Pennsylvania Department of Revenue Forms

Documents:

754

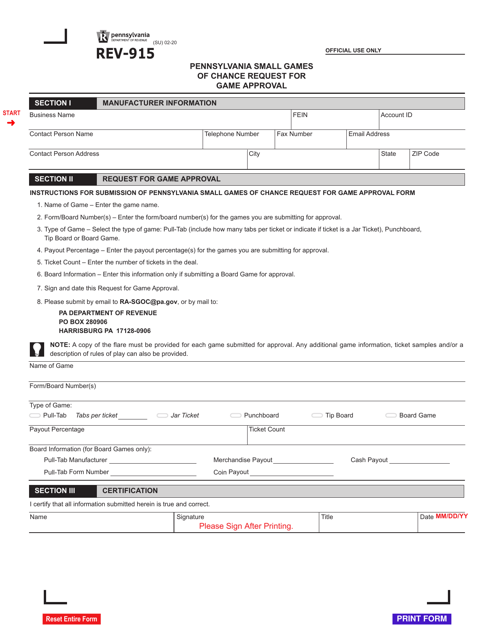

This form is used for submitting applications to obtain approval for small games of chance in Pennsylvania.

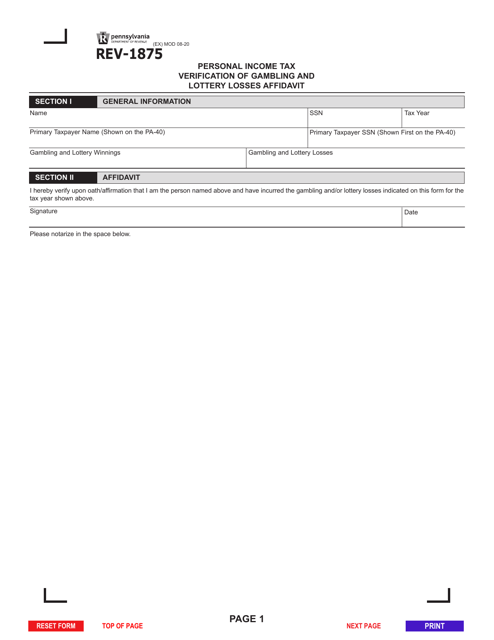

This Form is used for verifying gambling and lottery losses for personal income tax purposes in Pennsylvania.

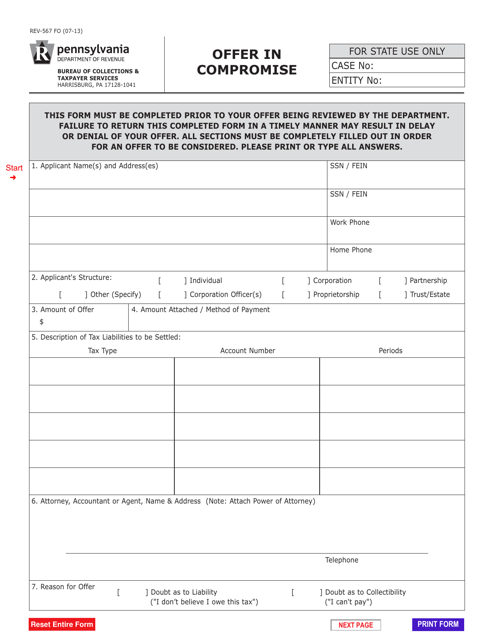

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

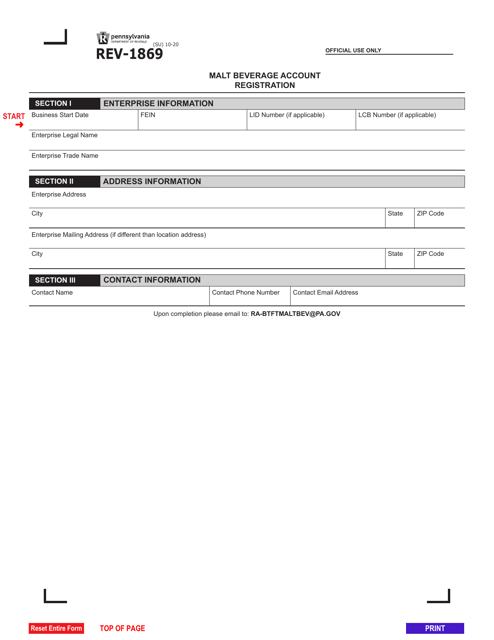

This form is used for registering a malt beverage account in the state of Pennsylvania.

