North Carolina Department of Revenue Forms

Documents:

615

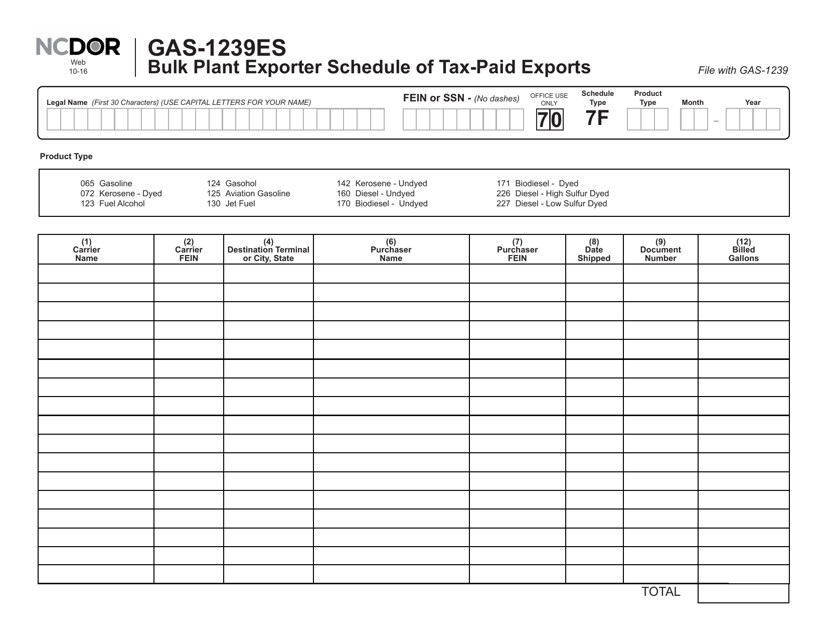

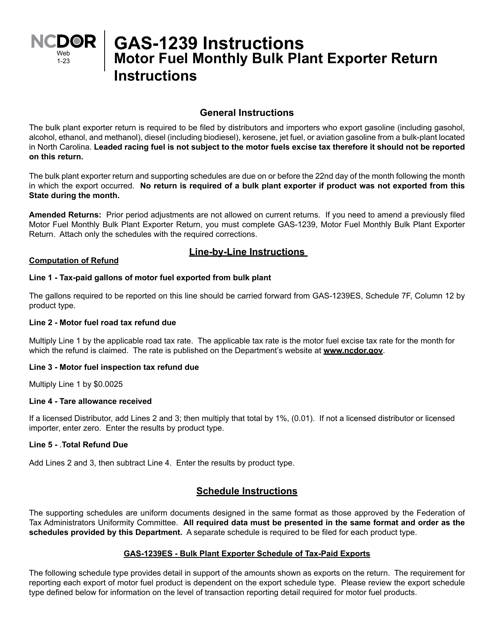

This form is used for reporting tax-paid exports of fuel from a bulk plant in North Carolina.

