Pennsylvania Department of Revenue Forms

Documents:

754

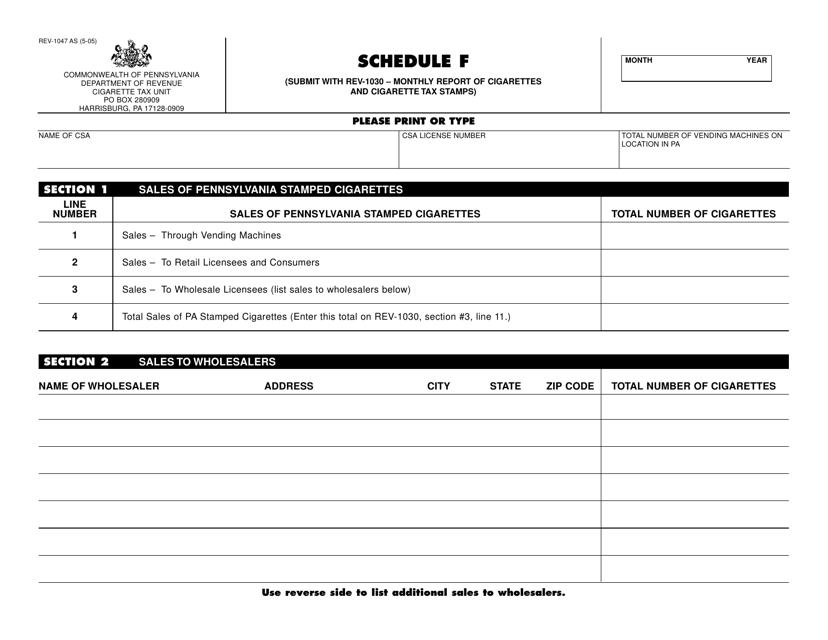

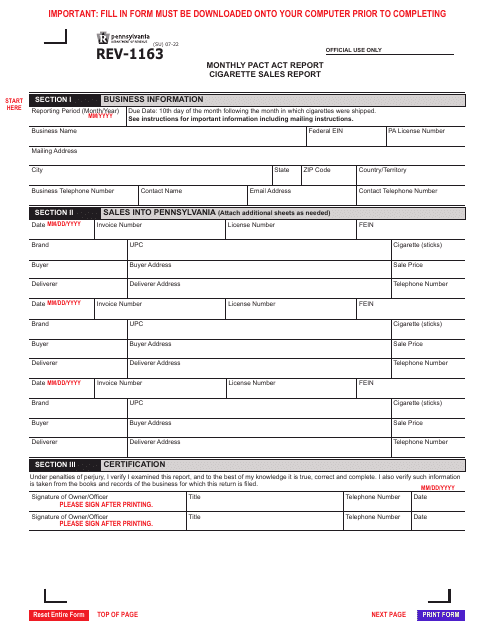

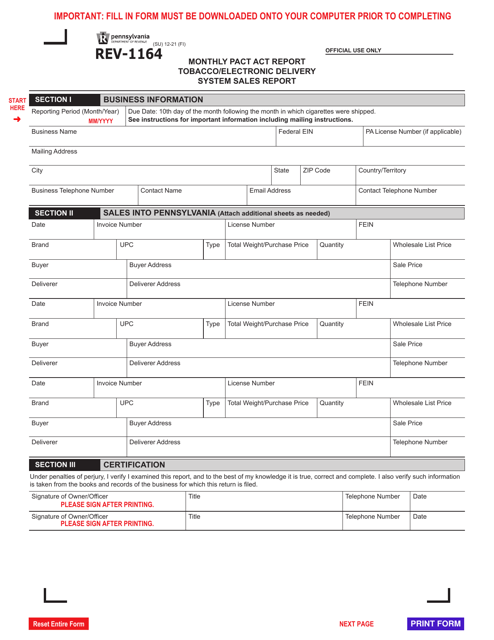

This Form is used for filing monthly reports of cigarettes and cigarette tax stamps in Pennsylvania.

