North Carolina Department of Revenue Forms

Documents:

615

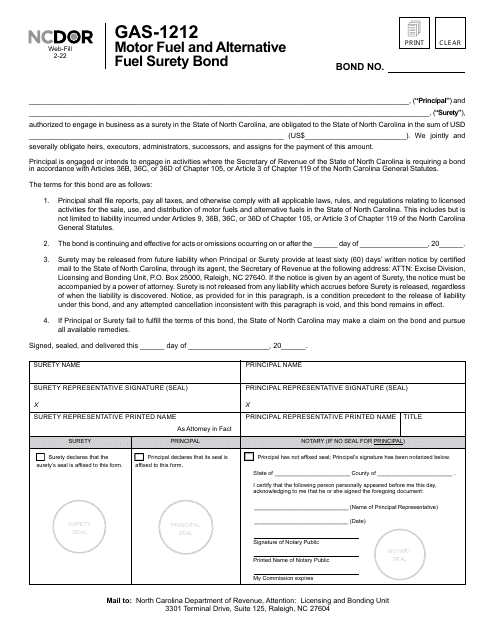

This Form is used for making changes to the liability bond for motor fuels tax in North Carolina due to a name change.

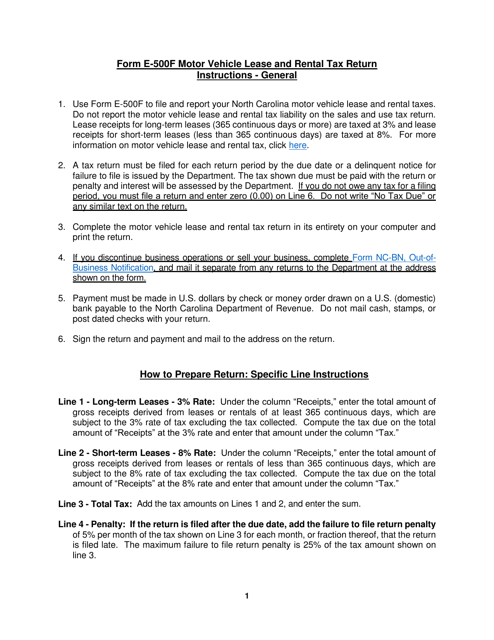

This form is used for reporting and paying motor vehicle lease and rental taxes in the state of North Carolina. It provides instructions on how to properly fill out and submit the E-500F tax return.

This Form is used for nonresident partners in North Carolina to affirm their residency status.

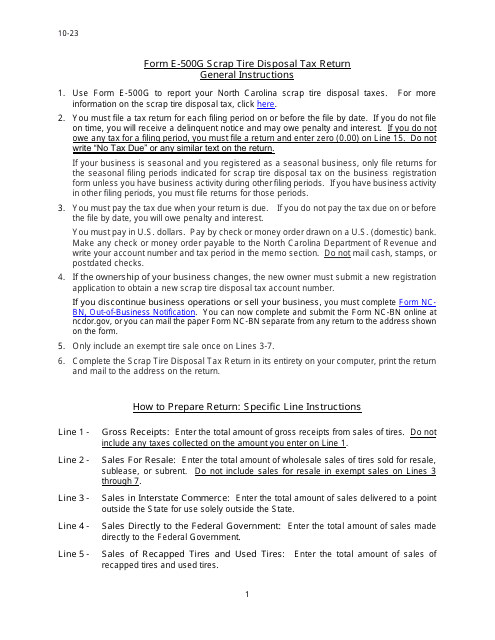

This form is used for reporting and paying the scrap tire disposal tax in the state of North Carolina.

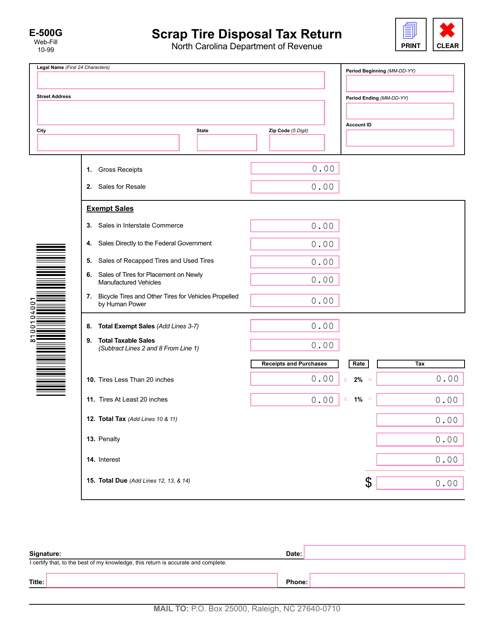

This form is used for applying for the agriculture, horticulture, and forestry present-use value assessment in North Carolina.

