New York State Department of Taxation and Finance Forms

Documents:

2566

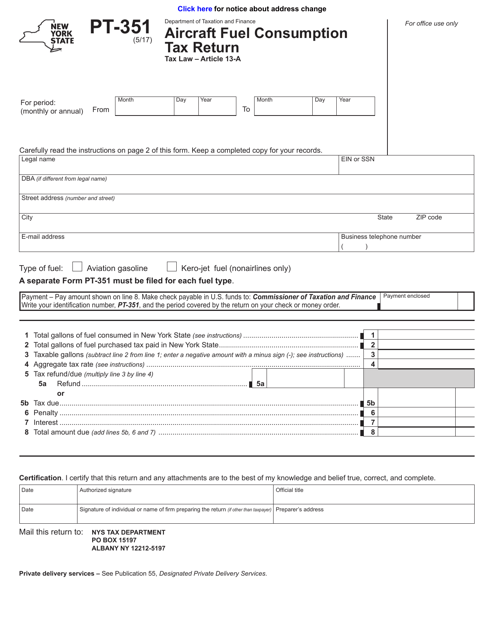

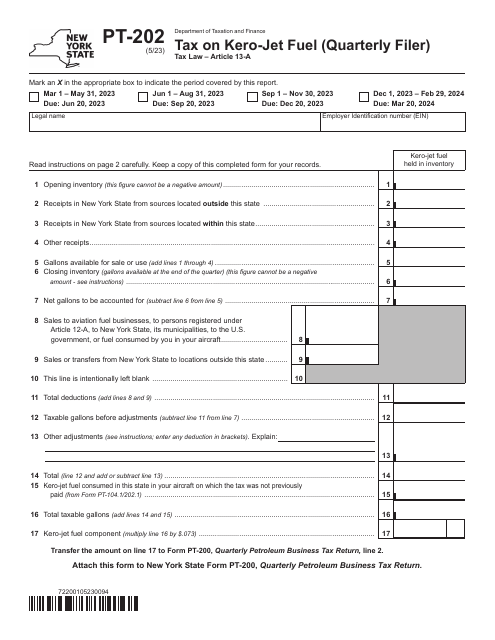

This form is used for filing the Aircraft Fuel Consumption Tax Return in the state of New York. It is required for reporting and paying taxes on fuel consumption by aircraft.

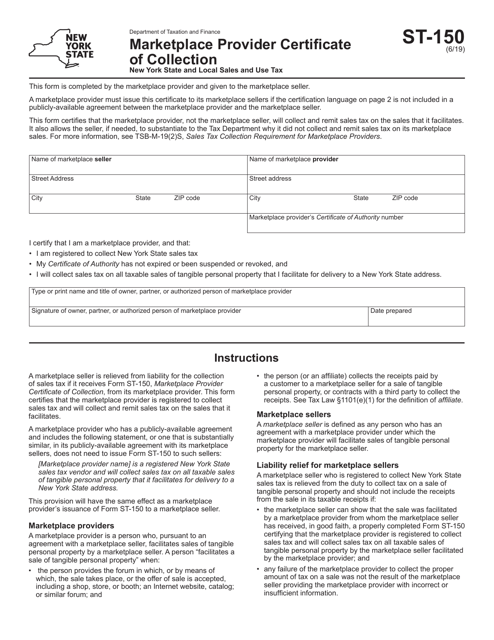

This form is used for marketplace providers in New York to certify their sales tax collection activities.

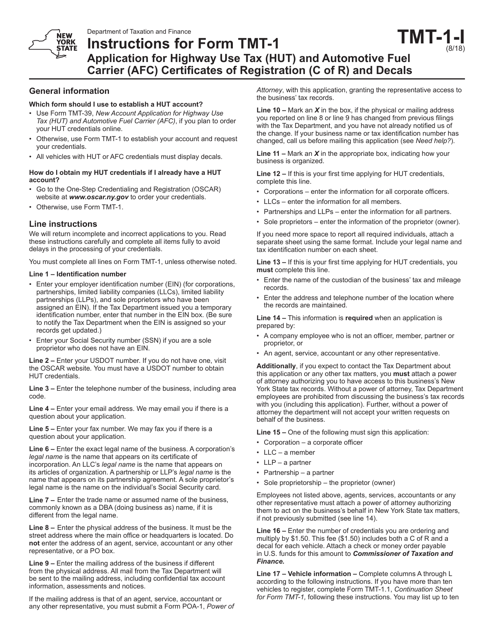

This Form is used for applying for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) Certificates of Registration (C of R) and Decals in the state of New York. It provides instructions on how to fill out the application and what documentation is required.

