Vermont Department of Taxes Forms

Documents:

572

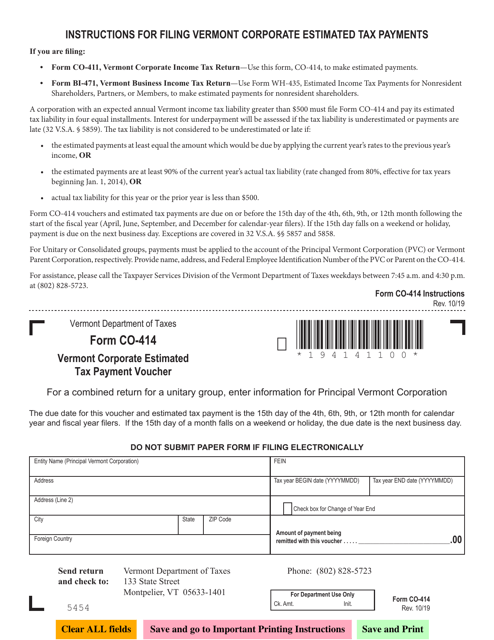

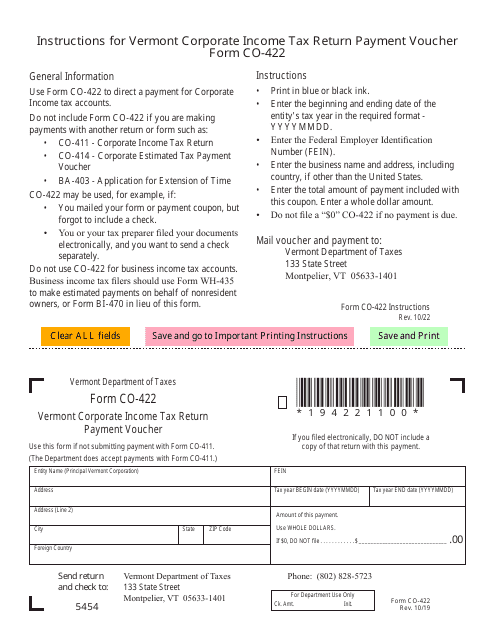

This document is a form used by corporations in Vermont to submit estimated tax payments.

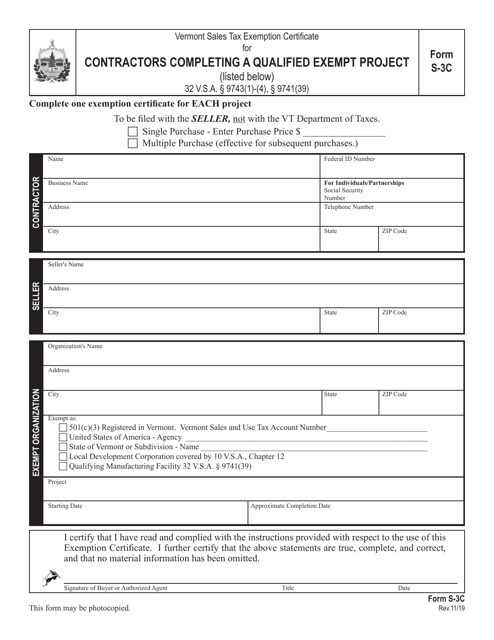

This form is used for contractors working on a qualified exempt project in Vermont to apply for a sales tax exemption.

