Free Budgeting Templates

What Is Budgeting?

Budgeting is a financial process of planning, composing, and managing budgets - a variety of financial estimates that list the revenue and expenses of a single individual or a particular entity over a set period of time. Whether your goal is to save enough money for a big purchase or you need better financial planning to ensure your company succeeds and grows, you can implement budgeting whenever you schedule and carry out financial operations.

To fill out a budgeting template, you need to collect the financial documentation you have accumulated already, figure out the costs and expenses required for your business operations, and subtract them from the determined or estimated sales and revenues.

Types of Budgeting Templates and Statements

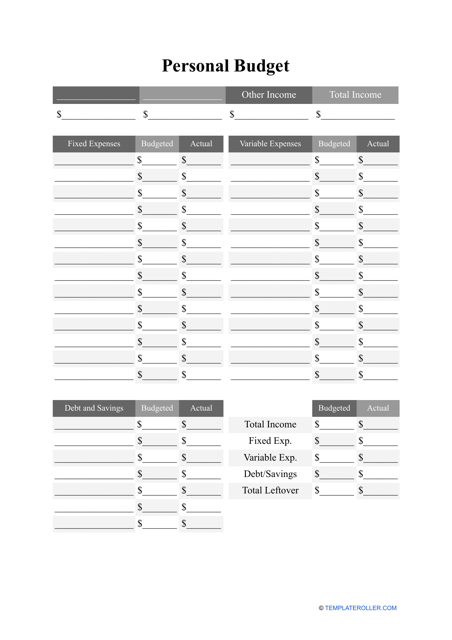

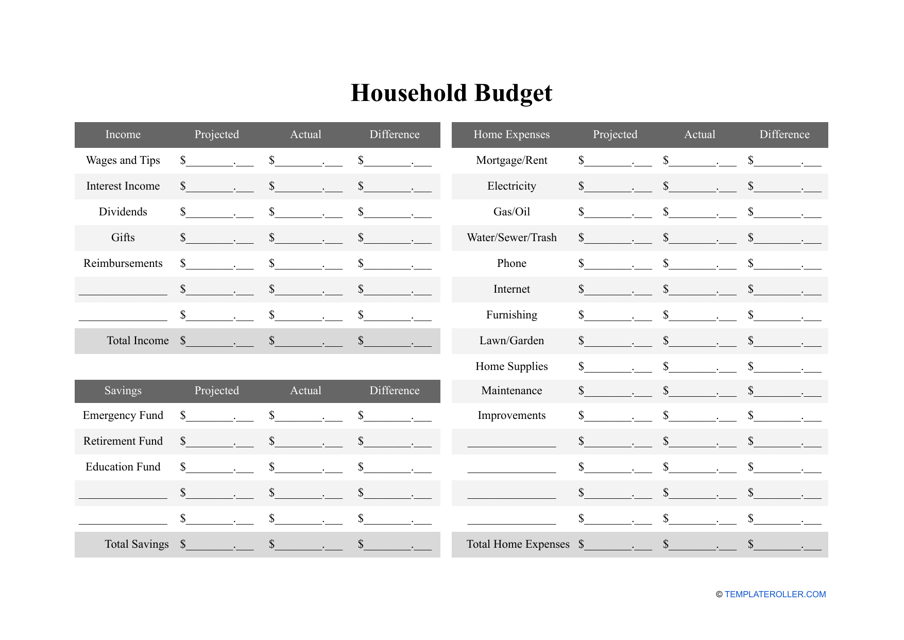

- Personal Budgeting Templates. Consider drafting a budgeting template to help you build an effective business plan - at a minimum, it is necessary to make sure your expenses do not exceed your income and you always have funds to deal with the liabilities and debts of the organization. Additionally, you should complete a Budgeting Spreadsheet to monitor your own finances or keep track of the income and expenses of your business.