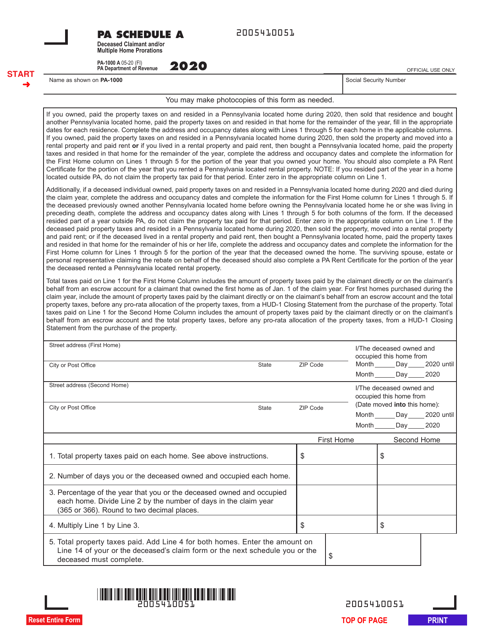

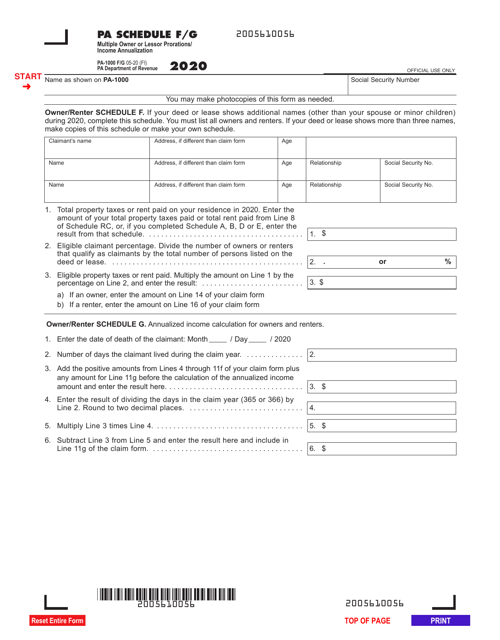

This form is used for calculating prorations and income annualization for multiple owners or lessors in Pennsylvania.

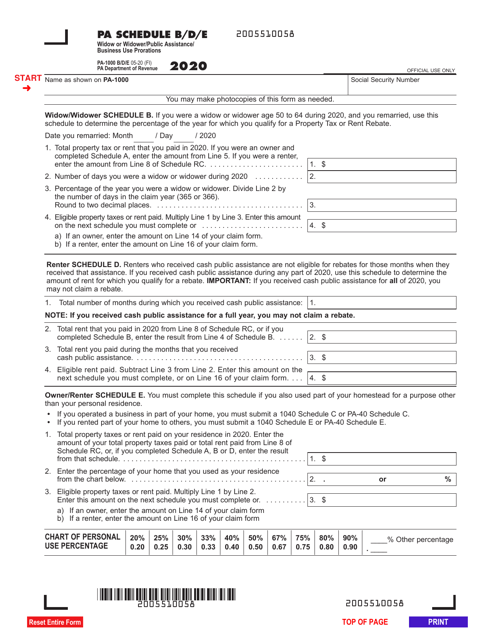

This Form is used for Widow or Widower/Public Assistance/Business Use Prorations in Pennsylvania.

