Pennsylvania Department of Revenue Forms

Documents:

754

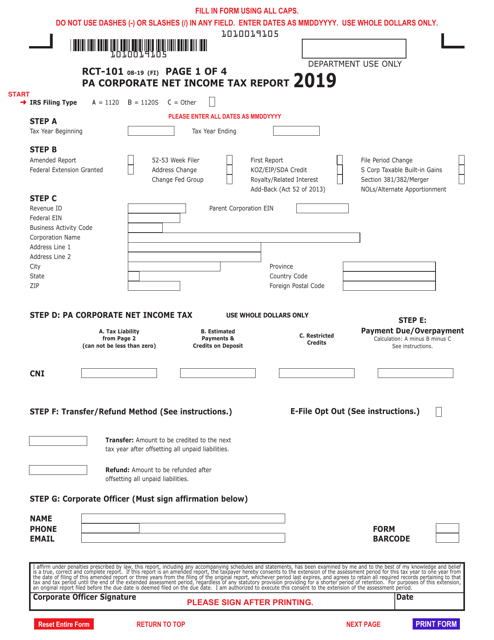

This form is used for reporting corporate net income tax in the state of Pennsylvania.

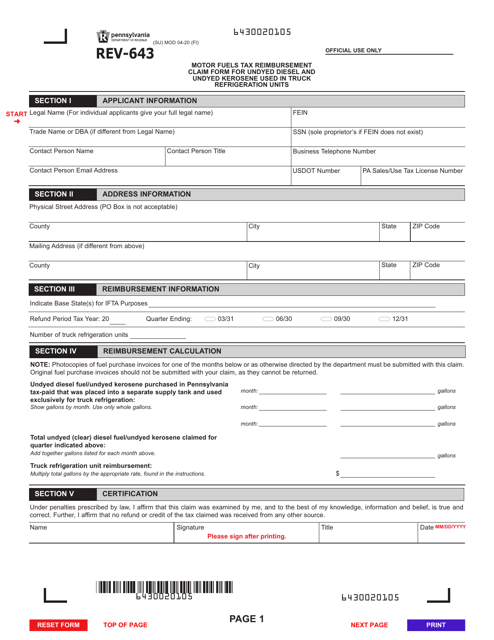

This Form is used for claiming reimbursement of motor fuels tax on undyed diesel and undyed kerosene used in truck refrigeration units in Pennsylvania.

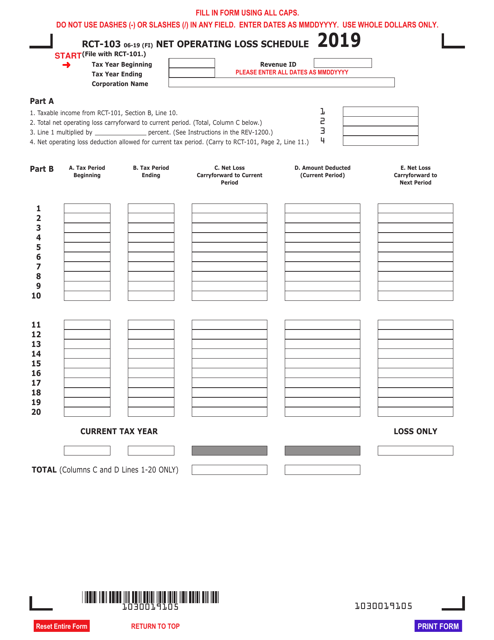

This form is used for reporting net operating losses in the state of Pennsylvania.