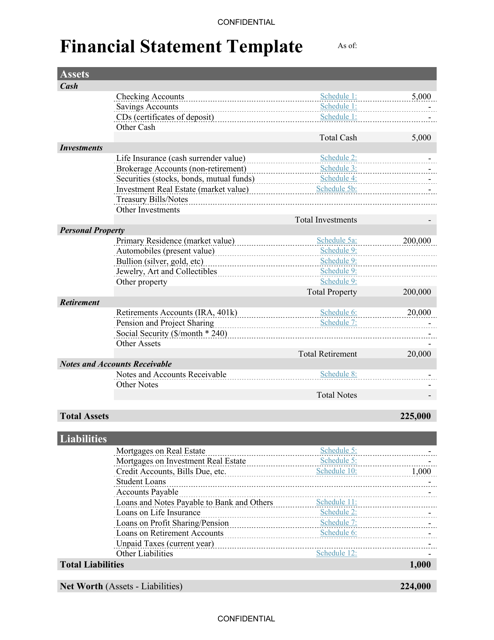

- Financial Statements. A Financial Statetment is any financial document prepared by the business that wants to organize its financial activities and arrange a complete list of the assets, expenses, debts, and revenues of the company to increase its efficiency on the market. Whether you are planning to manage the cash flow of the organization or compare the performance of the company to the past financial situation, this is how you will be able to assess operating, financing, and investing activities.

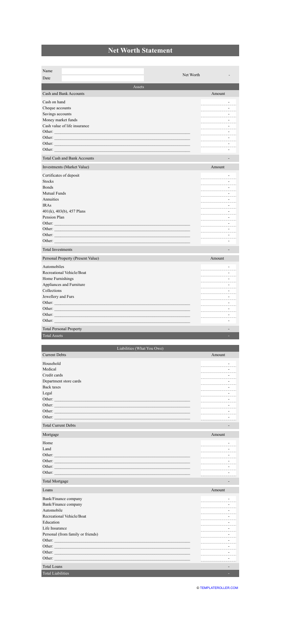

- Net-Worth Statements. This is a financial instrument that offers an overview of the company's financial position at a particular time - essentially, it represents the difference between what you own and what you owe. Prepare this document at the beginning and the end of the accounting period to examine your progress toward short- and long-term financial goals.

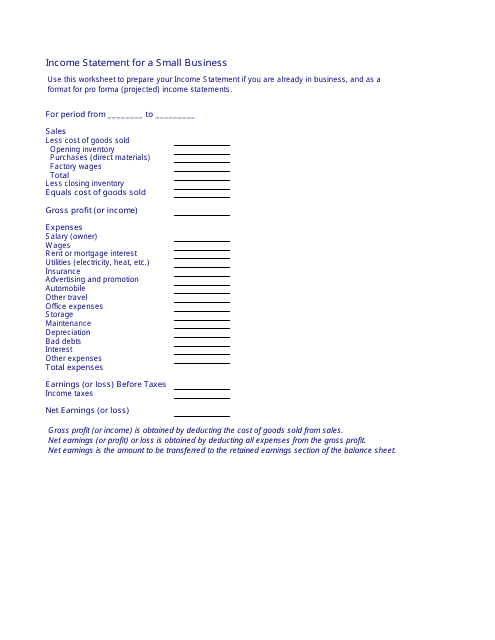

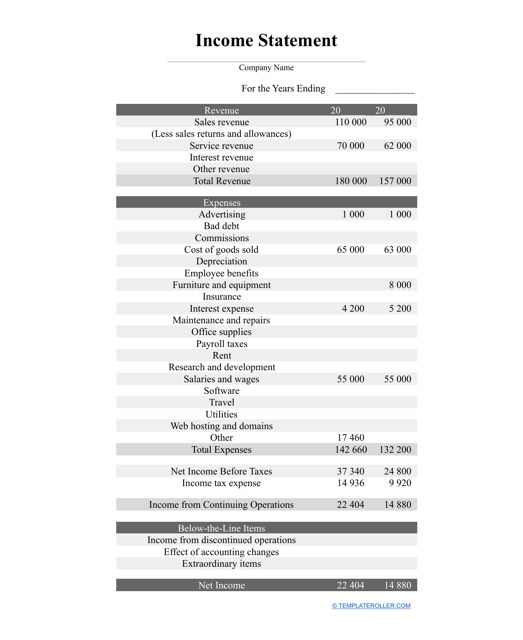

- Income Statements. Used by big and small companies, this document will serve as a report of the financial performance of your business - calculate your sales revenue, subtract the expenses and taxes, and find out how many gross profits your organization generates every week, month, or year. You can compose this statement for the internal records of the organization, for a financial institution, or for the prospective partner to show how profitable your company is.

