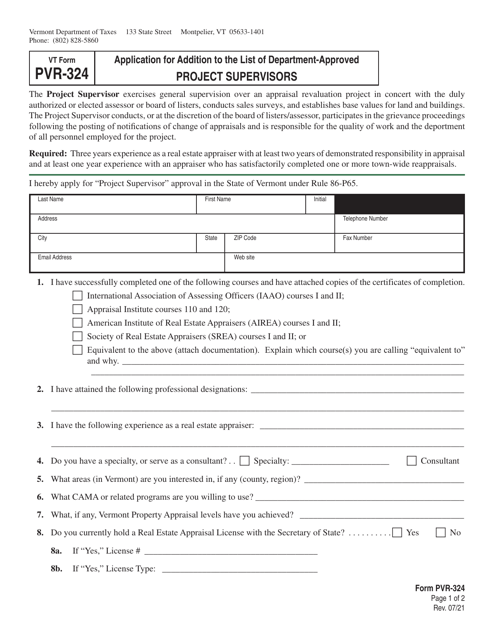

Vermont Department of Taxes Forms

Documents:

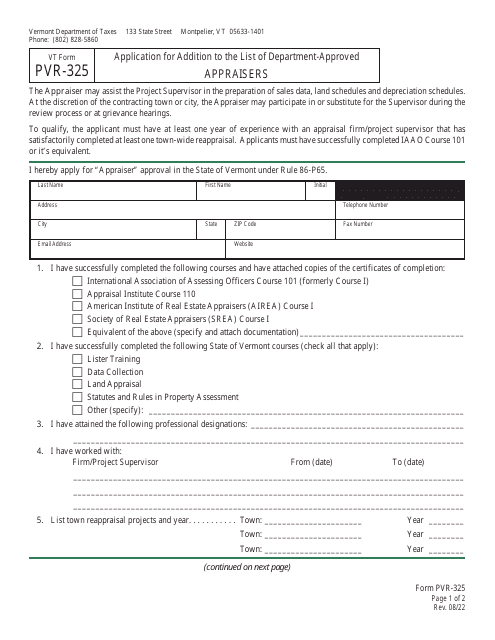

572

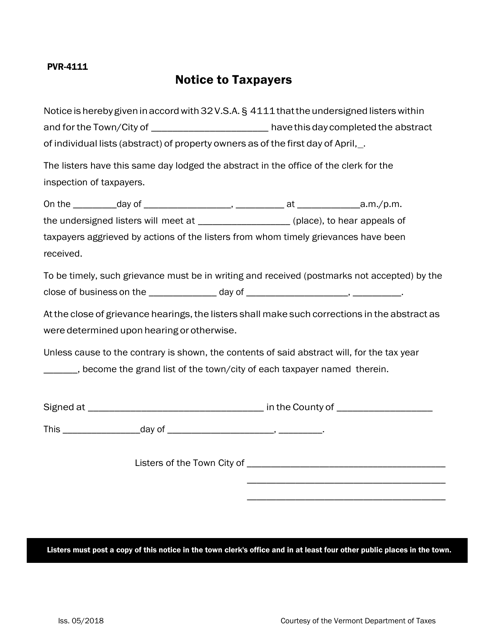

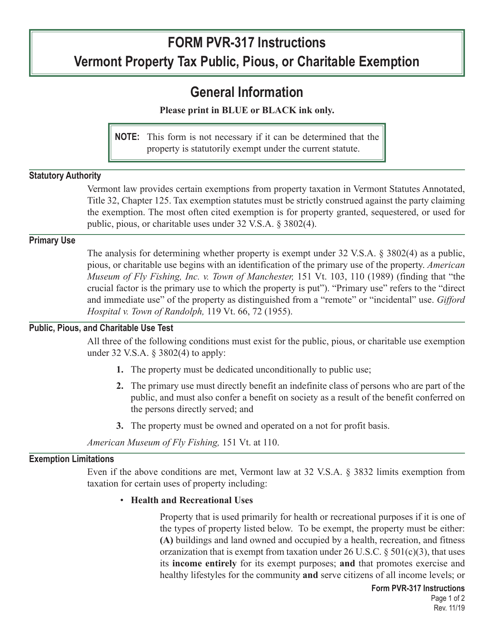

This is a notice form issued by the Vermont Department of Taxes to inform taxpayers about important tax-related information or changes.