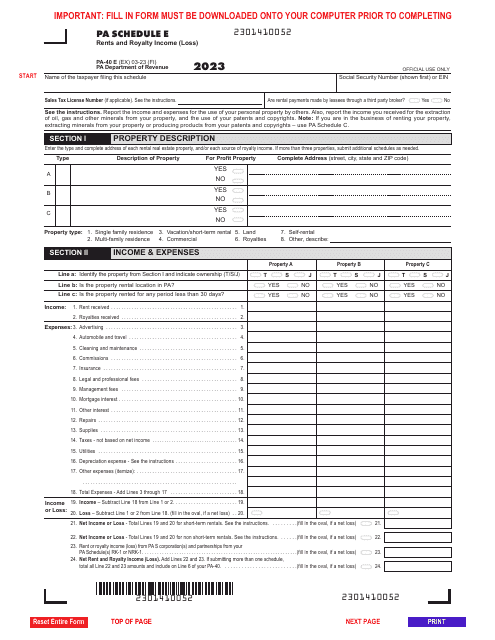

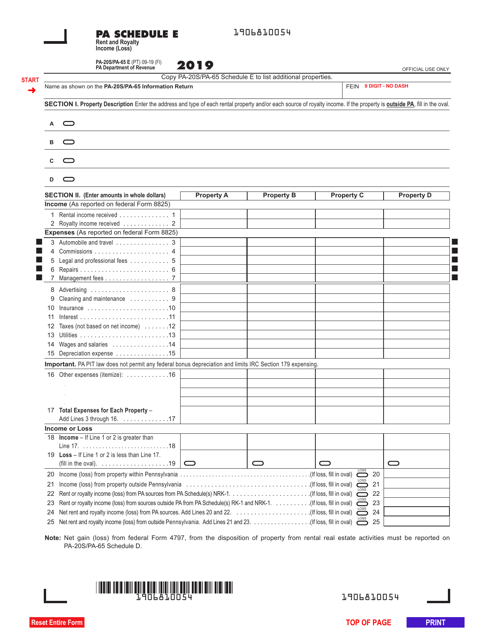

This form is used for reporting rental and royalty income or losses in the state of Pennsylvania. It is called Form PA-20S (PA-65) Schedule E.

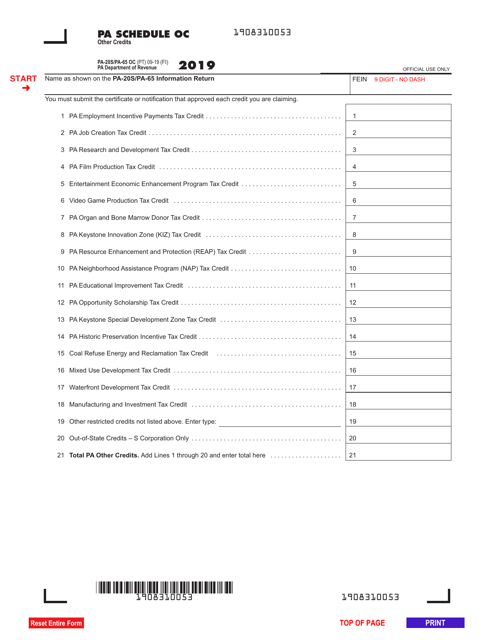

This Form is used for reporting other credits on the Pennsylvania PA-20S (PA-65) Schedule OC.

