Vermont Department of Taxes Forms

Documents:

572

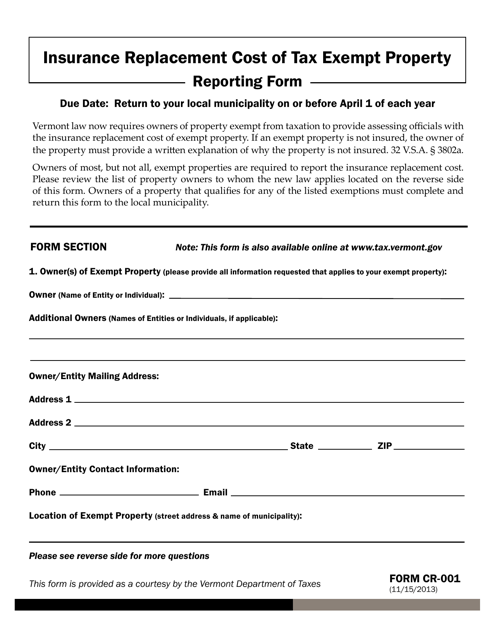

This form is used for reporting the replacement cost of tax exempt property for insurance purposes in Vermont.

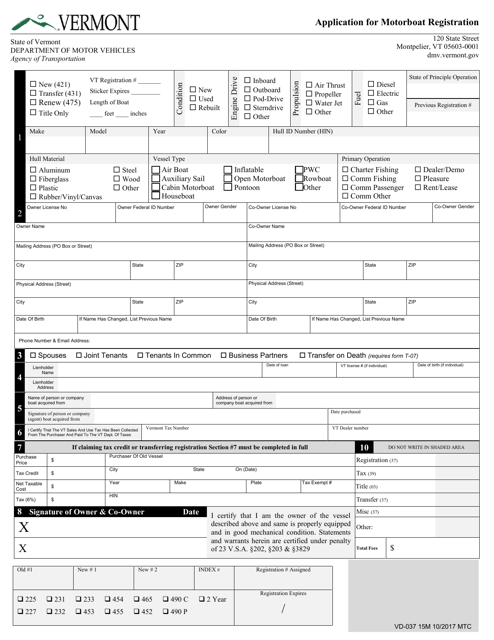

This Form is used for registering a motorboat in Vermont.

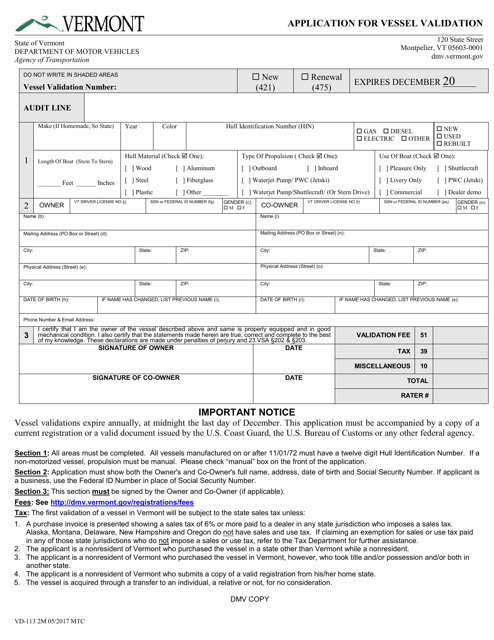

This form is used for applying for vessel validation in the state of Vermont.