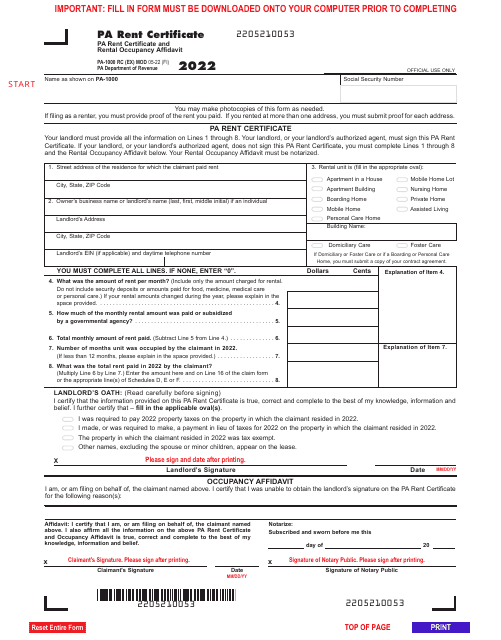

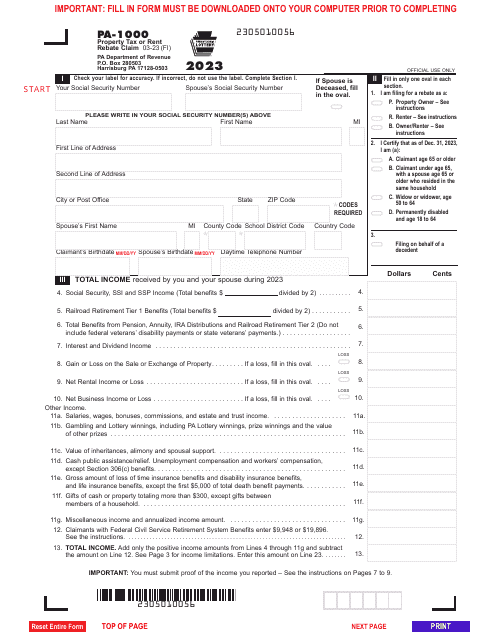

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

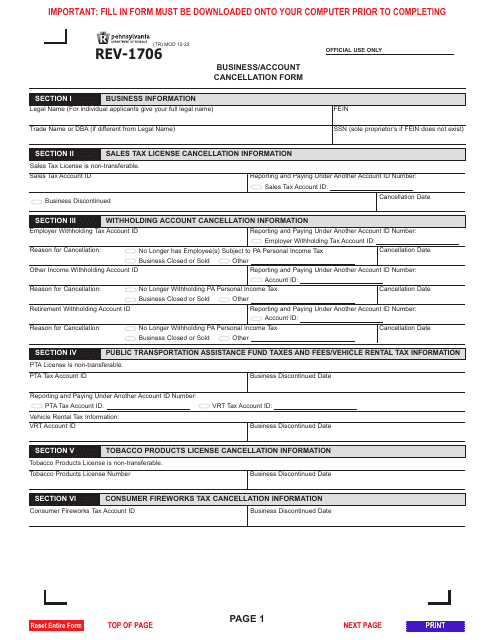

This is a legal document you need to fill out if you discontinue or sell your business, and if you cease all business operations of an entity situated in Pennsylvania.

