New York State Department of Taxation and Finance Forms

Documents:

2566

This Form is used for applying for a real property tax exemption in the City of Cohoes, New York, for capital improvements made to multiple dwelling buildings in certain cities.

This form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings in the City of Cohoes, New York.

This Form is used for applying for a real property tax exemption for capital improvements to multiple dwelling buildings within certain cities, specifically the City of Buffalo, New York. It provides instructions on how to fill out the application and includes important information regarding eligibility requirements and documentation needed.

This form is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Buffalo, located in New York.

This document provides instructions for completing Form RP-421-I, which is used to apply for a real property tax exemption for capital improvements made to multiple dwelling buildings within certain cities, specifically the City of Albany, New York.

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in certain cities, specifically Albany, New York.

This Form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings in specific cities in New York.

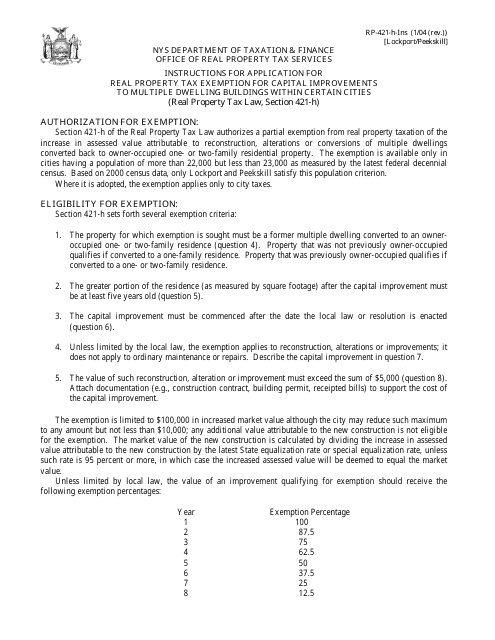

This form is used for applying for a real property tax exemption for capital improvements made to multiple dwelling buildings within the cities of Lockport and Peekskill in New York.

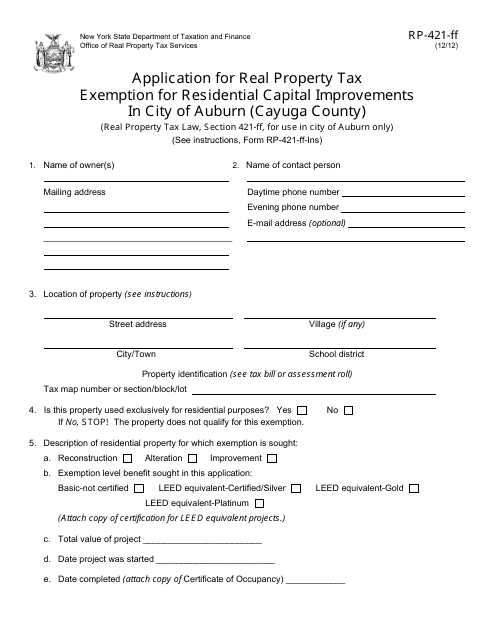

This form is used for applying for a real property tax exemption for residential capital improvements in the City of Auburn, located in Cayuga County, New York.

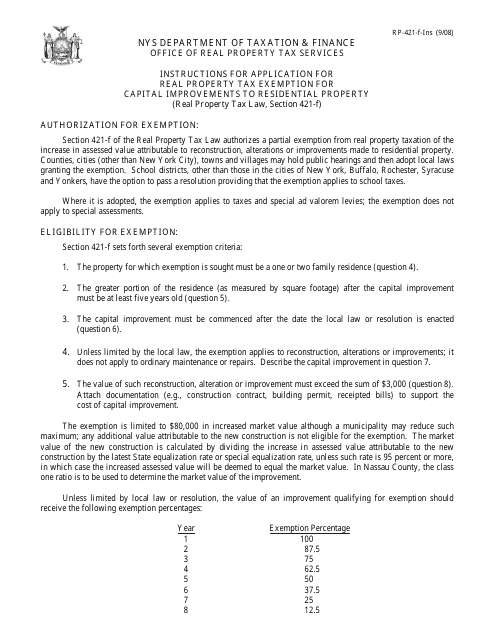

This Form is used for applying for a real property tax exemption for capital improvements made to residential property in New York. It provides instructions on how to complete the application and what documents are required.

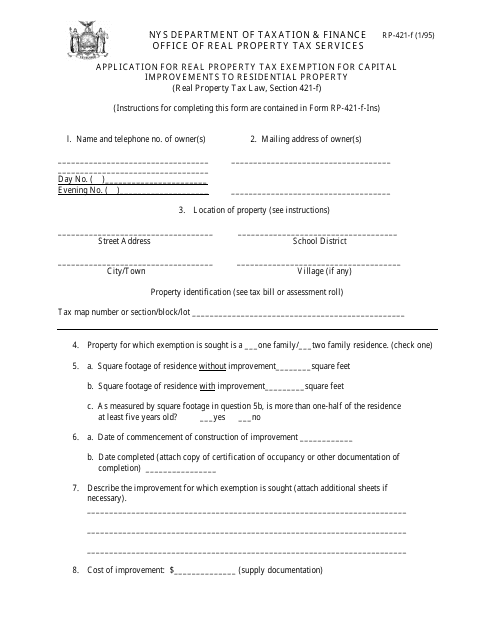

This Form is used for applying for a real property tax exemption in New York for capital improvements made to residential property.