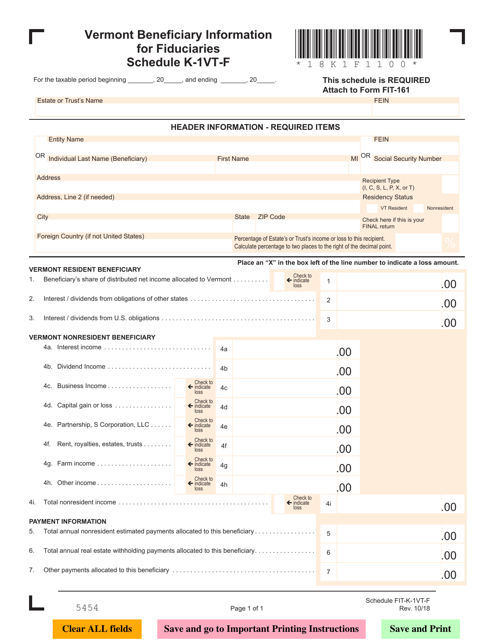

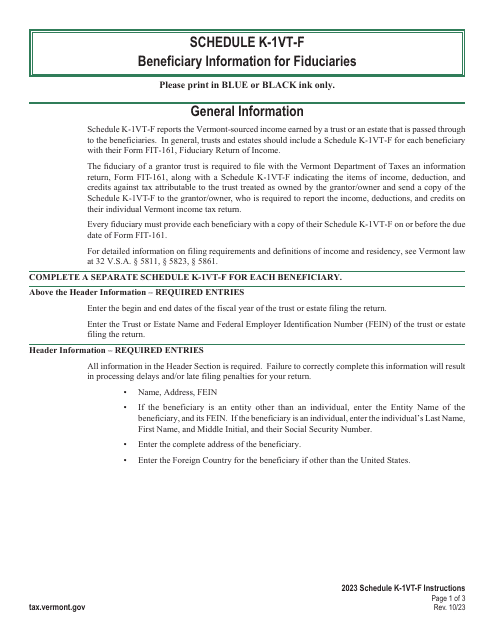

This document provides beneficiary information for fiduciaries in Vermont. It is used for reporting income from trusts or estates to individual beneficiaries.

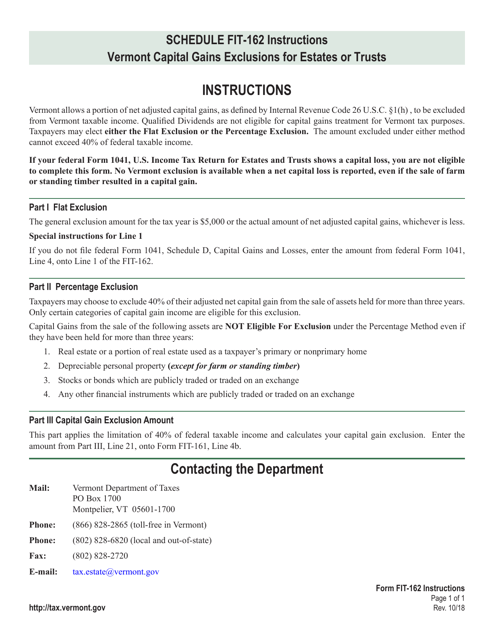

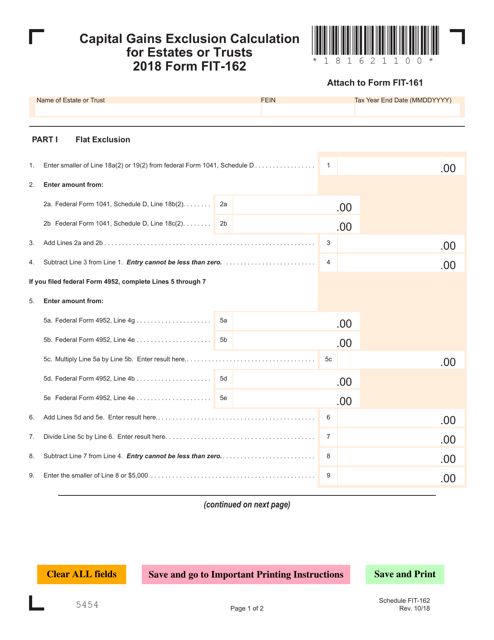

Instructions for VT Form FIT-162 Capital Gains Exclusion Calculation for Estates or Trusts - Vermont

This Form is used for calculating the capital gains exclusion for estates or trusts in Vermont. It provides instructions on how to determine the amount of capital gains that can be excluded for tax purposes.