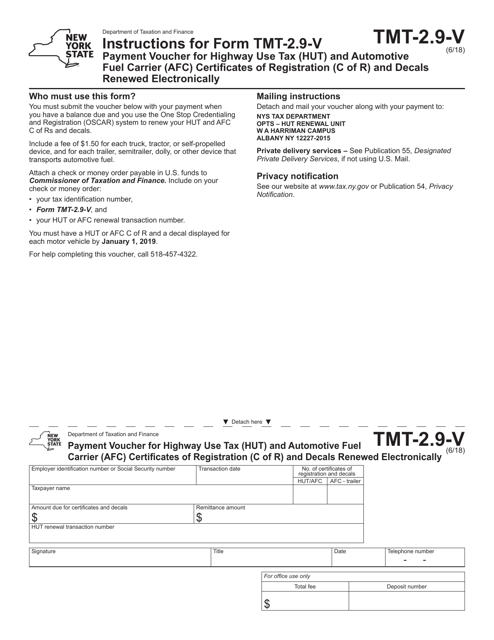

This form is used for submitting payment vouchers for the renewal of Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) Certificates of Registration (C of R) and Decals in New York.

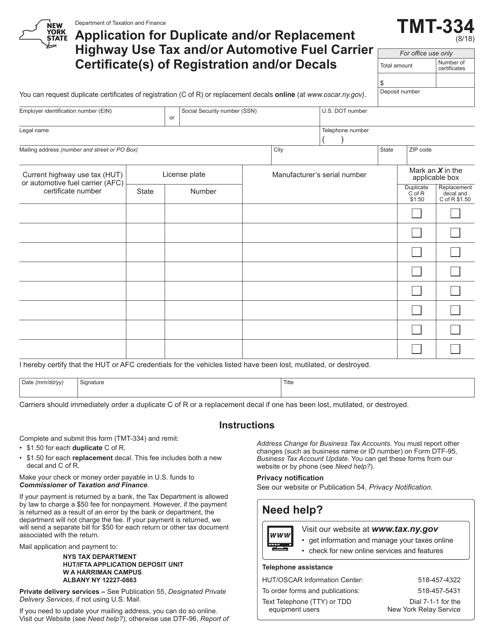

This form is used for applying for a duplicate or replacement Highway Use Tax and/or Automotive Fuel Carrier Certificate(s) of Registration and/or Decals in New York.

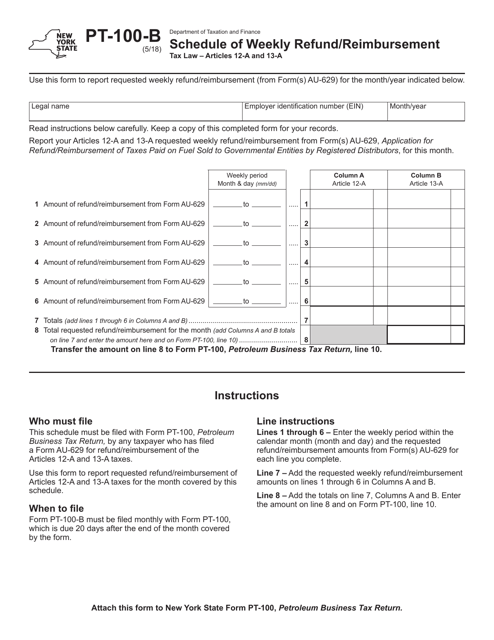

This form is used for requesting refunds or reimbursements on a weekly basis in the state of New York.

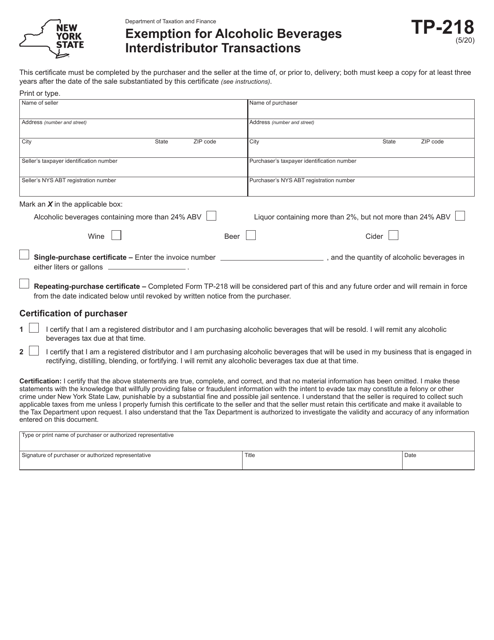

This form is used for requesting an exemption for alcoholic beverage interdistributor transactions in the state of New York.

