New York State Department of Taxation and Finance Forms

Documents:

2566

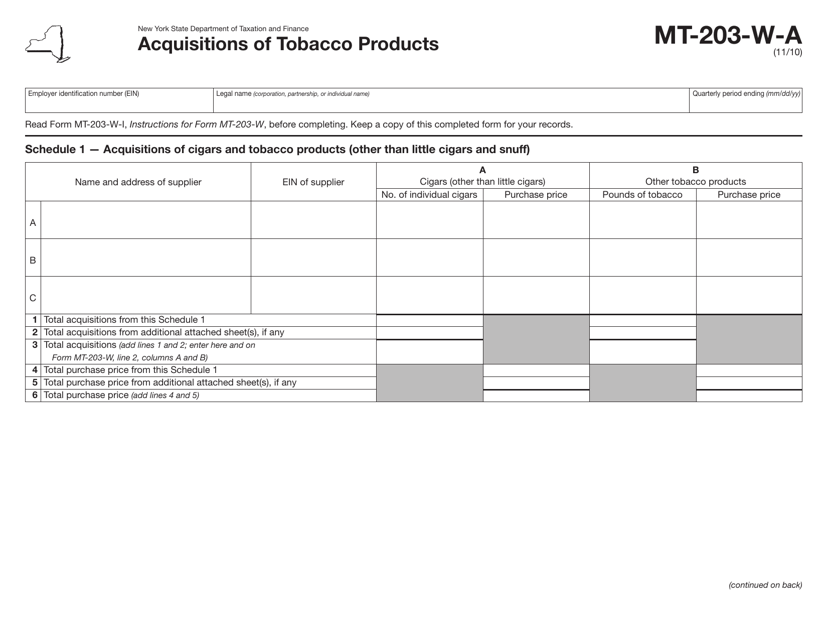

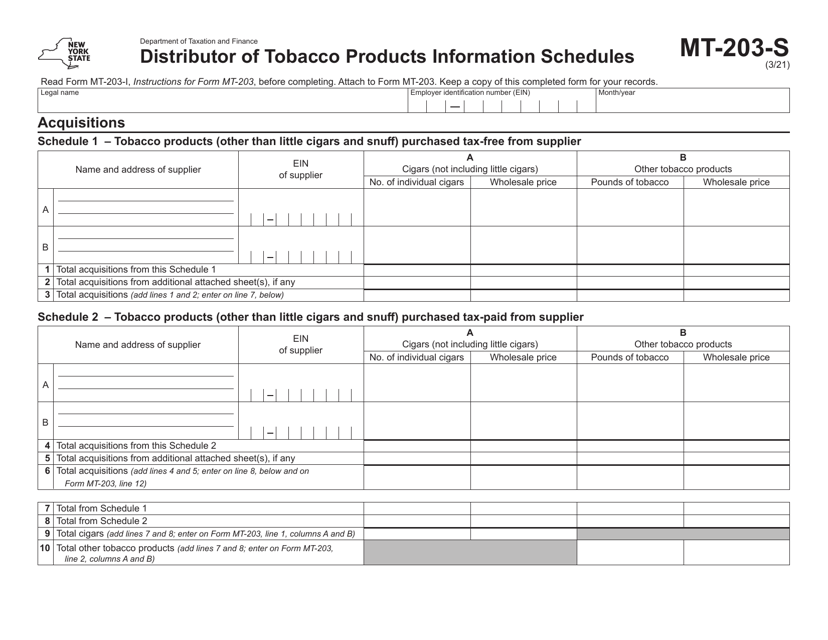

This form is used for reporting acquisitions of tobacco products in the state of New York.