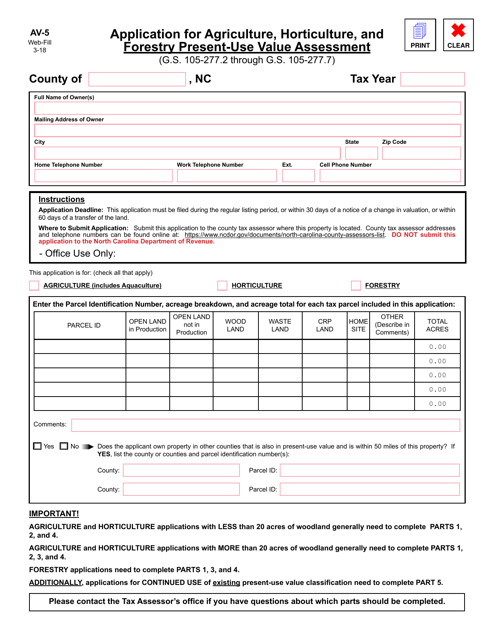

This form is used for the monthly return of resident cigarette distributors in North Carolina. It is used to report the sales and distribution of cigarettes within the state.

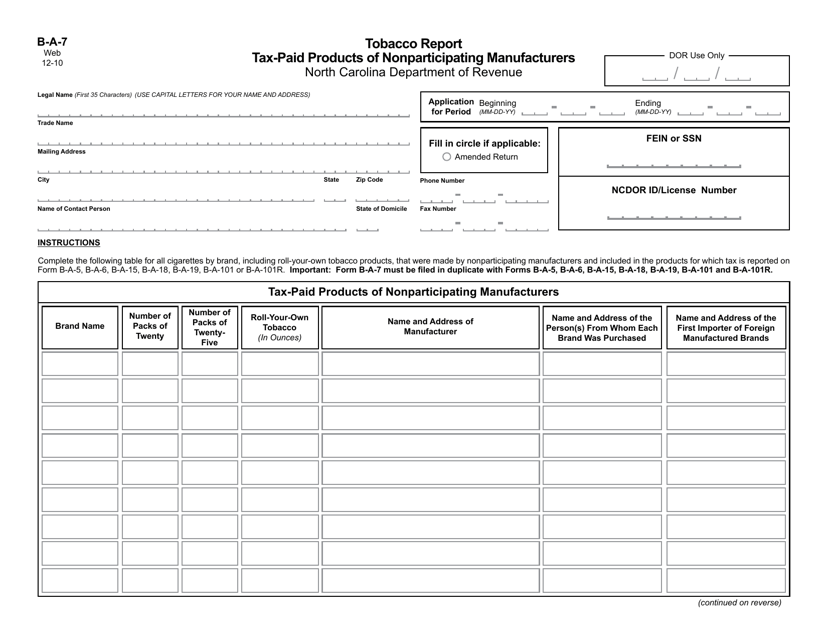

This form is used for reporting tax-paid tobacco products manufactured by nonparticipating manufacturers in North Carolina.

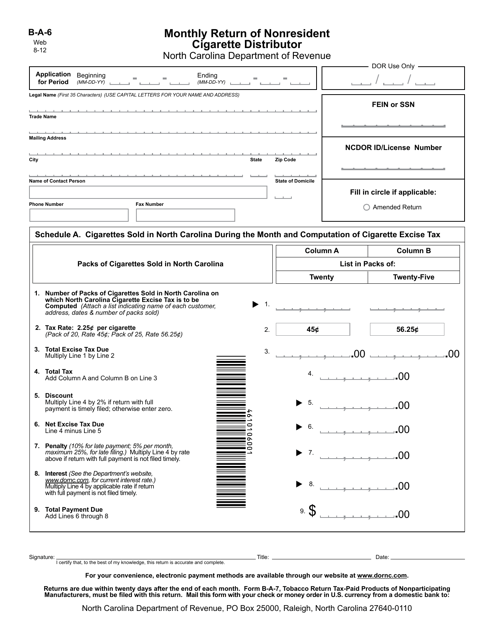

This form is used for nonresident cigarette distributors in North Carolina to report their monthly returns.