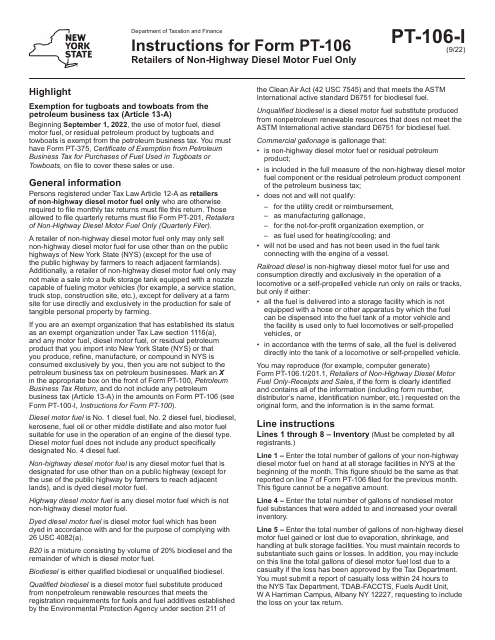

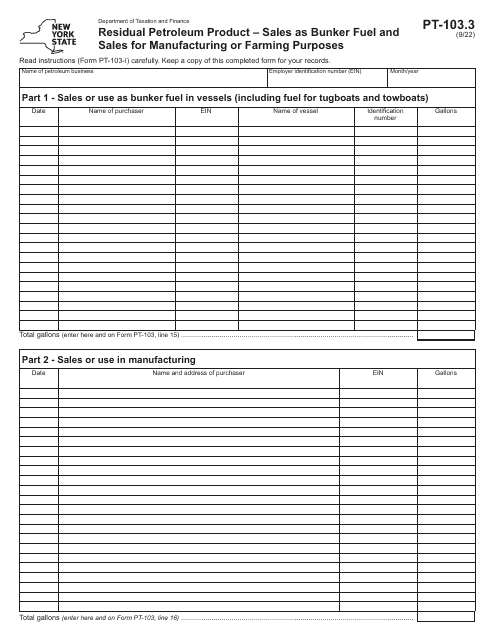

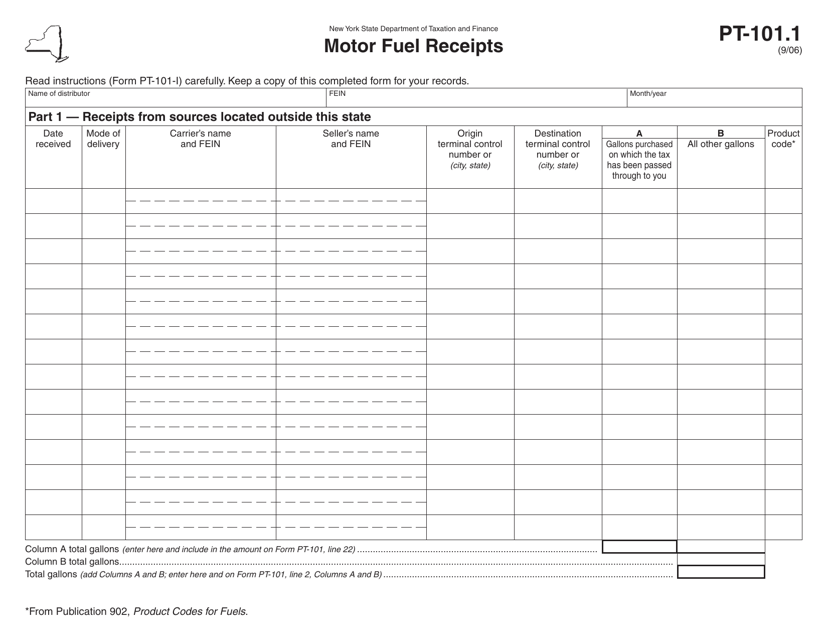

This form is used for reporting motor fuel receipts in the state of New York.

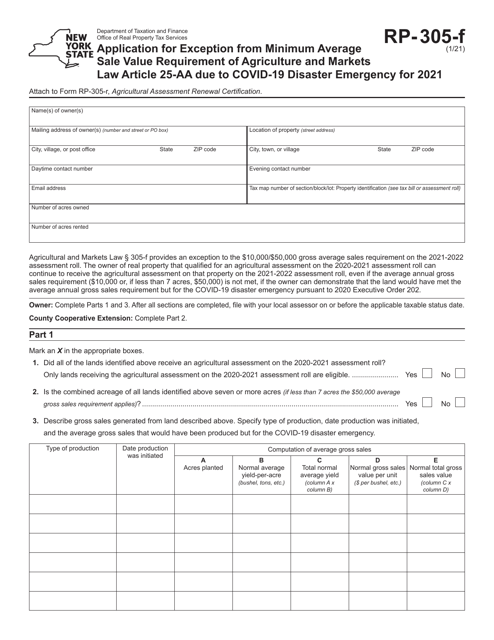

This form is used for applying for an exception from the minimum average sale value requirement of the Agriculture and Markets Law Article 25-aa in New York due to the Covid-19 disaster emergency.

