State Tax Forms and Templates

Documents:

933

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

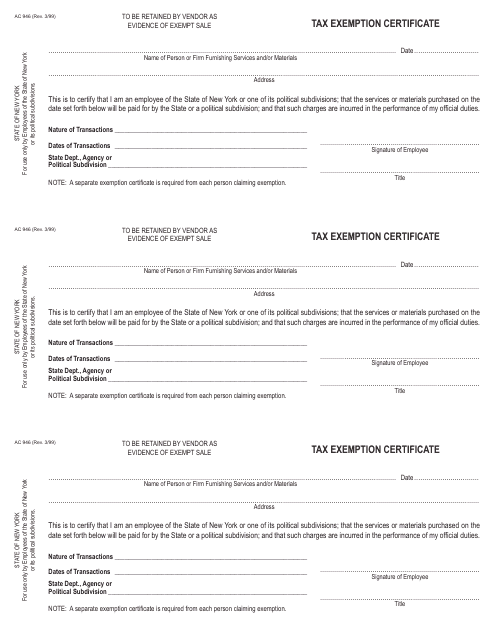

This type of document is used for obtaining tax exemption in New York.

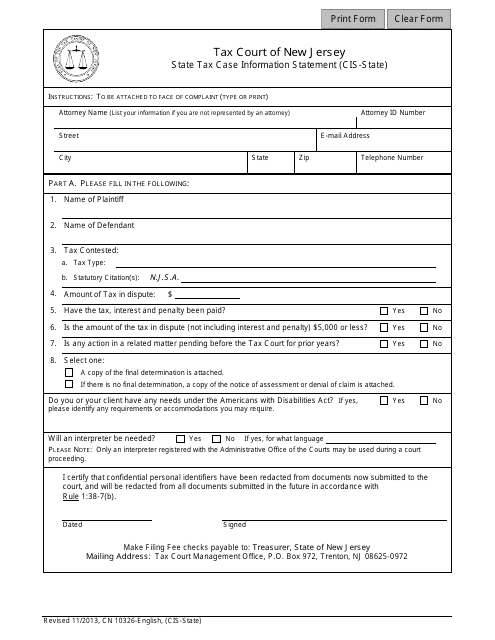

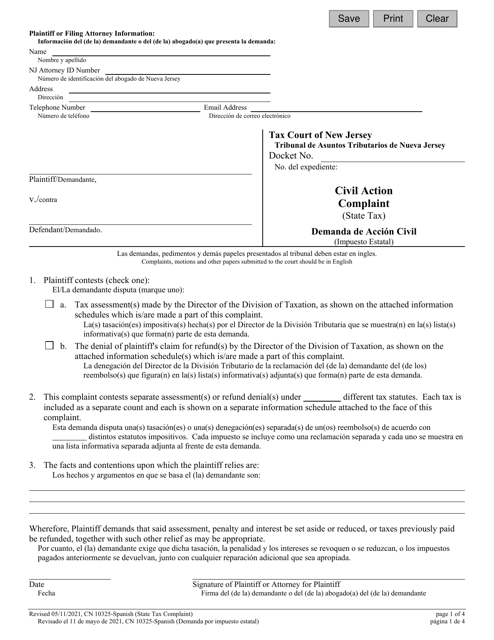

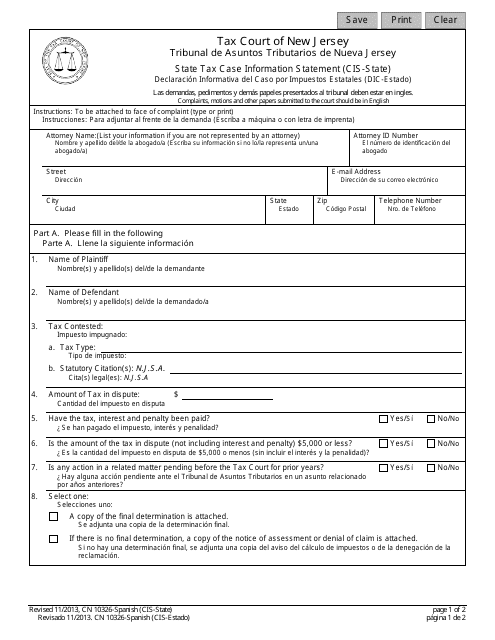

This document is used for providing state tax case information in the state of New Jersey.