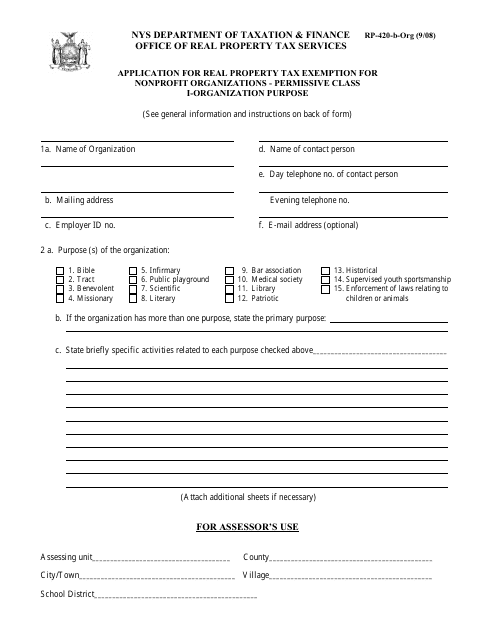

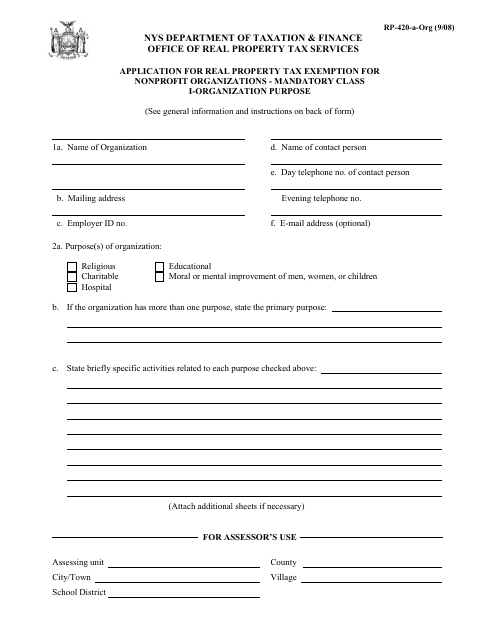

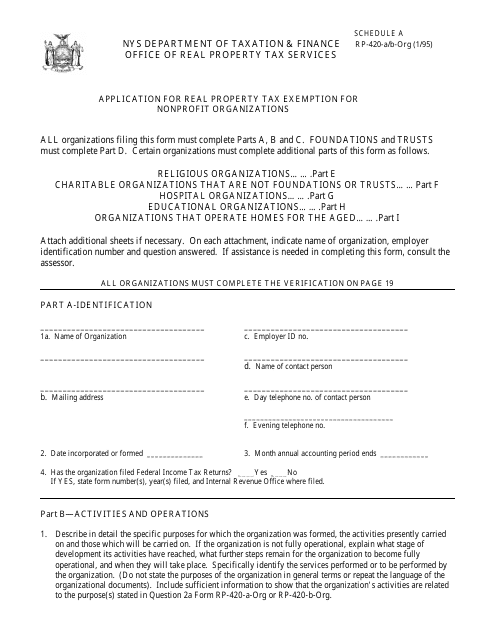

This form is used for applying for a real property tax exemption for nonprofit organizations in New York that fall under the Permissive Class I-Organization Purpose category.

This form is used for applying for a real property tax exemption for nonprofit organizations in the state of New York. It is specifically for organizations categorized as Class I-Organization Purpose.

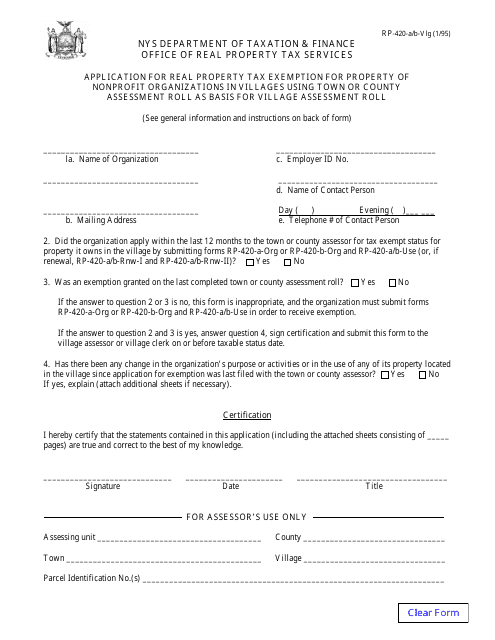

This document is used to apply for a real property tax exemption for nonprofit organizations in villages in New York. The exemption is based on the town or county assessment roll that is used for the village assessment roll.