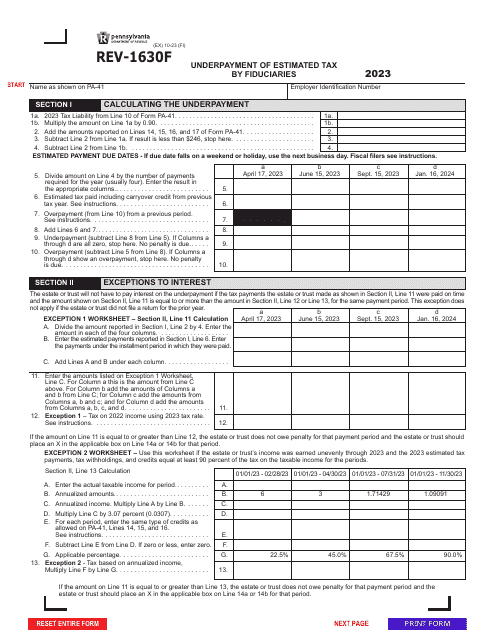

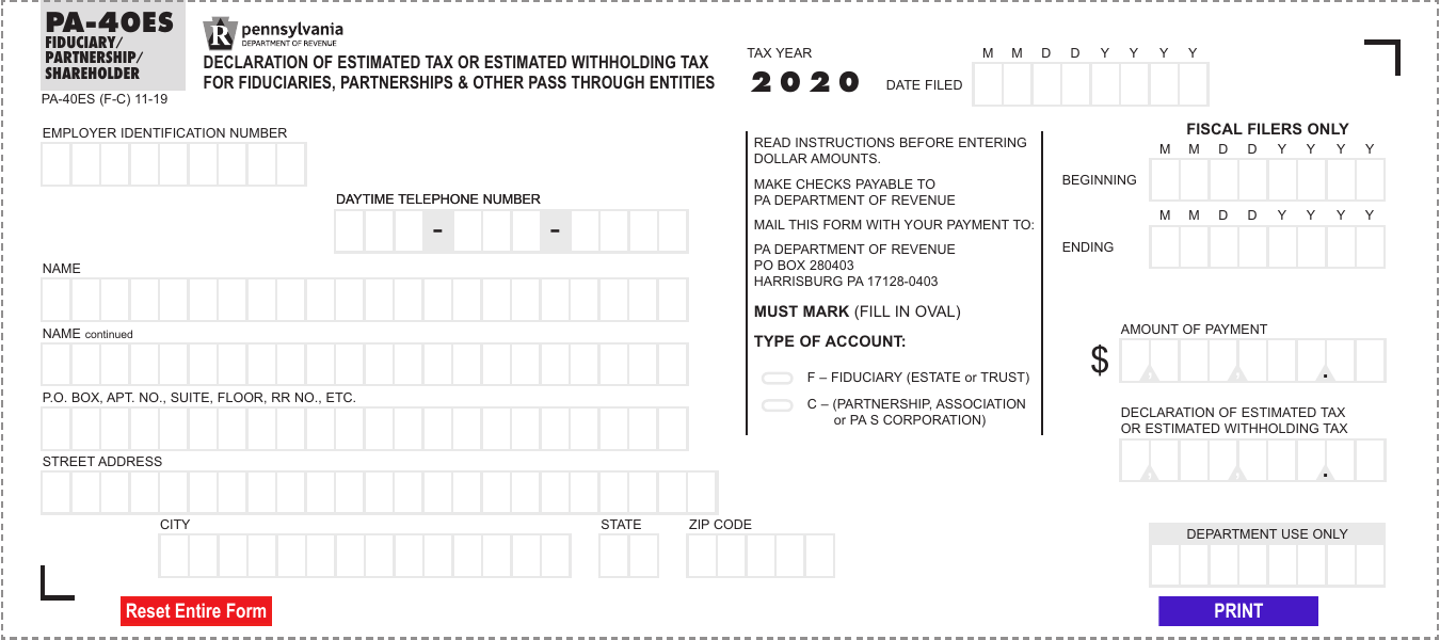

This Form is used for declaring estimated tax or estimated withholding tax for fiduciaries, partnerships, and other pass-through entities in Pennsylvania.

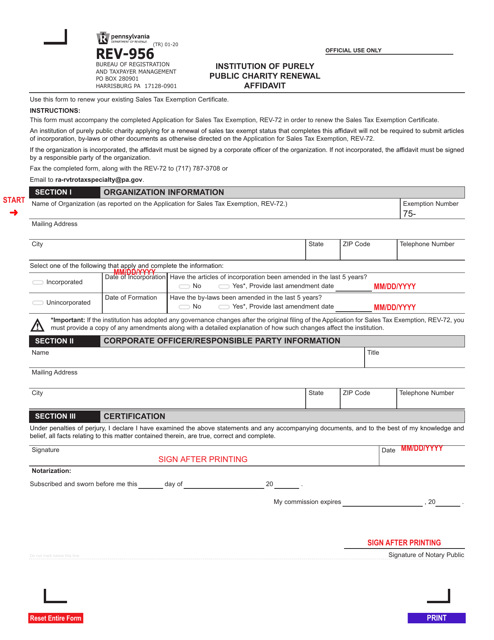

This Form is used for renewing the status of a purely public charity in Pennsylvania.