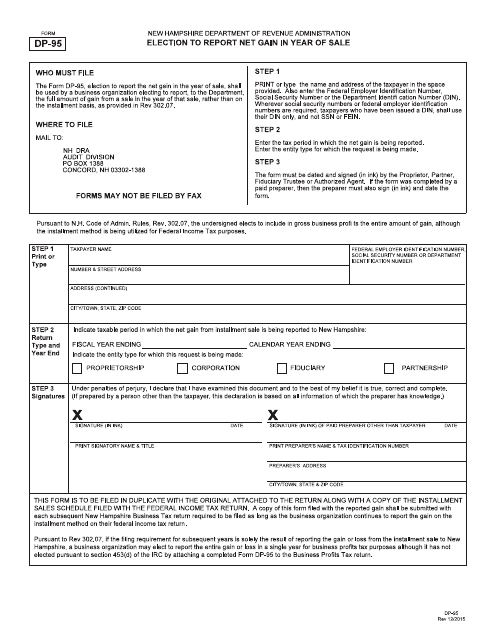

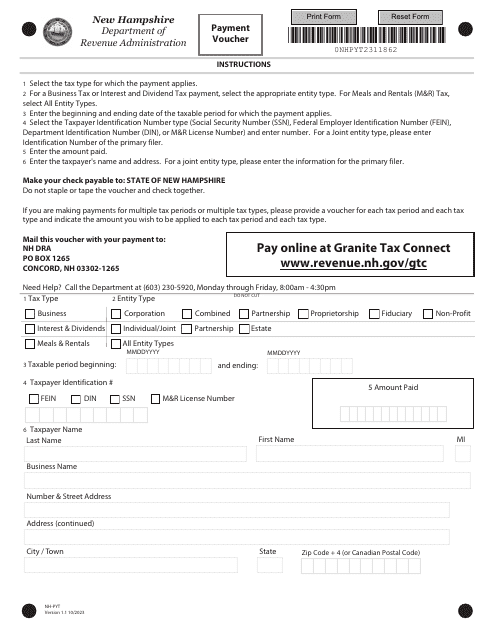

This form is used for electing to report net gain in the year of sale in New Hampshire.

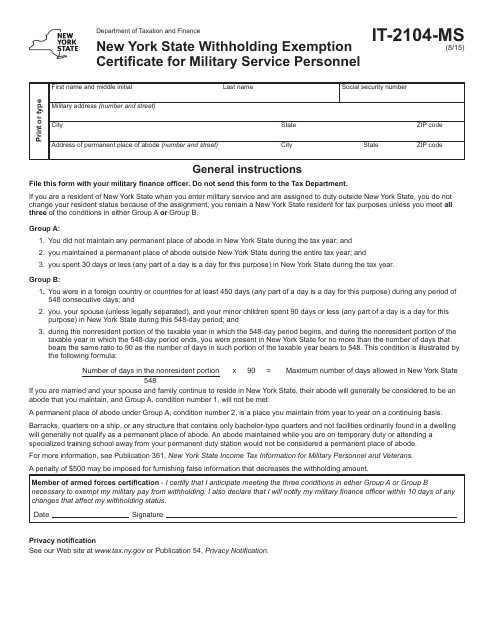

This Form is used for military service personnel in New York to claim withholding exemption from their income tax.

This form is used for providing case information related to state taxes in New Jersey. It is available in English and Spanish.

