State Tax Forms and Templates

Documents:

933

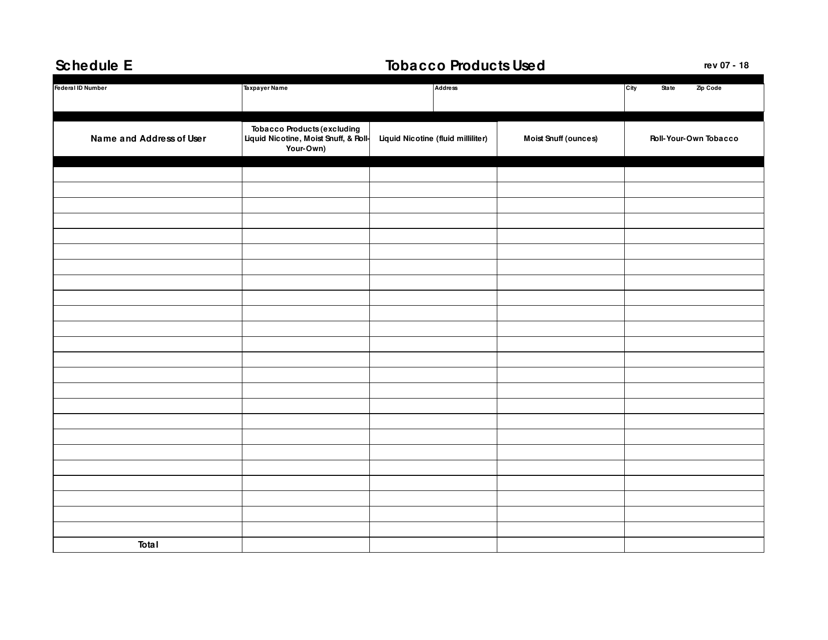

This document is used for reporting the usage of tobacco products in the state of New Jersey. It is a form that must be filled out by individuals or businesses who use tobacco products and is used for tax purposes.

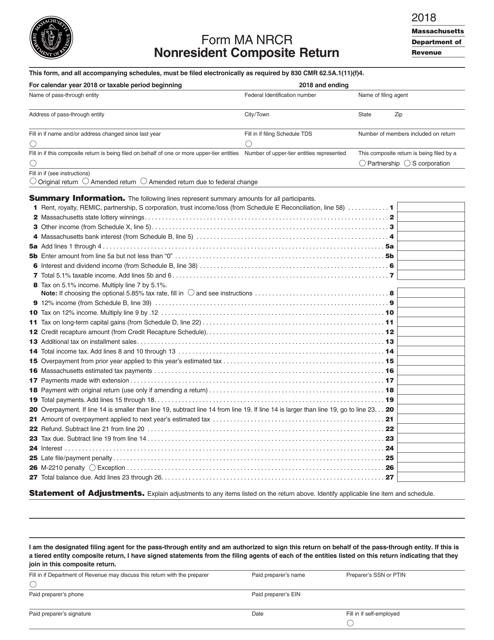

This form is used for nonresidents to file a composite return in Massachusetts.

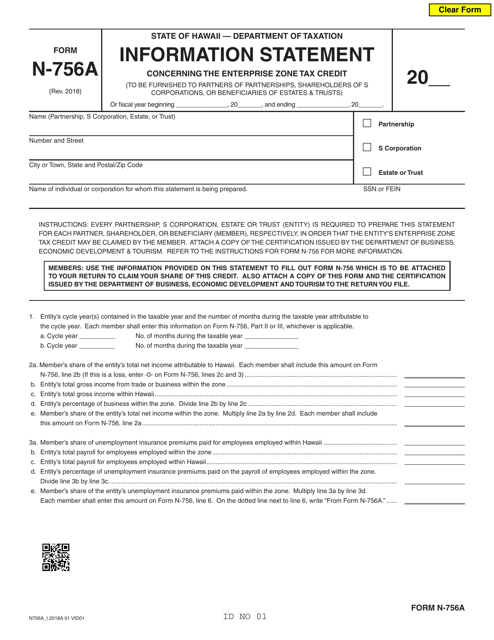

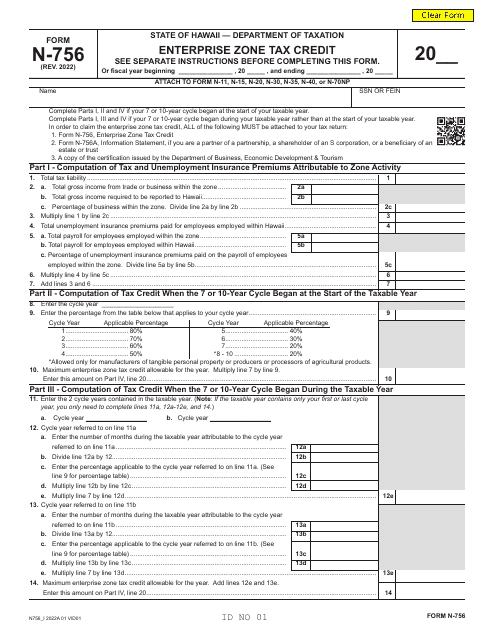

This document provides information about the Enterprise Zone Tax Credit specific to Hawaii. It includes details that individuals and businesses need to complete the Form N-756A.