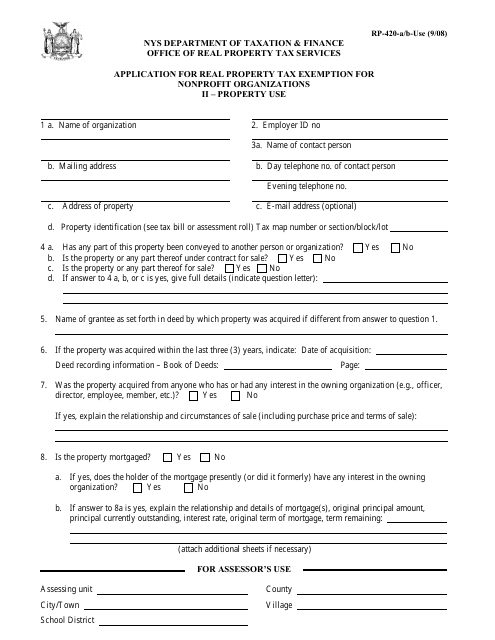

This form is used to apply for a real property tax exemption for nonprofit organizations in New York. It is specifically for nonprofit organizations that are seeking a tax exemption for property use.

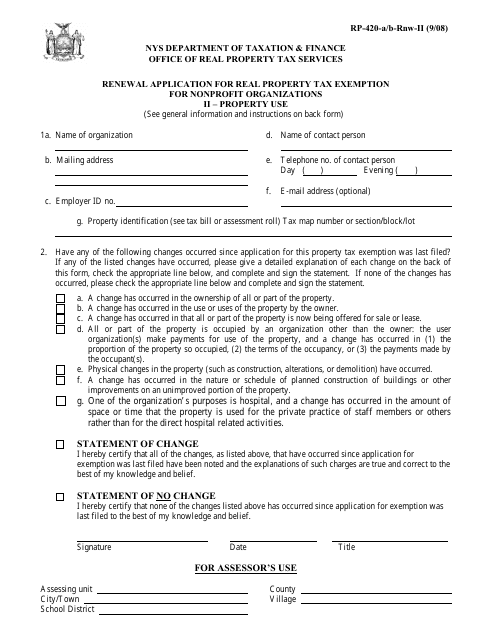

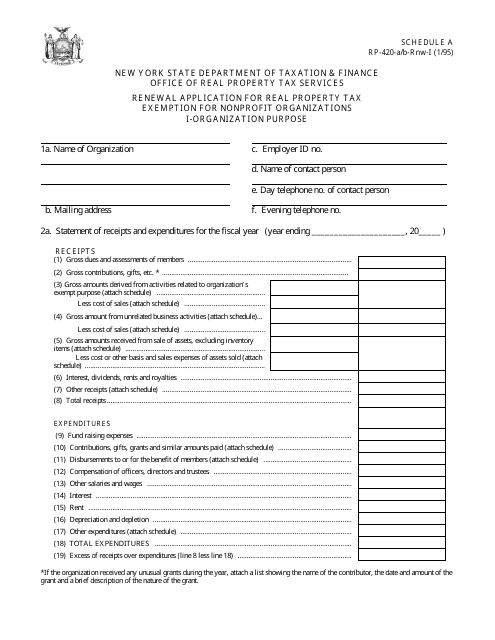

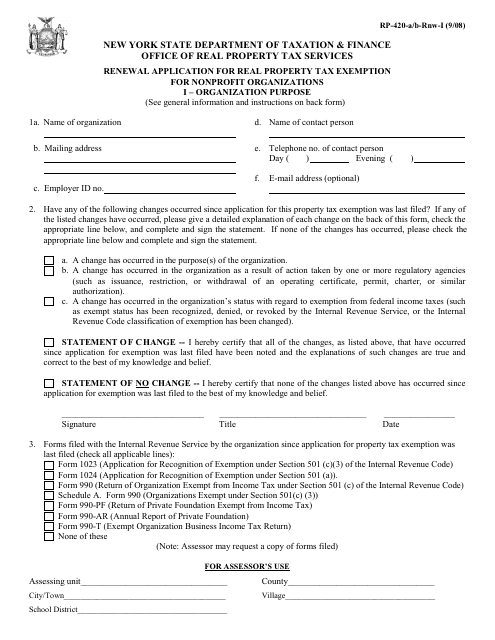

This form is used for renewing the real property tax exemption for nonprofit organizations in New York.

This Form is used for applying for the renewal of a real property tax exemption for nonprofit organizations in New York. It involves providing information about the organization's purpose.

This form is used for renewing the real property tax exemption for nonprofit organizations in New York. It is specifically for organizations that have a new purpose.

This Form is used for nonprofit organizations in New York to apply for a real property tax exemption.