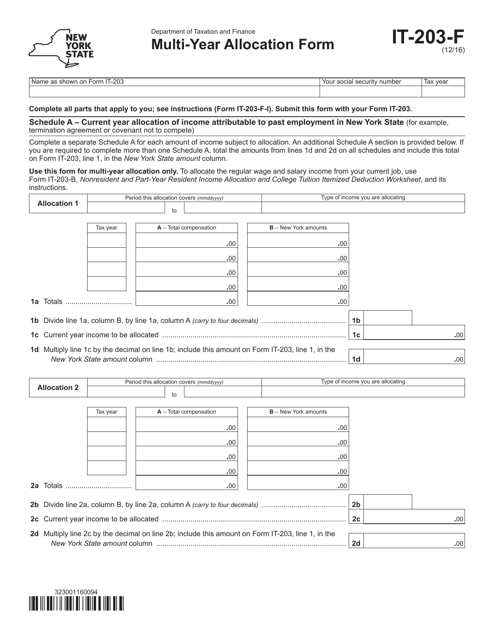

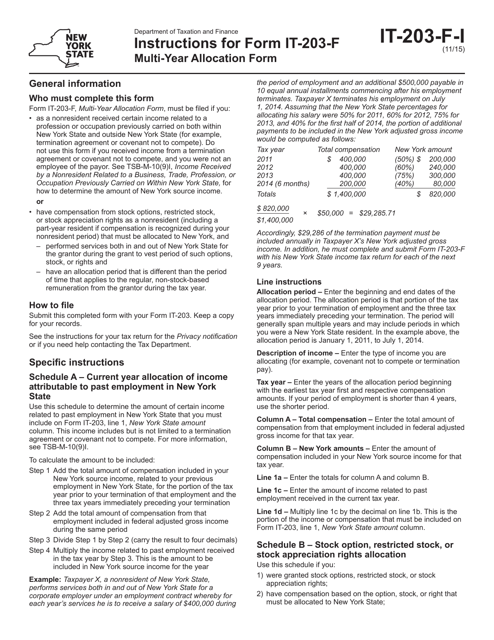

This Form is used for allocating income and deductions for multiple years in New York.

This document is used to provide instructions for completing Form IT-203-F Multi-Year Allocation Form in New York. It guides taxpayers on how to properly allocate income, deductions, and credits over multiple tax years.

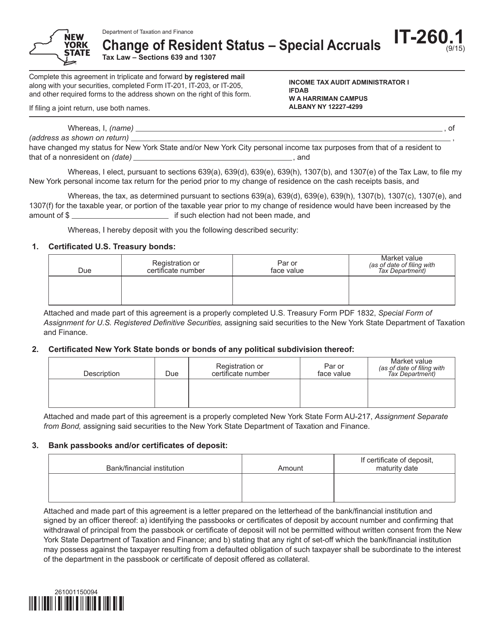

This form is used for reporting changes in resident status and special accruals in New York.

