New York State Department of Taxation and Finance Forms

Documents:

2566

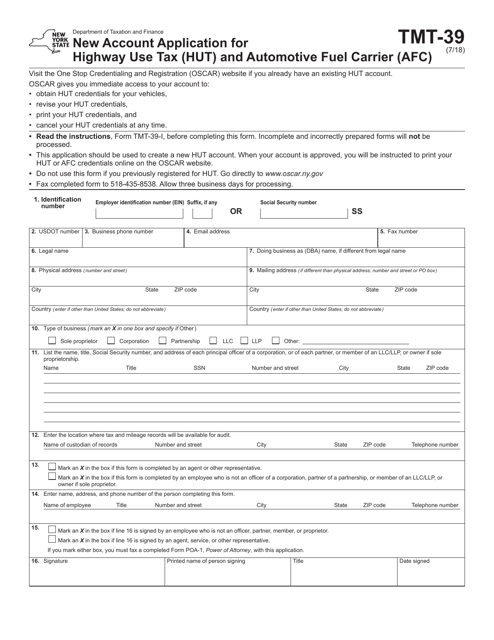

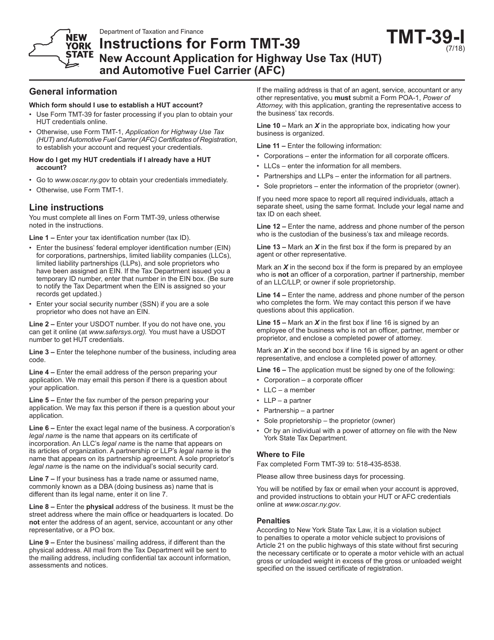

This form is used for applying for a new account for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) in New York.

This Form is used for applying for a new account for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) in New York.

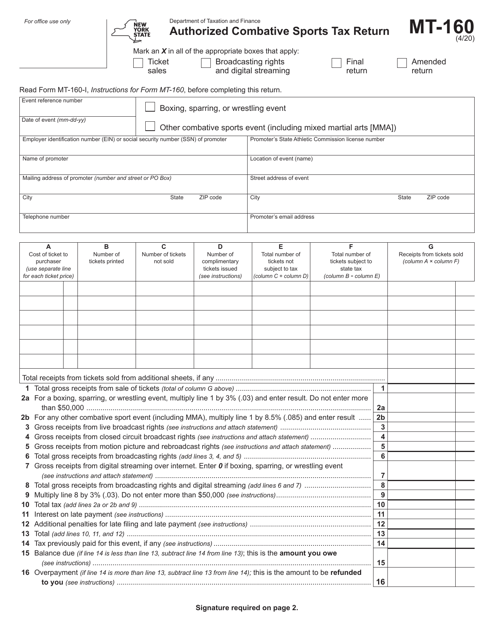

This Form is used for reporting and paying taxes related to authorized combative sports events in the state of New York.

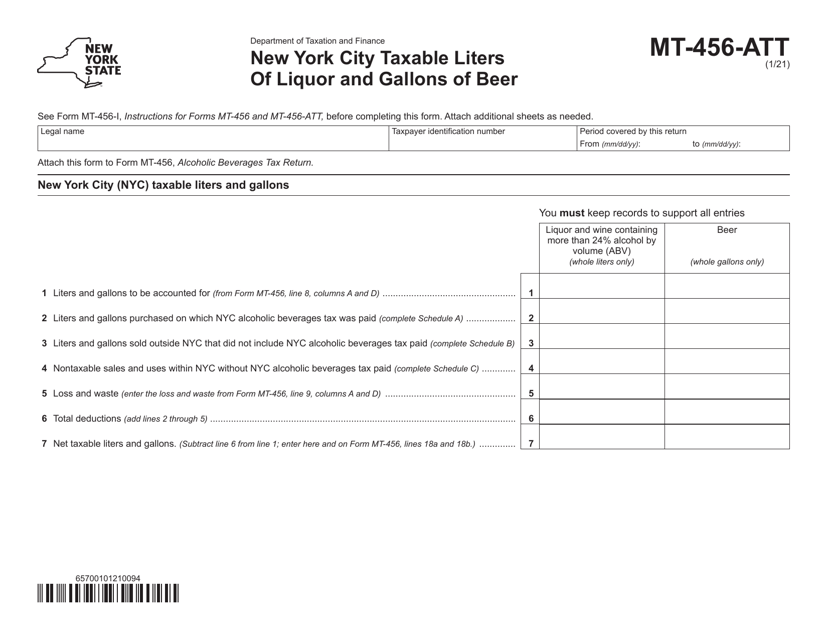

This form is used for reporting the taxable liters of liquor and gallons of beer in New York City for tax purposes.

