Canadian Federal Legal Forms and Templates

Documents:

5112

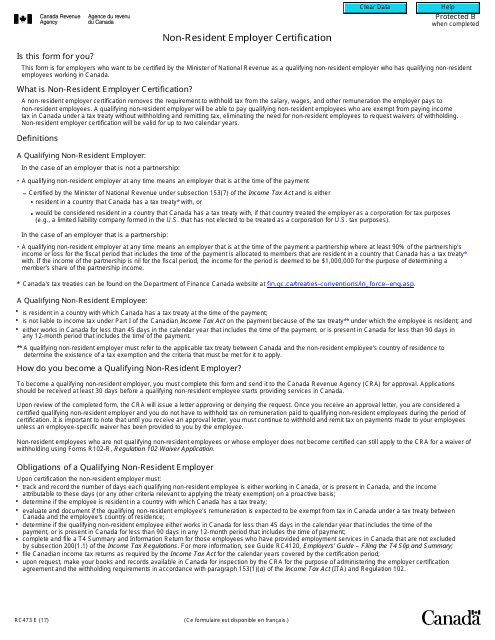

This form is used for non-resident employers in Canada to certify their status. It helps ensure proper tax withholding and reporting for non-resident employees.

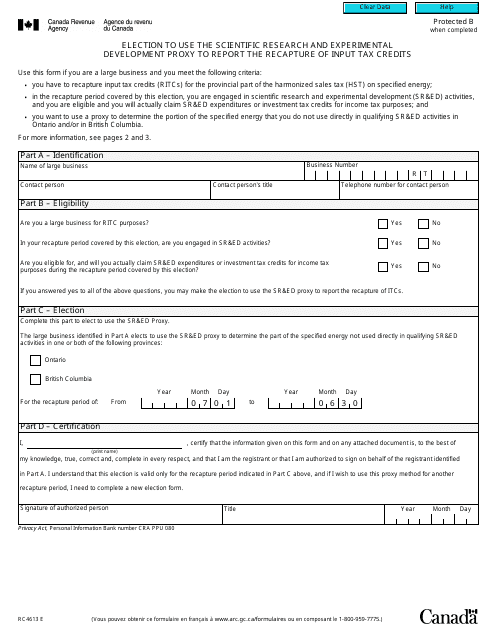

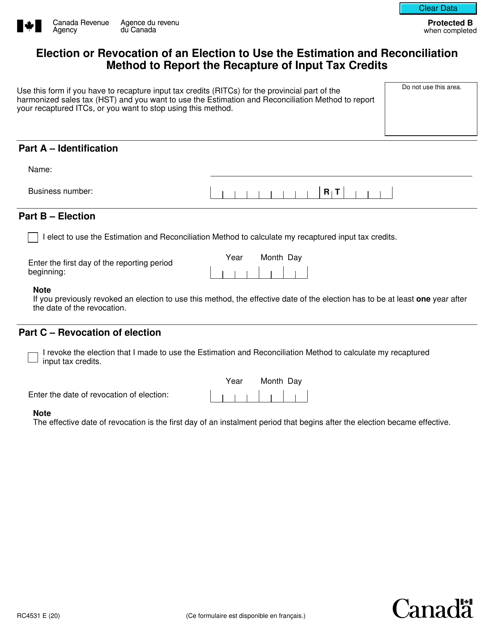

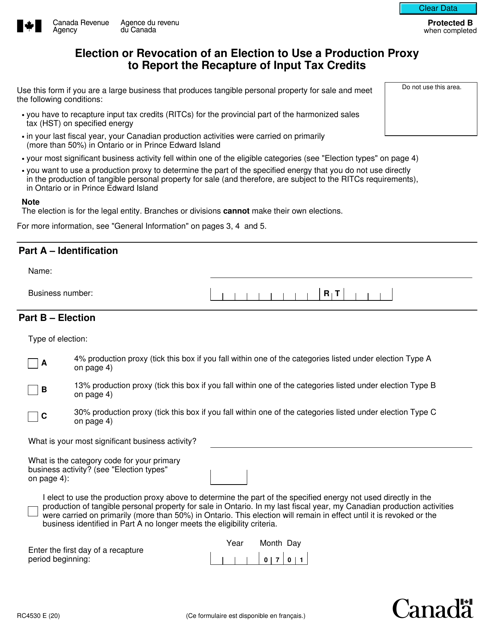

This form is used for reporting the recapture of input tax credits in Canada by electing to use the Scientific Research and Experimental Developmental (SR&ED) proxy method.