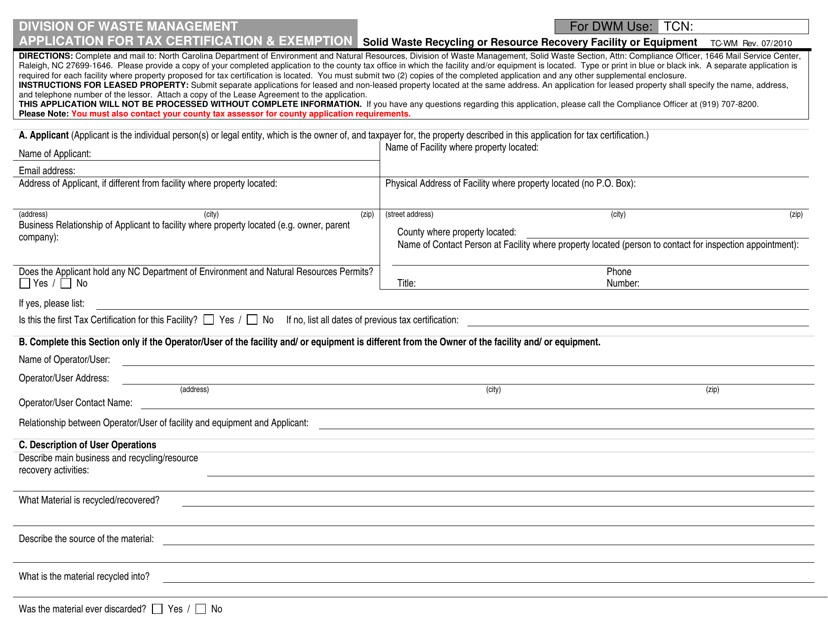

This form is used for applying for tax certification and exemption in North Carolina.