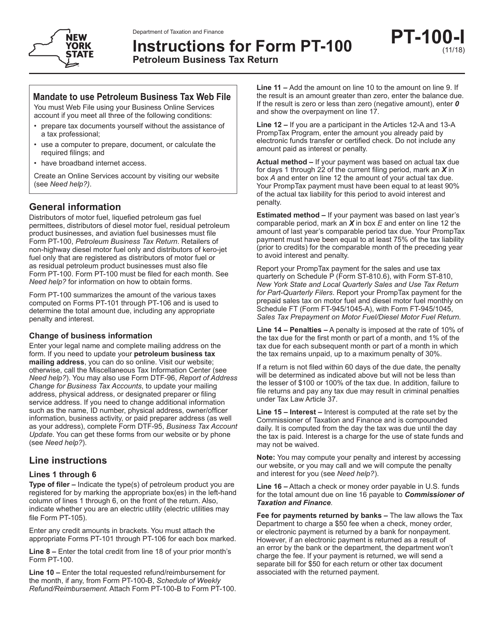

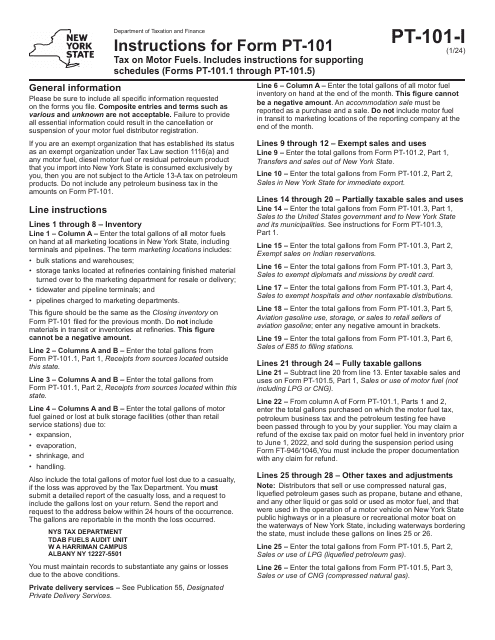

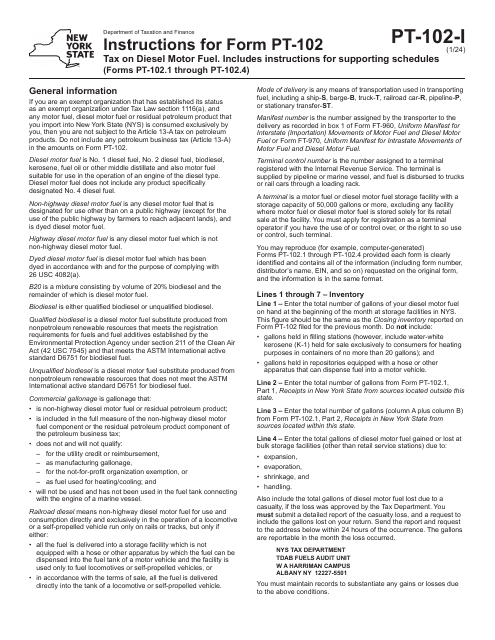

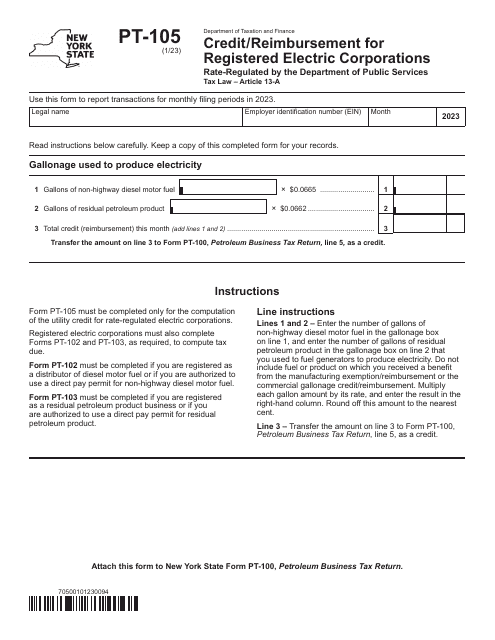

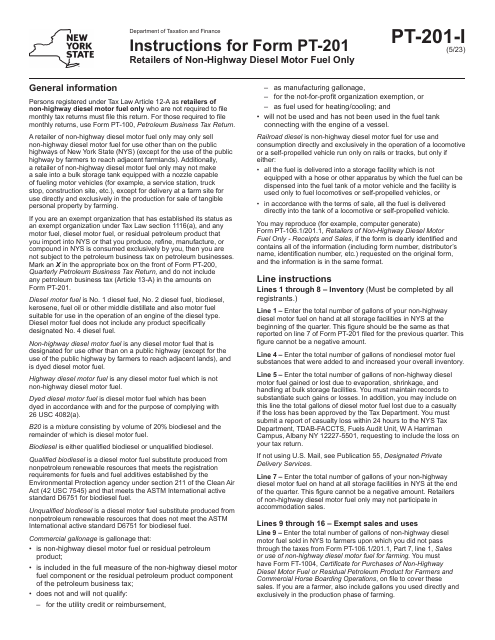

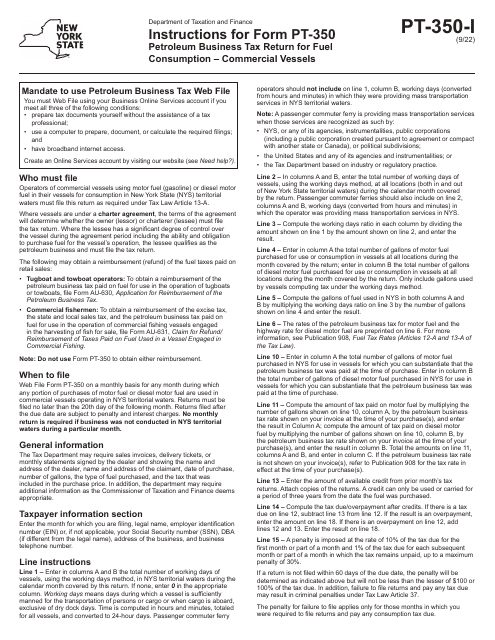

This Form is used for filing the Petroleum Business Tax Return in the state of New York. It provides instructions on how to accurately report and pay taxes related to petroleum products.

