North Carolina Department of Revenue Forms

Documents:

615

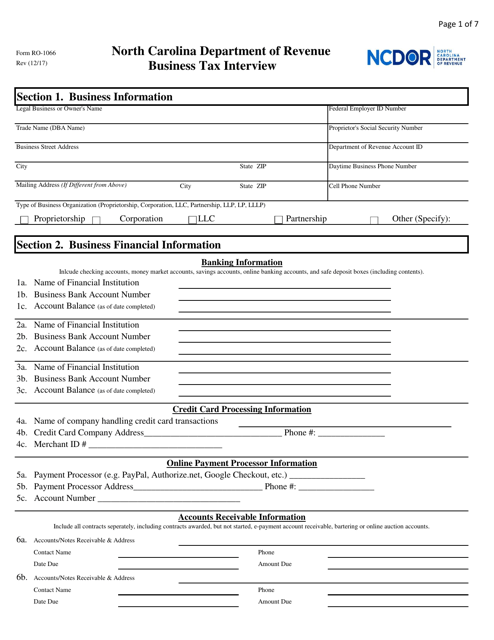

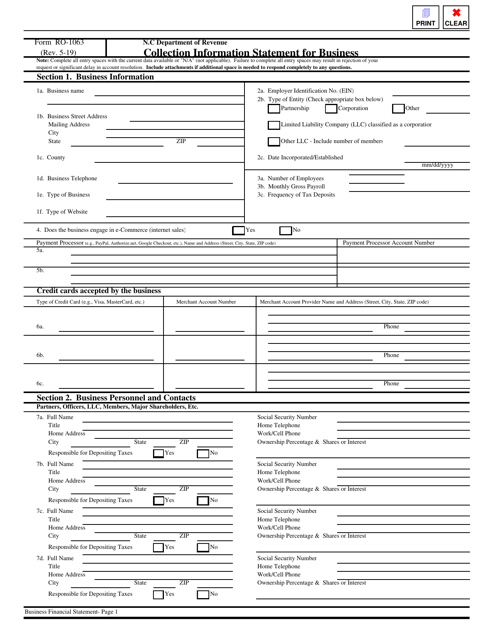

This form is used for conducting a business tax interview in North Carolina. It helps gather information related to business taxes and is an important step in the tax filing process for businesses in the state.

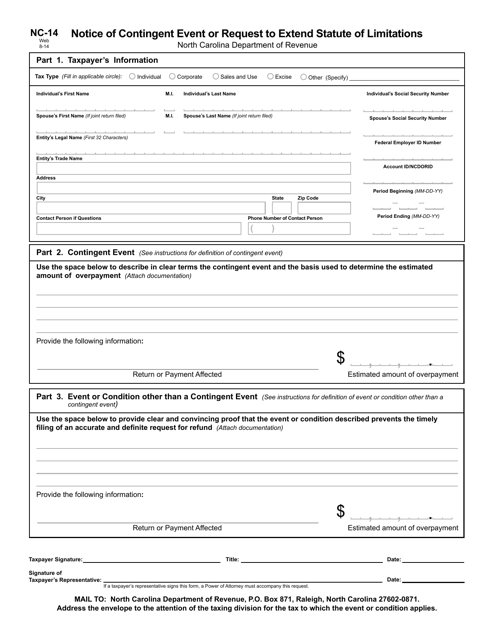

This Form is used for notifying a contingent event or requesting an extension of the statute of limitations in North Carolina.

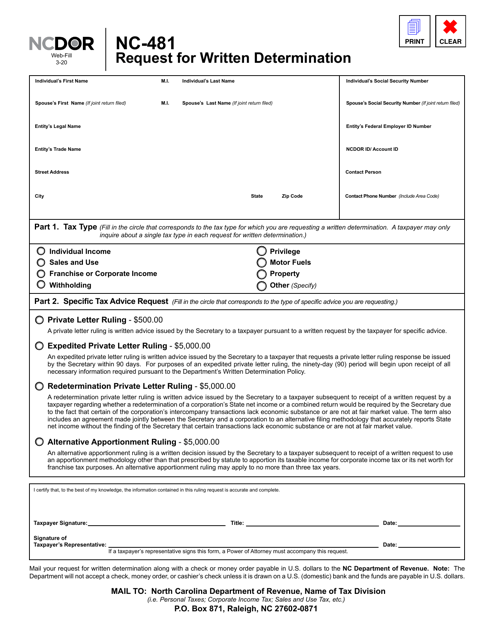

This Form is used for claiming a refund of taxes paid in the state of North Carolina.

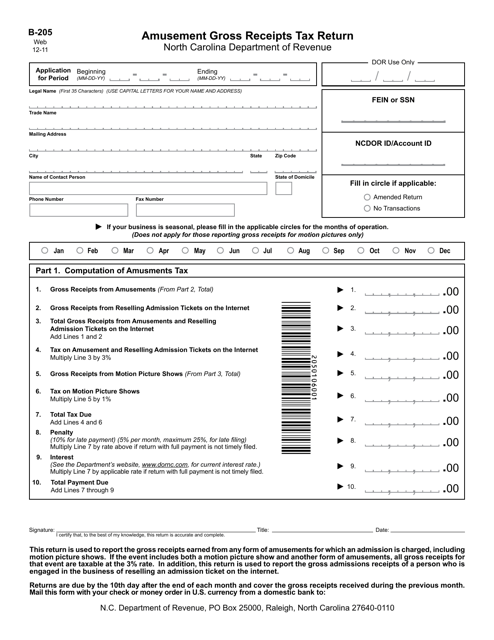

This document is used for reporting and paying the amusement gross receipts tax in North Carolina. It is a form that businesses engaged in amusement activities must fill out to calculate and remit the tax owed based on their gross receipts.