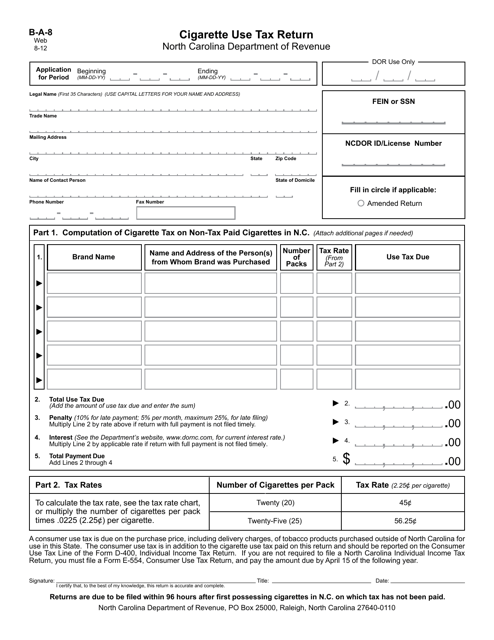

This document is used for reporting and paying cigarette use tax in North Carolina. It is required for individuals or businesses engaged in the sale, distribution, or importation of cigarettes in the state.

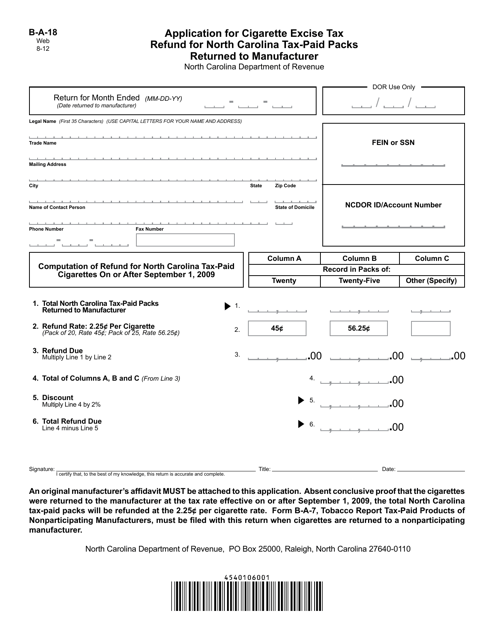

This form is used for applying for a refund of cigarette excise taxes paid in North Carolina for packs that were returned to the manufacturer.

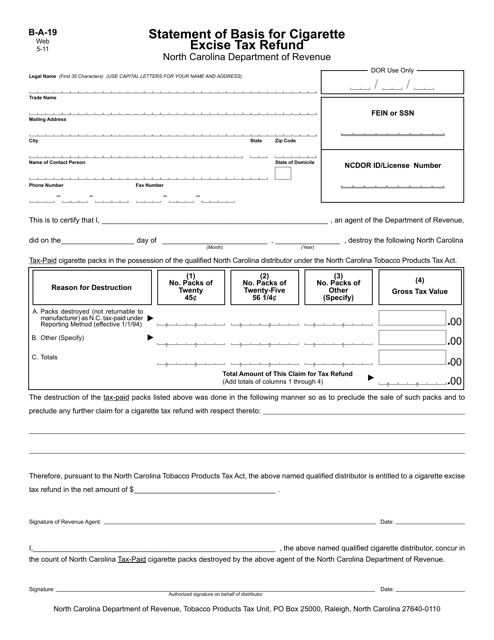

This form is used for filing a statement of basis to request a refund of cigarette excise tax in North Carolina.