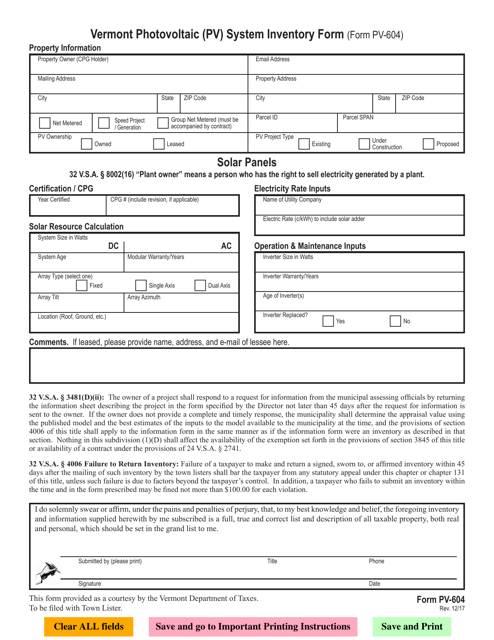

This Form is used for recording inventory details of photovoltaic (PV) systems in the state of Vermont.

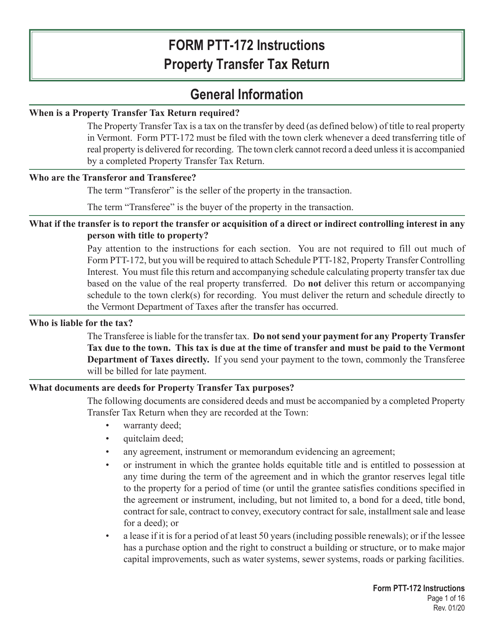

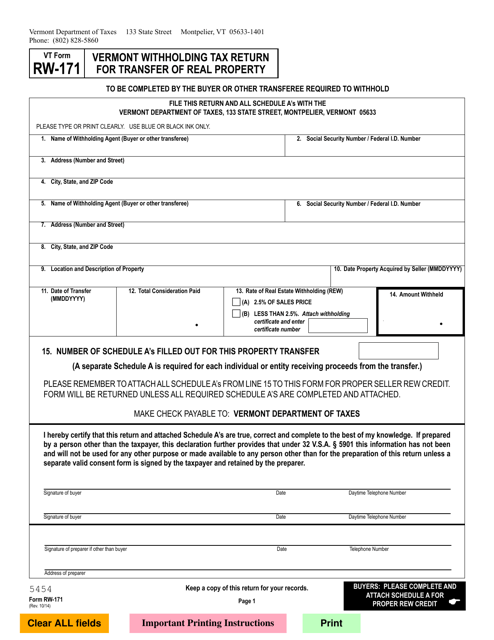

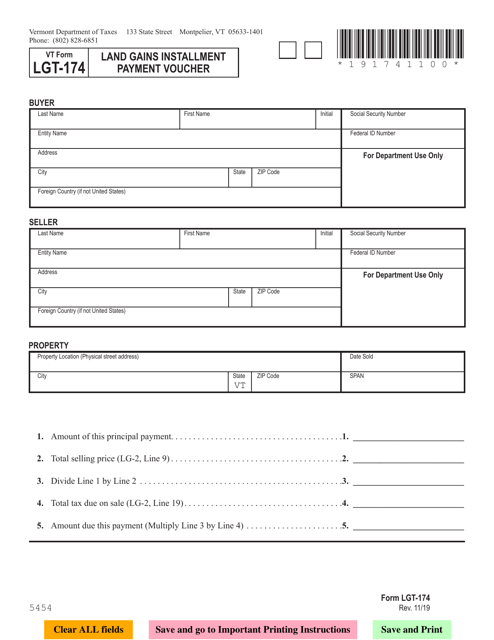

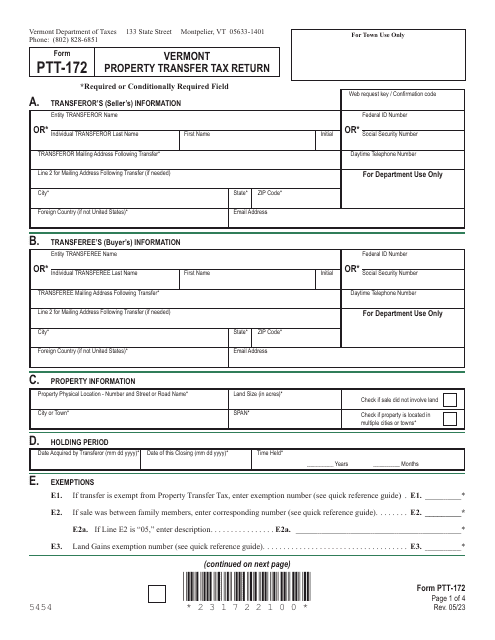

This Form is used for reporting withholding tax on the transfer of real property in Vermont.

