Free Property Rental Forms and Templates

What Is Property Rental?

Interested in investing in rental property? Property rental is an enterprise with one or more income-producing property items that are purchased and managed by an investor. These items can have one or more rooms that are rented out to tenants who are obliged to make regular monthly payments. Owning rental or leasing property as a business can be quite beneficial.

The property rental business does not differ from any other type of entrepreneurial activity. The most important issues are drafting a rental property business plan, getting financing, and setting a proper business goal.

You may rent or lease commercial and residential property, storage areas, farmland, or any other purchasable land. Not sure where to begin? Check out these agreements to find out more:

- Commercial Lease Agreements;

- Residential Lease Agreements;

- Land Lease Agreements;

- Farm Lease Agreements.

If cash flow stays positive on a particular piece of land, a rental property can become a good investment. Renting out residential property may be considered passive income and you are able to combine it with your main job. Entrepreneurs owning several rental buildings can create rental property companies where they can hire a manager who will keep accounts, collect payments, and solve any issues that may come up with the lease.

How to Start a Rental Property Business?

As mentioned previously, rental property is a structure being leased or rented to a tenant for a certain period of time. Depending on the terms of the deal, the concepts of a residential lease and a residential rental are picked out. A residential rental is considered to be a short-term rental while a residential lease is a long-term contract. After your business plan, budget, potential profits, and risks are calculated, it's time to create your enterprise legally. The first thing is composing an agreement. The requirements for these agreements may vary depending on which state you reside in.

A standard Lease Agreement or Rental Agreement often contains the following:

- Personal details about the landlord and the tenant;

- A fixed time period of lease or rental: the beginning and ending dates of the lease;

- The rent amount per month, the security deposit, and other payment terms;

- A description of the property to be rented: square footage, number of bedrooms or bathrooms, type of build (wood or concrete), parking if available, and property type (condo, townhome, duplex, triplex, or others).

The following sections are optional but may prove to be essential in your Lease or Rental Agreement:

- Cleaning Fee. This can protect you from any potential mess your tenant causes.

- Changes in the Terms of the Rental/Lease. Both the lessee and the lessor must have a clear understanding of the lease term. If there may be any changes in the rental period, the procedure for making them must be prescribed in the contract.

- Abandonment. This clause protects the rights of the landlord since tenants may leave the premises in unsatisfactory condition.

- Occupants and Pets. The landlord may have objections to the number of residents, children, or animals. An addendum regarding pets must be negotiated and signed in advance.

- Inventory and Inspection. These measures are necessary to prevent potential claims in a timely manner.

- Notification of Repair or Building Issues. If the apartment needs repair or replacement of expensive furniture and appliances, then most often these costs are either shared between the parties or are performed by the tenants, but then the landlord can temporarily reduce the rate. Repair and reconstruction in a rented apartment are not allowed without the consent of the owner.

- Utilities. The landlord may include the utilities cost in the rent, but make the payments himself to remove this concern from the tenants. The opposite situation is also possible: the owner reduces the rate, and the tenant pays all utilities.

- Termination. This point is essential in the contract as different circumstances may arise and you may need to stop renting;

- Sublease. Specify if the original tenant has a right to sublease the premises (with or without notifying the lessor).

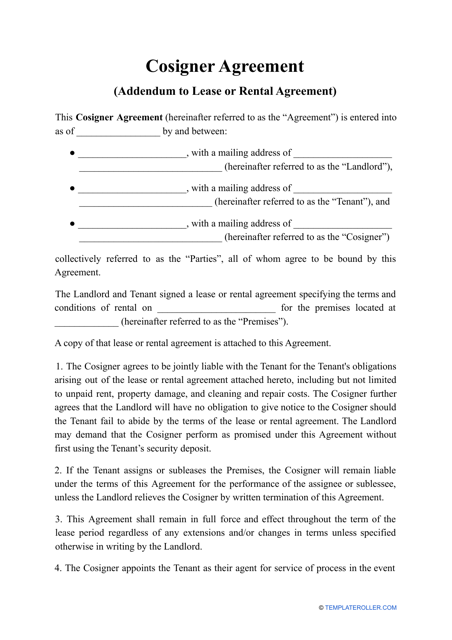

A Rental Application or a Cosigner Agreement may be attached to a contract if needed. Additional documents that may be useful for a potential property owner or lessee include:

How Much Profit Should You Make on a Rental Property?

There is no single answer about how profitable your rental property business should be. It depends on many circumstances: the type of investment property, the location, and first of all on your rental property management, and strategy. These are two important factors you have to calculate for a good start-up in a property rental business:

-

Screen the real estate market in your area. Analyze the demands of the potential tenants, existing offers, and prices.

