New York State Department of Taxation and Finance Forms

Documents:

2566

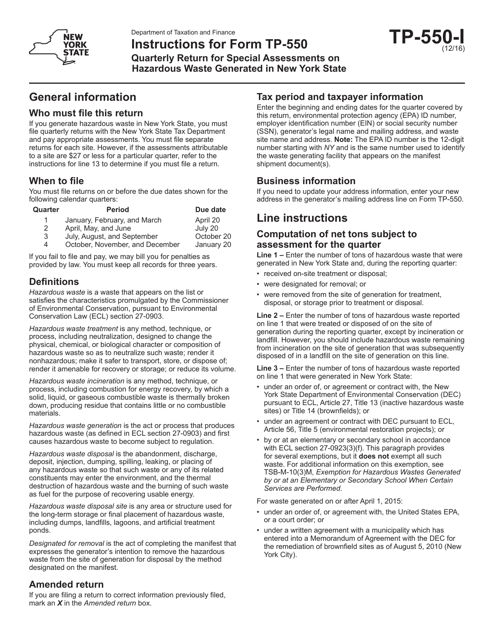

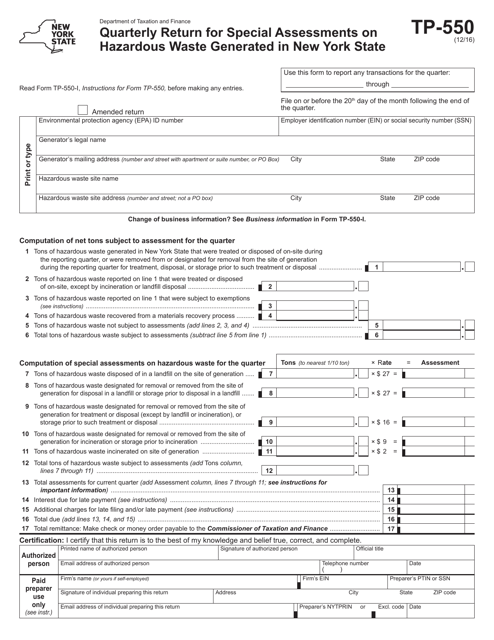

This form is used for reporting special assessments on hazardous waste generated in New York State on a quarterly basis. It provides instructions on how to fill out and submit the form correctly.

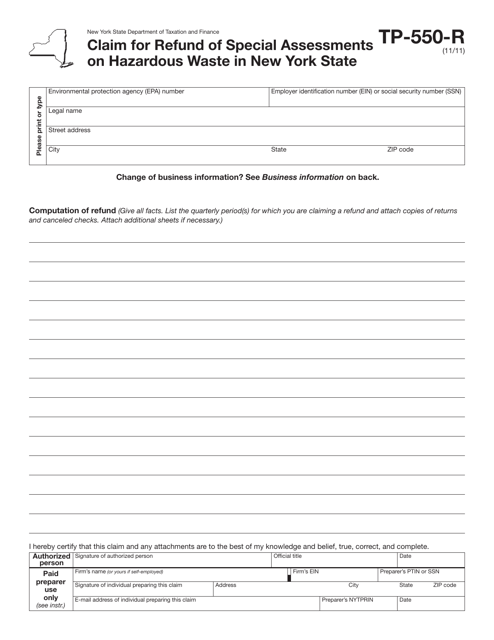

This Form is used for claiming a refund of special assessments on hazardous waste in the state of New York.

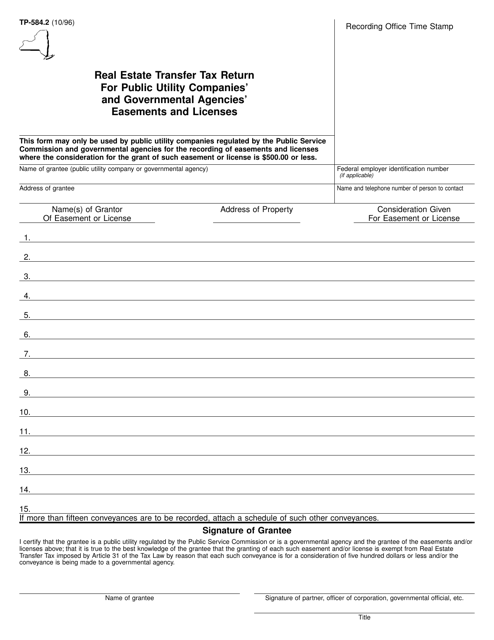

This form is used for reporting and paying transfer taxes on real estate transactions involving easements and licenses granted by public utility companies and governmental agencies in New York.

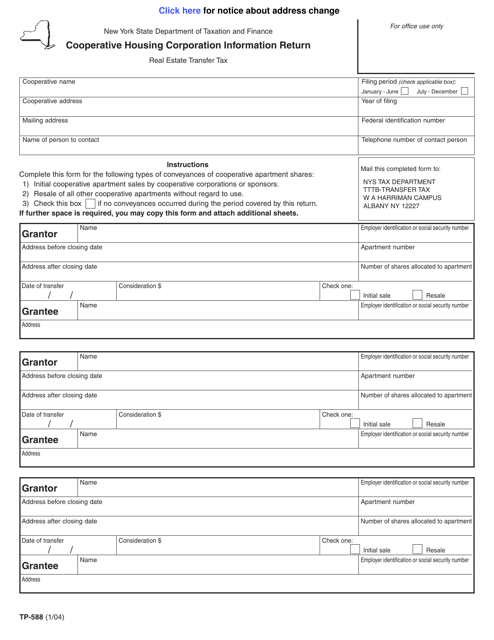

This Form is used for Cooperative Housing Corporations in New York to report their information to the state.

This form is used for reporting special assessments on hazardous waste generated in New York State on a quarterly basis. It is required for businesses in New York that generate hazardous waste.