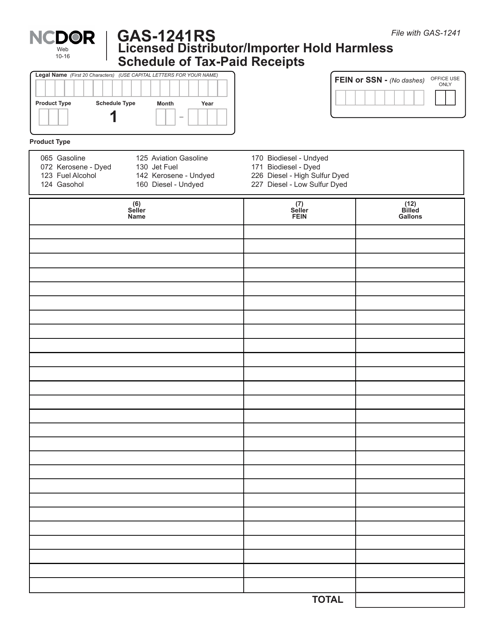

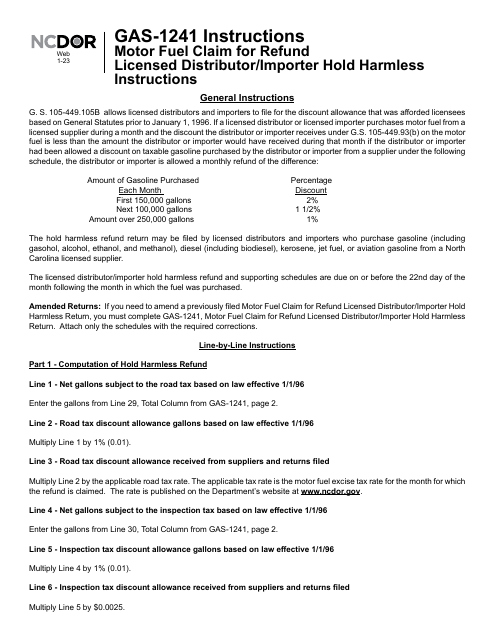

This form is used for licensed distributors and importers in North Carolina to submit a schedule of tax-paid receipts and to waive any liability for any taxes owed.

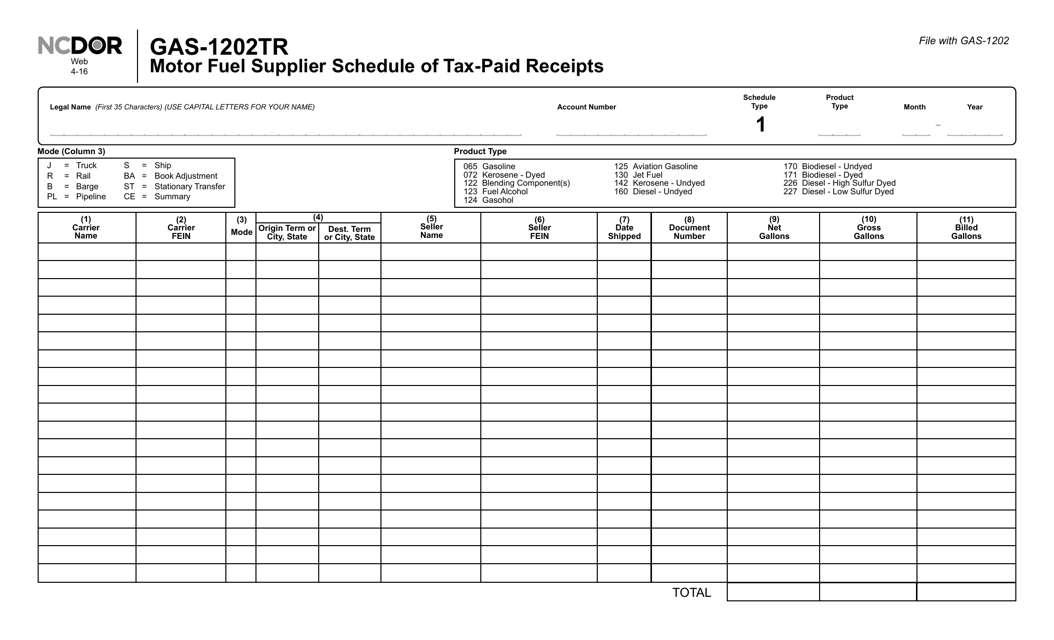

This Form is used for reporting tax-paid receipts for motor fuel suppliers in North Carolina.