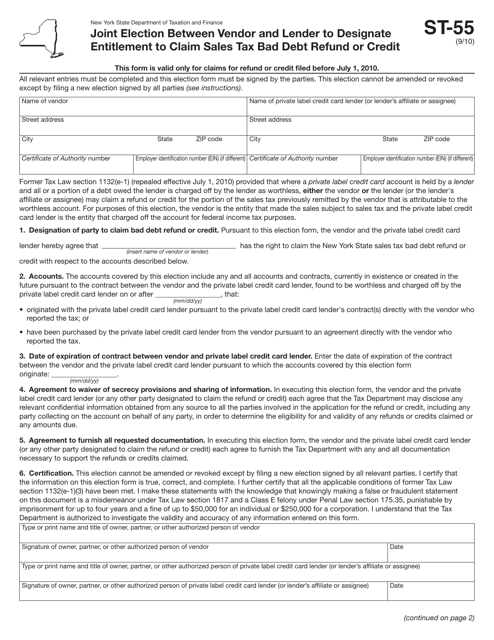

This Form is used for vendors and lenders in New York to jointly designate entitlement to claim sales tax bad debt refund or credit.

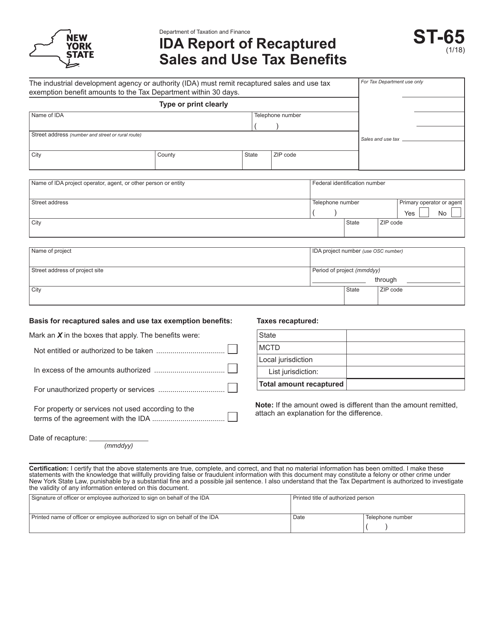

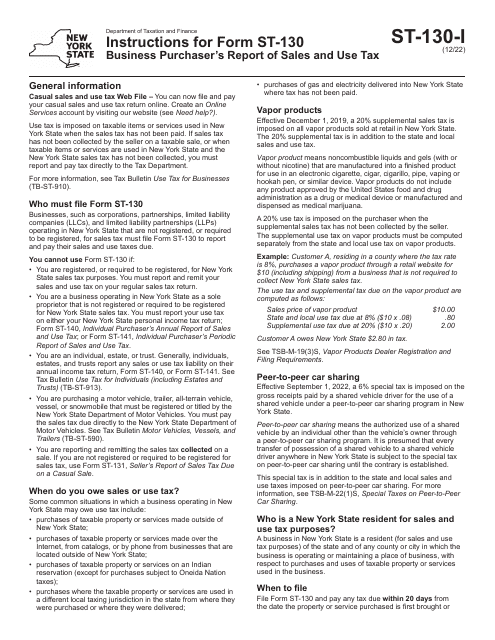

This document is used for reporting recaptured sales and use tax benefits in the state of New York.

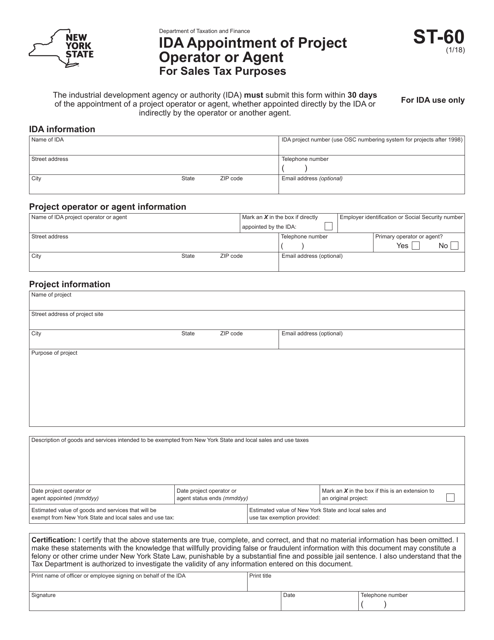

This Form is used for appointing a project operator or agent for sales tax purposes in New York.