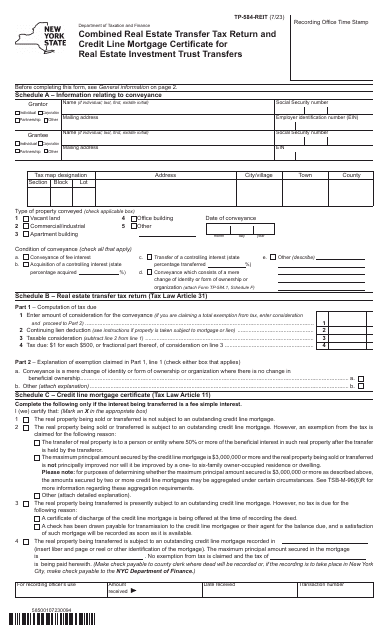

This form is used for reporting real estate transfers, credit line mortgages, and claiming exemption from paying estimated personal income tax in New York.

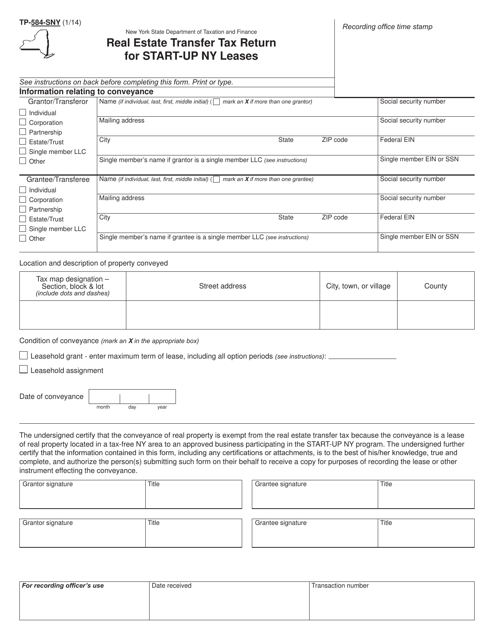

This form is used for reporting and paying the real estate transfer tax on Start-Up NY leases in New York.

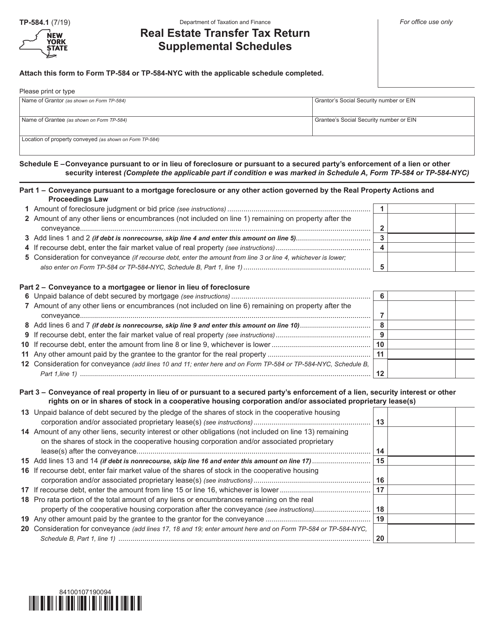

This form is used for reporting supplemental schedules related to the Real Estate Transfer Tax Return in New York.

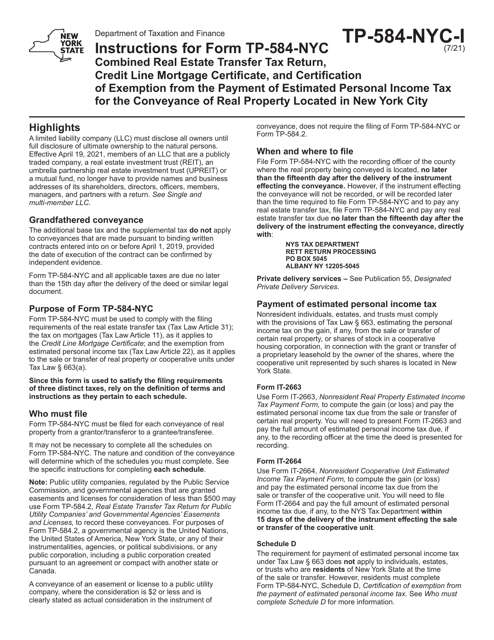

This Form is used for filing real estate transfer tax return, mortgage certificate, and exemption certification for properties located in New York City. It provides instructions on how to complete the form and file it correctly.

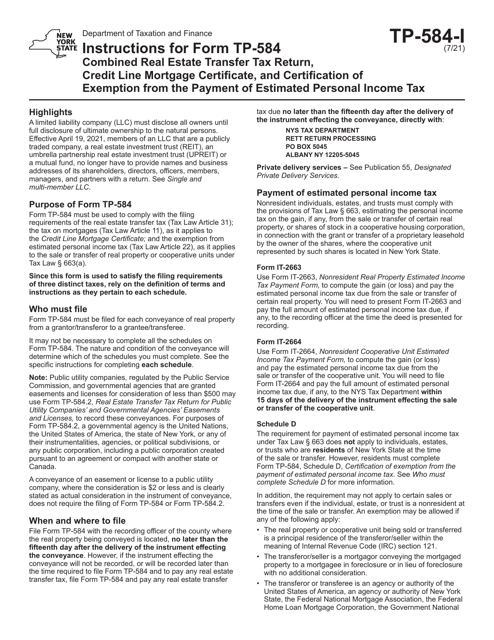

This form is used in New York for reporting real estate transfers, providing credit line mortgage information, and certifying exemption from estimated personal income tax payments. It includes instructions on how to accurately complete the form.