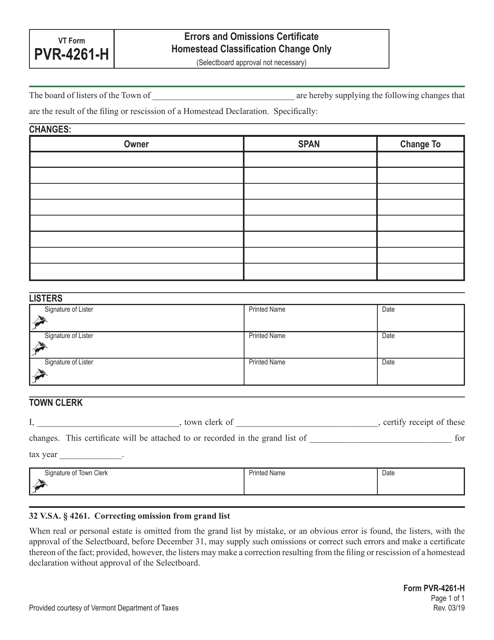

This form is used for making changes to the homestead classification in Vermont by verifying errors and omissions on the PVR-4261-H form.

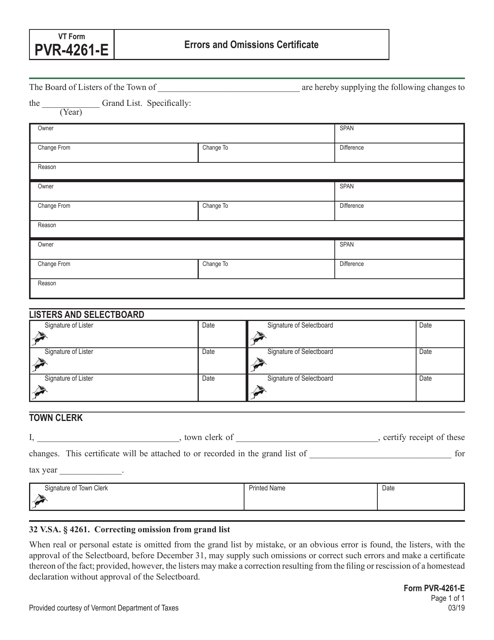

This form is used for submitting an Errors and Omissions Certificate in Vermont.

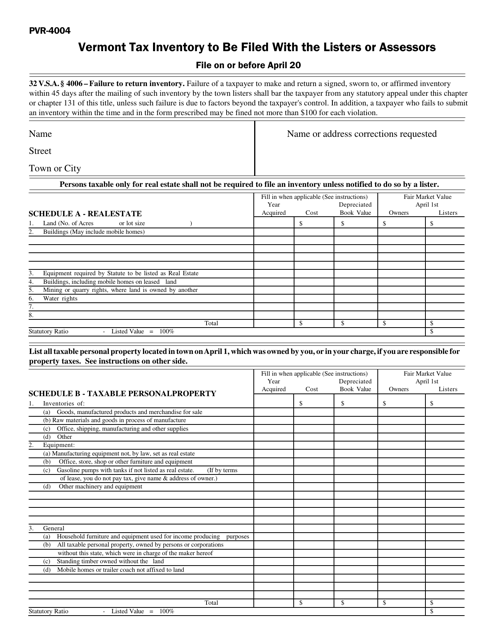

This Form is used for filing tax inventory with the listers or assessors in Vermont.