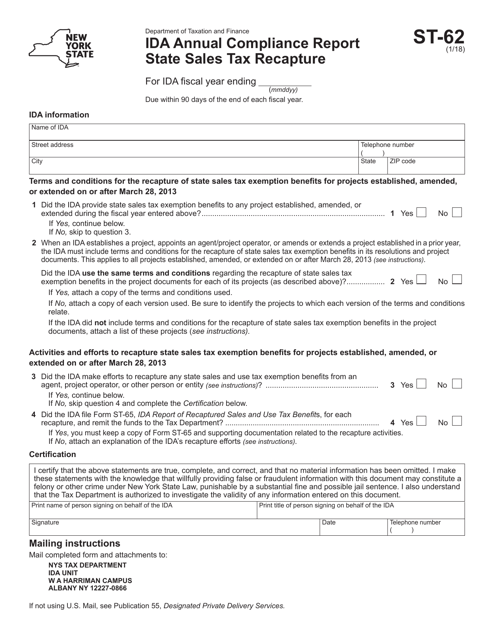

This form is used for reporting annual compliance with the State Sales Tax Recapture in New York.

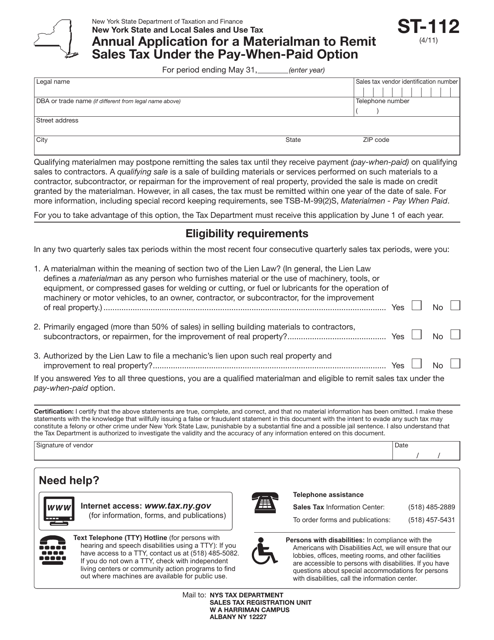

This form is used for an annual application by a materialman in New York to remit sales tax under the Pay'when'paid option.

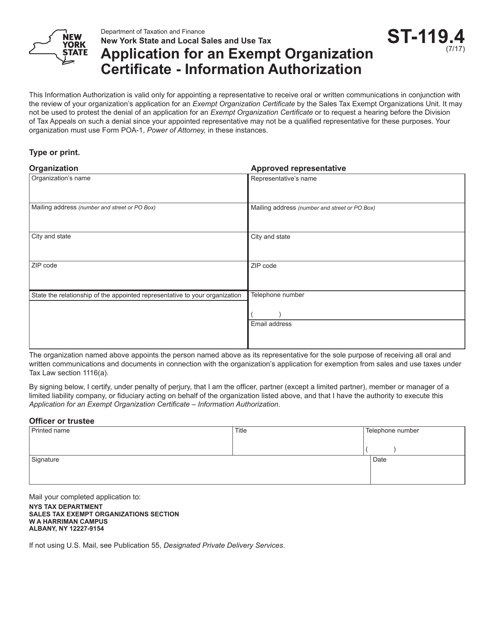

This Form is used for applying for an Exempt Organization Certificate and authorizing the release of information in New York.

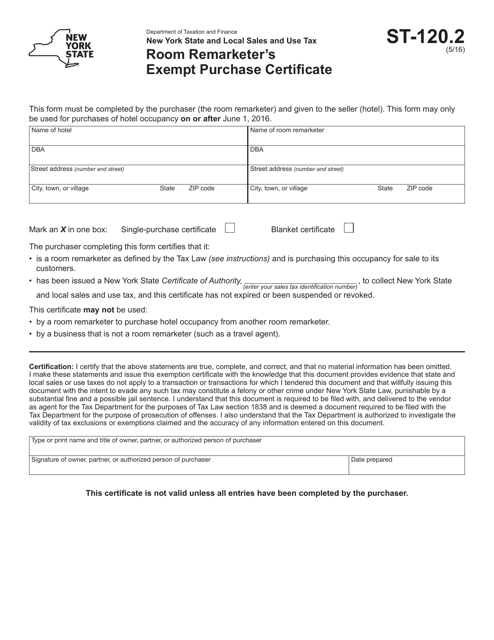

This document is used for exempt purchases made by room remarketers in New York.