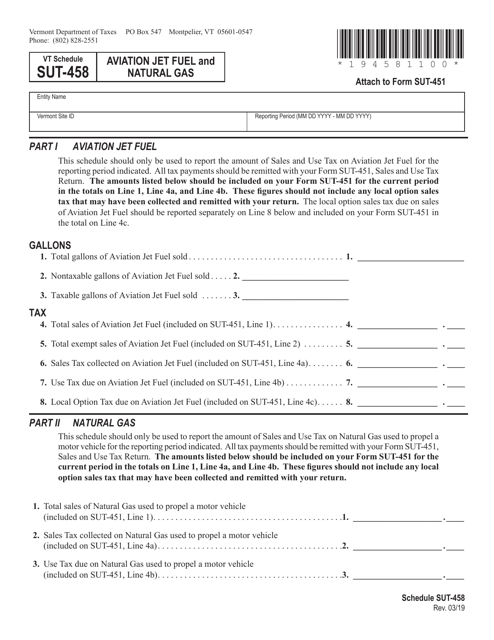

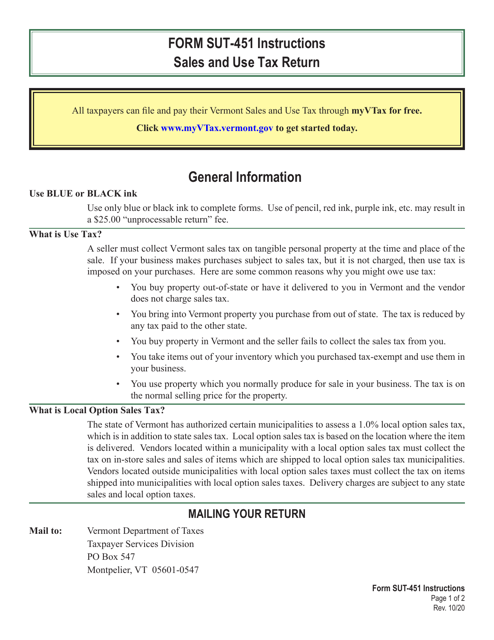

This document is used for reporting and paying the sales and use tax for aviation jet fuel and natural gas in Vermont.

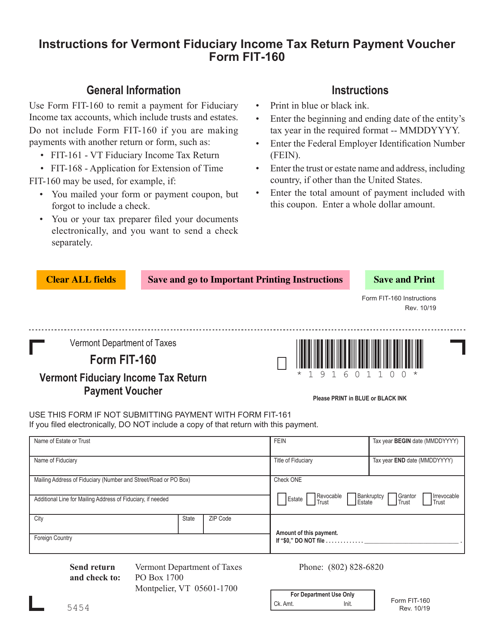

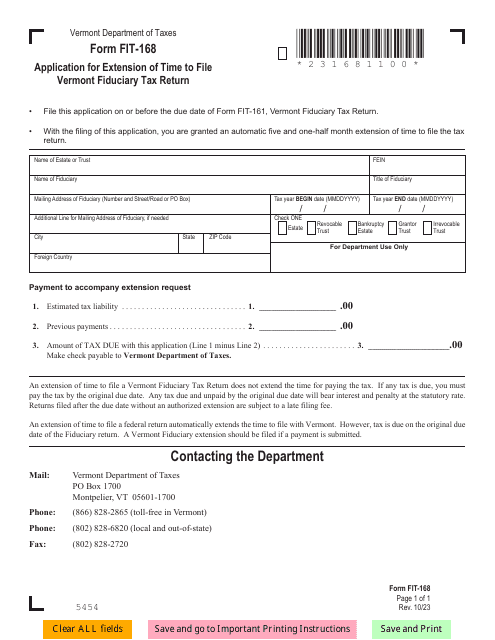

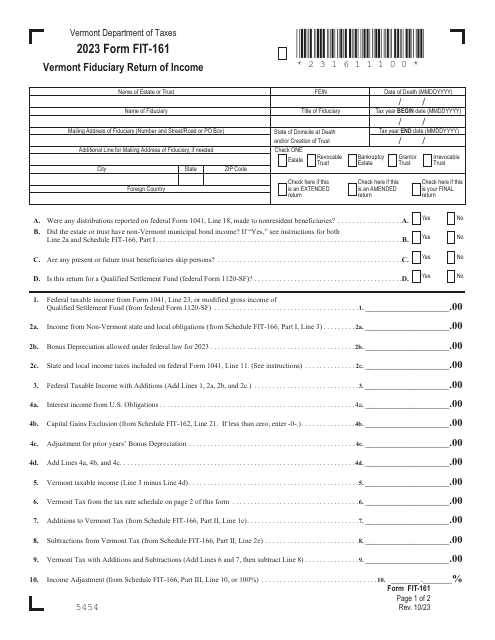

This Form is used for making payment for Vermont Fiduciary Income Tax Return.