Check out these related topics:

Related Articles

Documents:

13

This template is used to create an income statement for small businesses. It helps summarize the revenue, expenses, and net income for a specific period of time. Use it to track the financial performance of your small business.

This document template is used for creating a monthly budget spreadsheet. It can be helpful for students at Biola University to manage their finances.

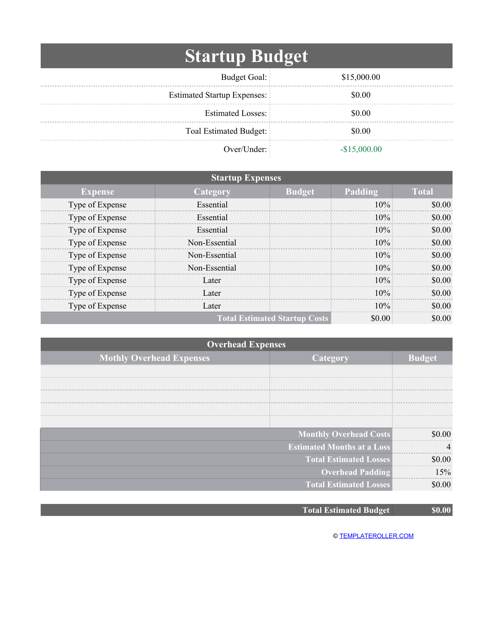

This document is a way for a startup business to assess all of the costs necessary to open their business based on income and expenses.

This is a written record that conveys the activities and the financial performance of your business or company.

Any individual may use this type of financial plan to manage their income in line with necessary expenses, debt payments, and savings.

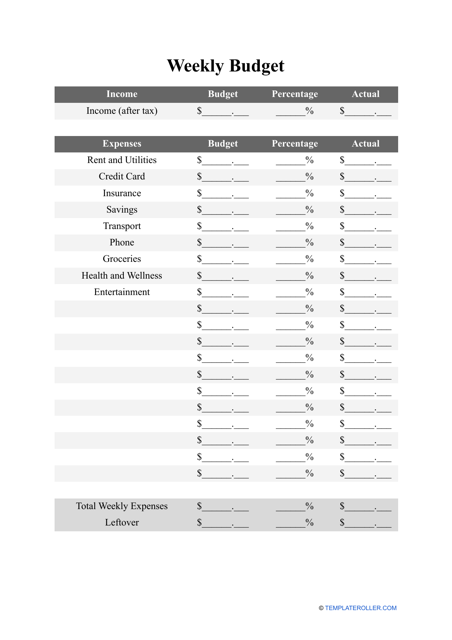

Individuals may use this type of budget template as an approximate estimate of the income and expenses of a particular week or several weeks at the same time.

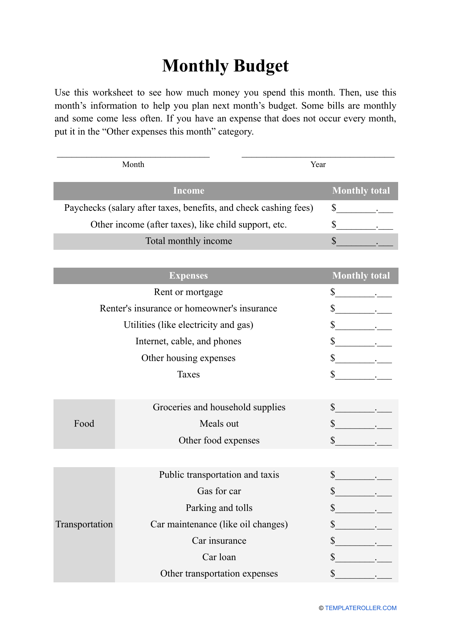

This type of template is a written statement that indicates the estimated income of an individual, household, or organization, organizes the finances, and allows the person who created it to stay on top of all expenses over the course of a monthly period.