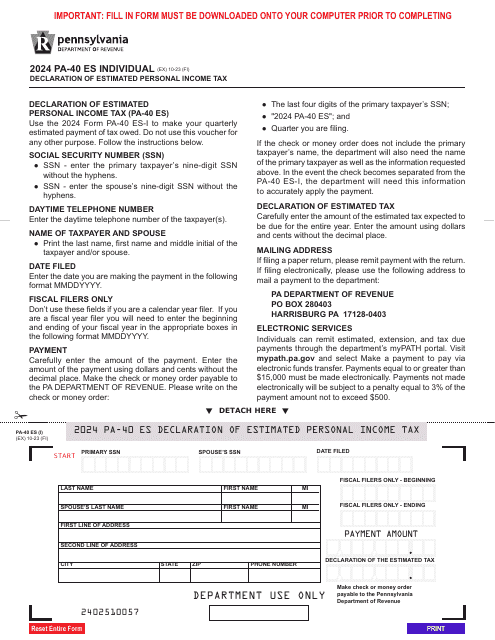

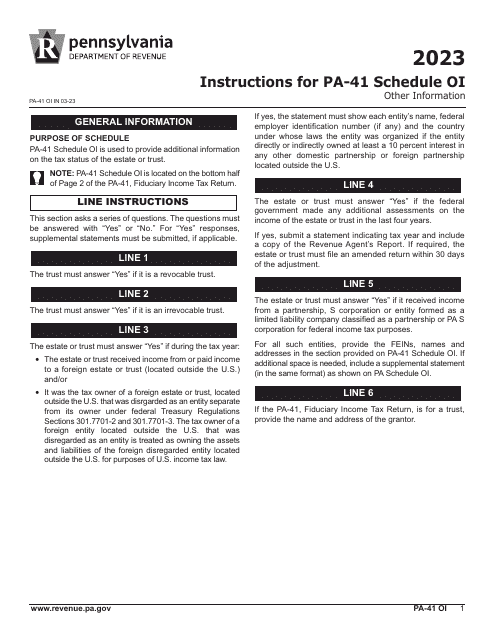

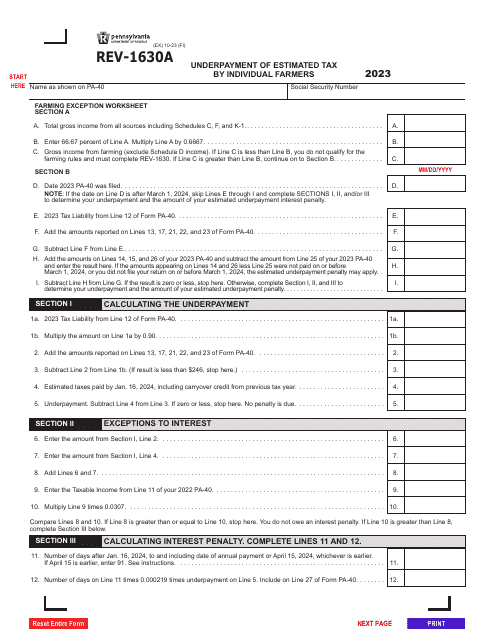

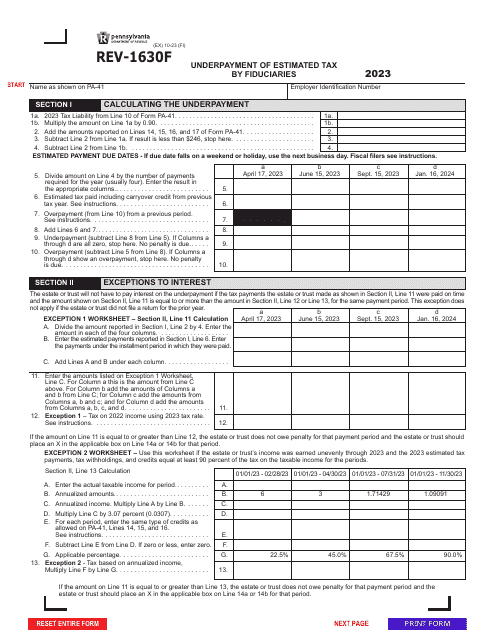

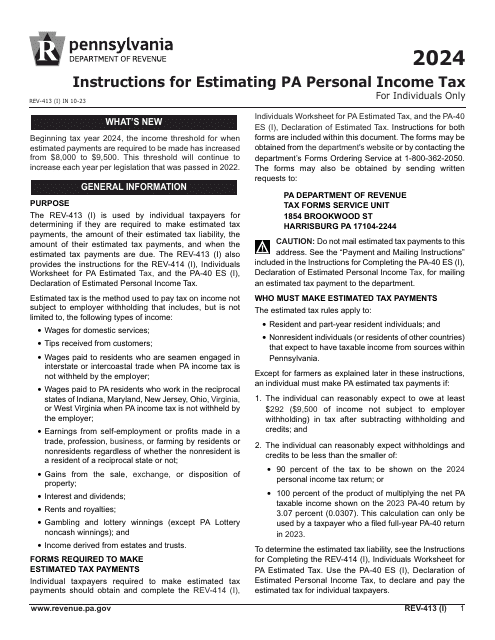

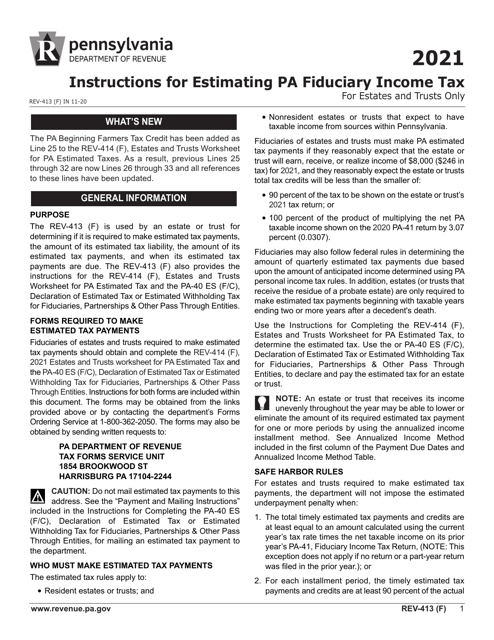

This form is used for submitting state tax payments and calculating estimated tax amounts. Instructions are provided to assist Pennsylvania residents in correctly filling out Form REV-414 (F) and Form REV-40 ES (F/C).