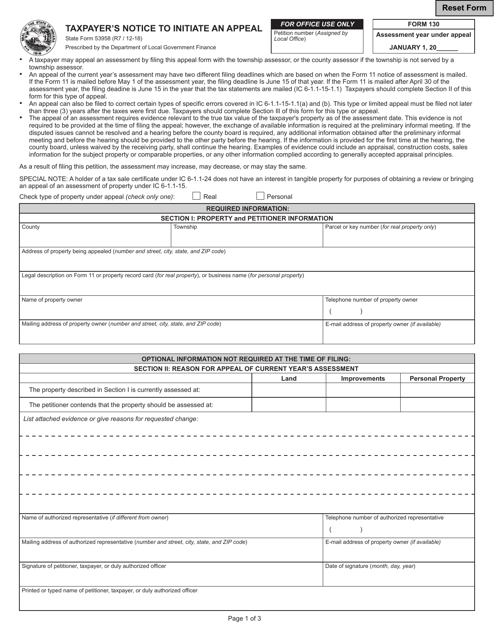

This form is used for Indiana residents who wish to initiate an appeal regarding their taxes.

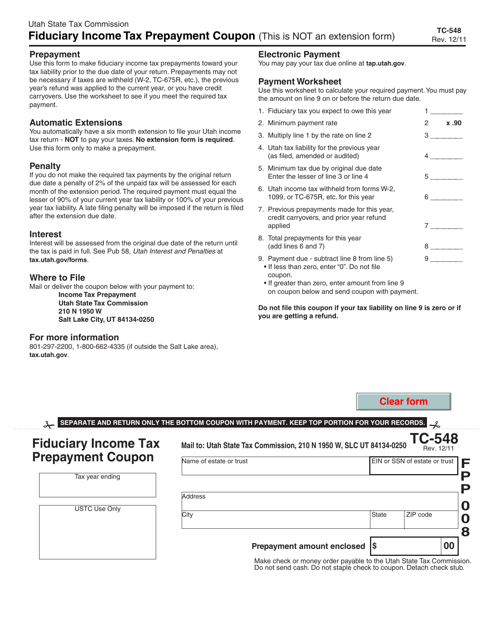

This form is used for making prepayments of fiduciary income tax in Utah.

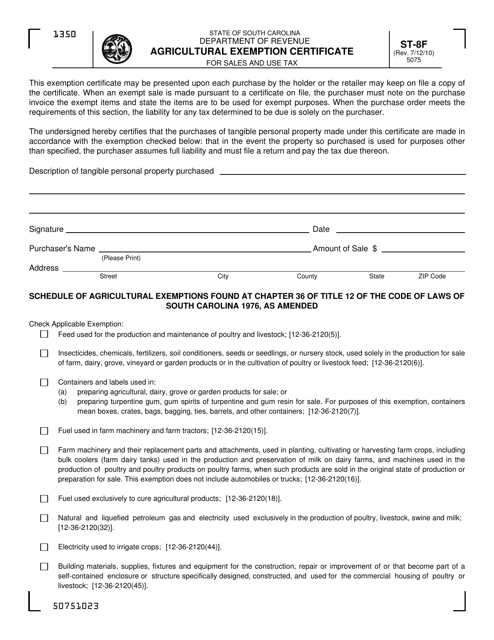

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

This form is used for homeowners' associations in Texas to apply for state tax exemption.

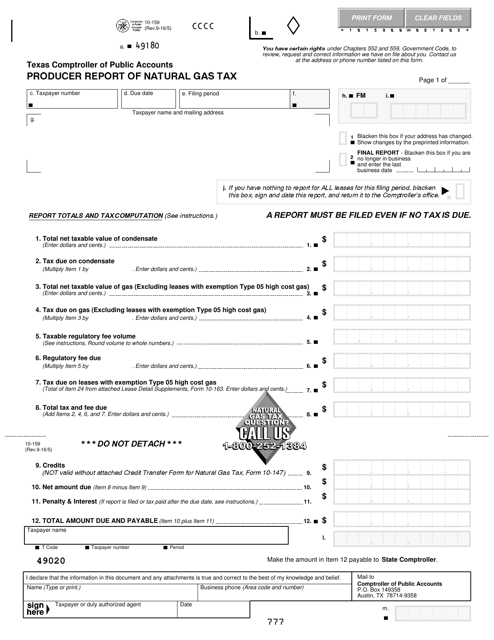

This Form is used for reporting natural gas tax by producers in the state of Texas.