Pennsylvania Department of Revenue Forms

Documents:

754

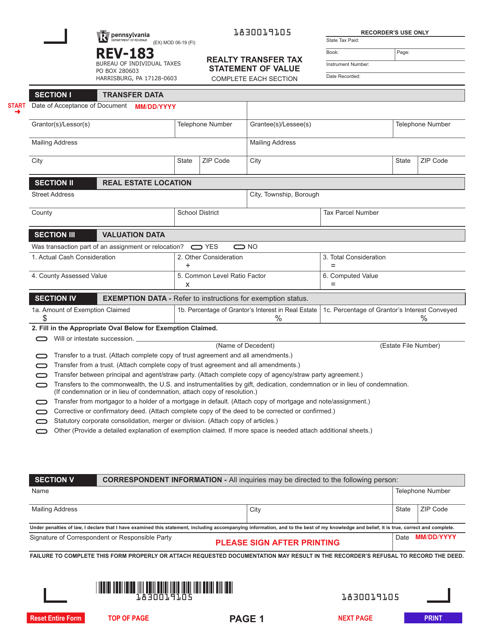

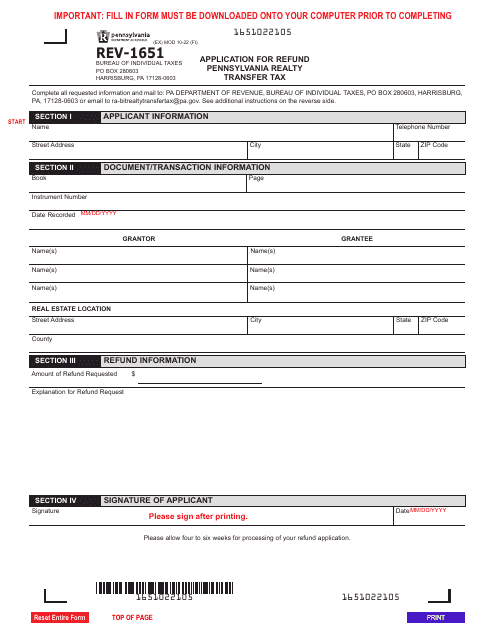

This form is used for reporting the value of a real estate transfer in Pennsylvania for tax purposes.

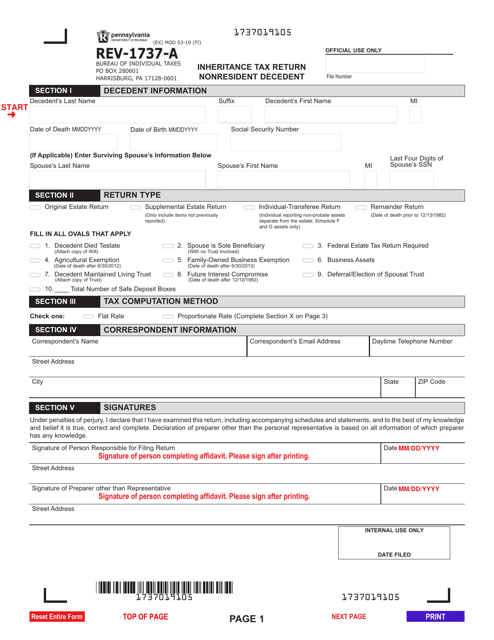

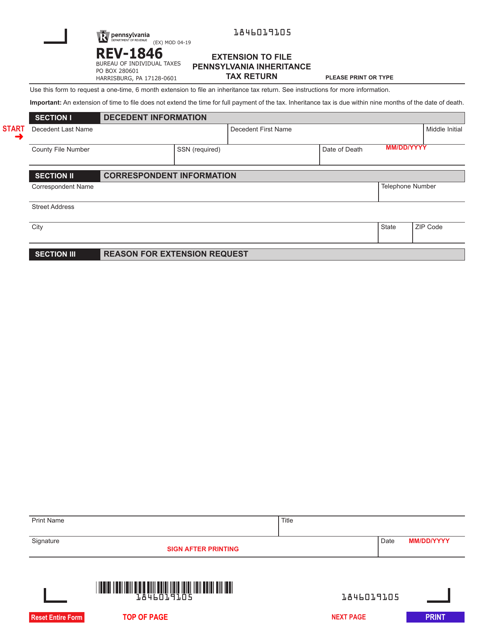

This Form is used for filing an extension to submit the Pennsylvania Inheritance Tax Return, which is required for reporting any inheritance taxes owed in the state of Pennsylvania.

