State Tax Forms and Templates

Documents:

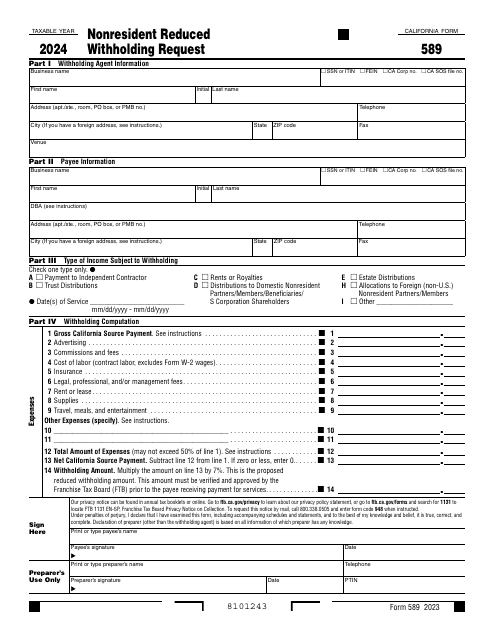

933

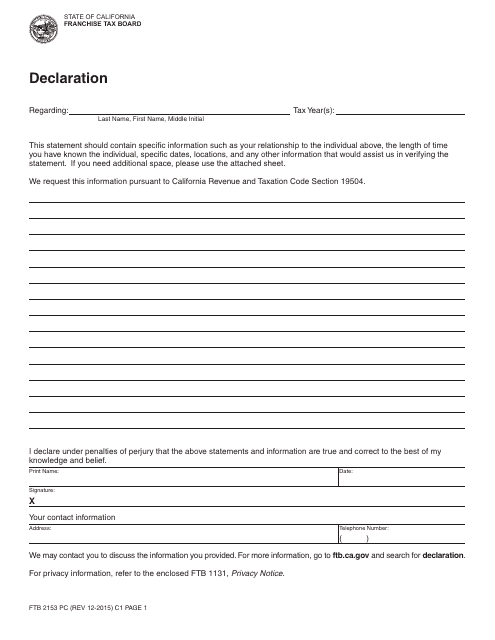

This form is used for filing a declaration of payment and/or communication of your personal income tax with the California Franchise Tax Board.

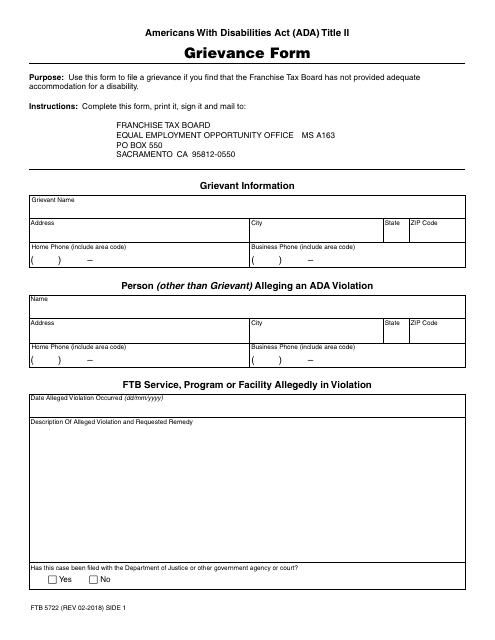

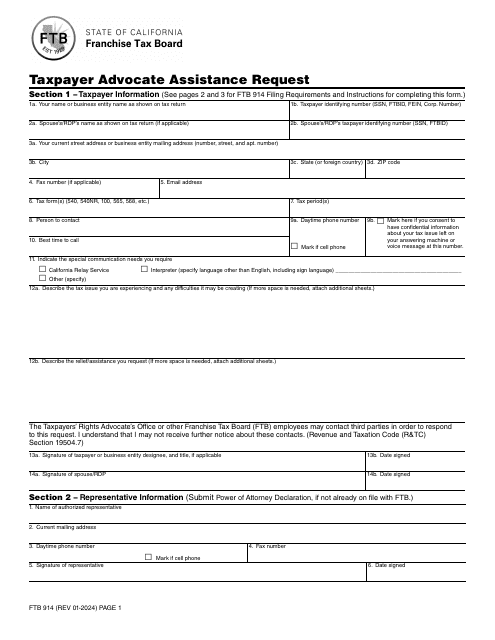

This form is used for filing a grievance with the California Franchise Tax Board (FTB).