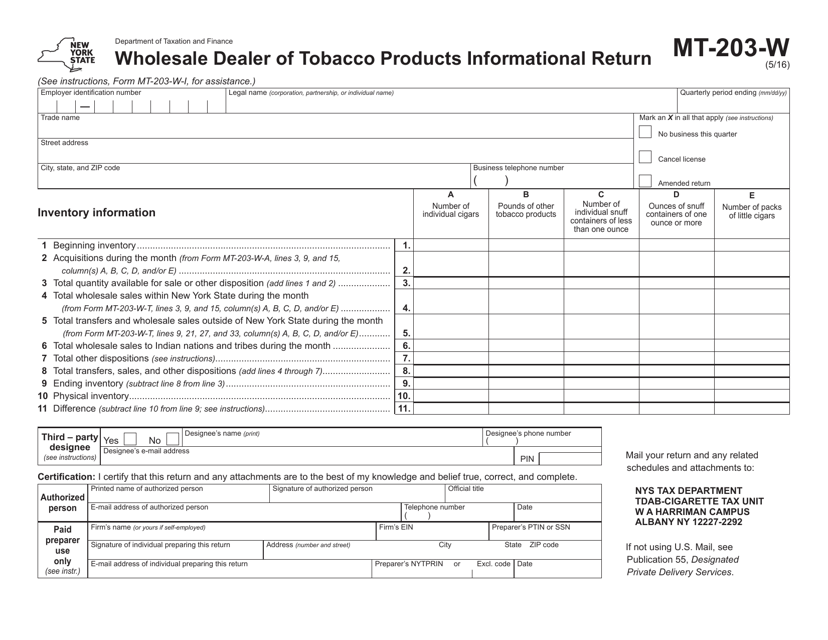

This form is used for reporting information on wholesale dealers of tobacco products in the state of New York. It is an informational return that must be filled out by businesses engaged in the sale of tobacco products.

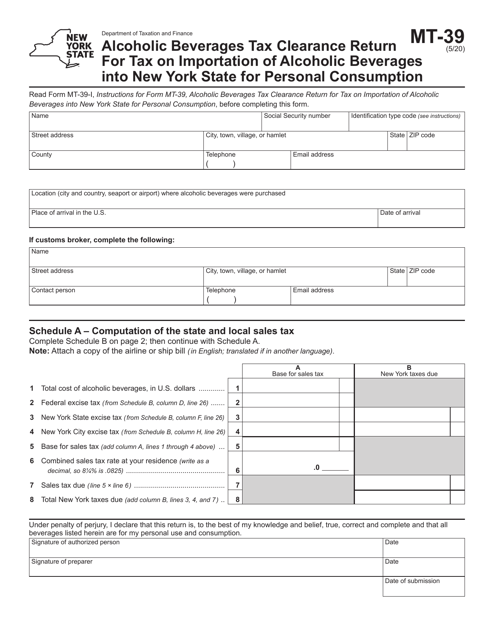

This form is used for reporting and paying tax on imported alcoholic beverages for personal consumption in New York State.

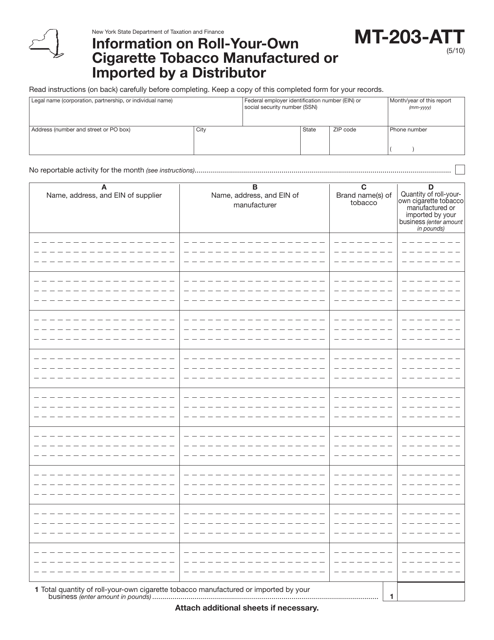

This form is used for providing information on roll-your-own cigarette tobacco manufactured or imported by a distributor in New York.