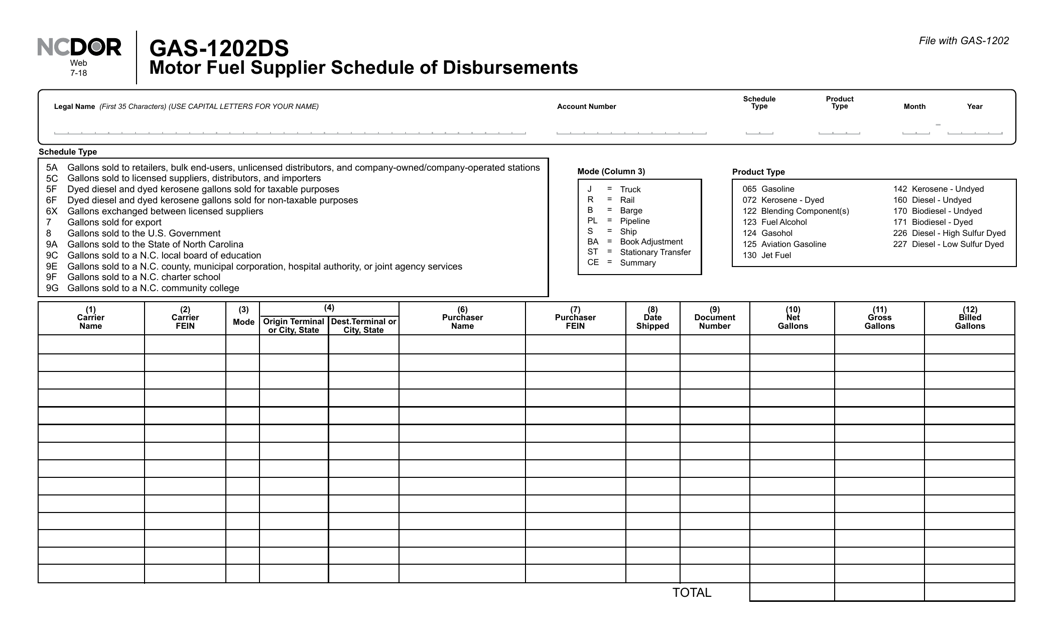

This form is used for motor fuel suppliers in North Carolina to report their schedule of disbursements.

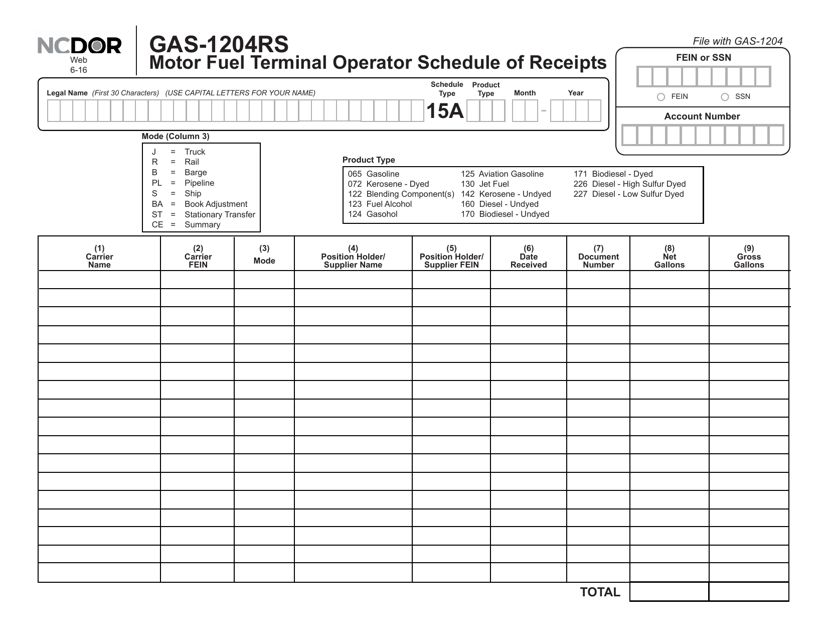

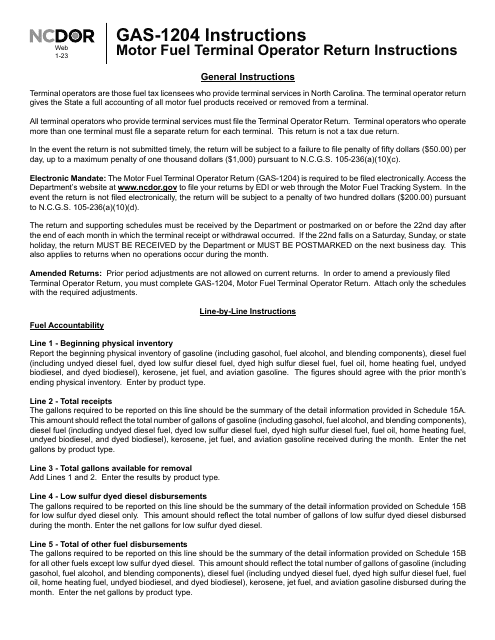

This form is used for reporting the schedule of fuel receipts by motor fuel terminal operators in North Carolina.

