Vermont Department of Taxes Forms

Documents:

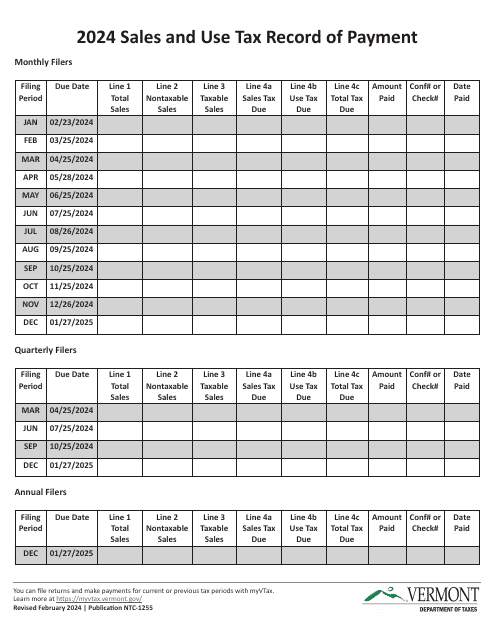

572

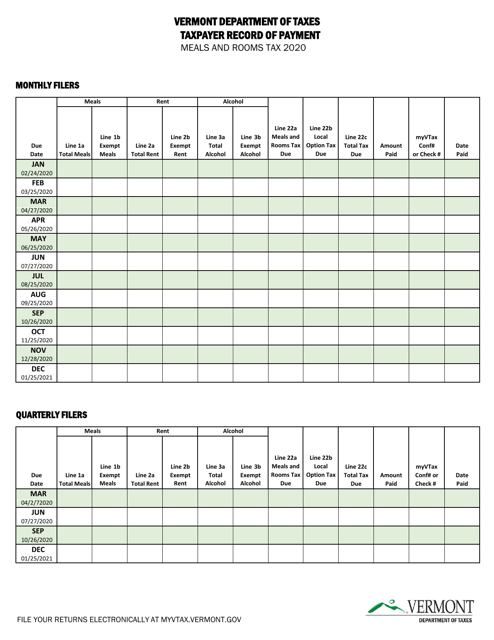

This document is used to record payments for the meals and rooms tax in the state of Vermont.

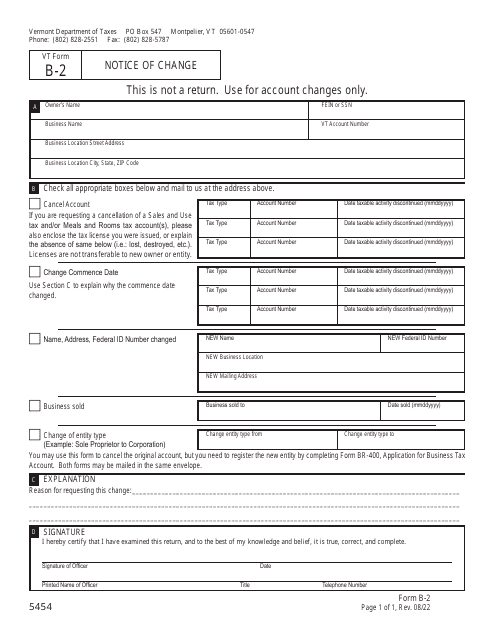

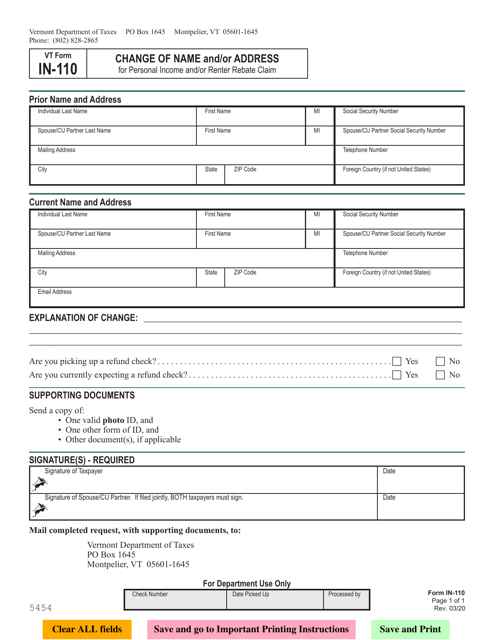

This form is used for residents in Vermont to request a change of name and/or address for their personal income and/or renter rebate claim. It is important to keep your personal information up to date for accurate processing of your claims.