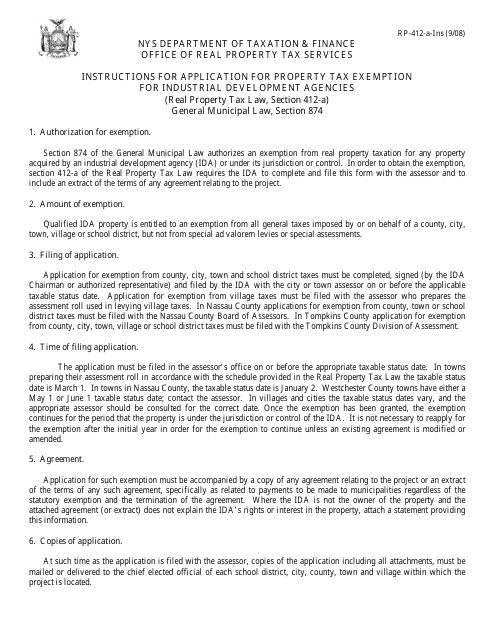

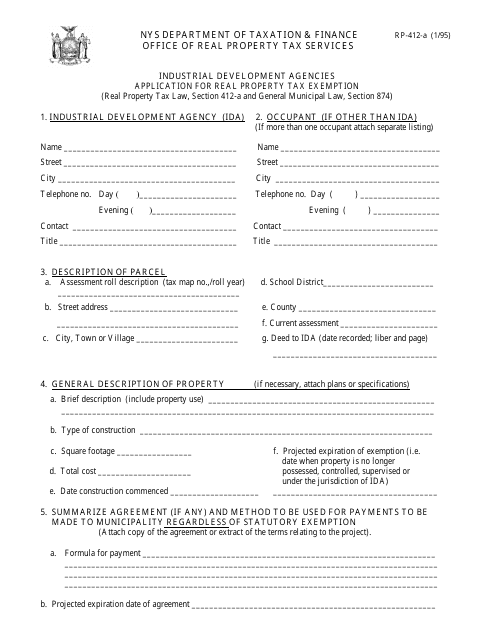

This Form is used for applying for a property tax exemption for Industrial Development Agencies in New York. It provides instructions on how to fill out the application.

Form RP-412-A Industrial Development Agencies Application for Real Property Tax Exemption - New York

This form is used for applying for a real property tax exemption through the Industrial Development Agencies (IDA) in New York. The application is for individuals or businesses seeking tax exemption on their industrial properties.

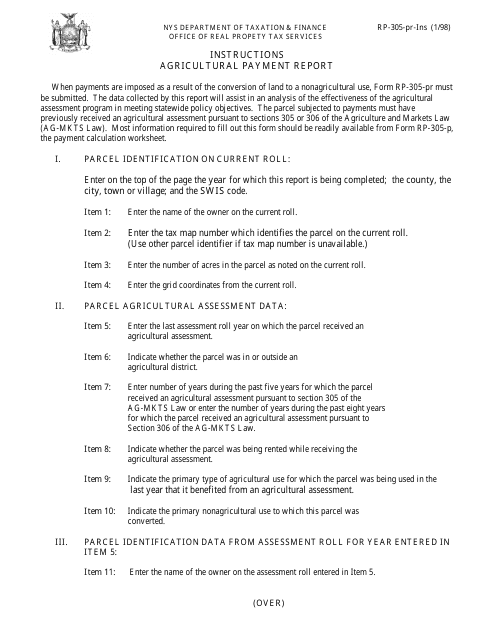

This Form is used for reporting agricultural payments in the state of New York. It provides instructions on how to accurately report and submit information related to agricultural payments.

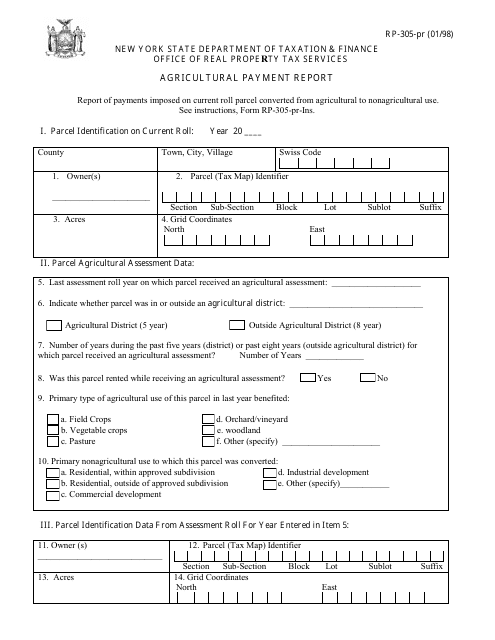

This form is used for reporting agricultural payments in the state of New York. It is required for individuals or businesses involved in agricultural activities to accurately report their payments to comply with state regulations.