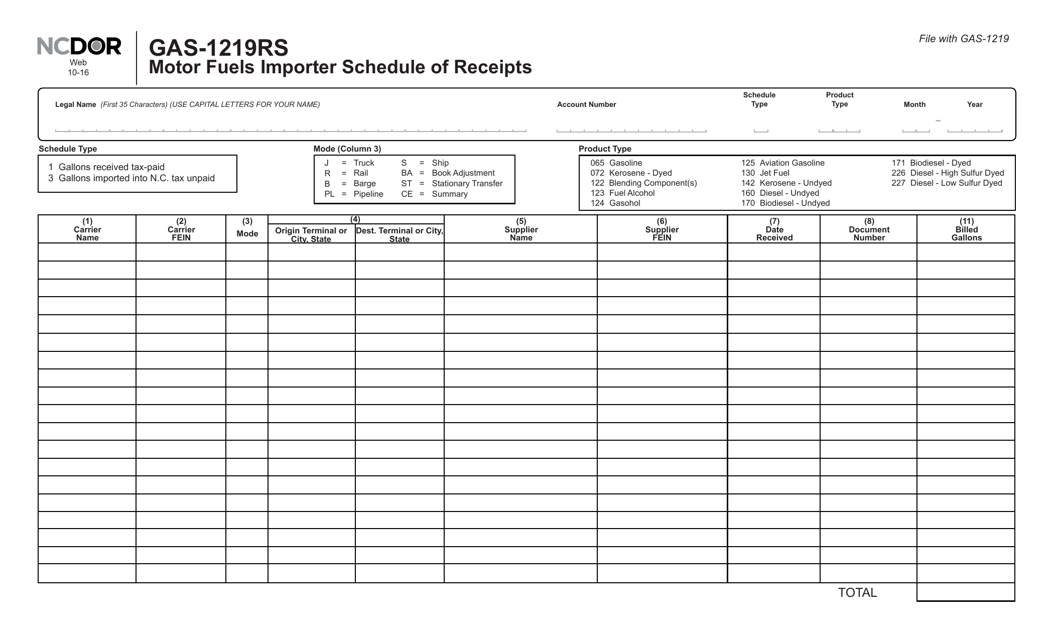

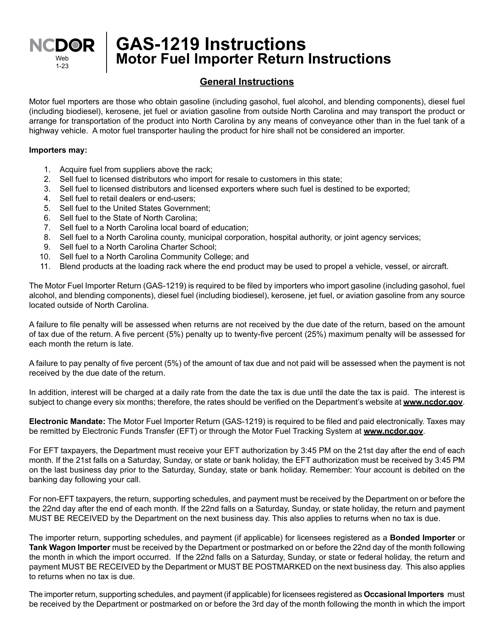

This Form is used for motor fuels importers in North Carolina to report their schedule of receipts. This document helps track and manage the import of motor fuels in the state.

