North Carolina Department of Revenue Forms

Documents:

615

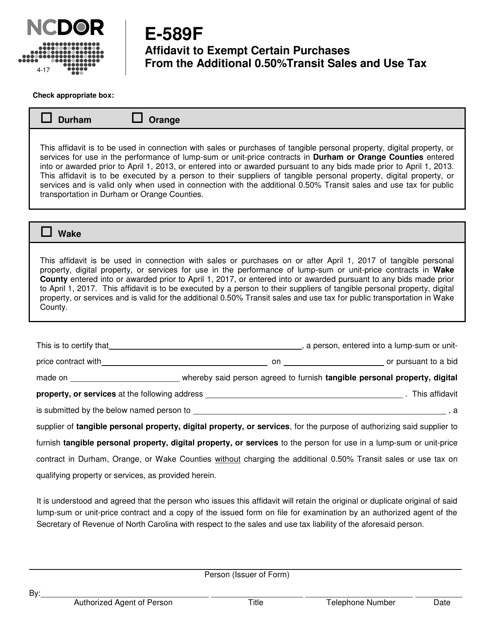

This form is used for requesting an exemption from the additional 0.50% transit sales and use tax on certain purchases in North Carolina.

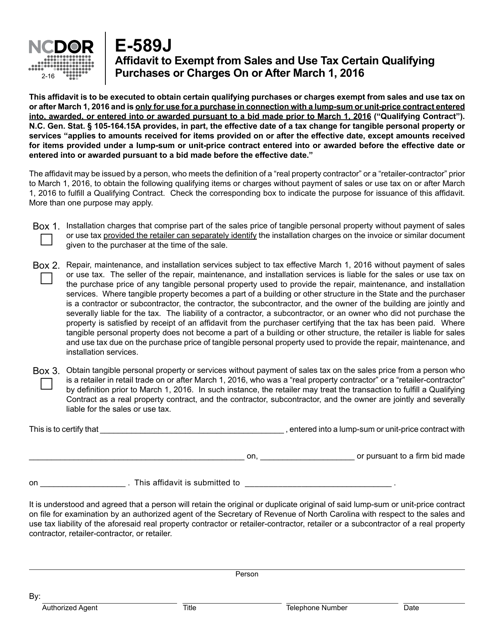

This form is used for individuals or businesses in North Carolina to claim an exemption from sales and use tax for certain qualifying purchases or charges made on or after March 1, 2016.

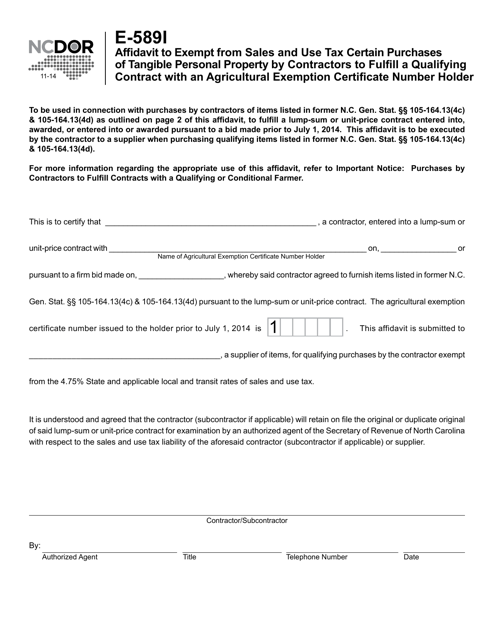

This form is used for contractors in North Carolina who need to exempt certain purchases of tangible personal property from sales and use tax. Contractors must have a qualifying contract with an Agricultural Exemption Certificate Number holder.

This Form is used for claiming a refund for the combined general rate of tax on utility, liquor, gas, and other items in North Carolina.