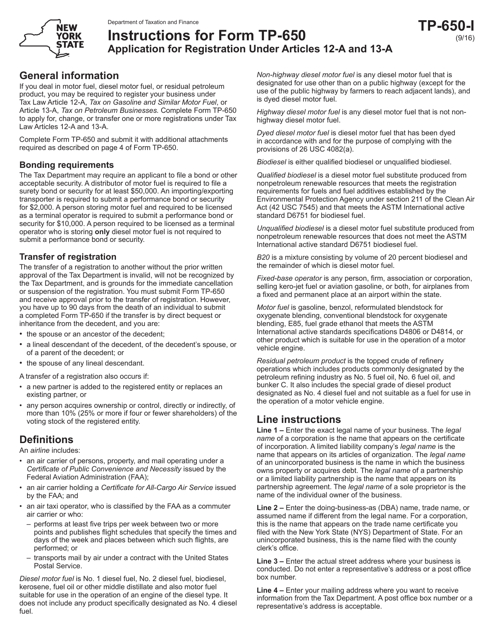

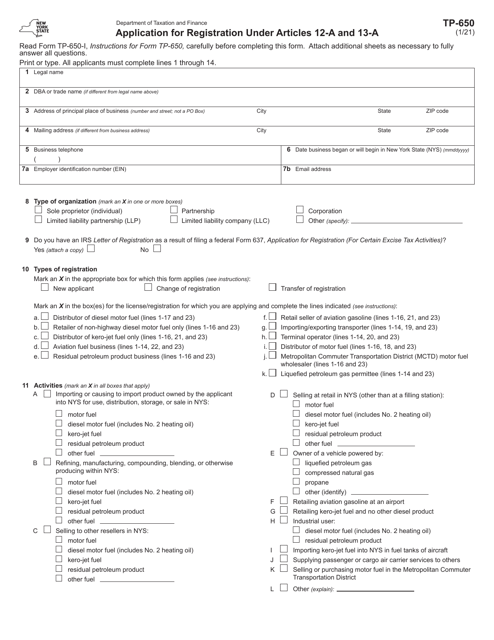

This Form is used for applying for registration under Articles 12-a and 13-a in the state of New York. It provides instructions for completing and submitting the application.

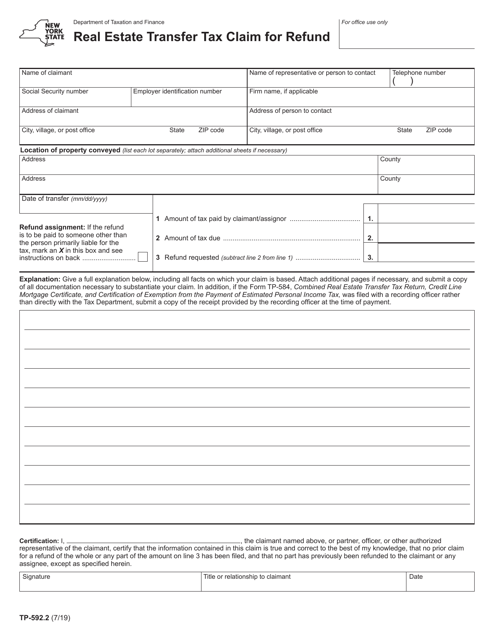

This form is used for claiming a refund of real estate transfer tax in New York.

This form is used for individuals or businesses to apply for registration under Articles 12-a and 13-a in the state of New York. It is required for certain types of permits and certifications.

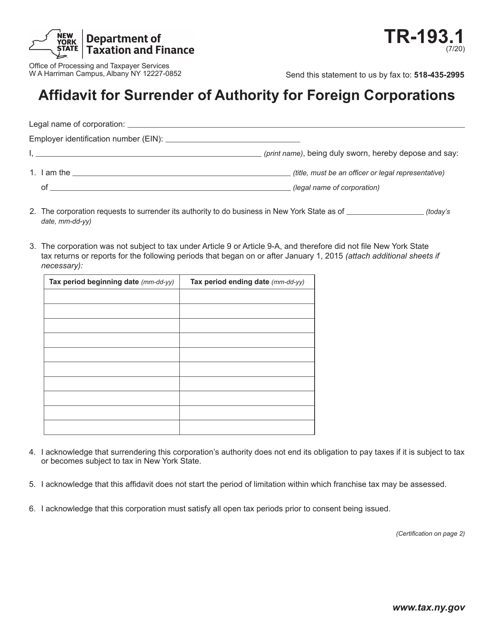

This document is used for foreign corporations in New York to surrender their authority.

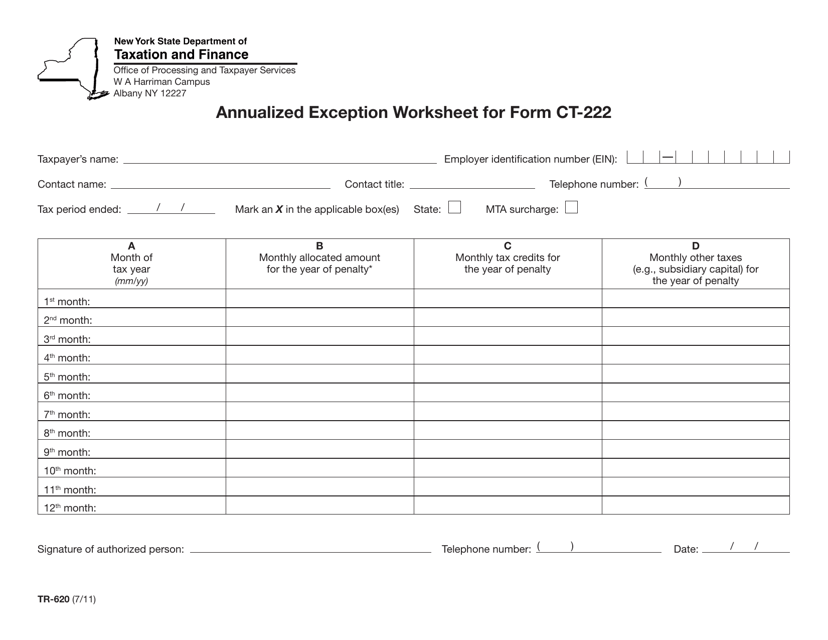

This form is used for calculating annualized exceptions for Form CT-222 in New York. It helps businesses determine their qualifying exceptions for state tax purposes.