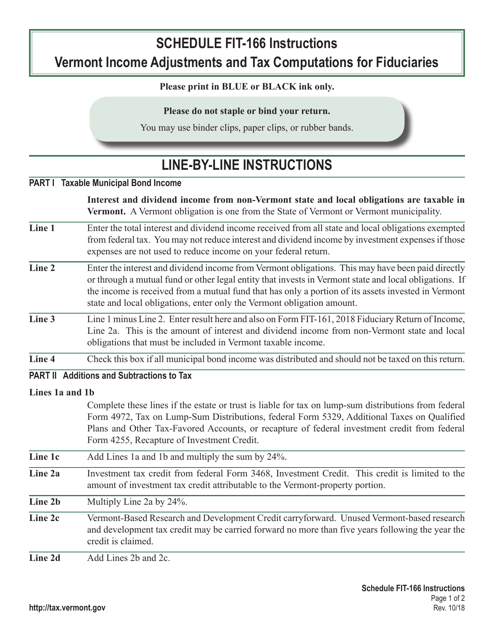

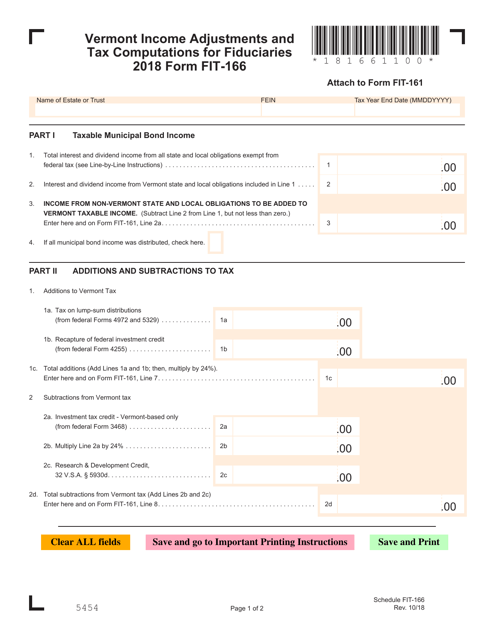

This Form is used for reporting income adjustments and tax computations for fiduciaries in Vermont. It provides instructions on how to accurately complete the VT Form FIT-166.

This form is used for calculating income adjustments and tax computations for fiduciaries in Vermont.

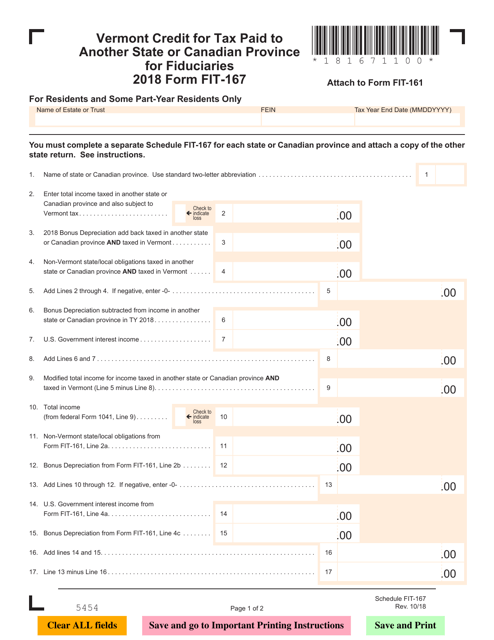

This form is used for claiming a credit for taxes paid to another state or Canadian province for fiduciaries in Vermont.

This document is used for calculating the capital gains exclusion for estates or trusts in Vermont. It provides instructions and worksheets to help with the calculation.

