Illinois Department of Revenue Forms

Documents:

857

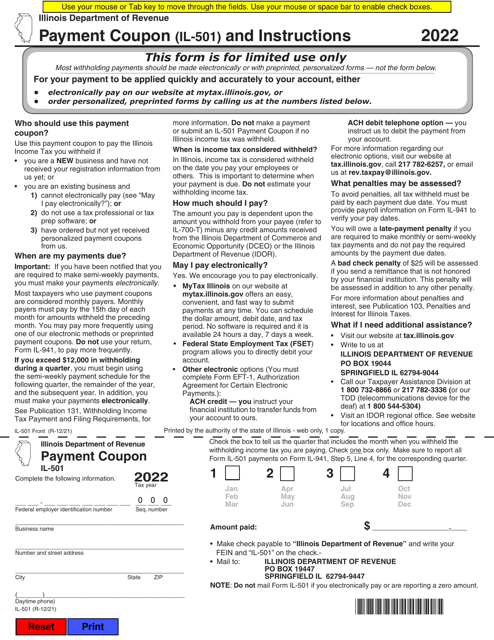

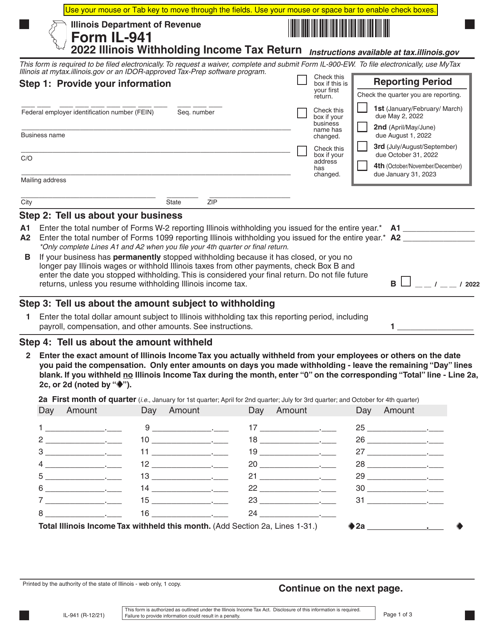

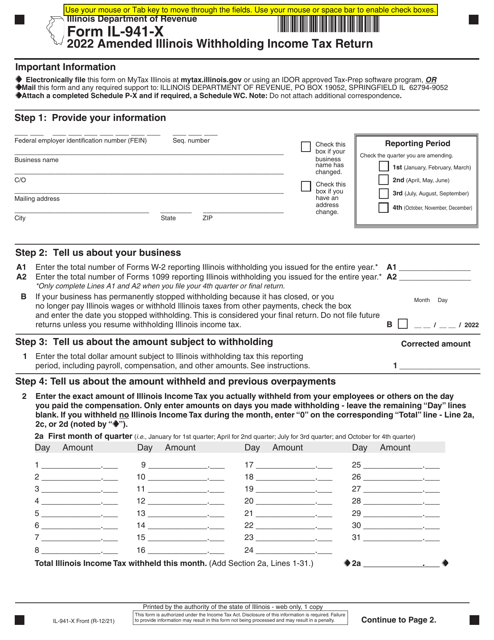

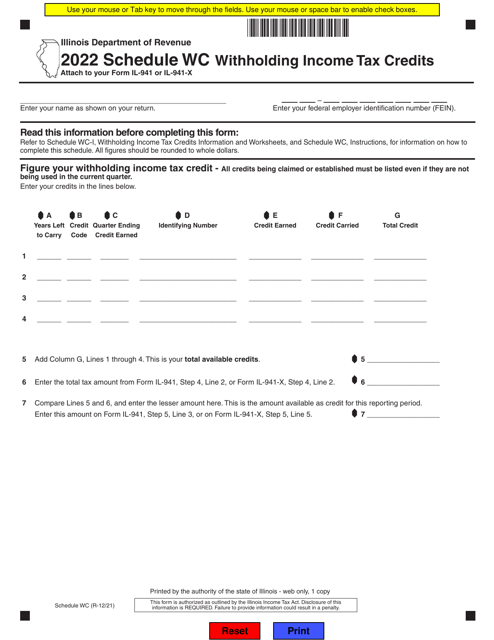

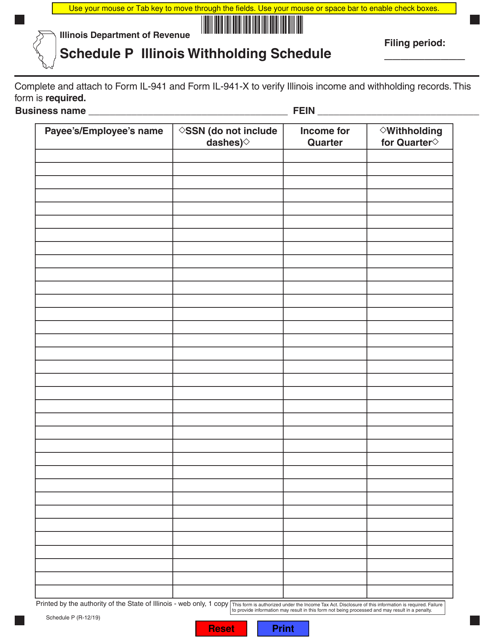

This Form is used for reporting Illinois withholding taxes. It provides a schedule for employers to detail the amount of withholding tax deducted from their employees' wages.

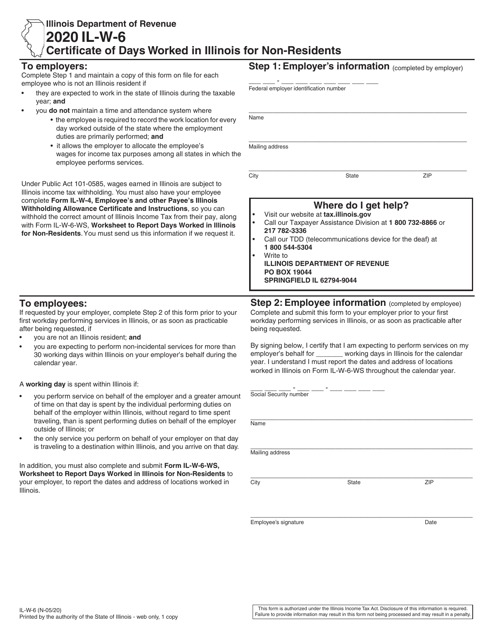