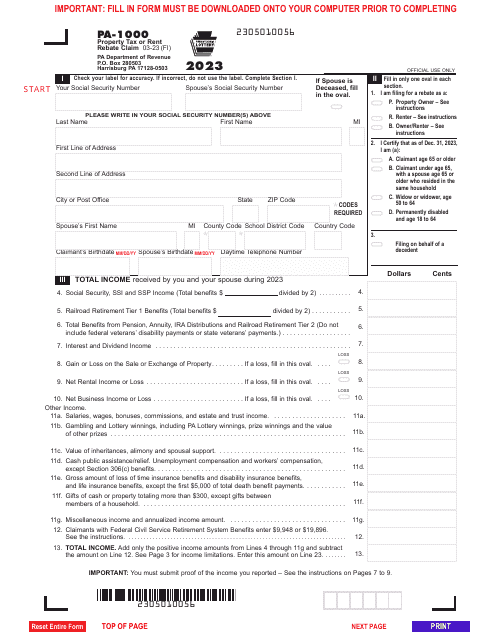

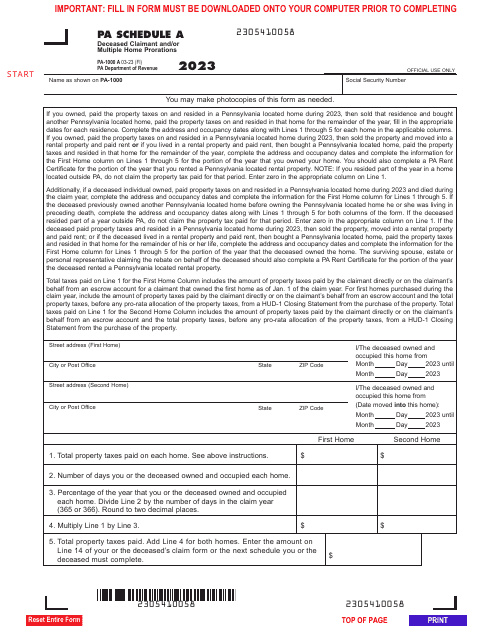

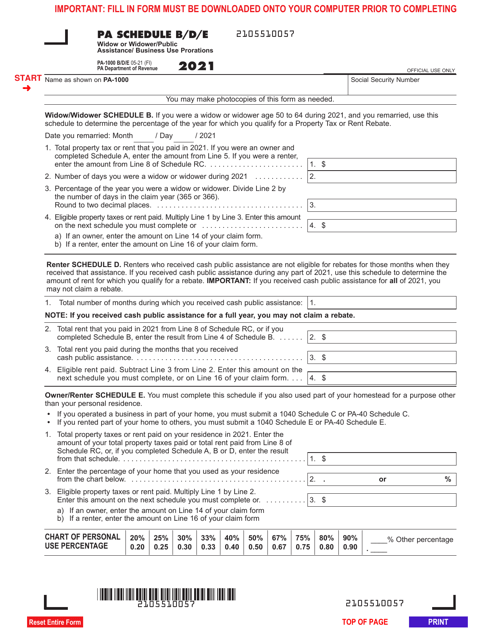

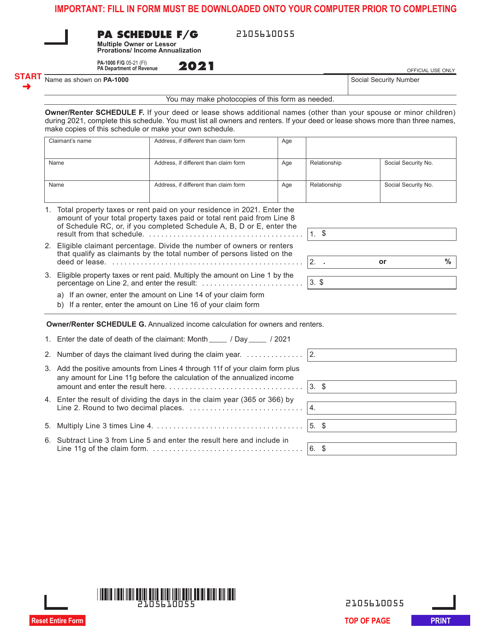

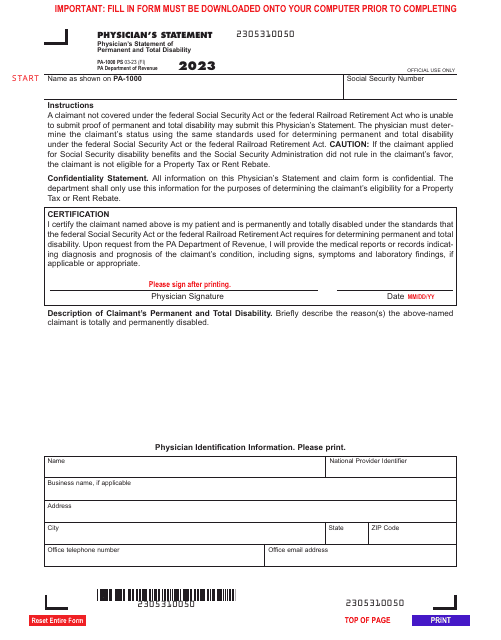

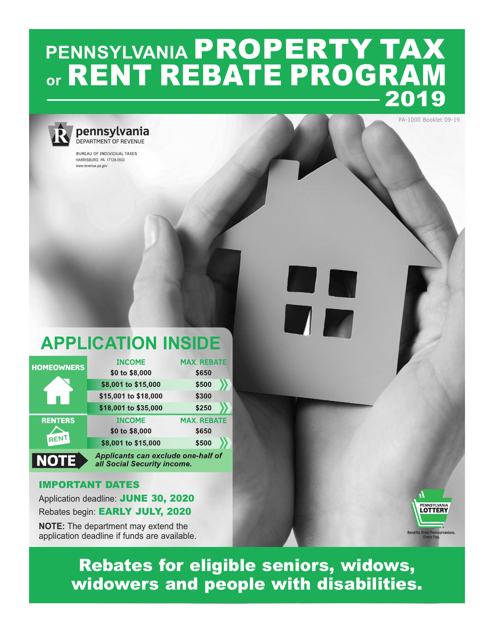

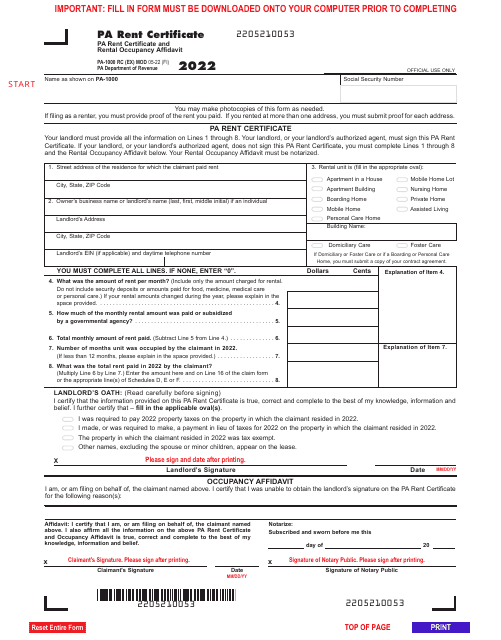

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

This guide provides instructions for preparing the Property Tax/Rent Rebate application in Pennsylvania. It explains the eligibility criteria and necessary documentation required for the rebate.