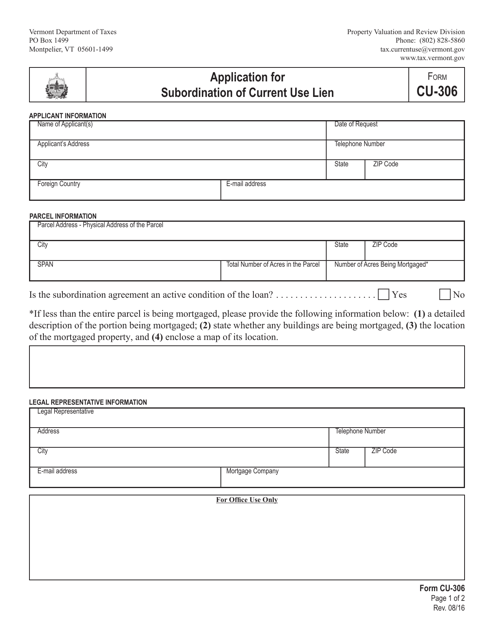

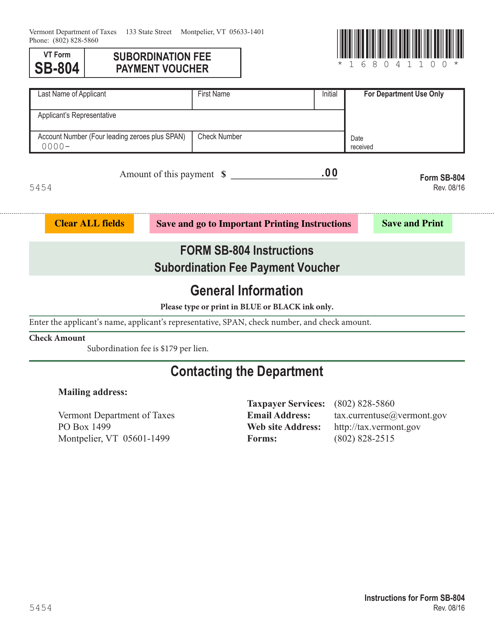

This Form is used for applying for subordination of the current use lien in Vermont. It allows property owners to request to prioritize another lien ahead of the current use lien on their property.

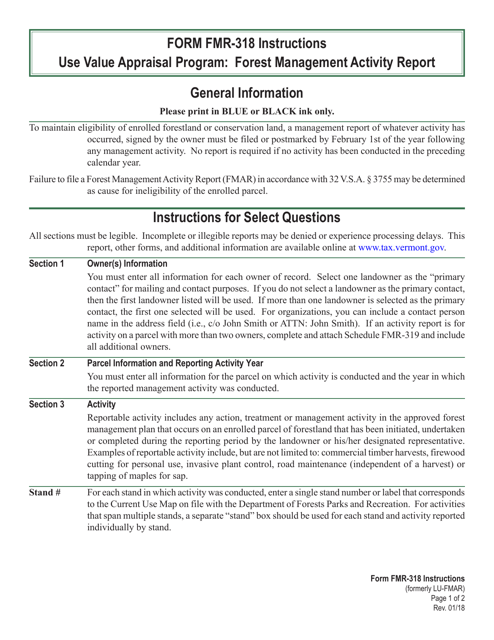

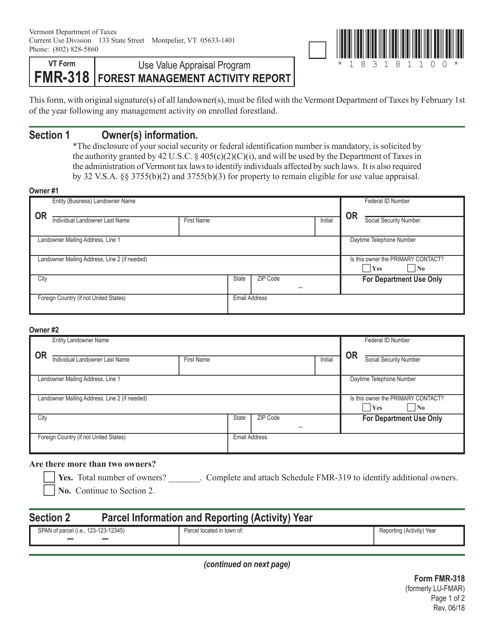

This document is used for reporting forest management activities in Vermont under the Use Value Appraisal Program. The report is required to demonstrate compliance with the program's requirements.