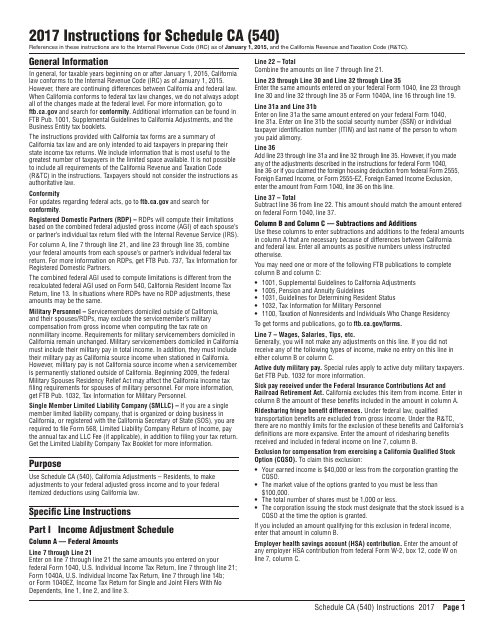

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

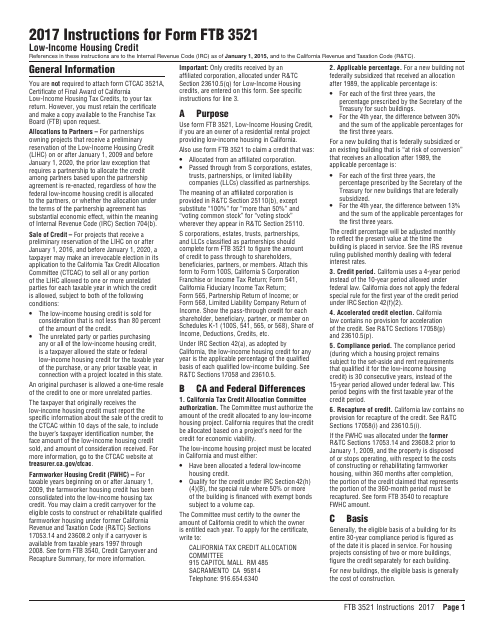

This Form is used for claiming the Low-Income Housing Credit in the state of California. It provides instructions on how to complete and submit the form to the California Franchise Tax Board.

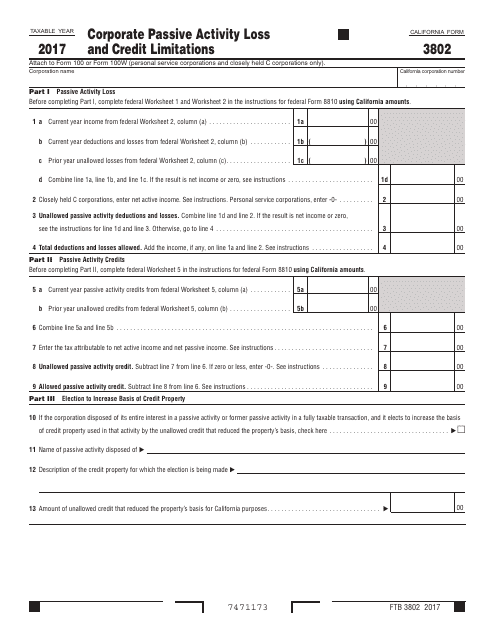

This form is used for reporting passive activity losses and credit limitations for corporations in California.