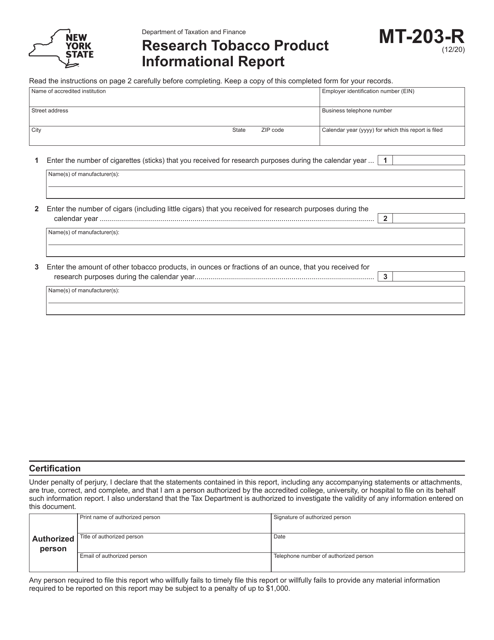

This Form is used for submitting a Research Tobacco Product Informational Report in New York.

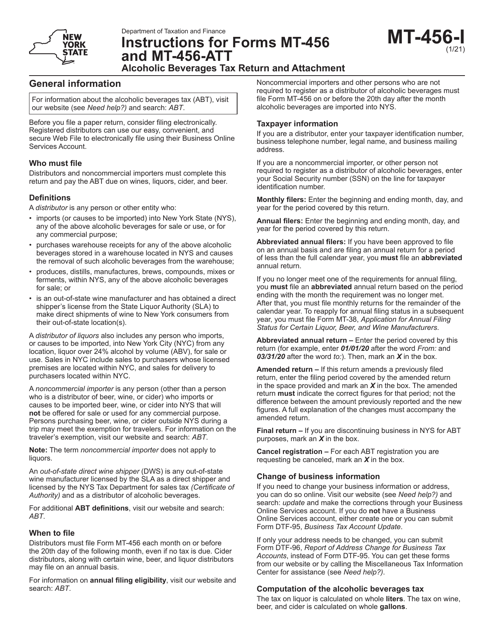

This Form is used for filing instructions for Form MT-456 and MT-456-ATT in the state of New York. It provides guidance on how to fill out and submit these tax forms accurately.