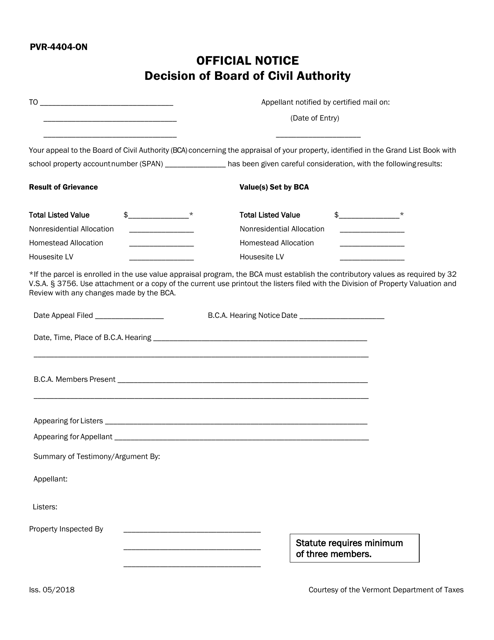

This form is used for receiving an official notice about the decision made by the Board of Civil Authority in Vermont. It is an important document for individuals residing in Vermont as it informs them about the decisions made by the board regarding various civil matters.

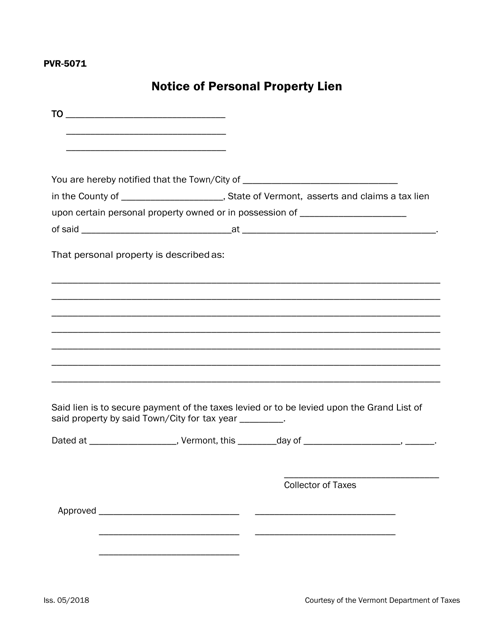

This form is used for filing a notice of personal property lien in Vermont. It is used to establish a legal claim on personal property owned by another person or business as security for a debt or obligation.

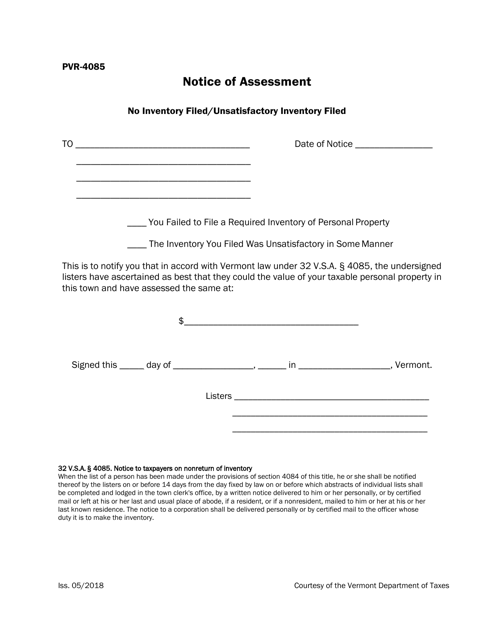

This Form is used for filing a Notice of Assessment for a Vermont taxpayer who did not file an inventory or filed an unsatisfactory inventory.