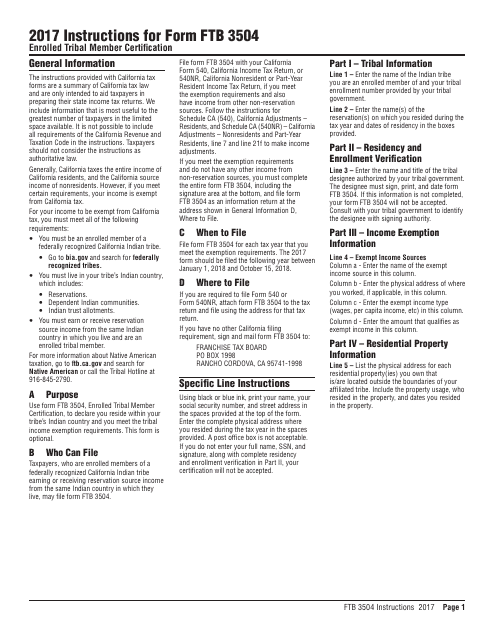

This form is used for enrolled tribal members in California to certify their status. It provides instructions on how to fill out and submit Form FTB3504.

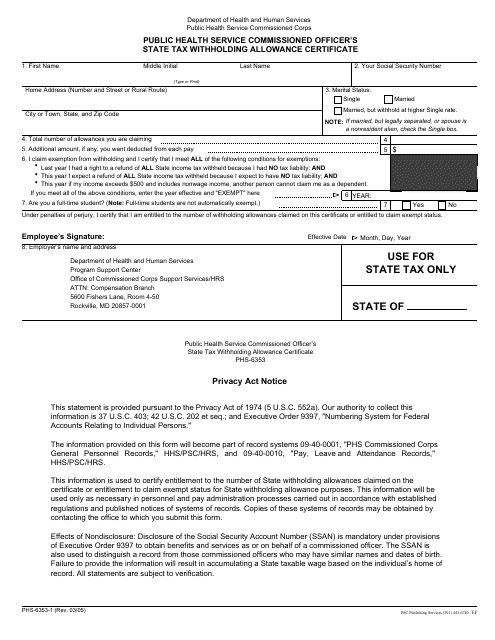

This type of document is used by Public Health Service Commissioned Officers to declare their state tax withholding allowances.

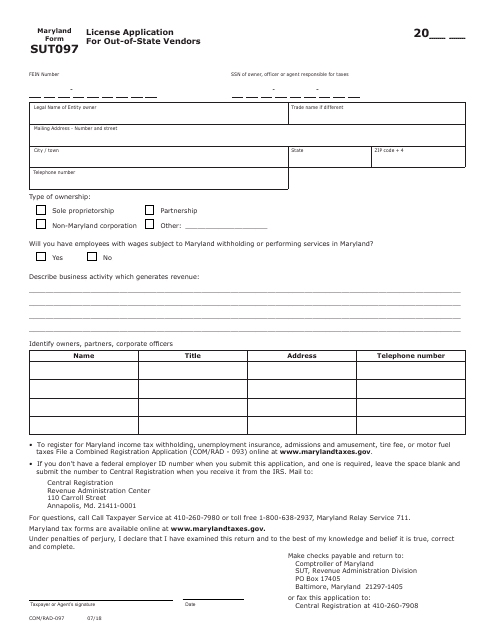

This form is used for applying for a license as an out-of-state vendor in Maryland.

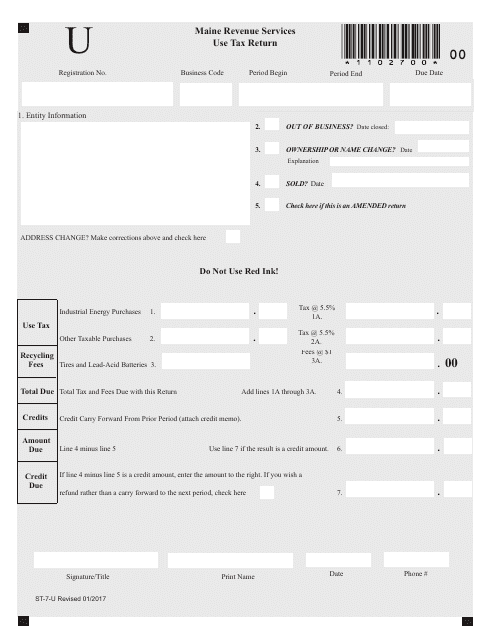

This form is used for reporting and paying use tax in the state of Maine. Use tax is a tax on purchases made outside of Maine but used within the state.