This form is used for non-residents of Illinois to certify the number of days worked in the state for tax purposes.

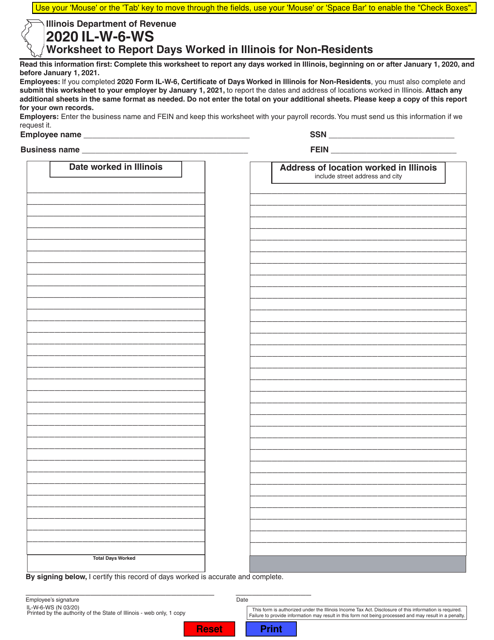

This form is used for non-residents to report the number of days worked in Illinois. It is a worksheet that helps calculate the amount of income subject to Illinois taxes.

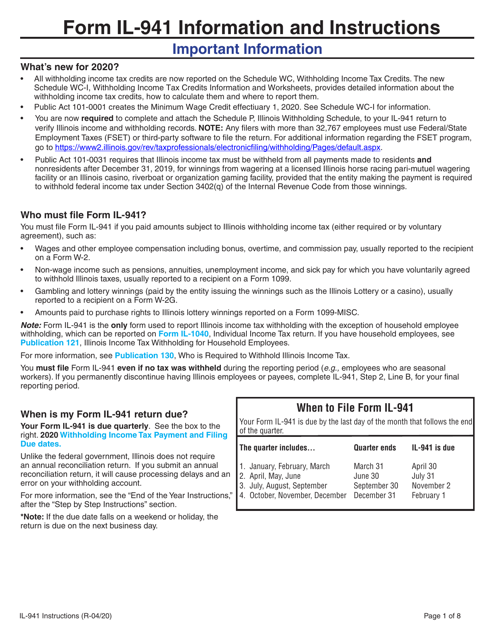

This document is used for filing the Illinois Withholding Income Tax Return in the state of Illinois. It provides instructions on how to accurately report and pay your withholding taxes to the Illinois Department of Revenue.