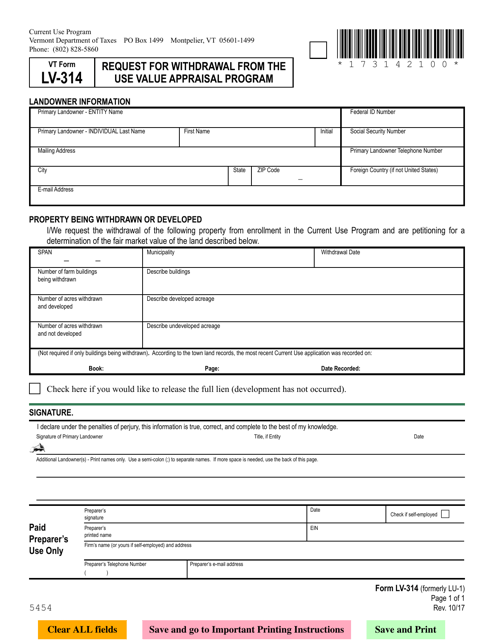

This form is used for requesting withdrawal from the Use Value Appraisal Program in Vermont.

This document is used in Vermont to request a withdrawal from the Use Value Appraisal Program. It provides instructions on how to fill out the VT Form LV-314.

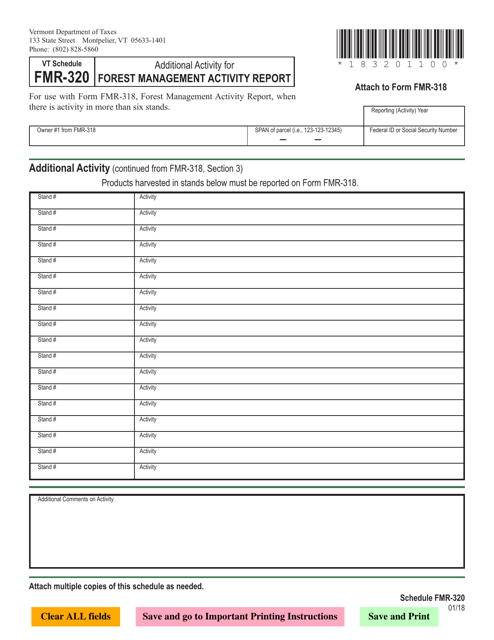

This document is used for reporting additional activity related to forest management in Vermont.

This document is used for reporting forest management activities as part of Vermont's Use Value Appraisal Program. It helps landowners maintain their forests and receive tax benefits.

This form is used for paying the subordination fee in Vermont.

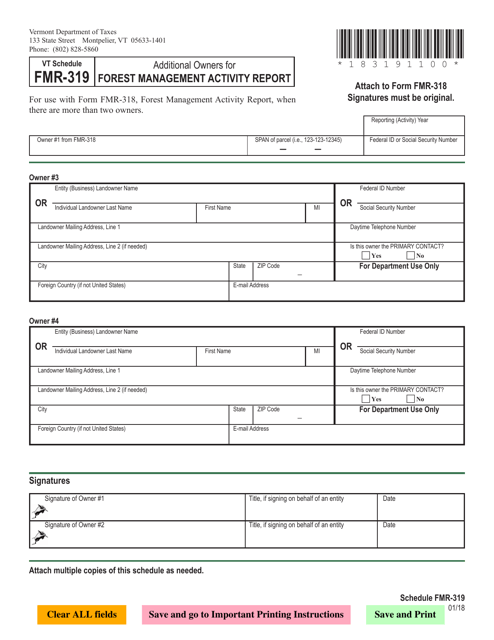

This type of document is used to add additional owners for the Forest Management Activity Report in Vermont.