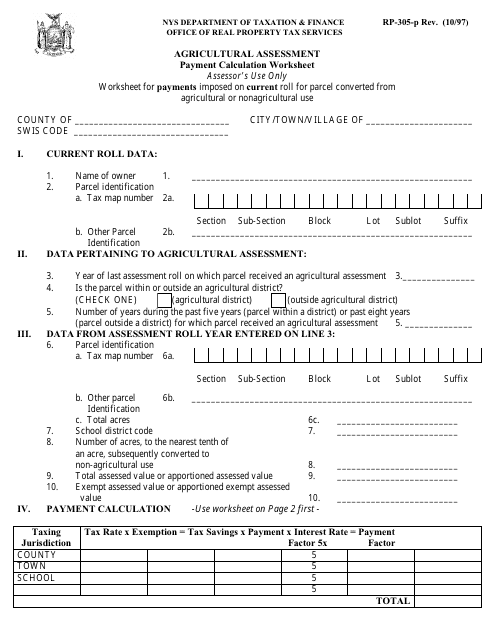

This form is used for calculating the payment for agricultural assessment in New York. It helps property owners determine their eligibility for agricultural tax exemptions and assists in the calculation of the appropriate tax rates and payments.

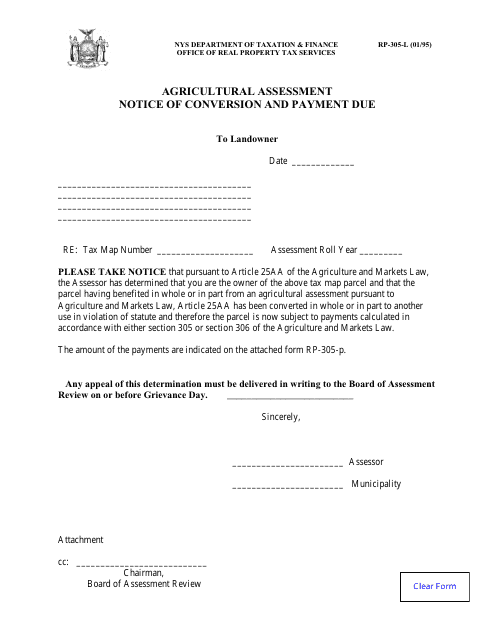

This form is used for notifying agricultural property owners in New York about the conversion of their land and the payment due for assessment.

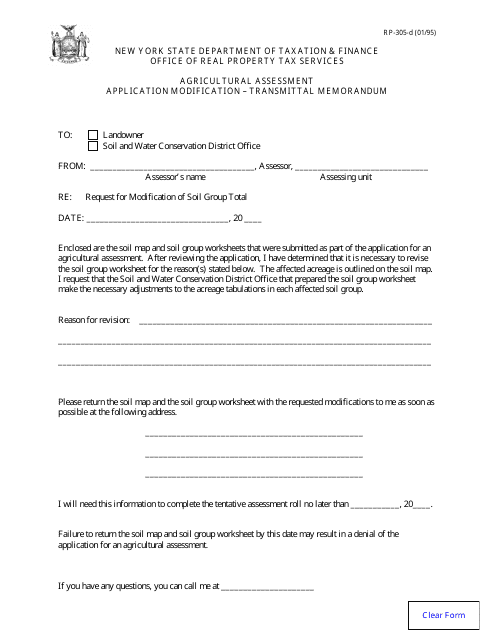

Form RP-305-D Agricultural Assessment - Application Modification - Transmittal Memorandum - New York

This form is used for requesting modifications to the agricultural assessment application in the state of New York. The form serves as a transmittal memorandum for submitting the application.

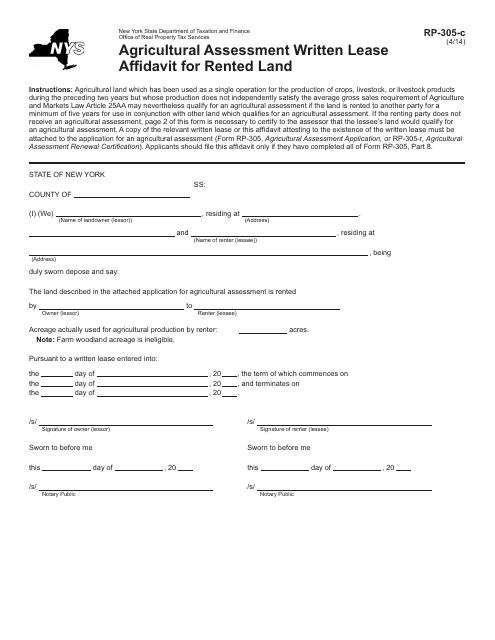

This form is used for reporting a written lease agreement for rented agricultural land in New York to qualify for agricultural assessment.

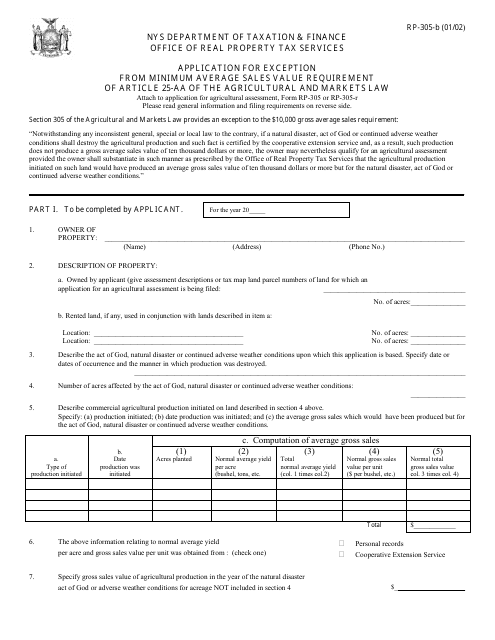

This document is used in New York to apply for an exception from the minimum average sales value requirement of Article 25-aa of the Agricultural and Markets Law.