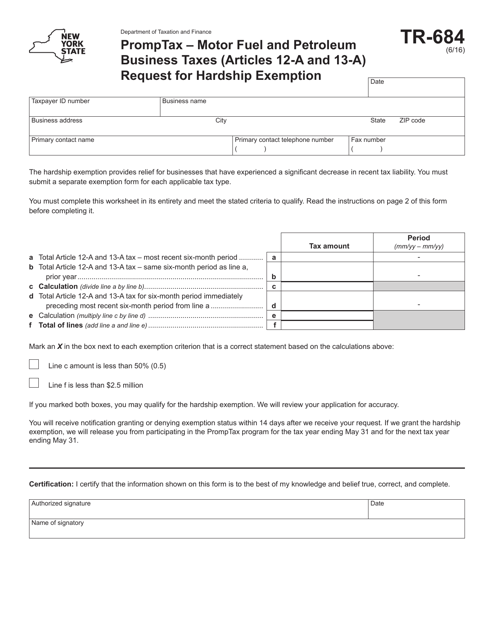

This form is used for requesting a hardship exemption for motor fuel and petroleum business taxes in New York, as outlined in Articles 12-a and 13-a.

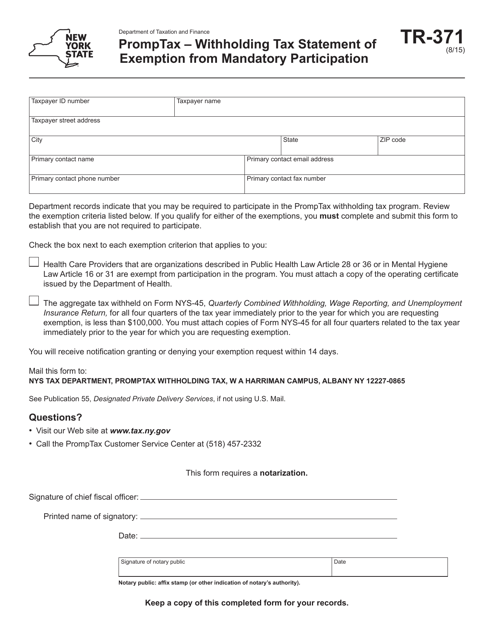

This Form is used for claiming exemption from mandatory participation in withholding tax in New York.

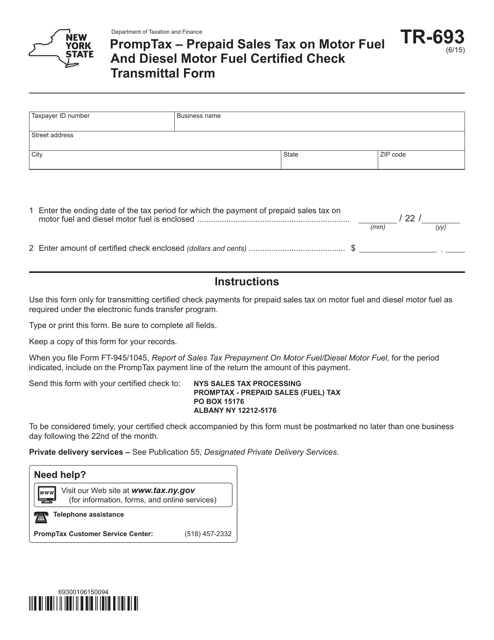

This form is used for transmitting certified checks for prepaid sales tax on motor fuel and diesel motor fuel in New York.

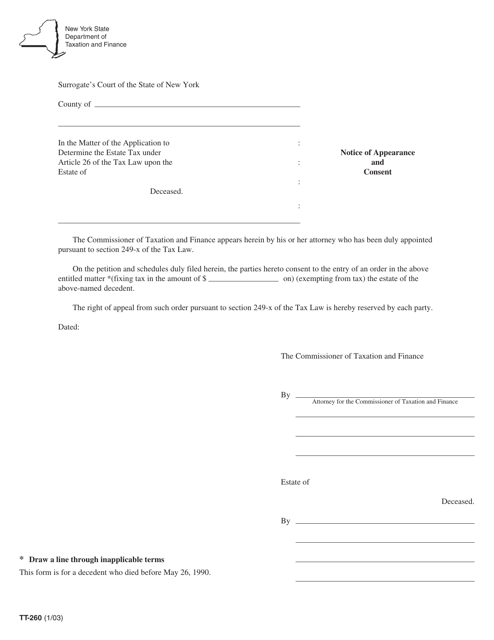

This document is used for submitting a notice of appearance and consent in New York. It is required when a party wants to participate in a legal proceeding and provide their consent.

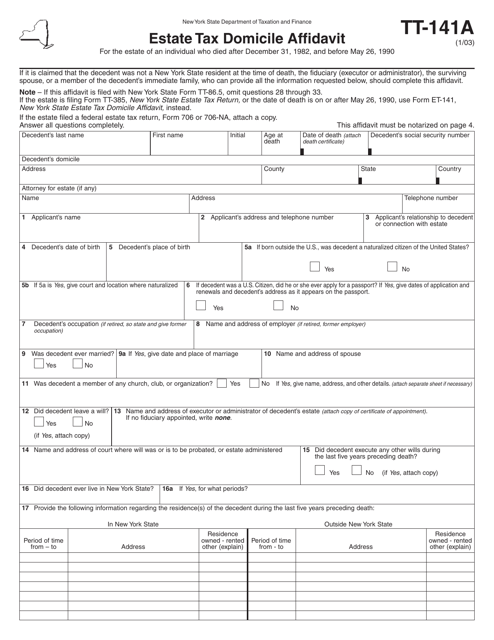

This form is used for declaring the domicile of a deceased individual for estate tax purposes in the state of New York.