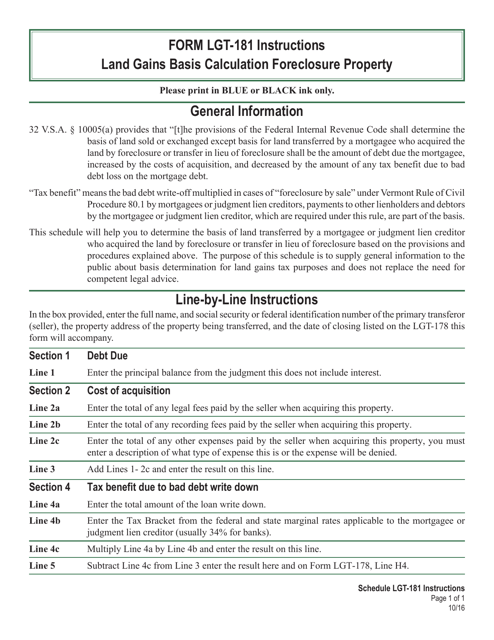

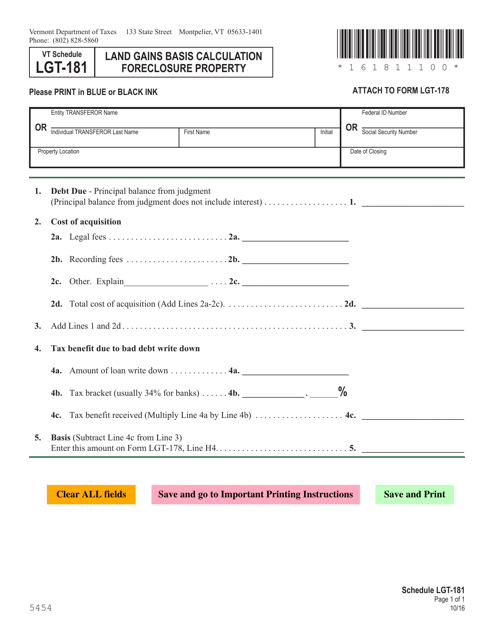

This Form is used for calculating the land gains basis for foreclosure properties in the state of Vermont. It provides instructions on how to determine the taxable amount for these properties.

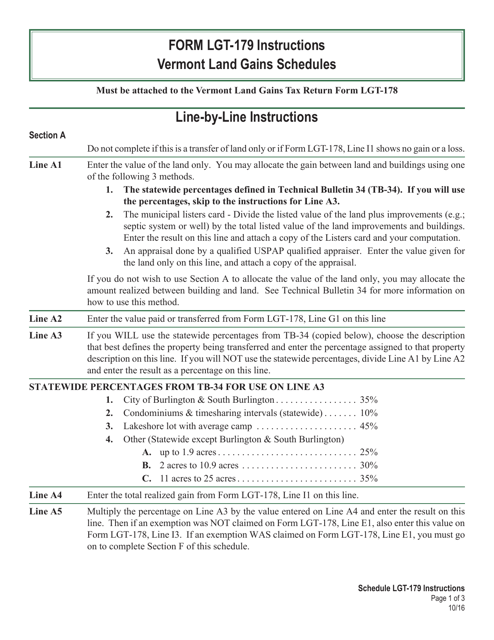

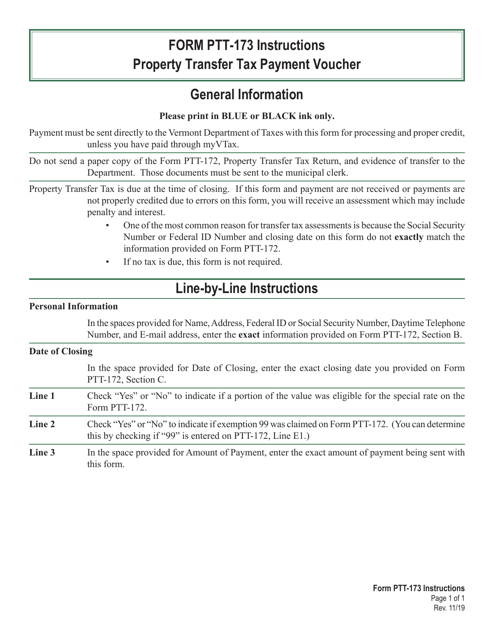

This Form is used for reporting capital gains from the sale of property in Vermont. It provides instructions for filling out the VT Form LGT-179 Vermont Land Gains Schedules.