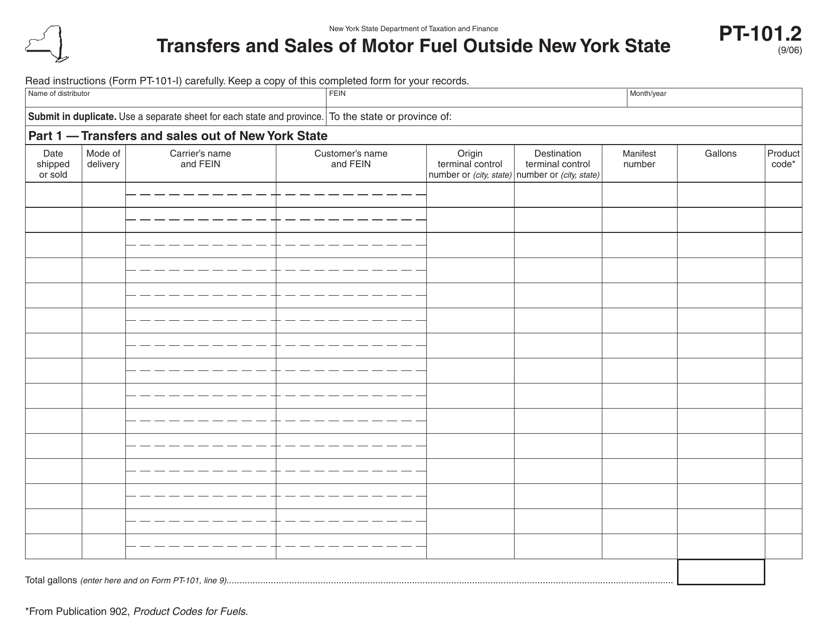

This form is used for reporting the transfers and sales of motor fuel that occur outside New York State but are subject to New York State taxes.

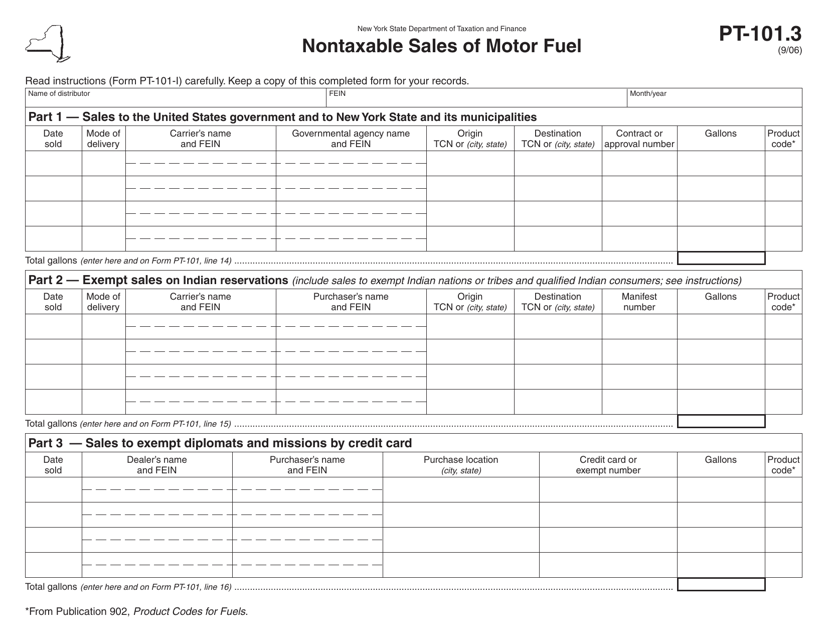

This form is used for reporting nontaxable sales of motor fuel in New York.

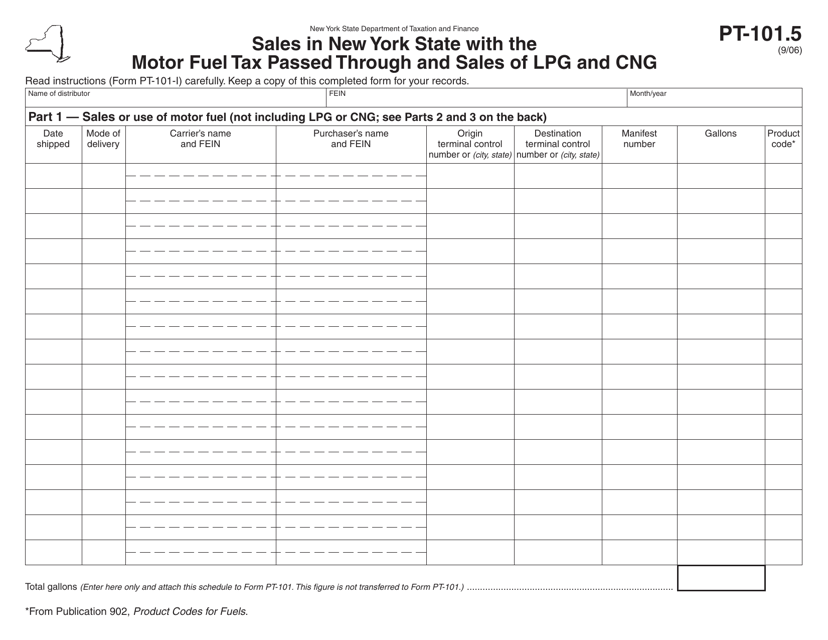

This form is used for reporting sales in New York State that includes the motor fuel tax passed through and sales of LPG and CNG.