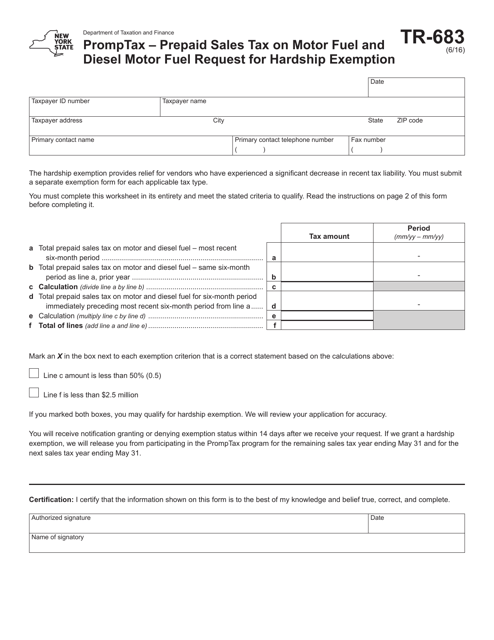

This form is used for requesting a hardship exemption for prepaid sales tax on motor fuel and diesel motor fuel in New York.

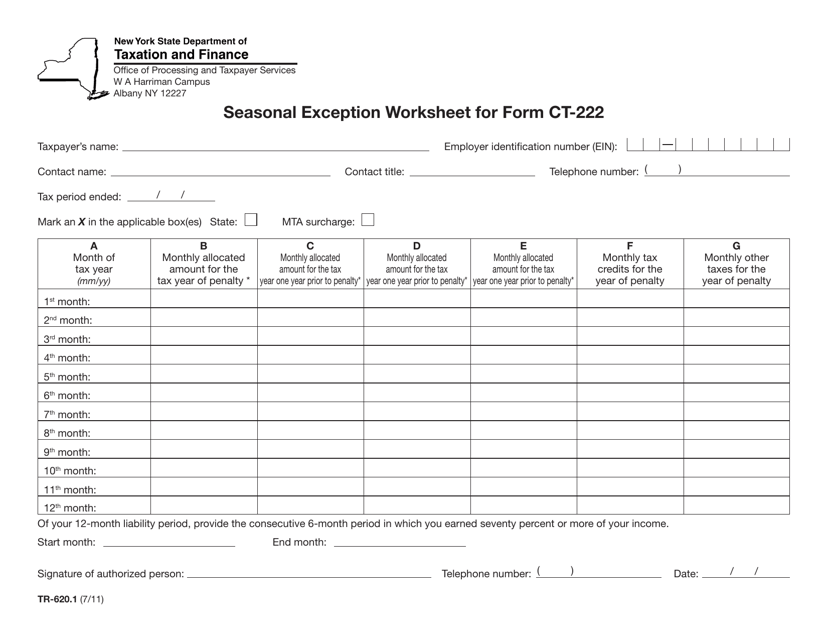

This form is used for calculating the seasonal exception for Form CT-222 in the state of New York. It helps businesses determine if they qualify for a reduced tax rate during certain seasons.

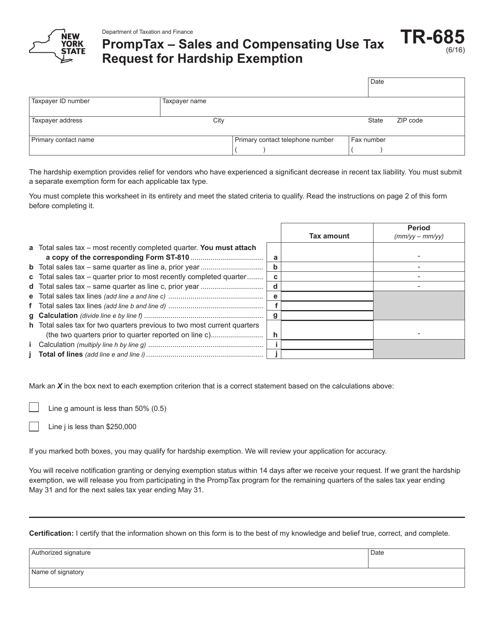

This form is used for requesting a hardship exemption from the sales and compensating use tax in the state of New York. It is specifically designated as Form TR-685 Promptax.

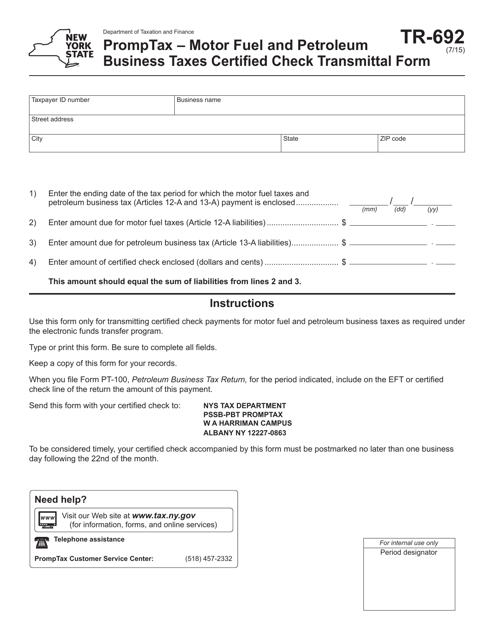

This form is used for transmitting certified checks for motor fuel and petroleum business taxes in New York.