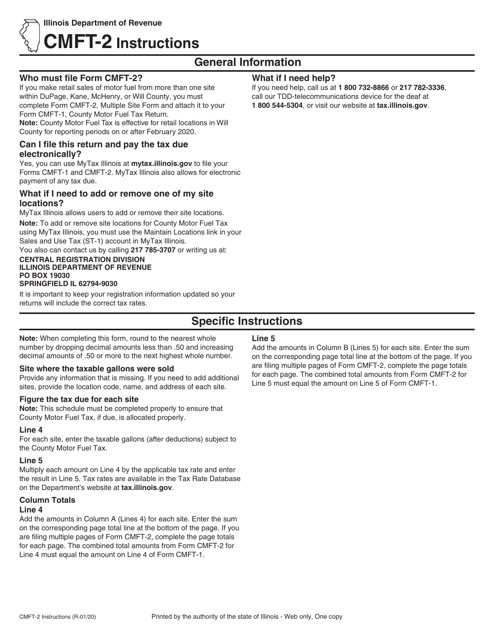

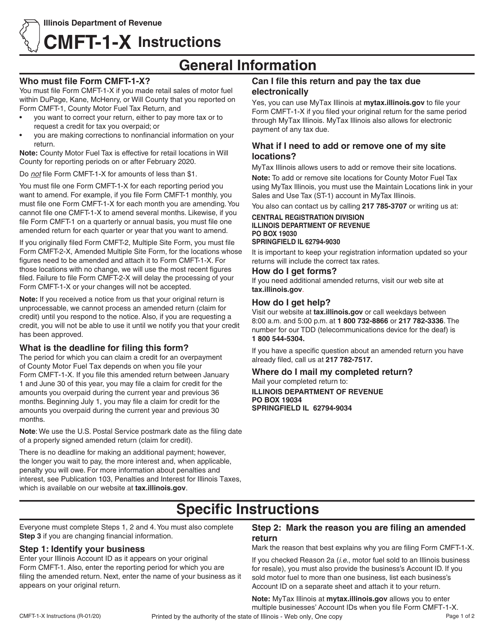

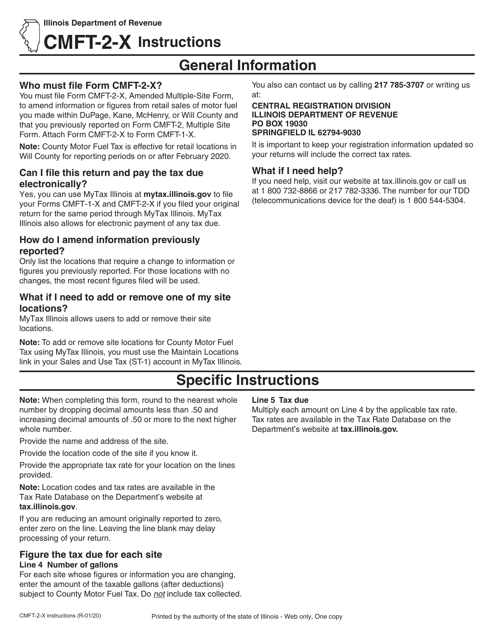

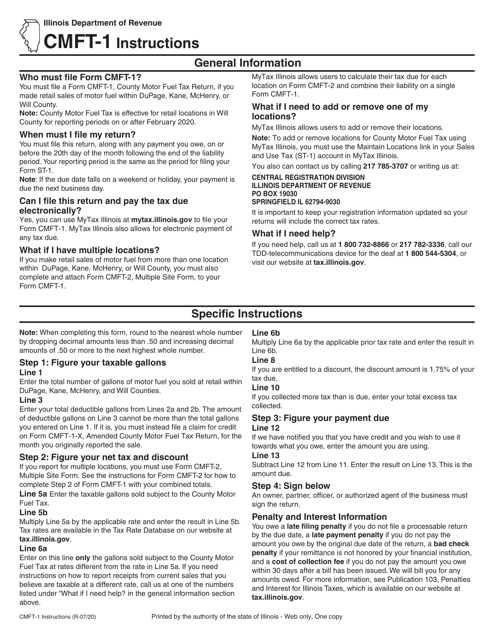

This Form is used for reporting multiple sites in Illinois. It provides instructions for filling out Form CMFT-2.

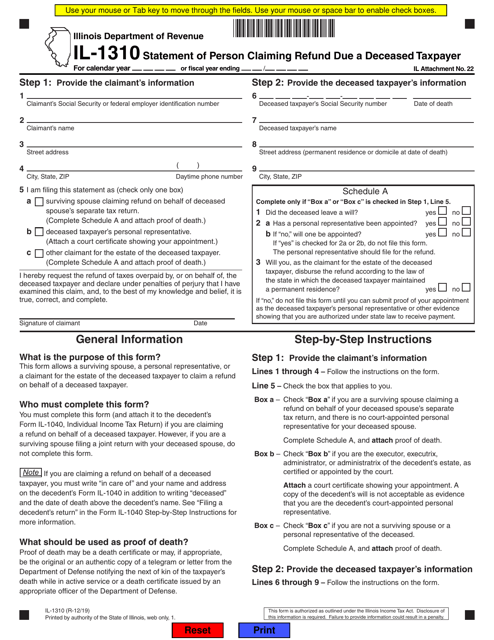

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Illinois.