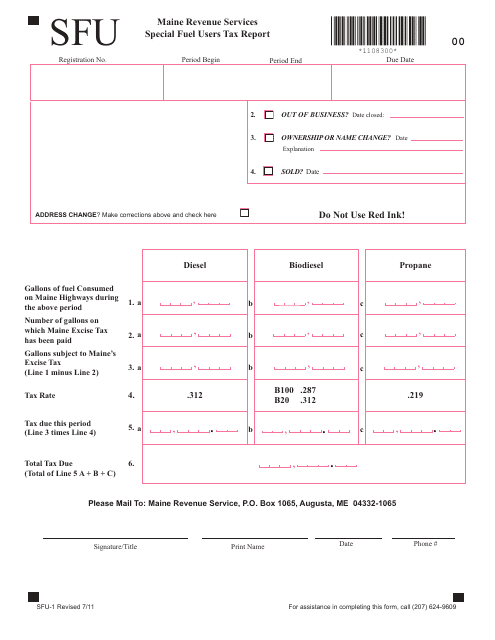

This form is used for reporting taxes on special fuel usage in the state of Maine. It is mandatory for businesses and individuals who use special fuel for their operations to file this report.

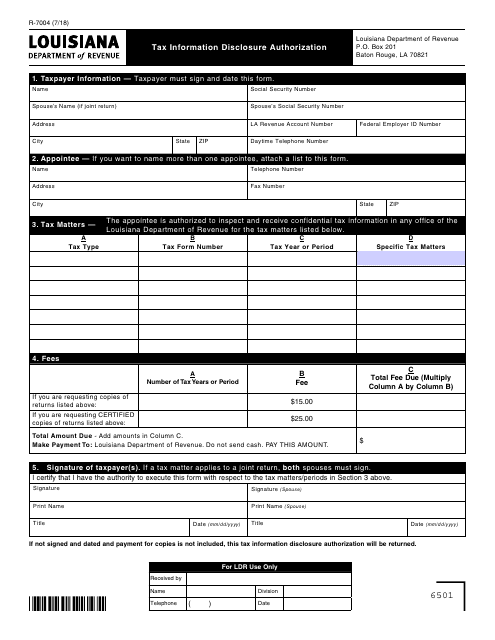

This form is used for authorizing the disclosure of tax information in the state of Louisiana.