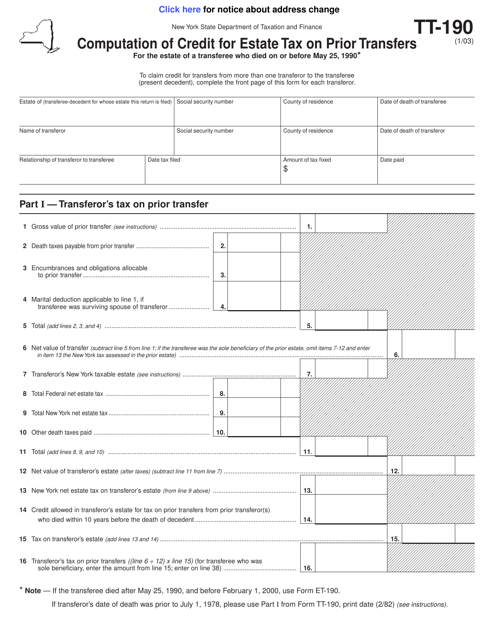

This Form is used for calculating the credit for estate tax on prior transfers for the estate of a transferee who died on or before May 25, 1990 in the state of New York.

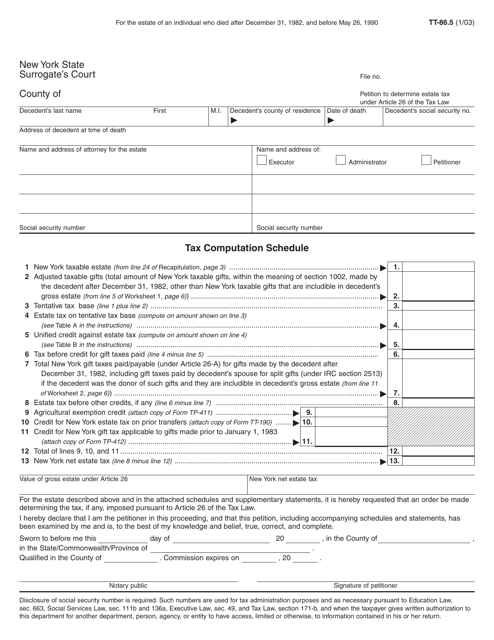

This form is used for petitioning the New York state to determine the estate tax for an individual who died between December 31, 1982, and May 26, 1990.

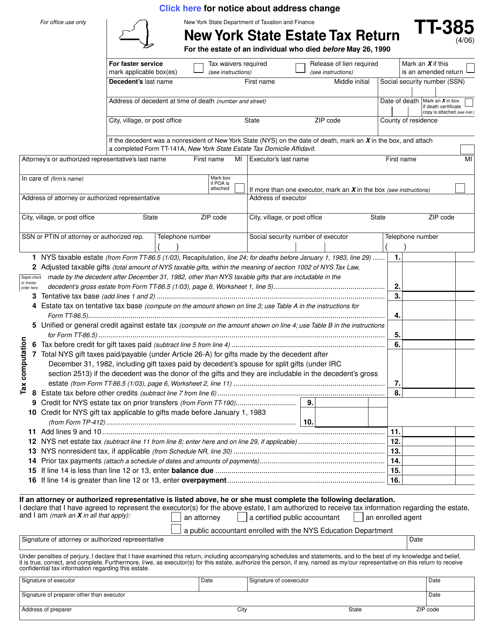

This form is used for filing the New York State Estate Tax Return for the estate of an individual who passed away before May 26, 1990 in New York.

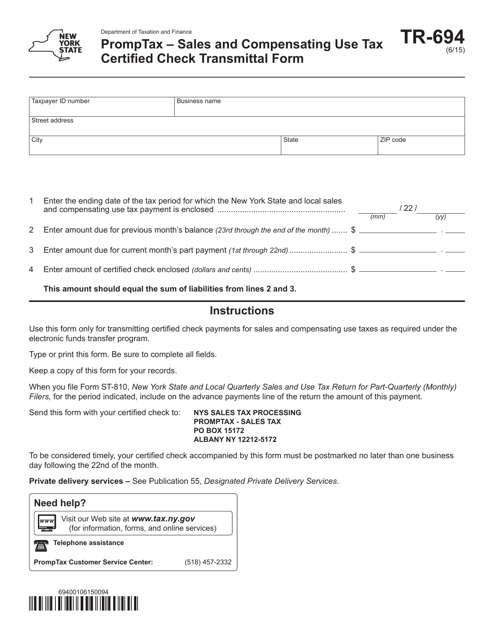

This form is used for transmitting certified checks for sales and compensating use tax in the state of New York.