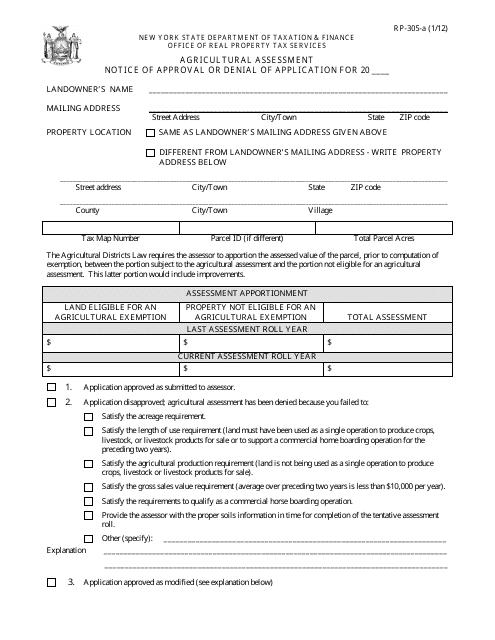

This form is used for the Agricultural Assessment Notice of Approval or Denial of Application in New York. It notifies individuals about the approval or denial of their application for agricultural assessment, which provides property tax benefits for qualifying agricultural landowners.

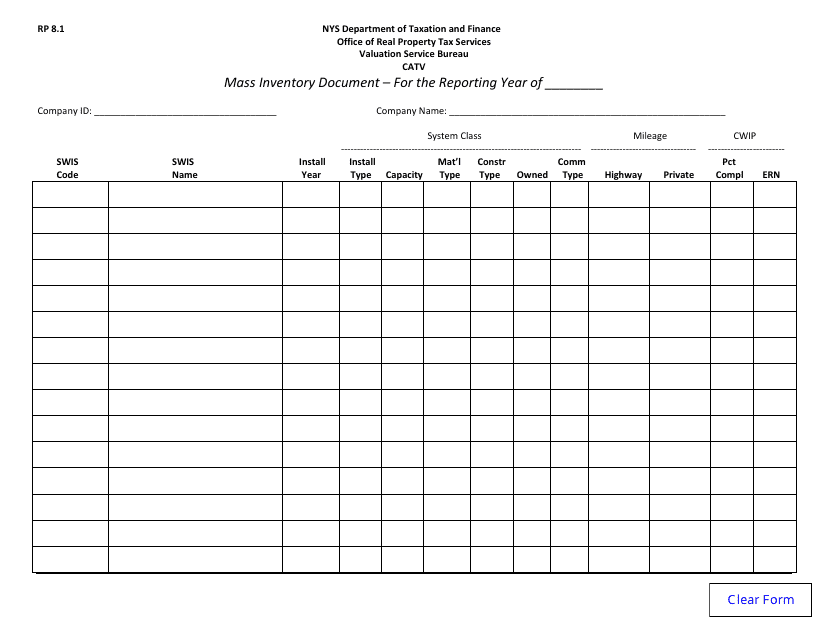

This Form is used for the mass inventory document in New York.

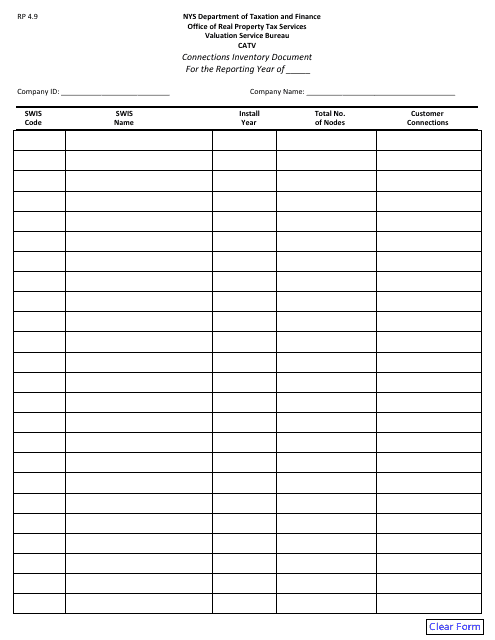

This document is used for inventory management of Catv connections in New York. It helps to keep track of the cable connections in the area.