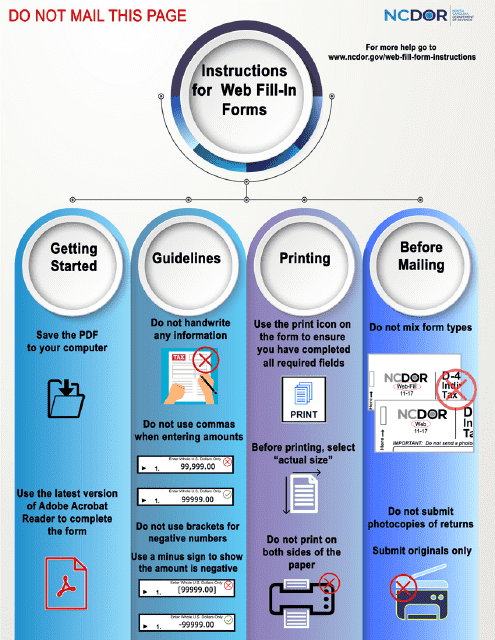

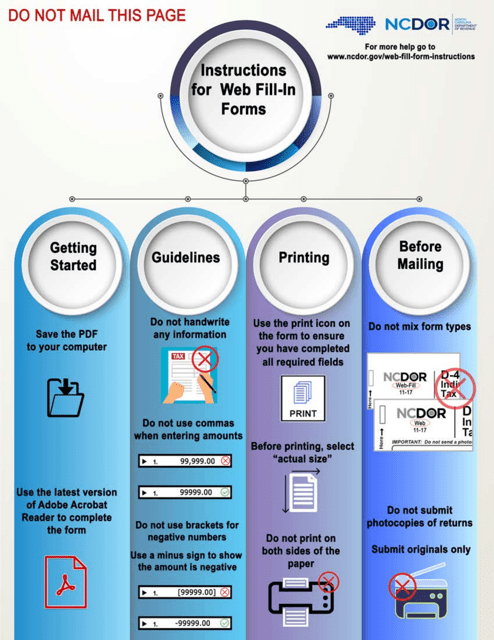

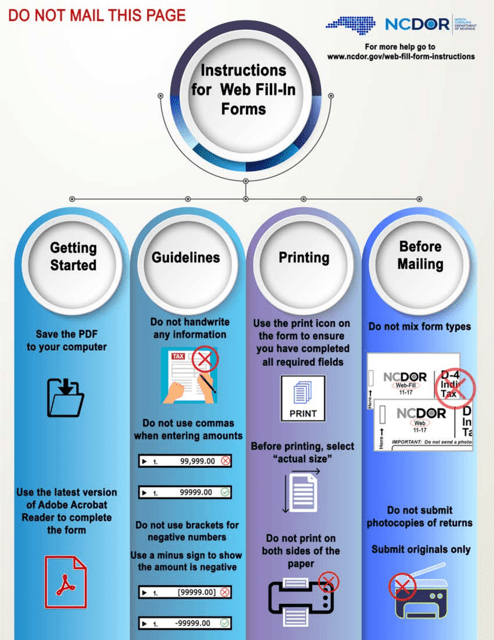

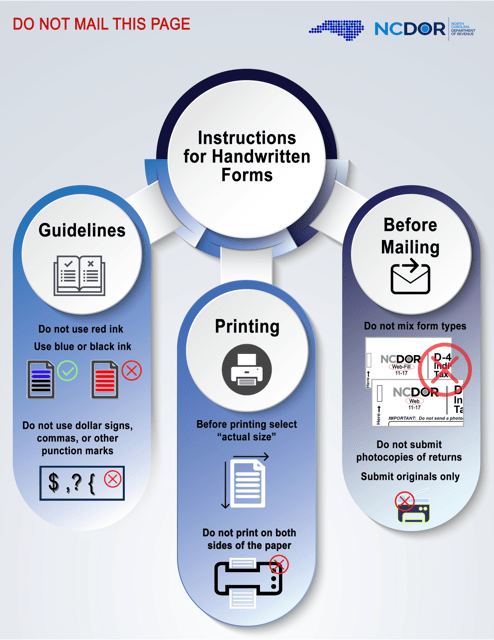

This document is for businesses in North Carolina who want to claim a refund for state, county, and transit sales and use taxes. It provides instructions on how to fill out and submit Form E-588.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

This Form is used for businesses in North Carolina to claim a refund on state, county, and transit sales and use taxes.

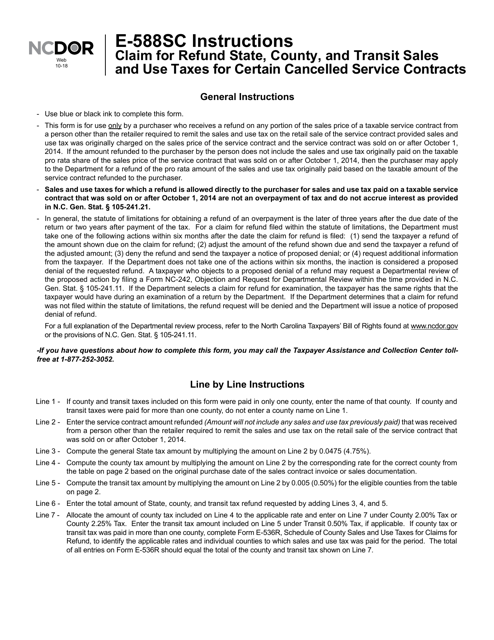

This form is used for claiming a refund for state, county, and transit sales and use taxes for certain cancelled service contracts in North Carolina. It provides instructions on how to fill out and submit the form to request a refund.

This Form is used for utility companies in North Carolina to claim a refund for state, county, and transit sales and use taxes.

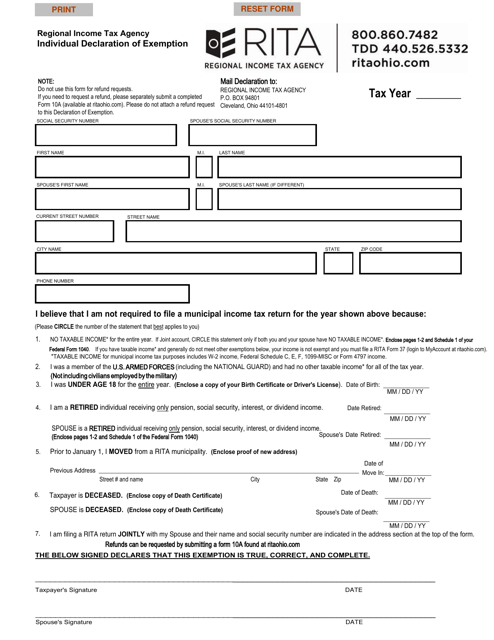

This document is used for individuals in Ohio to declare their exemption from certain taxes or fees. It allows individuals to claim exemptions for specific reasons such as religious beliefs or certain types of income.