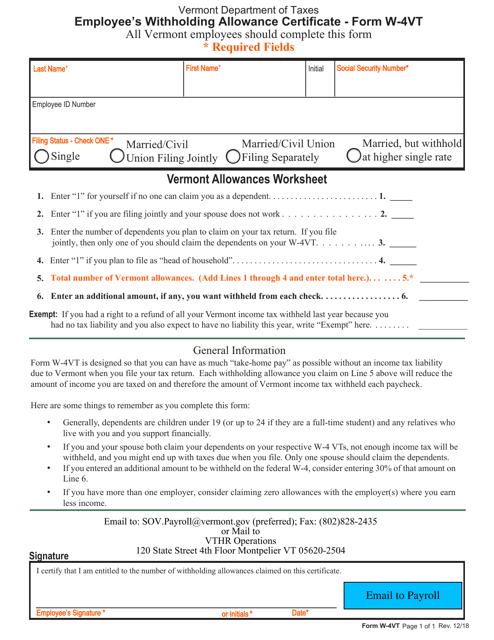

This Form is used for employees in Vermont to declare their withholding allowances for state income tax purposes. It helps determine the amount of income tax that should be withheld from an employee's paycheck.

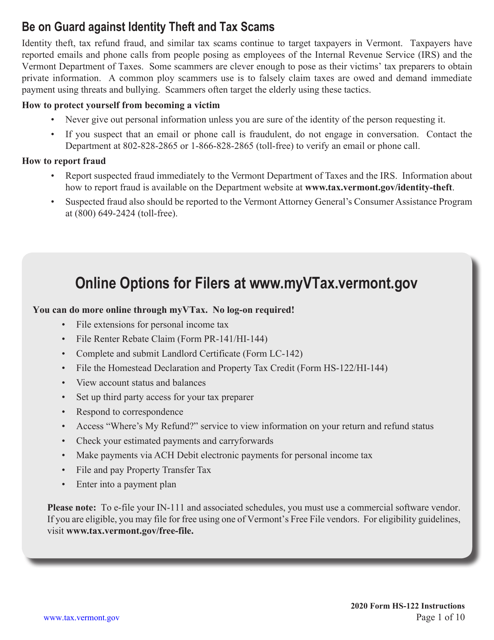

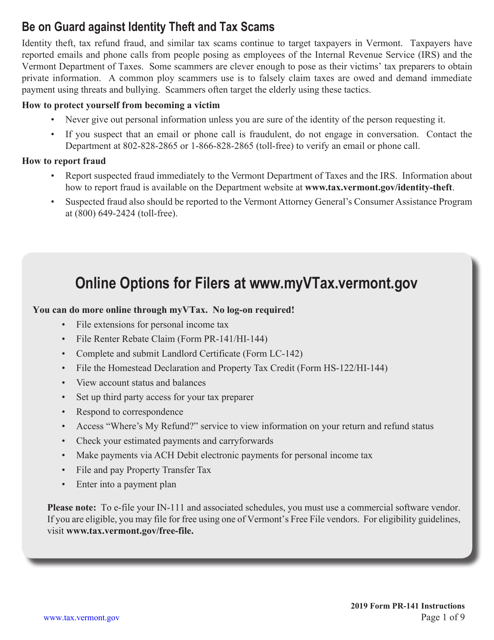

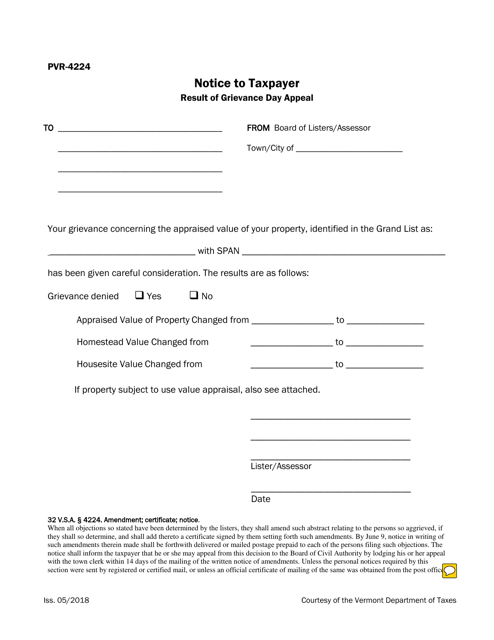

This form is used for notifying taxpayers about the result of their appeal on Grievance Day in Vermont.

