Land Purchase Agreement Forms by State

What Is a Land Purchase Agreement?

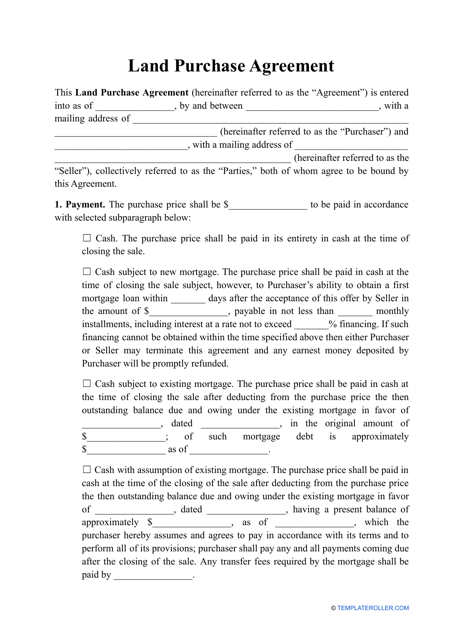

In real estate, a Land Purchase Agreement (not to be confused with a Land Contract) is a legal document used to record the terms and conditions of a deal concluded between an original landowner (the Seller) and a person or company intended to acquire this land or property (the Buyer). Generally, this agreement transfers ownership of the property from one person to another with different types of agreements serving different purposes. If you want to purchase land in the United States, it is better to get familiar with the most widespread types to find the one that suits you best.

A purchase contract for land can fall into one the following broad subcategories:

- General Purchase Agreement. This type of agreement is much shorter and contains only the most essential points. It is typically applied if the Buyer acquires the property directly from the Seller instead of purchasing it through a real estate agent;

- Property-Specific Purchase Agreement. This type of agreement is normally used as vacant land purchase and sales agreement; however, it may be customized to buy a mobile home, and other non-typical property. Buying vacant land is a complicated task that includes many aspects like the presence of hazardous materials, the condition of the soil, zoning of the area, and so on. That is why many real estate agents define vacant land purchase agreement that covers all points specific to vacant land transfer as a separate form of agreement;

- State or Association Purchase Agreement. Some realtor associations and states have standard sales contracts they require to use during the property transaction.

Types of Land Purchase Agreements

The different types of land purchase and sale agreements may depend on the payment plan and the guarantees Sellers can and want to offer to the Buyer. The most popular types of contracts are:

- Warranty Deeds. These are considered the most secure both for the purchase of land or any other type of real estate. When buying property via a warranty deed, the Seller guarantees that the property is free of debts or any other possible liens. The Seller is obliged to defend the title against any other claims and compensate the Buyer any unsettled debts or liabilities that may arise;

- Special Warranty Deeds. This type of contract does not cover the whole history of ownership. It states only that the property was not encumbered during the Seller’s ownership. This type of agreement is often used when buying land for commercial use in the U.S.;

- Grant Deeds. This document transfers all rights for the property from the Seller to the Buyer immediately. It secures two main guarantees: that the Seller is the legal owner or the property and that the Seller can transfer it free of debt. Unlike the regular or special warranty deed, it does not protect the Seller from any possible defects of title. It is typically used for residential real estate sales and when transferring the property ownership between spouses (e.g., in case of divorce);

- Bargain and Sale Deeds. In case of a land purchase via this deed, the Buyer will not be guaranteed that the Seller owns the real estate free and clear. This document will not protect the Buyer from any possible encumbrances. It only states that the Seller holds the title of the indicated real estate, but if any title defect appears at a later date - the Buyer may be in trouble. It is often used during sales of court-seized property;

- Quitclaim Deeds. This type of agreement provides the Buyer with the least amount of protection. It offers no warranty to the status of the property title. It only transfers all claims and rights for the real estate from one party to the other, often with no monetary exchange. This type of contract is generally used by spouses and other family members.

Related Articles

Documents:

1

This type of template acts as a legally binding contract that outlines the details of the sale and purchase of land - the physical ground with or without buildings erected upon it.