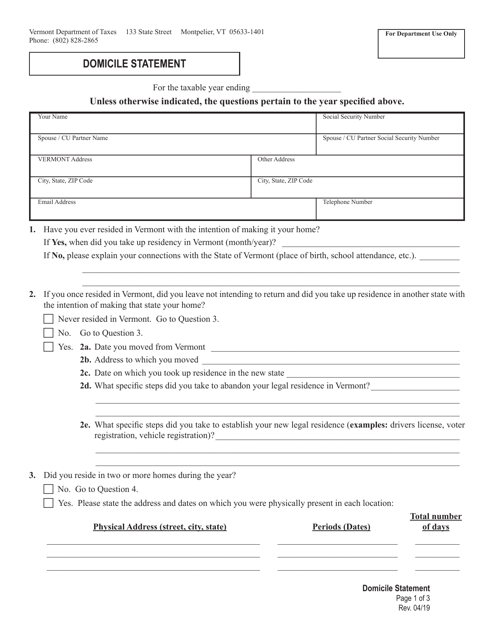

This form is used for declaring and proving residency in the state of Vermont. It is necessary for various legal and administrative purposes, such as applying for in-state tuition, voting, or obtaining certain state-specific benefits. The Domicile Statement Form requires detailed information about an individual's residence history and intentions to establish permanent residence in Vermont.

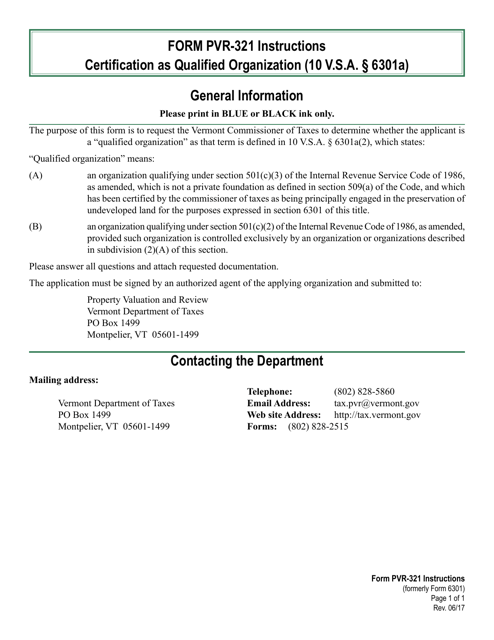

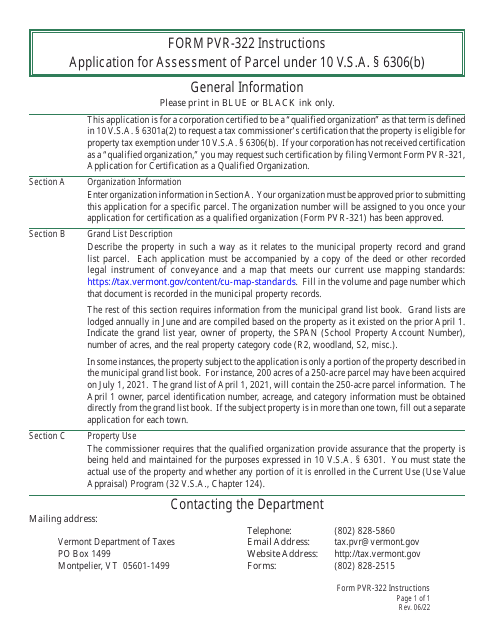

This form is used for applying to become a certified qualified organization in the state of Vermont.

This Vermont form is used for calculating the land gains basis for foreclosure property in Vermont.