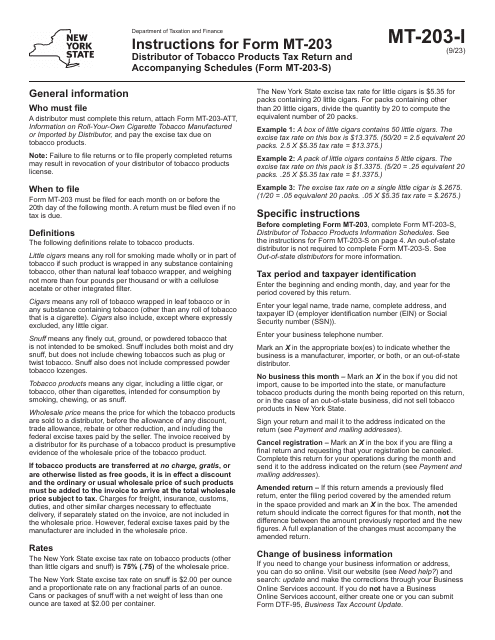

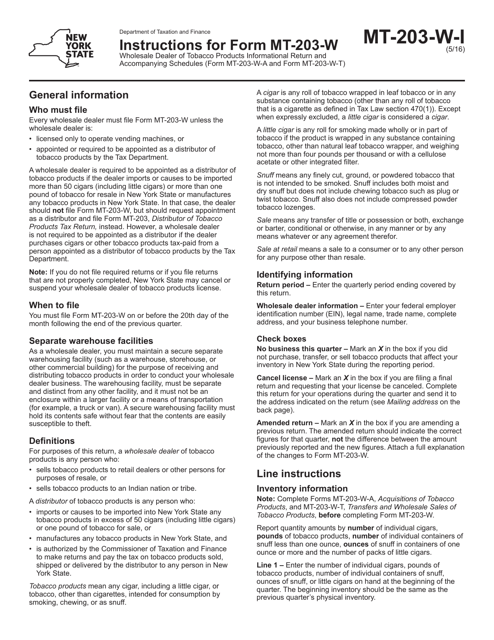

This type of document provides instructions for completing the Form MT-203-W, MT-203-W-A, and MT-203-W-T in the state of New York.

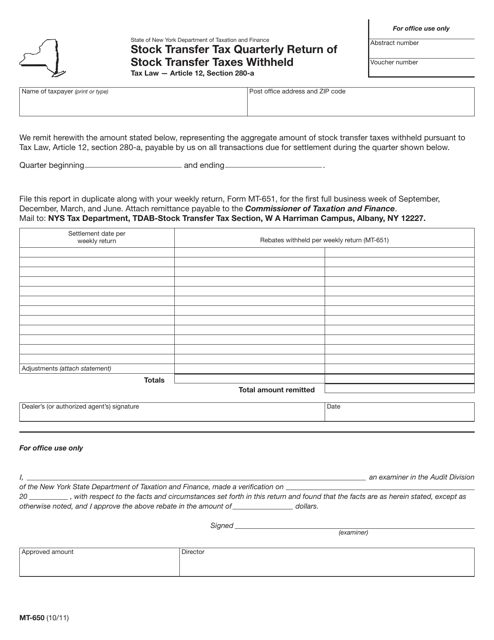

This Form is used for reporting and remitting stock transfer taxes withheld on transfers of stock in the state of New York on a quarterly basis.

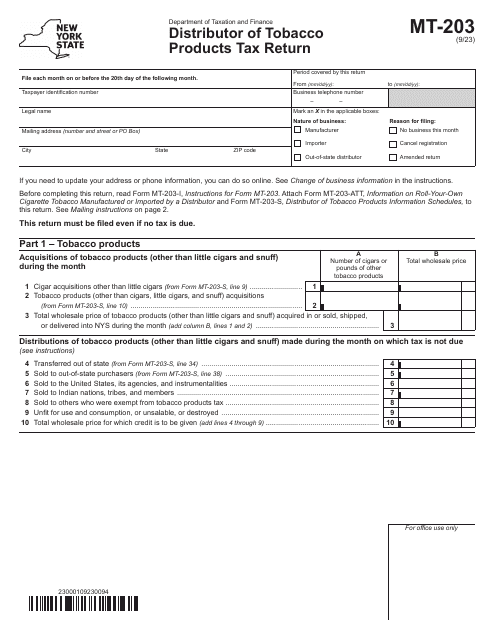

This form is used for providing information about distributors of tobacco products in New York.