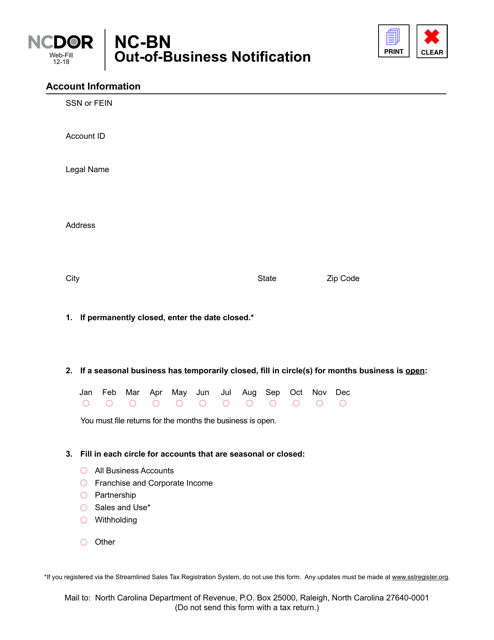

This Form is used for submitting an Out-of-Business Notification in the state of North Carolina.

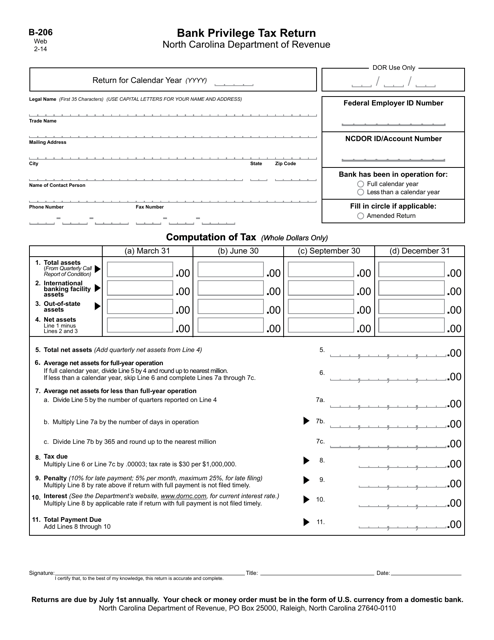

This Form is used for filing the Bank Privilege Tax Return in the state of North Carolina. The Bank Privilege Tax is a tax imposed on banks for the privilege of doing business in the state.

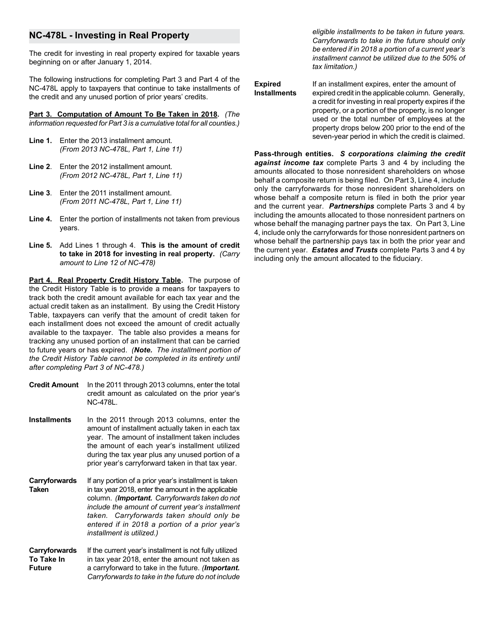

This form is used for reporting investments in real property in the state of North Carolina. It provides instructions on how to complete Form NC-478L.

This form is used for installment payment for life, accident, health, and title insurance companies in North Carolina.

This form is used for installment payment property and casualty companies in North Carolina.

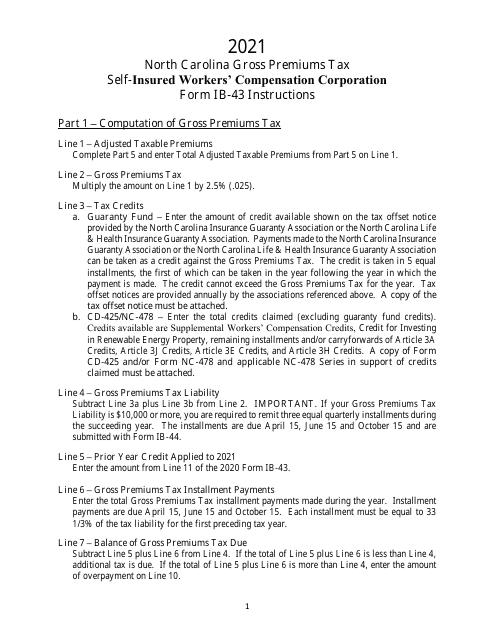

This form is used for making installment payments for workers' compensation insurance through the North Carolina Self-insured Workers' Compensation Corporation.