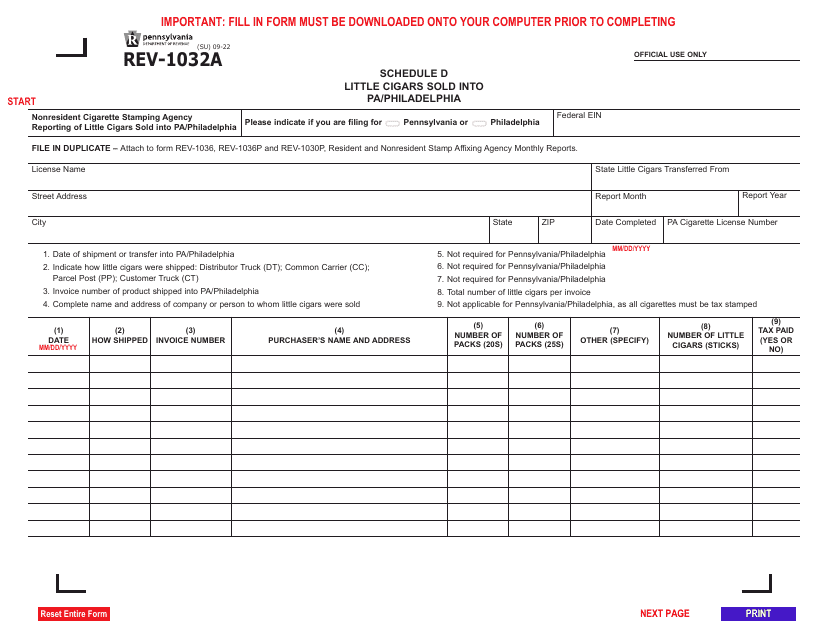

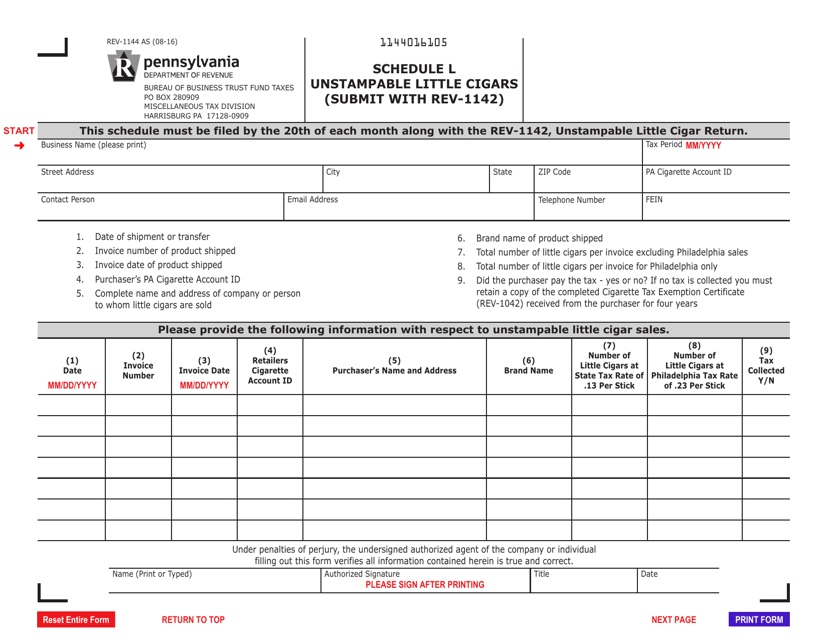

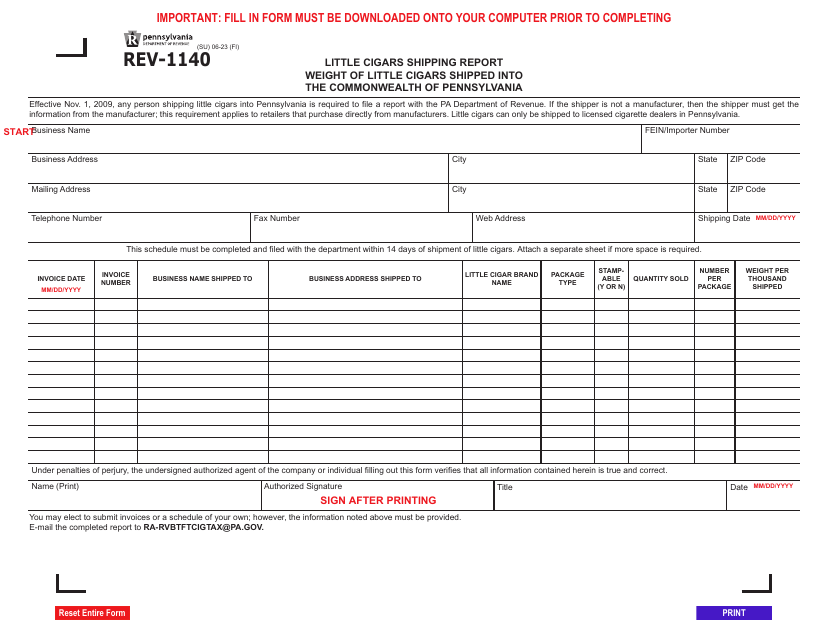

This form is used for reporting and paying the tax on unstampable little cigars in Pennsylvania.