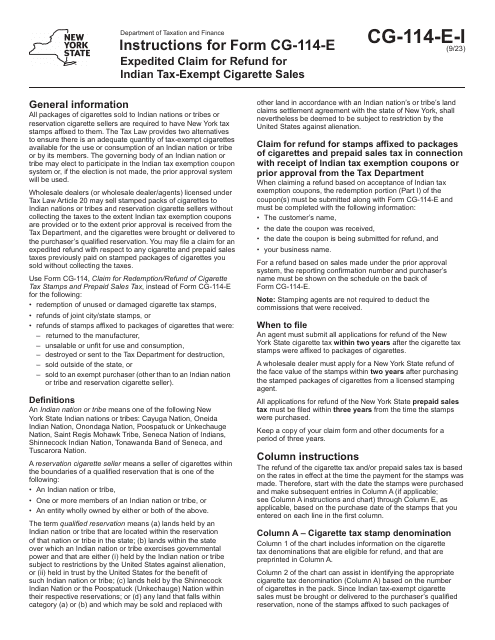

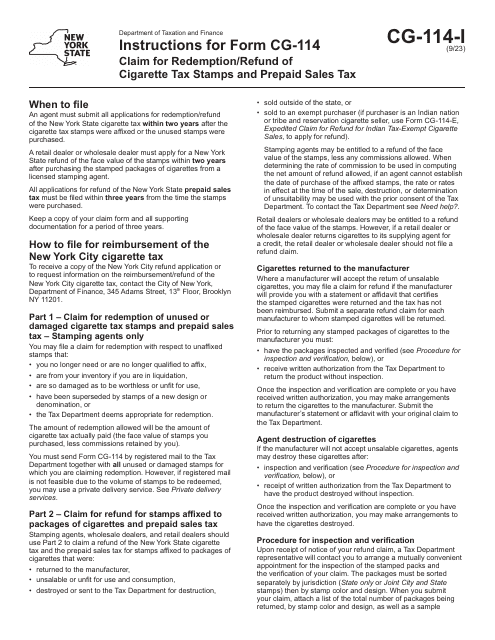

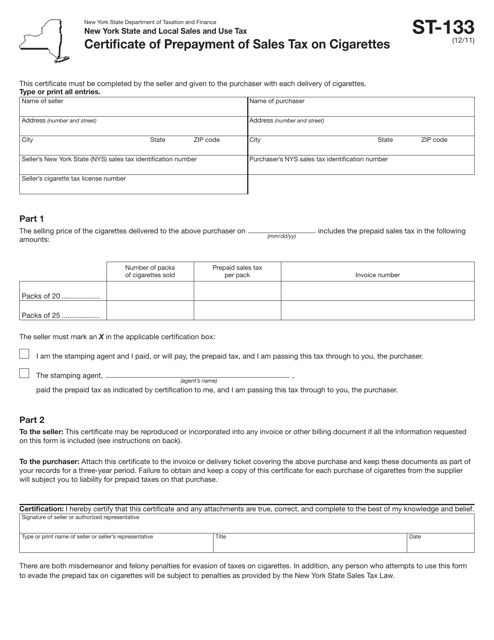

This form is used for certifying the prepayment of sales tax on cigarettes in the state of New York. It serves as proof that the required sales tax on cigarettes has been paid in advance.

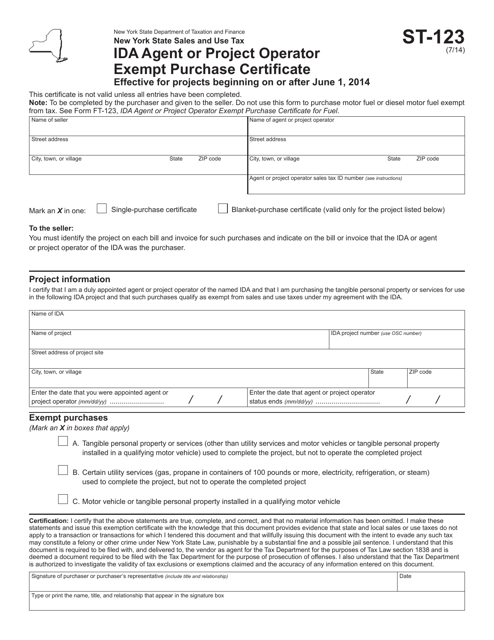

This form is used for claiming exemption on purchases for projects beginning on or after June 1, 2014 in the state of New York.

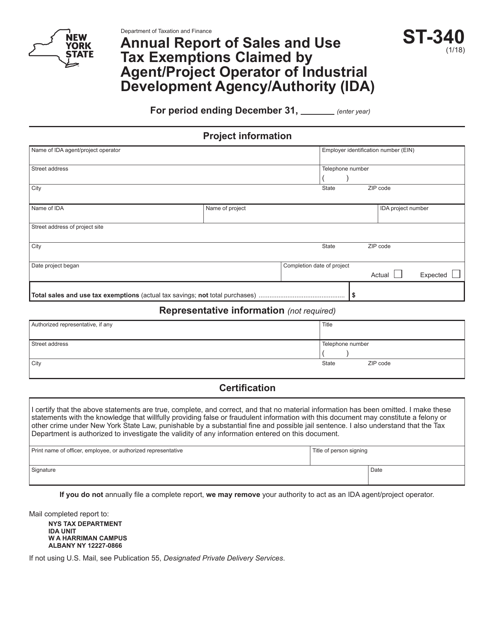

This document is used for reporting sales and use tax exemptions claimed by an agent or project operator of an Industrial Development Agency/Authority (IDA) in New York.