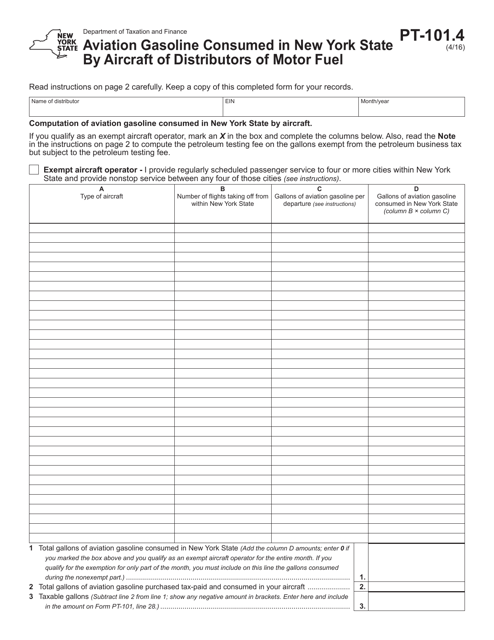

This form is used for reporting the amount of aviation gasoline consumed in New York State by aircraft owned by distributors of motor fuel.

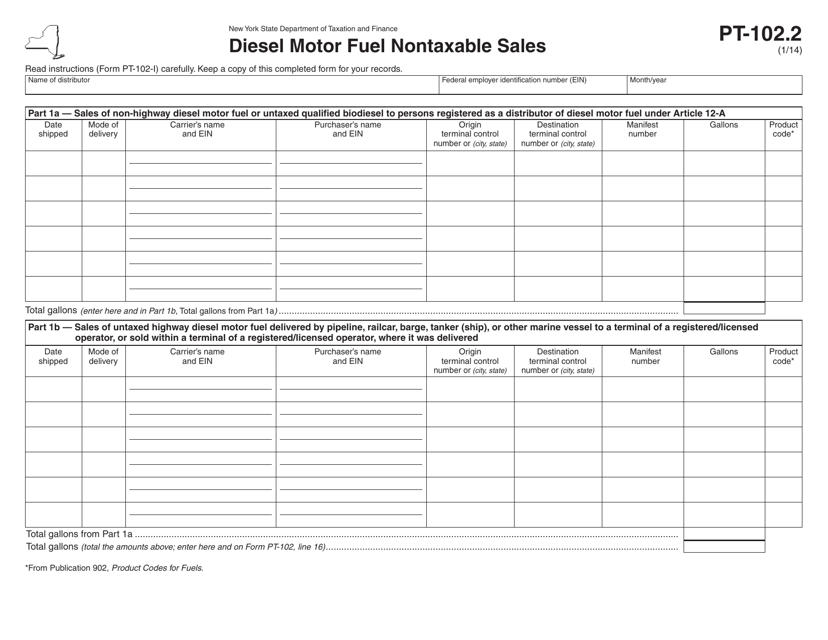

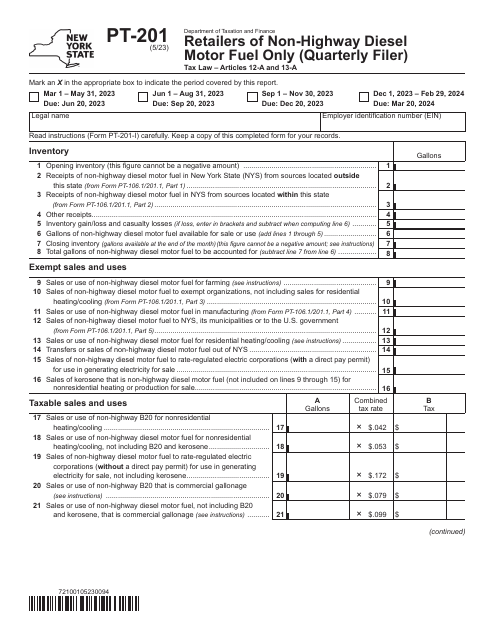

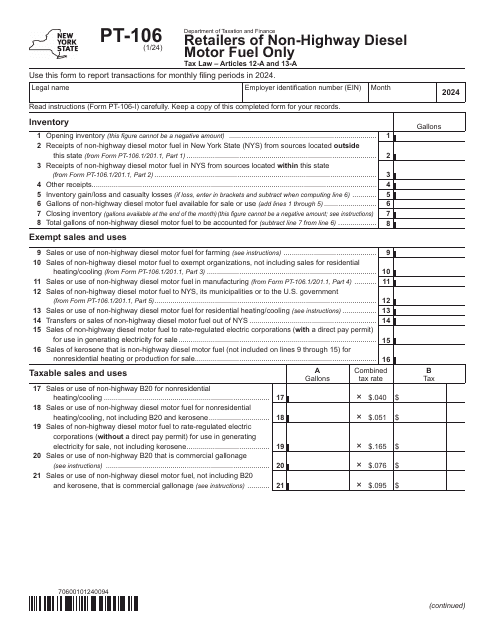

This form is used for reporting nontaxable sales of diesel motor fuel in the state of New York.

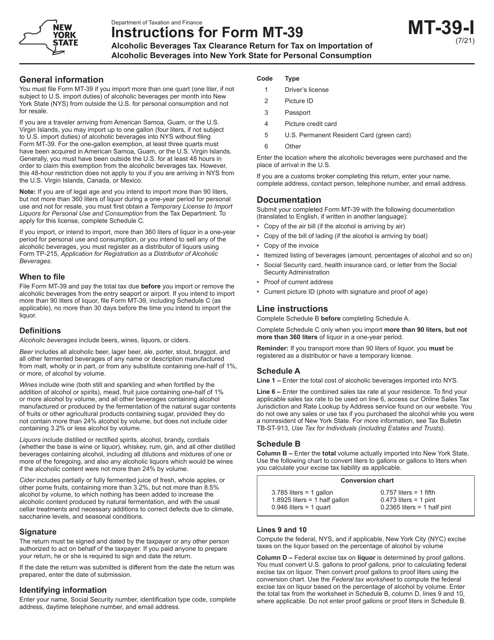