-

Count the expenses that you will have to cover:

- Property taxes;

- Rental property insurance;

- Maintenance and repair costs;

- Homeowner association fees;

- Advertisement;

- Monthly mortgage payments if you are buying rental property.

Exclude them from your expected money flow. Normally, the expenses are between 35 and 55 percent of your rent (not including the mortgage payments). If you are buying a rental property, take into account that the monthly rent on the property should be equal to or greater than 1 percent of the property purchase price. Often real estate investors set about 1.2 to 1.4 percent.

How to Calculate Depreciation on Rental Property?

Owning a rental property is not only about income and taxes. You can save money by taking depreciation of your rental property as the building(s) wears out over the years. Depreciation is a great tax advantage for rental property investors as it provides an annual tax deduction.

The Internal Revenue Service (IRS) allows you to depreciate the value of a rental structure over a period of 27.5 years for residential rental property and over 39 years for commercial rental property. To claim depreciation, you have to meet all the specific requirements:

- You must be the owner of the property.

- The building has to be used as a business.

- The property has a determinable useful life (1-year minimum).

- You can depreciate only structure, land and furniture cannot be depreciated.

A depreciation calculation is calculated like this: the value of the structure is divided by the number of years in lifespan. Rental property depreciation deduction is filed on Schedule E of IRS Form 1040.

Related Articles and Topics:

Related Articles

Documents:

304

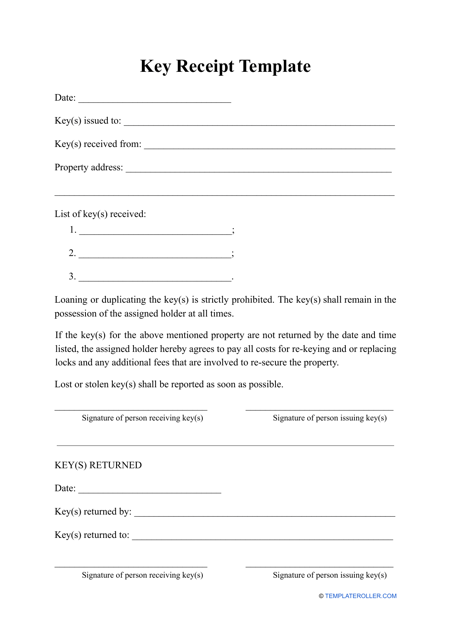

This form verifies that the tenant has received keys to a property they rent and guarantees to return them to the landlord or property manager by a certain date or when the Lease Agreement expires and the rental period is over.

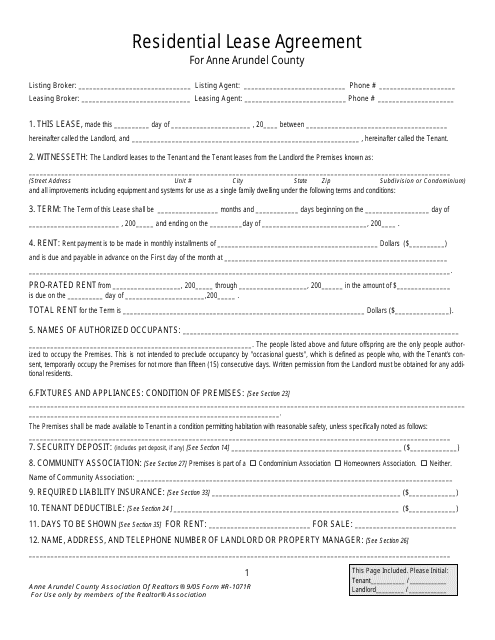

This Form is used for creating a residential lease agreement in Anne Arundel County, Maryland.

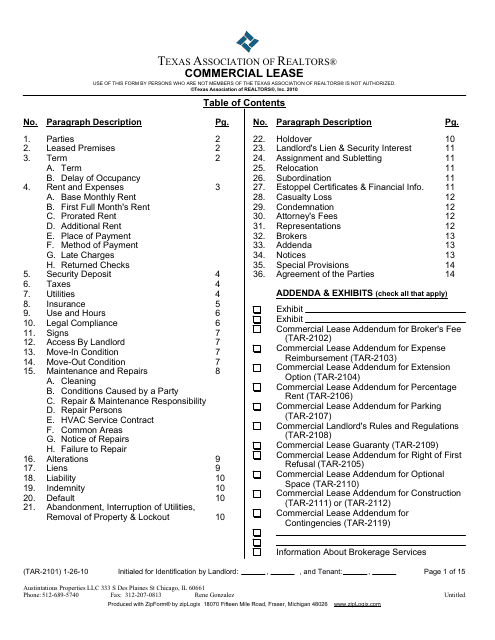

This form is used by Texas landlords and tenants to outline the details of the commercial property rental. It can only be filled out and signed by members of the Texas Association of Realtors (TAR).