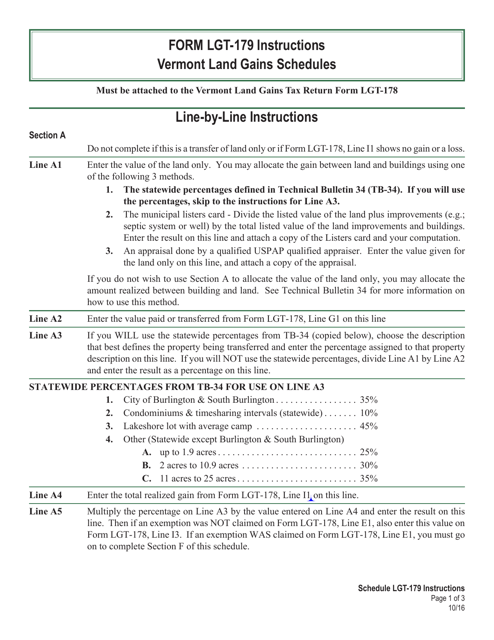

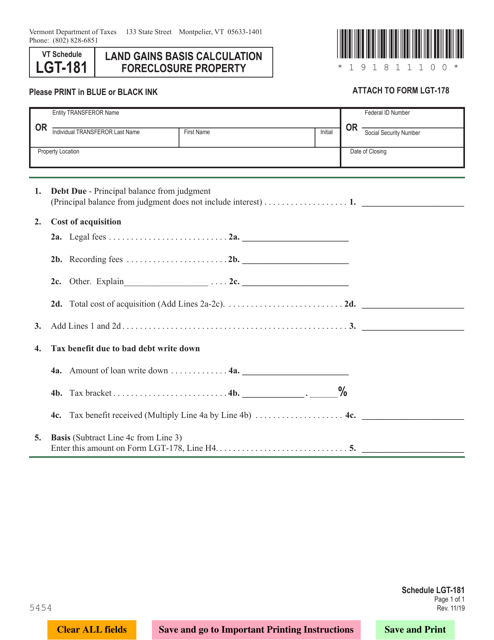

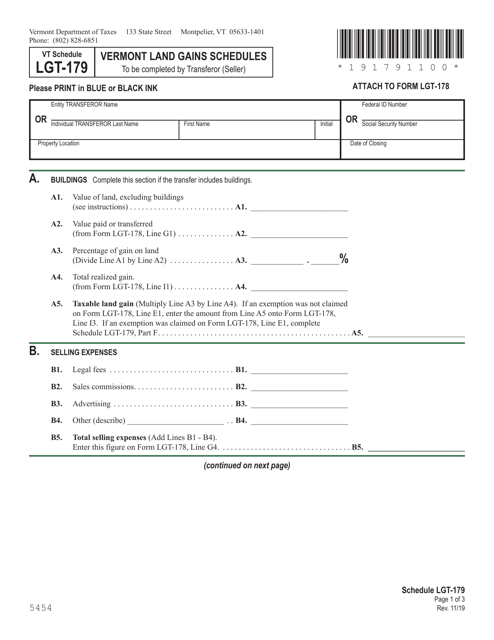

This document is a schedule form used in Vermont for reporting land gains. It is specifically designated as LGT-179.