This form is used for reporting and paying the taxes on the importation of alcoholic beverages into New York State for personal consumption. It provides instructions on how to fill out and submit Form MT-39, which is required by the New York State Department of Taxation and Finance.

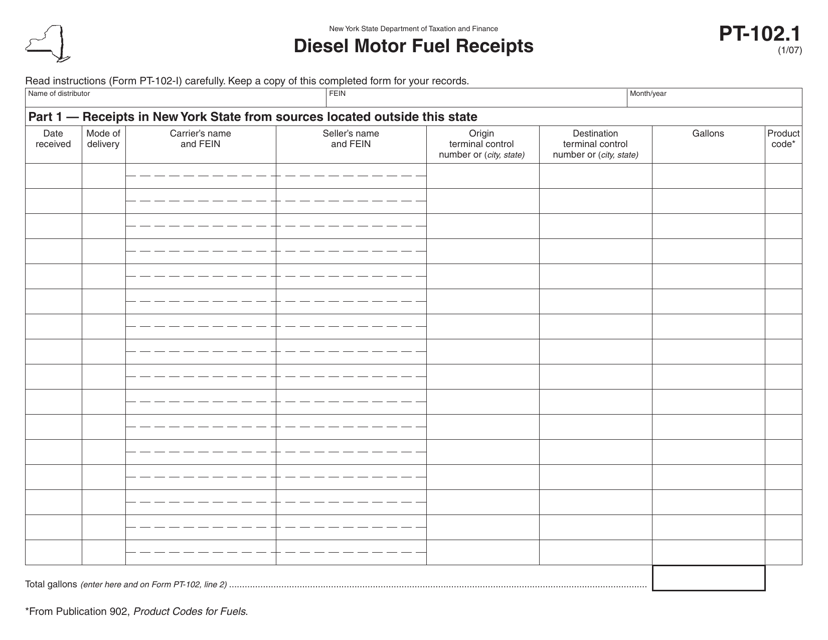

This form is used for reporting diesel motor fuel receipts in the state of New York.