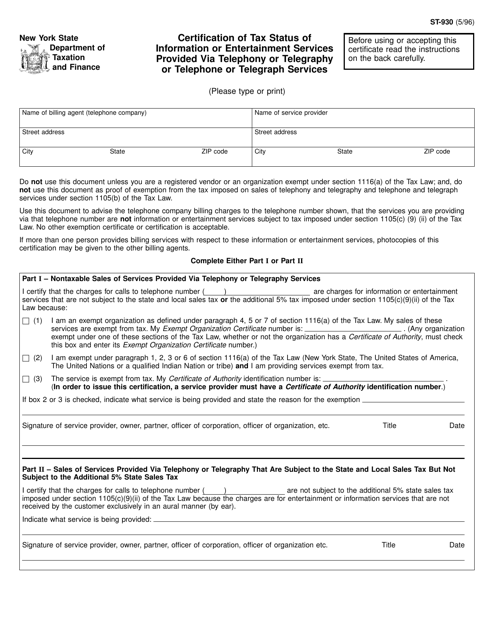

This Form is used for certifying the tax status of information or entertainment services provided through telephony or telegraphy services in New York.

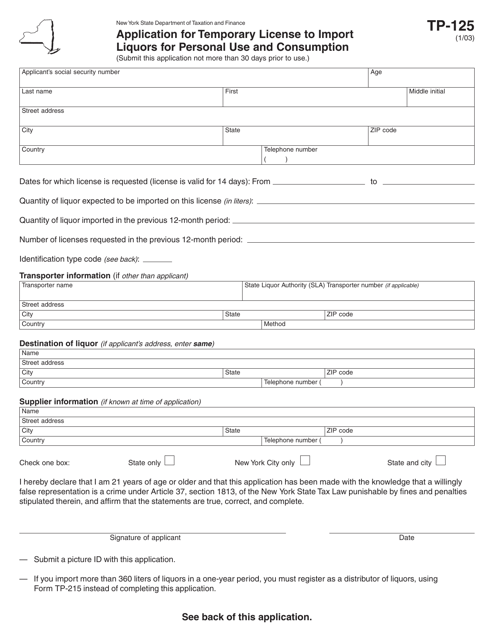

This form is used for applying for a temporary license to import liquors for personal use and consumption in New York.

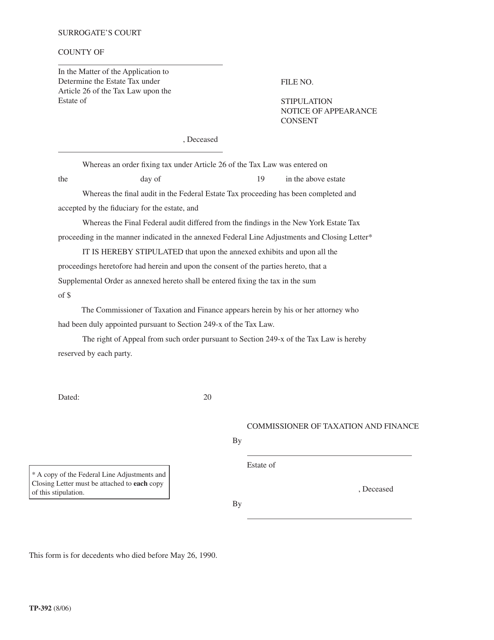

This form is used for notifying the court and other parties involved in a legal case of one's appearance and consent. It is specific to the state of New York.

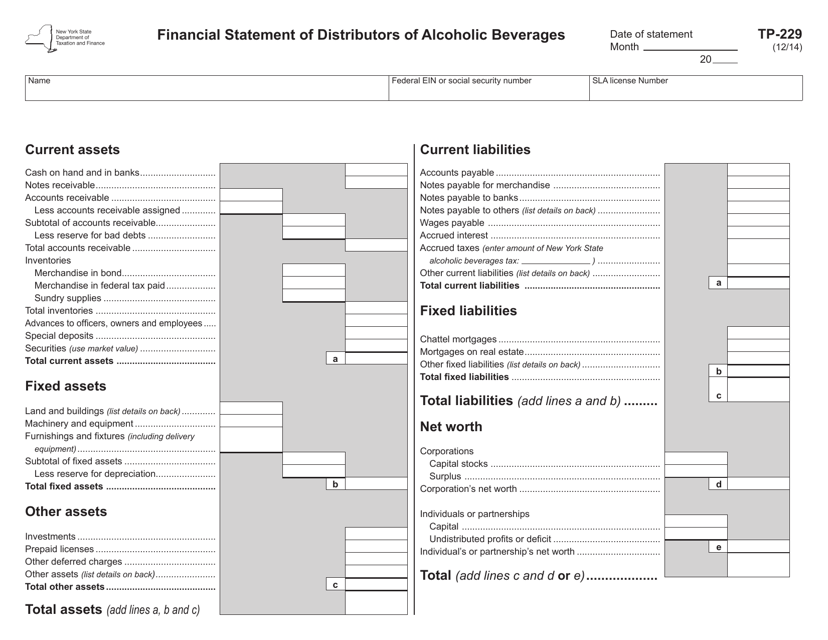

This form is used for distributors of alcoholic beverages in New York to provide their financial statement. It is a required document for regulatory compliance.