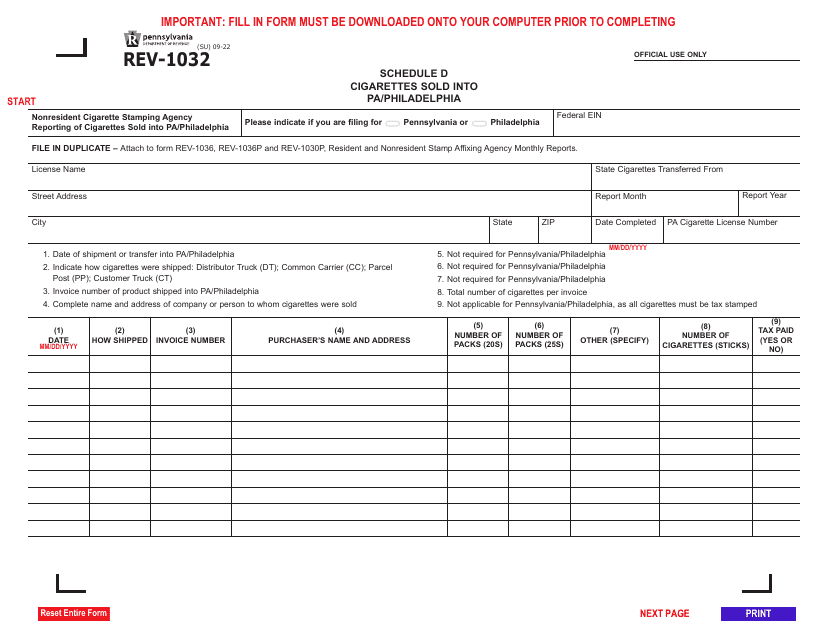

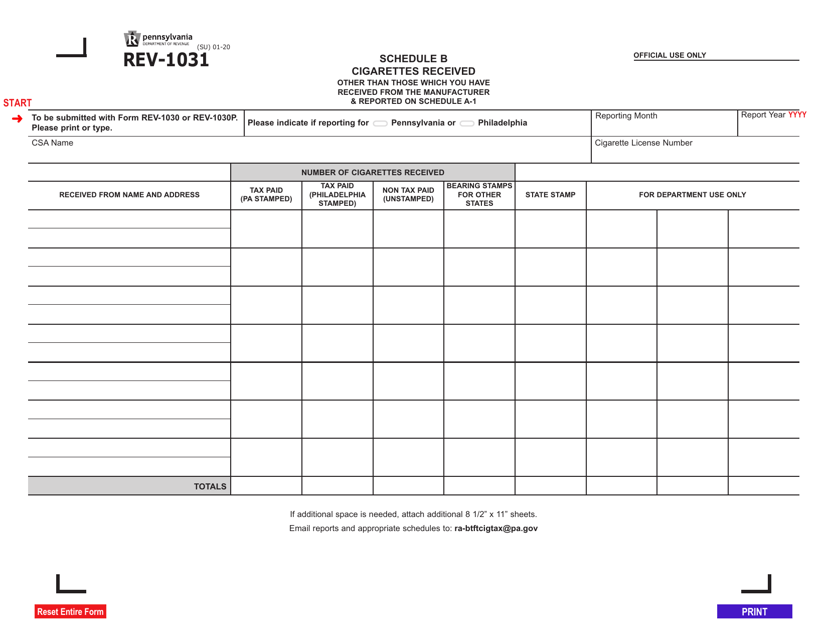

This Form is used for reporting the cigarettes received in the state of Pennsylvania. It is a schedule to be attached to Form REV-1031.

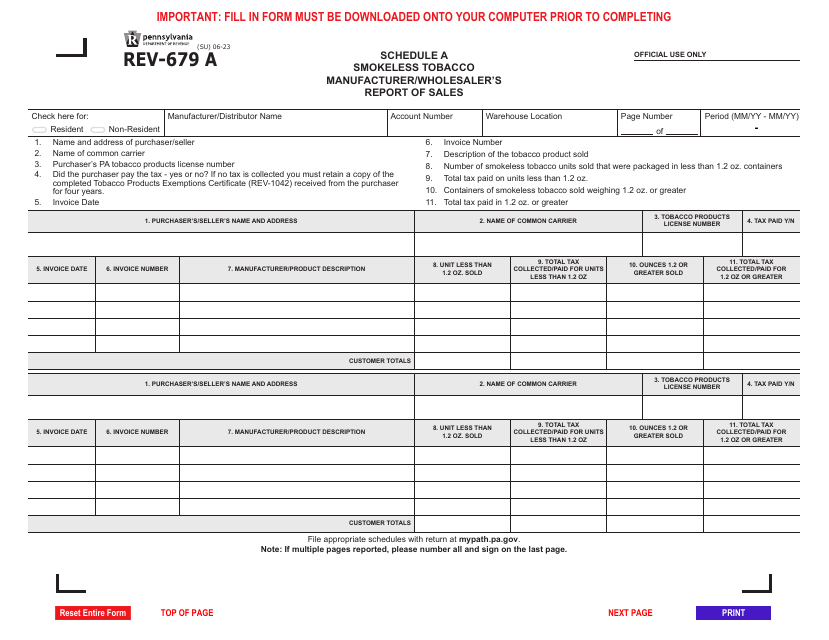

Form REV-679 A Schedule A Smokeless Tobacco Manufacturer/Wholesaler's Report of Sales - Pennsylvania

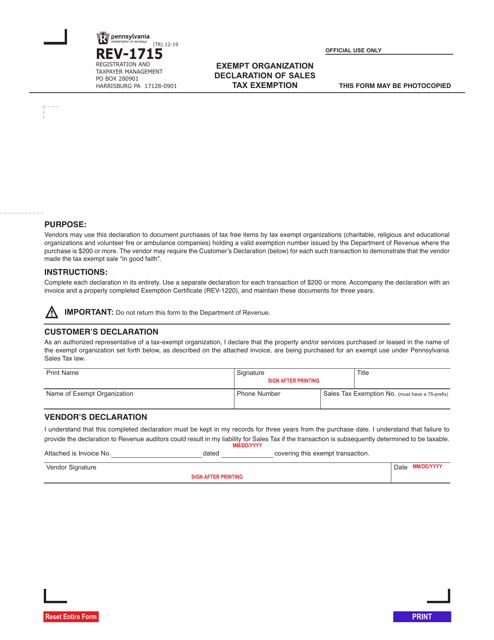

This Form is used for exempt organizations in Pennsylvania to declare their sales tax exemption status.