This Form is used for filing a property tax or rent rebate claim in Pennsylvania. It provides instructions on how to complete the application and claim a rebate for property taxes paid or rent paid for a principal residence.

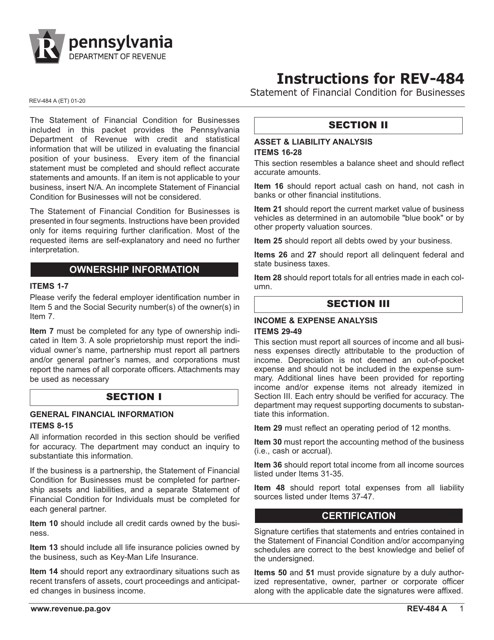

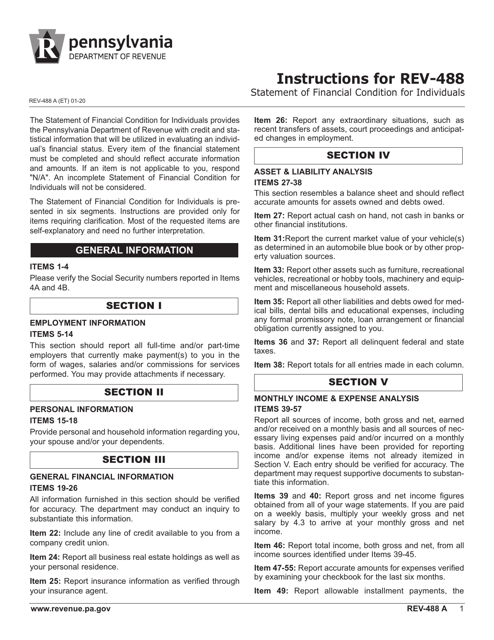

This document is used for individuals in Pennsylvania to provide a statement of their financial condition. It contains instructions on how to fill out the form REV-488 to report their assets and liabilities.