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

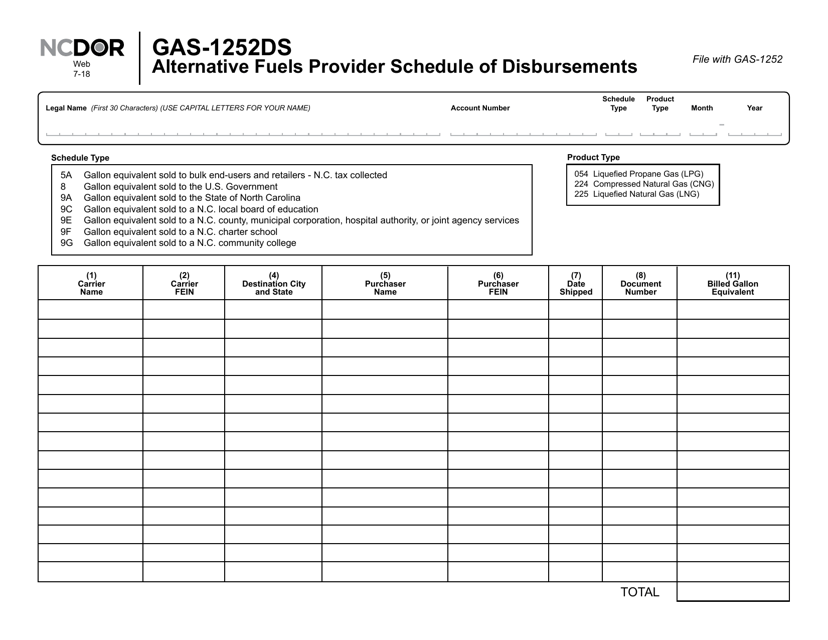

This form is used for alternative fuels providers in North Carolina to report their schedule of disbursements.

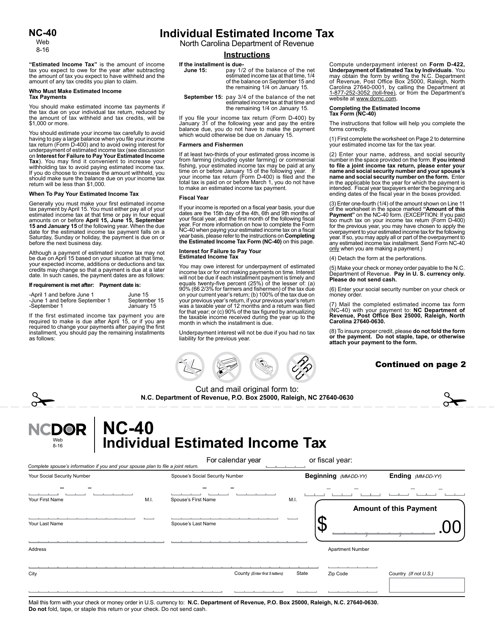

This Form is used for filing individual estimated income tax payments in the state of North Carolina.

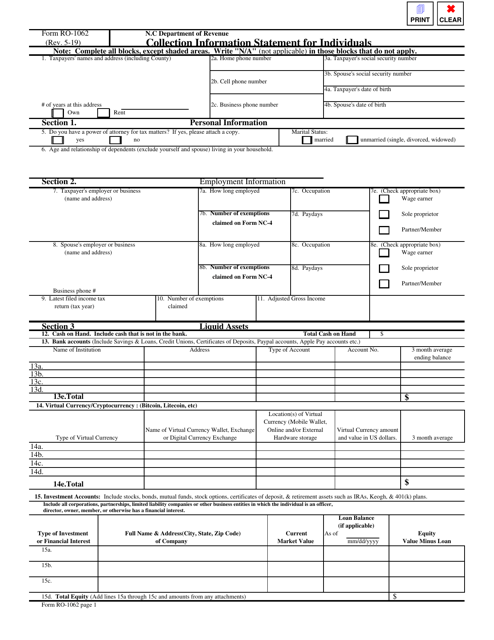

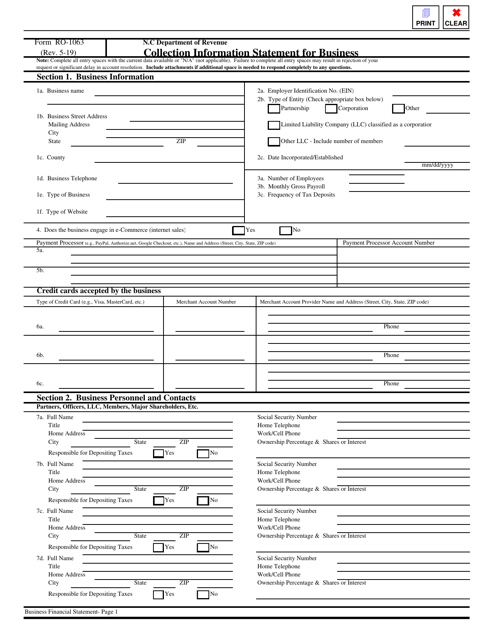

This Form is used for individuals in North Carolina to provide collection information to the North Carolina Department of Revenue. The form gathers information related to a person's income, assets, and liabilities to help determine their ability to pay outstanding tax liabilities.