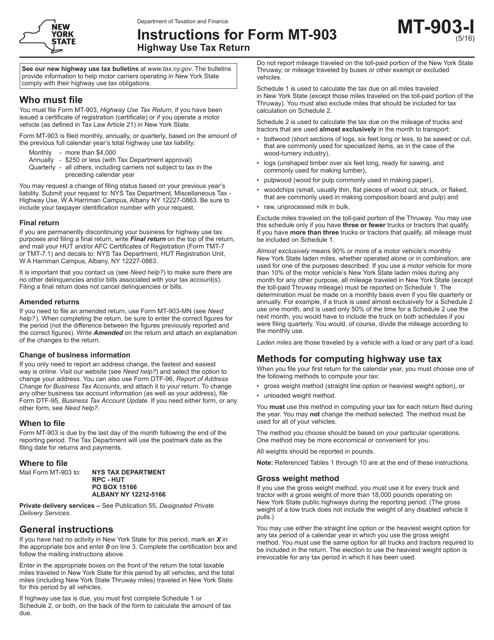

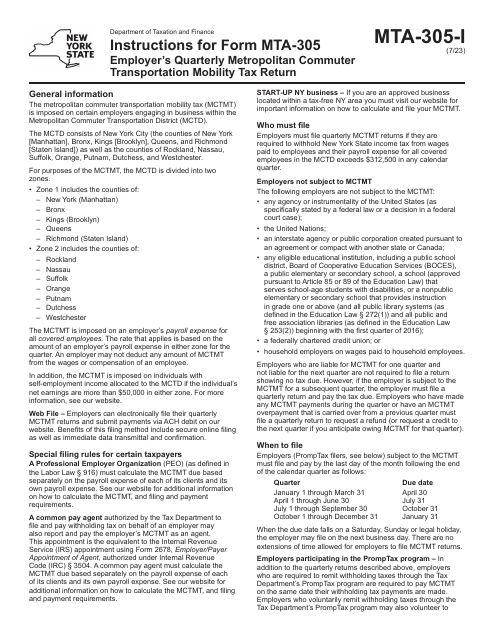

This Form is used for filing the Highway Use Tax Return in the state of New York. It provides instructions for completing and submitting the Form MT-903-MN.

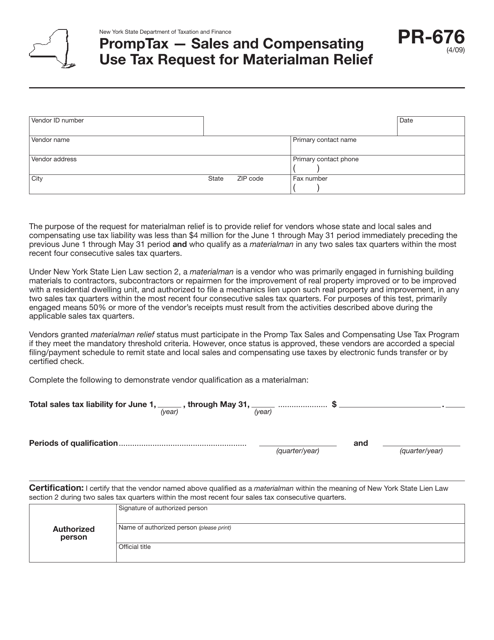

This Form is used for requesting materialman relief from sales and compensating use tax in New York.

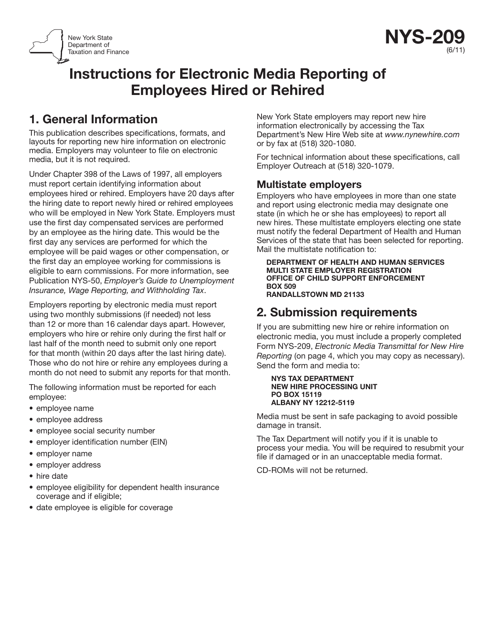

This form is used for electronically transmitting new hire information to the New York State Department of Taxation and Finance. It is required by employers to report the hiring of new employees.