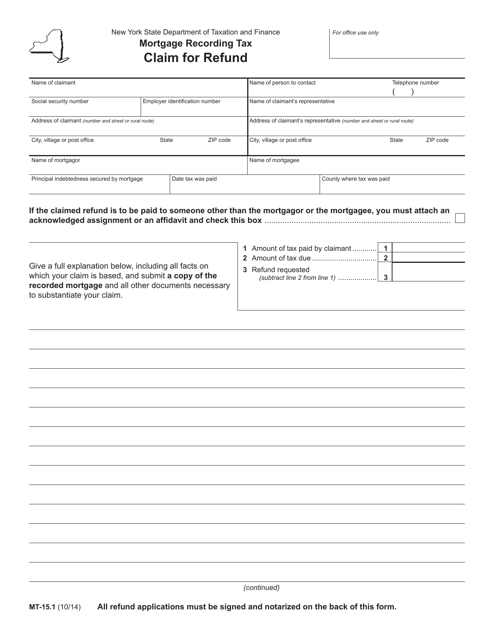

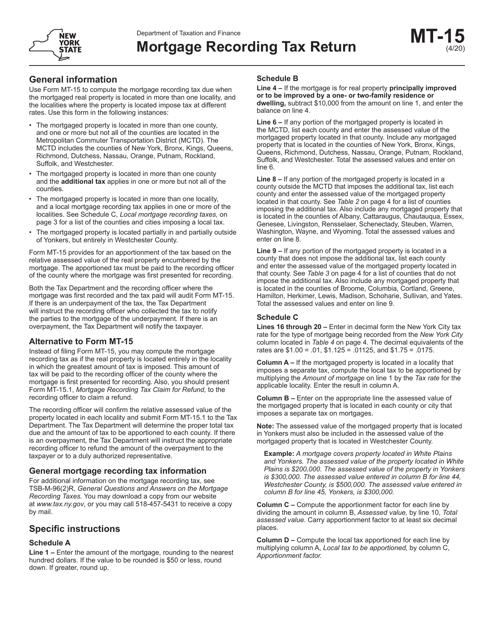

This form is used for claiming a refund on mortgage recording tax in the state of New York.

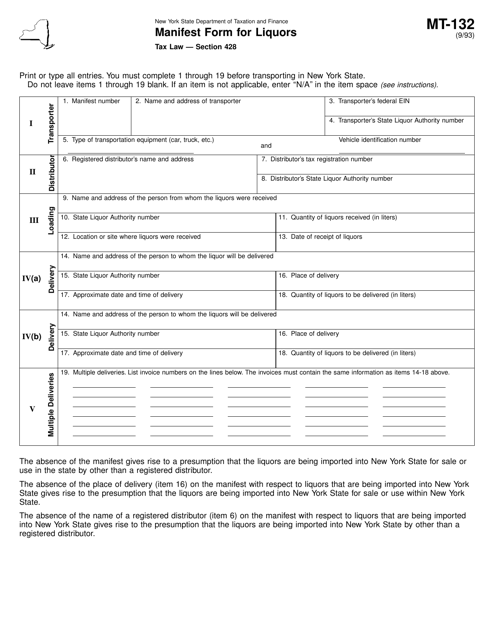

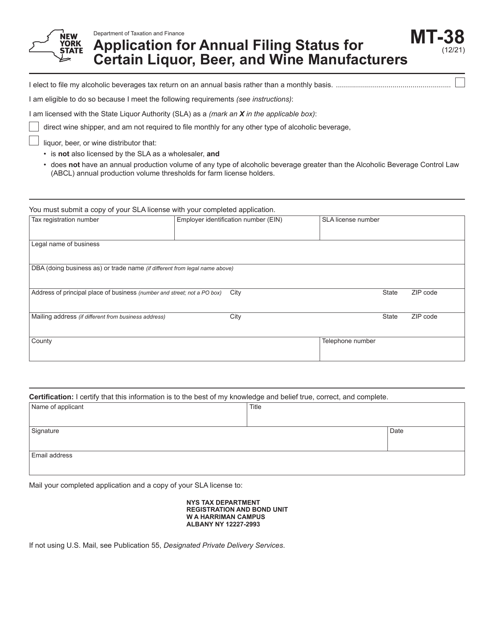

This form is used for manifesting liquors in the state of New York. It is required to accurately report the transportation and delivery of alcoholic beverages within the state.

This Form is used for reporting and paying the mortgage recording tax in the state of New York.

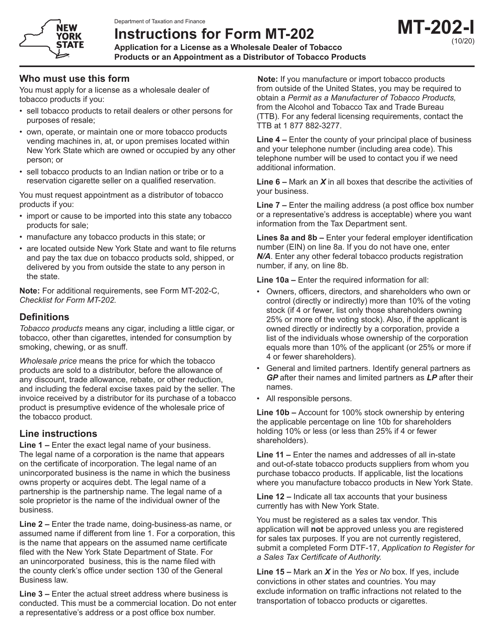

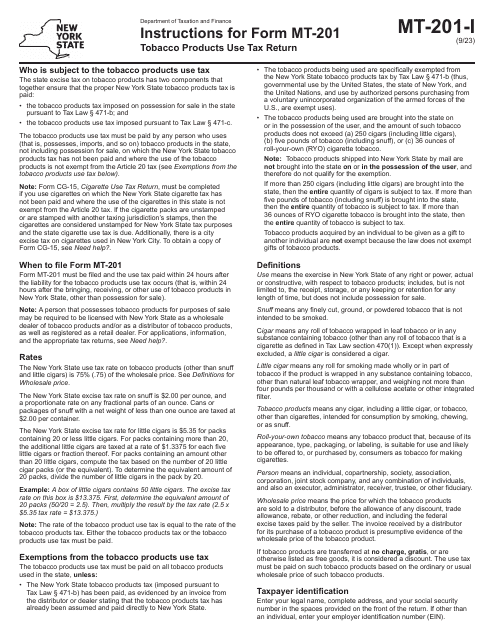

This Form is used for applying for a license as a wholesale dealer or distributor of tobacco products in New York State. It provides instructions on how to complete the application and includes information on the required documents and fees.