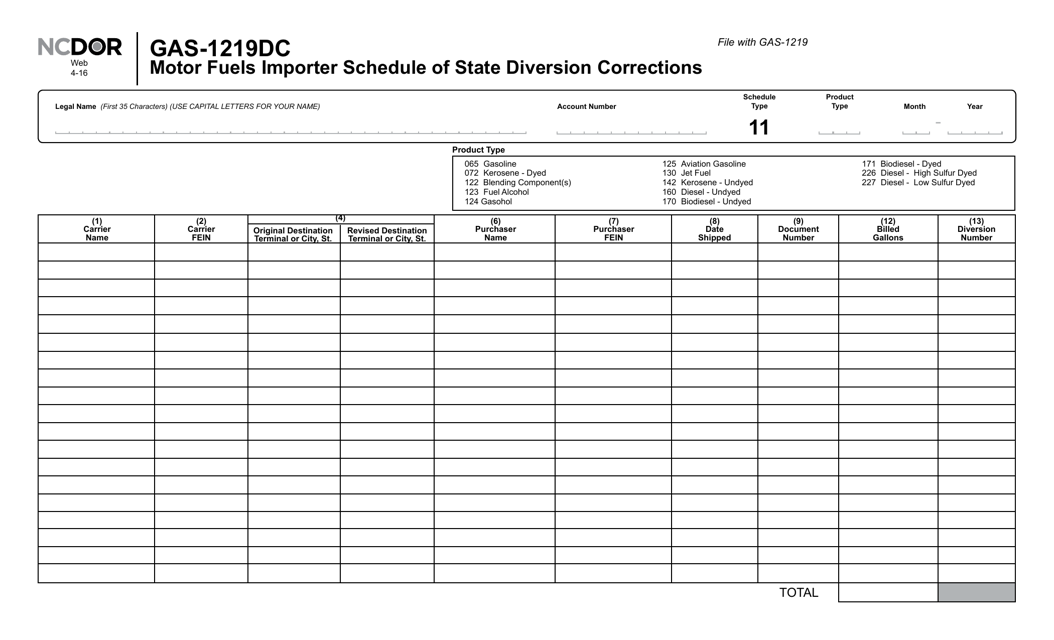

This form is used for North Carolina motor fuels importers to report state diversion corrections.

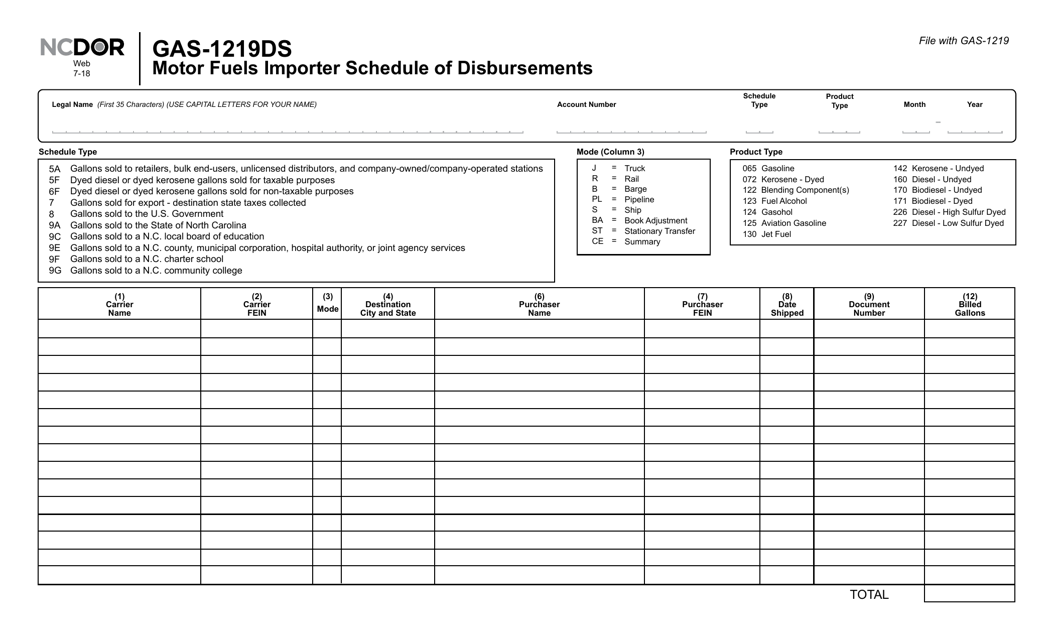

This Form is used for reporting the schedule of disbursements for motor fuels importers in North Carolina.