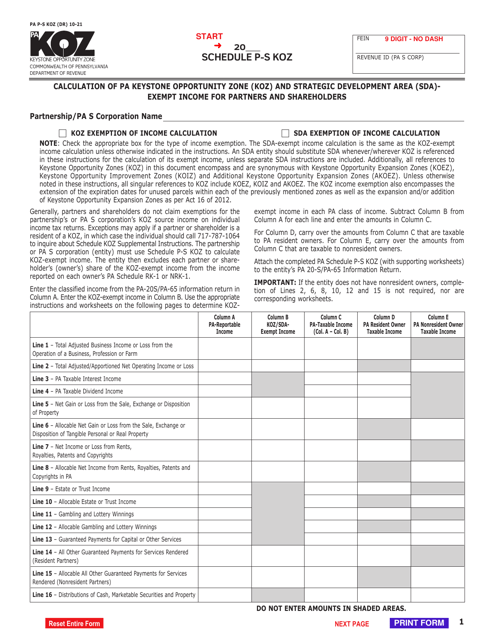

This form is used for applying for the Keystone Opportunity Zone (KOZ) or Keystone Opportunity Expansion Zone (KOEZ) in Pennsylvania.

This Form is used for calculating the tax credit for corporate net income tax in Keystone Opportunity Zone/Strategic Development Areas in Pennsylvania.

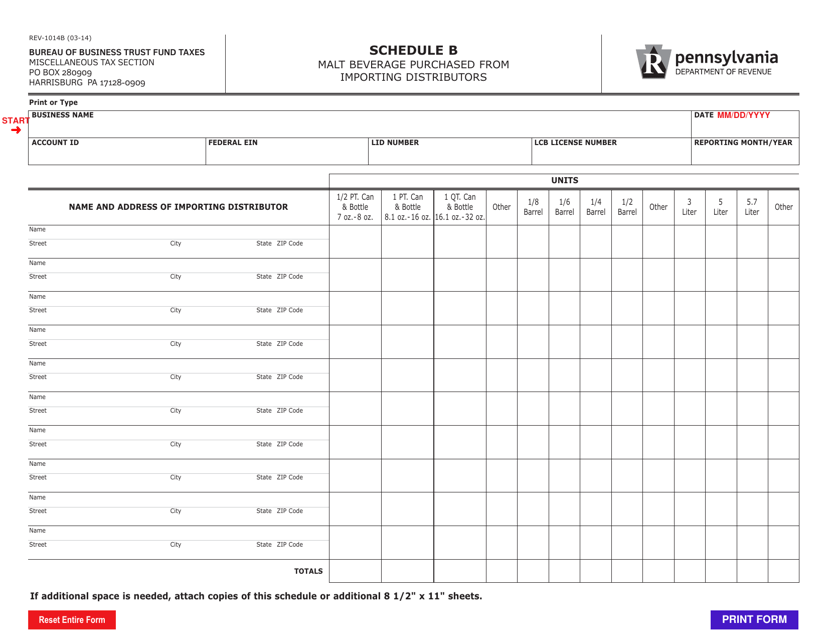

This form is used for reporting the purchase of malt beverages from an importing distributor located in Pennsylvania.