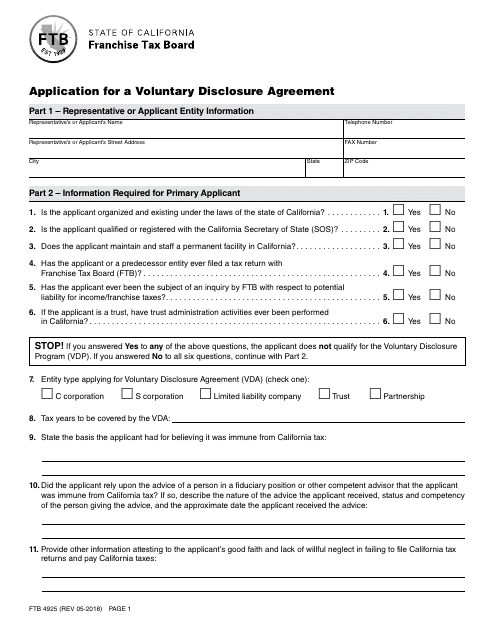

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

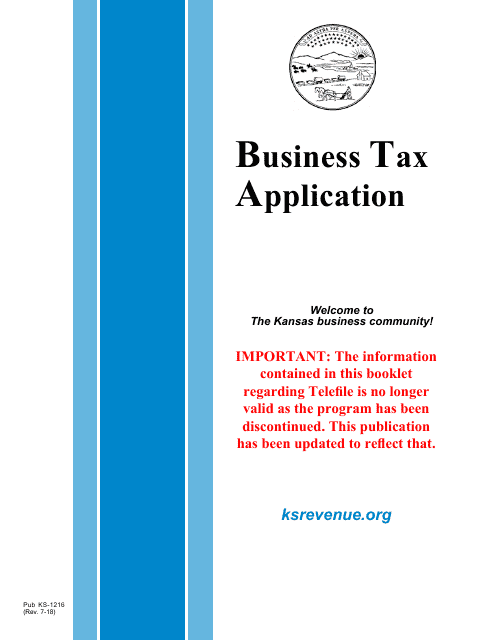

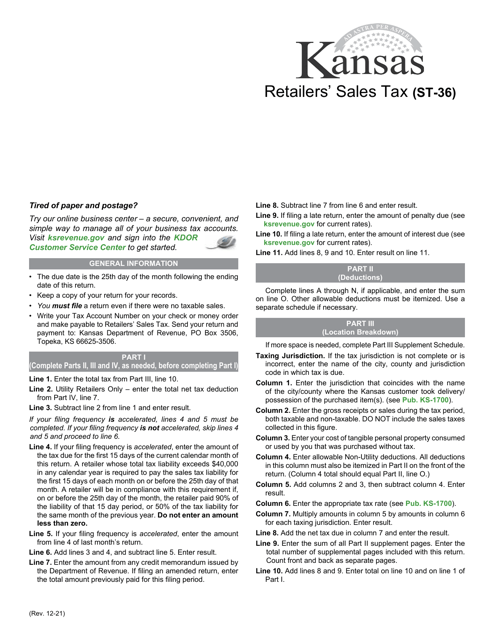

This Form is used for applying for business tax in the state of Kansas.

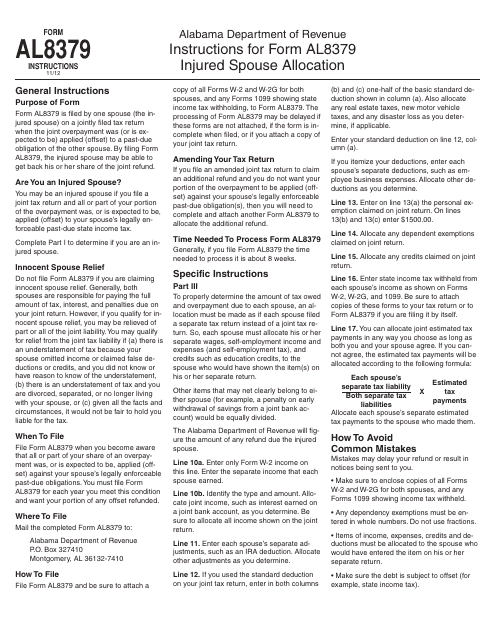

This Form is used for allocating the income and tax liability of a joint tax return when one spouse has outstanding debts or obligations. It is specifically for residents of Alabama.

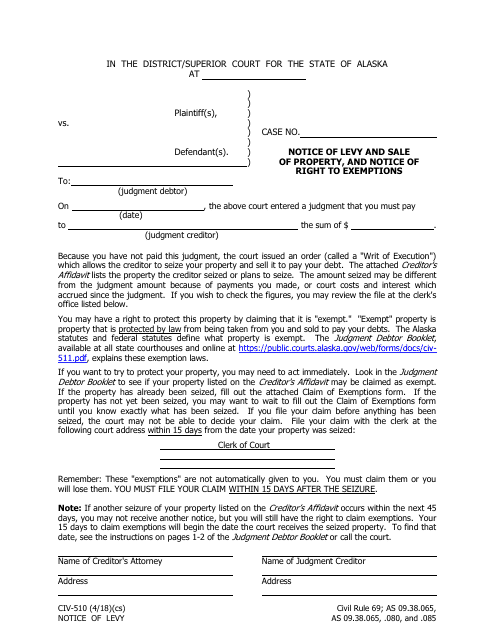

This form is used for giving notice of the levy and sale of property and also informing the recipient of their right to claim exemptions in the state of Alaska.