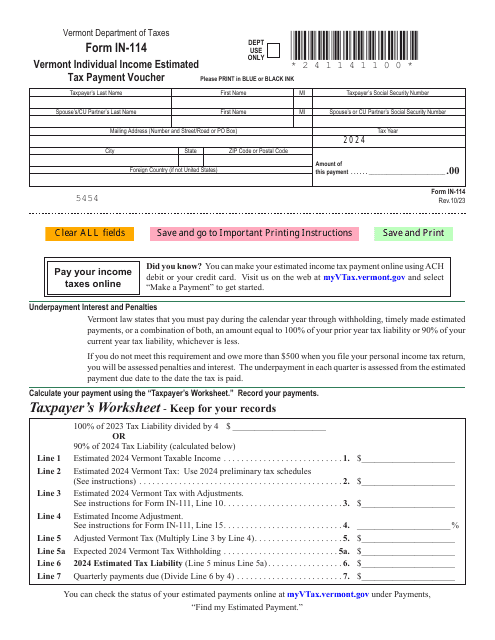

Instructions for Form IN-114 Vermont Individual Income Estimated Tax Payment Voucher - Vermont, 2024

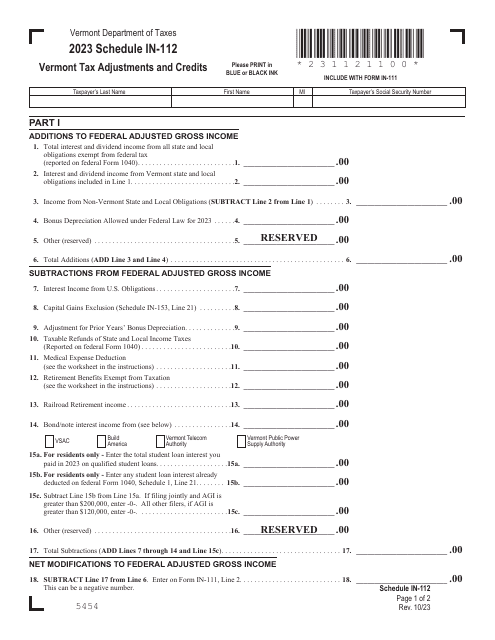

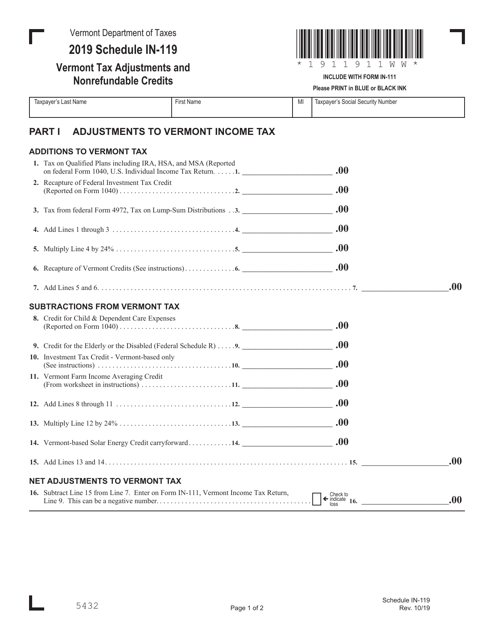