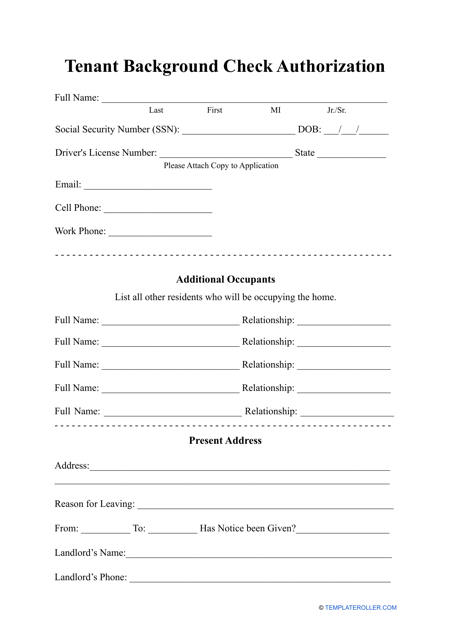

This form helps property managers make sure there are no hidden surprises with potential applicants.

This document outlines the services offered to each party of the agreement to protect the landlord in case any issues with the potential tenant arise.

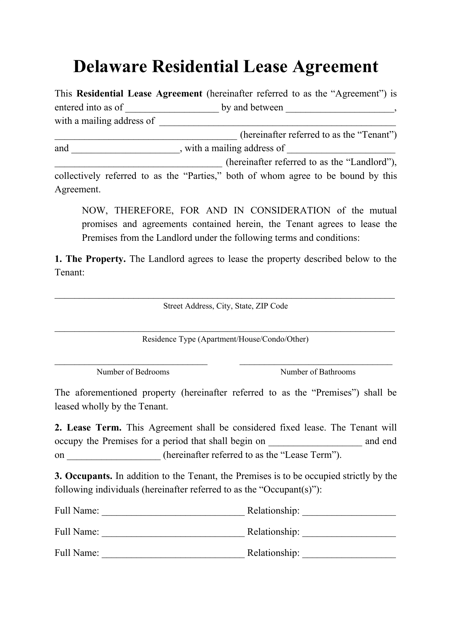

This document is a template for a residential lease agreement in the state of Delaware. It outlines the terms and conditions between a landlord and tenant for renting a residential property.

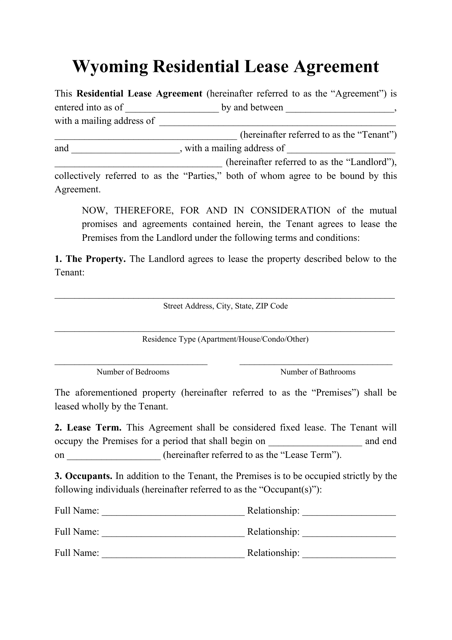

This document is used for creating a legally binding agreement between a landlord and a tenant in Wyoming for renting a residential property.

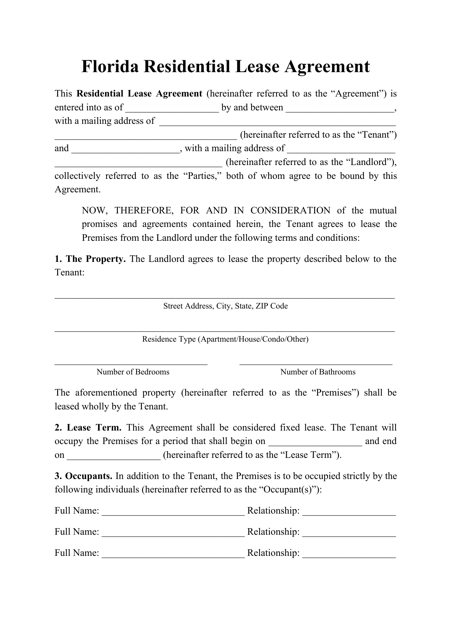

This document is a template for a residential lease agreement in the state of Florida. It provides a legally binding contract between a landlord and tenant for renting a residential property.