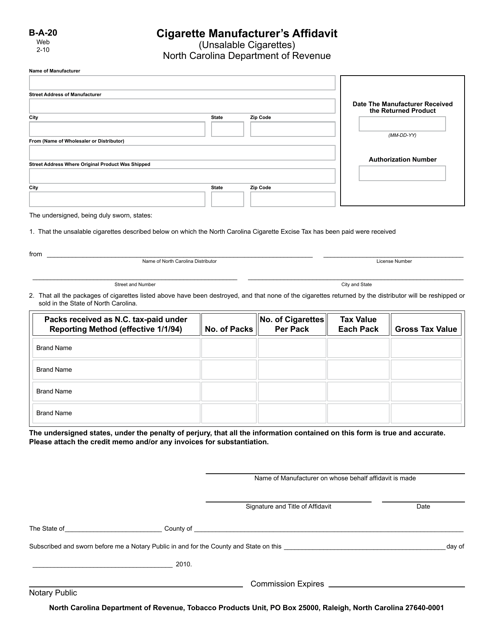

This form is used for cigarette manufacturers in North Carolina to certify that certain cigarettes are unsalable.

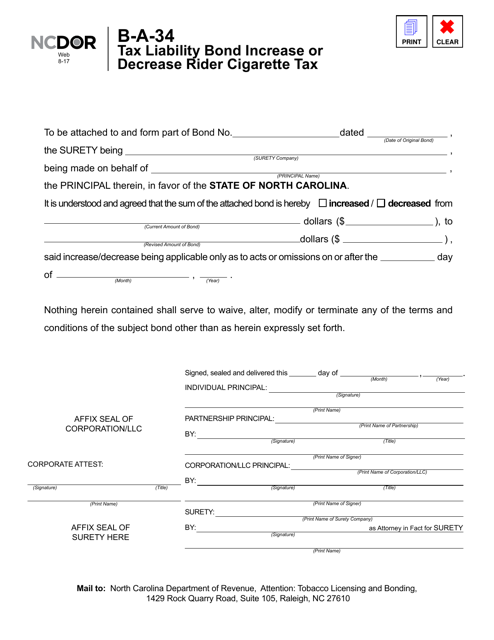

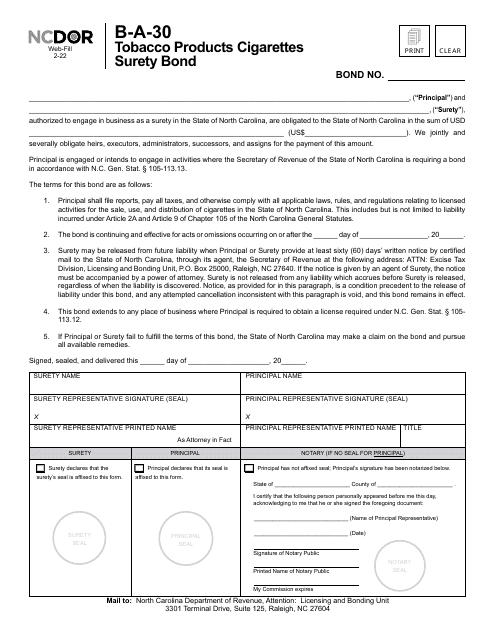

This form is used for increasing or decreasing the tax liability bond for cigarette taxes in North Carolina.