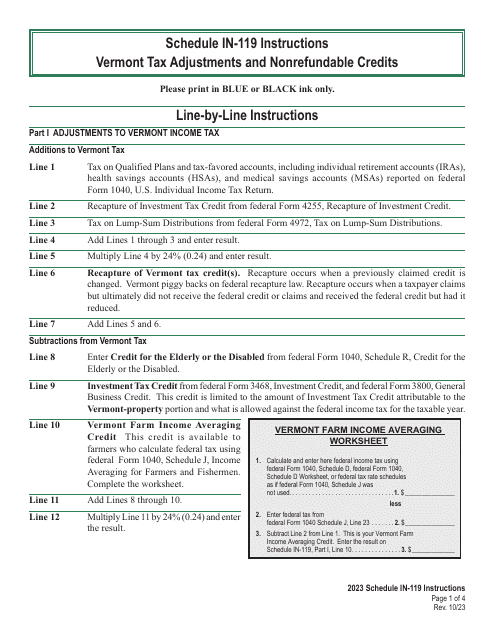

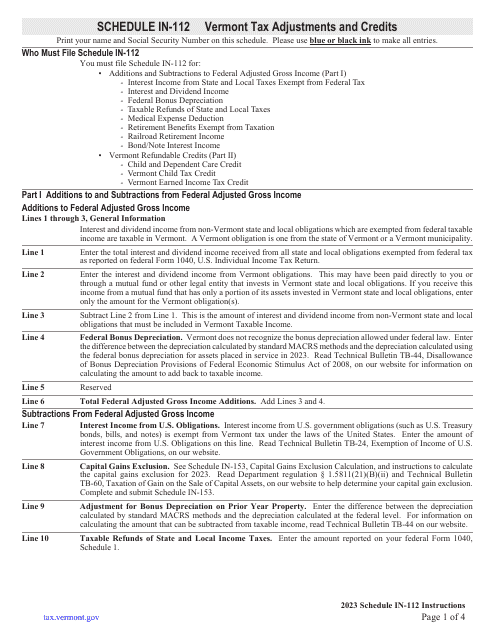

This form is used for reporting and calculating Vermont tax adjustments and nonrefundable credits for individuals.