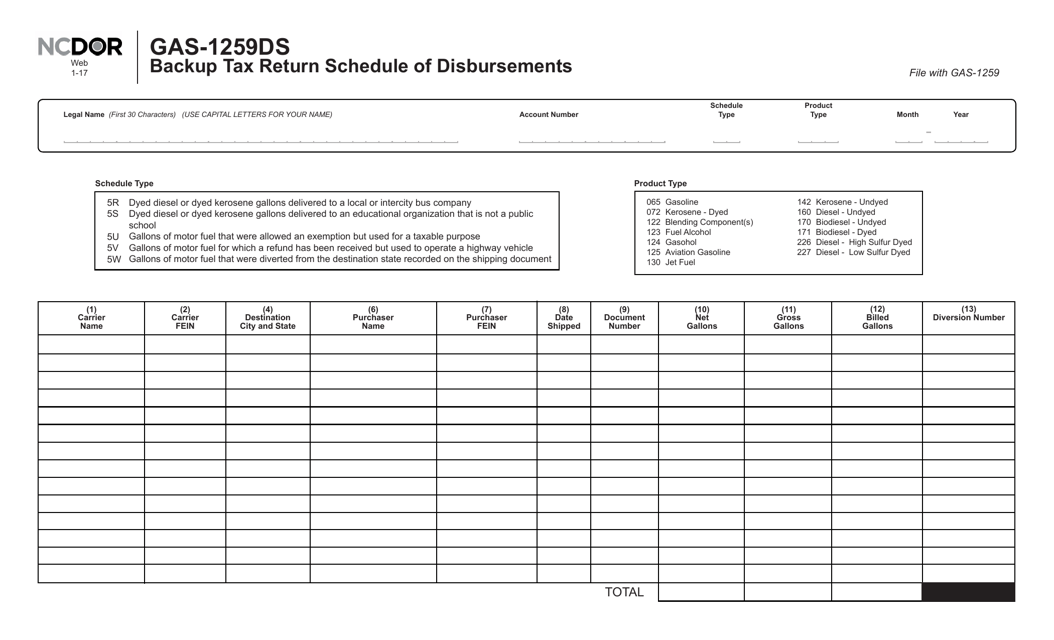

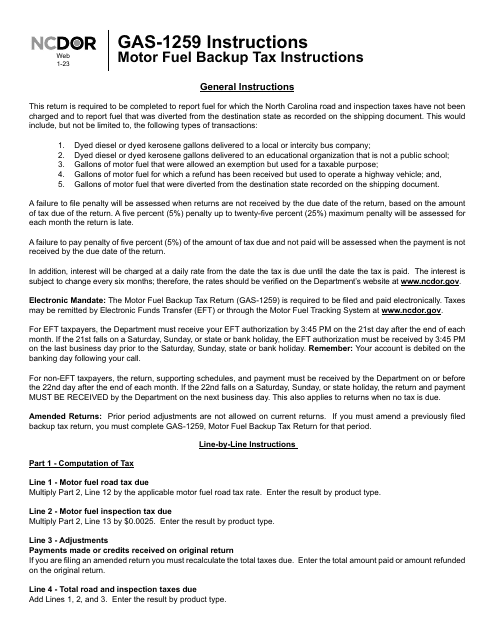

This form is used for backup tax return schedule of disbursements in North Carolina.

