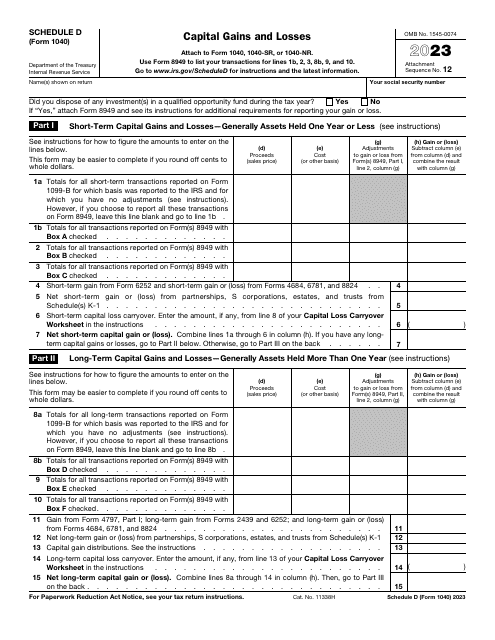

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.