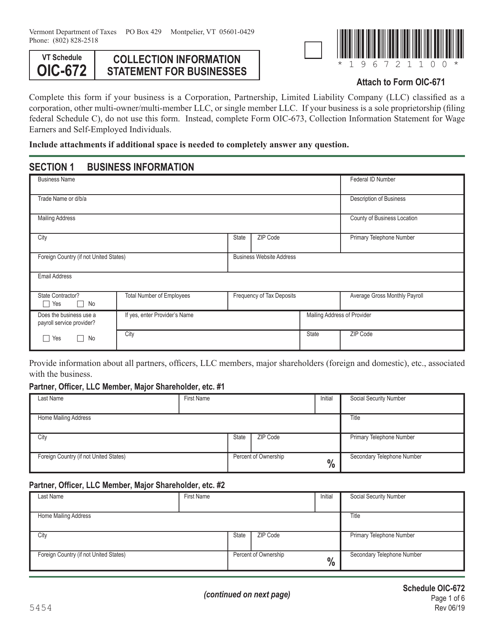

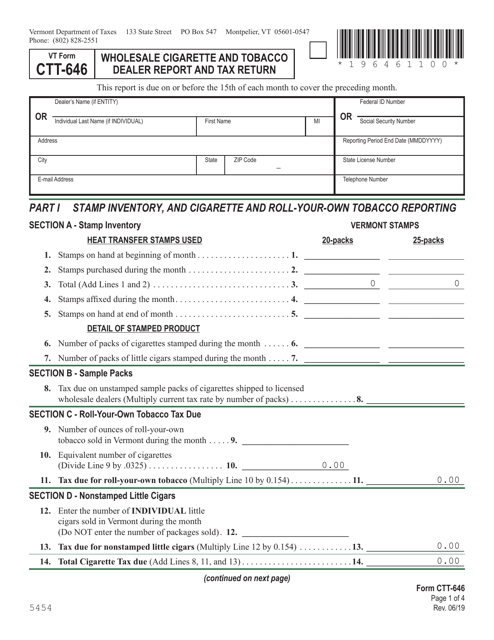

This document is used for filing a Collection Information Statement for businesses in Vermont. It helps the IRS evaluate the taxpayer's ability to pay off their tax debt.

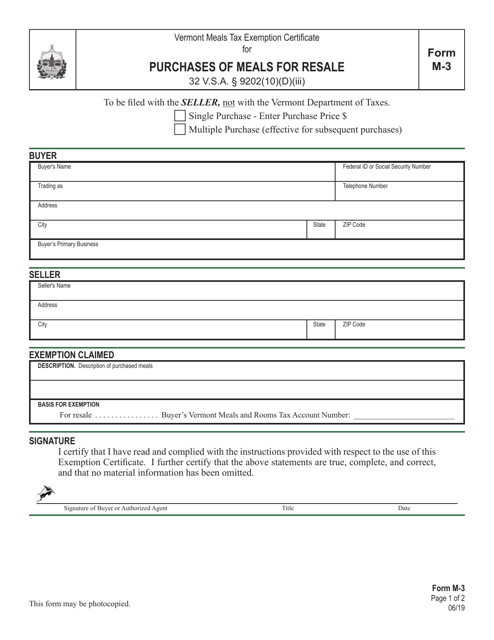

This Form is used for claiming exemption from Vermont meals tax on purchases of meals made for resale.

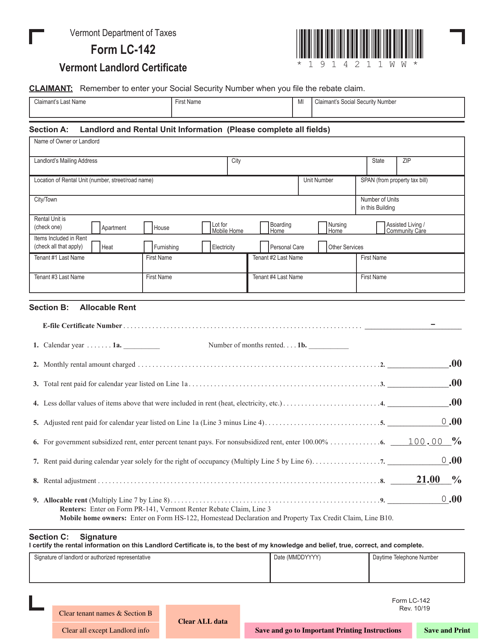

This Form is used for obtaining a landlord certificate in Vermont.