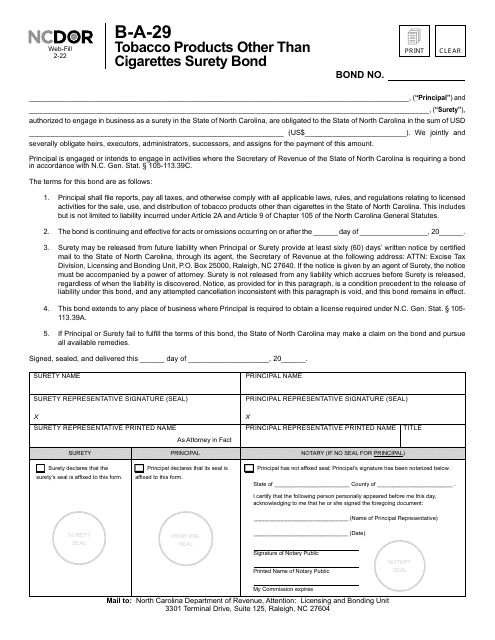

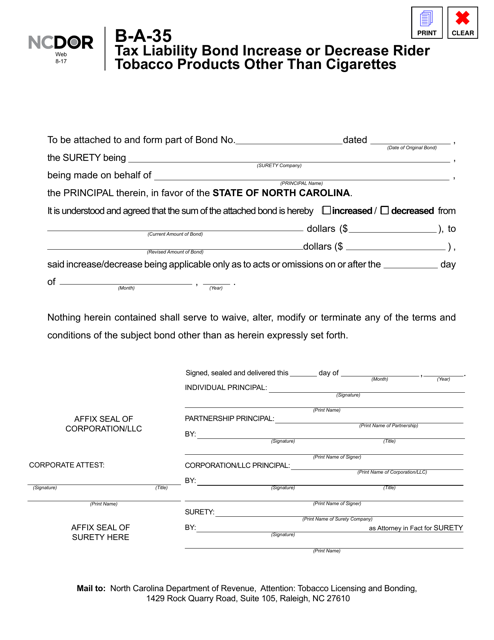

This form is used for increasing or decreasing the tax liability bond for tobacco products other than cigarettes in North Carolina.

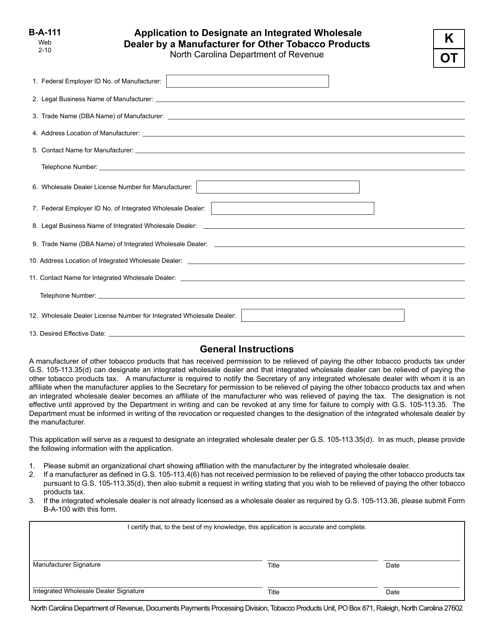

This form is used for manufacturers of other tobacco products in North Carolina to apply for designation as an integrated wholesale dealer.

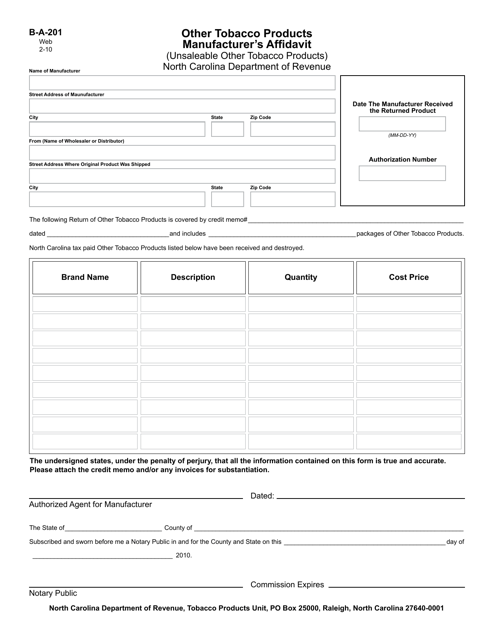

This form is used for other tobacco product manufacturers in North Carolina to submit an affidavit for unsaleable products.