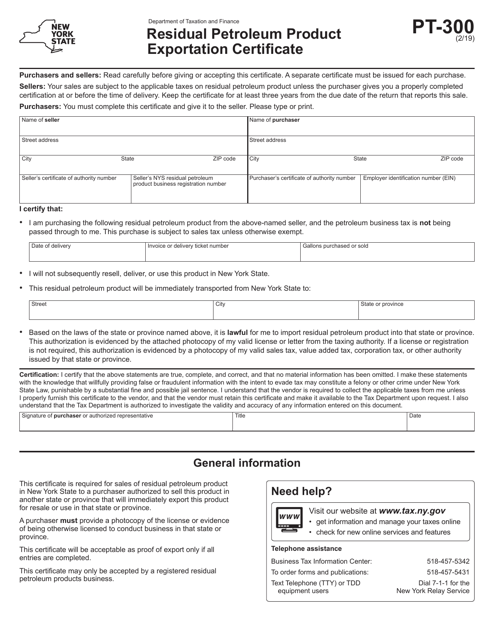

This form is used for obtaining a Residual Petroleum Product Exportation Certificate in New York. It is necessary for exporting residual petroleum products from the state.

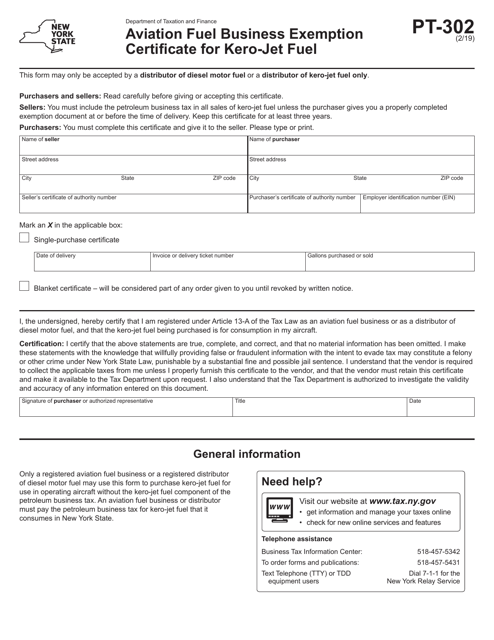

This form is used for obtaining an Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel in New York.

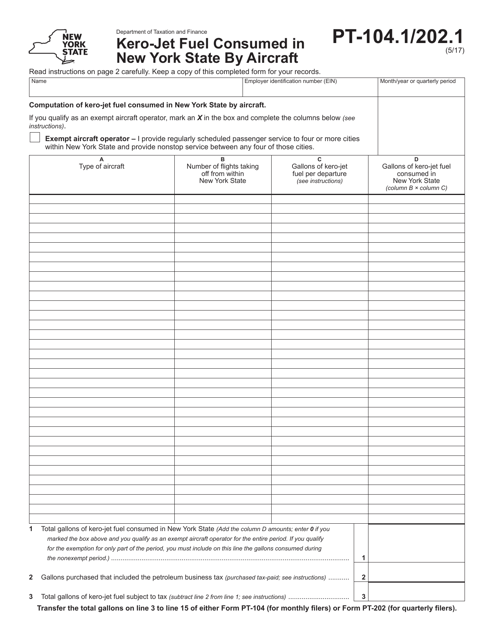

This form is used for reporting the amount of kero-jet fuel consumed by aircraft in New York State. It is important for tracking and regulating fuel consumption in the aviation industry.