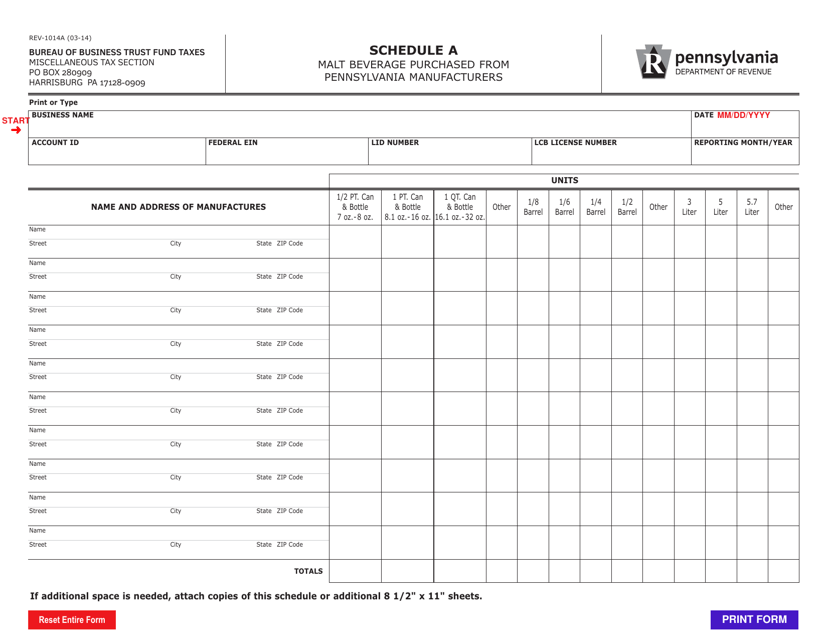

This form is used for reporting the purchase of malt beverages from Pennsylvania manufacturers in the state of Pennsylvania.

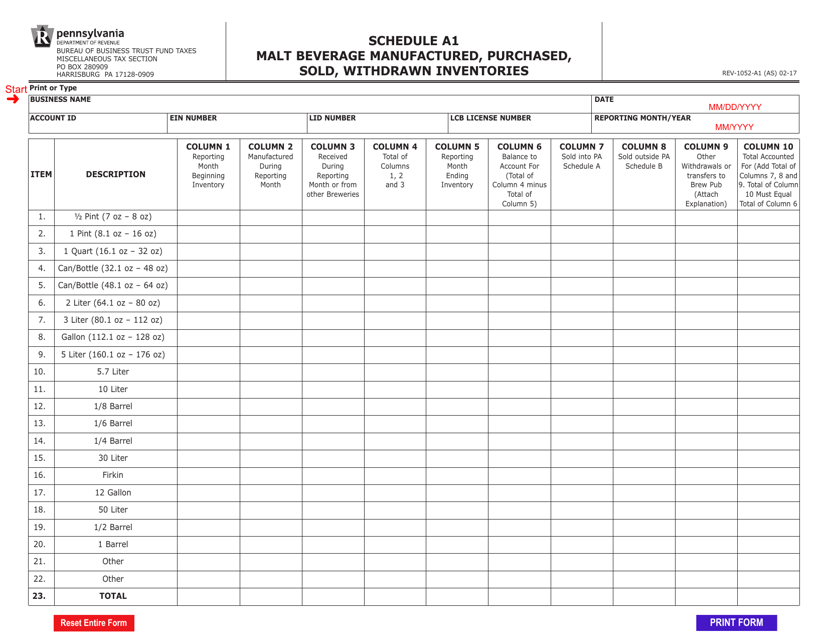

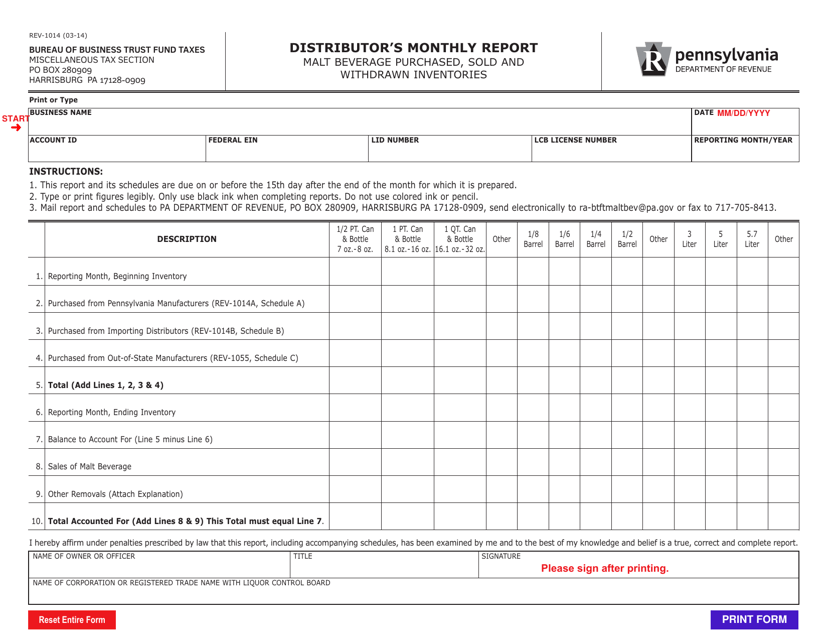

This form is used for reporting the inventory of malt beverages manufactured, purchased, sold, or withdrawn in the state of Pennsylvania.