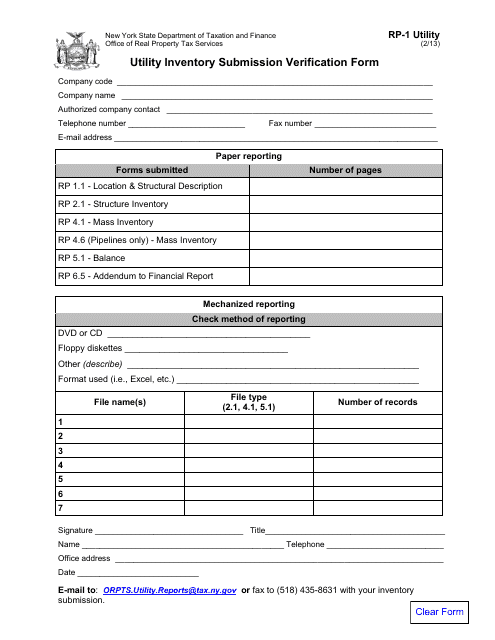

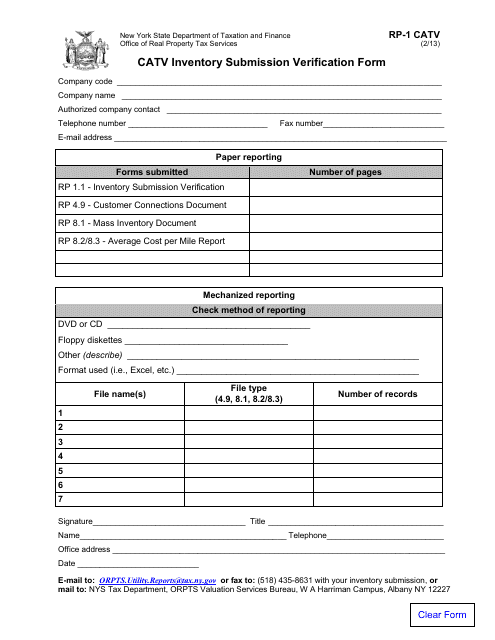

This form is used for submitting and verifying utility inventory in the state of New York.

This form is used for verifying the submission of CATV inventory in the state of New York.

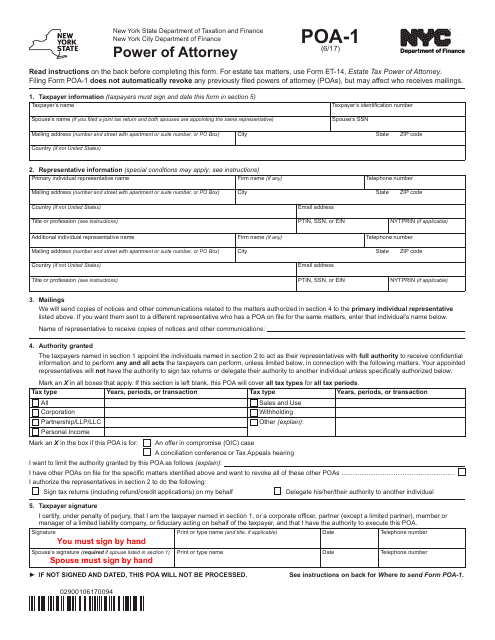

This form is used for granting someone else the power to make legal decisions on your behalf in the state of New York.

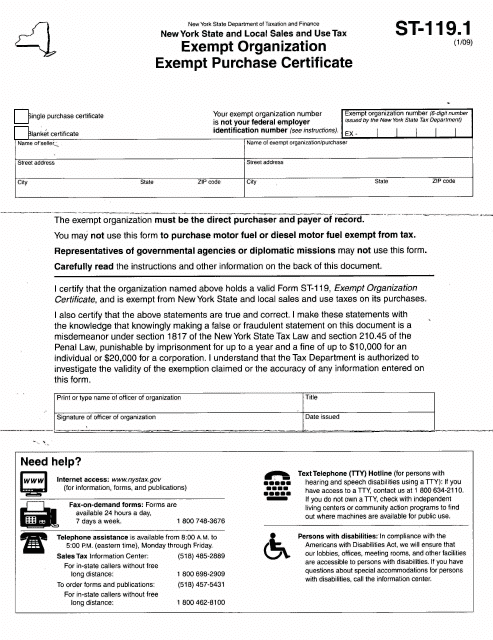

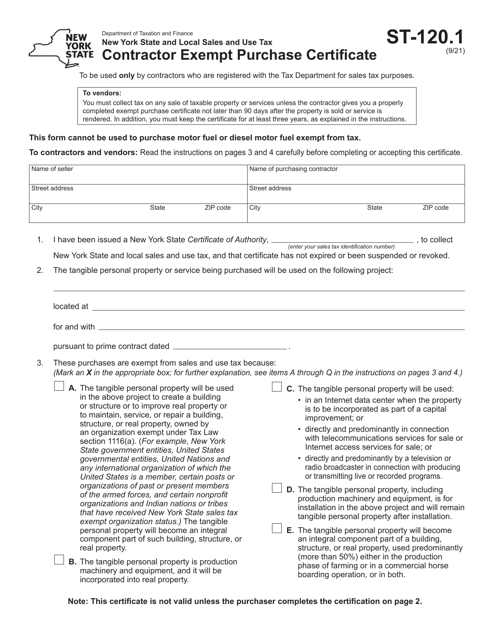

This form allows you to purchase tax-free products that are normally subject to sales tax. It is a state-specific document issued by the New York state (NY State Department of Taxation and Finance).