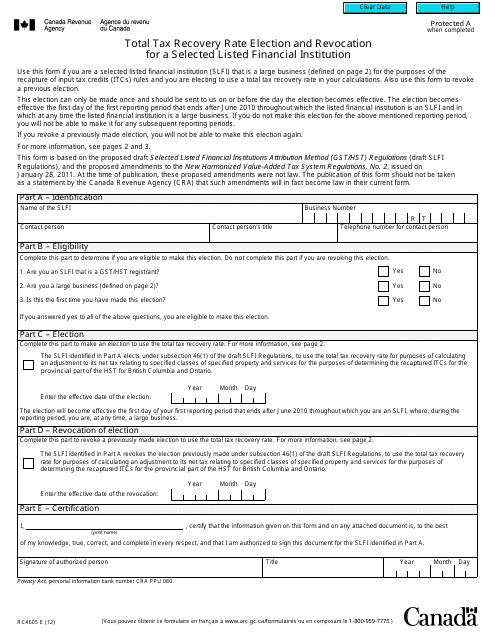

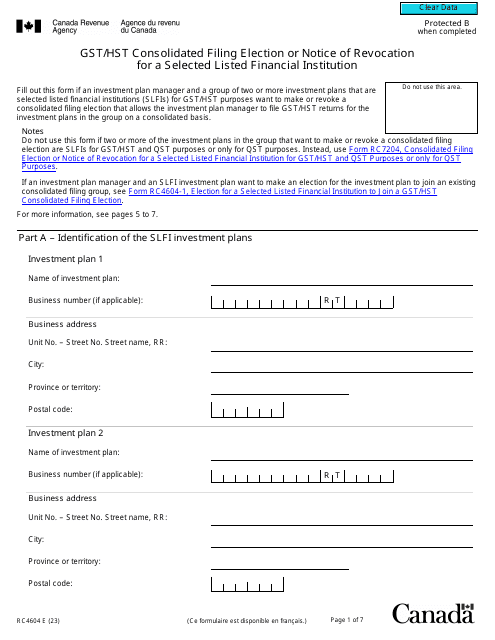

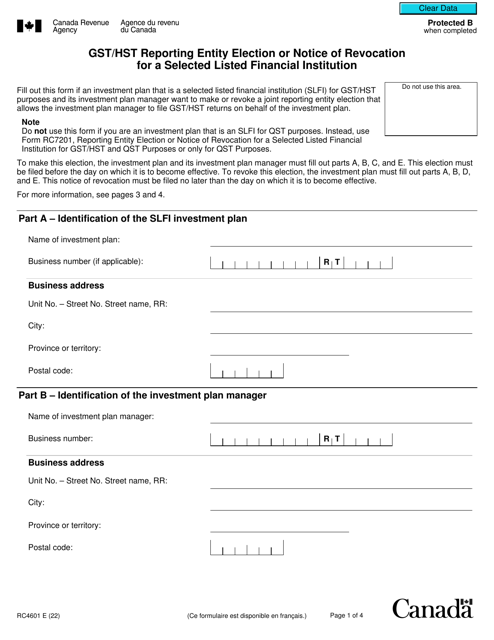

This form is used for making an election or revocation for the total tax recovery rate for a listed financial institution in Canada.

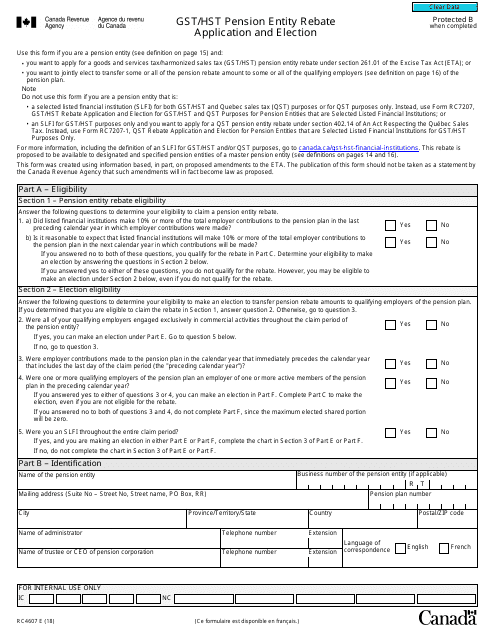

This form is used for applying for the GST/HST pension entity rebate and making an election in Canada.

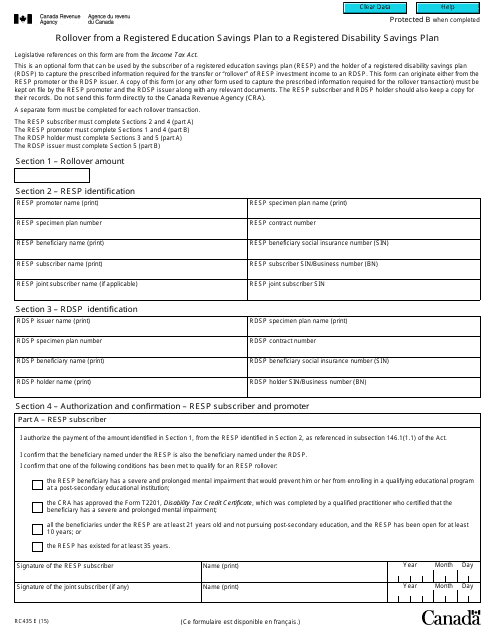

This form is used for transferring funds from a Registered Education Savings Plan (RESP) to a Registered Disability Savings Plan (RDSP) in Canada.