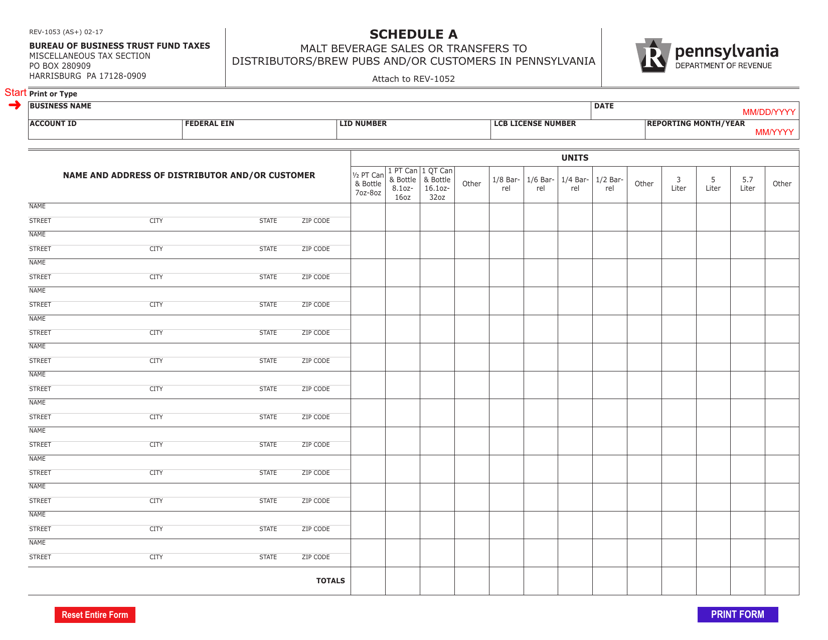

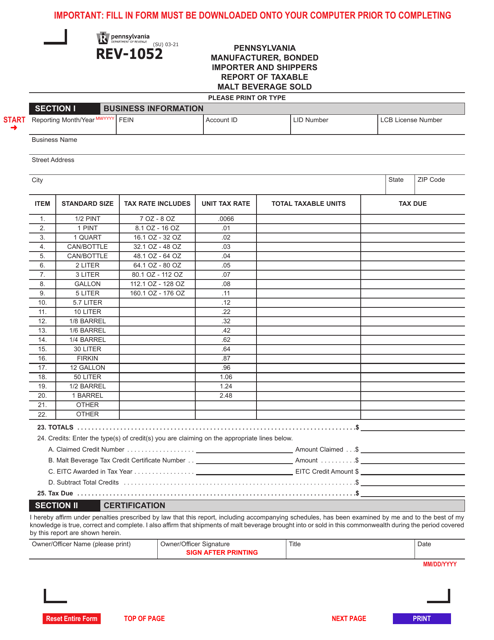

This form is used for reporting the sales of malt beverages to distributors and/or customers in Pennsylvania.

This Form is used for filing the annual report for Keystone Opportunity Zone Job Creation Tax Credit or Keystone Opportunity Expansion Zone Job Creation Tax Credit in Pennsylvania.

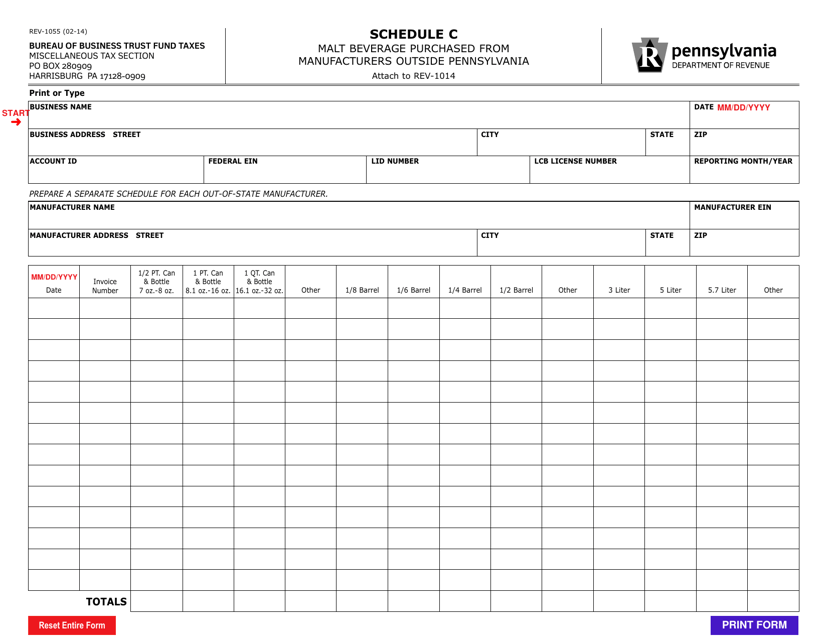

This document is used to report the purchases of malt beverages made from manufacturers outside Pennsylvania for tax purposes in Pennsylvania.