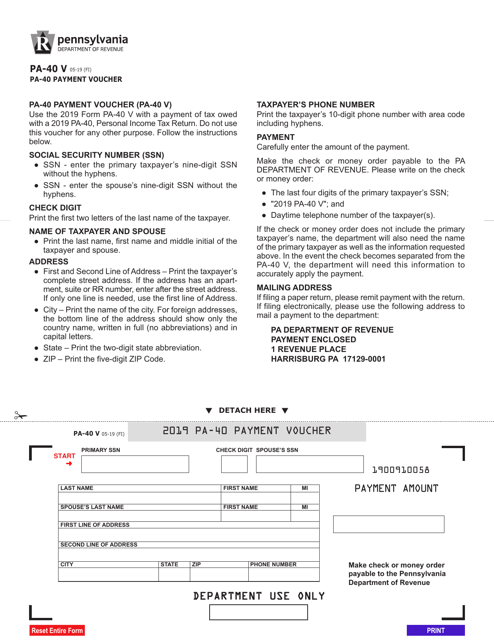

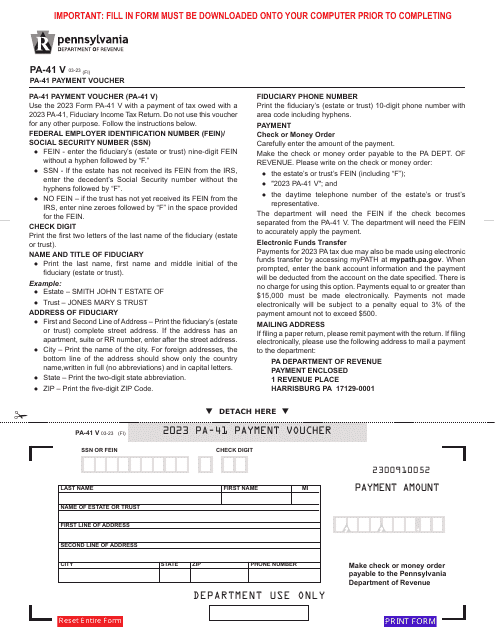

This form is used for making a payment to the state of Pennsylvania. It serves as a voucher to ensure the payment is properly credited.