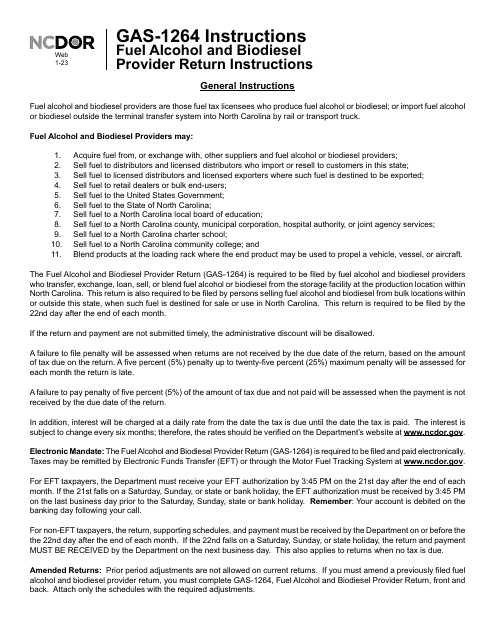

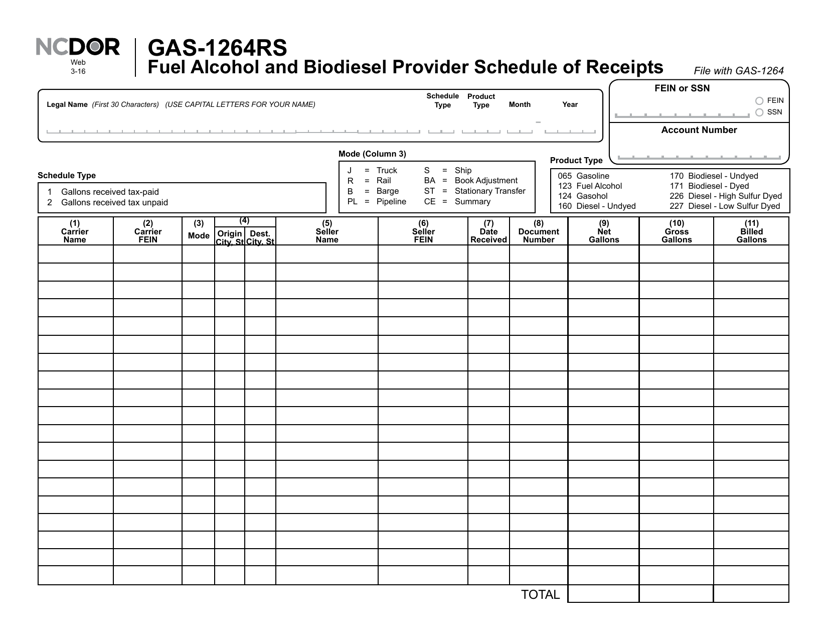

This Form is used for reporting the schedule of receipts for fuel alcohol and biodiesel providers in North Carolina.