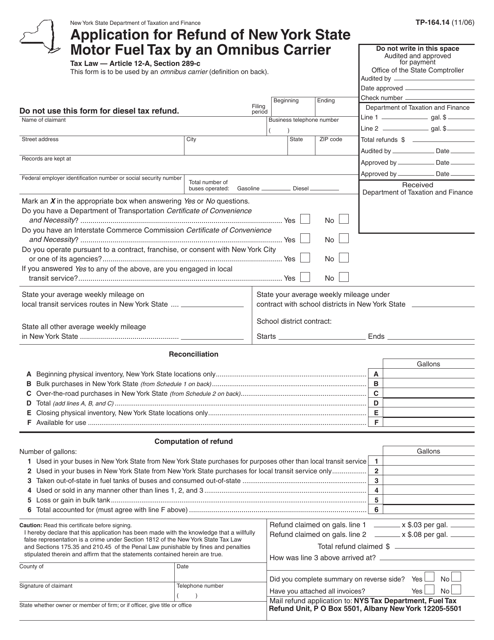

This form is used for omnibus carriers in New York to apply for a refund of the state motor fuel tax.

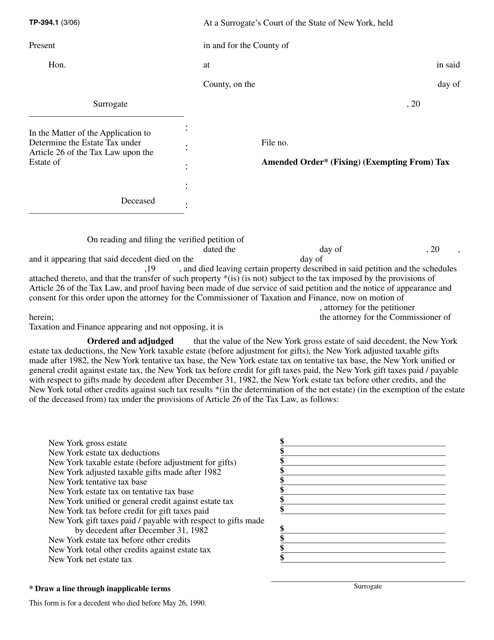

This form is used for making corrections to a previously filed order that relates to exempting or fixing tax in New York.

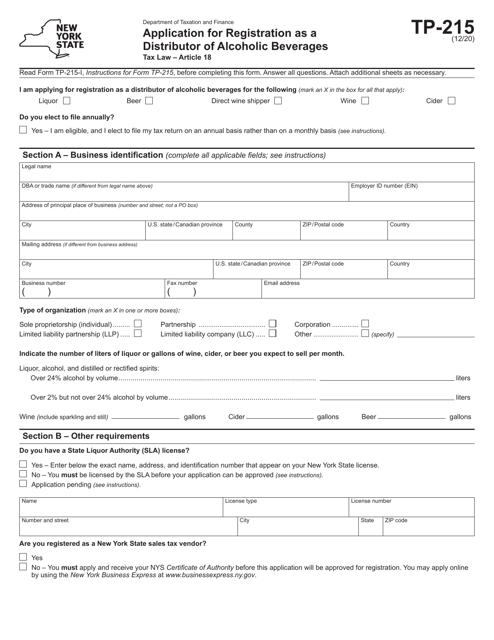

This Form is used for applying to become a distributor of alcoholic beverages in the state of New York.

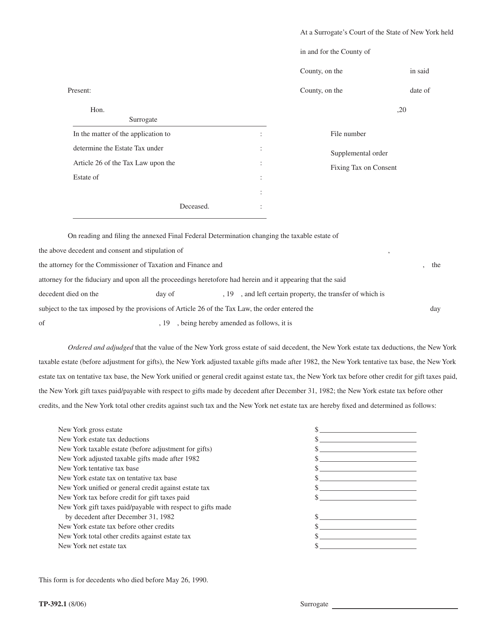

This Form is used for the supplemental order that fixes the tax on consent in New York.