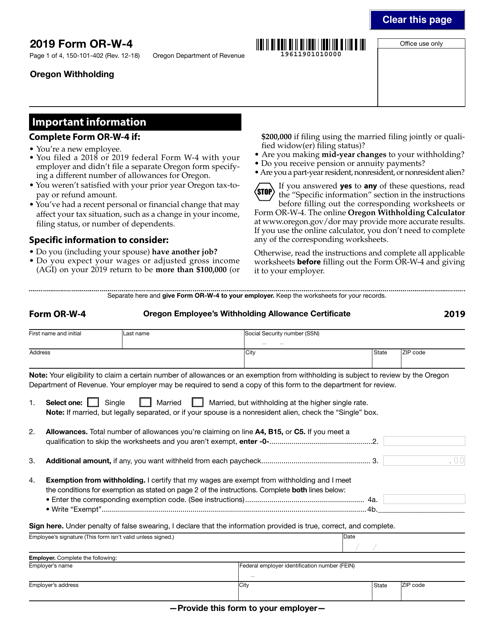

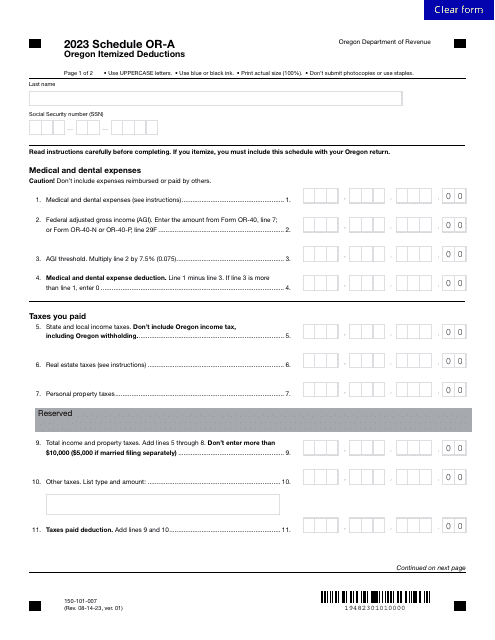

This form is used for Oregon residents to determine the correct amount of state income tax to withhold from their wages.

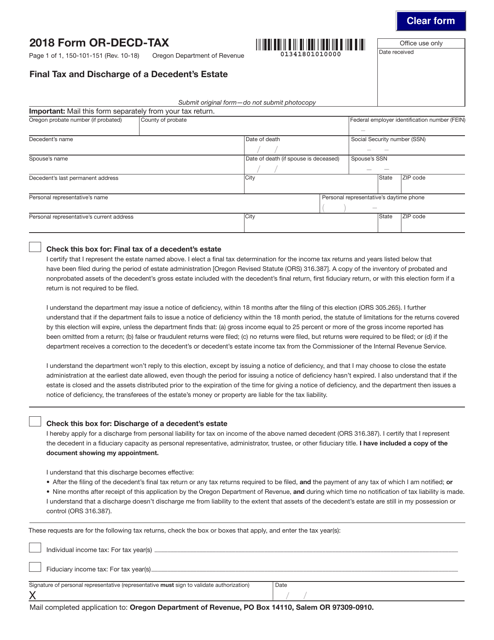

This form is used for the final tax and discharge of a decedent's estate in Oregon.

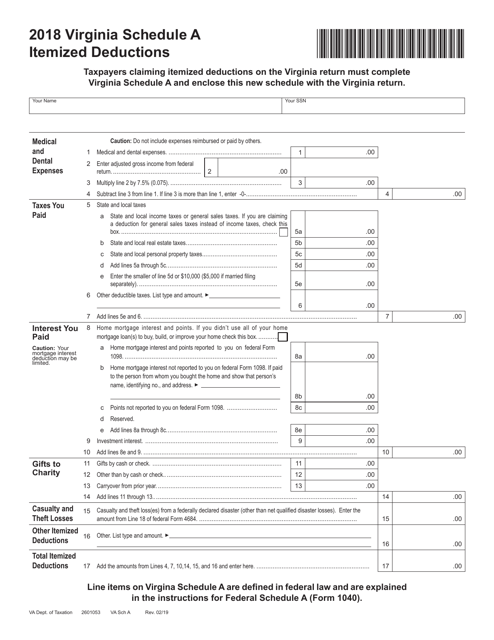

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.