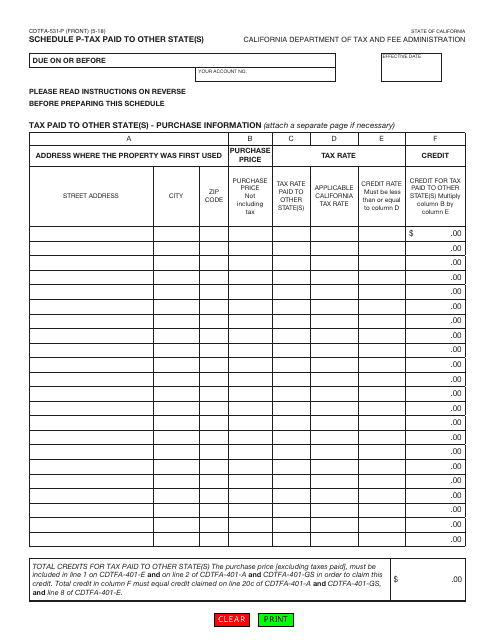

This form is used for reporting tax paid to other state(s) for California residents.

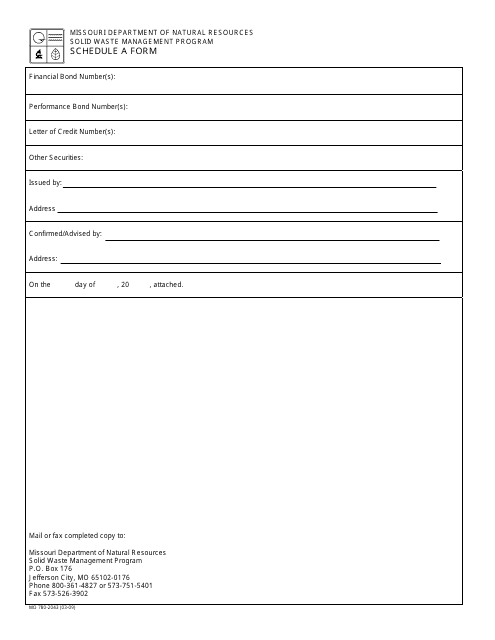

This Form is used for Schedule A Form in the state of Missouri.

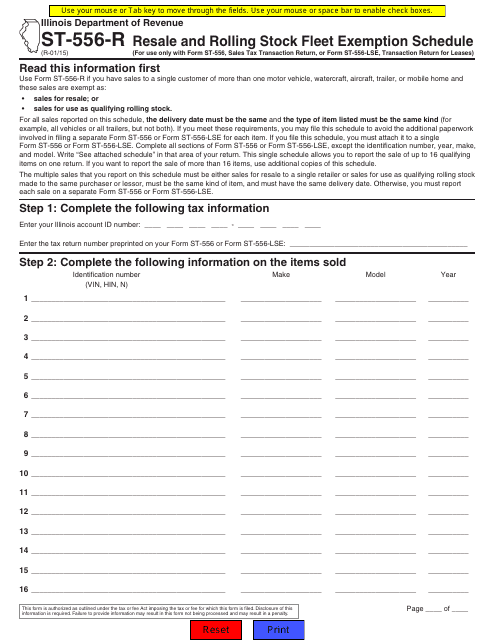

This form is used for reporting the resale and exemption schedule for rolling stock fleets in the state of Illinois.