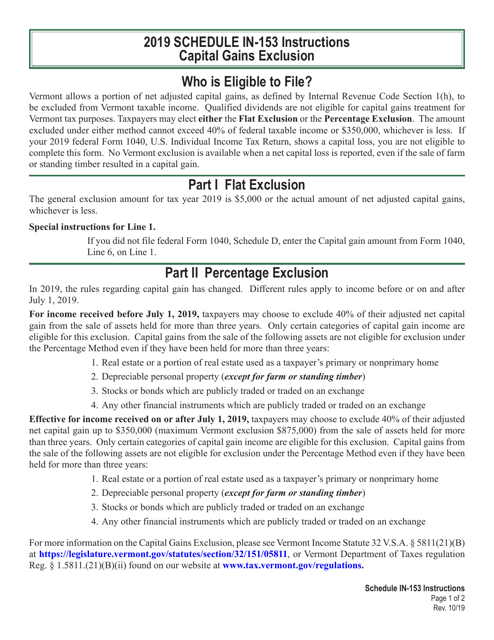

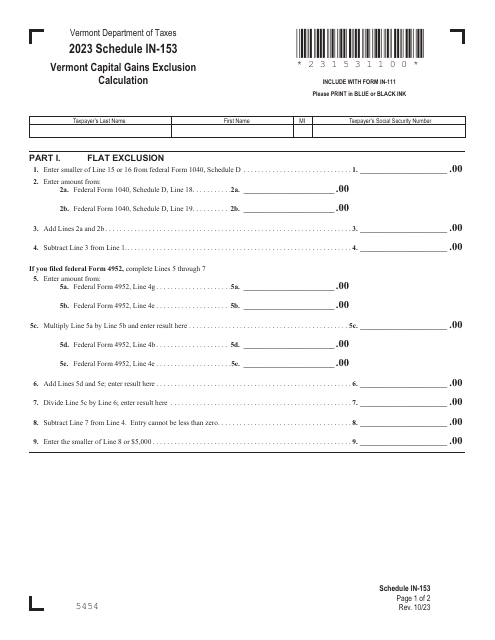

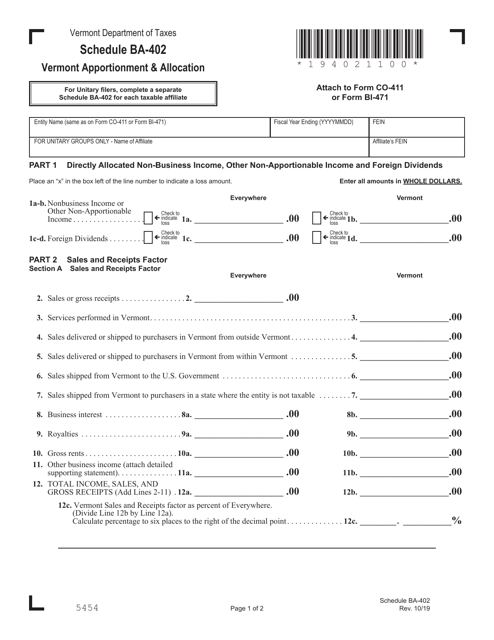

This Form is used for calculating the capital gain exclusion in the state of Vermont.

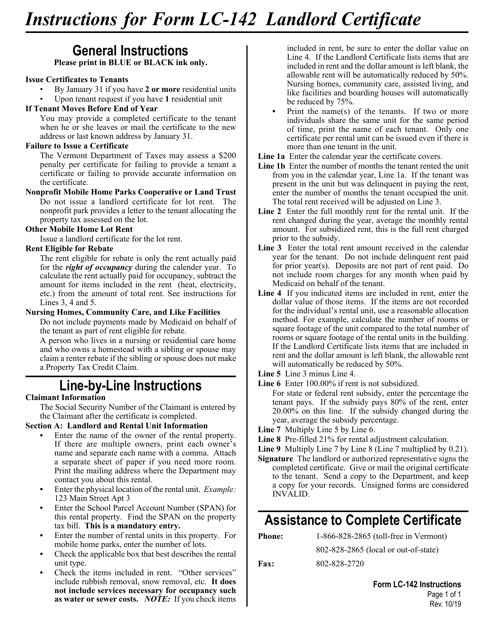

This document is used for obtaining a landlord certificate in the state of Vermont. It provides instructions on how to complete the form LC-142 and fulfill the necessary requirements to obtain the certificate.