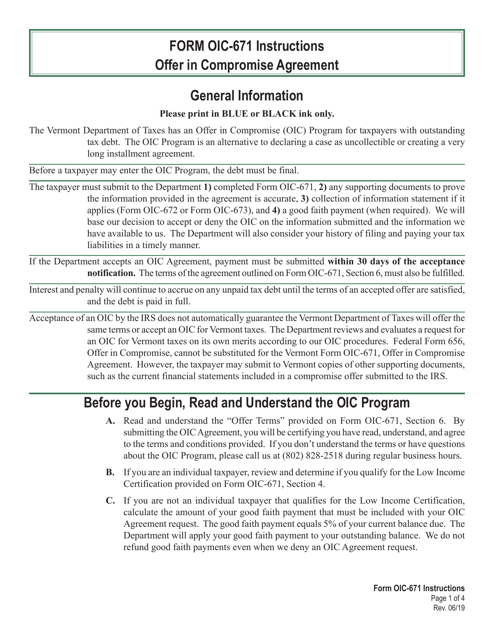

This form is used for making an offer in compromise to the state of Vermont. It is an agreement to settle a taxpayer's debt for less than the full amount owed.

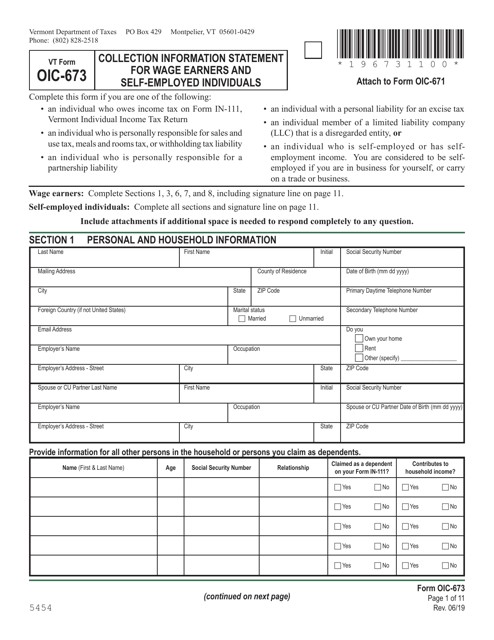

This Form is used for submitting a Collection Information Statement for wage earners and self-employed individuals in Vermont.

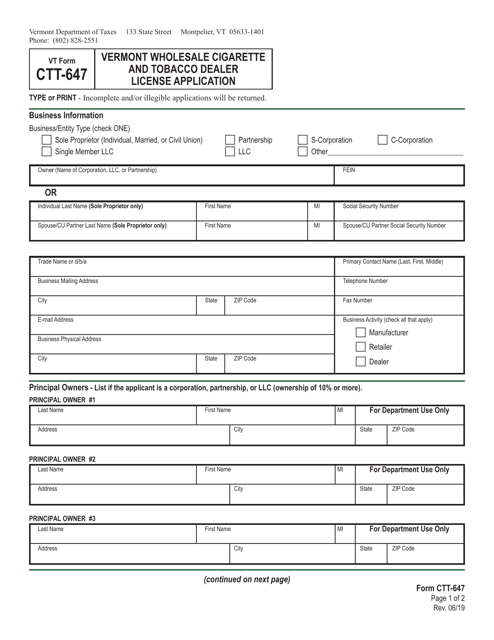

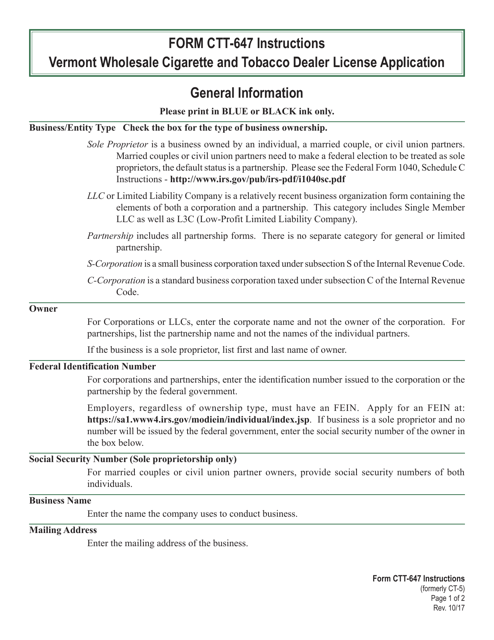

This document is for applying for a Vermont Wholesale Cigarette and Tobacco Dealer License. It provides instructions on how to complete the application form (VT Form CTT-647) for individuals or businesses involved in the sale of wholesale cigarettes and tobacco products in Vermont. This form is necessary to comply with state regulations and obtain the required license.