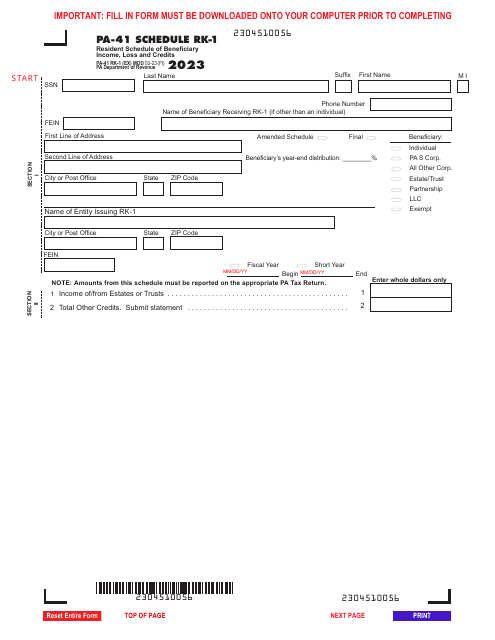

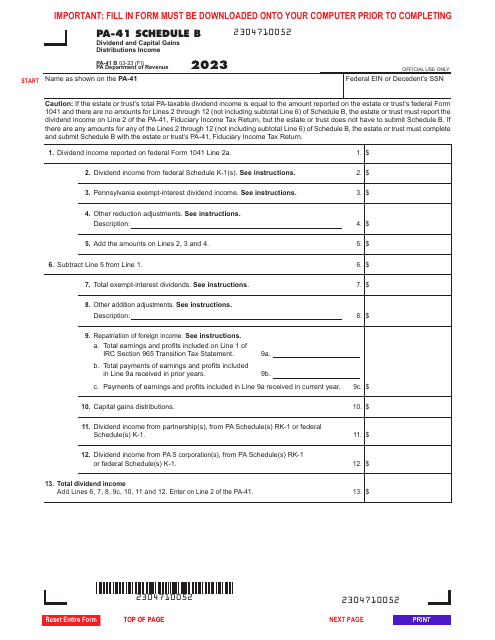

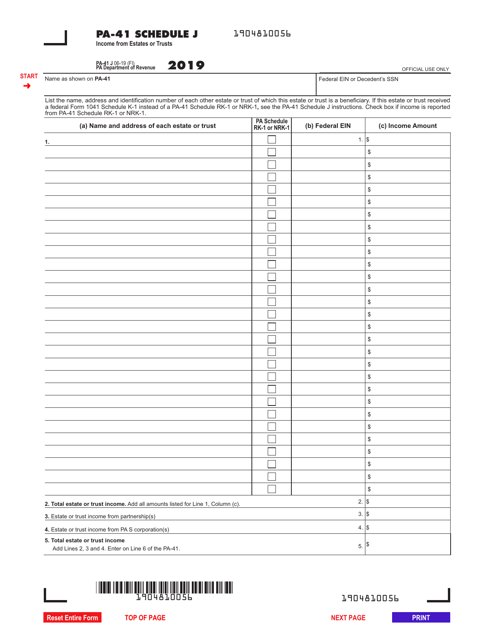

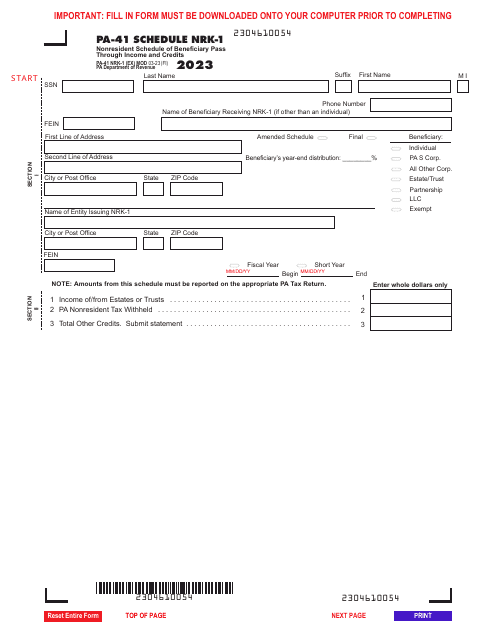

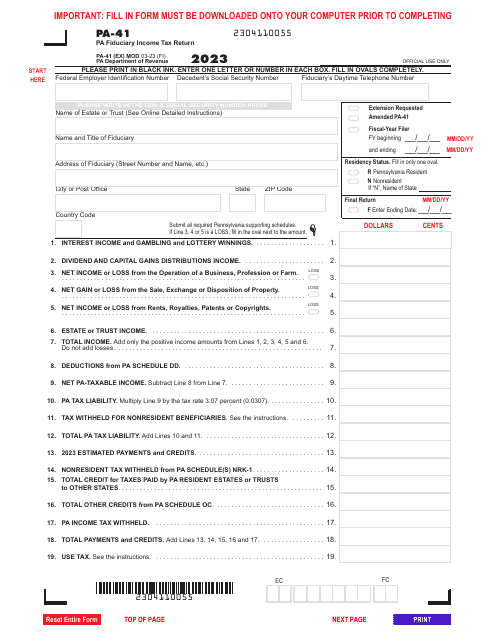

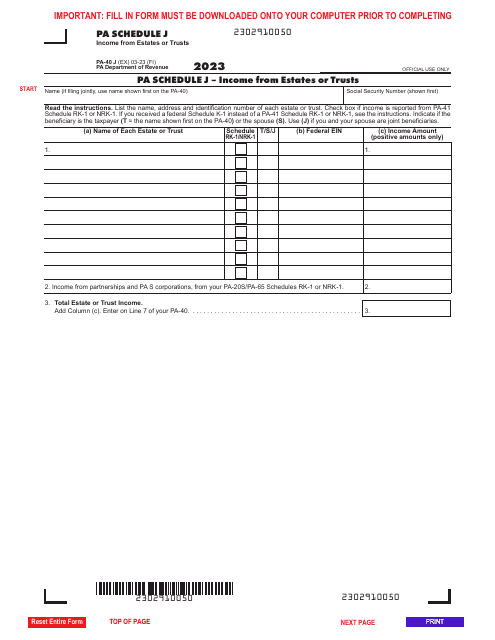

This Form PA-41 Addendum J is used for reporting income generated from estates or trusts in the state of Pennsylvania.