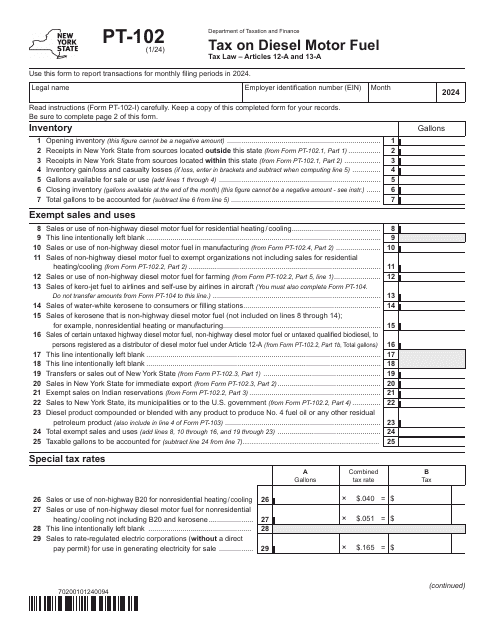

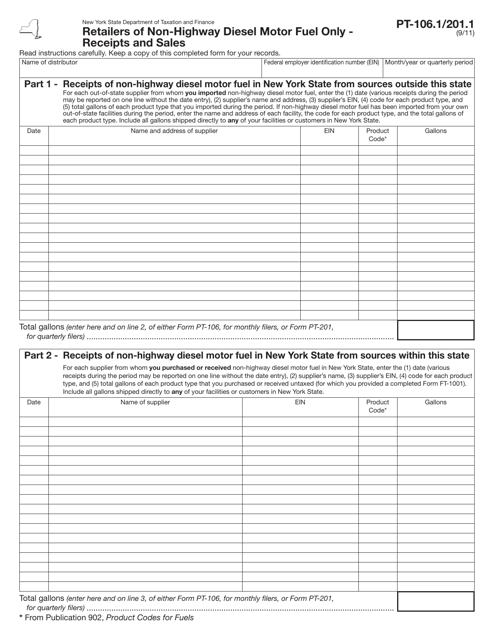

This form is used for retailers in New York who sell only non-highway diesel motor fuel to track their receipts and sales.

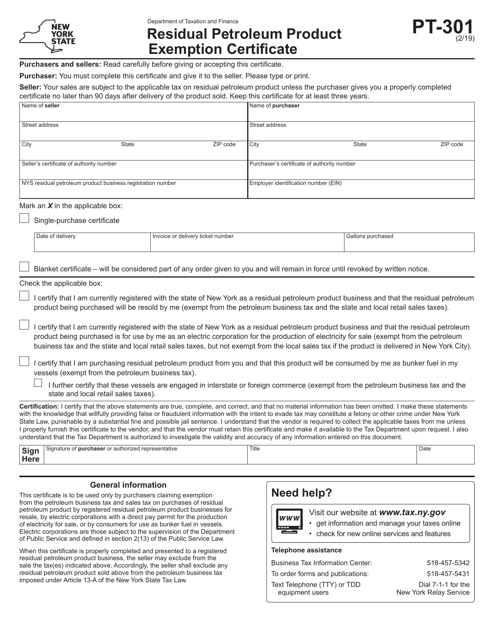

This form is used for applying for a Residual Petroleum Product Exemption Certificate in the state of New York.

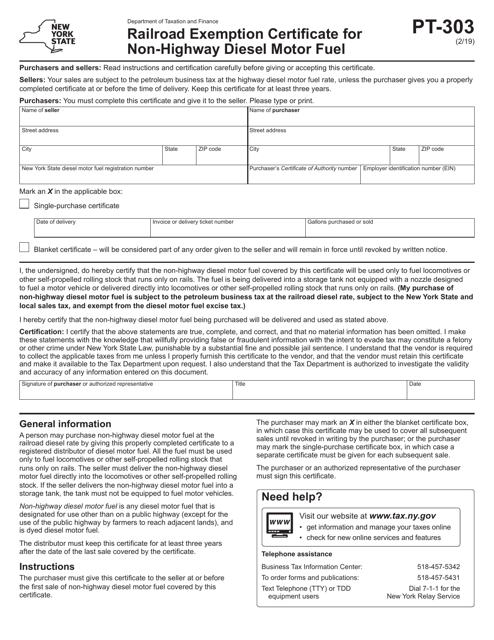

This form is used for applying for a tax exemption on non-highway diesel motor fuel used by railroads in the state of New York.

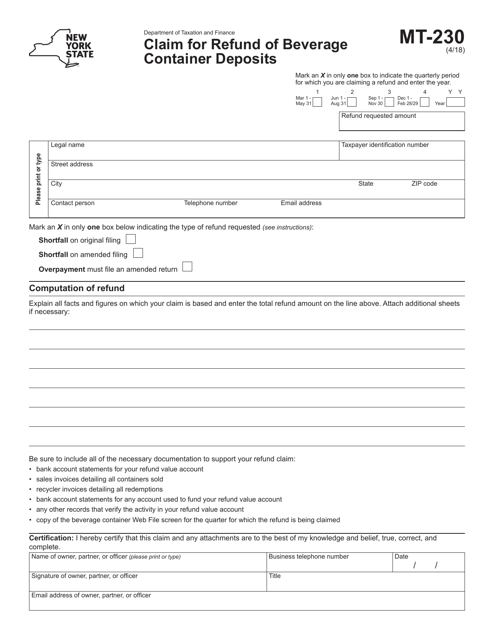

This form is used for claiming a refund of beverage container deposits in New York.