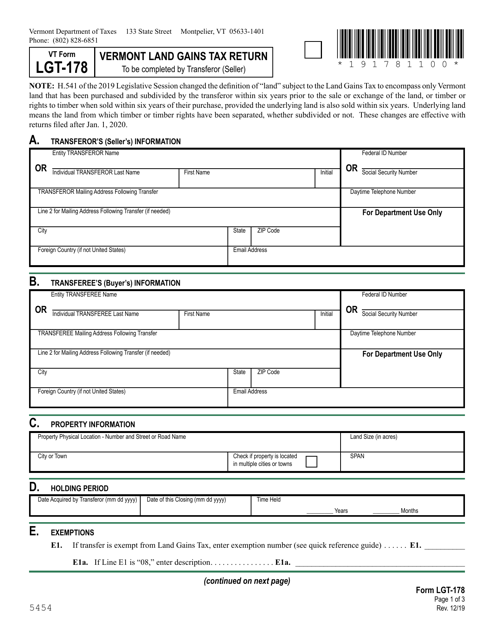

This form is used for reporting and paying the Vermont Land Gains Tax, which is a tax on the sale of certain Vermont real estate. This document must be filed by individuals or businesses who have realized a gain from the sale of qualifying property in Vermont.

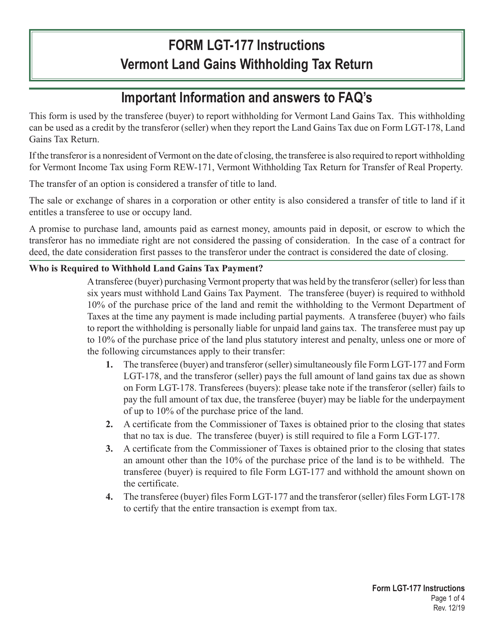

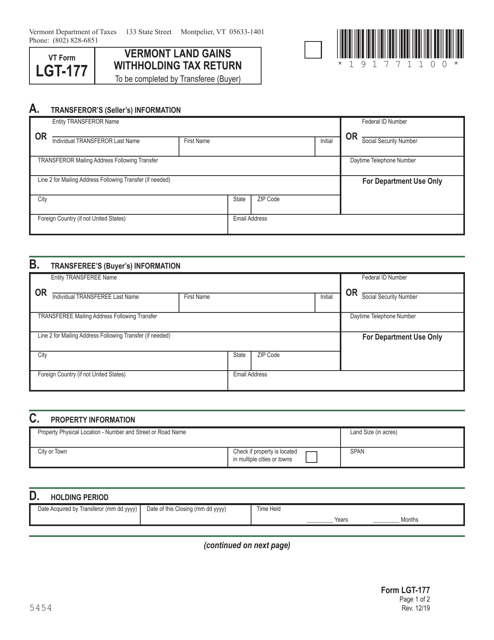

This form is used for filing the Vermont Land Gains Withholding Tax Return in Vermont.

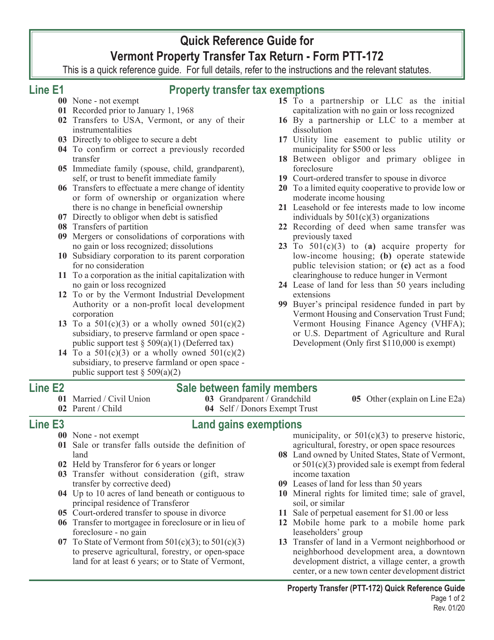

This document is used for reporting and paying the Vermont Property Transfer Tax when a property is being transferred in Vermont. It provides instructions on how to complete the Vermont Property Transfer Tax Return (Form PTT-172) and fulfill the associated tax obligations.