This form is used for distributors in Pennsylvania to report their monthly inventories of purchased, sold, and withdrawn malt beverages.

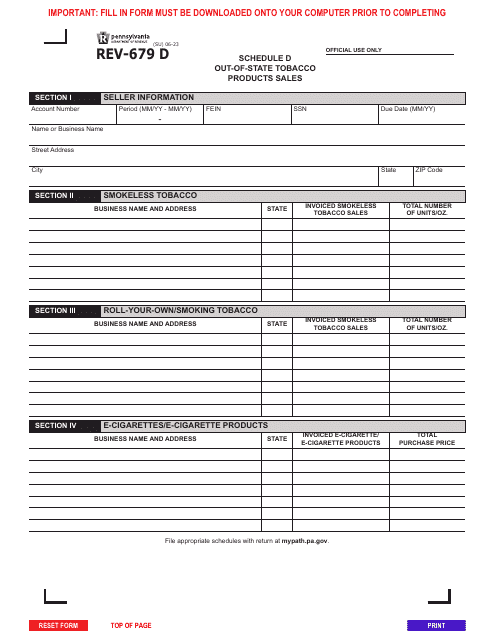

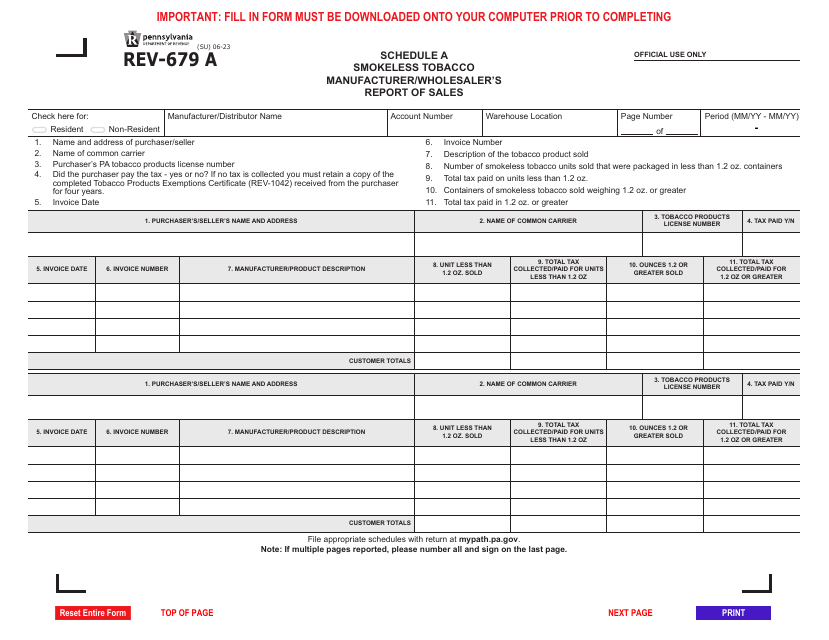

Form REV-679 A Schedule A Smokeless Tobacco Manufacturer/Wholesaler's Report of Sales - Pennsylvania

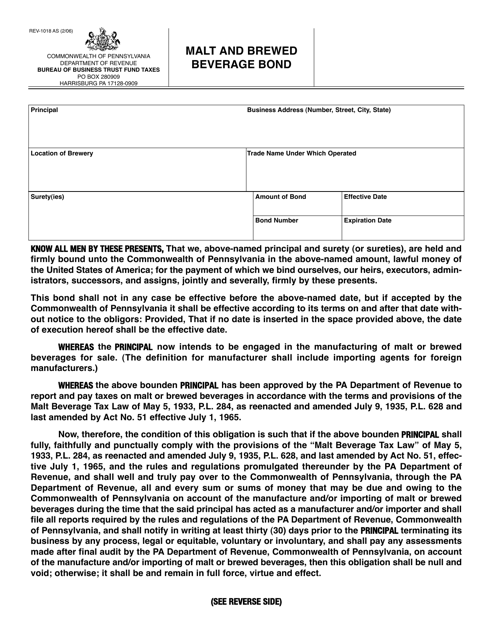

This Form is used for obtaining a Malt and Brewed Beverage Bond in the state of Pennsylvania.