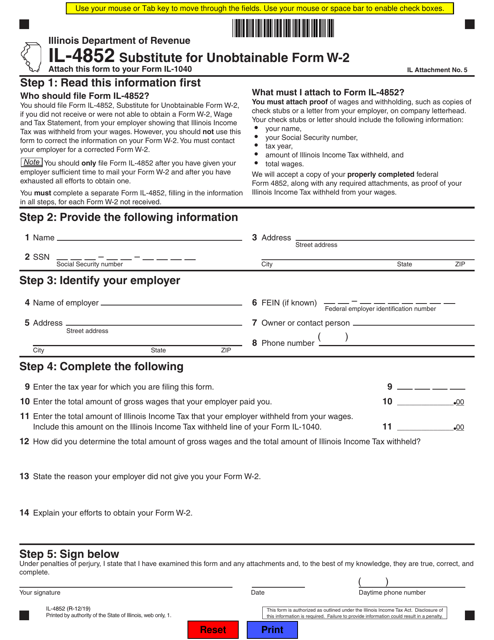

This Form is used for reporting income when an employee is unable to obtain their Form W-2 in the state of Illinois.

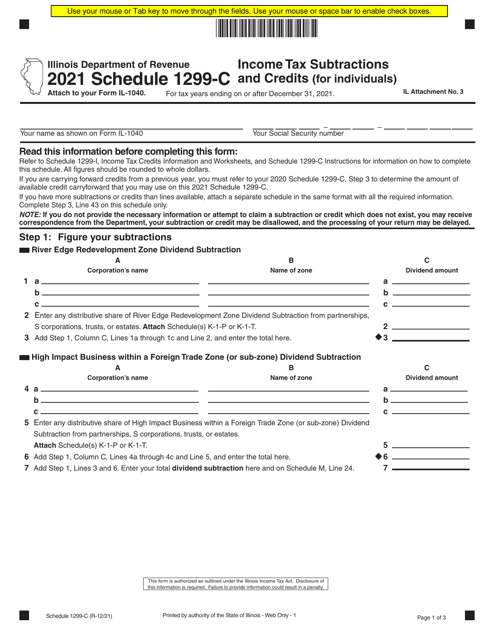

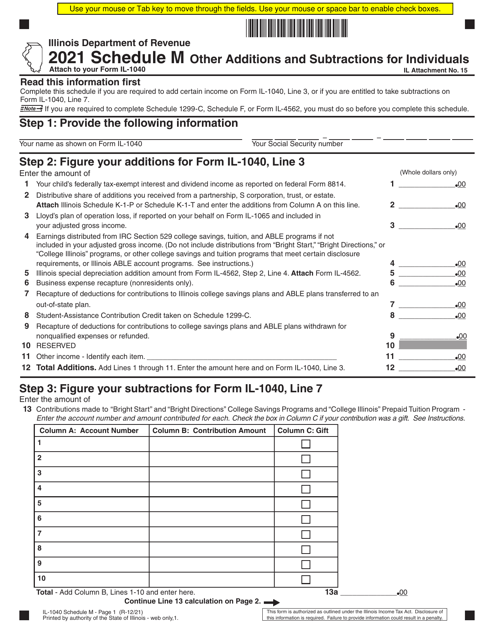

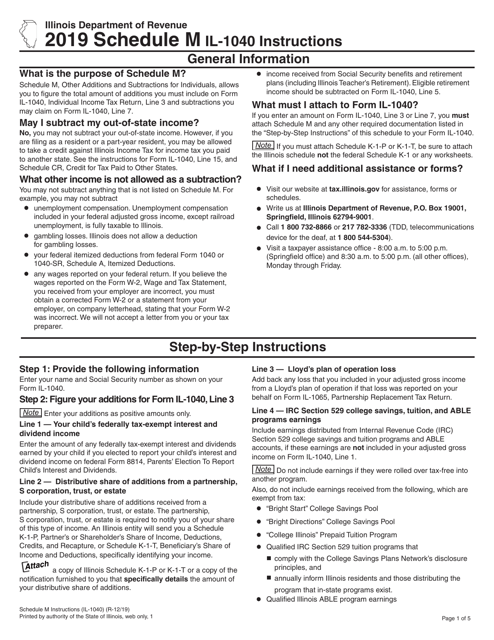

This Form is used for reporting other additions and subtractions on your Illinois Individual Income Tax Return (Form IL-1040). It helps calculate your total income or deductions for tax purposes in Illinois.