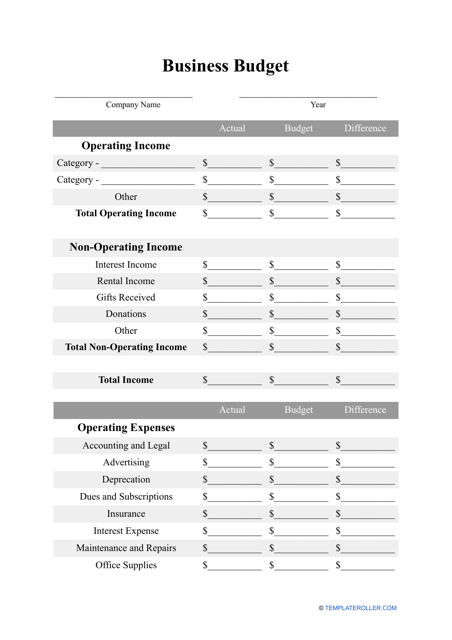

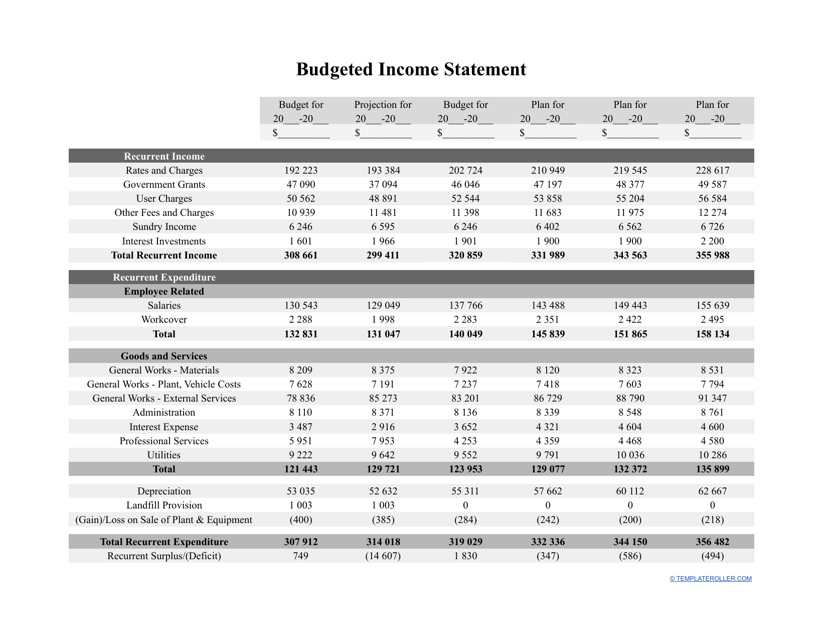

This template acts as an estimate of a company's revenue, expenses, and investments over a week, month, or year.

This worksheet helps individuals to project the income and expenses of a particular family household.

The purpose of this document is to assist a business in forecasting its financial standing in the future and distributing its funds and resources efficiently.

This statement contains information about the activities of a business and the income it generates.

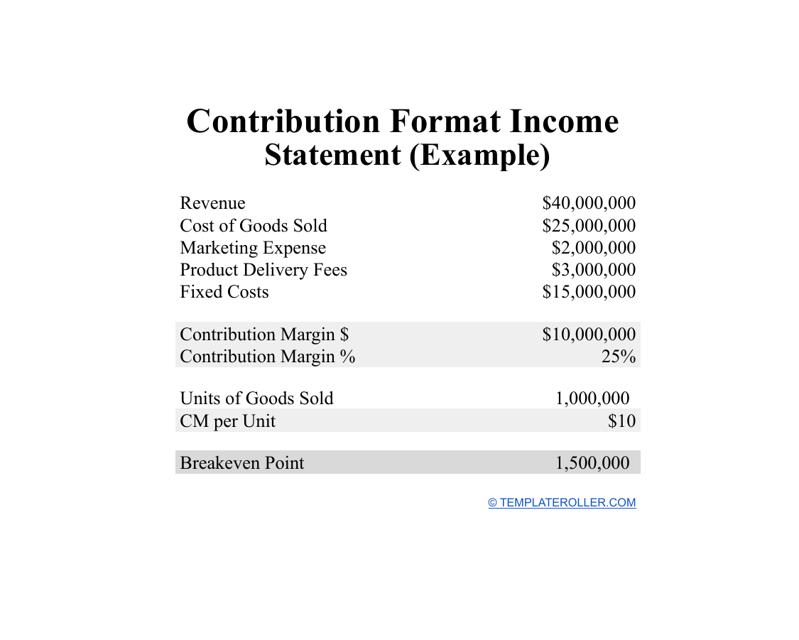

This type of template can be used as an internal financial document of a company that shows the distribution of their business expenses - both variable and fixed costs - and the differences between them.

A company or individual may use this type of financial document to report their current financial worth.