This document is a template for a Residential Lease Agreement in Alabama. It outlines the terms and conditions for renting a residential property in the state.

This document is used for creating a lease agreement for residential properties in Alaska. It includes important terms and conditions for both the tenant and landlord.

This document is a template for a Residential Lease Agreement in Georgia, USA. It outlines the terms and conditions between a landlord and tenant for the rental of a residential property. The agreement includes important details such as rent amount, lease duration, and responsibilities of both parties.

This document is a Residential Lease Agreement template for residents in the state of Arizona. It outlines the terms and conditions for renting a residential property.

This document is for creating a lease agreement for residential properties in the state of Arkansas. It provides a template that can be customized to meet the specific needs of landlords and tenants.

This document is a template for a Residential Lease Agreement in the state of California. It outlines the terms and conditions of renting a residential property, including rent amount, lease duration, and responsibilities of both the landlord and tenant.

This document is a template for a residential lease agreement specific to the state of Colorado. It outlines the terms and conditions of renting a residential property in Colorado.

This document is used for creating a legally binding agreement between a landlord and tenant for the rental of a residential property in Connecticut. It outlines the terms and conditions of the lease, including rent amount, duration, and responsibilities of both parties.

This document is a template for a residential lease agreement in the state of Iowa. It outlines the terms and conditions of renting a residential property in Iowa, including the rent amount, lease duration, and responsibilities of both the landlord and tenant.

This document is a template for a residential lease agreement in the state of Kansas. It outlines the terms and conditions of renting a residential property.

This document is a Residential Lease Agreement template for properties located in Wisconsin. It outlines the terms and conditions of the rental agreement between the landlord and the tenant.

This document is a template for a residential lease agreement in Hawaii. It outlines the terms and conditions for renting a residential property in the state. Use this form to ensure a clear understanding of rights and responsibilities between landlords and tenants in Hawaii.

This document is a template for a Residential Lease Agreement in the state of Idaho. It is used to outline the terms and conditions of a rental agreement between a landlord and a tenant for a residential property.

This document is a template for a residential lease agreement in Illinois. It outlines the terms and conditions of the lease, the rights and responsibilities of both the landlord and tenant, and other important details.

This document is a template for a residential lease agreement in the state of Indiana. Use it to create a legally binding contract between a landlord and tenant for the rental of a residential property.

This document is a template for a Residential Lease Agreement in Oklahoma. It is used to outline the terms and conditions for renting a residential property.

This document is a template for a residential lease agreement in the state of Oregon. It outlines the terms and conditions of renting a home or apartment in Oregon.

This document is a template for a residential lease agreement in the state of New York. It outlines the terms and conditions between the landlord and tenant for renting a residential property. Use this document to ensure both parties understand their rights and responsibilities during the lease term.

This document is a template for a residential lease agreement in Pennsylvania. It outlines the terms and conditions between a landlord and tenant for renting a residential property.

This document is a template for a residential lease agreement in South Dakota. It outlines the terms and conditions between a landlord and tenant for renting a residential property in the state of South Dakota.

This document is a template for a Residential Lease Agreement in Kentucky. It outlines the terms and conditions of the lease agreement between a landlord and a tenant for a residential property.

This document is a template for a residential lease agreement in South Carolina. It outlines the terms and conditions of renting a property in the state.

This document is a template for a residential lease agreement in Rhode Island. It outlines the terms and conditions for renting a residential property in the state. It is used by landlords and tenants to formalize their rental agreement.

This document is a template for a residential lease agreement in the state of Vermont. It is used to outline the terms and conditions of a rental agreement between a landlord and a tenant.

This document is a template for a residential lease agreement in the state of New Jersey. It outlines the terms and conditions of a rental agreement between a landlord and a tenant.

This document is a template for creating a residential lease agreement specifically for properties located in Louisiana. It outlines the terms and conditions between a landlord and tenant for renting a residential property.

This document is a template for a residential lease agreement in the state of New Mexico.

This document is a Residential Lease Agreement template for properties located in Maine. It outlines the terms and conditions between a landlord and tenant for renting a residential property.

This document is a template for a residential lease agreement in the state of Maryland. It outlines the terms and conditions of the lease between a landlord and tenant.

This document is a residential lease agreement template specifically designed for residents in Massachusetts. It outlines the terms and conditions of the lease agreement between a landlord and tenant for a residential property in Massachusetts.

This document is a template for a residential lease agreement in the state of Michigan. It outlines the terms and conditions of a rental agreement between a landlord and tenant.

This document is a template for a Residential Lease Agreement in the state of Virginia. It outlines the terms and conditions of the lease agreement between a landlord and a tenant for a residential property.