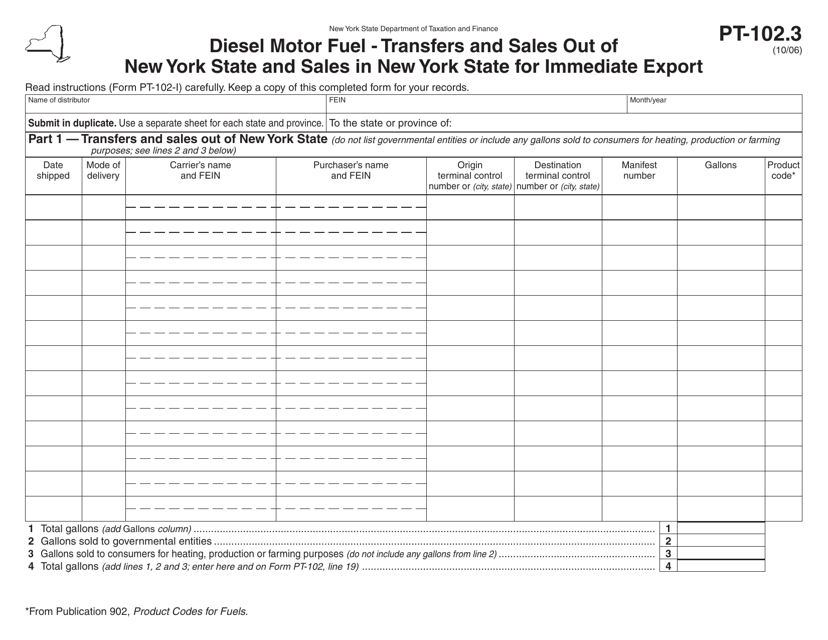

This form is used for reporting the transfers and sales of diesel motor fuel in and out of New York State, specifically for immediate export.

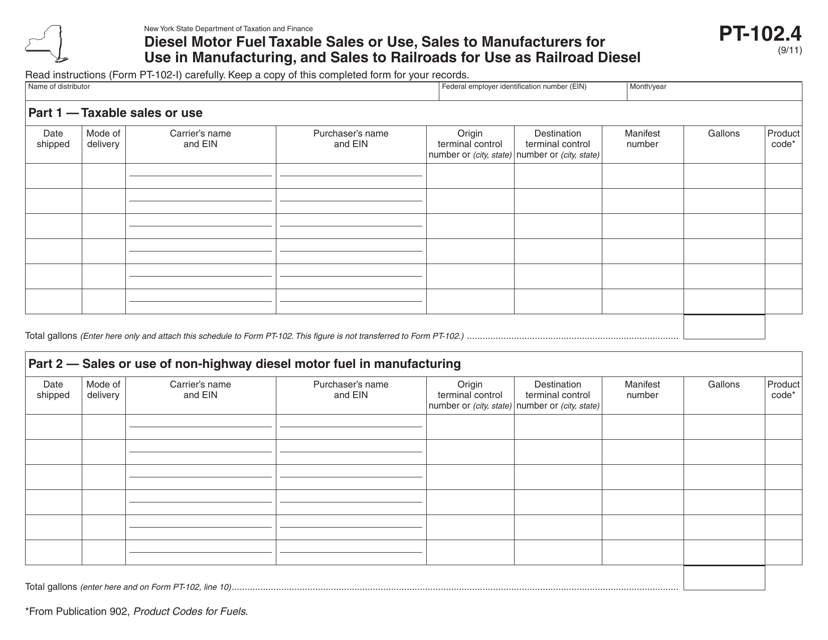

This form is used for reporting taxable sales or use of diesel motor fuel in New York, including sales to manufacturers for use in manufacturing and sales to railroads for use as railroad diesel.

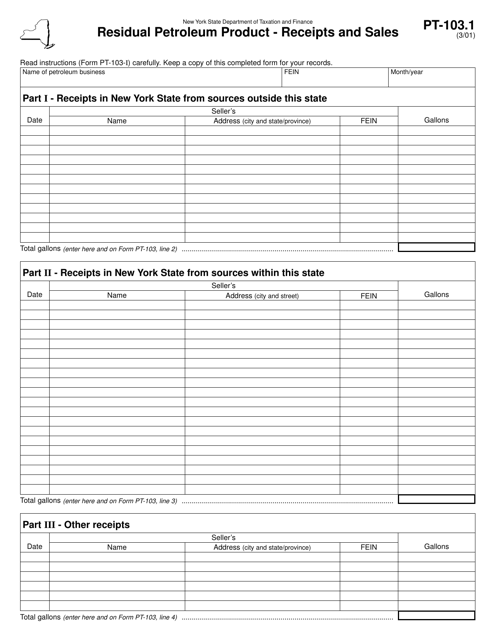

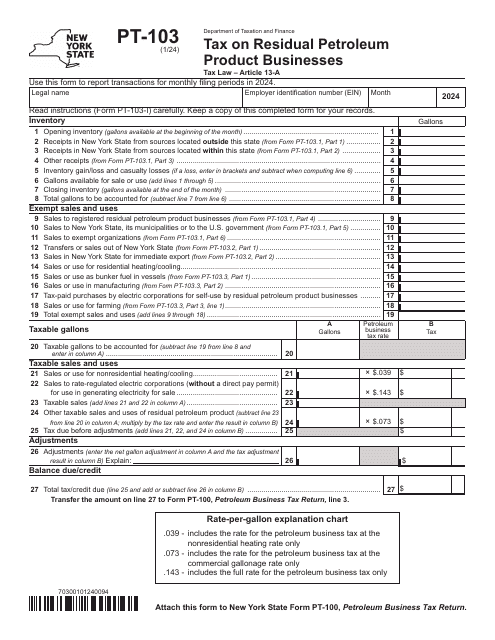

This form is used for recording the receipts and sales of residual petroleum products in the state of New York.