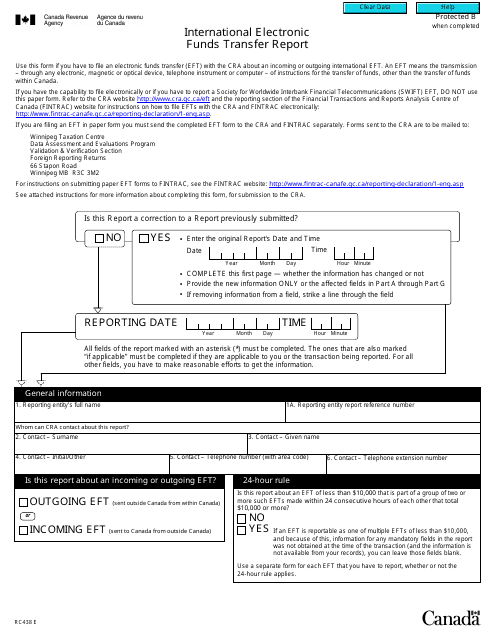

This form is used for reporting international electronic funds transfers in Canada.

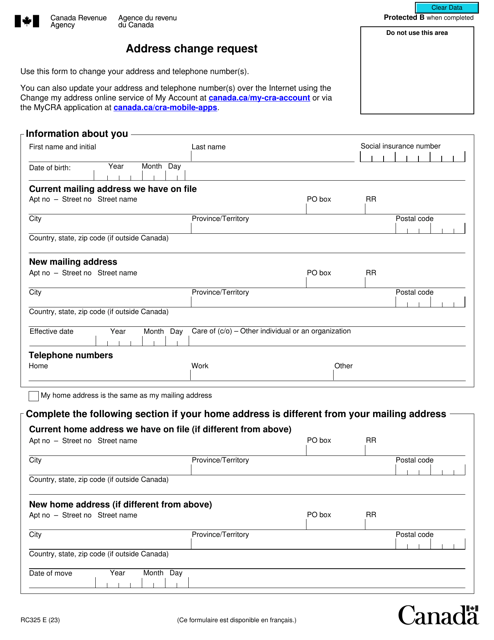

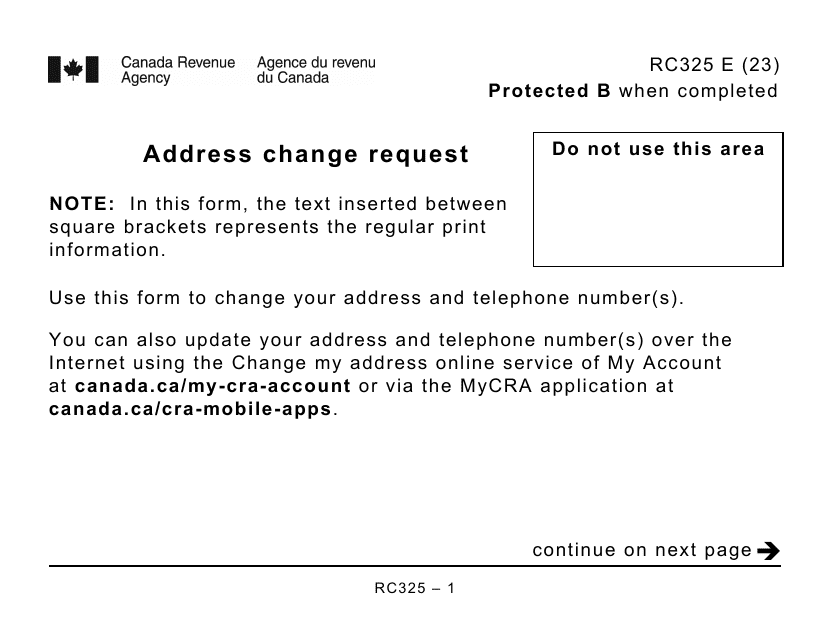

Canadian residents must prepare this form once they know their home address, mailing address, or telephone number has changed or will change in the immediate future.