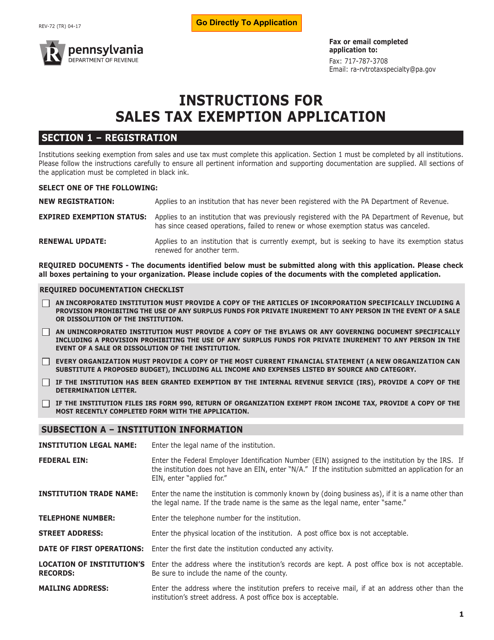

This Form is used for applying for a sales tax exemption in Pennsylvania.

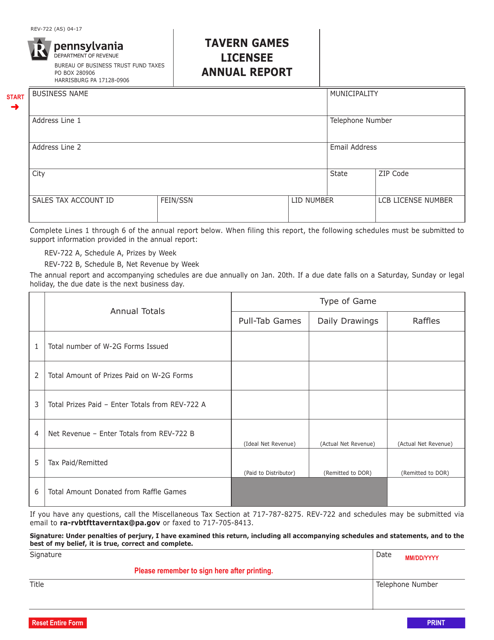

This Form is used for the annual reporting of tavern games licensees in Pennsylvania.

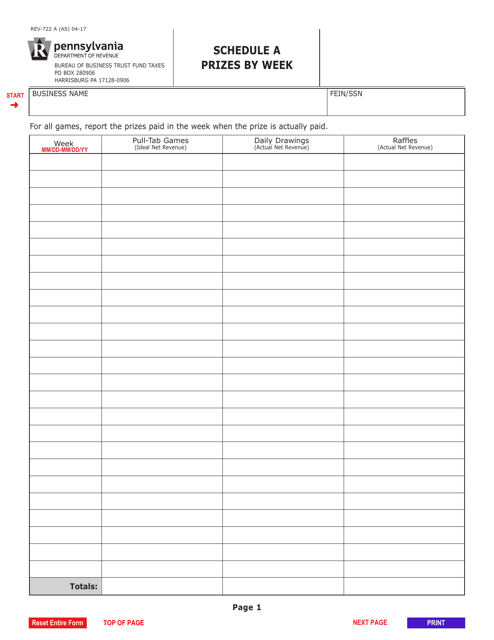

This Form is used for reporting Schedule A prizes by week in Pennsylvania.