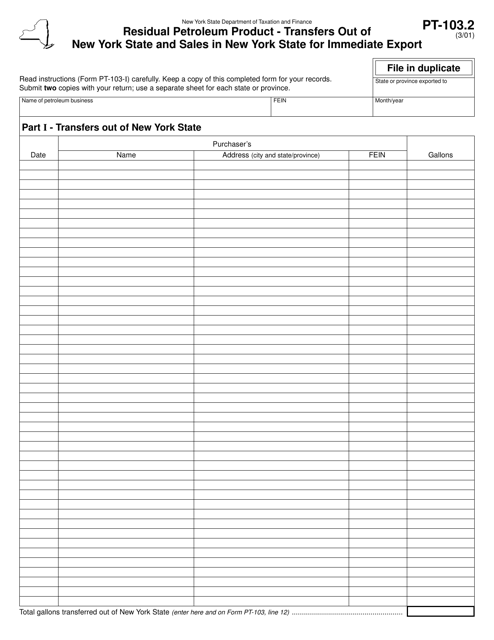

This form is used for reporting the transfer of residual petroleum products out of New York State and the sales of these products in New York State for immediate export.

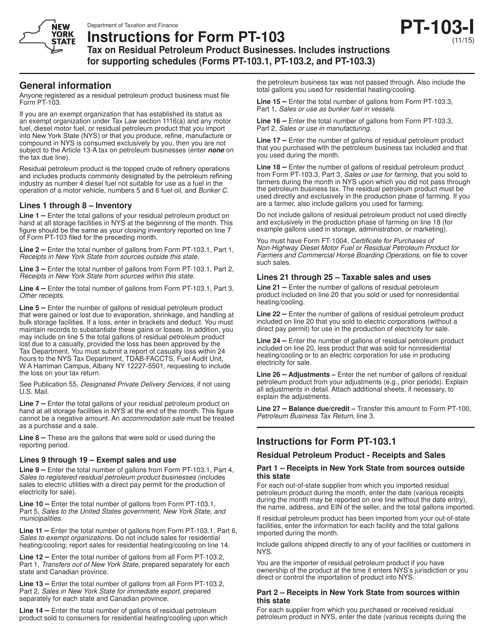

This Form is used for filing instructions for Form PT-103, PT-103.1, PT-103.2, and PT-103.3 in New York.

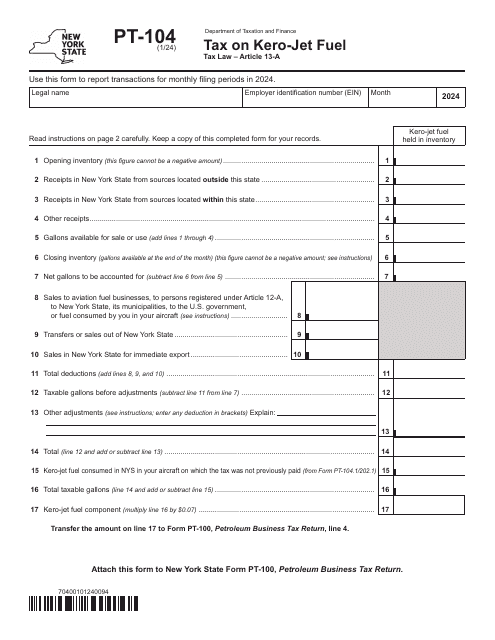

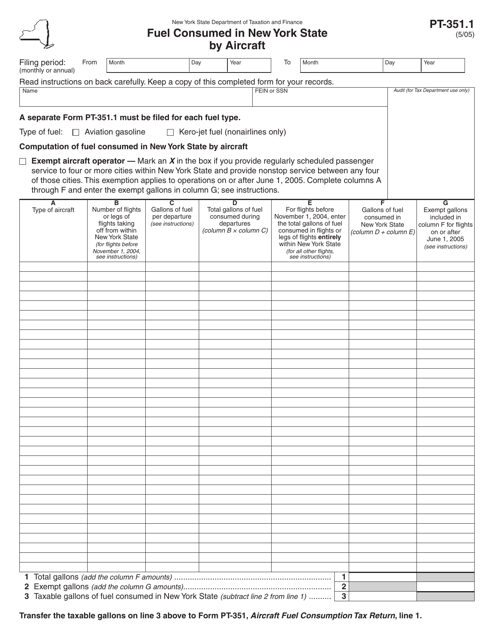

This form is used for reporting the amount of fuel consumed by aircraft in the state of New York. It is required by the New York State Department of Taxation and Finance.