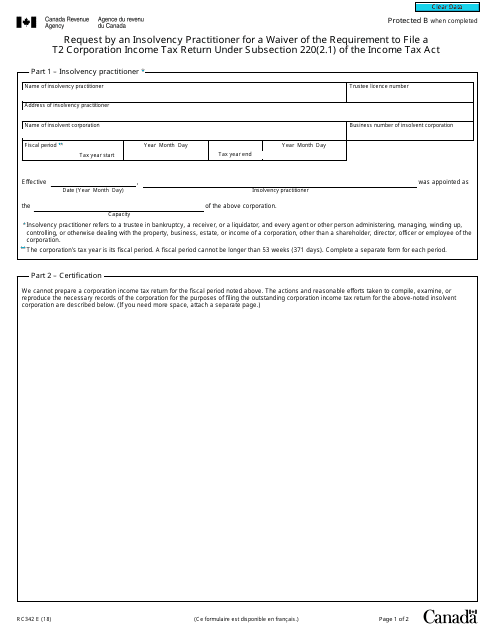

This form is used by an Insolvency Practitioner in Canada to request a waiver for the requirement to file a T2 Corporation Income Tax Return under Subsection 220(2.1) of the Income Tax Act.

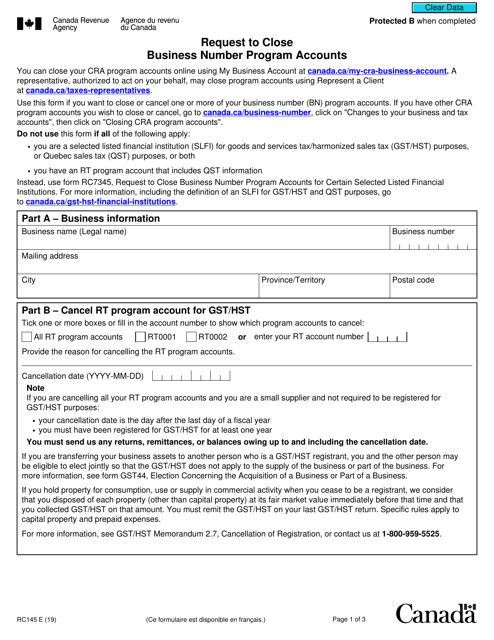

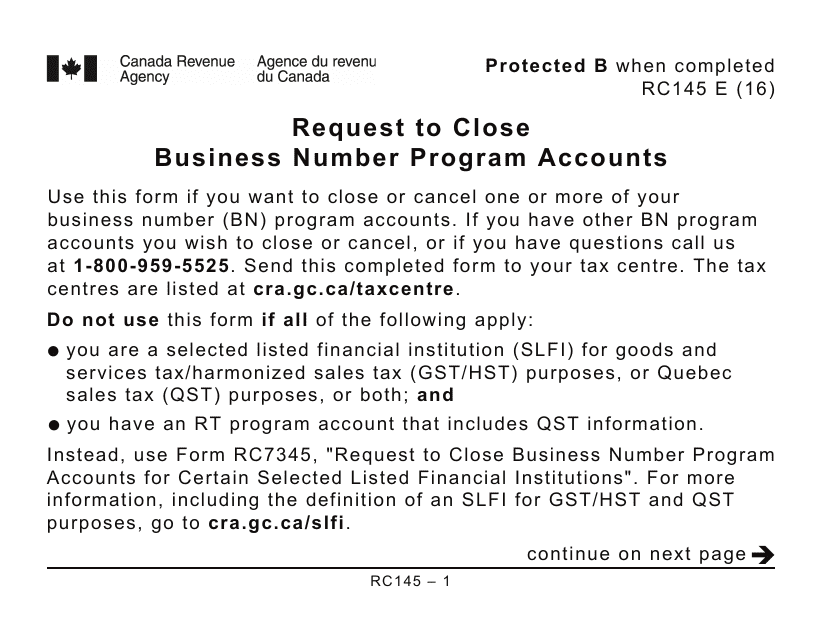

This document is used for requesting the closure of business number program accounts in Canada.

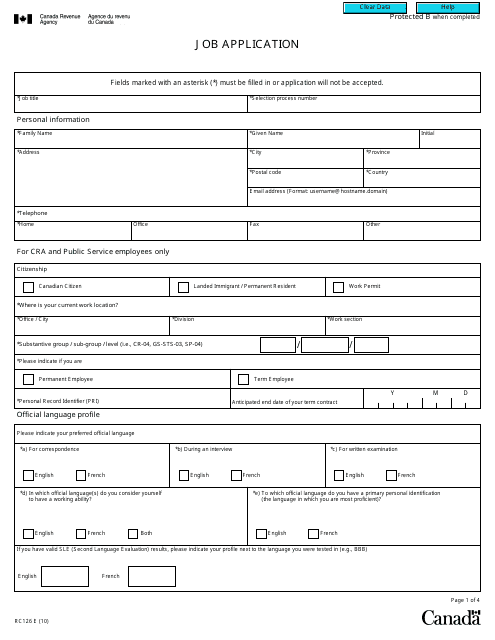

This form is used for submitting a job application in Canada.