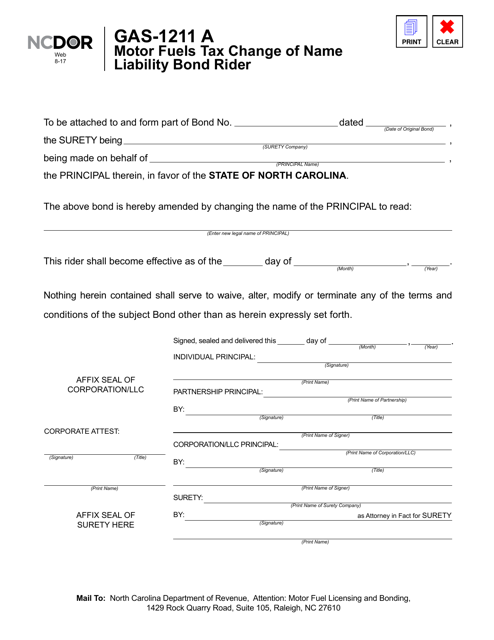

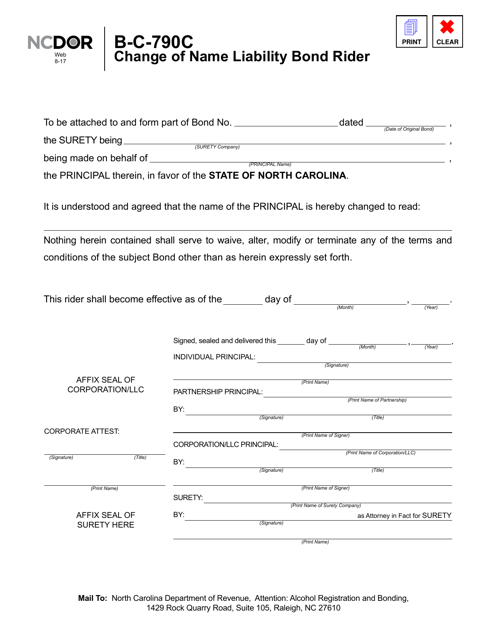

This form is used for adding or changing a liability bond rider for a name change in the state of North Carolina.

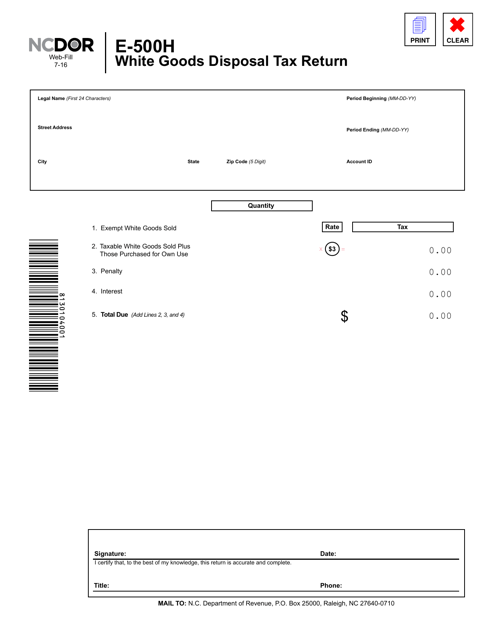

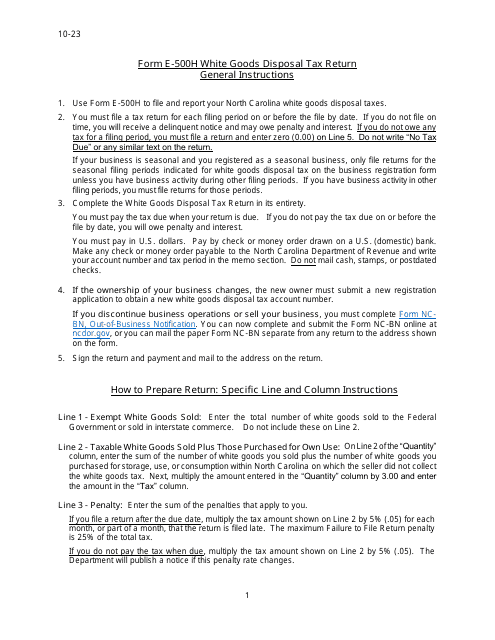

This form is used for reporting and paying the White Goods Disposal Tax in North Carolina. It is applicable to businesses that sell or dispose of white goods, such as refrigerators and washing machines.

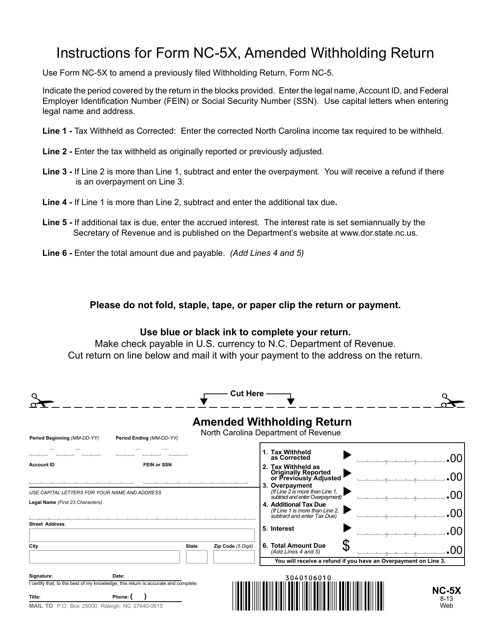

This form is used for filing an amended withholding return in the state of North Carolina.

This form is used for claiming a refund of the White Goods Disposal Tax in North Carolina.