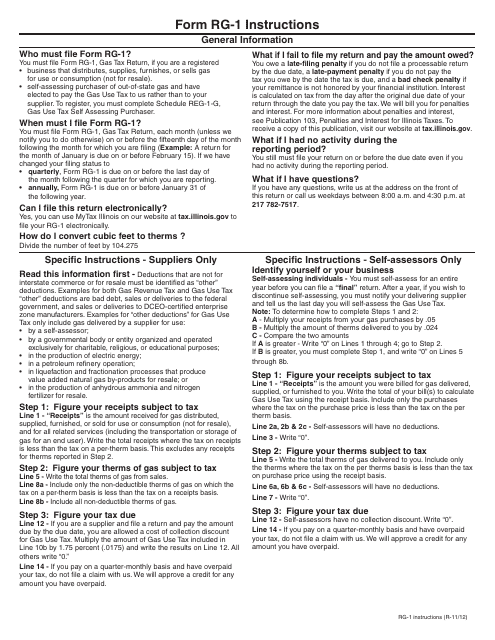

This Form is used for reporting and filing gas tax returns in the state of Illinois.

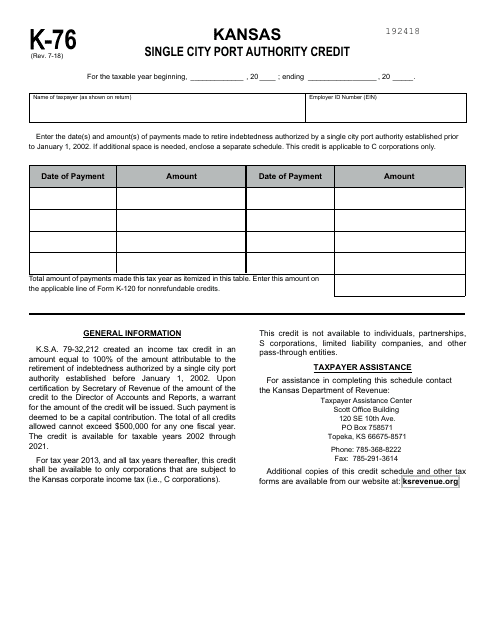

This Form is used for claiming a tax credit related to the operations of a single city port authority in Kansas.

This form is used for applying for a tax certificate in the state of Montana.

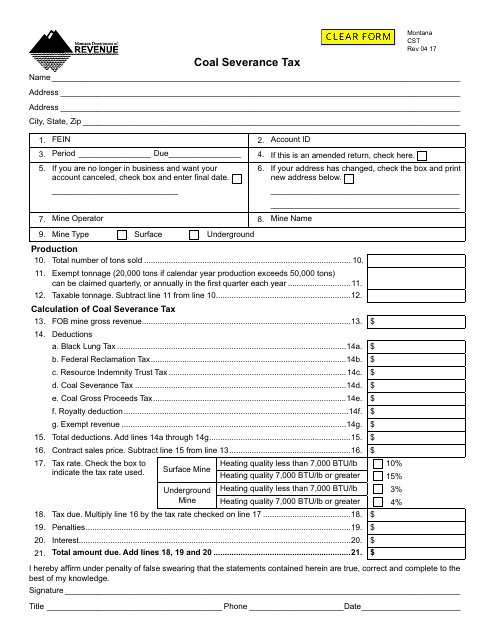

This Form is used for filing the coal severance tax in Montana. It is a tax form specifically for businesses involved in coal mining and extraction in the state.

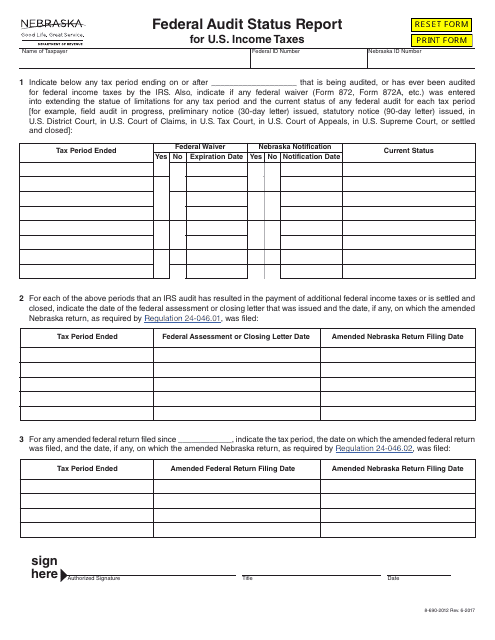

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.