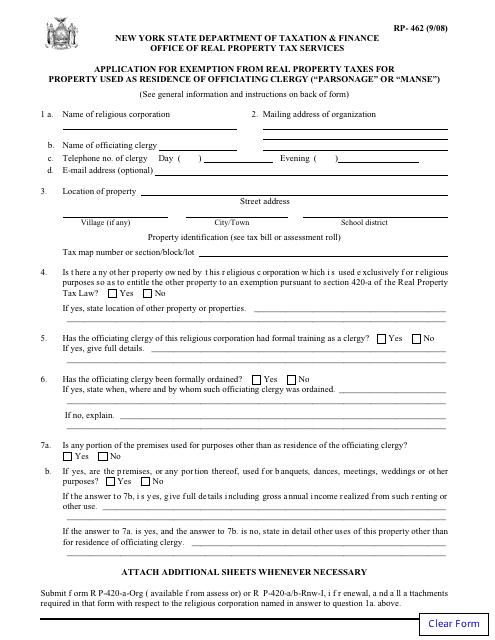

This form is used for applying for an exemption from real property taxes in New York for properties used as a residence by officiating clergy, such as a parsonage or manse.

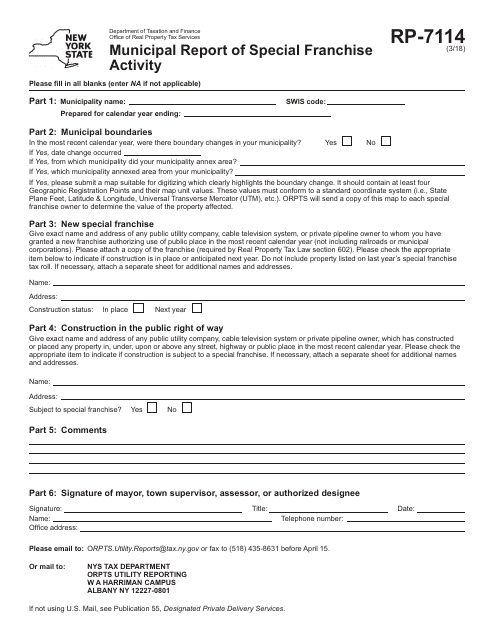

This form is used for reporting special franchise activity in municipalities in New York.

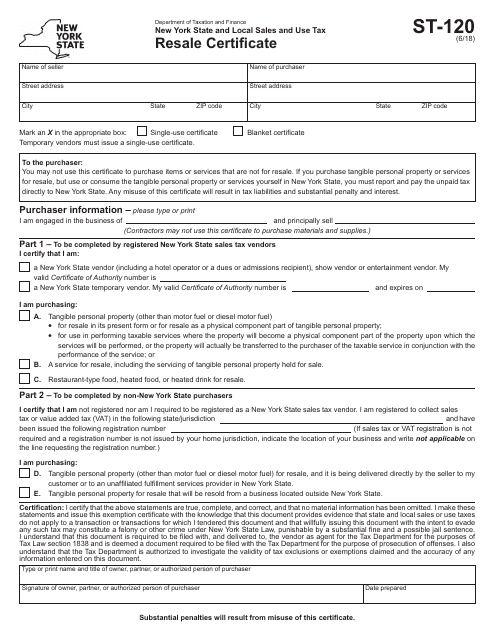

This Form is used for businesses in New York to provide a resale certificate for tax-exempt purchases.

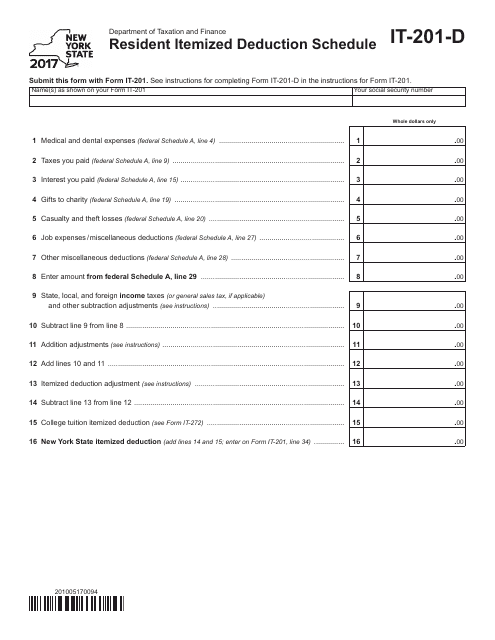

This form is used for reporting itemized deductions for residents of New York on their state tax return.

![Instructions for Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349862/instruction-for-form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york_big.png)

![Instructions for Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349864/instruction-for-form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york_big.png)

![Instructions for Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349866/instructions-for-form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-albany-new-york_big.png)

![Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york_big.png)

![Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york_big.png)