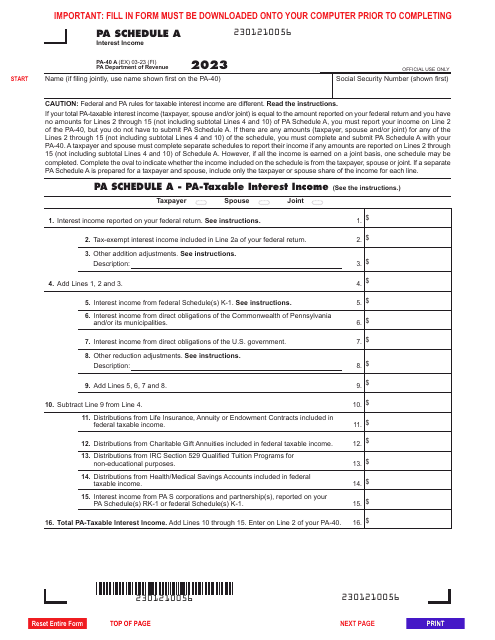

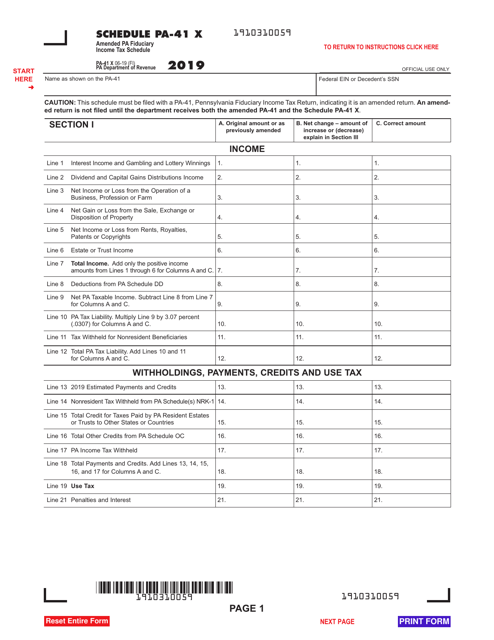

This document is a schedule used for filing an amended Pennsylvania Fiduciary Income Tax return.

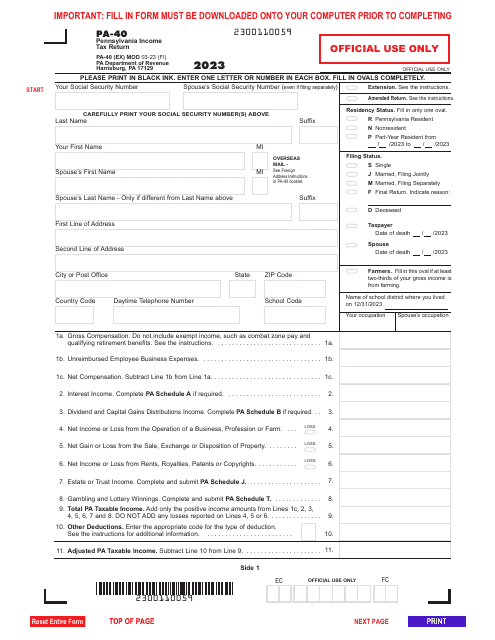

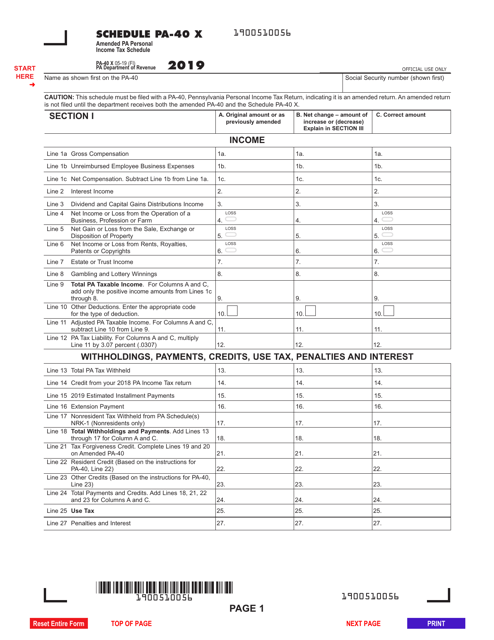

This document is used for filing an amended Pennsylvania Personal Income Tax Schedule, known as PA-40 X. It is used when you need to make changes or corrections to your previously filed state income tax return in Pennsylvania.