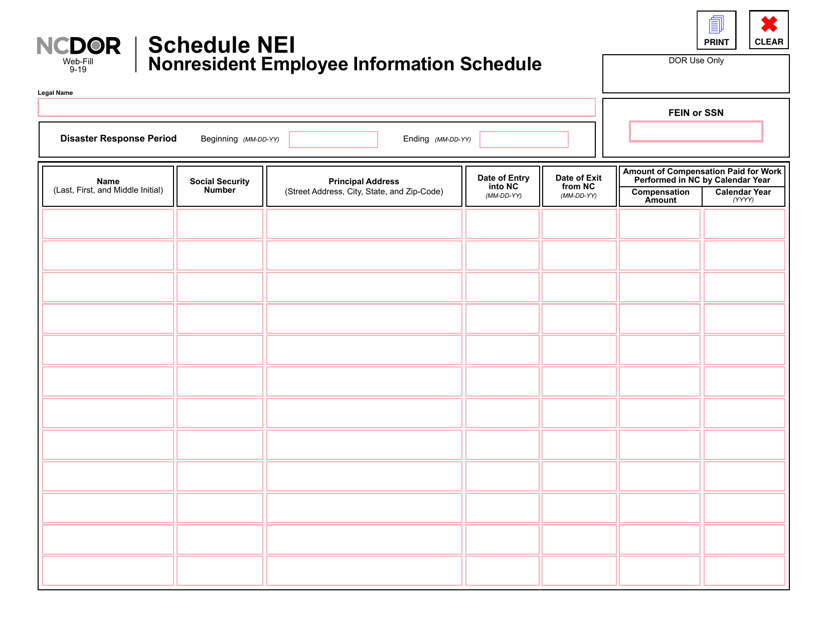

This document is used for reporting nonresident employee information in North Carolina.

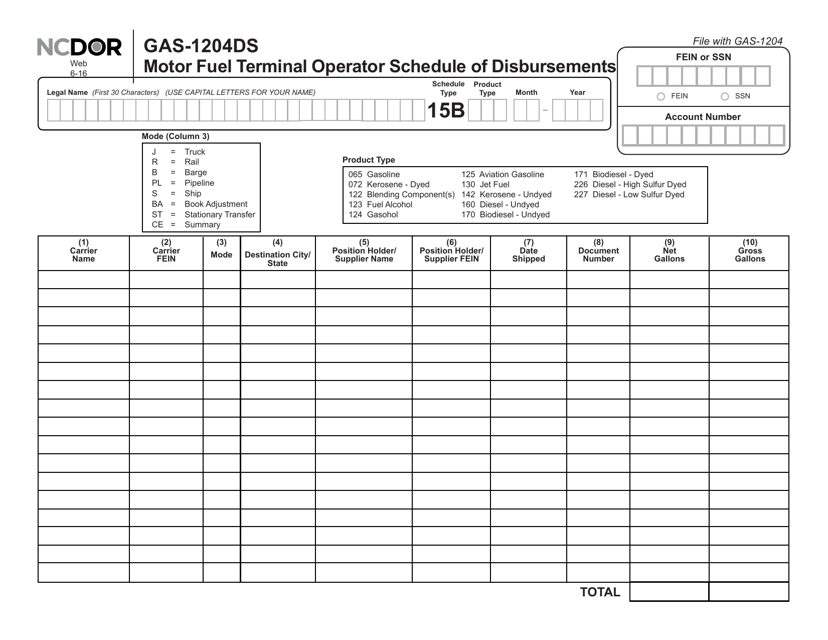

This form is used for reporting the schedule of disbursements made by motor fuel terminal operators in North Carolina.