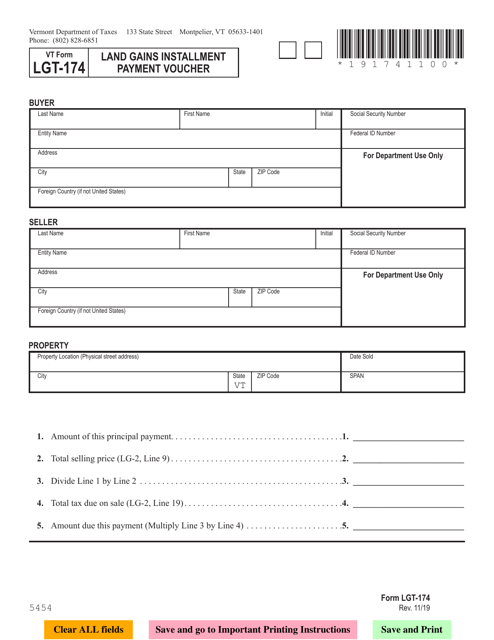

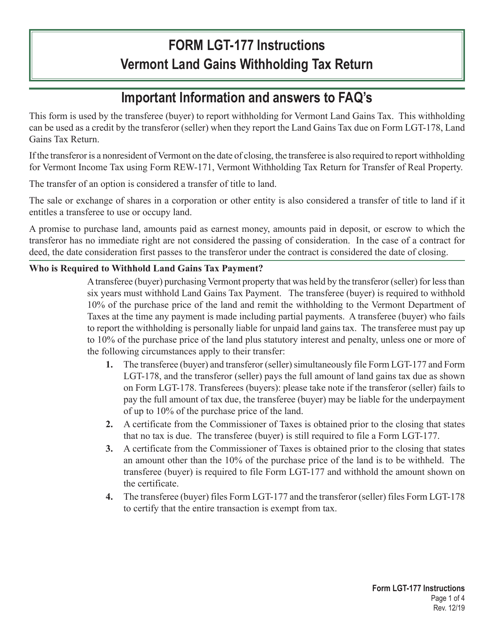

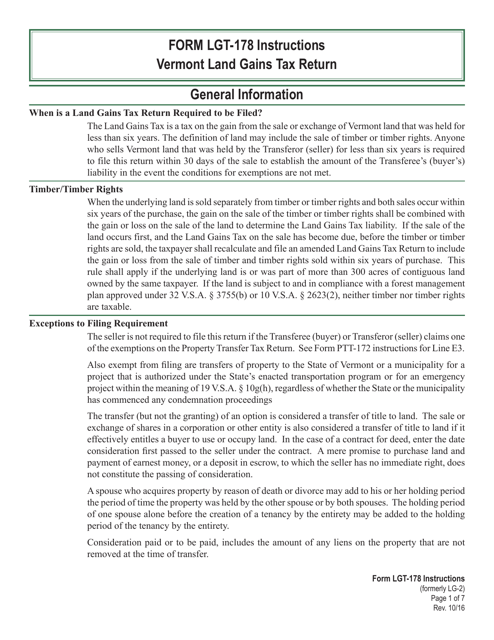

This document is used for filing the Vermont Land Gains Tax Return in the state of Vermont. It provides instructions on how to complete the form and report any taxable gains from the sale of land or real estate in Vermont.

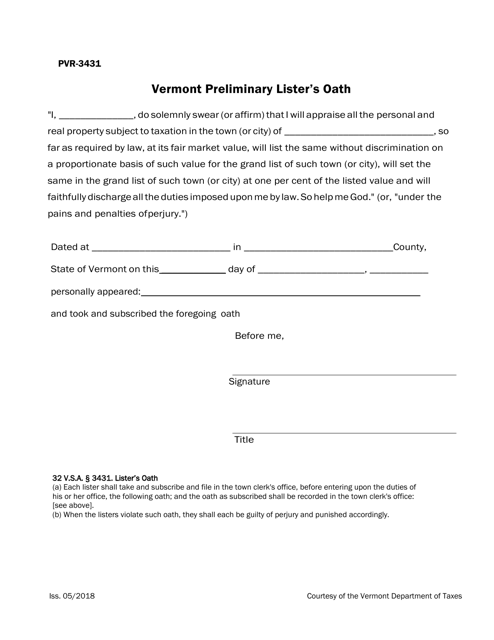

This form is used for the Vermont Preliminary Lister's Oath for property tax assessment purposes in Vermont.