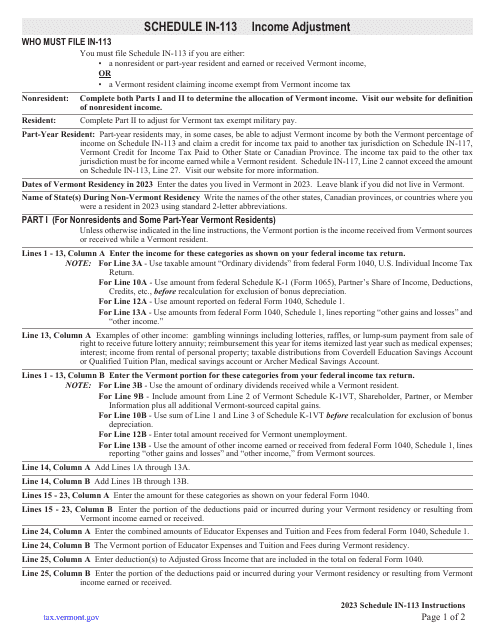

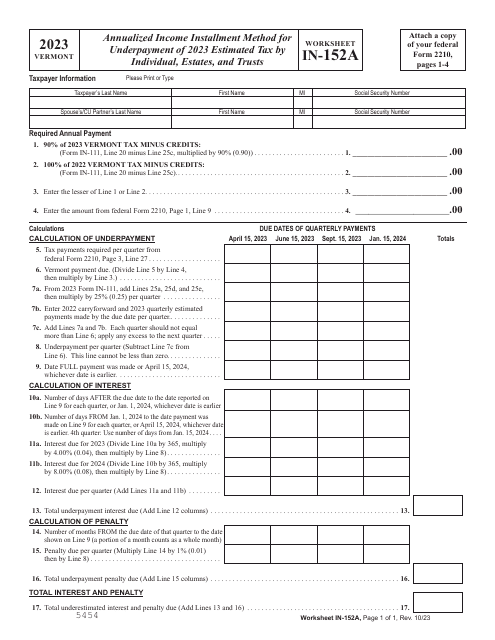

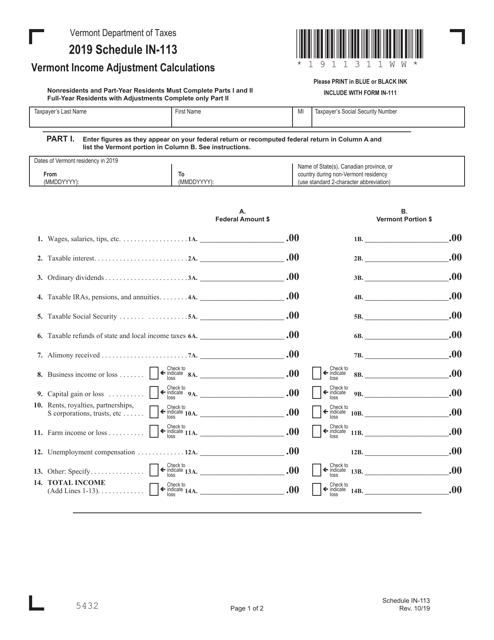

This form is used for calculating income adjustments in the state of Vermont.

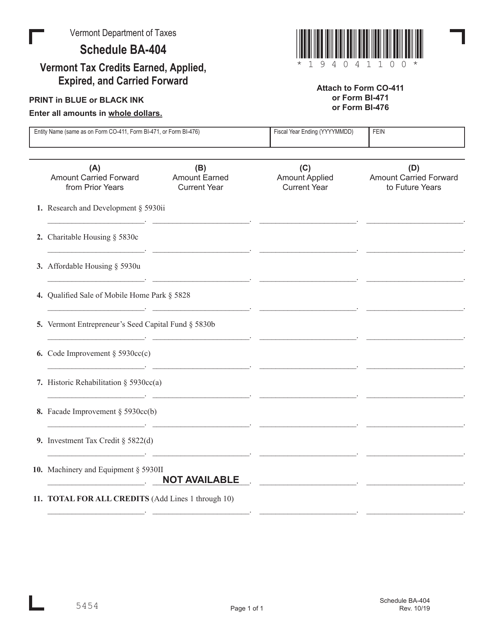

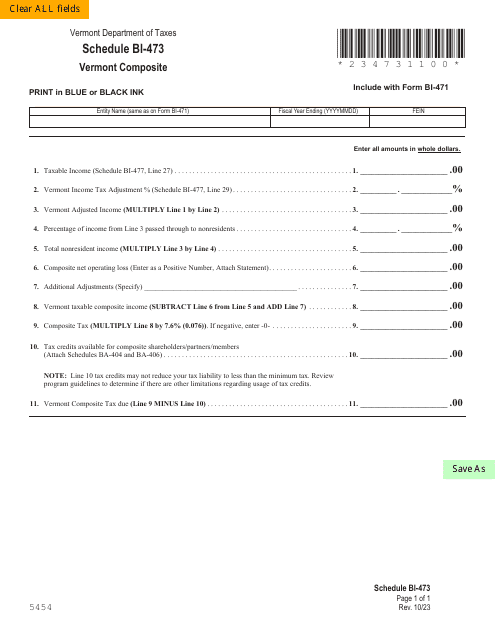

This Form is used for reporting Vermont tax credits earned, applied, expired, and carried forward.