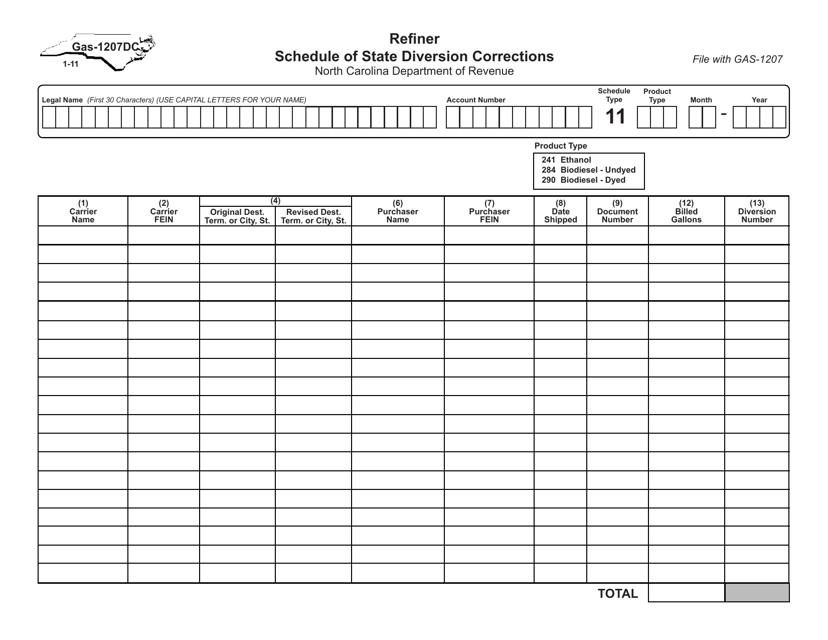

This Form is used for reporting state diversion corrections for refiners in North Carolina.

This form is used for claiming a refund of motor vehicle lease or subscription taxes in the state of North Carolina.

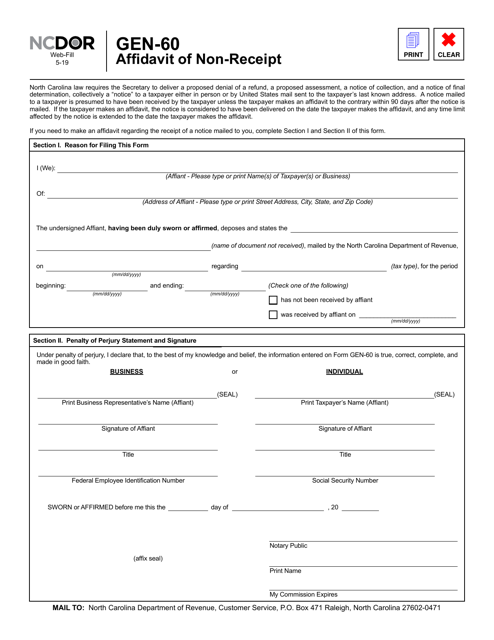

This Form is used for filing an affidavit stating that the individual did not receive a specific document or payment in North Carolina.

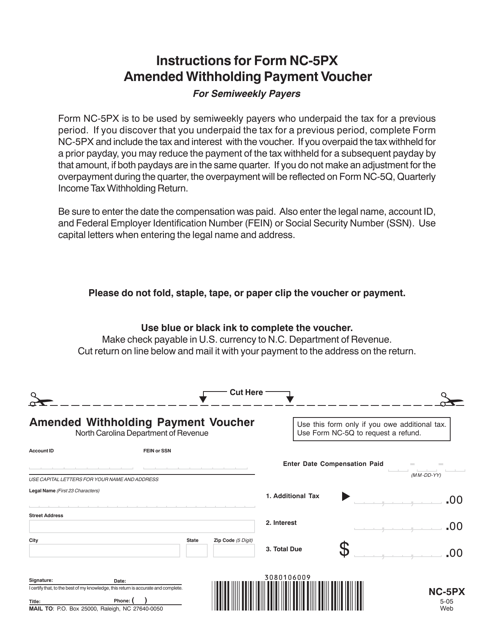

This form is used for making an amended withholding payment in the state of North Carolina.