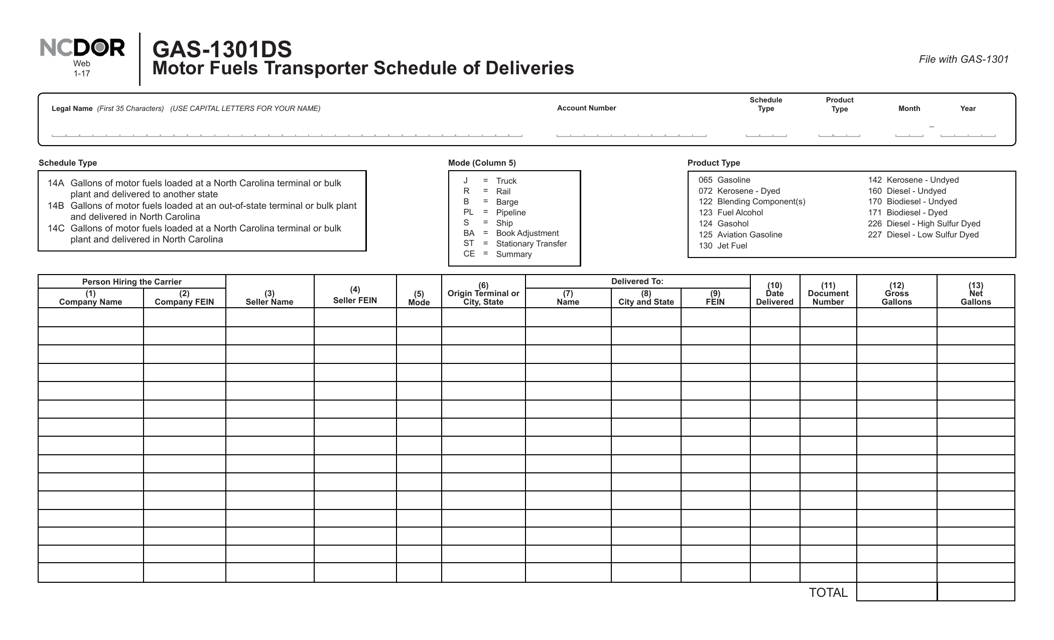

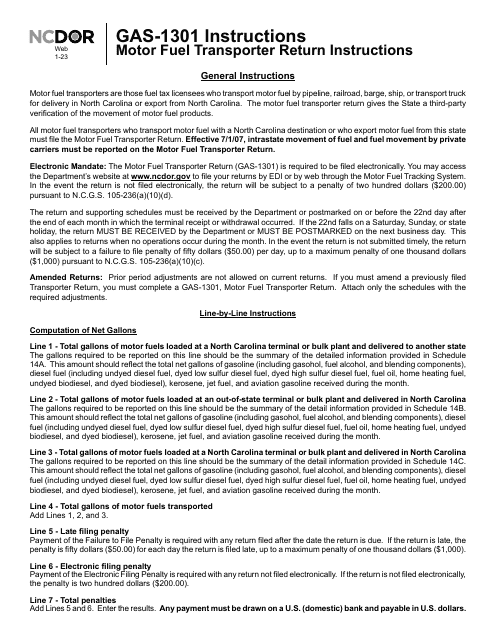

This Form is used for reporting the schedule of fuel deliveries by motor fuel transporters in North Carolina.

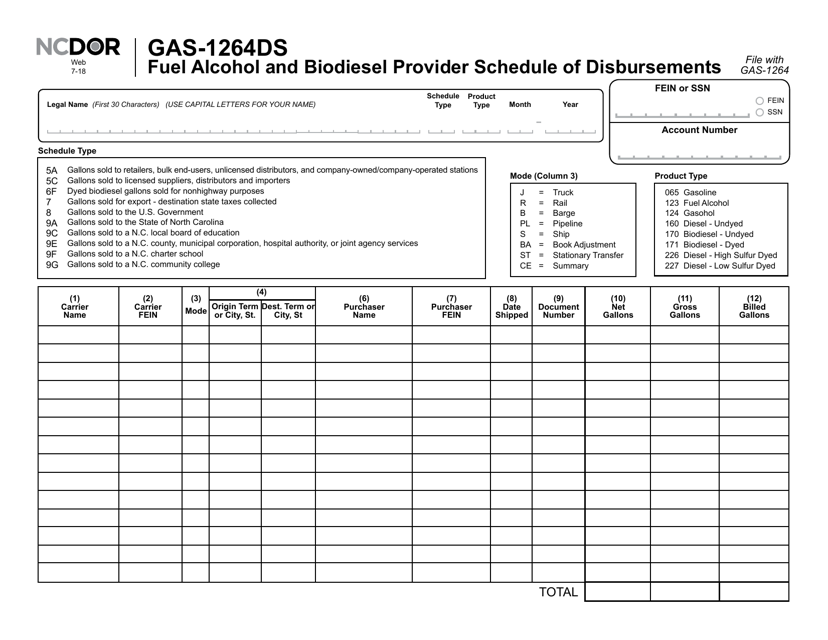

This Form is used for Fuel Alcohol and Biodiesel Providers in North Carolina to schedule and report their disbursements.

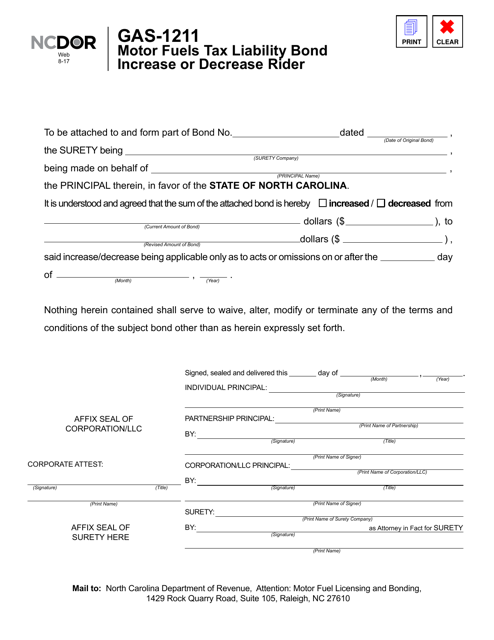

This form is used for applying for an increase or decrease of the motor fuels tax liability bond in North Carolina.