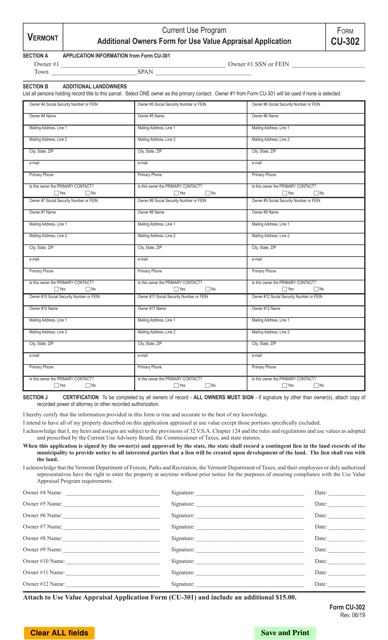

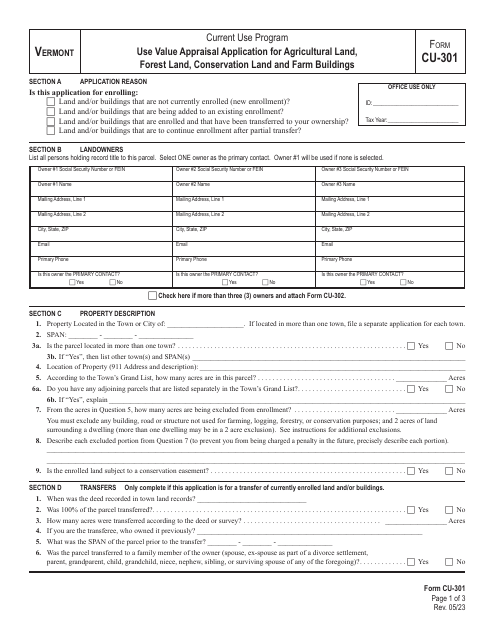

This form is used for adding additional owners to the Use Value Appraisal Application in Vermont.

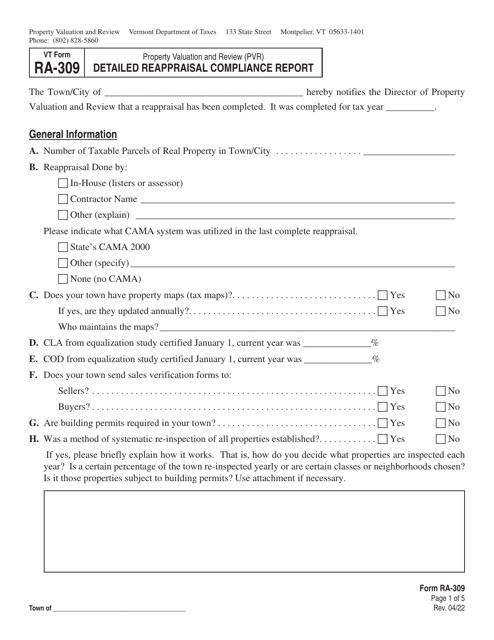

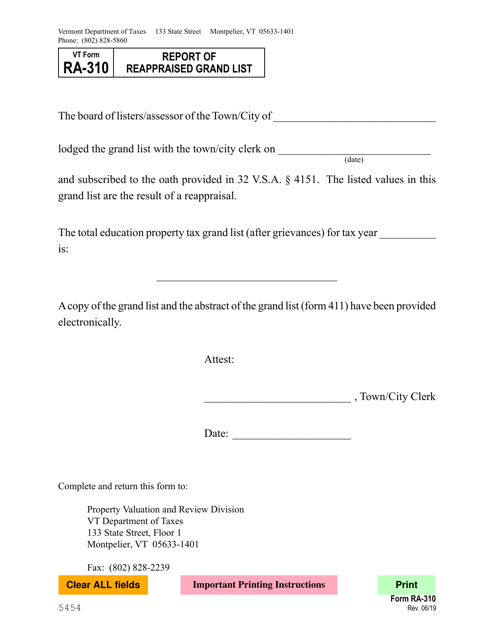

This Vermont form is used to report a reappraised grand list, which is an inventory of taxable properties in the state.