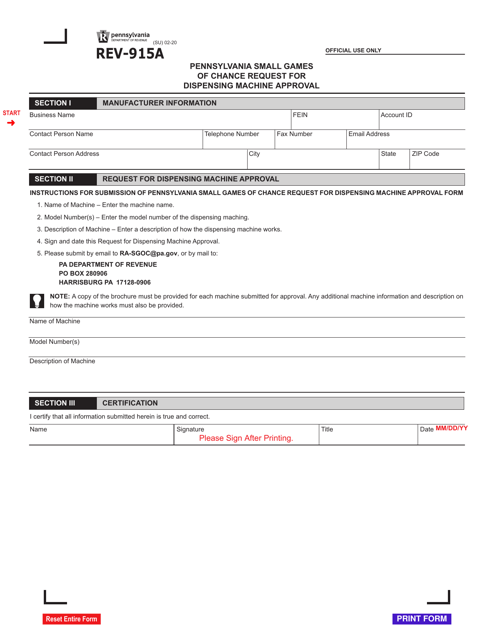

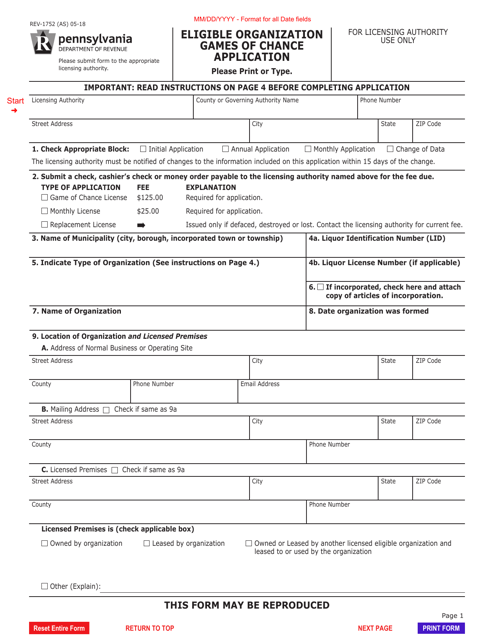

This form is used for eligible organizations to apply for games of chance in Pennsylvania.

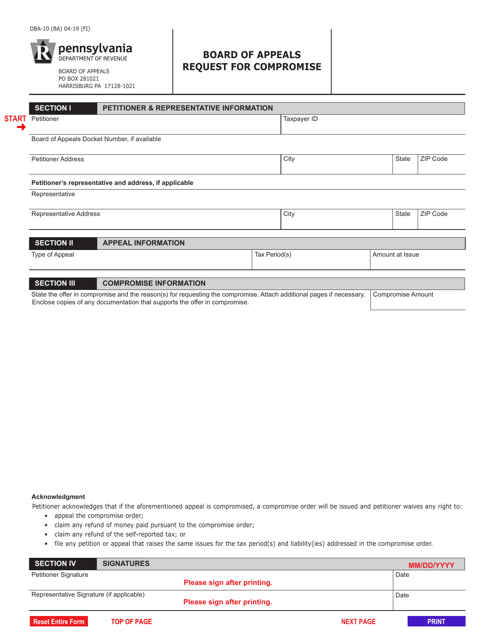

This form is used for requesting a compromise in the state of Pennsylvania.

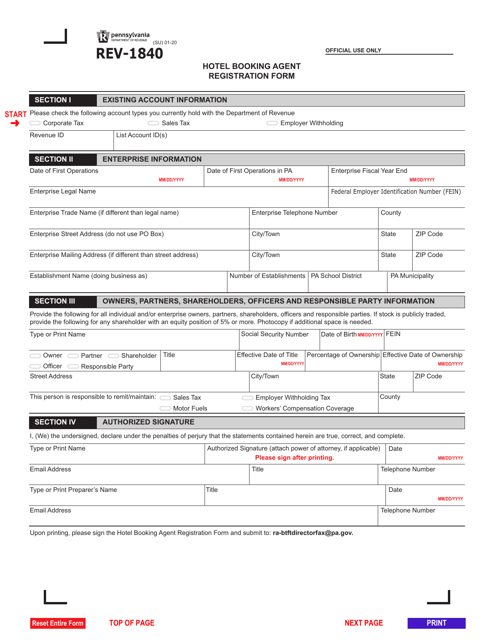

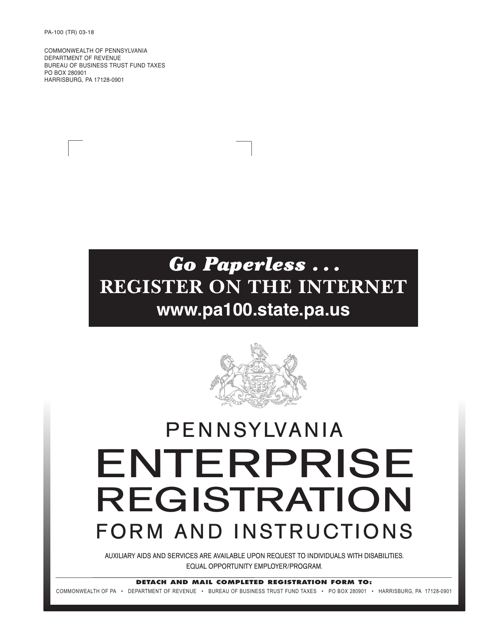

This Form is used for registering a new enterprise in Pennsylvania. It is necessary for businesses to complete this form in order to comply with state regulations and to obtain necessary licenses and permits.