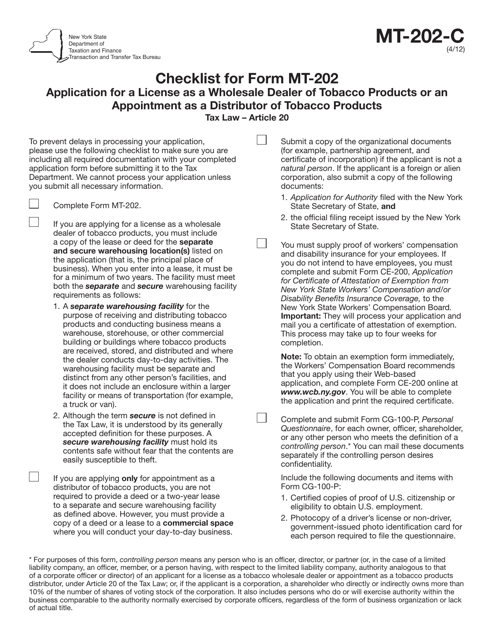

This form is used as a checklist for Form MT-202, which is an application for a license as a wholesale dealer of tobacco products or an appointment as a distributor of tobacco products in New York.

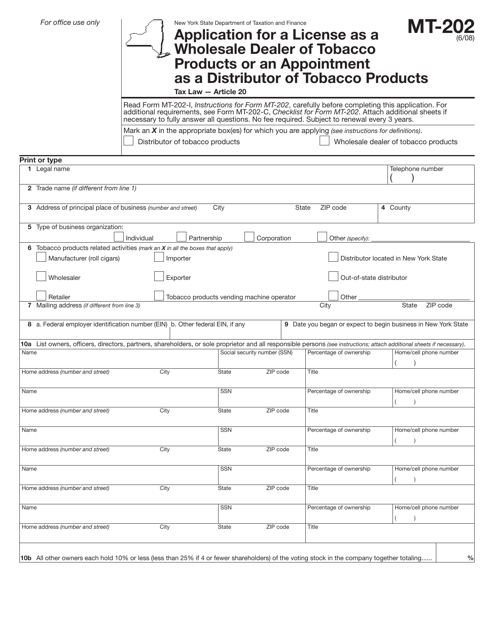

This form is used for applying for a license as a wholesale dealer or distributor of tobacco products in New York.

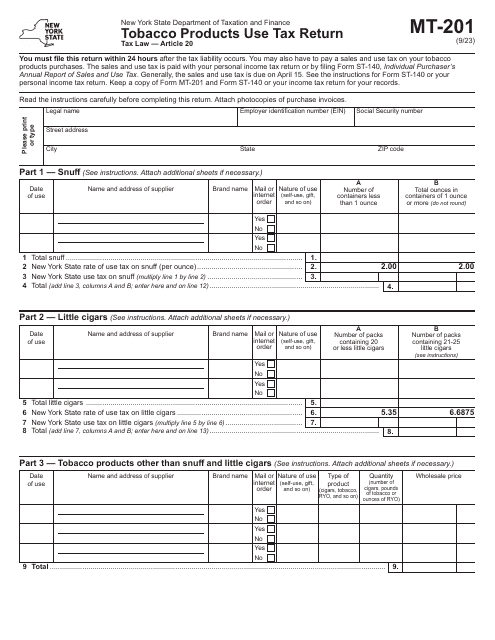

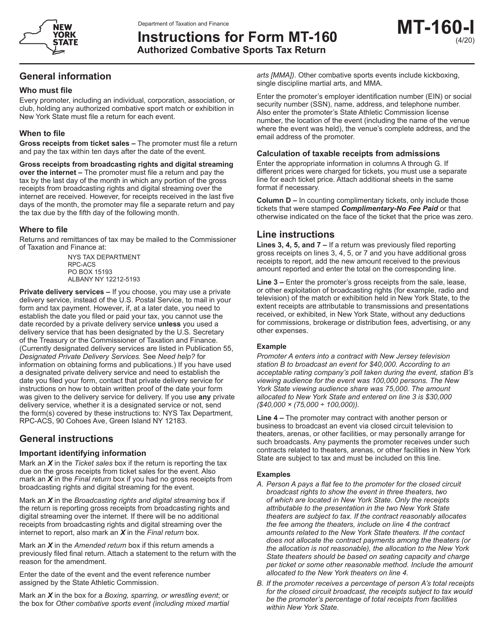

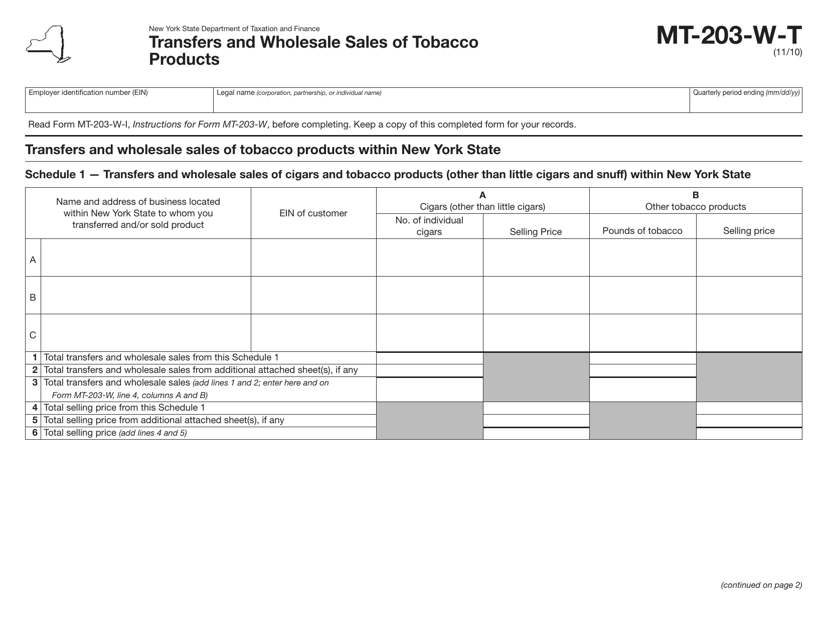

This Form is used for reporting transfers and wholesale sales of tobacco products in New York.